Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Clarius Film Financing Overview

Caricato da

PropertywizzCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Clarius Film Financing Overview

Caricato da

PropertywizzCopyright:

Formati disponibili

Clarius Capital Film Financing Overview

Clarius Capital provides subordinated debt (mezzanine) financing for experienced producers of feature

length motion pictures, with production budgets in the $10 million to $20 million range. Clarius also

provides $18 million of marketing financing (prints and advertising--P&A). This holistic approach to film

production and marketing financing allows independent producers to secure wide-release domestic

distribution agreements on favorable terms. Further, we structure each transaction so that our respective

interests are aligned. This fair and transparent approach, rare with studio financed productions, assures

that any profit participation is shared proportionately.

Subordinated Debt (Mezzanine) Financing Collateral Enhancement

In collaboration with Imperial Capital Banks Entertainment Finance group, in Los Angeles, Clarius can

provide collateral assets to the bank on behalf of the Producer/Borrower, which will facilitate a super gap

loan of up to 50% of the production budget. This is in addition to the standard gap loan that the bank is

able to provide, which is limited to 20% of the production budget. Hence, producers can secure as much

as 70% of the production budget through a combination of bank and Clarius mezzanine (or gap)

financing. The bank will also lend against government tax inducements and foreign territory minimum

guarantee licensing contracts, bringing the bank loan up to 100% of the production budget in most cases.

P&A Funding

Clarius Capital can contribute a substantial portion of the films P&A budget, typically as much as $18

million. As a result, Clarius is able to secure favorable distribution agreements on behalf of the

production, with a guaranteed release on at least 1,500 screens domestically. Essential to our marketing

strategy is the seamless integration into the story of global brands, which are willing to contribute

additional co-marketing resources to further promote awareness of the film. Clarius works closely with the

producers, director, and writer to selectively include appropriate global brands into the script. Clarius

handles these inputs with the utmost sensitivity. It would be self-defeating for the brand elements to

interfere overtly with the creative integrity of the story; modern audiences are sophisticated and highly

literate to subversive marketing. To secure for the production the optimum brand support, Clarius requires

of the producer an exclusive mandate for all brand integration for the film.

Production Budget Financing Summary:

Example $20 million Production Budget

SOURCES

AMOUNT

Government Tax Incentives

$ 3,600,000

18%

Bank Financed Pre-Sales Contracts

$ 2,400,000

12%

Bank Gap

$ 4,000,000

20%

Clarius Mezzanine Super Gap

$ 8,000,000

50%

Total Production Budget

$20,000,000

100%

Total P&A Expenditure (Clarius)

$18,000,000

100%

Page 2

Clarius Capital Mezzanine Financing Overview

Clarius Capital manages collateral assets that help facilitate production financing for experienced

independent filmmakers seeking a production loan from a commercial film-lending bank.

HERES HOW IT WORKS: Clarius pledges, on behalf of the film producer (the Borrower), cash collateral to

a film production lender, such as Imperial Capital Bank, for up to 50% of the film production budget. By so

doing, the bank is able to reduce its dependence on minimum guarantee pre-sales contracts as a form of

collateral since Clarius will have provided substitute collateral acceptable to the bank.

WHY THIS IS BENEFICIAL FOR THE PRODUCER: There are two primary benefits: First, if there are insufficient

pre-sales contracts to qualify for a loan that covers the entire production budget, then the producer must

either reduce the budget, contribute equity to cover the shortfall (the gap), or delay the production until

adequate pre-sales contracts have been secured. This frequently presents a problem when talent has

committed to a specific but limited time schedule. Second, a producer can usually negotiate more

lucrative terms for territorial pre-sale contracts if the film is already shooting. To begin principal

photography, however, a producer needs a bank loan secured by collateral, which are usually the presales contracts. This Catch-22 is solved by Clarius. The producer can delay selling most of the territory

rights until the film has secured a domestic distribution deal and has generated public awareness through

its marketing and publicity efforts.

