Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Balance Sheet Ratios

Caricato da

Mohit Sunil Anju Mehta0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

61 visualizzazioni3 pagineratios

Copyright

© © All Rights Reserved

Formati disponibili

RTF, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoratios

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato RTF, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

61 visualizzazioni3 pagineBalance Sheet Ratios

Caricato da

Mohit Sunil Anju Mehtaratios

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato RTF, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 3

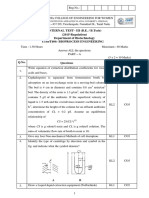

Balance Sheet Ratios

Ratio

Current

Quick

Debt-to-Worth

How to Calculate

Current Assets

Current Liabilities

Cash + Accounts Receivable

Current Liabilities

Total Liabilities

Net Worth

What it Means In Dollars and Cents

Measures solvency: The number of dollars in Current

Assets for every $1 in Current Lialilites.

For example: a Current Ratio of 1.76 means that for

every $1 of Current Liabilities, the company has $1.76 in

Current Assets with which to pay them.

Measures liquidity: The number of dollars in Cash and

Accounts Receivable for each $1 in Current Liabilities.

For example: a Quick Ratio of 1.14 means that for

every $1 of Current Liabilities, the company has $1.14

in Cash and Accounts Receivable with which to pay

them.

Measures financial risk: The number of dollars of Debt

owed for every $1 in Net Worth.

For example: a Debt-to-Worth ratio of 1.05 means that

for every $1 of Net Worth that the owners have invested,

the company owes $1.05 of Debt to its creditors.

Income Statement Ratios

Gross Margin

Net Margin

Gross Profit

Sales

Measures profitability at the Gross Profit level: The number

of dollars of Gross Margin produced for every $1 of Sales.

For example: a Gross Margin Ratio of 34.4% means that

for every $1 of Sales, the company produces 34.4 cents

of Gross Profit.

Net Profit Before Tax

Sales

Measures profitability at the Net Profit level: The number of

dollars of Net Profit produced for every $1 of Sales.

For example: a Net Margin Ratio of 2.9% means that for

every $1 of Sales, the company produces 2.9 cents of

Net Profit.

Overall Efficiency Ratios

Sales-To-Assets

Return On

Assets

Sales

Total Assets

Measures the efficiency of Total Assets in generating

sales: The number of dollars in Sales produced for every

$1 invested in Total Assets.

For example: a Sales-To-Asset Ratio of 2.35 means that

for every $1 invested in Total Assets, the company

generates $2.35 in Sales.

Net Profit Before Tax

Total Assets

Measures the efficiency of Total Assets in generating Net

Profit: The number of dollars in Net Profit produced for

every $1 invested in Total Assets.

For example: a Return on Assets Ratio of 7.1% means

that for every $1 invested in Assets, the company is

generating 7.1 cents in Net Profit Before Tax.

Return On

Net Profit Before Tax

Measures the efficiency of Net Worth in generating Net

Investment

Net Worth

Profit: The number of dollars in Net Profit produced for

every $1 invested in Net Worth.

For example: a Return on Investment Ratio of 16.1%

means that for every $1 invested in Net Worth, the

company is generating 16.1 cents in Net Profit Before

Tax.

Specific Efficiency Ratios

Inventory

Turnover

Cost of Goods Sold

Inventory

Measures the rate at which Inventory is being used on an

annual basis.

For example: an Inventory Turnover Ratio of 9.81 means

that the average dollar volume of Inventory is used up

almost ten times during the fiscal year.

Inventory

Turn-Days

360

Inventory Turnover

Converts the Inventory Turnover ratio into an average "days

inventory on hand" figure.

For example: a Inventory Turn-Days Ratio of 37 means

that the company keeps an average of thirty-seven days

of Inventory on hand throughout the year.

Accounts

Receivable

Turnover

Sales

Accounts Receivable

Measures the rate at which Accounts Receivable are being

collected on an annual basis.

For example: an Accounts Receivable Turnover Ratio of

8.00 means that the average dollar volume of Accounts

Recievalbe are collected eight times during the year.

