Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

KKR Kio

Caricato da

Hungreo411Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

KKR Kio

Caricato da

Hungreo411Copyright:

Formati disponibili

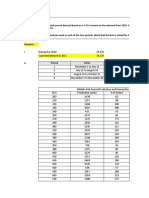

1. Portfolio data shown as a percentage of fair value at March 31, 2014.

2. The Fund has entered into a financing facility with a major financial institution. Under the terms of the leverage facility, the Fund has access to committed

financing of up to $145 million. While the use of leverage can result in greater returns in a rising market as well as increased income generation, its use can

also generate greater losses in a declining market as well as pressure income levels in an environment of higher borrowing costs. The Fund is required to

maintain prescribed asset coverage for its borrowings, and may be required to reduce its leverage at an inopportune time if Fund asset values decline.

3. Ratings are based on Fitch, Moodys or S&P, as applicable. Ratings, which are subject to change, apply to the creditworthiness of the issuers of the underlying

securities and not to the Fund or its shares. Credit ratings measure the quality of a bond based on the issuers creditworthiness, with ratings ranging from AAA,

being the highest, to D, being the lowest based on S&Ps measures. Ratings of BBB or higher by Standard and Poors (Baa or higher by Moodys) are considered

to be investment grade quality.

4. Calculations shown are levered.

OBJECTIVE AND STRATEGY

KKR Income Opportunities Fund (the Fund) is a non-diversified, closed end

management investment company. The Funds primary investment objective is to seek

a high level of current income with a secondary objective of capital appreciation. There

can be no assurance that the Fund will achieve its investment objectives or be able to

structure its investment portfolio as anticipated.

The Fund seeks to achieve its investment objectives by employing a dynamic strategy of

investing in a targeted portfolio of loans and fixed-income instruments of U.S. and non-

U.S. issuers and implementing hedging strategies in order to seek to achieve attractive

risk-adjusted returns. Under normal market conditions, the Fund will invest at least

80% of its Managed Assets (as defined herein) in loans and fixed-income instruments

or other instruments, including derivative instruments, with similar economic

characteristics (the 80% Policy). The Fund expects to invest primarily in first- and

second lien secured loans, unsecured loans and high-yield corporate debt instruments

of varying maturities. The instruments in which the Fund invests may be rated

investment grade or below investment grade by a nationally recognized statistical rating

organization, or unrated. The Funds investments in below investment grade loans,

below investment grade fixed-income instruments and debt instruments of financially

troubled companies are considered speculative with respect to the issuers capacity

to pay interest and repay principal. These investments are commonly referred to as

high-yield or junk instruments. The Fund seeks to tactically and dynamically allocate

capital across companies capital structures where KKR Asset Management LLC (the

Adviser) believes its due diligence process has identified compelling investment

opportunities, including where the Adviser has identified issuer distress, event-driven

misvaluations of securities or capital market inefficiencies.

FUND FACTS AND DATA

SYMBOL KIO

NAV SYMBOL XKIOX

INCEPTION DATE 7/25/2013

CLOSING MARKET PRICE

AS OF 3/31/14

$17.86

CLOSING NAV AS OF 3/31/14 $19.73

PREMIUM (DISCOUNT) -9.48%

CURRENT MONTHLY DIVIDEND

(PER SHARE)

$0.125

52 WEEK HIGH/LOW SHARE

CLOSING MARKET PRICE

$19.90/$17.18

52 WEEK HIGH/LOW NAV $19.77/$18.84

AVERAGE POSITION SIZE $3,526,331

NUMBER OF POSITIONS 112

DURATION (YEARS)

4

3.99

AVERAGE COUPON RATE

4

(%) 10.71%

AVERAGE YIELD TO MATURITY

4

(%)

10.46%

AVERAGE LIFE TO MATURITY

4

(YEARS)

4.98

CAPITAL STRUCTURE

TOTAL MANAGED ASSETS $433,936,626

NET ASSET VALUE $300,936,626

SHARES OUTSTANDING 15,255,236

LEVERAGE DOLLAR

% OF LEVERAGE

2

$133,000,000

30.65%

MANAGEMENT TEAM

ERIK FALK

CHRIS SHELDON

JAMIE WEINSTEIN

PORTFOLIO

COMPOSITION

1

63.0% High Yield Security

31.1% Leveraged Loan

4.0% Preferred Stock

1.9% Common Stock

CREDIT QUALITY

1

1.2% BBB

12.6% BB

57.8% B

14.5% CCC

13.9% NR/Other

KKR Income Opportunities Fund (KIO)

3

/

3

1

/

1

4

KKR Income Opportunities Fund (KIO)

* The industry classifications reported are from widely recognized market indexes or rating group indexes, and/or as defined by Fund management, with the primary

source being GICS.

