Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Promotion Book 2011

Caricato da

mevrick_guyTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Promotion Book 2011

Caricato da

mevrick_guyCopyright:

Formati disponibili

STATE BANK LEARNING CENTER, PANCHKULA

PREPARED BY SBLC PANCHKULA

(UPDATED UPTO 1ST June 2011)

STATE BANK LEARNING CENTER, PANCHKULA

STATE BANK LEARNING CENTER, PANCHKULA

(For Internal Circulation only)

Promotion Booklet

(Updated upto 01-06-2011)

STATE BANK LEARNING CENTRE

Sector-14, PANCHKULA

PHONE: 0172-4569401

While we have taken utmost care in incorporating latest information on

various topics, errors and omissions are likely. Hence the readers are

requested to be guided by the circulars issued by the Bank from time to

time and SBLC, Panchkula is not liable for any such inadvertent mistakes

and omissions, if any. We also request our readers to kindly bring to our

notice, any mistakes/omissions noticed by them to make suitable

corrections in the subsequent edition.

STATE BANK LEARNING CENTER, PANCHKULA

PROMOTION BOOKLET

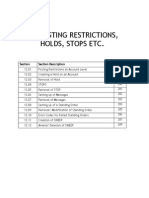

INDEX

Chapter

Name of the Chapters

no.

Page

Number

Policy Guidelines

1-5

Annual Results

6-8

General Banking

9-29

Inspection& Audit,

30-37

Basel-II, Capital Adequacy & Risk management

38-49

P-Segment Liability Products

50-68

P-Segment Assets Products

69-126

SME Liability Products

127-138

Micro Advances, PMEGP, SGSY,

139-142

10

SME Advances

143-201

11

NPA Management

202-208

12

Legal Aspects of Banking

209-245

13

International Banking

246-316

14

Agriculture Advances

317-386

15

Cash Deptt. Procedures & Govt. Business

387-411

16

CBS , Technology Products

412-463

17

Information Security System

464-475

18

BPR

476-480

19

Cross Selling

481-494

20

Awareness of Banking Finance & Economy

495-531

STATE BANK LEARNING CENTER, PANCHKULA

Policy Guidelines 2011-12

1.

As per Policy Guidelines Net Profit of S B I has been targeted to increase by

_______%, during the year 2011-12

a)

c)

2.

b)

d)

20

30

As per Policy Guidelines 2011-12, Corporate Centre has fixed the target for

growth in deposits for at:______

a)

c)

3.

18

25

23%

18.5%

b)

d)

32%

15.5%

Target for growth of advances (excluding food) for whole bank, as

Policy Guidelines has been fixed at:_________

a)

c)

20%

23%

b)

d)

per

22%

28%

4.

As per Policy Guidelines 2011-12, the return on equity has been targeted

at.. %

a) 18.50

b)

19.50

c) 15.20

d)

16.20

As per Policy Guidelines 2011-12., increase in CASA ratio for the whole bank

is to go up by , basis points.

a)

c)

6.

b)150

d)200

ALL SME customers with limit of Rs-----cr and above are to be provided with

CINB in 2011-12.

a)

c)

7.

120

140

1.00

2.5

b)

d)

3.00

1.5

As per Policy Guidelines 2011-12 the Bank has to focus on increasing other

income by ______%.

a) 28

c) 30

b) 26

d) 40

1

STATE BANK LEARNING CENTER, PANCHKULA

8.

As per Policy Guidelines 2011-12, target for growth in Housing and auto

loans in NBG has been fixed at .% & %.

a)

c)

9.

the return on assets has to increase by

b)

d)

3

7

1.08

1.03

the overheads growth is to be restricted

b)

d)

5

0 (SAME LEVEL)

1.00lac

1.50lac

b)

d)

0.50lac

0.75lac`

20 & 25

30 & 30

b)

d)

25 ,25

50 & 50

As per Policy Guidelines 2011-12, ------- % growth has been set for education

loan

a)

c)

15.

2.27

3.25

As per Policy Guidelines 2011-12,

the Forex retail purchases and retail

sales must grow by ------ % & .% .

a)

c)

14.

2

1.90

ratio for the whole Bank

Under Green Channel counter bank seeks to achieve ------transactions by 2012

a)

c)

13.

b)

d)

As per Policy Guidelines 2011-12,

to-----a)

c)

12.

3.50

1.15

As per Policy Guidelines 2011-12,

.%

a)

c)

11.

b) 27, 22

d) 26, 35

As per Policy Guidelines 2011-12 Gross NPA

should be ------ %

a)

c)

10.

20, 30

25, 32

25

45

b)

d)

30

40

As per Policy Guidelines 2011-12, -------- number of new mobile banking users

are to be added .

a)

c)

20lac

25 lac

b)

d)

10lac

30lac

2

STATE BANK LEARNING CENTER, PANCHKULA

16.

As per Policy Guidelines 2011-12, ------ lac new Retail users of INB are to be

added .

a)

c)

17.

120

200

b)

d)

300

150

10

25

b)

d)

20

15

As per Policy Guidelines 2011-12, net interest margin for the bank should be

-----------a)

c)

20.

50

25

As per Policy Guidelines 2011-12 the NRI deposits have been budgeted to

increase by %. Under the overall growth target for deposits.

a)

c)

19.

b)

d)

Income from cross selling Buisness is targeted to increase by ..% in 2011-12

a)

c)

18.

24

30

3.5

4.2

b)

d)

3.40

2.85

As per Policy Guidelines 2011-12 in the growth in agriculture advances is set

at ---------%

a)

c)

20

40

b)

d)

30

25

Key to Policy Guidelines 2011-12

1

C

6

A

11

B

16

A

2

A

7

B

12

A

17

B

3

C

8

D

13

B

18

A

4

D

9

B

14

A

19

B

5

C

10

D

15

A

20

D

STATE BANK LEARNING CENTER, PANCHKULA

Policy Guidelines 2011 - 12

1.

As per Policy Guidelines 2011-12. Target of cash recoveries in NPAs and also

upgradation of NPAs has been budgeted at crores,&..crores.

a)

c)

3000,5560

5000 ,6750

b)

d)

4000,4500

4200, 3200

2.

As per Policy Guidelines 2011-12, out of total advances to micro and small

enterprises ----- % should go to micro enterprises.

a) 40

b) 55

c) 60

d) 45

3.

As per Policy Guidelines 2011-12 , --------- no of Finanacial plans including

General plans have been budgeted to be prepared.

a) 1,20,000

c) 1,50,000

4.

b)

d)

1,00,000

2,00,000

As per Policy Guidelines 2011-12 , the market share of Deposits and Advances

is to increase by more than .. & .basis points .

a)

c)

60, 45

45, 40

b)

d)

65, 50

70, 65

5.

As per Policy Guidelines 2011-2012, %age of transactions through alternate

channels should be------%.

a) 40

b) 50

c) 60

d) 45

6.

As per Policy Guidelines 2011-2012, our capital adequacy should be above---------%

a)

c)

7.

b)

d)

15

13

As per Policy Guidelines 2011-2012, the average Daily Average Hits at ATMs

have to Increase from

a)

c)

8.

12

14

365 to 370

340 to 350

b)

d)

370 to 390

400 to 410

As per Policy Guidelines 2011-2012, all accounts under --------are to be RINB

enabled

a) SME

b) CSP

c) Saving Plus

d) Current a/c

4

STATE BANK LEARNING CENTER, PANCHKULA

9.

As per Policy Guidelines 2011-2012 the target for increase in Govt .

Commission is Budgeted to increase by about %

a) 35

b) 40

c) 33

d) 20

10.

The target for Credit Linking of SHGs for the year ending 31-03-2012 has been

fixed at Lacs

a)

c)

11.

4

3.5

b)

d)

As per Policy Guidelines 2011-2012 the target for opening of No Frill a/cs has

been fixed at --------lacs

a) 15

c) 10

12.

13.