Average

Collection

Period

360

A/RTurnover

Converts the Accounts Receivable Turnover ratio into the

average number of days the company must wait for its

Accounts Receivable to be paid.

For example: an Accounts Receivable Turnover ratio of

45 means that it takes the company 45 days on average

to collect its receivables.

Accounts

Payable

Turnover

Cost of Goods Sold

Accounts Payable

Measures the rate at which Accounts Payable are being

paid on an annual basis.

For example: an Accounts Payable Turnover ratio of

12.04 means that the average dollar volume of Accounts

Payable are paid about twelve times during the year.

Average

Payment

Period

360

Accounts Payable Turnover

Converts the Accounts Payable Turnover ratio into the

average number of days that a company takes to pay its

Accounts Payable.

For example: an Accounts Payable Turnover ratio of 30

means that it takes the company 30 days on average to

pay its bills.

Potrebbero piacerti anche

- CLO Investing: With an Emphasis on CLO Equity & BB NotesDa EverandCLO Investing: With an Emphasis on CLO Equity & BB NotesNessuna valutazione finora

- Financial Ratio Analysis: List of Financial RatiosDocumento3 pagineFinancial Ratio Analysis: List of Financial RatiosshahbazsiddikieNessuna valutazione finora

- (Eurex) Interest Rate Derivatives - Fixed Income Trading StrategiesDocumento109 pagine(Eurex) Interest Rate Derivatives - Fixed Income Trading StrategiesHelloBud2Nessuna valutazione finora

- EM302 Formula Sheet 2013Documento4 pagineEM302 Formula Sheet 2013Jeff JabeNessuna valutazione finora

- Understanding IFRS Fundamentals: International Financial Reporting StandardsDa EverandUnderstanding IFRS Fundamentals: International Financial Reporting StandardsNessuna valutazione finora

- Cost of Capital, WACC and BetaDocumento3 pagineCost of Capital, WACC and BetaSenith111Nessuna valutazione finora

- Alternative Investment Strategies A Complete Guide - 2020 EditionDa EverandAlternative Investment Strategies A Complete Guide - 2020 EditionNessuna valutazione finora

- 2.3 Fra and Swap ExercisesDocumento5 pagine2.3 Fra and Swap ExercisesrandomcuriNessuna valutazione finora

- Capital Structure A Complete Guide - 2020 EditionDa EverandCapital Structure A Complete Guide - 2020 EditionNessuna valutazione finora

- Equity Forward ContractDocumento6 pagineEquity Forward Contractbloomberg1234Nessuna valutazione finora

- Exam Prep for:: Business Analysis and Valuation Using Financial Statements, Text and CasesDa EverandExam Prep for:: Business Analysis and Valuation Using Financial Statements, Text and CasesNessuna valutazione finora

- 2020 - 11 - The Future of Fixed Income Technology - CelentDocumento26 pagine2020 - 11 - The Future of Fixed Income Technology - CelentProduct PoshanNessuna valutazione finora

- Treasury Operations In Turkey and Contemporary Sovereign Treasury ManagementDa EverandTreasury Operations In Turkey and Contemporary Sovereign Treasury ManagementNessuna valutazione finora

- Overview of Investment BankingDocumento28 pagineOverview of Investment Bankingsinwha321Nessuna valutazione finora

- Purchase Price Allocation A Complete Guide - 2021 EditionDa EverandPurchase Price Allocation A Complete Guide - 2021 EditionNessuna valutazione finora

- Secondary MarketDocumento26 pagineSecondary MarketMohit GuptaNessuna valutazione finora

- Bond and Equity ValuationDocumento18 pagineBond and Equity Valuationclassmate0% (1)

- Bond AnalysisDocumento45 pagineBond AnalysisAbhishekNessuna valutazione finora

- Hedging Strategies Using FuturesDocumento31 pagineHedging Strategies Using Futuressanjana jainNessuna valutazione finora

- Final Formula Sheet DraftDocumento5 pagineFinal Formula Sheet Draftsxzhou23Nessuna valutazione finora