** Holdings are subject to change and are provided for informational purposes only. This list does not constitute a recommendation to buy, sell or hold a security.

ABOUT KKR

KKR Asset Management LLC serves as the Funds investment adviser. Launched in 2004, the Adviser is a subsidiary of KKR & Co. L.P. (together

with the Adviser and its other affiliates, KKR), a leading global investment firm with a 37-year history of leadership, innovation and investment

excellence. The Advisers investment teams, which are organized by industry, invest across the capital structure with the goal of protecting

capital and achieving attractive risk-adjusted returns.

I NVESTMENT PRODUCTS: NOT FDI C OR SI PC I NSURED NO BANK GUARANTEE MAY LOSE VALUE

Past performance is no guarantee of future results. Both the market price for Fund shares and their NAV will fluctuate with market conditions.

Current performance may be higher or lower than the performance shown.

About Risk: An imbalance in supply and demand in the income market may result in valuation uncertainties and greater volatility, less liquidity,

widening credit spreads and a lack of price transparency in the market. Investments in income securities may be affected by changes in

the creditworthiness of the issuer and are subject to the risk of nonpayment of principal and interest. The value of income securities also

may decline because of real or perceived concerns about the issuers ability to make principal and interest payments. Borrowing to increase

investments (leverage) will exaggerate the effect of any increase or decrease in the value of Fund investments. Investments rated below

investment grade (typically referred to as junk) are generally subject to greater price volatility and illiquidity than higher rated investments.

As interest rates rise, the value of certain income investments is likely to decline. Senior loans are subject to prepayment risk. Investments in

foreign instruments or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political,

regulatory, geopolitical or other conditions. Changes in the value of investments entered for hedging purposes may not match those of the

position being hedged. The Fund may engage in other investment practices that may involve additional risks.

Common shares of the Fund are only available for purchase and sale at current market price on a stock exchange.

An investment in the Fund is not appropriate for all investors and is not intended to be a complete investment program. An investment in the

Fund involves risks, including the risk that you may receive little or no return on your investment or that you may lose part or even all of your

investment. Therefore, prospective investors should consider carefully the Funds investment objectives, risks, charges and expenses and should

consult with a tax, legal or financial advisor before making any investment decision. Shares of closed-end investment companies frequently trade

at a discount from their net asset value.

The information on this sheet is for U.S. residents only and does not constitute an offer to sell, or a solicitation of an offer to purchase, securities

in any jurisdiction to any person to whom it is not lawful to make such an offer.

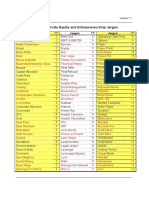

TOP 5 INDUSTRIES* (as of 3/31/14)

MATERIALS 11.0%

SOFTWARE & SERVICES 10.9%

MEDIA 9.9%

BANKS 8.3%

HEALTH CARE EQUIPMENT & SERVICES 7.6%

TOTAL 47.7%

KKR INCOME OPPORTUNITIES FUND (NYSE: KIO)

TOP 10 ISSUERS** (as of 3/31/14)

Ally Financial Inc 3.9%

Infor Global Solutions European Finance Sarl 3.8%

Cemex Materials LLC 3.8%

SquareTwo Financial Corp 3.7%

Brake Bros Ltd 3.7%

GCI Inc 3.7%

Towergate Finance PLC 3.2%

Hot Topic Inc 3.1%

Select Medical Corp 3.1%

SandRidge Energy Inc 2.9%

TOP TEN HOLDINGS 34.9%

GEOGRAPHY

USA 81.8%

United Kingdom 8.2%

Luxembourg 4.1%

Canada 1.9%

Switzerland 1.8%

Japan 1.0%

Sweden 0.7%

Singapore 0.6%

$15.0

$16.0

$17.0

$18.0

$19.0

$20.0

$21.0

7/2013 9/2013 11/2013 1/2014 3/2014

Market Price NAV

-9.48%

Discount

to NAV as

of 3/31/14

Potrebbero piacerti anche

- CLO Investing: With an Emphasis on CLO Equity & BB NotesDa EverandCLO Investing: With an Emphasis on CLO Equity & BB NotesNessuna valutazione finora