3

2

b)

d)

30

25

Per deposits and advances growth target set for SCE branches for the year

2011 -12 is ----- % & ------- %

a) 40, 40

b)35 , 35

c) 60, 40

d)50, 30

Net NPA %age for the year 2011-12 should be -------a) 1.00

b) 2.05

c) 2

d) 1.50

Key to Policy Guidelines 2011 - 12

1

C

6

D

11

D

2

C

7

A

12

B

3

A

8

B

13

A

4

C

9

D

5

B

10

A

STATE BANK LEARNING CENTER, PANCHKULA

ANNUAL RESULTS 2010-2011

1. The % of share held by government of India in SBI s equity is ----(a)59.63

(a)59.60

(c)59.40

(d)49.40

2. The total deposits of the bank as on 310311 have crossed ----- Cr.

(a) 833000

(b)923000

(c)933000

(d)943000

3. The total advances of the bank as on 310311have crossed.cr.

(a)350,000

(b)771000

(c)781000

(d)791000

4. Operatig profits of the bank have grown upto Rs. cr. For the year ending

2011.

(a)5000

(b)25335

(c)38351

(d)28351

5. The bank has declared a dividend of per share of Rs.for the year ending

2011 .

a)30

(b) 25

(c) 28

(d) 29

6. Interest income on loans has grown by% over FY 2010 .

a) 22.12

7

b) 20.26

c) 18.45

d) 23

The Bank has recorded a NIM of (Net Interest Margin ) % for the year

ending 2011 .

a) 3.09

b) 3.32

c) 2.83

d) 2.73

8. Market share in deposits for the year ending 31.03.2011 is ..%

a) 17.03,

b)15.40

c) 17.40

d) 16.40

9. How many domestic branches of SBI are there as on 31.03.11

a)

12596

b)

135332

c)

13542

d)

12156

STATE BANK LEARNING CENTER, PANCHKULA

10. The CASA ratio has improved from 46.67% as on March 2010 to -------as on Mar.2011 .

a) 48.66

b) 47.94

c)45.32

d) 46.01

11. The net profit of State Bank of India for the year ended 31st March 2011

was:____

a) Rs. 8361.52 crore

c) Rs. 8264.52crore

12.

b)

d)

Rs.9381 crore

Rs.9564.45 crore

The paid up capital of State Bank of India as on 31st March 2011 was:

a)

c)

Rs.562.29 crore

Rs.500 crore

b)

d)

Rs.1000 crore

Rs.635 crore

13. The authorised share capital of State Bank of India as at the end of 31st

Mar2011 was:

a) Rs.100 crore

c) Rs.500 crore

b)

d)

Rs.200 crore

Rs.1000 crore

14. The paid up capital and reserves of State Bank of India as at the end of 31st

March 2011 was in the range of:

a)Rs.50000 Rs. 60000 crore

c)Rs.45000 Rs. 48000 crore

15.

b)

d)

Rs.68000 Rs.70000 crore

Rs.64000 Rs.65000 crore

The number of State Bank Group ATMS as on 31st March.2011 are:

a) 25006

c) 25003

b)

d)

25005

24500

16. Profit for the fourth Quarter ending 2011 was -------- Rs.

a)28.08

17.

18.

b) 24.01

c) 20.88

d) 20.46

Earning per share (EPS) of State Bank of India for the year 2010-2011

was:

a) Rs.132.15

b) Rs.140.15

c) Rs166.31

d) Rs. 130.16

The Buisness growth for the year ending 31.03.2011 is Rs..Crores

a)250142

b) 190145

c )260139

d) 240139

STATE BANK LEARNING CENTER, PANCHKULA

19.

The credit deposit ratio for the year ending 2010-2011 is...%

a)75.74

20.

b)76.32

c)7 6.03

Gross and Net NPA,s as at the end of

a)3.28, 1.63

b) 2.98, 1.78

22.

b)11.98

Basel 11 is .% for the year ending

c)10.69

d) 11.79

The Bank has reached a provision coverage ratio of % for the year

ending 2011

a)64.95

23.

31.03.2011 are .,..%

c) 2.48 ,1.90 d) 3.05, 2.09

21. Banks Capital Adequacy Ratio as per

31032011 .

a)11.78

d) 74.94

b) 60.63

c)71.63

d) 59.37

Our Banks Cost of Deposits has decreased to % as on 31.03.2011

a)5.26

b)5.39

c)6.60

d)6.90

24. The return on equity for the year ending March 2011 is-------.

a)12.84

25.

b) 11.90

c)15.23

d)12.01

The return on average assets for the year ending 2011 is -------- %

a)0.71

b)0.65

c)0.63

d)0.68

KEY TO ANNUAL RESULTS 2010-2011

1

C

6

C

11

C

16

C

21

B

2

C

7

B

12

D

17

D

22

A

3

B

8

D

13

D

18

C

23

A

4

B

9

C

14

D

19

B

24

A

5

A

10

A

15

B

20

A

25

A

STATE BANK LEARNING CENTER, PANCHKULA

SAFE DEPOSIT LOCKERS/SAFE CUSTODY

1.

A has hired a locker with your branch, he sends the key by post with an

intention to surrender the locker, in this situation---------a) Bank will be discharged of its liability, if key is accompanied by a letter stating

the contents of the lockers as NIL

b) The bank will not be discharged of its liability

c) The bank should not accept

d) Bank can accept subject to its rights under reserve

2.

Your branch has a locker account in the joint names of A and B to be operated

as either or Survivor. You receive information of death of B, in this event--------:

a)

b)

c)

d)

3.

A authorizes B for operating his locker. B approaches the bank for surrender

there of. How would you react?

a)

b)

c)

d)

4.

B can surrender the locker

B cannot surrender the locker

If contents are nil he can surrender

None of the above

When a locker is broken open the presence of which of the following is not must-------a)

b)

c)

d)

5.

A can operate the locker with legal heirs of B

For operations of locker permission of court is needed

A can operate the locker

None of the above

Locker hirer or his legal heirs

Two independent witnesses

Branch officials

Representative of local police

A and his wife B have hired a locker in joint names; A is residing abroad. B

informs about loss of key of the locker and asks for breaking open the locker, in

this event-----:

a) Bank will not accept the request

b) Bank can accept on the basis of indemnity

c) Bank can accept the request on the basis of indemnity bond and power of

attorney in her favour from A

d) None of the above

STATE BANK LEARNING CENTER, PANCHKULA

6.

When a hirer surrenders a locker, the surrendered locker-------------a)

b)

c)

d)

7.

A locker on hire can not be given to which of the following-----------:

a)

b)

c)

d)

8.

Cannot be allotted to any other person

After interchanging the lock of the locker with any other empty locker, it can

be allotted to any new hirer

The surrendered locker can be allotted to new hirer only after 3 years from

date of surrender

None of the above

A minor

An illiterate person

To clubs, societies & associations

All of the above

A and his wife B are having locker with either or survivor clause. A informs that

his wife has gone insane and requests the bank not to allow her to operate the

locker. The bank--------------a) Will allow operation by B till A gives a certificate to the bank to the affect that

B has become insane and bank is satisfied with this.

b) Will not allow operation by her

c) Only joint operations here after

d) None of the above

9.

What would be the course of action in case of loss of safe custody receipt by the

customer----------:

a)

If satisfied, the bank can issue a duplicate on written request from the

customer

b) The contents would be seized

c) The bank can issue a duplicate after obtaining indemnity bond.

d) Duplicate cannot be issued as it is not a negotiable instrument

10.

When the bank accepts articles for keeping in safe custody, the relationship

between the banker and the customer is that of-----------a)

b)

c)

d)

Trustee and beneficiary

Bailor and bailee

Chief and agent

Bailee and Bailor

10

STATE BANK LEARNING CENTER, PANCHKULA

11.

A customer keeps NSCs in the name of his minor son in safe custody with the

bank. Immediately after attaining majority the son approaches the bank with a

request that the certificates be delivered to him as he is major now, in this event---------,

a) Bank will not deliver to him

b) Bank will deliver to him after attaining proper introduction and discharge

c) Bank will neither deliver him nor let him have the details

d) Bank will deliver to the father who had handed over the certificates to the

Bank

12.

Articles left in safe custody cannot be delivered on the basis of a succession

certificate because----:

a)

These are not included in debt and securities as defined under Indian

succession act 1925

b) It is not allowed under RBI act

c) It is not permitted under negotiable instruments act

d) None of the above

13.

A minor wants to keep certain articles in safe custody. The Bank -----------a)

b)

c)

d)

14.