The silo on the left in the graph below illustrates the collateralized assets against which the bank will

make a production loan. The other silos are the respective sources of collateral. The marketing budget is

sourced by Clarius, from its cadre of global brand relationships and private investors.

Page 3

CLARIUS ASSUMES THE SALES RISK. Clarius relies on the integrity of the sales estimates in unsold

territories when assessing the risk associated with pledging its resources to the bank, on behalf of the

Borrower. Clarius requires that the unsold territory sales estimates be at least 150% of the combined gap

loan amount, as a safety margin.

For example, if the production budget were $20 million, the Borrower could qualify for a total gap loan

(bank and Clarius combined) of $12,000,000, but only if there are unsold territory sales estimates of at

least $18,000,000 million (12 x 1.5). As the hired sales company converts these sales estimates to actual

territory license agreements, Clarius Capitals collateral exposure is reduced accordingly. If the actual

sales results are less than estimated, including the required safety margin, then the Bank applies Clarius

Capitals pledged collateral against payment of the production loan.

THE TERMS AND CONDITIONS OF A SUPER GAP LOAN. All production loans, including the Clarius-supported

super gap component, are originated and administered by the film lending bank, typically Imperial Capital

Bank. The Borrower must negotiate standard production loan terms directly with the Bank. For providing

additional collateral, Clarius is compensated by the Borrower for its risk as follows:

Clarius Commitment Amount: Up to 50% of the production loan, but typically not more than about

$10 million per transaction.

Clarius Gap Fee:

A fee equal to twelve percent (12%) of the Clarius Commitment

Amount, included in the production budget, payable on the closing

date of the Loan and may be paid with the proceeds of the initial Loan

advance.

Clarius Back-End Fee:

A quarterly fee equal to two percent (2%) of the Clarius Commitment

Amount at risk, accruing at the beginning of each quarter, which shall

be payable after all obligations owing to the Bank.

Legal and Due Diligence Fee:

Actual legal expenses, but capped at $45,000, of which half is

payable upon execution of the Bank Commitment Letter and the

balance payable on the closing date of the Loan and may be paid with

the proceeds of the initial Loan advance, and included in the

production budget.

Profit Sharing:

Clarius will be entitled to participate in the films profits, if any,

calculated on the same basis as the producers profit interest. Clarius

caps its profit participation at 50%, including its interest from an

investment in the marketing financing.

Other Provisions:

The Borrower will also contract with Clarius Pictures for purposes of

monitoring its collateral contribution, the international sales efforts,

production, marketing, (including research, positioning, and publicity),

and domestic distribution. The agreement will include reimbursement

for travel, lodging, and per diem during principal photography, at the

producers budgeted rate. Terms of the production credit are

negotiable, but typically include one Producer credit and two

Executive Producer credits on a shared card, and an animated

production company credit in the opening credits. Clarius will be

entitled to a reasonable number of invitations to all screenings,

premieres, ceremonies, film festivals, as well as promotional film

posters and DVDs when commercially available.

Page 4

INSTRUCTIONS TO PRODUCERS

THE PROCESS OF QUALIFYING AND SECURING PRODUCTION AND MARKETING FINANCING FROM CLARIUS

To qualify for production and marketing financing, with credit enhancement provided by Clarius Capital,

you must first assemble the following materials to be submitted to Clarius and a second set of materials to

be submitted by Clarius Capital to Imperial Capital Bank, or such other bank as mutually agreed:

Final Production Budget

Story Synopsis

Screenplay and the related chain of title documents

Location information and documents supporting any government tax inducements

1

Copies of existing pre-sale contracts and signed Notice of Assignments by the distributors

Sales estimates for unsold territories and info on Sales Agent, who will also need the following:

o Principal Cast list and related resumes

o Director and related resume

o Producers and related resumes

Info on selected Completion Bond company

The completion bond company, which the bank requires as a condition to making a production loan,

requires similar documentation. You should familiarize yourself with these requirements in advance by

exploring: Documents & Info We Require From You, http://www.ffi-web.com/documents/index.html

After direct discussions with the bank, assuming the materials submitted conform to the banks lending

guidelines, the bank will issue a term sheet, a copy of which should be provided to Clarius Capital. The

banks term sheet will include a Conditions Precedent clause that will set forth the general terms of the

Clarius collateral pledge.

