Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

BankAwareness 1

Caricato da

anant_sahu_1Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

BankAwareness 1

Caricato da

anant_sahu_1Copyright:

Formati disponibili

1. Which of the following is a foreign bank having branches in India?

A. HDFC Bank

B. ICICI Bank

C. Yes Bank

D. Standard Chartered Bank

E. Syndicate Bank

2. Consider the following statements with respect to IFSC code used in Banking System:

A) IFSC Stands for Indian Financial System Code

B) It is an 11-digit alphanumeric Unique Code

C) IFSC is used be the NEFT system to route the message to the destination banks/branches.

A. Only A

B. Only B

C. Only C

D. Only B and C

E. All A, B and C

3. The usual deposit accounts of banks are

A. Current Accounts, Insurance Premium Account and Electricity accounts

B. Current Accounts, Post office Savings account and Term deposit accounts

C. Loan Accounts, Term Deposit accounts and Savings Account

D. Term Deposit accounts, Current Accounts and Savings Account

E. Current bill accounts and term deposit account

4. When a bank returns a cheque unpaid, it is called?

A. Payment of cheque

B. Dishonor of cheque

C. Cancelling of cheque

D. Drawing of cheque

E. None of these

5. Which of the following is not a tool in the hands of RBI to control the inflationary pressure in the

country?

A. Bank Rate (BR)

B. Special Drawing Rights (SDR)

C. Statutory Liquidity Ratio (SLR)

D. Cash Reserve Ratio (CRR)

E. None of these

6. On the recommendation of which committee was NABARD established?

A. Rangarajan

B. Shivraman

C. Narasingam

D. Vijay Kelkar

E. Malegam

7. Which among the following does not decided the RBI?

A. CAR

B. CRR

C. Base Rate

D. Bank Rate

E. Repo Rate

8. An Increase in Cash Reserve Ratio (CRR) by Reserve Bank of India leads to:

A. Decrease in Deposit

B. Increase in Deposit

C. Decrease in lendable resources

D. Increase in lendable resources

E. None of these

9. What is meant by development oriented banking?

A. Infrastructure Financing

B. Taking up task of development of the economy by providing support to under privileged

sections of the society.

C. Extending loans to states which are underdeveloped

D. All of the above

E. None of these

10. Which of the following is classified as a Public Sector Banks?

A. ICICI Bank

B. Yes Bank

C. IDBI Bank

D. Local area Banks

E. None of these

11. Reserve Bank of India known as lender of last resort because

A. It has to meet the credit need of citizens to whom no one else is willing to lend

B. It comes to help bank in times of crisis

C. Banks lend to go to RBI as a last resort

D. All of the above

E. None of these

12. The banker-customer relationship in credit card payment is?

A. Agent-Principal

B. Principal-Agent

C. Creditor-Debtor

D. Debtor-creditor

E. None of these

13. The banker-customer relationship in credit card payment is?

A. Agent-Principal

B. Principal-Agent

C. Creditor-Debtor

D. Debtor-creditor

E. None of these

14. Bank Rate implies the rate of Interest -

A. Charges by banks on loans and advances

B. Paid by the RBI on the deposits if commercial banks

C. Payable on bonds

D. At which the RBI discounts the Bill of exchange

E. None of these

15. Increase in net RBI credit for central government represents -

A. Budgetary deficit

B. Monetized Deficit

C. Fiscal deficit

D. Revenue deficit

E. None of these

16. The rate of interest, banks charge to its main/ major and prime; customers is popularly called as

A. Cost of Fund

B. Repo Rate

C. Reserve Repo Rate

D. Prime Lending Rate

E. Risk Premium

17. Under provision of which of the following the Reserve Bank of India issues directive to the

Banks in India?

A. Essential Commodities Act

B. Banking Regulation Act

C. RBI Act

D. RBI Act and Banking Regulation Act

E. None of these

18. A loan bearing low rate of Interest is known as:

A. Hard Loan

B. Soft Loan

C. Capital loan

D. Real Loan

E. None of these

19. Which of the following is not an asset of a bank?

A. Notes and Small coins

B. Short Term Loans

C. Staff Advances

D. Overdue Recurring Deposits

E. None of these

20. The Base rate is set by which of the following organizations/ institution?

A. Individual Bank

B. Government of India

C. Reserve Bank of India

D. RBI in consultation with Government

E. State Bank of India

Potrebbero piacerti anche

- Dakshinanchal Vidyut Vitran Nigam LimitedDocumento34 pagineDakshinanchal Vidyut Vitran Nigam Limitedanant_sahu_1Nessuna valutazione finora

- BoqcomparativechartDocumento3 pagineBoqcomparativechartanant_sahu_1Nessuna valutazione finora

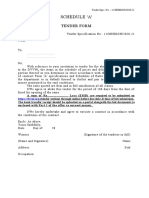

- ScheduleDocumento4 pagineScheduleanant_sahu_1Nessuna valutazione finora

- CA Pre-Open CHNG Prev. CloseDocumento8 pagineCA Pre-Open CHNG Prev. Closeanant_sahu_1Nessuna valutazione finora

- TTSE Discount Details: Sno. Name Email Mobile Course City Total Score Disc. Percentage Disc. Code StatusDocumento1 paginaTTSE Discount Details: Sno. Name Email Mobile Course City Total Score Disc. Percentage Disc. Code Statusanant_sahu_1Nessuna valutazione finora

- Qualification Requirement: Tender Spec. No. - 11/SE/EDCH/2020-21Documento2 pagineQualification Requirement: Tender Spec. No. - 11/SE/EDCH/2020-21anant_sahu_1Nessuna valutazione finora

