Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

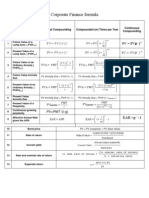

Corporate Finance Formula Sheet

Caricato da

Bronwen111Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Corporate Finance Formula Sheet

Caricato da

Bronwen111Copyright:

Formati disponibili

Receivables

Turnover=Sales/AR

Times

Int.

Earned=EBIT/interest

Accounting

veil:

not

affect

stock

prices

Break

Even:

Accounting:

Q=

(FC+D)/P-V

Total

OCF=

OCF

addition

to

NWC-capital

spending

Cash

Q=

(FC)/P-V

Can

only

service

op.

costs

not

investment

NI=0

Payback=N

NPV<0

IRR=0

OCF=0

Payback=infinity

NPV=Co<0

IRR=-100%

Financial:

Payback=N

Q=

(FC+OCF*)/P-V

NPV=0

OCF*=Co/PVAF

IRR=r

DOL=

1+

(FC/OCF)

DOL=

degree

to

which

Change

project

relies

on

fixed

OCF=DOL*%change

in

Q

costs

Bond

Value=

PV(Coupons)

+

PV(FV)

HPR=(P1-P0)/P0

SML! = ! + ! ! !

Does

not

require

companies

to

apy

dividends

&

have

steady

growth,

base

calculations

on

2

estimates,

explicitly

considers

risk.

Fixed

Asset

Turnover=

sales/net

fixed

assets

Total;

Debt

Ratio=

(Assets-Equity)/Assets

Capital Intensity Ratio:Total Assets/Sales (use % of sales approach)

Efficient Market: NPV=0, well organized markets

are efficient, investors get what they pay for, firms

get exact value.

Holding Period Yield: Rate where Co= PV(cash

inflows)

Price Earnings: P=EPS/R +NPVGO

DFL

= EBIT/(EBIT-Interest)

=%change in EPS/%change in EBIT

Long Term Debt Ratio = LT Debt/LT Debt+equity

Equity Multiplier: Total

Assrts/Total Equity

Days Sales in Receivable

=365/receivables turnover

M&M Proposition 1

! = !

= !

! ( )

= +

Arbitrage

Opp

when

Vl<Vu

Capital

Structure

Irrelevant

WACC

same

no

matterD/E

M&M

Proposition

2:

!

! = ! + (! ! )

Ra

=WACC

!

Cost of equity rises as debt increase

Equity Risk=business + financial

M&M Proposition 1 with Tax

1

! = !

!

! = ! + ()

straight line with slope of Tc. Y

intercept of Vu

Compound G of Dividends:

(! )!/! 1

And (1+r)*(1+r)^1/t - 1

M&M Proposition 2 with taxes:

! = ! + (! ! )(1 )

= ( ! )(1 )/!

CAPM:

! = ! + ! ! !

! = ! (1 + )

Interval Measure: current

assets/avg. daily op. costs

DuPoint

ROE

=

NI/Total

Equity

=(NI/Assets)

X

(Total

Assets/Total

Equity)

=(NI/S)

X

(S/A)

X

(A/E)

=(NI/S)

X

(S/A)

X

(1+

D/E)

=Profit

Margin

x

total

asset

turnover

x

equity

multiplier

Dividends:

Share

price

cum

div

=

equity/#of

sharesw

Share

price

ex

div

=

share

price

div

Share

price

=PV(all

future

divs)

Dividend

Payout

Ratio

=

Dividends/NI

Cost of Equity Capital=R=(D1/Po)

+g = dividend yield +capital gains

yield

Point of financial leverage

Indifference: EPS(with

Debt)=EPS(without Debt)

EBIT = interest/ 1 (#shares with

debt/#shares without Debt)

Nominal Risk Prem=Avg. Nom

Return-Risk free= arithmetic

Real Risk Free Rate= Risk free avg.

infl.