Concurrently with your discussions with the bank, Clarius will review its copy of the submitted materials

and begin preparing its own term sheet, setting forth the general terms of its collateral pledge. Clarius will

leverage the banks own due diligence procedures and concentrate its independent analysis on the

integrity of the sales agent and the validity of the sales estimates for unsold territory rights.

Upon approval of the loan by the banks credit committee, the bank will issue a commitment letter.

Subject to successful completion of due diligence and review of the transaction documentation, Clarius

will provide directly to the bank the collateral, in the form of a cash deposit, required to secure the super

gap loan and equity. The Borrower and Clarius will execute a mezzanine financing agreement, along with

any other documents required to memorialize the agreement between the parties.

From the time the producer submits the completed package of materials to the bank and the time the loan

is approved and actually funded is typically about three to four weeks. The velocity of the process is

largely dependent on the producers ability to be responsive to all data requests.

For further information about a super gap loan enhanced by Clarius Capital, along with P&A funding

support, please contact:

William Sadleir

Clarius Capital, LLC

310-360-7000

bill@clariuscapital.com

1

A minimum guarantee pre-sales contract from at least three primary territories is required. Primary territories include

United Kingdom, Germany, France, Italy, Japan, Australia, Spain, Benelux, Scandinavia, Canada, and the United

States.

Potrebbero piacerti anche

- Notary Signing Agent ScriptDocumento5 pagineNotary Signing Agent ScriptMyaW731100% (4)

- ContractsDocumento645 pagineContractsFRANCISCO CARRIZALES VERDUGO100% (4)

- Film Project Package Prospectus (Template)Documento3 pagineFilm Project Package Prospectus (Template)Neil BrimelowNessuna valutazione finora

- The Business of FilmDocumento287 pagineThe Business of FilmUmair Nasir AliNessuna valutazione finora

- Film Distribution WorksheetDocumento1 paginaFilm Distribution WorksheetRFrearsonNessuna valutazione finora

- Film Distribution: HandbookDocumento21 pagineFilm Distribution: HandbookIoana-Claudia MateiNessuna valutazione finora

- FS For Independent MovieDocumento59 pagineFS For Independent MovieWiraswasta Mandiri100% (2)

- Analyzing ROI of Independent Film FinanceDocumento25 pagineAnalyzing ROI of Independent Film FinanceGNS100% (1)

- Draft Film Financing Agreement1Documento4 pagineDraft Film Financing Agreement1Mike KrauseNessuna valutazione finora

- An Analytical Solution To Reasonable Royalty Rate CalculationsDocumento16 pagineAn Analytical Solution To Reasonable Royalty Rate CalculationsPropertywizzNessuna valutazione finora

- Film SchedulingDocumento4 pagineFilm SchedulingNishit Mohan SinghNessuna valutazione finora

- Template For Feature Film Business PlanDocumento2 pagineTemplate For Feature Film Business PlanSteven Parr25% (8)

- Film Production - Financing Investment IssuesDocumento3 pagineFilm Production - Financing Investment IssuesMichael Gaughan0% (1)

- Uk Film Council 2001 Distribution Guide PDFDocumento84 pagineUk Film Council 2001 Distribution Guide PDFNARCOLeproNessuna valutazione finora

- Freelance CrewDocumento4 pagineFreelance CrewafilmwriterNessuna valutazione finora

