Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Options Strategies

Caricato da

sneha496Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Options Strategies

Caricato da

sneha496Copyright:

Formati disponibili

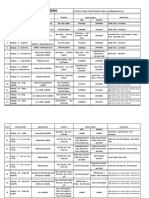

Strategies

Action

When to use

Risk

Reward

Break-even Point

Limited to the Premium.

Long Call

Buy Call Option

Investor is very bullish on the (Maximum loss if market

stock / index.

expires at or below the

Unlimited

Strike Price + Premium

option strike price).

Investor is very aggressive and

Short Call

Sell Call Option

he is very bearish about the

Unlimited

stock / index

Limited

to

the

amount of premium

Strike Price + Premium

When ownership is desired of

Synthetic Long

Buy Stock + Buy

Call

Put Option

stock yet investor is concerned Losses limited to Stock

about near-term downside risk. price + Put Premium

The outlook is conservatively Put Strike price

bullish.

87 | P a g e

Profit potential is

Put Premium + Stock

unlimited.

Price

A long Put is a Bearish

Long Put

Buy Put Option

strategy. To take advantage of Investor is bearish about

a falling market an investor can the stock / index.

Short Put

Sell Put Option

stock / index. The main idea is

to make a short term income.

This is often employed when

an investor has a short-term

neutral to moderately bullish

view on the stock he holds. He

Covered Call

88 | P a g e

to

amount

the

of Stock Price - Premium

Premium paid.

buy Put options

Investor is very Bullish on the

Limited

Put Strike Price Put

Premium

Limited

amount

to

the

of

Premium received

Put

Strike

Price

Premium

If the stock price falls to

zero, the investor loses

the entire value of the

stock

but

retains

the

premium, since the call Limited to (Call

Buy Stock + Sell takes a short position on the will not exercise against Strike Price - Stock Stock Price paid

Call option to generate income

Call Option

Paid)

+ Premium received

him. So maximum risk = Price

from the option premium.

stock Price Paid- Call Premium received

Since the stock is purchased

Premium. If the stock

simultaneously with writing

price rises beyond the

(selling) the call, the strategy is

strike price the investor

commonly referred to as "buygives up all the gains on

write".

Long Combo :

Sell a Put, Buy

a Call

Sell a Put + Buy

a Call

the stock.

Investor is Bullish on the

stock

Unlimited (Lower Strike

+ net debit)

Unlimited

Higher strike + net debit

If the investor is of the view

Protective

Call/Synthetic

Long Put

Short

Stock

Buy Call Option

that the markets will go down

Limited. Maximum Risk

Maximum is Stock

(bearish) but wants to protect is Call Strike Price Price

against any unexpected rise in Stock Price + Premium

Call

Premium

Stock

Price

Call

Premium

the price of the stock.

Covered Put

Long Straddle

89 | P a g e

Short Stock +

Short Put Option

If the investor is of the view

that

the

markets

Unlimited if the price of

are the

moderately bearish.

stock

rises

substantially

Maximum is (Sale

Price of the Stock

Sale Price of Stock +

Strike Price) + Put Put Premium

Premium

Upper Breakeven Point

Buy Put + Buy

The investor thinks that the

Call

underlying stock / index will premium paid.

experience

significant

Limited to the initial

Unlimited

= Strike Price of Long

Call + Net Premium

Paid; Lower Breakeven

volatility in the near term.

Point = Strike Price of

Long Put - Net Premium

Paid

Upper Breakeven Point

= Strike Price of Short

The investor thinks that the

Short Straddle

Sell Put + Sell underlying stock / index will

Call

experience very little volatility

Unlimited

Limited

to

the

premium received

in the near term.

Call + Net Premium

Received;

Breakeven

Lower

Point

Strike Price of Short Put

- Net Premium Received

Upper Breakeven Point

= Strike Price of Long

The investor thinks that the

Long Strangle

Buy OTM Put + underlying stock / index will

Buy OTM Call

Limited to the initial

experience very high levels of premium paid

volatility in the near term.

Call + Net Premium

Unlimited

Paid; Lower Breakeven

Point = Strike Price of

Long Put - Net Premium

Paid

90 | P a g e

Upper Breakeven Point

This options trading strategy is

taken

Short Strangle

when

Sell OTM Put + investor

Sell OTM Call

the

thinks

underlying

= Strike Price of Short

options

that

stock

the

will

Limited

Unlimited

to

the

premium received

experience little volatility in

Call + Net Premium

Received

Breakeven

Lower

Point

Strike Price of Short Put

the near term.