- Cube Test 18 DecDocumento1 paginaCube Test 18 Decanant_sahu_1Nessuna valutazione finora

- LR TestDocumento3 pagineLR Testanant_sahu_1Nessuna valutazione finora

- Constitution of IndiaDocumento19 pagineConstitution of Indiaanant_sahu_1Nessuna valutazione finora

- Scholarship Test 3mayDocumento3 pagineScholarship Test 3mayanant_sahu_1Nessuna valutazione finora

- Custom DutyDocumento5 pagineCustom Dutyanant_sahu_1Nessuna valutazione finora

- Infrastructure News ArticlesDocumento31 pagineInfrastructure News Articlesanant_sahu_1Nessuna valutazione finora

- Anita Teachers DayDocumento1 paginaAnita Teachers Dayanant_sahu_1Nessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Monetary Policy and Role of Its InstrumentsDocumento23 pagineMonetary Policy and Role of Its Instrumentsbhargavchotu15534Nessuna valutazione finora

- TT1 Bahasa Inggris Niaga Adbi4201Documento1 paginaTT1 Bahasa Inggris Niaga Adbi4201lutfiNessuna valutazione finora

- Regular Payment of An AnnuityDocumento11 pagineRegular Payment of An AnnuityKarla BangFerNessuna valutazione finora

- Full Dollarization: The Case of PanamaDocumento46 pagineFull Dollarization: The Case of Panamamario_utamaNessuna valutazione finora

- Session 4 International FinanceDocumento4 pagineSession 4 International FinanceTumbleweedNessuna valutazione finora

- Chapter 26 Web Chapter: The ISLM Model: Economics of Money, Banking, and Fin. Markets, 10e (Mishkin)Documento23 pagineChapter 26 Web Chapter: The ISLM Model: Economics of Money, Banking, and Fin. Markets, 10e (Mishkin)Ahmad Tawfiq DarabsehNessuna valutazione finora

- Homework #1: Nguyen Xuan Thanh Strategy division-TCBDocumento2 pagineHomework #1: Nguyen Xuan Thanh Strategy division-TCBThanh NguyenNessuna valutazione finora

- What Is Cash Reserve Ratio and How Will The CRR Hike ImpactDocumento4 pagineWhat Is Cash Reserve Ratio and How Will The CRR Hike ImpactNaveen SharmaNessuna valutazione finora

- Three Players in The Money Supply ProcessDocumento4 pagineThree Players in The Money Supply ProcessDeavoNessuna valutazione finora

- Inflation in Pakistan Economics ReportDocumento15 pagineInflation in Pakistan Economics ReportQanitaZakir75% (16)

- Economics of Money Banking and Financial Markets 9th Edition by Mishkin Solution Manual PDFDocumento19 pagineEconomics of Money Banking and Financial Markets 9th Edition by Mishkin Solution Manual PDFjvggfa0% (1)

- Amortization & Sinking FundDocumento27 pagineAmortization & Sinking FundkimNessuna valutazione finora

- Quiz Study Unit 2 PDFDocumento2 pagineQuiz Study Unit 2 PDFVinny HungweNessuna valutazione finora

- Term LoanDocumento16 pagineTerm LoanPriyaNessuna valutazione finora

- Functions of Central and Commercial BanksDocumento11 pagineFunctions of Central and Commercial BanksDeepjyotiNessuna valutazione finora

- Balu Florentina Olivia Bran Anca Georgiana Bran Florin PaulDocumento11 pagineBalu Florentina Olivia Bran Anca Georgiana Bran Florin PaulConstantinescu DanaNessuna valutazione finora

- MCQ Central BankingDocumento5 pagineMCQ Central BankingYogesh GharpureNessuna valutazione finora

- Chapter FOUR 4. The Money Supply ProcessDocumento19 pagineChapter FOUR 4. The Money Supply ProcessBicaaqaa M. AbdiisaaNessuna valutazione finora

- The Mortgage Professor'S Amortization Worksheet EnterDocumento14 pagineThe Mortgage Professor'S Amortization Worksheet EnterKaushal KumarNessuna valutazione finora

- 2022list of LC - 0331 PDFDocumento45 pagine2022list of LC - 0331 PDFEden AguinaldoNessuna valutazione finora

- Central Bank and Its EvolutionDocumento6 pagineCentral Bank and Its EvolutionSadia AshadNessuna valutazione finora

- Chapter 5Documento61 pagineChapter 5Zuka GabaidzeNessuna valutazione finora

- Mortgage MarketsDocumento28 pagineMortgage Marketssweya juliusNessuna valutazione finora

- L12: Actual and Constant DollarsDocumento11 pagineL12: Actual and Constant DollarsSajid IqbalNessuna valutazione finora

- EconomicsDocumento12 pagineEconomicsDeeksha PakhariyaNessuna valutazione finora

- ECN 2223d Phillips CurveDocumento7 pagineECN 2223d Phillips CurveKanchana Geeth SamaraweeraNessuna valutazione finora

- Chapter 28 NotesDocumento4 pagineChapter 28 Notesburneymcb100% (1)

- International Monetary FundDocumento16 pagineInternational Monetary Fundtapan mistryNessuna valutazione finora

- Loan AgreementDocumento2 pagineLoan AgreementKesavanNessuna valutazione finora

- Econ 1 - Problem Set 8 With SolutionsDocumento10 pagineEcon 1 - Problem Set 8 With SolutionsChilly WuNessuna valutazione finora