- Deal Point Checklist: Co-Production Agreement (Film)Documento2 pagineDeal Point Checklist: Co-Production Agreement (Film)saiful100% (1)

- Film Business PlanDocumento9 pagineFilm Business PlancreativeaddaNessuna valutazione finora

- Understanding Capital MarketsDocumento114 pagineUnderstanding Capital MarketsPropertywizzNessuna valutazione finora

- Film Business Plan Edit111Documento13 pagineFilm Business Plan Edit111Kelvin SilverNessuna valutazione finora

- Cinematographer ContractDocumento2 pagineCinematographer ContractMarius G.Mihalache100% (4)

- Film FinancingDocumento10 pagineFilm Financingjaikishan86100% (2)

- Legal Issues in Film ProductionDocumento15 pagineLegal Issues in Film ProductionPropertywizzNessuna valutazione finora

- Legal Issues in Film ProductionDocumento15 pagineLegal Issues in Film ProductionPropertywizzNessuna valutazione finora

- Film& VideoBudgets5thedtionsample PDFDocumento23 pagineFilm& VideoBudgets5thedtionsample PDFMichael Wiese Productions100% (1)

- Sample PDF Getting The MoneyDocumento22 pagineSample PDF Getting The MoneyMichael Wiese Productions86% (7)

- Investor AgreementDocumento4 pagineInvestor AgreementLeticia Fernandez VegaNessuna valutazione finora

- Investor Pitch Deck of Trio EntertainmentDocumento12 pagineInvestor Pitch Deck of Trio EntertainmentAnand LalNessuna valutazione finora

- Goldman Future of Finance - Payment EcosystemsDocumento87 pagineGoldman Future of Finance - Payment Ecosystemsnirav kakariyaNessuna valutazione finora

- Film Incentives BriefDocumento12 pagineFilm Incentives BriefAnonymous GF8PPILW5Nessuna valutazione finora

- Call SheetDocumento2 pagineCall SheetMichaelNessuna valutazione finora

- Short Film Agreement 1 13Documento11 pagineShort Film Agreement 1 13Christopher A. WrightNessuna valutazione finora

- Distribution and AdvertisingDocumento4 pagineDistribution and AdvertisingIrina SamsonNessuna valutazione finora

- Film Funds BookDocumento96 pagineFilm Funds BookGrupo Chaski / Stefan KasparNessuna valutazione finora

- Film Distribution: Definition of A DistributorDocumento5 pagineFilm Distribution: Definition of A DistributorNinaNCNessuna valutazione finora

- B8 Case Study - Project: AnnieDocumento1 paginaB8 Case Study - Project: AnnieBuffalo 8Nessuna valutazione finora

- Documentary Film Pitching Deck ContentsDocumento2 pagineDocumentary Film Pitching Deck ContentsDyan LuceroNessuna valutazione finora

- A Sample Film and Video Production Business Plan TemplateDocumento16 pagineA Sample Film and Video Production Business Plan TemplateToluwalope Sammie-Junior BanjoNessuna valutazione finora

- Ipmanagement Royalty RatesDocumento15 pagineIpmanagement Royalty RatesPropertywizzNessuna valutazione finora

- The Business - Understanding FilmmakingDocumento1 paginaThe Business - Understanding FilmmakingShreyaas100% (1)

- So Com Film Financing Commission AgreementDocumento3 pagineSo Com Film Financing Commission AgreementchangfuNessuna valutazione finora

- Film Production ProposalDocumento2 pagineFilm Production ProposalIkhwanul MukminNessuna valutazione finora

- MBFW - Crew Welcome LetterDocumento10 pagineMBFW - Crew Welcome LetterSei-Kai LeungNessuna valutazione finora

- Distribution AgreementDocumento4 pagineDistribution AgreementAmel Sanhaji100% (1)

- Indie Budget BuddyDocumento16 pagineIndie Budget BuddyAmish Schulze100% (6)

