Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Introduction

Caricato da

Kuladeepa KrCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Introduction

Caricato da

Kuladeepa KrCopyright:

Formati disponibili

INTRODUCTION

The automobile industry is one of Indias most vibrant and growing industries. This industry

accounts for 22 per cent of the country's manufacturing gross domestic product (GDP). The

auto sector is one of the biggest job creators, both directly and indirectly. It is estimated that

every job created in an auto company leads to three to five indirect ancillary jobs.

India's domestic market and its growth potential have been a big attraction for many global

automakers. India is presently the world's third largest exporter of two-wheelers after China

and Japan. According to a report by Standard Chartered Bank, India is likely to overtake

Thailand in global auto-export market share by the year 2020.

The next few years are projected to show solid but cautious growth due to improved

affordability, rising incomes and untapped markets. With the governments backing, and

trends in the international scenario such as the decline in prices of natural rubber, the Indian

automobile industry is slated to witness some major growth.

Market size

The cumulative foreign direct investment (FDI) inflows into the Indian automobile industry

during the period April 2000 August 2014 was recorded at US$ 10,119.68 million, as per

data by Department of Industrial Policy and Promotion (DIPP).

Data from industry body Society of Indian Automobile Manufacturers (SIAM) showed that

137,873 passenger cars were sold in July 2014 compared to 131,257 units during the

corresponding month of 2013. Among the auto makers, Maruti Suzuki, Hyundai Motor India

and Honda Cars India emerged the top three gainers with sales growth of 15.45 per cent, 12

per cent and 11 per cent, respectively.

The three-wheeler segment posted a 24 per cent growth to 51,461 units on the back of

increased demands from the urban market. Total sales across different vehicle segments grew

12 per cent year on year (y-o-y) to 1,586,123 units.

Scooter sales have jumped by 29 per cent in the ongoing fiscal, and now form 27 per cent of

the total two-wheeler market from just 8 per cent a decade back. The ever-rising demand for

scooters, which has far outstripped supply has prompted Honda to set up its first dedicated

scooter plant in Ahmedabad.

Tractor sales in the country is expected to grow at a compound annual growth rate (CAGR)

of 89 per cent in the next five years making India a high-potential market for many

international brands.

INVESTMENTS

To match production with demand, many auto makers have started to invest heavily in

various segments in the industry in the last few months. Some of the major investments and

developments in the automobile sector in India are as follows:

Ashok Leyland plans to invest Rs 450500 crore (US$ 73.5481.71 million) in India, by way

of capital expenditure (capex) and investment during FY15. The company is required to

manage Rs 6,000 crore (US$ 980.56 million) of assets in seven locations across the world, for

which maintenance capex is needed.

Honda Motors plans to set up the world's largest scooter plant in Gujarat to roll out 1.2

million units annually and achieve leadership position in the Indian two-wheeler market. The

company plans to spend around Rs 1,100 crore (US$ 179.76 million) on the new plant in

Ahmedabad, and expand its range with a few more offerings.

Yamaha Motor Co has restructured its business in India. Now, Yamaha Motor India (YMI)

will take care of its India operations. The restructuring is part of Yamahas mid-term plan

aimed at improving organisational efficiency, as per Mr Hiroyuki Suzuki, Chief Executive

and Managing Director. YMI would be responsible for corporate planning and strategy,

business planning and business expansion, quality control, and regional control of Yamaha

India Business.

Tata Motors plans to use the 'hub-and-spoke' model in which India will be the key

manufacturing base while it will have mini-hubs in overseas markets. The company also

plans to set up mini hubs in potential markets like Africa, Middle-East and South East Asia.

Hero Cycles through its unit OPM Global has acquired a majority stake in German bicycle

company Mitteldeutsche Fahrradwerke AG (MIFA) for 15 million (US$ 19.11 million). The

company plans to invest an additional 4 million (US$ 5.09 million) as capital expenses in

restructuring the acquired company.