A, while keeping a sealed packet in safe custody gives instruction to the bank

that the packet should be delivered to the B after his death. In this event, bank --------a)

b)

c)

d)

15.

Will not accept the articles

Can accept and keep articles in safe custody

Can accept if it is a fixed deposit in his name

None of the above

Can accept the articles

Should not accept the packet

Can accept with power of attorney in favour of B

None of the above

In case of accepting articles in safe custody, the nomination facility is available

under

a)

b)

c)

d)

Negotiable instruments act 1981

Banking Regulations act 1949

RBI act 1934

Indian contract act 1872

11

STATE BANK LEARNING CENTER, PANCHKULA

16.

Mr. X, approaches your branch to deposit in safe custody, his term deposit

receipt (issued by other bank), How would you react----------------------a)

b)

c)

d)

17.

The packets or boxes accepted for keeping in safe custody must bear which one

of the following seals------------:

a)

b)

c)

d)

18.

It can be accepted, provided the other bank has no objection to this

It can be accepted, if the customer provides indemnity bond

It can be accepted in normal course

It cannot be accepted, since it is a term deposit issued by another bank, this

has primary lien on deposit.

Seal of the Bank

Seal of the depositor

Both the above

None of the above

The relationship between the bank and hirer of a locker is that of------------:

a)

c)

19.

Debtor-Creditor

Licensor -Licensee

b)

d)

Bailor-Bailee

Principal-agent

Locker hiring Charges for a locker (small type) in a Urban Branch are------:

a)

c)

Rs. 550 p.a.

Rs. 1000/- p.a.

b)

d)

Rs. 750/- p.a.

None of the above

20. Safe custody receipt in respect of branch duplicate keys is kept in the

a)

b)

c)

d)

joint custody of the branch manager and manager cash

sole custody of the branch manager in his hand safe.

joint custody of the accountant and cash officer

sole custody of accountant

KEY : Safe Deposit Lockers/Safe custody

Q.

Ans.

Q.

Ans.

1

a

11

b

2

c

12

a

3

b

13

c

4

d

14

b

5

c

15

b

6

b

16

c

7

a

17

b

8

c

18

c

9

c

19

c

10

d

20

b

12

STATE BANK LEARNING CENTER, PANCHKULA

DISPOSAL OF ASSETS OF DECEASED CONSTITUENTS

1.

The term intestate is used with reference to -----------a) Settlement of claim in case of a deceased customer

b) Payment to the nominee in case of a deceased customer

c) A person died without leaving a will.

d) A person died after leaving a will

2.

As per extant instructions regarding payment of balances in the deceased

constituents accounts, no separate affidavit (COS 539) would be required for an

aggregate amount upto Rs.______

a) Rs. 0.50 lacs

b) Rs. 1 lac

c) Rs. 2 lacs

d) Rs. 3 lacs

3.

As per extant instructions regarding payment of balances in the deceased

constituents accounts, for an aggregate amount above Rs. 1 lac separate

stamped affidavit (COS 539) would be required, which should be signed by:

a) One person

b) Two persons

c) Three person

d) four persons

4.

A person will be declared as legally dead, if for a period of_.....year or more, the

persons who would have normally known of his existence have not heard of him /

known of his existence:

a)

5

b)

6

c)

7

d)

8

5.

When a person dies without leaving behind a will, a person appointed by court to

manage his estate is called:

a)

An executor

b)

An attorney

c)

An administrator

d)

A trustee

A box was kept as a safe deposit article at your branch. The legal heir to the

estate of the deceased has now requested you to deliver the article to him.

Which of the following documents is to be obtained?

a) Succession certificate

b) Letter of administration

c) Affidavit -cum-indemnity bond

d) A simple receipt signed by the heir

6.

13

STATE BANK LEARNING CENTER, PANCHKULA

7.

A Probate is-------------------------a) Will of the deceased.

b) The last will of a person certified by legal heirs

c) A copy of will certified by a court for settlement of property of the deceased.

d) A registered will of the deceased.

8.

A will is Probated by the Court under which of the following Act-------------------a) Indian Succession Act

b) Banking Regulation Act

c) Indian Contract Act

d) Hindu Succession Act

9.

An Executor is-------------:

a) A person appointed by the court to sell the assets of a deceased person.

b) A person who is named in the will of a deceased person to manage his estate

c) A person appointed by the legal heirs to execute their orders.

d) None of the above.

10

As per extant instructions as regards to payment of balances in the deceased

constituents accounts, no surety would be required for an aggregate amount upto

Rs.----------a) Rs.1, 000

b) Rs. 50,000

c) Rs. 10,000

d) Rs. 20,000

11

A succession certificate is--------------a) A document in the form of a court certificate which authorises a person to

succeed to the properties of a deceased person.

b) A document which authorises to receive property

c) An order by a court.

d) A petition approved by a court.

12.

A succession certificate issued by a court of law is operative ---------a)

b)

c)

d)

13.

Within the Distt.

Within the State

Within India.

At a place specified in the certificate.

A succession certificate is issued in respect of which of the following-----:

a)

Debts and Securities due to the deceased (i.e. deposits and

shares/securities)

b) Gold Silver etc.

c) Gold offered as security of loan.

d) None of the above.

14

STATE BANK LEARNING CENTER, PANCHKULA

14.

Which of the following statement is not correct----------?

a) Nomination can be made by illiterate depositor

b) Nomination can be made in joint Accounts also

c) Only one person can be nominated in deposit accounts

d) Two persons can be nominated in the Joint Deposit Accounts

15.

Nomination by illiterate to be witnessed by------------a)

b)

c)

d)

16

For a deposit account in the name of a minor, who can make the nomination-----a)

b)

c)

d)

17.

The natural guardian or legal guardian

The minor himself

No nomination in minor deposits

None of the above

Nomination, cancellation of Nomination and change in nomination require--------a)

b)

c)

d)

18.

One person

Two persons

A Bank Official

Nominee

Registration with Revenue authorities

Registration with Co. Act

Registration with RBI under BR Act

No Registration is required

In case the nominee predeceases the account holder, the nomination---------------a)

b)

c)

d)

Automatically Stands cancelled

Requires request for cancellation

Legal representation is required

Will require renewal

19.

Nomination can be made in favour of------------:

a) Institutions/Societies

b) Joint Nominee

c) Individuals

d) Blood Relation only

20

The person who makes a Will is

a) Legatee

b) Testator

c) Executor

d) None of the above

15

STATE BANK LEARNING CENTER, PANCHKULA

21.

The person who inherits property under a Will is

a) Legatee

b) Testator

c) Executor

d) None of the above

22.

A will to be valid must be ------a) Attested or witnessed by 2 or more witnesses

b) Attested or witnessed by one witness is sufficient

c) Attested or witnessed by 4 or more witnesses

d) Need not be attested or witnessed

23.

A will to be valid must be ------a) Should be stamped

b) Attracts advalorem

c) No stamp duty is required

d) To be executed on a stamp paper

24.

The document that alters, adds or explains a will and is deemed to be part of a

will is------a)

b)

c)

d)

Annexure

Add-on will

Codicil

None of these

25.

While opening account in the name of an executor we must obtain---a) Original Will

b) Probate

c) Succession Certificate

d) Letter of Administration

26.

Balance in the account of a deceased constituent can be attached by a

a) Garnishee order issued by the Court

b) Attachment order of Revenue Authority

c) None of these

27.

Which of the following documents you will call for in permitting removal of the

contents of the locker in case of death of locker hirer who has not nominated any

one?

a)

Heir ship certificate

b)

Succession certificate

c)

Certificate of administration general

d)

Letter of administration

16

STATE BANK LEARNING CENTER, PANCHKULA

28.

As per RBI instructions claim upto Rs. ________ can be settled without legal

representation if there is no dispute and Bank has no reasonable doubt about the

claimant and all legal heirs join in indemnifying.

a)

b)

c)

d)

10 lacs

25 lacs

100 lacs

No limit

29.

Payment to the claimants of deceased claim cases is made---------a)

by credit to the accounts of claimants

b)

by adding the name of the claimants to the accounts of the deceased

constituent

c)

to be made through Bankers Cheque, which should be properly

discharged

d)

by cash

30.

