Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

E-Circular: Mobile Banking Service (MBS) Fraud Reported

Caricato da

mevrick_guyDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

E-Circular: Mobile Banking Service (MBS) Fraud Reported

Caricato da

mevrick_guyCopyright:

Formati disponibili

e-Circular

CORPORATE STRATEGY & NEW BUSINESSES.

Sl. No. : 205/2011 - 12

Circular No. : CS&NB/CS&NB-TECH/10/2011 - 12

Tuesday,June 14,2011.

.

13.06.2011

Circular CS&NB/MBS/2011-12/07

The Chief General Manager,

State Bank of India,

Local Head Office,

All Circles

Dear Sir/Madam,

Mobile Banking Service (MBS)

Fraud Reported

Recently one of the Circles has reported a case wherein fraud could be perpetrated due

to lapse on the part of the branch functionaries to verify the signature of the applicant on

the Application Form for Mobile Banking Service. The modus operandi of the fraud case

is as under:

A Savings Bank account was opened in one of the branches by the fraudster on

the strength of voter ID card, electricity bill as proof of identity and address

respectively and an introduction from an account holder. Subsequently, after

obtaining required information about some customers and their accounts, the

fraudster approached different branches to enable these accounts for Mobile

Banking Service using different mobile numbers and transferred Rs.5,58,700/from these accounts to his newly opened account. The fraud came to light when

two of the customers informed the Bank that they have not enabled Mobile

Banking for their accounts and that the funds have been transferred fraudulently.

2. An internal investigation was carried out by the Circle and findings of the report

bring out the following lapses on the part of branch functionaries:

Signatures of the customers on the application forms for Mobile Banking

Service differed from those on record indicating that the branch staff did not

verify the signatures before enabling the accounts for Mobile Banking Service.

The account of the fraudster was opened without proper verification of the

documents submitted and the genuineness of the introducer.

3. In order to obviate the possibilities of such incidents in other branches, we reiterate

the Circular instructions issued in regard to enabling a customers account for Mobile

Banking Service:

After completing the validation process over mobile handset which includes

obtaining User ID & default MPIN and changing the default MPIN, the customer

can complete the registration process either over ATM or at the home branch of

the account to be enabled for Mobile Banking Service.

If the customer approaches the branch for registration for MBS, an application

has to be obtained from him in the prescribed form (Annexure A).

The application form should be scrutinized by the official in charge of Registration

of Mobile Banking Service to verify the genuineness of the information submitted

by the applicant. It should be ensured that the applicant has the authority to

operate the account by verifying the signature on the application form with

that on record in the Banks System. This can be done during the registration

process also. After entering the account number (both primary and secondary

accounts) in the CBS screen for MBS registration, the signature can be invoked

and scrutinized by pressing F10 button on the keypad.

The registration for MBS has been enabled for staff having the capability level of

5 and above without maker-checker which means that an official of capability

level 5 and above can enable a customer for MBS in his sole rights. Though

mobile banking registration is treated as a non financial transaction, it may

be borne in mind that linking a particular account to a given user id and

mobile number, gives unfettered authority to the owner of the mobile

number to debit the linked account. Hence utmost caution should be

exercised in scrutinizing the application form and signature verification.

The application forms for MBS registration may be serially numbered, arranged

and suitably preserved for permanent record in a fashion similar to the Account

Opening Forms.

Joint accounts where the account is to be operated by all or some of the account

holders jointly cannot be registered for mobile banking service.

4. Please bring the contents of the Circular to the notice of all the branches under your

control and ensure meticulous compliance.

Yours faithfully,

Chief General Manager (CS&NB)

The Branch Manager

State Bank of India

Date :

Sl. No.:

-------------------------* I/we wish to register/ deregister for Mobile Banking Services of SBI offered under State Bank FreedoM.

I/we submit the information required for the purpose as under:

Name of Customer (Maximum 20 Characters and leave a box blank after each name)

(Surname)

Email id:

(First Name)

(Middle Name)

Date of Birth:

User ID

DD

MM

YY

My Mobile Number:

Primary /Main Account number

Other Account Numbers

Single/Joint# Accounts

Single/Joint # Accounts

Add/ Delete

I/we have read the terms and conditions prescribed by the Bank for offering Mobile Banking Services to its

customers and unconditionally accept them. I/we am/are also aware that Bank is entitled to modify the terms

and conditions without any notice and posting them on the Banks website would constitute appropriate

notice. I/we agree that the transactions executed while using mobile banking services under my/our User ID

and MPIN will be binding on me/ all the joint account holders.