- Accounting 3 StatementsDocumento149 pagineAccounting 3 StatementsArthur M100% (1)

- Investment and Portfolio ManageemntDocumento2 pagineInvestment and Portfolio Manageemntumair aliNessuna valutazione finora

- MortgageModels MOOCMasterSlidesDocumento40 pagineMortgageModels MOOCMasterSlidesMariano Valenzuela BlásquezNessuna valutazione finora

- Chapter 7a - Bonds ValuationDocumento22 pagineChapter 7a - Bonds ValuationAian CortezNessuna valutazione finora

- 5 Macroeconomics PDFDocumento31 pagine5 Macroeconomics PDFKing is KingNessuna valutazione finora

- Corporate Finance Chapter6Documento20 pagineCorporate Finance Chapter6Dan688Nessuna valutazione finora

- What's A Bond?: What's A Bond? Types of Bonds Bond Valuation Techniques The Bangladeshi Bond Market Problem SetDocumento30 pagineWhat's A Bond?: What's A Bond? Types of Bonds Bond Valuation Techniques The Bangladeshi Bond Market Problem SetpakhijuliNessuna valutazione finora

- Global Investments PPT PresentationDocumento48 pagineGlobal Investments PPT Presentationgilli1trNessuna valutazione finora

- Fabozzi Ch06Documento26 pagineFabozzi Ch06cmb463Nessuna valutazione finora

- Business Economics ICFAIDocumento20 pagineBusiness Economics ICFAIDaniel VincentNessuna valutazione finora

- Bond Markets (W4)Documento50 pagineBond Markets (W4)Sam PskovskiNessuna valutazione finora

- No-Armageddon Measure For Arbitrage-Free Pricing of Index Options in A Credit CrisisDocumento21 pagineNo-Armageddon Measure For Arbitrage-Free Pricing of Index Options in A Credit CrisisSapiensNessuna valutazione finora

- Share Purchase Agreements: Purchase Price Mechanisms and Current Trends in Practice 2nd EditionDocumento12 pagineShare Purchase Agreements: Purchase Price Mechanisms and Current Trends in Practice 2nd EditionLê Bá Thái QuỳnhNessuna valutazione finora

- Asset Backed SecuritiesDocumento179 pagineAsset Backed SecuritiesShivani NidhiNessuna valutazione finora

- Social Impact Bond CaseDocumento21 pagineSocial Impact Bond CaseTest123Nessuna valutazione finora

- Chapter 6 Pilbeam Finance and Financial Markets 4th EditionDocumento64 pagineChapter 6 Pilbeam Finance and Financial Markets 4th EditionJay100% (1)

- Stock ValuvationDocumento30 pagineStock ValuvationmsumanraoNessuna valutazione finora

- Investments & RiskDocumento20 pagineInvestments & RiskravaladityaNessuna valutazione finora

- FX Risk ManagementDocumento27 pagineFX Risk ManagementSMO979100% (1)

- Understanding Capital MarketsDocumento15 pagineUnderstanding Capital MarketsSakthirama VadiveluNessuna valutazione finora

- Financial Modelling HandbookDocumento76 pagineFinancial Modelling Handbookreadersbusiness99Nessuna valutazione finora

- International Finance - Part II International Financial Markets & InstrumentsDocumento282 pagineInternational Finance - Part II International Financial Markets & InstrumentsMohit SharmaNessuna valutazione finora

- CH - 04 Mutual Funds and Other Investment CompaniesDocumento27 pagineCH - 04 Mutual Funds and Other Investment CompaniesshomudrokothaNessuna valutazione finora

- Fund AccountingDocumento43 pagineFund AccountingthisisghostactualNessuna valutazione finora

- Chapter 4 Interest Rate FormulasDocumento4 pagineChapter 4 Interest Rate FormulasJohnNessuna valutazione finora

- Bond ValuationDocumento52 pagineBond ValuationDevi MuthiahNessuna valutazione finora