Real Risk Prem=Avg Real return-

RealRisk Free

Dilution:

NI increases by ROE x New issue

amount

New Market share price: use EPS

not sale price

Effective Annual Rate:

Home

250,000

Downpmt

12500

Loan

237,500

Term

120m

APR

13% SEMI ANNUAL COMPOUND

EAR

(1+6.5%)^2 -1 =0.134225

Effective monthly rate (1+EAR)power(1/12) -1

Set your calculator to BEG

PV =-237,500

T=120

R=1.0551

FV=0

THEN COMPUTE PMT = 3462.31

Check: EAR = ! 1

Theoretical Value of a right:

!

! =

+ 1

! =common share price

with rights

S=subscription

Price

N= # of rights required to buy 1

share=#old

shares/#of

new shares

= ! ! = share price exrights

= (! )/ = Ex rights value

of a right

Funds raised= S*#new shares

Dollar Flotation cost=

funds raised net proceeds

% Flotation Cost=

Dollar FC/Funds Raised

Return

on

Portfolio:

! = ! ! + (! ! )

EFN

=

-

pSR

+

g(A-pSR)

=A(g)-pSR(1+g)-CL(g)

Exact

Fisher

Effect:

(1+Rnom)=(1+Rreal)

x

(1+infl)

! = ! ! + (! ! (= 0))

BASE CASE NPV

PV(ATOCF)+(PV(CCATS)+PV(Salvage)+

PV(NWC Recovered)- Co-Initial NWC

NWC to total assets = (current

assets-current liabilities)/total

assets

NWC Turnover=Sales/NWC

OCF Basic = EBIT+D-Taxes

Private Leverage:

OCF Bottom up= NI+D

Leverage reduces value of firm

OCF TopDown=S-Costs-Taxes

when:

OCF Tax Shield= (S-C)(1-T)+(D*T)

1 ! < (1 ! )(1 ! )

Analysis OCF=[(P-V)Q-FC) X (1-T)]+TD =

C=corporate tax rate

Annuity:

S=private dividend tax rate

Annuity Due=PMT PVAF(1+r)

If> then increases

!"#

!!! !

If = then indifferent

PVgrowing Annuity =

[1

]

!!!

!!!

If B=S then leverage increases

PVgrowing perp = PMT/r-g

firm value

P/E =price/EPS

Capital Budgeting Alternatives:

P Index= PV(cash flows)/Investment > 1 NPV

(may lead to wrong dec. when mut. Ex)

IRR (IRR>R = accepted)

Profit Margin=NI/Sales

Payback Ruke

ROA=NI/Total Assets

Discounted Payback rule

Retention ratio= pSR X(1+g) or RE/NI

Avg. Accounting Return

Std Dev on Calculator:

Capital Budgeting: adjust for

2nd F, Mode,0,0,Mode,1,0, data enter,

time value? Adjust for risk?

alpha, 5 =

Provide information & value

Reward to Risk= (ERi Rf)/Betai

@equilibrium:RTRA=RTRB=RTRp

r^2=portion of total risk that is

systematic

Growth

=b x ROE

Sustainable=(ROE X R)/(1-(ROE X R))

Internal

Growth:

=pSR/(A-pSR)

ROA

X

R)/(1-(ROA

X

R))

= (! ! ) + (! ! )

Total

Amnt

raised

=Project

Cost/1-WAFC

Capital

Structure

Weights=

MV(Debt)=BondPrice*#bonds/Assets

MV(Equity)=

Price*#shares/assets

MV(PS)=PS

Price*#of

PS/Assets

Unlevered/Levered

Borrowing:

D/E=0.5,

EPS=2.5,

i=10%

D=0.5E,

@

E=2000,

D=1000.

Total=3000,

#shares=3000/20=150,

Expected

Payoff=EPS(Shares)-

(1000*0.1)=375-100=275,

Expected

Payoff=375+100=475

(lender)

! !!

Stock

Valuation=

! = ! !

Constant

Growth:

! =

!!!

!!

!!!

Supernormal Growth = ! =

!!

(!!!)!

