Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Aim

Caricato da

Timothy BrownCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Aim

Caricato da

Timothy BrownCopyright:

Formati disponibili

Aim & Objectives of SEBI:

The overall objectives of SEBI are to protect the interest of investors and to promote the development of

stock exchange and to regulate the activities of stock market. The objectives of SEBI are:

1. To regulate the activities of stock exchange.

2. To protect the rights of investors and ensuring safety to their investment.

3. To prevent fraudulent and malpractices by having balance between self regulation of business and its

statutory regulations.

4. To regulate and develop a code of conduct for intermediaries such as brokers, underwriters, etc.

Functions of SEBI:

The SEBI performs functions to meet its objectives. To meet three objectives SEBI has three important

functions. These are:

i. Protective functions

ii. Developmental functions

iii. Regulatory functions.

1. Protective Functions:

These functions are performed by SEBI to protect the interest of investor and provide safety of

investment.

As protective functions SEBI performs following functions:

Importance

Stock market is an important part of the economy of a country. The stock market plays a play a pivotal role in the

growth of the industry and commerce of the country that eventually affects the economy of the country to a

great extent. That is reason that the government, industry and even the central banks of the country keep a close

watch on the happenings of the stock market. The stock market is important from both the industrys point of

view as well as the investors point of view.

Whenever a company wants to raise funds for further expansion or settling up a new business venture,

they have to either take a loan from a financial organization or they have to issue shares through the stock

market. In fact the stock market is the primary source for any company to raise funds for business

expansions. If a company wants to raise some capital for the business it can issue shares of the company

that is basically part ownership of the company. To issue shares for the investors to invest in the stocks a

company needs to get listed to a stocks exchange and through the primary market of the stock exchange

they can issue the shares and get the funds for business requirements. There are certain rules and

regulations for getting listed at a stock exchange and they need to fulfill some criteria to issue stocks and

go public. The stock market is primarily the place where these companies get listed to issue the shares

and raise the fund. In case of an already listed public company, they issue more shares to the market for

collecting more funds for business expansion. For the companies which are going public for the first

time, they need to start with the Initial Public Offering or the IPO. In both the cases these companies have

to go through the stock market.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Global Marketing and Sales DevelopmentDocumento15 pagineGlobal Marketing and Sales Developmentdennis100% (2)

- Project On Elasticity of DemandDocumento11 pagineProject On Elasticity of Demandjitesh82% (50)

- Bba ProjectDocumento14 pagineBba ProjectAnonymous JLYztYvd100% (1)

- Pediasure - Marketing Analytics - Spring 2020Documento21 paginePediasure - Marketing Analytics - Spring 2020Asmer Duraid KhanNessuna valutazione finora

- Final Year Project PaperDocumento39 pagineFinal Year Project PaperWong Shet Mooi100% (1)

- The RSI Scalping StrategyDocumento30 pagineThe RSI Scalping StrategyDavid Gordon83% (23)

- Food DeclarationDocumento1 paginaFood DeclarationTimothy BrownNessuna valutazione finora

- Agarwal Neha Pradeep: ObjectiveDocumento2 pagineAgarwal Neha Pradeep: ObjectiveTimothy BrownNessuna valutazione finora

- Mahatma GandhiDocumento3 pagineMahatma GandhiTimothy BrownNessuna valutazione finora

- Shiv Parvati Building A' Wing Mahesh ParkDocumento1 paginaShiv Parvati Building A' Wing Mahesh ParkTimothy BrownNessuna valutazione finora

- GST For Exporter Importer With Photo.Documento4 pagineGST For Exporter Importer With Photo.ABNessuna valutazione finora

- Ansari Afreen BanoDocumento1 paginaAnsari Afreen BanoTimothy BrownNessuna valutazione finora

- Lake PalaceDocumento6 pagineLake PalaceTimothy BrownNessuna valutazione finora

- Subject: Resignation For ACEDocumento1 paginaSubject: Resignation For ACETimothy BrownNessuna valutazione finora