- Capital Structure A Complete Guide - 2020 EditionDa EverandCapital Structure A Complete Guide - 2020 EditionNessuna valutazione finora

- Third Point 2011 ADV Part 2a BrochureDocumento23 pagineThird Point 2011 ADV Part 2a BrochureWho's in my FundNessuna valutazione finora

- On Buy Back of ShareDocumento30 pagineOn Buy Back of Shareranjay260Nessuna valutazione finora

- Private Equity Unchained: Strategy Insights for the Institutional InvestorDa EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNessuna valutazione finora

- Investing in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketDa EverandInvesting in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketNessuna valutazione finora

- Trian GE StakeDocumento3 pagineTrian GE StakeBenzingaProNessuna valutazione finora

- Pershing Square 3Q-2016 Investor LetterDocumento16 paginePershing Square 3Q-2016 Investor LettersuperinvestorbulletiNessuna valutazione finora

- Icahn LetterDocumento3 pagineIcahn Lettergrw7Nessuna valutazione finora

- TransdigmDocumento4 pagineTransdigmTMFUltimateNessuna valutazione finora

- Private Equity JargonDocumento14 paginePrivate Equity JargonWilling ZvirevoNessuna valutazione finora

- Equity Financing A Complete Guide - 2020 EditionDa EverandEquity Financing A Complete Guide - 2020 EditionNessuna valutazione finora

- Key Terms of The Investment AgreementDocumento7 pagineKey Terms of The Investment AgreementYsmari Maria TejadaNessuna valutazione finora

- Buyouts: Success for Owners, Management, PEGs, ESOPs and Mergers and AcquisitionsDa EverandBuyouts: Success for Owners, Management, PEGs, ESOPs and Mergers and AcquisitionsNessuna valutazione finora

- PIPE Investments of Private Equity Funds: The temptation of public equity investments to private equity firmsDa EverandPIPE Investments of Private Equity Funds: The temptation of public equity investments to private equity firmsNessuna valutazione finora

- OQ Methodolgy For Hedge FundsDocumento23 pagineOQ Methodolgy For Hedge FundsSteve KravitzNessuna valutazione finora

- Loan Workouts and Debt for Equity Swaps: A Framework for Successful Corporate RescuesDa EverandLoan Workouts and Debt for Equity Swaps: A Framework for Successful Corporate RescuesValutazione: 5 su 5 stelle5/5 (1)

- Alternative Investment Strategies A Complete Guide - 2020 EditionDa EverandAlternative Investment Strategies A Complete Guide - 2020 EditionNessuna valutazione finora

- Cadbury Trian LetterDocumento14 pagineCadbury Trian Letterbillroberts981Nessuna valutazione finora

- Lazard Secondary Market Report 2022Documento23 pagineLazard Secondary Market Report 2022Marcel LimNessuna valutazione finora

- Lbo Model Short FormDocumento4 pagineLbo Model Short FormAkash PrasadNessuna valutazione finora

- Ipo Guide 2016Documento88 pagineIpo Guide 2016Rupali GuravNessuna valutazione finora

- The Growing Importance of Fund Governance - ILPA Principles and BeyondDocumento3 pagineThe Growing Importance of Fund Governance - ILPA Principles and BeyondErin GriffithNessuna valutazione finora

- Preparing For Corporate Finance InterviewsDocumento14 paginePreparing For Corporate Finance InterviewsNabeel QureshiNessuna valutazione finora

- High Yield Bond MarketDocumento6 pagineHigh Yield Bond MarketYash RajgarhiaNessuna valutazione finora

- Balance Sheet Management: Squeezing Extra Profits and Cash from Your BusinessDa EverandBalance Sheet Management: Squeezing Extra Profits and Cash from Your BusinessNessuna valutazione finora

- 6 Unit 8 Corporate RestructureDocumento19 pagine6 Unit 8 Corporate RestructureAnuska JayswalNessuna valutazione finora

- Leveraged Buyout (LBO) Private EquityDocumento4 pagineLeveraged Buyout (LBO) Private EquityAmit Kumar RathNessuna valutazione finora

- Lecture 16: Overview of Private Equity: FNCE 751Documento50 pagineLecture 16: Overview of Private Equity: FNCE 751jkkkkkkkkkretretretrNessuna valutazione finora

- The Executive Guide to Boosting Cash Flow and Shareholder Value: The Profit Pool ApproachDa EverandThe Executive Guide to Boosting Cash Flow and Shareholder Value: The Profit Pool ApproachNessuna valutazione finora

- Quantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskDa EverandQuantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskValutazione: 3.5 su 5 stelle3.5/5 (1)

- Behind the Curve: An Analysis of the Investment Behavior of Private Equity FundsDa EverandBehind the Curve: An Analysis of the Investment Behavior of Private Equity FundsNessuna valutazione finora

- Fortress Investment GroupDocumento8 pagineFortress Investment GroupAishwarya Ratna PandeyNessuna valutazione finora

- Arbitrage PDFDocumento60 pagineArbitrage PDFdan4everNessuna valutazione finora

- Capital Structure of An LBO PDFDocumento3 pagineCapital Structure of An LBO PDFTim OttoNessuna valutazione finora

- 2016 Preqin Global Private Equity and Venture Capital Report Sample Pages PERACS PersistenceDocumento2 pagine2016 Preqin Global Private Equity and Venture Capital Report Sample Pages PERACS PersistenceTDGoddardNessuna valutazione finora

- Lawsuit Against DellDocumento25 pagineLawsuit Against DellDealBookNessuna valutazione finora

- A Note On Venture Capital IndustryDocumento9 pagineA Note On Venture Capital Industryneha singhNessuna valutazione finora

- Regulation A+ and Other Alternatives to a Traditional IPO: Financing Your Growth Business Following the JOBS ActDa EverandRegulation A+ and Other Alternatives to a Traditional IPO: Financing Your Growth Business Following the JOBS ActNessuna valutazione finora

- Arnaud Ajdler Investing in ChangeDocumento44 pagineArnaud Ajdler Investing in ChangeValueWalk100% (5)

- Ninepoint Tec Private Credit Fund OmDocumento86 pagineNinepoint Tec Private Credit Fund OmleminhptnkNessuna valutazione finora

- Justice Is Best Served Flame BroiledDocumento53 pagineJustice Is Best Served Flame Broileddude5041Nessuna valutazione finora

- Company Analysis and ValuationDocumento13 pagineCompany Analysis and ValuationAsif Abdullah KhanNessuna valutazione finora

- Managing Liquidity in Banks: A Top Down ApproachDa EverandManaging Liquidity in Banks: A Top Down ApproachNessuna valutazione finora

- Defenses Against Hostile TakeoversDocumento30 pagineDefenses Against Hostile TakeoversNeerav SharmaNessuna valutazione finora

- SERIES 24 EXAM STUDY GUIDE 2021 + TEST BANKDa EverandSERIES 24 EXAM STUDY GUIDE 2021 + TEST BANKNessuna valutazione finora

- Long Term Capital Management Case StudyDocumento6 pagineLong Term Capital Management Case Studysatyap127Nessuna valutazione finora

- 2012 q3 Letter DdicDocumento5 pagine2012 q3 Letter DdicDistressedDebtInvestNessuna valutazione finora

- CLO Default PricingDocumento96 pagineCLO Default Pricingprimus_interpares01Nessuna valutazione finora

- The End of Arbitrage, Part 1Documento8 pagineThe End of Arbitrage, Part 1Carmine Robert La MuraNessuna valutazione finora

- Edelweiss Alpha Fund - November 2016Documento17 pagineEdelweiss Alpha Fund - November 2016chimp64Nessuna valutazione finora

- Homework 1 Doug DiamondDocumento2 pagineHomework 1 Doug DiamondIgnacio Andrés VinkeNessuna valutazione finora

- Kevin Buyn - Denali Investors Columbia Business School 2009Documento36 pagineKevin Buyn - Denali Investors Columbia Business School 2009g4nz0Nessuna valutazione finora

- IPO and SEOsDocumento30 pagineIPO and SEOsXinwei YeNessuna valutazione finora

- Securitization and Structured Finance Post Credit Crunch: A Best Practice Deal Lifecycle GuideDa EverandSecuritization and Structured Finance Post Credit Crunch: A Best Practice Deal Lifecycle GuideNessuna valutazione finora

- Pershing Square European Investor Meeting PresentationDocumento67 paginePershing Square European Investor Meeting Presentationmarketfolly.com100% (1)

- Quantitative Analytics in Debt Valuation & ManagementDa EverandQuantitative Analytics in Debt Valuation & ManagementNessuna valutazione finora

- Resume Book PDFDocumento27 pagineResume Book PDFFarrukhNessuna valutazione finora