What is the procedure of delivering the gold ornaments pledged to the bank

without legal representation?

a)

The Letter of Indemnity is to be obtained on the appropriate form

b)

The receipt of the claimants is to be obtained in the Gold Loan Ledger

under authentication of the joint custodians

c)

A separate receipt detailing the items delivered is to be obtained from the

claimants

d)

All the above

31. As per RBI instruction the claims up to a threshold limit of Rs------------ will be

entertained without insisting for valid death certificate in case of missing persons.

a)1.00lac

b) 0.50lac

c)2.00lac

d)1.50lac

32. The documents required for settling claim in respect of missing persons without

production of valid death certificate are

a) FIR

b)Non-traceable report issued by the police authorities.

c) Indemnity from the claimant

d) all the above

17

STATE BANK LEARNING CENTER, PANCHKULA

Answers

DISPOSAL OF ASSETS OF DECEASED CONSTITUENTS

1

c

11

a

21

a

31

2

b

12

c

22

a

a

3

a

13

a

23

c

32

4

c

14

d

24

c

d

5

c

15

a

25

b

6

b

16

a

26

b

7

c

17

d

27

d

8

a

18

a

28

d

9

b

19

c

29

c

10

b

20

b

30

d

18

STATE BANK LEARNING CENTER, PANCHKULA

TRANSFER PRICE MECHANISM

1. MRFTP STANDS FOR

(a) Money related funds transfer procedure

(b) Money related funds transfer pricing

(c) Market related funds transfer procedure

(d) Market related funds transfer pricing

2. MRFTP has been launched with the undernoted objectives in mind

(a)

(b)

(c)

(d)

the previous exercise use to take lot of pain & labour

to save considerable time

to facilitate consolidation & transmission of the TPM reports to corporate center

Maintenance of backup registers, manual calculations /interventions and

validations were making the whole process of preparations of P Form a

cumbersome one

(e) All of the above

3. MRFTP is a scientific internal funds

supplement the .

(a) Top management

(b) Profitability

(c) Asset Liability management

(d) Market pricing

4.

transfer price mechanism evolved to

MRFTP is a system under which the market is scanned on a daily basis to arrive at

the &

(a) TP Bid rates

(b)TP Offer rates

(c) Interest Rates

(d) a & b above

5. TP Bid rate is equivalent to

(a) C.O interest rates for deposits

(b) SBAR

(c) Bank Rate

(d) None of the above

19

STATE BANK LEARNING CENTER, PANCHKULA

6. TP offer rate is equivalent to

(a)C.O interest rates for advances

(b)SBAR

(c) Bank Rate

(d)None of the above

7. TP rates are arrived at by a method called

( a) market Pricing

(b) Security Pricing

(c) Matched maturity funding

(d) T P Funding

8 TP rates are calculated by taking into consideration . of the account.

(a) the origination date

(b)Maturity date

(c ) repayment schedule

(d)repricing characteristics

(e)All of the above

9 Under MRTFP , TP rates are assigned to each deposit /advance account except for

(a) Cash Credit Account

(b) MTL A/c

(c) Demand Deposits

(d) None of the above

10 TP rates are different for different market segments

(a) Are same for all the segments and population groups

(b) Similar for AGR & SIB segments only

(c) Different for metros, urban , Semi Urban & Rural areas

(d) Same for metro and urban and different for semi urban and rural

11

For staff deposits TP bid rate is ------basis points over and above the interest

tate of the account

(a) 25

(b) 30

(c) 10

(d) 15

20

STATE BANK LEARNING CENTER, PANCHKULA

12 For all term deposit products the TP bid rates are picked up from the .., on

the date of origination of the deposit, for the tenor/period of the deposit.

(a) Market

(b) ALM Deptt

(c) RBI

(d) TP Bid Curve

13.

The Demand deposits are non maturity deposit accounts like Savings account,

Current Account where maturity pattern is arrived at based on the behavioral

study of . .

(a) Customers

(b) Share Market

(c) Debt Market

(d) the said accounts

14.

For Savings , it is assumed that 10 % of the balances are paid on the . day

and the remaining balance of 90 % is paid at the end of the 1st year, 3rd Year

and 5th Year in equal proportions.

a)

14th

b)

10 th

c)

30th

d) 15th

15.

TP bid rate for Savings account is

(a)

(b)

(c)

(d)

16.

TP bid rate for Current account is

(a)

(b)

(c)

(d)

17.

14day rate* 0.10,+(1 yr rate*0.3)+(3 yrs rae*0.3 )+5 yrs rate *0.3)

10day rate *0.10,+(1 yr rate*0.3)+(3 yrs rae*0.3 )+5 yrs rate *0.3)

15day rate *0.10,+(1 yr rate*0.3)+(3 yrs rae*0.3 )+5 yrs rate *0.3)

30day rate *0.10,+(1 yr rate*0.3)+(3 yrs rae*0.3 )+5 yrs rate *0.3)

14day rate* 0.15,+(1 yr rate*0.3)+(3 yrs rae*0.3 )+5 yrs rate *0.25)

10day rate *0.10,+(1 yr rate*0.3)+(3 yrs rae*0.3 )+5 yrs rate *0.3)

15day rate *0.10,+(1 yr rate*0.3)+(3 yrs rae*0.3 )+5 yrs rate *0.3)

30day rate *0.10,+(1 yr rate*0.3)+(3 yrs rae*0.3 )+5 yrs rate *0.3)

TP bid rate for special schemes/ Foreign currency deposits is arrived at by

adding to the interest rate of the deposits

(a) Expenses

(b) Commission

(c) 30 basis points

(d) None of the above

21

STATE BANK LEARNING CENTER, PANCHKULA

18.

For cash balance Tp offer rate of-----day/days as on date of transfer pricing date

is taken

(a) 14

(b) 7

(c) 1

(d) 3

19. For fixed rate loans as demand deposits,(except demand deposits against banks

own securities and term loans TP offer rate is arrived at by a method called -----(a) duration

(b) behavioural analysis

(c) moving averages

(d) projection

20. For fixed rate loans like CC&OD TP offer rate is arrived , just like in

(a) DL

(b) TL

( c) SB/CA

(d) one of the above

KEY TO ASSIGNMENT

TRANSFER PRICE MECHANISM

1

D

6

A

11

A

16

A

2

E

7

C

12

D

17

C

3

C

8

E

13

D

18

C

4

D

9

C

14

A

19

A

5

A

10

A

15

A

20

C

22

STATE BANK LEARNING CENTER, PANCHKULA

Remittances/Collections-1

1. RTGS stands for ----------a) Risk Taking Guarantee Scheme

c) Right Transaction General Scheme

b)

Real Time Gross Settlement

None of the above

d)

2. RTGS Scheme is managed by---------a) State Bank of India

c) Reserve Bank of India

b)

Indian Banks Association

d) None of the above

3. For customer to customer transaction minimum amount that can be sent is

a)

b)

c)

d)

Rs2.00lacs

Rs5.00lacs

Rs1.00lacs

No minimum

4. Transactions under RTGS are reconciled at--------a) CDC Belapur

c) F.D. Calcutta

b) IOR Deptt. C.O. Mumbai

d) Reserve Bank Of India

5. In case of payment of IOI, the paying Banker is protected under

section_______ of Negotiable Instrument Act1881, if other conditions are

satisfied:

a) 85

c) 131

b) 85A

d) 138

6. A duplicate IOI can be issued for an amount up to Rs. ____ without waiting for

the non-payment advice from the drawee branch:

a) Rs.5,000

c) Rs.15, 000

b)

d)

Rs.10, 000

Rs.15, 000

7. For valued constituents, a duplicate IOI can be issued without insisting for any

surety, where the amount of IOI is below Rs. --------a)

b)

c)

d)

Cannot be issued without obtaining surety

Rs.60, 000/Rs.80, 000/Rs.50, 000/-

23

STATE BANK LEARNING CENTER, PANCHKULA

8. The drawer of a cheque has the right to stop its payment. In the case of a IOI-----:

a)

b)

c)

d)

The branch issuing the IOI has a right to stop its payment

Only the applicant for the IOI has a right to stop its payment

Payment of IOI cannot be stopped

None of the above]