- Draft Agreement - DISTRIBUTION TERM SHEETDocumento7 pagineDraft Agreement - DISTRIBUTION TERM SHEETkrishnanmr2005100% (1)

- DATES Film ProposalDocumento9 pagineDATES Film Proposalcreativeadda0% (1)

- Development Budget Template For Feature FilmDocumento1 paginaDevelopment Budget Template For Feature FilmPankaj Johar100% (1)

- Actor Film AgreementDocumento3 pagineActor Film AgreementpragnendraNessuna valutazione finora

- China - Film IndustryDocumento39 pagineChina - Film IndustrySimon Kai T. WongNessuna valutazione finora

- Business Plan For A Movie Production TemplateDocumento4 pagineBusiness Plan For A Movie Production TemplateMariam Oluwatoyin CampbellNessuna valutazione finora

- Bank Loan Covenants PrimerDocumento5 pagineBank Loan Covenants PrimerPropertywizzNessuna valutazione finora

- Film Distribution ProcessDocumento23 pagineFilm Distribution ProcessBrain FartNessuna valutazione finora

- AGICL AXIS Bank Statement MO OCT 16 PDFDocumento6 pagineAGICL AXIS Bank Statement MO OCT 16 PDFSagar AsatiNessuna valutazione finora

- BRAC Bank Statement 10052023 PDFDocumento7 pagineBRAC Bank Statement 10052023 PDFMd Mizanur Rahman100% (1)

- B8 Case Study - Project: FreewaterDocumento4 pagineB8 Case Study - Project: FreewaterBuffalo 8Nessuna valutazione finora

- Bondit OneSheets WhyBondit 01b PDFDocumento1 paginaBondit OneSheets WhyBondit 01b PDFBuffalo 8Nessuna valutazione finora

- B8 Case Study - Project: Jimmy VestvoodDocumento1 paginaB8 Case Study - Project: Jimmy VestvoodBuffalo 8Nessuna valutazione finora

- Tax Motivated Film Financing at Rexford StudiosDocumento13 pagineTax Motivated Film Financing at Rexford StudiosNiketPaithankarNessuna valutazione finora

- Crew Deal MemoDocumento2 pagineCrew Deal MemoEz A FilmmakerNessuna valutazione finora

- BondIt Case Study Sheet - Project: The OutsiderDocumento1 paginaBondIt Case Study Sheet - Project: The OutsiderBuffalo 8100% (1)

- B8 Case Study - Project: As You AreDocumento1 paginaB8 Case Study - Project: As You AreBuffalo 8Nessuna valutazione finora

- Film DistributionDocumento8 pagineFilm DistributionNinaNCNessuna valutazione finora

- Rating Global Film Rights SecuritizationsDocumento26 pagineRating Global Film Rights SecuritizationsAdrian Dascal100% (1)

- Case Study - Minimum Guarantee Financing - King CobraDocumento1 paginaCase Study - Minimum Guarantee Financing - King CobraBuffalo 8Nessuna valutazione finora

- B8 Case Study - Project: The InfiltratorsDocumento1 paginaB8 Case Study - Project: The InfiltratorsBuffalo 8Nessuna valutazione finora

- Film Funding Opportunities GermanyDocumento17 pagineFilm Funding Opportunities GermanyFabiana FabianNessuna valutazione finora

- Practice Questions and SolutionsDocumento7 paginePractice Questions and SolutionsLiy TehNessuna valutazione finora

- Medida vs. CADocumento1 paginaMedida vs. CANiñoMaurinNessuna valutazione finora

- 2311 Acct6131039 Lhfa TK1-W3-S4-R2 Team8Documento8 pagine2311 Acct6131039 Lhfa TK1-W3-S4-R2 Team8Nadilla NurNessuna valutazione finora

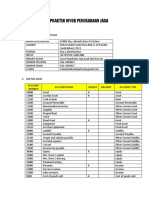

- Soal Praktek Myob Perusahaan JasaDocumento4 pagineSoal Praktek Myob Perusahaan Jasahani ramadiyantiNessuna valutazione finora