- Case Study Mobile World Lo-Res PDFDocumento2 pagineCase Study Mobile World Lo-Res PDFHungreo411Nessuna valutazione finora

- Ic 79810Documento1 paginaIc 79810Hungreo411Nessuna valutazione finora

- VOF Annual Report Final PDFDocumento92 pagineVOF Annual Report Final PDFHungreo411Nessuna valutazione finora

- 2010 ADB Vietnam Inclusive Business Feasibility Study FINALDocumento75 pagine2010 ADB Vietnam Inclusive Business Feasibility Study FINALHungreo411Nessuna valutazione finora

- CJ CGV (079160 KS-Buy)Documento6 pagineCJ CGV (079160 KS-Buy)Hungreo411Nessuna valutazione finora

- VOF Annual Report Final PDFDocumento92 pagineVOF Annual Report Final PDFHungreo411Nessuna valutazione finora

- Upload A Document - Scribd PDFDocumento8 pagineUpload A Document - Scribd PDFHungreo411Nessuna valutazione finora

- Econbrowser - Analysis O... C Conditions and PolicyDocumento6 pagineEconbrowser - Analysis O... C Conditions and PolicyHungreo411Nessuna valutazione finora

- Social Security and Paid-Up Workers - EconbrowserDocumento21 pagineSocial Security and Paid-Up Workers - EconbrowserHungreo411Nessuna valutazione finora

- Market+outlook+report 2014 8 14 EDocumento27 pagineMarket+outlook+report 2014 8 14 EHungreo411Nessuna valutazione finora

- Market CommentaryDocumento14 pagineMarket CommentaryHungreo411Nessuna valutazione finora

- VPBSDailyMarketReview2014 06 03EDocumento14 pagineVPBSDailyMarketReview2014 06 03EHungreo411Nessuna valutazione finora

- 2014 - CafeFDocumento6 pagine2014 - CafeFHungreo411Nessuna valutazione finora

- LSE ThesisDocumento18 pagineLSE ThesisHungreo411Nessuna valutazione finora

- PDocumento1 paginaPHungreo411Nessuna valutazione finora

- Due Diligence Checklist - Small Business - SME - M&a - Caprica OnlineDocumento3 pagineDue Diligence Checklist - Small Business - SME - M&a - Caprica OnlineHungreo411Nessuna valutazione finora

- Investment Management Programme - September TimetableDocumento1 paginaInvestment Management Programme - September TimetableHungreo411Nessuna valutazione finora

- Private Equity Case Studies in 3017 WordsDocumento7 paginePrivate Equity Case Studies in 3017 Wordsmayor78100% (1)

- The Influential InvestorDocumento35 pagineThe Influential InvestorHungreo411Nessuna valutazione finora

- PresentationDocumento38 paginePresentationHungreo411Nessuna valutazione finora

- Apec Oct2013Documento17 pagineApec Oct2013Hungreo411Nessuna valutazione finora

- ProfessionsDocumento55 pagineProfessionsHungreo411Nessuna valutazione finora

- Investor PresDocumento24 pagineInvestor PresHungreo411Nessuna valutazione finora

- Bain and Company Global Private Equity Report 2012 PDFDocumento72 pagineBain and Company Global Private Equity Report 2012 PDFLinus Vallman JohanssonNessuna valutazione finora

- KKR 2013Documento388 pagineKKR 2013Hungreo411Nessuna valutazione finora

- KKRDocumento48 pagineKKRHungreo411100% (1)

- Eurocrisis TimelineDocumento18 pagineEurocrisis TimelineHungreo411Nessuna valutazione finora

- Chronology Economic Financial CrisisDocumento96 pagineChronology Economic Financial CrisisGiselle MuhammadNessuna valutazione finora

- Bosaf36855 1409197541817Documento3 pagineBosaf36855 1409197541817mafisco3Nessuna valutazione finora

- Aptitude For Civil ServicesDocumento17 pagineAptitude For Civil Servicesnagarajuvcc123Nessuna valutazione finora

- 6 Special Favors Given To Muhammad ( ) by Allah (Notes) - AuthenticTauheed PublicationsDocumento10 pagine6 Special Favors Given To Muhammad ( ) by Allah (Notes) - AuthenticTauheed PublicationsAuthenticTauheedNessuna valutazione finora

- Prismatic Battery Pack Se-Mi Auto Production Line ProposalDocumento25 paginePrismatic Battery Pack Se-Mi Auto Production Line ProposalCheemaNessuna valutazione finora