- L8 - Green BondDocumento36 pagineL8 - Green BondCLNessuna valutazione finora

- How To Read Your MT4 Trading StatementDocumento7 pagineHow To Read Your MT4 Trading StatementwanfaroukNessuna valutazione finora

- Accounting! What's It All About?: THE Business CycleDocumento10 pagineAccounting! What's It All About?: THE Business CycleMarcinNessuna valutazione finora

- Overview of Capital MarketsDocumento31 pagineOverview of Capital MarketsDiwakar BhargavaNessuna valutazione finora

- Survey of Microstructure of Fixed Income Market PDFDocumento46 pagineSurvey of Microstructure of Fixed Income Market PDF11: 11100% (1)

- Valuation of Bank Credit CardDocumento8 pagineValuation of Bank Credit Cardsaleem403Nessuna valutazione finora

- Types of SwapsDocumento25 pagineTypes of SwapsBinal JasaniNessuna valutazione finora

- The Myth of Diversification S PageDocumento2 pagineThe Myth of Diversification S PageGuido 125 LavespaNessuna valutazione finora

- Review of Basic Bond ValuationDocumento6 pagineReview of Basic Bond ValuationLawrence Geoffrey AbrahamNessuna valutazione finora

- Determining The Target Cash Balance: Appendix 27ADocumento8 pagineDetermining The Target Cash Balance: Appendix 27AEstefanīa Galarza100% (1)

- Ratio AnalysisDocumento24 pagineRatio Analysisrleo_19871982100% (1)

- (Bank of America) Guide To Credit Default SwaptionsDocumento16 pagine(Bank of America) Guide To Credit Default SwaptionsAmit SrivastavaNessuna valutazione finora

- Wendi C. Lassiter, Raleigh NC ResumeDocumento2 pagineWendi C. Lassiter, Raleigh NC ResumewendilassiterNessuna valutazione finora

- BluetoothDocumento28 pagineBluetoothMilind GoratelaNessuna valutazione finora

- Hotel ManagementDocumento34 pagineHotel ManagementGurlagan Sher GillNessuna valutazione finora

- A PDFDocumento2 pagineA PDFKanimozhi CheranNessuna valutazione finora

- Office Storage GuideDocumento7 pagineOffice Storage Guidebob bobNessuna valutazione finora

- ATPDraw 5 User Manual UpdatesDocumento51 pagineATPDraw 5 User Manual UpdatesdoniluzNessuna valutazione finora

- Tanzania Finance Act 2008Documento25 pagineTanzania Finance Act 2008Andrey PavlovskiyNessuna valutazione finora

- Hotel Reservation SystemDocumento36 pagineHotel Reservation SystemSowmi DaaluNessuna valutazione finora

- CANELA Learning Activity - NSPE Code of EthicsDocumento4 pagineCANELA Learning Activity - NSPE Code of EthicsChristian CanelaNessuna valutazione finora

- Linux For Beginners - Shane BlackDocumento165 pagineLinux For Beginners - Shane BlackQuod Antichristus100% (1)

- Online Learning Interactions During The Level I Covid-19 Pandemic Community Activity Restriction: What Are The Important Determinants and Complaints?Documento16 pagineOnline Learning Interactions During The Level I Covid-19 Pandemic Community Activity Restriction: What Are The Important Determinants and Complaints?Maulana Adhi Setyo NugrohoNessuna valutazione finora

- A320 Basic Edition Flight TutorialDocumento50 pagineA320 Basic Edition Flight TutorialOrlando CuestaNessuna valutazione finora

- Ikea AnalysisDocumento33 pagineIkea AnalysisVinod BridglalsinghNessuna valutazione finora

- Intermediate Accounting (15th Edition) by Donald E. Kieso & Others - 2Documento11 pagineIntermediate Accounting (15th Edition) by Donald E. Kieso & Others - 2Jericho PedragosaNessuna valutazione finora

- Lockbox Br100 v1.22Documento36 pagineLockbox Br100 v1.22Manoj BhogaleNessuna valutazione finora