- N.K.T. International School and Shri. Shankar Shetty Junior College of Science & CommerceDocumento4 pagineN.K.T. International School and Shri. Shankar Shetty Junior College of Science & CommerceTimothy BrownNessuna valutazione finora

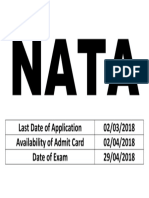

- Last Date of Application 02/03/2018 Availability of Admit Card 02/04/2018 Date of Exam 29/04/2018Documento1 paginaLast Date of Application 02/03/2018 Availability of Admit Card 02/04/2018 Date of Exam 29/04/2018Timothy BrownNessuna valutazione finora

- Daily ScheduleDocumento3 pagineDaily ScheduleTimothy BrownNessuna valutazione finora

- Mvat ActDocumento28 pagineMvat ActTimothy BrownNessuna valutazione finora

- Jayesh 33Documento1 paginaJayesh 33Timothy BrownNessuna valutazione finora

- Mht-Cet 2018: B.E/B.Tech & B.Pharm./Pharm.D. B. Sc. (Honours) /B.AgricultureDocumento2 pagineMht-Cet 2018: B.E/B.Tech & B.Pharm./Pharm.D. B. Sc. (Honours) /B.AgricultureTimothy BrownNessuna valutazione finora

- Climate of MaharashtraDocumento4 pagineClimate of MaharashtraTimothy BrownNessuna valutazione finora

- Taj MahalDocumento3 pagineTaj MahalTimothy BrownNessuna valutazione finora

- Sitaram SurjarDocumento1 paginaSitaram SurjarTimothy BrownNessuna valutazione finora

- 1st Receipt 45000Documento1 pagina1st Receipt 45000Timothy BrownNessuna valutazione finora

- Safdasf Asdfsaf Asasf Saf Safd Sadf Asf Sadf Sadf Asdf Saf As FDDocumento1 paginaSafdasf Asdfsaf Asasf Saf Safd Sadf Asf Sadf Sadf Asdf Saf As FDTimothy BrownNessuna valutazione finora

- Michael JacksonDocumento1 paginaMichael JacksonTimothy BrownNessuna valutazione finora

- Inv Date Inv No Type Debit Rs Credit Rs Balance Opening Bal 164,006Documento4 pagineInv Date Inv No Type Debit Rs Credit Rs Balance Opening Bal 164,006Timothy BrownNessuna valutazione finora

- Khan Mariya Afzal: "Plagiarism"Documento16 pagineKhan Mariya Afzal: "Plagiarism"Timothy BrownNessuna valutazione finora

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Documento1 paginaIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Timothy BrownNessuna valutazione finora

- MotivationDocumento24 pagineMotivationTimothy BrownNessuna valutazione finora

- New Microsoft Office Word DocumentDocumento1 paginaNew Microsoft Office Word DocumentTimothy BrownNessuna valutazione finora

- Date: Name: H.Q: Designatiot M Region Worked Plabhandari Compound DR.'S Name DR Speciality. Observation / RemarksDocumento2 pagineDate: Name: H.Q: Designatiot M Region Worked Plabhandari Compound DR.'S Name DR Speciality. Observation / RemarksTimothy BrownNessuna valutazione finora

- Tanishq ElevatorsDocumento5 pagineTanishq ElevatorsTimothy BrownNessuna valutazione finora

- Care Er Objectiv Es On QualificationDocumento3 pagineCare Er Objectiv Es On QualificationTimothy BrownNessuna valutazione finora

- Haathi Mere Saathi: Phi Phenomenon Photographing Motion Picture Camera Animation CGI Computer Animation Visual EffectsDocumento2 pagineHaathi Mere Saathi: Phi Phenomenon Photographing Motion Picture Camera Animation CGI Computer Animation Visual EffectsTimothy BrownNessuna valutazione finora

- ECO603m.pricing Options Reviewer.3.2016-17Documento4 pagineECO603m.pricing Options Reviewer.3.2016-17Neale CacNessuna valutazione finora

- Go-To-Market Strategy Template - AsanaDocumento7 pagineGo-To-Market Strategy Template - AsanareachslbNessuna valutazione finora