- ConjunctionDocumento15 pagineConjunctionAlfian MilitanNessuna valutazione finora

- Timothy L. Mccandless, Esq. (SBN 147715) : Pre-Trial Documents - Jury InstructionsDocumento3 pagineTimothy L. Mccandless, Esq. (SBN 147715) : Pre-Trial Documents - Jury Instructionstmccand100% (1)

- Hybrid and Derivative Securities: Learning GoalsDocumento2 pagineHybrid and Derivative Securities: Learning GoalsKristel SumabatNessuna valutazione finora

- National Geographic Traveller India - July 2016-P2PDocumento104 pagineNational Geographic Traveller India - July 2016-P2PPeter100% (2)

- BeneHeart D3 Defibrillator Product BrochureDocumento4 pagineBeneHeart D3 Defibrillator Product BrochureJasmine Duan100% (1)

- Athletic KnitDocumento31 pagineAthletic KnitNish A0% (1)

- 1classic Greek SaladDocumento6 pagine1classic Greek SaladEzekiel GumayagayNessuna valutazione finora

- Class 8 PPT - Abhijeet Singh GureniyaDocumento16 pagineClass 8 PPT - Abhijeet Singh Gureniyasimran simmyNessuna valutazione finora

- ColceruM-Designing With Plastic Gears and General Considerations of Plastic GearingDocumento10 pagineColceruM-Designing With Plastic Gears and General Considerations of Plastic GearingBalazs RaymondNessuna valutazione finora

- BcuDocumento25 pagineBcuyadvendra dhakadNessuna valutazione finora

- Letter Response From AG Rob Bonta's Office Re: Batmobile InvestigationDocumento2 pagineLetter Response From AG Rob Bonta's Office Re: Batmobile InvestigationLeah WorthingtonNessuna valutazione finora

- IO RE 04 Distance Learning Module and WorksheetDocumento21 pagineIO RE 04 Distance Learning Module and WorksheetVince Bryan San PabloNessuna valutazione finora

- Vistas 1-7 Class - 12 Eng - NotesDocumento69 pagineVistas 1-7 Class - 12 Eng - Notesvinoth KumarNessuna valutazione finora

- Naresh Kadyan: Voice For Animals in Rajya Sabha - Abhishek KadyanDocumento28 pagineNaresh Kadyan: Voice For Animals in Rajya Sabha - Abhishek KadyanNaresh KadyanNessuna valutazione finora

- Excel For MAC Quick Start GuideDocumento4 pagineExcel For MAC Quick Start GuideMalaquías HuamánNessuna valutazione finora

- CHAPTER 2-3 LipidDocumento20 pagineCHAPTER 2-3 LipidDaniel IsmailNessuna valutazione finora

- Orca Share Media1579045614947Documento4 pagineOrca Share Media1579045614947Teresa Marie Yap CorderoNessuna valutazione finora

- Affin Bank V Zulkifli - 2006Documento15 pagineAffin Bank V Zulkifli - 2006sheika_11Nessuna valutazione finora

- Bartolome vs. MarananDocumento6 pagineBartolome vs. MarananStef OcsalevNessuna valutazione finora

- Factoring Problems-SolutionsDocumento11 pagineFactoring Problems-SolutionsChinmayee ChoudhuryNessuna valutazione finora

- The Craving Mind From Cigarettes To Smartphones To Love - Why We Get Hooked and How We Can Break Bad Habits PDFDocumento257 pagineThe Craving Mind From Cigarettes To Smartphones To Love - Why We Get Hooked and How We Can Break Bad Habits PDFJacques Savariau92% (13)

- VVP Engg. CollegeDocumento32 pagineVVP Engg. Collegechotaimanav17Nessuna valutazione finora

- SwimmingDocumento19 pagineSwimmingCheaNessuna valutazione finora

- CONCEPTUAL LITERATURE (Chapter 2)Documento2 pagineCONCEPTUAL LITERATURE (Chapter 2)lilibeth garciaNessuna valutazione finora

- War: Causation of War, Total War, Limited War, Strategic Culture: Determinants of Strategic Culture Deterrence: Theory and Practice With SpecialDocumento52 pagineWar: Causation of War, Total War, Limited War, Strategic Culture: Determinants of Strategic Culture Deterrence: Theory and Practice With SpecialMazhar HussainNessuna valutazione finora

- Martin Vs MalcolmDocumento17 pagineMartin Vs Malcolmronnda100% (2)