- Net Premium Received

The collar is a good strategy to

use if the investor is writing

Collar

Buy Stock + Buy

Put + Sell Call

covered calls to earn premiums

Purchase

but wishes to protect himself Limited

Limited

Underlying

from an unexpected sharp drop

Price

of

Call

Premium + Put Premium

in the price of the underlying

security

Buy a Call with a

Bull Call Spread lower

Strategy

(ITM) +

strike Investor is moderately bullish

Sell a

Call with a higher

91 | P a g e

Limited to any initial Limited

to

the

Price

of

in difference between Strike

establishing the position. the two strikes Purchased call + Net

Maximum loss occurs minus net premium Debit Paid

premium

paid

where

underlying cost.

the

Maximum

strike (OTM)

falls to the level of the profit occurs where

lower strike or below.

the underlying rises

to the level of the

higher

strike

or

above

Limited to the net

Limited. Maximum loss

Bull Put Spread

Strategy : Sell

Sell a Put + Buy

Put Option, Buy a Put

When

the

investor

moderately bullish

Put Option

is

occurs

where

the

underlying falls to the

level of the lower strike

or below

premium

credit.

Maximum

profit

occurs

where Strike Price of Short Put

underlying rises to - Net Premium Received

the level of the

higher

strike

or

above.

Bear

Call

Sell a Call with a

Limited to the net

Limited to the difference premium received

Spread Strategy

When the investor is mildly

Lower

(ITM) + Buy a

between the two strikes for the position i.e.,

: Sell ITM Call,

bearish on market.

premium received credit

Call with a higher

minus the net premium.

Buy OTM Call

for the short call

strike (OTM)

lower

strike

minus the premium

92 | P a g e

Strike

Net

paid for the long

call.

Buy a Put with a

Bear Put Spread higher

strike

Strategy : Buy (ITM) + Sell a

Put, Sell Put

Put with a lower

Limited

to

the

amount

paid

for

net Limited

the

the difference between

When you are moderately spread. i.e. the premium the

bearish on market direction

to

two

strike

Strike Price of Long Put

paid for long position prices minus the - Net Premium Paid

less premium received net premium paid

strike (OTM)

for short position

for the position.

Upper Breakeven Point

= Strike Price of Higher

Sell 2 ATM Call

Long

butterfly

Call + Buy 1 ATM

Call + Buy 1

OTM Call

When the investor is neutral

Difference between

on

adjacent

market

direction

bearish on volatility.

and Net debit paid

strikes

minus net debit

Strike Long Call - Net

Premium Paid ; Lower

Breakeven

Point

Strike Price of Lower

Strike Long Call + Net

Premium Paid

93 | P a g e

Upper Breakeven Point

Investor is neutral on market Limited

Buy 2 ATM Call direction

Short

Butterfly

and

bullish

to

the

net

= Strike Price of Highest

on difference between the

Limited to the net Strike Short Call - Net

Call + Sell 1 ITM Call volatility. Neutral means that adjacent strikes (Rs. 100 premium received Premium

+

Sell

1 you expect the market to move in this example) less the for

OTMCall

the

Received

option Lower Breakeven Point

in either direction - i.e. bullish premium received for the spread.

= Strike Price of Lowest

and bearish.

Strike Short Call + Net

position.

Premium Received

Buy 1 ITM Call

Option

(Lower

Strike),

Sell

ITM Call Option

Long

Condor

Call (Lower Middle),

Sell 1 OTM Call

Option

(Higher

Middle), Buy 1

OTM Call Option

(Higher Strike)

94 | P a g e

Limited to the minimum

When an investor believes that of the difference between

the underlying market will the

lower

strike

call

trade in a range with low spread less the higher

volatility until the options call spread less the total

expire.

premium paid for the

condor.

Limited.

The

maximum profit of Upper Breakeven Point

a long condor will = Highest Strike Net

be realized when Debit

the stock is trading Breakeven

Lower

Point

between the two Lowest Strike + Net

middle

prices.

strike Debit

Short 1 ITM Call

Option

(Lower

Limited.

Strike), Long 1

ITM

Short

Condor

Call

option

Call

Call When an investor believes that

(Lower the underlying market will

Middle), Long 1 break out of a trading range

OTM Call Option but is not sure in which

(Higher Middle), direction.

Short 1 OTM Call

Option

Strike)

95 | P a g e

(Higher

The

maximum profit of

Limited. The maximum a

short

condor

loss of a short condor occurs when the

occurs at the center of the underlying stock /

option spread

index

is

trading

past the upper or

lower strike prices.