GOVERNMENT INITIATIVES

The Government of India encourages foreign investment in the automobile sector and allows

100 per cent FDI under the automatic route. To boost manufacturing, the government had

lowered excise duty on small cars, motorcycles, scooters and commercial vehicles to eight

per cent from 12 per cent, on sports utility vehicles to 24 per cent from 30 per cent, on mid-

segment cars to 20 per cent from 24 per cent and on large-segment cars to 24 per cent from

27 per cent.

The governments decision to resolve VAT disputes has also resulted in the top Indian auto

makers namely, Volkswagen, Bajaj Auto, Mahindra & Mahindra and Tata Motors

announcing an investment of around Rs 11,500 crore (US$ 1.87 billion) in Maharashtra.

The Automobile Mission Plan for the period 20062016, designed by the government is

aimed at accelerating and sustaining growth in this sector. Also, the well-established

Regulatory Framework under the Ministry of Shipping, Road Transport and Highways, plays

a part in providing a boost to this sector.

The Government of India-appointed SIAM and Automotive Components Manufacturers

Association (ACMA) are responsible in working for the development of the Indian

automobile industry.

Road Ahead

The future of the auto industry depends on the positive sentiments and the demand for

vehicles in the market. With the festival season coming up, the Indian auto sector will see a

rise in demand which is expected to bring in major growth. An auto dealer survey by firm

UBS suggested that the Indian auto industry, riding on trends like the upcoming festival

season and decline in fuel price, will observe a 12 per cent y-o-y growth in FY15.

Exchange Rate Used: INR 1 = US$ 0.0163 as on October 28, 2014.

MIACHEL POTTERS FIVE FORCE MODEL

RIVALRY AMONG FIRMS- HIGH

The key players in two-wheeler industries are Hero Honda motor ltd. (HHML), Bajaj Auto

ltd and TVS motor Company ltd. The other players are Kinetic, LML, Yamaha, Majestic auto

ltd, Royal Enfield ltd and Honda motorcycle & scooter India.

Two-wheelers domestic market growth rate for 2008-09 is 19.4% which is very high when

compared to that of three wheelers, Passenger and commercial vehicles.

Indian Auto policy 2002 gives added advantage to two-wheeler manufacturers to enter even

other countries outside India.

Since big manufacturer plant with high technology and good R&D team needed many of

them dose not enter in two-wheeler Industries. Only the companies which are in automobile

line will expand their product line like Mahindra.

(2)Threat of New Entrants LOW TO MODERATE

Capital investment is very huge

Sports bikes entering in Indian market

Harley Davidson launching in India

(3)Threat of Substitute Products Low to Moderate

Substitute products for two-wheeler industries are bus transportation, Auto transportation and

even low-end cars, but people using two-wheelers can only use the service of buses and auto

as a substitute product.

Sometimes low-end car is a substitute product for the people using high-end motorcycles.

Normal buses to hi-tech ac buses which is threat to two-wheeler industry.

Penetration of Metro trains in Metropolitans.

(4)Bargaining Power of Suppliers Low

Some of the components in two-wheeler industry are very common for all the two-wheeler

industries like steel, aluminium, tyres and tubes, these material are available in abundant.

This makes them to drive a smooth production of their finished products.

(5)Bargaining Power of Customer High

Buyer has added advantage than seller because there are five to six big popular brands of

two-wheelers are available in India, so that they can switch brand from one another.

Buyers are very conscious in spending their money to purchase two-wheeler, because it

attracts most of the middle-income groups seller cannot price their product very high.

FAILED PRODUCT

TATA NANO

When the Tata Nano, a stripped-down minicar priced at around $2,000, was introduced in

2009, it was marketed as a car that would transform the way aspiring consumers in India and

other developing countries got around.

But the low-cost automotive revolution fizzled. Selling poorly at home and with exports

drying up, the Nano has become a cautionary tale of misplaced ambitions and a drag on sales

and profit at TATA MOTORS Ltd. Indias fourth-largest auto maker and the owner of Jaguar

and Land Rover luxury vehicles.