Date:

Customers Signature

(* Please choose the option)

(# Rights on the SBI FreedoM Service will be same as that in your account at the Branch. Accounts which

are operated by all or some of the account holders jointly are not eligible for mobile banking services.)

FOR OFFICE USE ONLY

Verified the details of the account holder from the record and found correct. Signature (s) of the applicant

(s) verified with those on record with the Bank and found correct. The applicant is permitted to subscribe

to Mobile Banking Services offered by the Bank.

Date:

Authorised Official

Details uploaded on the Core System for enabling the account(s) for Mobile Banking Services requested by

the customer

Date:

Authorised Official

Potrebbero piacerti anche

- Application FormDocumento1 paginaApplication FormManoj AsNessuna valutazione finora

- Mobile Banking Application FormDocumento1 paginaMobile Banking Application FormMohd QuddusNessuna valutazione finora

- Registration Form For Net BankingDocumento14 pagineRegistration Form For Net BankingPraveen Kumar100% (1)

- Mbs Registration FormDocumento1 paginaMbs Registration FormavijayakumarsamyNessuna valutazione finora

- Application Form For Mobile Banking: Branch: Sol Id: DateDocumento2 pagineApplication Form For Mobile Banking: Branch: Sol Id: DateKaran chetryNessuna valutazione finora

- 4 1 4 4 1 8 4 S.Seeni Hamsa Abdul Salam KeelakaraiDocumento2 pagine4 1 4 4 1 8 4 S.Seeni Hamsa Abdul Salam KeelakaraiAafiya AafiyaNessuna valutazione finora

- Bankof BarodaDocumento2 pagineBankof Barodajaideep333Nessuna valutazione finora

- RegistrationForm Southeast BankDocumento2 pagineRegistrationForm Southeast BankAbdullah Al Jahid100% (1)

- Mobilebanking Application 01Documento2 pagineMobilebanking Application 01sibiNessuna valutazione finora

- Internet Banking FormLIMTDDocumento3 pagineInternet Banking FormLIMTDVivek SharmaNessuna valutazione finora

- Mobile Banking Application Form11Documento1 paginaMobile Banking Application Form11Zakir AkhtarNessuna valutazione finora

- E-Circular: Mobile Banking Service Interbank Mobile Payment Service (IMPS) Allotment of MMIDDocumento2 pagineE-Circular: Mobile Banking Service Interbank Mobile Payment Service (IMPS) Allotment of MMIDmevrick_guyNessuna valutazione finora

- Final ApplicaFinal Application Form For IMPS With TC - Pdftion Form For IMPS With TCDocumento5 pagineFinal ApplicaFinal Application Form For IMPS With TC - Pdftion Form For IMPS With TCdreamrunNessuna valutazione finora

- APPLICATION FORM For Internet (Retail) / Mobile / Tele Banking FacilitiesDocumento2 pagineAPPLICATION FORM For Internet (Retail) / Mobile / Tele Banking FacilitiesAtul GuptaNessuna valutazione finora

- MobileBanking ApplicationFormDocumento1 paginaMobileBanking ApplicationFormvenkuemailNessuna valutazione finora

- Canara Bank Netbanking Application FormDocumento3 pagineCanara Bank Netbanking Application FormShreyas Ramnath100% (2)

- ISA FormDocumento2 pagineISA FormAkram SayeedNessuna valutazione finora

- Application Form For Internet / Mobile Banking (For Individuals)Documento2 pagineApplication Form For Internet / Mobile Banking (For Individuals)swarnimNessuna valutazione finora

- IB Application FormDocumento2 pagineIB Application Formasdfghjkl007Nessuna valutazione finora

- SMS Internet Banking FormDocumento4 pagineSMS Internet Banking FormSayed InsanNessuna valutazione finora

- Andhra Bank Internet Banking ApplicationDocumento2 pagineAndhra Bank Internet Banking ApplicationPemmasaniSrinivasNessuna valutazione finora

- Declaration: Fax Copy To CO:DIT. Please Retain The Application Form at Branch For Record PurposeDocumento1 paginaDeclaration: Fax Copy To CO:DIT. Please Retain The Application Form at Branch For Record Purposedrmas009Nessuna valutazione finora

- Ecs New Form LicDocumento4 pagineEcs New Form LicAtul Thakur0% (1)

- Mobile Banking FaqDocumento4 pagineMobile Banking FaqSenthil KumarNessuna valutazione finora

- Citizens Charter Cbi19Documento20 pagineCitizens Charter Cbi19Movies BlogNessuna valutazione finora

- Retail BotswanaDocumento4 pagineRetail BotswanaFarheen alamNessuna valutazione finora

- M Banking App PDFDocumento21 pagineM Banking App PDFManmohan RathiNessuna valutazione finora