9. In the event of Original and duplicate IOI are presented for payment through

clearing, by two different banks on the same day, the Bank------------a) Will pay the duplicate

c) Will return both

b) Will pay the original

d) both will have to be paid

10. Hologram will be affixed on all IOI of Rs.____ & above includingIOI issued on

continuous stationary:

a)

c)

Rs.0.50 lac

Rs. 2 lacs

b) Rs.1 lac

d) Rs. 10 lacs

11. In case of collection of IOI the collecting Banker is protected under section..

Of Negotiable Instrument Act1881.

a)

c)

85

131

b)

d)

85 A

131 A

12. Branches will provide immediate credit to customers accounts in respect of

outstation cheques up to Rs _______ as per RBI directives:

a) Rs.5, 000

c) Rs.15, 000

b)

Rs. 7,500

d)

Rs. 20,000

13. While making the payment of a Bankers Cheque by cancellation, which of the

following statement is not true:

a) A stamped letter of Indemnity on COS 537 would be required

b) The purchaser can give a simple request letter for cancellation

c) His receipt on the back of the Bankers Cheque (on a revenue stamp if the

amount is Rs 500 and above) under the words, Received Payment by

Cancellation would need to be obtained

d) Strict identification should be insisted upon if the amount is paid in cash

24

STATE BANK LEARNING CENTER, PANCHKULA

14. The present ceiling limit per transaction under Electronic Fund Transfer (EFT)

is ------------:

a) Rs. 1 lac

c) Rs. 2 crores

b)

d)

Rs. 5 lacs

No Ceiling since 01-11-04

15. Interest on delayed collection of instruments is paid by debit to------:

a) Interest Account

c) Savings Bank Interest Account

b) Charges Account-Sundries

d) None of these

16. Drop box facility should not be used for which of the following type of

instruments-----------:

a)

b)

c)

d)

Local Clearing Cheques

Cheques drawn on Branch

Cheques against Government Challans

Outstation cheques for collection

17. A drop box with 03 slits/compartments has three coloured powder coated

compartments-which are these colours:

a) Red, Blue, Green

c) Blue, Red, Yellow

b) Blue, Green, Yellow

d) Red, Green, Yellow

18. As per extant RBI instructions relating to payment of compensation for delayed

collection of instruments, banks should pay interest @ ______________ for the

period of delay.

a) 2% above fixed deposit rate applicable for abnormal delay

b) 1.5% above fixed deposit rate applicable for abnormal delay

( c) 1% above fixed deposit rate applicable for abnormal delay

( d) Savings Bank Rate

19. Bank has decided to waive, issue of draft advices in Agency Clearing upto Rs.-----:

a) 25,000

c) 10,000

b) 50,000

d) 1,00,000

20. A customer X deposits Rs. 5000/- with the bank for remittance by way of

telegraphic transfer for credit of Ys account at other station. The relationship

between Y and bank in this case is that of a:a) Principal and agent

c) Debtor and Creditor

b) Beneficiary and trustee

d) Trustee and beneficiary

25

STATE BANK LEARNING CENTER, PANCHKULA

KEY TO ASSIGNMENT

Remittances/Collections-1

Q.

Ans

Q.

Ans

1

b

11

d

2

c

12

d

3

c

13

a

4

d

14

d

5

b

15

b

6

b

16

c

7

d

17

c

8

c

18

d

9

a

19

c

10

b

20

b

26

STATE BANK LEARNING CENTER, PANCHKULA

Remittances/Collections-2

21. An IOI can be revalidated--------a) Once

b) Twice

c) No restrictions

d) It cant be revalidated

22. Banker Cheques are to be credited to charges account if they are unclaimed

for-------a) Six months

b) One year

c) Three years

d) None of these

23. Maximum amount for which an IOI can be issued is

a) Rs100,00,00,000

c) 99,00,00,000

b) Rs99,99,99,999

d) none of these

24. Which one of the following is required to be submitted by an applicant for

issuance of DDs, BCs of Rs. 50,000 and above-------a) Form 60/61

c) Neither a nor b

b) PAN No.

d) either a or b

25. IOI has ----------digit running serial number

a) 12

b)10

c)11

d)16

26. IOI is valid for----a) 6 months

c) so long it is revalidated

b) 12 months

d) none of the above

27. IOI instruments when examined under Ultra violet rays will show the water mark

of--------a) our corporate centre building

c) words SBI

28. The Hologram has nine digit number.

a) Circle code

c) RBI allotted code for our bank

b) SBIs logo

d) none of the above

The first two digits represent --------b) First two digits of BSR code

d) First two digits of branch code

27

STATE BANK LEARNING CENTER, PANCHKULA

29. Before allowing immediate credit facility (DDP), it is to be ensured that, --------a) Account has been opened for a period not less than six months

b) Minimum balance requirements are met

c) Cheques deposited for collection/credit to the account have not been returned

unpaid

d) All the above

30. What is the time frame for collection of cheques (drawn on our own branches),

between Metropolitan Centres/ Major A Class cities?

a) 6 days

c) 8 days

b) 7 days

d) 10days

31. What is the time frame for collection of cheques (drawn on other bank

branches), between Metropolitan Centres/ Major A Class cities?

a) 6 days

c) 8 days

b) 7 days

d) 10days

32. What is the time frame for collection of cheques (drawn on our own branches),

between Metropolitan Centres / Major A Class cities and State Capitals (Other

than North Eastern States & Sikkim) ?

a) 6 days

c) 8 days

b) 7 days

d) 10days

33. What is the time frame for collection of cheques (drawn on other bank

branches), between Metropolitan Centres / Major A Class cities and State

Capitals (Other than North Eastern States & Sikkim) ?

a) 6 days

c) 8 days

b) 7 days

d) 10days

34. What is the time frame for collection of cheques (drawn on other bank

branches), between centres other than Metropolitan Centres/ Major A Class

cities and State Capitals (Other than North Eastern States & Sikkim) ?

a) 8 days

c) 14 days

b) 7 days

d) 10days

35. What is the time frame for collection of cheques (drawn on our bank branches),

between centres other than Metropolitan Centres/ Major A Class cities and

State Capitals (Other than North Eastern States & Sikkim) ?

a) 8 days

b) 7 days

c) 14 days

d) 10days

28

STATE BANK LEARNING CENTER, PANCHKULA

37.The compensation on account of delays in collection of instruments in foreign

currency would be-a) At 5% p.a. if the period of delay is beyond prescribed collection period and upto 45

days where proceeds of the instruments are to be credited to deposit accounts

b) At 4% p.a. if the period of delay is beyond prescribed collection period and upto 45

days where proceeds of the instruments are to be credited to deposit accounts

c) At 1.5% p.a. if the period of delay is beyond prescribed collection period and upto 45

days where proceeds of the instruments are to be credited to deposit accounts

d) At 2% p.a. if the period of delay is beyond prescribed collection period and upto 45

days where proceeds of the instruments are to be credited to deposit accounts

38.If the collection is realized beyond 45 days it is treated as--------a) Normal Delay

b) Abnormal dealy

b) Delay is delay, it hardly matters whether normal or abnormal

d) No such classification

39.If there is abnormal delay in realization of collection and the proceeds were

meant for credit to overdraft or loan account of the customer, the interest payable

would be at------a) Savings Bank Rate

b) SBAR

c) Rate applicable on Overdraft/Loan

d)1% above the applicable interest rate to the loan account or SBAR, whichever is

lower

40.Force Majure means

a) external acts over which the Bank has control

b) the Bank is liable to compensate the customers for such acts

c) These are the acts done by the customer

d) these are unforeseen events beyond the control of the Bank

KEY TO ASSIGNMENT

Remittances/Collections-2

Q.

Ans.

Q.

Ans.

21

a

31

a

22

c

32

b

23

b

33

c

24

b

34

d

25

a

35

c

26

a

36

d

27

a

37

a

28

a

38

b

29

d

39

d

30

c

40

d

29

STATE BANK LEARNING CENTER, PANCHKULA

INSPECTION/AUDIT-I

1.

RFIA stands for--------a) Return Focus Internal Audit

c) Risk Focused Internal Audit

2.