- Clearance Procedures: Typical Release Requirements For Errors and OmissionsDocumento2 pagineClearance Procedures: Typical Release Requirements For Errors and OmissionsYoungNessuna valutazione finora

- Sample PDF of BankrollDocumento25 pagineSample PDF of BankrollMichael Wiese Productions100% (1)

- Business Case For Green Building Report WEB 2013-04-11Documento124 pagineBusiness Case For Green Building Report WEB 2013-04-11topsygrielNessuna valutazione finora

- 03 CH 2Documento15 pagine03 CH 2PropertywizzNessuna valutazione finora

- 2015 Texas Relocation ReportDocumento55 pagine2015 Texas Relocation ReportPropertywizzNessuna valutazione finora

- Graphene Frontiers Inventing The FutureDocumento7 pagineGraphene Frontiers Inventing The FuturePropertywizzNessuna valutazione finora

- 7 Project Labor Agreement - 201305131448459652Documento25 pagine7 Project Labor Agreement - 201305131448459652PropertywizzNessuna valutazione finora

- BioSensor & Chemical Gel SensorPerdue UniversityDocumento2 pagineBioSensor & Chemical Gel SensorPerdue UniversityPropertywizzNessuna valutazione finora

- A VetAdmin Program Contracts PrimerDocumento100 pagineA VetAdmin Program Contracts PrimerPropertywizzNessuna valutazione finora

- ItalyDocumento32 pagineItalyPropertywizzNessuna valutazione finora

- (Bio) Chemical Sensors Tno GroupDocumento3 pagine(Bio) Chemical Sensors Tno GroupPropertywizzNessuna valutazione finora

- Implied RatingsMoodyexhibit 13Documento38 pagineImplied RatingsMoodyexhibit 13PropertywizzNessuna valutazione finora

- Melamine Sensing in Milk Products Raman TechnologyDocumento7 pagineMelamine Sensing in Milk Products Raman TechnologyPropertywizzNessuna valutazione finora

- Perdue Graphene Chemically Prepared Graphene Sheets On Sensor ApplicationsDocumento15 paginePerdue Graphene Chemically Prepared Graphene Sheets On Sensor ApplicationsPropertywizzNessuna valutazione finora

- Permian Basin 12 NotesDocumento7 paginePermian Basin 12 NotesPropertywizzNessuna valutazione finora

- Hedging With A Put OptionDocumento4 pagineHedging With A Put OptionPropertywizzNessuna valutazione finora

- Injunctions, Hold-Up, and Patent RoyaltiesDocumento39 pagineInjunctions, Hold-Up, and Patent RoyaltiesPropertywizzNessuna valutazione finora

- Problem Loan Process in BankingDocumento4 pagineProblem Loan Process in BankingPropertywizzNessuna valutazione finora

- BIG MEMS Perssure Sensor Top in 2014Documento10 pagineBIG MEMS Perssure Sensor Top in 2014PropertywizzNessuna valutazione finora

- Bank Line of Credit StudyDocumento48 pagineBank Line of Credit StudyPropertywizzNessuna valutazione finora

- Bank WorkOuts More Than A LoanDocumento3 pagineBank WorkOuts More Than A LoanPropertywizzNessuna valutazione finora

- BFS Info Sheet Gov Contractors 1-08Documento1 paginaBFS Info Sheet Gov Contractors 1-08PropertywizzNessuna valutazione finora

- Grand Bahama Port Authority Grand Bahama Island Development: Executive SummaryDocumento3 pagineGrand Bahama Port Authority Grand Bahama Island Development: Executive SummaryPropertywizzNessuna valutazione finora

- Insurance Commissioners OfficeDocumento9 pagineInsurance Commissioners OfficePropertywizzNessuna valutazione finora