Upper Break even Point

= Highest Strike Net

Credit ; Lower Break

Even Point

= Lowest

Strike + Net Credit

Potrebbero piacerti anche

- Option Market Making : Part 1, An Introduction: Extrinsiq Advanced Options Trading Guides, #3Da EverandOption Market Making : Part 1, An Introduction: Extrinsiq Advanced Options Trading Guides, #3Nessuna valutazione finora

- Formula Options Trading StrategiesDocumento2 pagineFormula Options Trading StrategiesSameer88% (8)

- Bull Call Spread & Put SpreadDocumento16 pagineBull Call Spread & Put Spreadravirana60Nessuna valutazione finora

- Option Trading Workbook (Deb Sahoo)Documento25 pagineOption Trading Workbook (Deb Sahoo)Deb SahooNessuna valutazione finora

- Options Strategies PDFDocumento66 pagineOptions Strategies PDFsrinivas_urv100% (3)

- Options Trading StrategiesDocumento20 pagineOptions Trading Strategiesmaheshmuralinair6100% (5)

- Promodh Kumar OPTION Trading ASTrageyDocumento4 paginePromodh Kumar OPTION Trading ASTrageyRajesh Kumar100% (1)

- 5 Favorite Options Setups PDFDocumento40 pagine5 Favorite Options Setups PDFquantum70Nessuna valutazione finora

- Option Trading Strategies SummaryDocumento6 pagineOption Trading Strategies SummaryRavi Khushalani100% (1)

- Options BasicsDocumento27 pagineOptions BasicsAmit KumarNessuna valutazione finora

- Option StrategiesDocumento24 pagineOption Strategiesarvi2020100% (1)

- Options Trading Strategies: Option Spread Strategy Description Reason To Use When To UseDocumento6 pagineOptions Trading Strategies: Option Spread Strategy Description Reason To Use When To UseSGNessuna valutazione finora

- Delta Neutral Dynamic HedgingDocumento9 pagineDelta Neutral Dynamic HedgingParmit ChoudhuryNessuna valutazione finora

- Options Trading: Generating Real Income in a Zero Interest World: A Guide to Generating Reliable Income by Trading Options on Blue Chip StocksDa EverandOptions Trading: Generating Real Income in a Zero Interest World: A Guide to Generating Reliable Income by Trading Options on Blue Chip StocksNessuna valutazione finora

- Option Trading StrategiesDocumento79 pagineOption Trading Strategiesasifanis100% (1)

- Option Greek - The Option GuideDocumento6 pagineOption Greek - The Option GuidePINALNessuna valutazione finora

- Options Trading Strategies - Treat Implied Volatility of Calls Separate From The IV of PutsDocumento2 pagineOptions Trading Strategies - Treat Implied Volatility of Calls Separate From The IV of PutsHome Options Trading0% (1)

- Options SoftwaresDocumento54 pagineOptions SoftwaresAmit Barman100% (1)

- Formula Options - Trading - Strategies PDFDocumento2 pagineFormula Options - Trading - Strategies PDFSameer Shinde100% (1)

- Options - My Way of Looking at ItDocumento4 pagineOptions - My Way of Looking at Itravi lathiyaNessuna valutazione finora

- Analysis of Option Strategies, Greeks-Ankit KocharDocumento60 pagineAnalysis of Option Strategies, Greeks-Ankit KocharJames Austin100% (4)

- Class Notes On OptionsDocumento7 pagineClass Notes On OptionsAnvesha TyagiNessuna valutazione finora

- The Only Options Trading Book You'll Ever Need: Options Trading Workbook for Beginners to Hedge Your Stock Market Portfolio and Generate IncomeDa EverandThe Only Options Trading Book You'll Ever Need: Options Trading Workbook for Beginners to Hedge Your Stock Market Portfolio and Generate IncomeNessuna valutazione finora

- Option Arbitrage Trading Strategies - BrochureDocumento8 pagineOption Arbitrage Trading Strategies - Brochurejul123456Nessuna valutazione finora

- Advanced Option Strategies NotebookDocumento78 pagineAdvanced Option Strategies NotebookCapavara Lin100% (4)

- Option Trading Strategies SampleDocumento27 pagineOption Trading Strategies SampleMeenakshiNessuna valutazione finora

- Pasi-Option Trading GuideDocumento64 paginePasi-Option Trading GuideBharat75% (4)

- Options Trading GuideDocumento57 pagineOptions Trading Guidecallmetarantula85% (13)