- Gistration Form To The Branch Manager State Bank of Hyderabad .Documento3 pagineGistration Form To The Branch Manager State Bank of Hyderabad .Akram AhmedNessuna valutazione finora

- ECS Direct Debit Mandate FormDocumento3 pagineECS Direct Debit Mandate FormManish KumarNessuna valutazione finora

- Mobile Banking Guidelines To CustomerDocumento3 pagineMobile Banking Guidelines To CustomerVaibhav BulkundeNessuna valutazione finora

- Canara Bank Account FormDocumento2 pagineCanara Bank Account Formgopalc19400% (1)

- Bank Terms and ConditionDocumento5 pagineBank Terms and ConditionLibin VargheseNessuna valutazione finora

- Uti Sip FormDocumento1 paginaUti Sip FormSulekha ChakrabortyNessuna valutazione finora

- Unit 3. Procedure For Opening & Operating of Deposit AccountDocumento11 pagineUnit 3. Procedure For Opening & Operating of Deposit AccountBhagyesh ThakurNessuna valutazione finora

- Unit 3 TybbaDocumento11 pagineUnit 3 TybbaChaitanya FulariNessuna valutazione finora

- Mobile Banking ApplicationDocumento4 pagineMobile Banking ApplicationR GanesanNessuna valutazione finora

- E BankingvDocumento1 paginaE BankingvHaris JavedNessuna valutazione finora

- Conversion Form Customer Undertaking For Converting Existing Savings Account To Senior Citizen AccountDocumento2 pagineConversion Form Customer Undertaking For Converting Existing Savings Account To Senior Citizen AccountIlyas SafiNessuna valutazione finora

- Terms and Conditions (Mobile Banking Service)Documento5 pagineTerms and Conditions (Mobile Banking Service)PriyaNessuna valutazione finora

- Insurance Thru AtmDocumento1 paginaInsurance Thru AtmKoolPalNessuna valutazione finora

- Application Form For Internet (For Individuals) : Residential Status: Resident Non Resident OccupationDocumento4 pagineApplication Form For Internet (For Individuals) : Residential Status: Resident Non Resident OccupationKarpov BabuNessuna valutazione finora

- The Accounts of The Customers of Five Associate Banks Should Be Treated As Other Bank AccountDocumento6 pagineThe Accounts of The Customers of Five Associate Banks Should Be Treated As Other Bank AccountEr Mosin ShaikhNessuna valutazione finora

- Giro Form For Utilities ACC1006 ProjectDocumento2 pagineGiro Form For Utilities ACC1006 ProjectrachmmmNessuna valutazione finora

- Helpful Tips For Quick Activation:: Electronic Clearing Service (Debit) Clearing / Direct DebitDocumento1 paginaHelpful Tips For Quick Activation:: Electronic Clearing Service (Debit) Clearing / Direct DebitArka MitraNessuna valutazione finora

- Change in Bank DetailDocumento2 pagineChange in Bank Detailjha.sofcon5941Nessuna valutazione finora

- Online RR Registration Form To The Branch Manager State Bank of India .Documento3 pagineOnline RR Registration Form To The Branch Manager State Bank of India .Anonymous ZGcs7MwsLNessuna valutazione finora

- Application Form Retail CombinedDocumento3 pagineApplication Form Retail CombinedVaibhav KwatraNessuna valutazione finora

- PsbOnline R IDocumento2 paginePsbOnline R Igoyalpuneet007Nessuna valutazione finora

- Channel Registration Form A4Documento4 pagineChannel Registration Form A4wake12upNessuna valutazione finora

- NEFT Through Internet Banking Channel (As Request) : User GuideDocumento18 pagineNEFT Through Internet Banking Channel (As Request) : User GuideDevinder Kumar GoyalNessuna valutazione finora

- Internet Banking ApplicationDocumento5 pagineInternet Banking ApplicationBala Murugan ThangaveluNessuna valutazione finora

- User Manual For Mbs Over UssdDocumento6 pagineUser Manual For Mbs Over Ussdmussk5Nessuna valutazione finora

- Neft Mandate Form Format For LICDocumento2 pagineNeft Mandate Form Format For LICksbbsNessuna valutazione finora

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaDa EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNessuna valutazione finora

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountDa EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountValutazione: 2 su 5 stelle2/5 (1)

- 21St Century Computer Solutions: A Manual Accounting SimulationDa Everand21St Century Computer Solutions: A Manual Accounting SimulationNessuna valutazione finora

- 47-Corporate Salary Package - CSPDocumento3 pagine47-Corporate Salary Package - CSPmevrick_guyNessuna valutazione finora