- LancPoll Hosp Report - Lo-ResDocumento36 pagineLancPoll Hosp Report - Lo-ResPropertywizzNessuna valutazione finora

- Emigrant Mortgage NINA Loan Program PdfServletDocumento5 pagineEmigrant Mortgage NINA Loan Program PdfServletPropertywizzNessuna valutazione finora

- Commercial Bank Management Sem IIIDocumento11 pagineCommercial Bank Management Sem IIIJanvi MhatreNessuna valutazione finora

- Additional ConceptsDocumento12 pagineAdditional ConceptsDr Sakshi SharmaNessuna valutazione finora

- Inherent RiskDocumento2 pagineInherent RiskMae Dela PenaNessuna valutazione finora

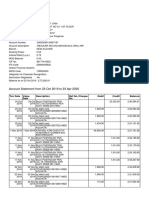

- OpTransactionHistoryTpr17 09 2019 PDFDocumento2 pagineOpTransactionHistoryTpr17 09 2019 PDFSonu DangiNessuna valutazione finora

- History and Growth of Islamic Banking and FinanceDocumento13 pagineHistory and Growth of Islamic Banking and FinancerababNessuna valutazione finora

- Hamza Azam CurrentDocumento1 paginaHamza Azam CurrentHamza AzamNessuna valutazione finora

- IFRS 9 Impairment Where Do I Start March 2018Documento9 pagineIFRS 9 Impairment Where Do I Start March 2018DerickBrownThe-GentlemanNessuna valutazione finora

- ProjectDocumento111 pagineProjectGanesh KumarNessuna valutazione finora

- Overview of Functions and Operations BSPDocumento2 pagineOverview of Functions and Operations BSPKarla GalvezNessuna valutazione finora

- Blackrock ETF Fee Exhibit DDocumento6 pagineBlackrock ETF Fee Exhibit DZerohedgeNessuna valutazione finora

- IT Income From Other Sources Pt-2Documento7 pagineIT Income From Other Sources Pt-2syedfareed596Nessuna valutazione finora

- SBI Cards and Payment Services (Sbicard In) : Q1FY21 Result UpdateDocumento8 pagineSBI Cards and Payment Services (Sbicard In) : Q1FY21 Result UpdatewhitenagarNessuna valutazione finora

- B Dam SBI Silchar AC PDFDocumento3 pagineB Dam SBI Silchar AC PDFsanjibannathNessuna valutazione finora

- Auditing S2 - Chapter 5Documento11 pagineAuditing S2 - Chapter 5p aloaNessuna valutazione finora

- XYZ Investing INC. Trial BalanceDocumento3 pagineXYZ Investing INC. Trial BalanceLeika Gay Soriano OlarteNessuna valutazione finora

- LT Nifty Next 50 Index FundDocumento2 pagineLT Nifty Next 50 Index FundQUALITY12Nessuna valutazione finora

- Grade 10 Provincial Exam Accounting P1 (English) November 2019 Possible Answers - 050305Documento6 pagineGrade 10 Provincial Exam Accounting P1 (English) November 2019 Possible Answers - 050305hobyanevisionNessuna valutazione finora

- Summary Notes - PSA 120Documento2 pagineSummary Notes - PSA 120Laila ContadoNessuna valutazione finora

- Research Paper On Kisan Credit CardDocumento8 pagineResearch Paper On Kisan Credit Cardqzafzzhkf100% (1)

- 1.1history of BankingDocumento18 pagine1.1history of BankingHarika KollatiNessuna valutazione finora

- Respon Code Edc Miniatm-1Documento1 paginaRespon Code Edc Miniatm-1hasibuanNessuna valutazione finora

- Mrs - Gauri Prashant Sankpal: Page 1 of 2 M-5629864Documento2 pagineMrs - Gauri Prashant Sankpal: Page 1 of 2 M-5629864Savinay KambleNessuna valutazione finora