- Strategy BookDocumento12 pagineStrategy BookMairembam Yepiz SasangkaNessuna valutazione finora

- Trading Options Developing A PlanDocumento32 pagineTrading Options Developing A Planjohnsm2010Nessuna valutazione finora

- Options Trading PackDocumento47 pagineOptions Trading PackelisaNessuna valutazione finora

- Mastering Options StrategiesDocumento40 pagineMastering Options Strategiesluong847180% (1)

- Bullish: Option Strategies For Bullish ViewDocumento10 pagineBullish: Option Strategies For Bullish ViewAshutosh ChauhanNessuna valutazione finora

- The Option School - Option Strategies by IIM AlumnusDocumento6 pagineThe Option School - Option Strategies by IIM Alumnushnarwal14% (7)

- Options Open Interest AnalysisDocumento21 pagineOptions Open Interest AnalysisMan Zeal100% (1)

- Options Strategies Workbook - JitendraDocumento29 pagineOptions Strategies Workbook - JitendrajitendrasutarNessuna valutazione finora

- Options Trading StrategiesDocumento19 pagineOptions Trading StrategiesAkshay SahooNessuna valutazione finora

- Power: Passive Option Writing Exceptional Return StrategyDa EverandPower: Passive Option Writing Exceptional Return StrategyNessuna valutazione finora

- Option Volatility & Pricing Workbook: Practicing Advanced Trading Strategies and TechniquesDa EverandOption Volatility & Pricing Workbook: Practicing Advanced Trading Strategies and TechniquesValutazione: 4.5 su 5 stelle4.5/5 (11)

- Option Hedge Strategy: (+200 CE & - 200 PE)Documento3 pagineOption Hedge Strategy: (+200 CE & - 200 PE)Sushanta100% (1)

- Option Strategy Cheat Sheet: Condition Volatility Skew Time NotesDocumento1 paginaOption Strategy Cheat Sheet: Condition Volatility Skew Time Notesraj33% (3)

- Understanding LEAPS: Using the Most Effective Options Strategies for Maximum AdvantageDa EverandUnderstanding LEAPS: Using the Most Effective Options Strategies for Maximum AdvantageValutazione: 3 su 5 stelle3/5 (1)

- Option StrategiesDocumento13 pagineOption StrategiesArunangshu BhattacharjeeNessuna valutazione finora

- Expiry Trading Using StraddlesDocumento29 pagineExpiry Trading Using Straddleskamal_satnaNessuna valutazione finora

- Study of Open InterestDocumento10 pagineStudy of Open InterestRahul ChaturvediNessuna valutazione finora

- 12 - Advanced Option GreeksDocumento72 pagine12 - Advanced Option Greekssoutik sarkar100% (2)

- 10-Trading Strategies Involving OptionsDocumento24 pagine10-Trading Strategies Involving OptionsSaupan UpadhyayNessuna valutazione finora

- Options For Volatility: Sample Investing PlansDocumento10 pagineOptions For Volatility: Sample Investing PlansNick's GarageNessuna valutazione finora

- Summary of Michael Sincere's Understanding Options 2EDa EverandSummary of Michael Sincere's Understanding Options 2EValutazione: 2 su 5 stelle2/5 (1)

- OptionDocumento75 pagineOptionsachin251Nessuna valutazione finora

- Option Strategies That Can Be Implemented Based On Implied VolatilityDocumento8 pagineOption Strategies That Can Be Implemented Based On Implied Volatilitysivasundaram anushanNessuna valutazione finora

- Option Chain File Using GuideDocumento10 pagineOption Chain File Using GuideMonil SharmaNessuna valutazione finora

- The 8 Minute Options Trading CookbookDocumento36 pagineThe 8 Minute Options Trading Cookbookrod_198033% (3)

- Advanced Trading Strategies in OptionsDocumento6 pagineAdvanced Trading Strategies in OptionsPrakash Joshi100% (1)

- Proffesional Option TraderDocumento15 pagineProffesional Option TraderNehang PandyaNessuna valutazione finora

- Trading StrategiesDocumento13 pagineTrading Strategiesrk877Nessuna valutazione finora

- Hedging Strategies Using OptionsDocumento13 pagineHedging Strategies Using OptionsDushyant MudgalNessuna valutazione finora

- Greeks and Greek RatiosDocumento41 pagineGreeks and Greek RatiosVitorDuarteNessuna valutazione finora

- Selling OptionsDocumento19 pagineSelling Optionsktmahen6698100% (2)

- Uts Teori AkuntansiDocumento6 pagineUts Teori AkuntansiARYA AZHARI -Nessuna valutazione finora