- HandloomDocumento4 pagineHandloomRahulNessuna valutazione finora

- Extent of The Use of Instructional Materials in The Effective Teaching and Learning of Home Home EconomicsDocumento47 pagineExtent of The Use of Instructional Materials in The Effective Teaching and Learning of Home Home Economicschukwu solomon75% (4)

- Abu Hamza Al Masri Wolf Notice of Compliance With SAMs AffirmationDocumento27 pagineAbu Hamza Al Masri Wolf Notice of Compliance With SAMs AffirmationPaulWolfNessuna valutazione finora

- M J 1 MergedDocumento269 pagineM J 1 MergedsanyaNessuna valutazione finora

- Ces Presentation 08 23 23Documento13 pagineCes Presentation 08 23 23api-317062486Nessuna valutazione finora

- Employees' Pension Scheme, 1995: Form No. 10 C (E.P.S)Documento4 pagineEmployees' Pension Scheme, 1995: Form No. 10 C (E.P.S)nasir ahmedNessuna valutazione finora

- Microsoft Word - Claimants Referral (Correct Dates)Documento15 pagineMicrosoft Word - Claimants Referral (Correct Dates)Michael FourieNessuna valutazione finora

- RevisionHistory APFIFF33 To V219Documento12 pagineRevisionHistory APFIFF33 To V219younesNessuna valutazione finora

- 500 Logo Design Inspirations Download #1 (E-Book)Documento52 pagine500 Logo Design Inspirations Download #1 (E-Book)Detak Studio DesainNessuna valutazione finora

- Deed of Assignment CorporateDocumento4 pagineDeed of Assignment CorporateEric JayNessuna valutazione finora

- MRT Mrte MRTFDocumento24 pagineMRT Mrte MRTFJonathan MoraNessuna valutazione finora

- ARUP Project UpdateDocumento5 pagineARUP Project UpdateMark Erwin SalduaNessuna valutazione finora

- Process States in Operating SystemDocumento4 pagineProcess States in Operating SystemKushal Roy ChowdhuryNessuna valutazione finora

- Aluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyDocumento2 pagineAluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyJoachim MausolfNessuna valutazione finora

- BST Candidate Registration FormDocumento3 pagineBST Candidate Registration FormshirazNessuna valutazione finora

- Getting to Yes: How to Negotiate Agreement Without Giving InDa EverandGetting to Yes: How to Negotiate Agreement Without Giving InValutazione: 4 su 5 stelle4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Da EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Valutazione: 4.5 su 5 stelle4.5/5 (14)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Da EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Valutazione: 4.5 su 5 stelle4.5/5 (14)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineDa EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNessuna valutazione finora

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindDa EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindValutazione: 5 su 5 stelle5/5 (231)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Da EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Valutazione: 4 su 5 stelle4/5 (33)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsDa EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsValutazione: 5 su 5 stelle5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItDa EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItValutazione: 4.5 su 5 stelle4.5/5 (14)

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookDa EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNessuna valutazione finora

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Da EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Valutazione: 4.5 su 5 stelle4.5/5 (5)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsDa EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsValutazione: 4 su 5 stelle4/5 (7)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessDa EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessValutazione: 4.5 su 5 stelle4.5/5 (28)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCDa EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCValutazione: 5 su 5 stelle5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeDa EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeValutazione: 4 su 5 stelle4/5 (21)

- Financial Accounting For Dummies: 2nd EditionDa EverandFinancial Accounting For Dummies: 2nd EditionValutazione: 5 su 5 stelle5/5 (10)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetDa EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetValutazione: 4.5 su 5 stelle4.5/5 (14)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookDa EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookValutazione: 5 su 5 stelle5/5 (4)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageDa EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageValutazione: 4.5 su 5 stelle4.5/5 (109)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditDa EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditValutazione: 5 su 5 stelle5/5 (1)

- Controllership: The Work of the Managerial AccountantDa EverandControllership: The Work of the Managerial AccountantNessuna valutazione finora

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Da EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Valutazione: 4.5 su 5 stelle4.5/5 (5)