Inspection and Management Audit Department, Corporate Centre is located

at--a) Navi Mumbai

c) Hyderabad

3.

b)

c)

d)

Inspection and Management Audit Department, Corporate Centre,

Hyderabad

Circle Audit Department

RBI Auditors

Concurrent Auditors

Statutory Audit is conducted by----------a)

b)

c)

d)

5.

b) Jaipur

d) Lucknow

Who conducts Credit Audit?

a)

4.

b) Risk Factor Internal Audit

d) None of the above

Banks Internal Auditors

RBI Officials

Charted Accountants empanelled by RBI

Concurrent Auditors

What is true in respect of RFIA?

a) RBI introduced Risk Based Supervision in banking industry due to frequent

changes in International Banking Scenario & globalisation,

b) RBI announced the move towards Risk Based Supervision in its monitory

policy for 2001-02

c) RFIA is part of RBS

d) All the above

6.

Frequency of circle audit is

a) once a year

b) in between two corporate centre audits

c) Once in two years

d) As directed by RBI

30

STATE BANK LEARNING CENTER, PANCHKULA

7.

Under circle audit branche has to submit compliance remarks within

months?

a)

b)

c)

d)

8.

Serious Drawback in Risk management

Serious Deviations in Risk management

Serious Deficiency in Risk management

Small Deficiency in Risk management

When was RFIA introduced in SBI?

a)

b)

c)

d)

11.

SDRM

MRDS

DRSM

None of the above

SRDM stands for------a)

b)

c)

d)

10.

4

1

3

2

Serious Irregularities under Group Heading (SIGH) of the erstwhile inspection

report format has been replaced by------a)

b)

c)

d)

9.

-------

01-04-2003

01-04-2002

01-01-2003

None of these

New branched are eligible for RFIA in ---months

a)

12

b)

24

c)

15

d)

18

12.

Audit conducted in respect of a particular area either at the request of controller

or decided by Inspection dept, LHO depending on circumstances is called?

a)

b)

c)

d)

controlled audit

internal audit

concurrent audit

spot audit

31

STATE BANK LEARNING CENTER, PANCHKULA

13.

What is a Management Letter?

a)

b)

c)

d)

14.

Under RFIA Branches are categorised into ------- groups

a)

b)

c)

d)

15.

High Risk

Medium Risk

Low Risk

No Risk

Group-III branches are ------a)

b)

c)

d)

18.

Group I

Group II

Group III

No such criteria

Group-II branches are ------a)

b)

c)

d)

17.

Two

Three

Five

Seven

All branches with a minimum aggregate advance of Rs15 cr are placed under

a)

b)

c)

d)

16.

It indicates the staff strength of a branch

It describes the customer service of the branch

It highlights crucial issues of concern

It is the confidential report on the various functionaries at the branch

High Risk

Medium Risk

Low Risk

No Risk

All CAG ,MCG and SAMG branches come under?

a)

b)

c)

d)

Group I

Group II

Group III

No such criteria

32

STATE BANK LEARNING CENTER, PANCHKULA

KEY TO ASSIGNMENT

INSPECTION/AUDIT-I

Q.

Ans.

Q.

Ans.

1

c

11

a

2

c

12

d

3

a

13

c

4

c

14

b

5

d

15

b

6

b

16

b

7

d

17

c

8

a

18

a

9

b

19

10

a

20

33

STATE BANK LEARNING CENTER, PANCHKULA

INSPECTION/AUDIT-II

1

ARF stands for

a) Audit related form

b) Audit rating format

c) Audit report format

d) audir review form

2. Under RFIA ARF

a)

b)

c)

d)

for different branches is-------?

Different for different categories of branches

Same for all branches

Same for group I and II

Same for Group II and III

3. Which parameter has been delinked from RFIA?

a)

b)

c)

d)

4

Risk Rating based on Risk Parameters (1000 Marks)

Business Rating based on Business Parameters (500 Marks)

General Efficiency Rating on the basis of aggregate of Tier I & Tier II

None of these

One of the following is not covered in ARF of Group I branches?

a) External compliance

b) Credit risk management

c) Operational risk management

d) Hardware risk management

5 Maximum credit risk management score for group I branch in ARF is ----a)

b)

c)

d)

525

425

600

750

6 Maximum credit risk management score for group I branch in ARF is-------a)

b)

c)

d)

400

425

500

650

34

STATE BANK LEARNING CENTER, PANCHKULA

7. Maximum operational risk management score for group II branch in ARF is____

a) 700

b) 750

c) 800

d) 650

8 Out of total score of 1000 marks under Risk Rating a branch rated as

Unsatisfactory

has a score of--------a)

b)

c)

d)

9

less than 50%

less than 55%

less than 45%

less than 40%

Which of the following does not fall under high risk under Zero Tolerance

a) false certification of substantive nature in Branch Manager Monthly Certificate

b) Non-checking of VVRs/BGL by a person other than whom they relate to

c) Maintenance of password secrecy and prompt reporting of loss of password of

the INB Customer to the Security Manager, INB Mumbai.

d) Proper custody and accounting of preprinted INB Kit, ATM Pin Mailers and

Welcome Kit

e) None of the above

10.

What is the revised periodicity of RFIA with effect from 01-01-2006 for branches

scoring >85% under Group I?

a) within 18 months

c) within 15 months

11.

What is the revised periodicity of RFIA with effect from 01-01-2006 for branches

scoring 70 -85 % Group II?

a) within 21 months

c) within 15 months

12.

b) within 12 months

d) within 21 months

b) within 12 months

d) within 18 months

What is the revised periodicity of RFIA with effect from 01-01-2006 for branches

scoring 50%> under Group I ?

a) within 18 months

c) within 12 months

b) within 15 months

d) within 21 months

35

STATE BANK LEARNING CENTER, PANCHKULA

13. What is the revised periodicity of RFIA with effect from 01-01-2006 for branches

scoring 50%> under Group II and III?

a) within 12 months

c) within 15 months

14.

b) within 18 months

d) within 21 months

What is the revised periodicity of RFIA with effect from 01-01-2006 for branches

< scoring 50%?

a) 10-12 months

c) 8-10 months

15.

What is the revised periodicity of RFIA with effect from 01-01-2006 for Newly

opened branches?

a)

b)

c)

d)

16.

17.

within 18 months

within 12 months irrespective of Group

within 6-8 months irrespective of Group

within 10 months

One of the following is not covered under operational risk----a) customer service

b) control system

c) general branch mangement

d) problem loan management

One of the following is not covered under credit risk---?

a)

b)

c)

d)

18.

b) 6-8 months

d) 7-9 months

Pre sanction

Problem loan management

remittances

post sanction

Post Audit process comprises of------a) Rectification of irregularities by branches

b) Causes of deficiencies to be identified

c) Controllers to submit action taken for correction along with recommendations for

closer of report

d) All the above

19.

Credit Audit covers borrower accounts with credit limits -----a)

b)

c)

d)

Rs. 5 crore and above

Rs10 crore and above

Rs. 15 crore and above

Rs.3 crore and above

36

STATE BANK LEARNING CENTER, PANCHKULA

20.

Systems audit has been renamed as

a)

b)

c)

d)

21.

Procedure audit

Operational audit

Compliance audit

Systems and procedure audit

RBI Audit is conducted under------?

a)

b)

c)

d)

section 35 of Banking Regulation Act

section 51 of Banking Regulation Act

section 35 of RBI Act

section 35 of SBI Act

KEY TO ASSIGNMENT

INSPECTION/AUDIT-II

Q.

Ans.

Q.

Ans.

Q.

Ans.