It turns out that those climbing into India's middle class want cheap cars, but they don't want

cars that seem cheapand are willing to pay more than Tata reckoned for a vehicle that has a

more upmarket image.

Now, Nano is trying remake the "people's car," into the "cool people's car." It has given the

car itself a face-lift, adding a stereo, hubcaps and chrome trim, raised the price and started a

new marketing campaign to give it more cachet.

The remake failed to boost sales of the Nano, a Tata mainstay, the company's outlook could

be grim. Tata Motors has been laying off workers and cutting production. Analysts say

without a revival in Nano demand, Tata Motors could cut further jobs next year.

"This was the flagship product for the passenger-car market. The disappointing sales are a

pretty big negative for the group," said Anil Sharma, an analyst at IHS Automotive, an

industry consulting company.

Tata made a big bet on the Nano. It spent close to $400 million developing the vehicle and

hundreds of millions more building a factory capable of manufacturing 15,000 to 20,000 of

the tiny cars a month.

With sales now hovering around 2,500 a month, down from a peak of about 10,000 in April

2012, that means a lot of idle capacity at the plant in the western state of Gujarat, and a lot of

frustrated Tata dealers around the country.

Tata's September sales in India were down 40% from a year earlier. Second-quarter net

income for the company as a whole was down 23% year-to-year despite a large increase in

income from sales of Jaguars and Land Rovers. It was the company's third straight quarterly

decline in profit.

A sharp deceleration in the Indian economy this year that has hit auto sales across the board

isn't helping.

"I think I would be imprudent to say we aren't worried. We are," said Ankush Arora, the head

of Tata's passenger-vehicle business.

One of the few bright spots is Tata's U.K.-based Jaguar Land Rover luxury-vehicle unit

acquired from Ford Motor Co. in 2008. For the three months ended June 30, profit at that unit

rose 33% to 675 million ($1.07 billion), while sales rose 11% from a year earlier to 4

billion.

In August, Tata sold about the same number of Jaguar XF sedans than Nanos. Roughly 19

Nanos could be purchased for the about $47,000 starting price of an XF base model in the

U.S. market.

When Tata first designed the Nano, engineers tried to pare down features to keep costs in

check. The car is the least expensive mass-produced automobile in the world.

When the first models hit the roads, the base model had no air conditioning, no stereo and

just a single windshield wiper. The Spartan interior had no glove box and thinly padded seats

that didn't adjust.

WHY TATA NANO FAILED

ALTERNATIVES: For the price of a Nano, I could easily get a 3 year old "full" car. Why

would you spend 150,000 INR for a "toy" car? Nano is not suitable as the only car at home

given its various limitations. In Indian families, car rides can involve as many as 6 people on

a few occasions.

ASPIRATIONAL: Tata made it look utilitarian. However, Indian car buyers are not

utilitarian but aspirational. They want to show-off their car. Tata's marketing made sure that

the car looked "cheap" and not "hip". Tata re-positions 'cheap' Nano car

Intra-city transportation: In India, intra-city transportation is fairly well addressed by auto

rickshaws and taxis. It is the intercity transportation that middle class often needs the car for

(such as going to your family temple or visiting in-laws). These roads range from fast

highways to unstopped mud roads. Nano is terrible on both these roads.