- IBPS Interview Prep - Graduation Related Questions BE, BCom, BADocumento33 pagineIBPS Interview Prep - Graduation Related Questions BE, BCom, BAmevrick_guyNessuna valutazione finora

- 9th Issue E-Gyan May, 2014 PDFDocumento17 pagine9th Issue E-Gyan May, 2014 PDFmevrick_guyNessuna valutazione finora

- NIOS Culture NotesDocumento71 pagineNIOS Culture Notesmevrick_guy0% (1)

- 1st Issue E-Gyan, July-2013Documento13 pagine1st Issue E-Gyan, July-2013mevrick_guyNessuna valutazione finora

- 01.15 Bod EodDocumento25 pagine01.15 Bod Eodmevrick_guy100% (1)

- 01.20 Government BusinessDocumento48 pagine01.20 Government Businessmevrick_guyNessuna valutazione finora

- 01.09-User System ManagementDocumento12 pagine01.09-User System Managementmevrick_guyNessuna valutazione finora

- 01 21-RBIremittanceDocumento11 pagine01 21-RBIremittancemevrick_guyNessuna valutazione finora

- 8 To 8 Functionality: Section Section DescriptionDocumento7 pagine8 To 8 Functionality: Section Section Descriptionmevrick_guyNessuna valutazione finora

- 01.19 Safe CustodyDocumento9 pagine01.19 Safe Custodymevrick_guyNessuna valutazione finora

- 01.15 Bod EodDocumento25 pagine01.15 Bod Eodmevrick_guy100% (1)

- 01.17 Currency ChestDocumento10 pagine01.17 Currency Chestmevrick_guyNessuna valutazione finora

- 01.13 ClearingDocumento38 pagine01.13 Clearingmevrick_guy0% (1)

- 01.14 Maker Checker FunctionalitiesDocumento19 pagine01.14 Maker Checker Functionalitiesmevrick_guyNessuna valutazione finora

- 01.10 RemittancesDocumento40 pagine01.10 Remittancesmevrick_guyNessuna valutazione finora

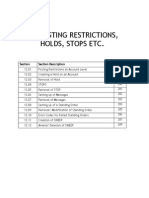

- 01.12 Posting RestrictionsDocumento14 pagine01.12 Posting Restrictionsmevrick_guyNessuna valutazione finora

- 01.05 Transaction ProcessingDocumento23 pagine01.05 Transaction Processingmevrick_guyNessuna valutazione finora

- 01.04-DepositAccounts Other FunctionalitiesDocumento30 pagine01.04-DepositAccounts Other Functionalitiesmevrick_guyNessuna valutazione finora

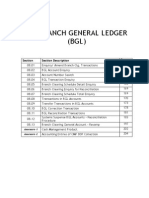

- 01 08-BGLDocumento40 pagine01 08-BGLmevrick_guy100% (2)

- Customer Service - Point of EncounterDocumento3 pagineCustomer Service - Point of Encountermevrick_guyNessuna valutazione finora

- IT-Mobile Banking & Wallet: P-REVIEW March 2012Documento10 pagineIT-Mobile Banking & Wallet: P-REVIEW March 2012mevrick_guyNessuna valutazione finora

- 01 02-CifDocumento25 pagine01 02-Cifmevrick_guyNessuna valutazione finora

- 01 06-CashDocumento21 pagine01 06-Cashmevrick_guyNessuna valutazione finora

- 01.03-Deposit Accounts OpeningDocumento38 pagine01.03-Deposit Accounts Openingmevrick_guy0% (1)

- Promotion Book 2011Documento535 paginePromotion Book 2011mevrick_guy100% (1)

- 532-27-10-2009 - Gold Debit CardDocumento3 pagine532-27-10-2009 - Gold Debit Cardmevrick_guyNessuna valutazione finora

- Measuring Customer Satisfaction in The Banking IndustryDocumento9 pagineMeasuring Customer Satisfaction in The Banking Industrymevrick_guyNessuna valutazione finora

- 01.01 IntroductionDocumento16 pagine01.01 Introductionmevrick_guyNessuna valutazione finora

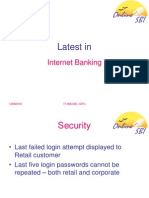

- Latest In: Internet BankingDocumento9 pagineLatest In: Internet Bankingmevrick_guyNessuna valutazione finora

- DZHABBAROVDocumento2 pagineDZHABBAROVfaaaafNessuna valutazione finora

- Icici Kyc ChecklistDocumento1 paginaIcici Kyc ChecklistSiddhartha DuttaNessuna valutazione finora