/ 1 +

Funds

to

be

Raised

=

Net

Proceeds/1-flotation

spread

MV(Before)=#of

old

shares

*

Rights

on

share

price

MV(after)=(Total

*Me)-(#of

new

shares*S)

0.010551

@Sustainable g, company can

increase sales & Assets without

selling equity. Debt can increase

Calculator to Find IRR

Cfi,2ndf,

CA,ON,data,ON,2ndf,cash,2ndf,CA

Nonconventional Cash flows: use

diff between cash flows for each

project and use as entries

MIRR: Method 1: discount 2nd

negative cash flow back to Co

Method2: FV all cash flows and

add to last negative cash

flow.3)use both methods simult.

Replacement of equipment:

NPV= Net Investment +

PV (ATOCF) +PV(net salvage

value=salvage of old-salvage of

new)+PV(CCATS, C=New cost-old

salvage)

Setting Price on a bid:

NPV=0=Capital

spending+PF(Salvage)+addition/

recovery of NWC+PV(ATOCF)(S-

C)(1-T) + tax sield on CCA. Then

find S and Q.

Avg Account. Return: Avg.NI/Avg

Investment(1/2 of Co, need target)

EFN=increase in total assets-

addition to RE-New Borrowing

Dividend Growth Model:

Re=(D1/Po)+g

Days Sales in

Inventory=365/Inventory Turnover

Approximate:

Rnom=Rreal+infl.

Inventory Turn. =COGS/Inv.

EAC = PV(Costs)/ PVAF

Equally risky investments=equally

risky returns

Homemade leverage: assumption that

individuals can lend& borrow at same rate as

the firm

Potrebbero piacerti anche

- Accounting and Finance Formulas: A Simple IntroductionDa EverandAccounting and Finance Formulas: A Simple IntroductionValutazione: 4 su 5 stelle4/5 (8)

- Kelly's Finance Cheat Sheet V6Documento2 pagineKelly's Finance Cheat Sheet V6Kelly Koh100% (4)

- Corporate Finance Formula SheetDocumento4 pagineCorporate Finance Formula Sheetogsunny100% (3)

- CorpFinance Cheat Sheet v2.2Documento2 pagineCorpFinance Cheat Sheet v2.2subtle69100% (4)

- CheatSheet (Finance)Documento1 paginaCheatSheet (Finance)Guan Yu Lim100% (3)

- Corporate Finance - FormulasDocumento3 pagineCorporate Finance - FormulasAbhijit Pandit100% (1)

- EM302 Formula Sheet 2013Documento4 pagineEM302 Formula Sheet 2013Jeff JabeNessuna valutazione finora

- Formulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceDocumento6 pagineFormulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceNaeemNessuna valutazione finora

- Corporate Finance FormulasDocumento3 pagineCorporate Finance FormulasMustafa Yavuzcan83% (12)

- Cheat Sheet Final - FMVDocumento3 pagineCheat Sheet Final - FMVhanifakih100% (2)

- Corporate Finance Math SheetDocumento19 pagineCorporate Finance Math Sheetmweaveruga100% (3)

- Bonds Exam Cheat SheetDocumento2 pagineBonds Exam Cheat SheetSergi Iglesias CostaNessuna valutazione finora

- Quick Reference To Managerial AccountingDocumento2 pagineQuick Reference To Managerial AccountingAmilius San Gregorio100% (1)

- Managerial Accounting Mid-Term Cheat SheetDocumento6 pagineManagerial Accounting Mid-Term Cheat SheetĐạt Nguyễn100% (1)

- Fnce 100 Final Cheat SheetDocumento2 pagineFnce 100 Final Cheat SheetToby Arriaga100% (2)

- Corporate Finance Cheat SheetDocumento3 pagineCorporate Finance Cheat Sheetdiscreetmike50Nessuna valutazione finora

- Cheat Sheet For Financial AccountingDocumento1 paginaCheat Sheet For Financial Accountingmikewu101Nessuna valutazione finora