1

c

11

d

21

a

2

a

12

c

3

b

13

a

4

d

14

b

5

a

15

b

6

c

16

d

7

b

17

d

8

a

18

d

9

e

19

b

10

a

20

d

37

STATE BANK LEARNING CENTER, PANCHKULA

BASEL II, Capital Adequacy & Risk Managment

1. The worlds oldest international financial organization, Bank for International

Settlements (BIS) having 55 member central banks is situated at:

a)

b)

c)

d)

Paris

Tokyo

London

Basle/Basel, Switzerland

2. The Basel Committee on Banking Supervision [BCBS], is a committee of central

banks that meets_____________ at the Bank for International Settlement [BIS] in

Basel, to provide broad policy guidelines governing the capital adequacy of

internationally active banks

a)

b)

c)

d)

Every month

Every three months

Every six months

Once in a year

3. The Basel Committee on Banking Supervision [BCBS], was set up in ________

by G-10 countries.

a)

b)

c)

d)

1970

1972

1975

1978

4. Basel standards are being used as a benchmark by ____________ in conducting

their assessment of the banking system of a country.

a)

b)

c)

d)

IMF

World Bank

Both of the above

None of the above

5. Basel II norms relate to

a)

b)

c)

d)

Corporate Governance

Non Performing Assets

Capital Adequacy Ratio (CAR)

None of the above

38

STATE BANK LEARNING CENTER, PANCHKULA

6. The Rationale for maintaining Capital Adequacy is

a)

b)

c)

d)

7.

To meet the unexpected losses or losses beyond normal range of operations

To meet the expected losses

Both of the above

None of the above

International Convergence of Capital Measurement and Capital Standards: A

Revised Framework (Basel II ) released by BCBS on __________

a)

b)

c)

d)

26 June 2004

30 June 2004

30 August 2004

26 July 2004

8. The Basel II revised framework consists of three mutually reinforcing pillars. Which

among the following is not the reinforcing pillar ?

a)

b)

c)

d)

Minimum capital requirement

Market discipline

Supervisory review of capital adequacy

ALM Management

9. The Risks Which Determine Capital Requirement under Pillar 1

a)

b)

c)

d)

10.

Credit Risk

Market Risk

Operational Risk

All of the above

As per Basel II Capital Adequacy Ratio should be :

a)

b)

c)

d)

8%

9%

10%

11%

11. As per RBI Capital Adequacy Ratio should be :

a)

b)

c)

d)

8%

9%

10%

11%

39

STATE BANK LEARNING CENTER, PANCHKULA

12.

As per Basel II Capital Adequacy Ratio is :

a)

b)

c)

d)

13.

As per the Prudential Guidelines on Capital Adequacy issued by RBI, Indian

banks having operational presence outside India shall adopt Basic Indicator

Approach with effect from

a)

b)

c)

d)

14.

Tier 1 + Tier 2/ Risk Weighted Assets for Credit risk + Operational risk

Tier 1 + Tier 2/ Risk Weighted Assets for Credit risk +Market risk

Tier 1 + Tier 2/ Risk Weighted Assets for Market risk + Operational risk

Tier 1 + Tier 2/ Risk Weighted Assets for Credit risk +Market risk +

Operational risk

March 31, 2010

March 31, 2009

March 31, 2008

March 31, 2007

Basel II recognises the element of diversification of risk in the

___________sector/s and has assigned a lower risk weight for retail exposure

under standardised approach.

a)

b)

c)

d)

SME

AGL

Both of the above

None of the above

15.

RBI has put forward a framework consisting of few options for

calculating

operational risk capital charges in a continuum of increasing sophistication and

risk sensitivity. These options are:

a) The Basic Indicator Approach (BIA)

b) The Standardised Approach (TSA)

c) Advanced Measurement Approaches (AMA).

d) All of the above

16.

Under the Basic Indicator Approach, banks have to hold capital for operational

risk equal to __________ of average Gross Income for the preceding 3 years.

a)

b)

c)

d)

15%

18%

20%

10%

40

STATE BANK LEARNING CENTER, PANCHKULA

17.

For measuring Credit Risk which of the following menu of Approaches is not

suggested:

a)

b)

c)

d)

18.

For measuring Market Risk which of the following menu of Approaches is not

suggested:

a)

b)

c)

d)

19.

Standard Approach

Internal Models Approach

Advanced Measurement Approach (AMA)

None of the above

For measuring Operational Risk which of the following menu of Approaches is

not suggested:

a)

b)

c)

d)

20.

Standardised Approach

Foundation Internal Rating Based (IRB) Approach

Advanced Internal Rating (IRB) Approach

Internal Models Approach

Basic Indicator Approach

Standardised Approach

Advanced Measurement Approach (AMA)

None of the above

The Revised Framework (Basel II) consists of _______Pillar/s

a) Minimum Capital Requirements

b) Supervisory Review of Capital Adequacy

c) Market Discipline

d) All of the above

21.

The Bank has migrated to Basel II Framework with effect from:

a)

b)

c)

d)

22.

31-03-2008

31-03-2009

31-03-2007

01-01-2008

RBI has asked banks to submit applications for implementing The Standardized

Approach (TSA) by:

a.

b.

c.

d.

31-03-2008

01-04-2009

01-04-2010

01-01-2010

41

STATE BANK LEARNING CENTER, PANCHKULA

23.

The Standardized Approach (TSA) involves the reclassification of the income and

interest expenses of the Bank into ________ business lines:

a) 4

b) 8

c) 7

d) 9

24.

For implementation of TSA all new accounts being opened have to be classified

either under Retail Banking or Commercial Banking. Which of the following

statements are correct in this regard:

I. All advances and deposits in PER segment will be treated as Retail

Banking.

II. Exposure (fund based & non-fund based) to an individual person or

persons or to a small business will be treated as Retail Banking.

III. All existing Deposit accounts in National Banking Group (NBG) shall be

classified under Retail Banking Group.

IV. All Deposit accounts in Corporate Accounts Group (CAG) and Mid

Corporate Group (MCG) will be treated as Commercial, except Staff

accounts.

a)

c)

25.

(i) & (iv)

(i), (iii) & (iv)

b)

d)

(ii) , (iii) & (iv)

All of the above

For implementation of TSA Small Business is defined as one:

(i)

(ii)

(iii)

(iv)

a)

c)

where the total annual turnover is less than Rs. 50 crores

The maximum aggregate Fund Based exposure should not exceed the

absolute threshold limit of Rs. 5 Crores irrespective of the existing

segmentation into SSI, C&I.

The maximum aggregate exposure (Fund Based + Non Fund Based)

should not exceed the absolute threshold limit of Rs. 5 Crores

irrespective of the existing segmentation into SSI & C&I.

the maximum aggregate exposure (Fund Based + Non Fund Based)

should not exceed the absolute threshold limit of Rs. 5 Crores

irrespective of the existing segmentation into SSI, C&I or AGL

(i) & (iv)

(i) & (iii)

b)

d)

(i) & (ii)

None of the above

42

STATE BANK LEARNING CENTER, PANCHKULA

KEY

BASEL II, Capital Adequacy & Risk Managment

1

d

11

b

21

a

2

b

12

d

22

c

3

c

13

c

23

b

4

c

14

a

24

d

5

c

15

d

25

a

6

a

16

a

7

a

17

d

8

d

18

c

9

d

19

d

10

a

20

d

43

STATE BANK LEARNING CENTER, PANCHKULA

BASEL II, CAPITAL ADEQUACY & RISK MANAGMENT

1.

The overall responsibility for overseeing the risk management processes in our

Bank is of _____________.

a)

b)

c)

d)

2.

The Chairman and convener of Operational Risk Management Committee is ______:

a.

b.

c.

d.

3.

b)

c)

d)

To limit the impact of a disruption caused by any disaster, on people,

processes and infrastructure

To ensure continuity, resumption and recovery of critical business

processes at an agreed level, to be approved for each business

function/Office

To take into account the potential for major disasters that could impact an

entire region and plan for minimizing its impact on business and staff.

All of the above.

Business Continuity policy applies to:

a)

b)

c)

d)

5.

Chairman

Managing Director & CCRO

CGM (Risk Management)

CGM (I & A)

The objective/s of the Business Continuity Plan is/are:

a)

4.

Chairman

The Risk Management Committee of the Board (RMCB)

Risk Management Department, Corporate Office

None of the above.

Branches only

Corporate office

LHOs and Administrative Offices

All business and functional areas within the Bank which includes all its

branches and offices.

As per regulatory requirements, the Bank needs to put in place BCP for all its

offices within a specified time frame by ___________.

a)

b)

c)

d)

31-03-2008

31-03-2009

31-03-2010

No time limit has been fixed by RBI for the purpose.

44

STATE BANK LEARNING CENTER, PANCHKULA

6.

The deadline for switching over to the New CRA Models (CRA 2007) by all

Branches was:

a)

b)

c)

d)

7.