- 2023 Bske Tot Guidelines InstructionDocumento54 pagine2023 Bske Tot Guidelines InstructionwarynNessuna valutazione finora

- Rims-Crmp Certification Handbook: 1407 Broadway, 29th Floor, New York, NY 10018Documento16 pagineRims-Crmp Certification Handbook: 1407 Broadway, 29th Floor, New York, NY 10018Saurabh DNessuna valutazione finora

- Electronic Reservation Slip Irctcs E-Ticketing Service (Agent)Documento1 paginaElectronic Reservation Slip Irctcs E-Ticketing Service (Agent)Rohit KumarNessuna valutazione finora

- Biometrics 101Documento21 pagineBiometrics 101ZuhdijaNessuna valutazione finora

- Brokers Information Sheet IndividualDocumento1 paginaBrokers Information Sheet IndividualJaemscralNessuna valutazione finora

- Coimbatore To ChennaiDocumento2 pagineCoimbatore To Chennaidhanoosh bNessuna valutazione finora

- CDR ACR I-Card IssuanceDocumento1 paginaCDR ACR I-Card IssuancechachiNessuna valutazione finora

- Confidential: Personal Data FormDocumento10 pagineConfidential: Personal Data Formfarrukh71185100% (1)

- Q A For LL ExamDocumento12 pagineQ A For LL ExamSri SaiNessuna valutazione finora

- Application For Replacement or Transfer of Title: DMV Use OnlyDocumento2 pagineApplication For Replacement or Transfer of Title: DMV Use OnlyDoug LymanNessuna valutazione finora

- 4074 PDFDocumento162 pagine4074 PDFShubham SambhavNessuna valutazione finora

- VaishaliDocumento2 pagineVaishaliPrakharNessuna valutazione finora

- L!ler: Department of EbutationDocumento5 pagineL!ler: Department of EbutationAprilJaedTamoriteApostolNessuna valutazione finora

- Vande Bharat Exp Chair Car (CC) : Electronic Reserva On Slip (ERS)Documento2 pagineVande Bharat Exp Chair Car (CC) : Electronic Reserva On Slip (ERS)Subhash KumarNessuna valutazione finora

- Cae Speaking GuideDocumento11 pagineCae Speaking Guideelisadp83% (6)

- AMLA Refresher Training Program June 2016 PDFDocumento41 pagineAMLA Refresher Training Program June 2016 PDFCandy CunananNessuna valutazione finora

- (Click To Print) : Handwriting Sample (To Be Copied From Screen As Instructed)Documento4 pagine(Click To Print) : Handwriting Sample (To Be Copied From Screen As Instructed)DevashrutBharadwajNessuna valutazione finora

- RegistrationDocumento3 pagineRegistrationAnonymous BIOzGv3PhNessuna valutazione finora

- Degree Attestation Ministry of Foreign Affairs PakistanDocumento4 pagineDegree Attestation Ministry of Foreign Affairs PakistanMuhammad Fahad Raza25% (4)

- Auction 328 CatalogueDocumento140 pagineAuction 328 CatalogueJohn DavisNessuna valutazione finora

- KPSI HRD BUFR 004 Application Form - R1 RevDocumento6 pagineKPSI HRD BUFR 004 Application Form - R1 Revamir uddinNessuna valutazione finora

- Re-KYC Diligence & Operationalizing In-Operative' NRI AccountDocumento4 pagineRe-KYC Diligence & Operationalizing In-Operative' NRI Accountranjit12345Nessuna valutazione finora

- Advisory Opinion No. 2021-027 - SGDDocumento6 pagineAdvisory Opinion No. 2021-027 - SGDDan Warren NuestroNessuna valutazione finora

- Study On Home LoansDocumento52 pagineStudy On Home LoansbrijeshcocoNessuna valutazione finora

- Cato Institute: Annual Report 2006Documento50 pagineCato Institute: Annual Report 2006Cato InstituteNessuna valutazione finora

- Indiana DOR Letter of Findings: 04-20100641 09-20100639 10-20100640 (Oct. 26, 2011)Documento10 pagineIndiana DOR Letter of Findings: 04-20100641 09-20100639 10-20100640 (Oct. 26, 2011)Paul MastersNessuna valutazione finora

- SMDC-SADM-SRES-RARegular-English-01232019-v14.Annex A PDFDocumento2 pagineSMDC-SADM-SRES-RARegular-English-01232019-v14.Annex A PDFcecile fantonialNessuna valutazione finora

- Transaction ID: 100001739479673: Fare DetailsDocumento2 pagineTransaction ID: 100001739479673: Fare Detailsrajiv kumarNessuna valutazione finora