- Midsem Cheat Sheet (Finance)Documento2 pagineMidsem Cheat Sheet (Finance)lalaran123Nessuna valutazione finora

- Equity Valuation DCF, WACC and APVDocumento64 pagineEquity Valuation DCF, WACC and APVstf2xNessuna valutazione finora

- CH 9 Solutions Solution Manual Principles of Corporate FinanceDocumento7 pagineCH 9 Solutions Solution Manual Principles of Corporate FinanceMercy Dadzie100% (1)

- Free Cash Flows FCFF & FcfeDocumento56 pagineFree Cash Flows FCFF & FcfeYagyaaGoyalNessuna valutazione finora

- APV Vs WACCDocumento8 pagineAPV Vs WACCMario Rtreintaidos100% (2)

- Corporate Finance - Beny W2011Documento38 pagineCorporate Finance - Beny W2011cparka12Nessuna valutazione finora

- CFA Level 1 Corporate Finance - Our Cheat Sheet - 300hoursDocumento14 pagineCFA Level 1 Corporate Finance - Our Cheat Sheet - 300hoursMichNessuna valutazione finora

- FCFF Vs FCFE Valuation ModelDocumento5 pagineFCFF Vs FCFE Valuation Modelksivakumar09Nessuna valutazione finora

- Valuation Spreadsheet DCFDocumento8 pagineValuation Spreadsheet DCFHilal MilmoNessuna valutazione finora

- Case 2 Corporate FinanceDocumento5 pagineCase 2 Corporate FinancePaula GarciaNessuna valutazione finora

- FIN6215-Cheat Sheet BigDocumento3 pagineFIN6215-Cheat Sheet BigJojo Kittiya100% (1)

- LBO Model - ValuationDocumento6 pagineLBO Model - ValuationsashaathrgNessuna valutazione finora

- Cheat Sheet Corporate - FinanceDocumento2 pagineCheat Sheet Corporate - FinanceAnna BudaevaNessuna valutazione finora

- Finance Cheat SheetDocumento4 pagineFinance Cheat SheetRudolf Jansen van RensburgNessuna valutazione finora

- Cheat Sheet - Financial STDocumento2 pagineCheat Sheet - Financial STMohammad DaulehNessuna valutazione finora

- Fundamentals of Corporate Finance, SlideDocumento250 pagineFundamentals of Corporate Finance, SlideYIN SOKHENG100% (4)

- Finance Cheat SheetDocumento2 pagineFinance Cheat SheetMarc MNessuna valutazione finora

- Simple LBO ModelDocumento14 pagineSimple LBO ModelSucameloNessuna valutazione finora

- Cfa Level I - Us Gaap Vs IfrsDocumento4 pagineCfa Level I - Us Gaap Vs IfrsSanjay RathiNessuna valutazione finora

- Formula Sheet Corporate Finance (COF) : Stockholm Business SchoolDocumento6 pagineFormula Sheet Corporate Finance (COF) : Stockholm Business SchoolLinus AhlgrenNessuna valutazione finora

- Ss11 646 Corporate FinanceDocumento343 pagineSs11 646 Corporate Financed-fbuser-32825803100% (12)

- 3 - FCF CalculationDocumento2 pagine3 - FCF CalculationAman ManjiNessuna valutazione finora

- Q: What Do You Think Is Wrong With The First Question I Asked in The Application Questions? How Does This Impact Your Answer, If at All?Documento1 paginaQ: What Do You Think Is Wrong With The First Question I Asked in The Application Questions? How Does This Impact Your Answer, If at All?PratikNessuna valutazione finora

- Solution Manual Finance For Executives Managing For Value Creation 4th Edition by Gabriel Hawawini SLC1085Documento17 pagineSolution Manual Finance For Executives Managing For Value Creation 4th Edition by Gabriel Hawawini SLC1085thar adelei33% (3)

- Merger Model - Blank Template: Control Panel Outputs Sensitivities Model Comps Data Diluted Shares CalculationDocumento49 pagineMerger Model - Blank Template: Control Panel Outputs Sensitivities Model Comps Data Diluted Shares CalculationGugaNessuna valutazione finora