PRICING NETHERLAND: Nano is priced at a range where it is too expensive for the

lower middle class and too shabby for the upper middle class. The class in-between always

looks to the upper class & upper middle class, and thus avoided altogether. TATA NANO:

Failure Due to Perception

UNCLEAR TARGETING: A college kid would rather pay Rs.80, 000 for a cool looking

Pulsar motorcycle than an Rs.150, 000 cheap car. For older people, the low suspension is

really uncomfortable. For family people, there is not enough space to keep stuff.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- San Miguel Corporation: Architect: Franciso "Bobby" ManosaDocumento34 pagineSan Miguel Corporation: Architect: Franciso "Bobby" ManosaHazel Joy Castillo50% (2)

- Scratch On SEAT BACK BAR GARNISH by Convertible Top Contacting PDFDocumento6 pagineScratch On SEAT BACK BAR GARNISH by Convertible Top Contacting PDFAnonymous Xhxs7XYomRNessuna valutazione finora

- S08303-Troubleshooting Guide PDFDocumento220 pagineS08303-Troubleshooting Guide PDFJhony Kize100% (4)

- AFR February 01-15-2016-LrDocumento28 pagineAFR February 01-15-2016-LrKuladeepa KrNessuna valutazione finora

- 02 CopywritingDocumento22 pagine02 CopywritingZonaira PervezNessuna valutazione finora

- Cycle Time ImprovementDocumento134 pagineCycle Time ImprovementKuladeepa KrNessuna valutazione finora

- Creative Side and Message StrategyDocumento18 pagineCreative Side and Message StrategyKuladeepa KrNessuna valutazione finora

- Framework For Assessing Multinational StrategiesDocumento10 pagineFramework For Assessing Multinational StrategiesKuladeepa KrNessuna valutazione finora

- S.No Description Cash Credit TotalDocumento1 paginaS.No Description Cash Credit TotalKuladeepa KrNessuna valutazione finora

- Finacial Reporting and Analyis Assignment-1Documento7 pagineFinacial Reporting and Analyis Assignment-1Kuladeepa KrNessuna valutazione finora

- Questionnaire Behavior of Customer'S Towards Nestle ProductsDocumento4 pagineQuestionnaire Behavior of Customer'S Towards Nestle ProductsKuladeepa KrNessuna valutazione finora

- Presenatation On Fund Flow Statement: BY: Weena Yancey Kyrmen Singleman DipjoytiDocumento22 paginePresenatation On Fund Flow Statement: BY: Weena Yancey Kyrmen Singleman DipjoytiKuladeepa KrNessuna valutazione finora

- Concept of Child AbuseDocumento4 pagineConcept of Child AbuseKuladeepa KrNessuna valutazione finora

- Work Done One Page Description One Page Description: Signature of External Guide With SealDocumento1 paginaWork Done One Page Description One Page Description: Signature of External Guide With SealKuladeepa KrNessuna valutazione finora

- Target Advertisers Bangalore Balance Sheet-ConsolidatedDocumento2 pagineTarget Advertisers Bangalore Balance Sheet-ConsolidatedKuladeepa KrNessuna valutazione finora

- 1Hwzrun0Hgld, Qyhvwphqwv: 3uhylrxv HduvDocumento2 pagine1Hwzrun0Hgld, Qyhvwphqwv: 3uhylrxv HduvKuladeepa KrNessuna valutazione finora

- Money ControlDocumento2 pagineMoney ControlKuladeepa KrNessuna valutazione finora

- Shrunga M N: Career ObjectiveDocumento3 pagineShrunga M N: Career ObjectiveKuladeepa KrNessuna valutazione finora

- Growth of The Café Industry in IndiaDocumento2 pagineGrowth of The Café Industry in IndiaKuladeepa KrNessuna valutazione finora

- Ingo Bauernfeind - Concorde - Supersonic Icon - 50th Anniversary Edition-Bauernfeind Press (2018)Documento209 pagineIngo Bauernfeind - Concorde - Supersonic Icon - 50th Anniversary Edition-Bauernfeind Press (2018)André ProvensiNessuna valutazione finora

- Product Recommendation Toyota Forklift Trucks, Diesel 7FDA50Documento2 pagineProduct Recommendation Toyota Forklift Trucks, Diesel 7FDA50Walker SkyNessuna valutazione finora

- Practice Automotive Industries Tarea 2Documento3 paginePractice Automotive Industries Tarea 2Oscar FerNessuna valutazione finora