- L0193 Neuberger Berman Profile EmeaDocumento4 pagineL0193 Neuberger Berman Profile EmeaBenz Lystin Carcuevas YbañezNessuna valutazione finora

- Prospectus (As of November 2, 2015) PDFDocumento132 pagineProspectus (As of November 2, 2015) PDFblackcholoNessuna valutazione finora

- Living LegendsDocumento8 pagineLiving LegendsTBP_Think_Tank100% (3)

- IBD Type of Investor Are You PDFDocumento1 paginaIBD Type of Investor Are You PDFmathaiyan,arunNessuna valutazione finora

- Pacific Group - EB-5 Visa ProgramDocumento7 paginePacific Group - EB-5 Visa ProgramOK-SAFE, Inc.Nessuna valutazione finora

- Fundamentals of Corporate Finance Are Given in The Diagram Below.Documento24 pagineFundamentals of Corporate Finance Are Given in The Diagram Below.Nidhi Kulkarni100% (2)

- Old Mutual International InformerDocumento28 pagineOld Mutual International InformerJohn SmithNessuna valutazione finora

- Designing The Roadmap For Pre IncubationDocumento9 pagineDesigning The Roadmap For Pre IncubationQuốc Phòng An NinhNessuna valutazione finora

- BMODocumento187 pagineBMOsmutgremlinNessuna valutazione finora

- H G Infra Engineering LTD: Subscribe For Long Term Price Band: INR 263 - 270Documento8 pagineH G Infra Engineering LTD: Subscribe For Long Term Price Band: INR 263 - 270SachinShingoteNessuna valutazione finora

- Cooking The BookDocumento9 pagineCooking The BookSimeony SimeNessuna valutazione finora

- Pale Yellow Pink Digitalism Simple PresentationDocumento23 paginePale Yellow Pink Digitalism Simple Presentationjeanclairetolosa78Nessuna valutazione finora

- AttachmentDocumento308 pagineAttachmentAnotidaishe NyakudyaNessuna valutazione finora

- Ten Year Treasury YieldsDocumento1 paginaTen Year Treasury YieldsCLORIS4Nessuna valutazione finora

- ch01 PenmanDocumento27 paginech01 PenmansaminbdNessuna valutazione finora

- A Project On: Submitted To University of Pune For The Partial Fulfilment of Master of Business AdministrastionDocumento69 pagineA Project On: Submitted To University of Pune For The Partial Fulfilment of Master of Business AdministrastionharshNessuna valutazione finora

- Infinity and Beyond: Iscussion OpicsDocumento2 pagineInfinity and Beyond: Iscussion Opicsdiana100% (1)

- TOP Stocks: Adversity Leads To OpportunityDocumento168 pagineTOP Stocks: Adversity Leads To OpportunityJoyce Dick Lam PoonNessuna valutazione finora

- Investment Decision and Portfolio ManagementDocumento35 pagineInvestment Decision and Portfolio Managementtarunasha50% (2)

- 50 Prosperity ClassicsDocumento18 pagine50 Prosperity ClassicsNeha Rajliwal100% (4)

- Sapm Punithavathy PandianDocumento27 pagineSapm Punithavathy Pandiananandhi_jagan0% (1)

- Part A - About IndustryDocumento69 paginePart A - About IndustrySudharshan Reddy PNessuna valutazione finora

- Nism Series II B Registrar To An Issue Mutual Funds Workbook in PDFDocumento184 pagineNism Series II B Registrar To An Issue Mutual Funds Workbook in PDFLingamplly Shravan KumarNessuna valutazione finora

- SEBI:-How It Protect The Interest of The InvestorsDocumento12 pagineSEBI:-How It Protect The Interest of The InvestorsMonique RamirezNessuna valutazione finora

- Sweet Dreams Inc. Case AnalysisDocumento13 pagineSweet Dreams Inc. Case Analysisdontcare3267% (3)

- Advance Subscription AgreementDocumento8 pagineAdvance Subscription AgreementYanz RamsNessuna valutazione finora

- Bank of Baroda ProjectDocumento30 pagineBank of Baroda ProjectKevinRajNessuna valutazione finora

- Resumo BTG Pactual PDFDocumento206 pagineResumo BTG Pactual PDFJulio Cesar Gusmão CarvalhoNessuna valutazione finora

- Regulatory Framework of Mutual Funds in IndiaDocumento14 pagineRegulatory Framework of Mutual Funds in Indiaayushi guptaNessuna valutazione finora