- Financial Accounting: Tools For Business Decision-Making, Third Canadian EditionDocumento6 pagineFinancial Accounting: Tools For Business Decision-Making, Third Canadian Editionapi-19743565100% (1)

- Axial Discounted Cash Flow Valuation CalculatorDocumento4 pagineAxial Discounted Cash Flow Valuation CalculatorUdit AgrawalNessuna valutazione finora

- Finance Cheat Sheet - Formulas and Concepts - RM NISPEROSDocumento27 pagineFinance Cheat Sheet - Formulas and Concepts - RM NISPEROSCHANDAN C KAMATHNessuna valutazione finora

- Financial Statement AnalysisDocumento10 pagineFinancial Statement AnalysisAli Gokhan Kocan100% (1)

- Dividend Policy at FPLDocumento24 pagineDividend Policy at FPLKinnari PandyaNessuna valutazione finora

- Ratio AnalysisDocumento38 pagineRatio AnalysisMoses FernandesNessuna valutazione finora

- The Tesla Acquisition - PitchbookDocumento18 pagineThe Tesla Acquisition - PitchbookArchit Lohokare100% (1)

- FIN 401 - Cheat SheetDocumento2 pagineFIN 401 - Cheat SheetStephanie NaamaniNessuna valutazione finora

- Corporate FinanceDocumento2 pagineCorporate Financeapi-294072125Nessuna valutazione finora

- Corporate FinanceDocumento10 pagineCorporate Financeandrea figueroaNessuna valutazione finora

- E V: A A P: Perceived MispricingDocumento19 pagineE V: A A P: Perceived MispricingHeidi HCNessuna valutazione finora

- CFA Level I Formula SheetDocumento27 pagineCFA Level I Formula SheetAnonymous P1xUTHstHT100% (4)

- O o o o o Total Costs Q X V + FC o Accounting Break-Even: Q (FC + D) / (P-V)Documento3 pagineO o o o o Total Costs Q X V + FC o Accounting Break-Even: Q (FC + D) / (P-V)Ana C. RichiezNessuna valutazione finora

- Business Valuation Models: Two Methods: 1. Discounted Cash Flow 2. Relative ValuesDocumento24 pagineBusiness Valuation Models: Two Methods: 1. Discounted Cash Flow 2. Relative ValuesIndra S ChaidrataNessuna valutazione finora

- Pvif 1 - (1+i) - N (1 - (1+i) - N) /i I FVIF (1+i) N - 1 (1+i) (N) - 1) /i IDocumento12 paginePvif 1 - (1+i) - N (1 - (1+i) - N) /i I FVIF (1+i) N - 1 (1+i) (N) - 1) /i ISyed Abdul Mussaver ShahNessuna valutazione finora

- GSFSD 2 SDocumento32 pagineGSFSD 2 SJay SmithNessuna valutazione finora

- CPA Review Notes 2019 - BEC (Business Environment Concepts)Da EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Valutazione: 4 su 5 stelle4/5 (9)

- Course 1 What Is EconometricsDocumento8 pagineCourse 1 What Is EconometricsMihai StoicaNessuna valutazione finora

- COURSE 6 ECONOMETRICS 2009 RegressionDocumento36 pagineCOURSE 6 ECONOMETRICS 2009 RegressionMihai StoicaNessuna valutazione finora

- COURSE 5 ECONOMETRICS 2009 Chi SquareDocumento15 pagineCOURSE 5 ECONOMETRICS 2009 Chi SquareMihai StoicaNessuna valutazione finora

- COURSE 7 ECONOMETRICS 2009 Multiple RegressionDocumento18 pagineCOURSE 7 ECONOMETRICS 2009 Multiple RegressionMihai StoicaNessuna valutazione finora

- COURSE 4 ECONOMETRICS 2009 Hypothesis TestingDocumento8 pagineCOURSE 4 ECONOMETRICS 2009 Hypothesis TestingMihai StoicaNessuna valutazione finora