- News Flash Reading Comprehension Exercises 12981Documento1 paginaNews Flash Reading Comprehension Exercises 12981Huznul KhatimahNessuna valutazione finora

- Prikolice I DodatciDocumento52 paginePrikolice I DodatciAlan MiletićNessuna valutazione finora

- Toyota Training New Vehicle TechnologyDocumento7 pagineToyota Training New Vehicle Technologysara100% (50)

- Joint Light Tactical VehicleDocumento16 pagineJoint Light Tactical Vehicleramesh0% (1)

- SDLG LG956L Wheeled LoaderDocumento4 pagineSDLG LG956L Wheeled LoaderSergio Pinheiro100% (2)

- Toyota: Global Expansion StrategiesDocumento38 pagineToyota: Global Expansion StrategiesDewesh ThakurNessuna valutazione finora

- BKG NG 737 FamilyDocumento6 pagineBKG NG 737 FamilyJaafar El HajjNessuna valutazione finora

- VOITH Retarder Product brochure-General-ENDocumento16 pagineVOITH Retarder Product brochure-General-ENFreddy AndresNessuna valutazione finora

- Spatial Development Trends Around Arumbakkam Metro Rail Station in ChennaiDocumento5 pagineSpatial Development Trends Around Arumbakkam Metro Rail Station in ChennaiFrozFuriNessuna valutazione finora

- Autokoi Pricelist - 00024Documento2 pagineAutokoi Pricelist - 00024amitNessuna valutazione finora

- Pamphlet 9 - Recommnended Practices For Handling Chlorine Bulk Highway TransportDocumento62 paginePamphlet 9 - Recommnended Practices For Handling Chlorine Bulk Highway TransportJacques BlueqNessuna valutazione finora

- LA Metro - 940Documento2 pagineLA Metro - 940cartographica100% (1)

- Clean Ganga Fund: Rs. 66 Crore and Counting: Utilisation of FundsDocumento3 pagineClean Ganga Fund: Rs. 66 Crore and Counting: Utilisation of FundsAmit Kumar BaghelNessuna valutazione finora

- Trend For Public Transportation in The PhilippinesDocumento1 paginaTrend For Public Transportation in The PhilippinesAl-juffrey Luis AmilhamjaNessuna valutazione finora

- Swot Analysis of Skoda IndiaDocumento13 pagineSwot Analysis of Skoda IndiaKaran Umesh SalviNessuna valutazione finora

- Bentley Brochure PDFDocumento9 pagineBentley Brochure PDFDr.Abdulrahman saadehNessuna valutazione finora

- Compartive Balance SheetDocumento79 pagineCompartive Balance SheetbootNessuna valutazione finora

- GM Has A New Model For ChangeDocumento3 pagineGM Has A New Model For ChangeTrishna ShuklaNessuna valutazione finora

- 2011 Cushman Titan 36v 2p Tech SpecDocumento6 pagine2011 Cushman Titan 36v 2p Tech SpecForklift Systems IncorporatedNessuna valutazione finora

- Shipping Statistics and Market ReviewDocumento17 pagineShipping Statistics and Market ReviewMiguel PachecoNessuna valutazione finora

- 19 Beriev 200 Project Development The Be 200 in The USA Dina Krivonosova Dave BaskettDocumento43 pagine19 Beriev 200 Project Development The Be 200 in The USA Dina Krivonosova Dave BaskettKrasakKrusuk Si MaulNessuna valutazione finora

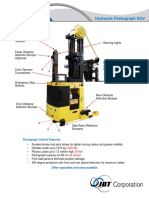

- Hydraulic Pantograph SGVDocumento2 pagineHydraulic Pantograph SGVHo Van RoiNessuna valutazione finora

- Downloaded From Manuals Search EngineDocumento120 pagineDownloaded From Manuals Search EngineGururajNessuna valutazione finora

- Visual Basic PR-WPS OfficeDocumento1 paginaVisual Basic PR-WPS OfficeSpatelNessuna valutazione finora