- A Study On "The Impact of Online Shopping Upon Retail Trade Business"Documento5 pagineA Study On "The Impact of Online Shopping Upon Retail Trade Business"ShankarNessuna valutazione finora

- Retail Bond Paper.Documento1 paginaRetail Bond Paper.dharam singhNessuna valutazione finora

- Leverage and Capital Structure: University of Economics - Ho Chi Minh CityDocumento24 pagineLeverage and Capital Structure: University of Economics - Ho Chi Minh CityNhân TrịnhNessuna valutazione finora

- Practice Test 10: Numerical ReasoningDocumento13 paginePractice Test 10: Numerical ReasoningaddeNessuna valutazione finora

- Marketing Plan in Apple: Yubo Yang Xi Chen Sitong Lu Bosheng HuDocumento20 pagineMarketing Plan in Apple: Yubo Yang Xi Chen Sitong Lu Bosheng HuYubo YangNessuna valutazione finora

- Pratyush - CV Latest - 08-Jul-17 - 00 - 18 - 46Documento4 paginePratyush - CV Latest - 08-Jul-17 - 00 - 18 - 46PRATYUSH K YadavNessuna valutazione finora

- Forex BookDocumento31 pagineForex Bookibudanish79Nessuna valutazione finora

- Introduction To Buiness DevelopmentDocumento46 pagineIntroduction To Buiness DevelopmentAugustine ChukwudiNessuna valutazione finora

- MKT Juice PlanDocumento12 pagineMKT Juice PlanMita Afreen100% (3)

- Financial Market Regulation Project TitlesDocumento2 pagineFinancial Market Regulation Project TitlesAmitesh TejaswiNessuna valutazione finora

- 10-Slide Pitch Deck TemplateDocumento16 pagine10-Slide Pitch Deck TemplateRahul Agnihotri100% (1)

- Chapter3 4Documento24 pagineChapter3 4kakolalamamaNessuna valutazione finora

- Chapter 12 CUSTOMER SERVICEDocumento42 pagineChapter 12 CUSTOMER SERVICESYAZANA FIRAS SAMATNessuna valutazione finora

- Market Entry Handbook PDFDocumento232 pagineMarket Entry Handbook PDFdoniaNessuna valutazione finora

- Effect of Foreign Institutional Investors On Corporate Board Attributes A Literature ReviewDocumento7 pagineEffect of Foreign Institutional Investors On Corporate Board Attributes A Literature ReviewRiya CassendraNessuna valutazione finora

- Working Capital Management in Steel IndustryDocumento54 pagineWorking Capital Management in Steel IndustryPrashant Singh50% (2)

- SWOT Analysis Textile IndustryDocumento23 pagineSWOT Analysis Textile Industrydumitrescu viorelNessuna valutazione finora

- 4 Application of Ss and DD TheoriesDocumento60 pagine4 Application of Ss and DD TheoriesMilon MirdhaNessuna valutazione finora

- LIBOR - Its End & The Transition To SOFR - Morgan StanleyDocumento7 pagineLIBOR - Its End & The Transition To SOFR - Morgan StanleyKhalilBenlahccen100% (1)

- Specimen 2020 QP - Paper 1 CIE Economics IGCSEDocumento10 pagineSpecimen 2020 QP - Paper 1 CIE Economics IGCSEDd KNessuna valutazione finora

- It Is A Stock Valuation Method - That Uses Financial and Economic Analysis - To Predict The Movement of Stock PricesDocumento24 pagineIt Is A Stock Valuation Method - That Uses Financial and Economic Analysis - To Predict The Movement of Stock PricesAnonymous KN4pnOHmNessuna valutazione finora

- Marketing Mix of LifebuoyDocumento4 pagineMarketing Mix of Lifebuoyvivek singhNessuna valutazione finora

- Full Download Test Bank For Todays Health Information Management An Integrated Approach 2nd Edition by Mcway PDF Full ChapterDocumento36 pagineFull Download Test Bank For Todays Health Information Management An Integrated Approach 2nd Edition by Mcway PDF Full Chapterseesaw.insearchd8k4100% (20)