- COURSE 3 ECONOMETRICS 2009 Hypothesis TestingDocumento37 pagineCOURSE 3 ECONOMETRICS 2009 Hypothesis TestingMihai StoicaNessuna valutazione finora

- COURSE 2 ECONOMETRICS 2009 Confidence IntervalDocumento35 pagineCOURSE 2 ECONOMETRICS 2009 Confidence IntervalMihai StoicaNessuna valutazione finora

- COURSE 6 ECONOMETRICS 2009 RegressionDocumento36 pagineCOURSE 6 ECONOMETRICS 2009 RegressionMihai StoicaNessuna valutazione finora

- COURSE 7 ECONOMETRICS 2009 Multiple RegressionDocumento18 pagineCOURSE 7 ECONOMETRICS 2009 Multiple RegressionMihai StoicaNessuna valutazione finora

- COURSE 5 ECONOMETRICS 2009 Chi SquareDocumento15 pagineCOURSE 5 ECONOMETRICS 2009 Chi SquareMihai StoicaNessuna valutazione finora

- COURSE 2 ECONOMETRICS 2009 Confidence IntervalDocumento35 pagineCOURSE 2 ECONOMETRICS 2009 Confidence IntervalMihai StoicaNessuna valutazione finora

- COURSE 4 ECONOMETRICS 2009 Hypothesis TestingDocumento8 pagineCOURSE 4 ECONOMETRICS 2009 Hypothesis TestingMihai StoicaNessuna valutazione finora

- COURSE 3 ECONOMETRICS 2009 Hypothesis TestingDocumento37 pagineCOURSE 3 ECONOMETRICS 2009 Hypothesis TestingMihai StoicaNessuna valutazione finora

- Managerial Decision Making and Problem Solving PDFDocumento22 pagineManagerial Decision Making and Problem Solving PDFMihai StoicaNessuna valutazione finora

- Intercultural CommunicationDocumento22 pagineIntercultural CommunicationCristina IonescuNessuna valutazione finora

- Course 1 What Is EconometricsDocumento8 pagineCourse 1 What Is EconometricsMihai StoicaNessuna valutazione finora

- The Control Process in An Int'L ContextDocumento9 pagineThe Control Process in An Int'L ContextMihai StoicaNessuna valutazione finora

- Cross-Cultural Motivation PDFDocumento25 pagineCross-Cultural Motivation PDFMihai StoicaNessuna valutazione finora

- Oster NNNNDocumento17 pagineOster NNNNMihai StoicaNessuna valutazione finora

- Ethics and Social ResponsibilityDocumento21 pagineEthics and Social ResponsibilityMihai StoicaNessuna valutazione finora

- Organization of Multinational Operations PDFDocumento23 pagineOrganization of Multinational Operations PDFMihai StoicaNessuna valutazione finora

- The Controlling Process PDFDocumento13 pagineThe Controlling Process PDFMihai StoicaNessuna valutazione finora

- Int'L Management and The Cultural ContextDocumento27 pagineInt'L Management and The Cultural ContextMihai StoicaNessuna valutazione finora

- ManagementDocumento21 pagineManagementSînziana VoicuNessuna valutazione finora

- The Imperial SWOT PESTLE AnalysisDocumento4 pagineThe Imperial SWOT PESTLE AnalysisMihai StoicaNessuna valutazione finora

- KKRDocumento2 pagineKKRMihai StoicaNessuna valutazione finora

- Assignment 1Documento1 paginaAssignment 1Mihai StoicaNessuna valutazione finora

- Course and Seminar PresentationDocumento13 pagineCourse and Seminar PresentationMihai StoicaNessuna valutazione finora

- KKR PresentationDocumento10 pagineKKR PresentationMihai StoicaNessuna valutazione finora

- Cross-Cultural Motivation PDFDocumento25 pagineCross-Cultural Motivation PDFMihai StoicaNessuna valutazione finora