30th September, 2007

26th November, 2007

31st December, 2007

31st March, 2008

The new CRA models will be applicable to all accounts in :

Non-Trading Sector (C&I, SSI & AGL segments)

Trading Sector (Including Services).

Both of the above

All segments of the Bank

a)

b)

c)

d)

8.

The new CRA models will be applicable to all accounts with Aggregate Exposure

(FBL + NFBL) of Rs. ____________

a)

b)

c)

d)

9.

CRA 2007 have ______________ models:

a)

b)

c)

d)

10.

Simplified Model

Regular Model

Both of the above

Basel Model

Simplified Model covers accounts with exposure of

a)

b)

c)

d)

11.

10 lacs and above

25 lacs and above

50 lacs and above

100 lacs and above

Rs. 10 lacs and above, but upto Rs. 1 crore.

Rs. 25 lacs and above, but upto Rs. 2 crores.

Rs. 25 lacs and above, but upto Rs. 5 crores.

Rs. 100 lacs and above, but upto Rs. 10 crores.

Regular Model covers accounts with exposure

a)

b)

c)

d)

above

above

above

above

Rs. 1 crores.

Rs. 2 crores.

Rs. 5 crores.

Rs. 10 crores.

45

STATE BANK LEARNING CENTER, PANCHKULA

12.

Simplified Model has __________rating/s

a)

b)

c)

d)

13.

Regular Model has __________rating/s

a)

b)

c)

d)

14.

08, SB 08

10, SB 10

12, SB 12

16, SB 16

The Rating Scale under Facility Rating has been expanded to _______ Grades

(FR1 to ______)

a)

b)

c)

d)

16.

Borrower Rating

Facility Rating

Country Rating

Both (a)&(b)

The Rating Scale under Borrower Rating has been expanded to _______ Grades

(SB1 to ______)

a)

b)

c)

d)

15.

Borrower Rating

Facility Rating

Country Rating

All of the above

08, FR 08

10, FR 10

12, FR 12

16, FR 16

Hurdle Grade under Borrower Rating is ______ & under Facility Rating is

________

a)

b)

c)

d)

SB 04 & FR 04

SB 08 & FR 08

SB 10 & FR 10

SB 12 & FR 12

46

STATE BANK LEARNING CENTER, PANCHKULA

17.

Units having ____________will be eligible for additional Score under Borrower

Rating.

a)

Solicited Ratings from recognised External Credit Rating Agencies

( ECRA)

Current Ratio > 1.33:1

TOL/TNW < 1.50

None of the above

b)

c)

d)

18.

Country Ratings are applicable for units having ________Assets/ Cash flows

originating outside India:

a)

b)

c)

d)

19.

25% or more Assets

25% or more Assets & cash flows

20% or more Assets

20% or more Assets & cash flows

Country Ratings circulated by

a)

b)

c)

d)

20.

Credit Policy and Procedures Department

Credit Risk Management Department

Foreign Department /GMU Kolkata

Risk Management Department

While mapping ratings of borrowers as per the new CRA Model vis--vis the old

Model, which of the following combination is not correct:

(i)

(ii)

(iii)

(iv)

a)

c)

(ii)

(ii) & (iii)

New Rating

SB1, SB2

SB3, SB4, SB5

SB 10

SB8, SB9

b)

d)

Old Rating

SB1

SB2

SB5

SB4

(iii)

None of the above

47

STATE BANK LEARNING CENTER, PANCHKULA

21.

While mapping ratings of borrowers as per the new CRA Model vis--vis the old

Model, which of the following combination is not correct:

(i)

(ii)

(iii)

(iv)

a)

c)

22.

(iv)

None of the above

All branches,

All CPCs

Administrative Offices & LHOs

All branches, CPCs and other offices of the Bank.

Risk Register is required to be introduced by 30-6-2009 and requisite data

relating to FY 2009-10 starting from _________ till date should be incorporated

therein.

a)

b)

c)

d)

24.

b)

d)

Old Rating

SB 6

SB 3

SB 7

SB 8

"Risk Register" is to be maintained to capture and record the range of high level

risk events that might have an impact on the performance of an operating unit

and the plans for mitigating them by :

a)

b)

c)

d)

23.

(ii)

(ii) & (iii)

New Rating

SB11, SB12

SB6, SB7

SB 13, SB 14

SB 15, SB 16

01-04-09

01-06-09

01-07-09

01-01-09

Under Centralised Access Control Policy for de-provisioning of user-IDs, the

User-ID of the staff who has been posted abroad/ outside the Bank in other

organisation etc. (on deputation) will be

a)

b)

c)

d)

De-activated. However, it can be activated by LHO functionaries as and

when required.

Permanently deactivated with past records

Deactivated by the respective transferor branch. The user-IDs will be

reactivated upon resuming duty at the transferee branch.

None of the above.

48

STATE BANK LEARNING CENTER, PANCHKULA

25.

Under Centralised Access Control Policy for de-provisioning of user-IDs, the

User-ID of the staff who has been transferred to other branch/office will be

a)

b)

c)

d)

26.

Under Centralised Access Control Policy for de-provisioning of user-IDs, the

User-IDs not put to use in CBS for 15 days and above will be automatically

Deactivated in CBS and reactivation will be made at the request of branch head/

department head/ controller

a)

c)

27.

De-activated. However, it can be activated by LHO functionaries as and

when required.

Permanently deactivated with past records

Deactivated by the respective transferor branch. The user-IDs will be

reactivated upon resuming duty at the transferee branch.

None of the above.

15 days

45 days

b)

d)

30 days

60 days

One of the prerequisites for migration to Internal Rating Based (IRB) Approach

under Credit Risk is that the Bank should have capability to estimate

a)

Probability of Default (PD)

b)

Loss Given Default (LGD)

c)

Exposure at Default (EAD)

d)

All of the above

Key

BASEL II, Capital Adequacy & Risk Management

1

b

10

c

19

c

2

b

11

c

20

d

3

d

12

a

21

b

4

d

13

d

22

d

5

d

14

d

23

a

6

b

15

d

24

a

7

c

16

c

25

c

8

b

17

a

26

a

9

c

18

b

27

d

49

STATE BANK LEARNING CENTER, PANCHKULA

ASSIGNMENT 1 (Deposit Accounts)

01

As per Savings Bank Rules- Minors who can adhere to uniform signature and are

not less than 10 years old, can open Savings Bank Accounts in their single name

and can maintain a maximum balance of:

a)

b)

02

Rs 1.00 lac

Rs 5.00 lac

Rs.1/Rs.10/-

b)

d)

Rs.5/Rs.50/-

Rs. 5/Rs. 50/-

b)

d)

Rs. 10/Rs. 100/-

Rs. 5/- per entry

Rs.15/- per entry

b)

d)

Rs.10/- per entry

Rs.20/- per entry

What is the minimum average balance required to be maintained in a current

account by Non-Individuals in Rural Areas & Other Areas

a)

c)

07

b)

d)

What are the service charges for debit entries in excess of thirty entries excluding

alternate

channels like transactions through State Bank ATMs and Internet

Banking during a half year in Savings Bank Account?

a)

c)

06

Rs. 50000/Rs 20.00 lac

What is the minimum permissible amount for withdrawal from a Savings Bank

Account?

a)

c)

05

Rs.50,000/Rs.2,00,000/-

What is the minimum cash amount that can be deposited in a Savings Bank

Account?

a)

c)

04

b)

d)

The Maximum deposit in the minors a/c under guardianship can be up to-----:

a)

c)

03

Rs.20,000/Rs.10,000/-

Rs.2500 & Rs. 5000/- respectively b) Rs. 5000 & Rs. 10000/- respectively

Rs.2000 & Rs. 5000/- respectively d) Rs.1000 & Rs. 5000/- respectively

What is the minimum average balance required to be maintained in a current

account by Individual in Rural Areas & Other Areas

a)

c)

Rs.2500 & Rs. 5000/- respectively b) Rs. 5000 & Rs. 10000/- respectively

Rs.2000 & Rs. 5000/- respectively d) Rs.1000 & Rs. 5000/- respectively

50

STATE BANK LEARNING CENTER, PANCHKULA

08