Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

PBC 176664

Caricato da

Jim KatTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

PBC 176664

Caricato da

Jim KatCopyright:

Formati disponibili

MOODYS.

COM

27 OCTOBER 2014

NEWS & ANALYSIS

Corporates 2

Retailers Data Security Breaches Will Delay NCRs

De-Leveraging

Infrastructure 3

Exelons Nuclear Reactor Operating Extension Is Credit Positive

Banks 4

U.S. Bancorps Commercial Loan Pricing Strategy Is Squeezing

Its Profitability

Colombias Creation of Deposit-Taking and Transfer Companies

Is Credit Positive for Banks

European Resolution Funds Will Weigh on Bank Profitability, a

Credit Negative

Russias Large Private Banks Would Benefit from Central Bank

Capital Injections

Kazakhstan Plan to Recapitalize Two Large Banks Is

Credit Positive

Bank Permatas Issuance of Basel III-Compliant Subordinated

Debt Is Credit Positive

Insurers 15

Health Insurers Gain Little with Affordable Care Act Opt-

Out Clause

US Mortgage Insurers Will Benefit from Housing

Finance Reforms

US Public Finance 19

Low Oil Prices Will Pressure States Reliant on Extraction Taxes

PLUS Loan Eligibility Expansion Benefits Universities Serving

Low-Income Students

Colorado Supreme Court Upholds State and Local Government

Pension Reforms, a Credit Positive

Securitization 24

New York Probe into Ocwen Is Credit Negative for Company

and the RMBS It Services

Spanish Covered Bond Law Would Reduce Collateral, a

Credit Negative

RATINGS & RESEARCH

Rating Changes 27

Last week we downgraded PETROBRAS, Russian Railways, Tesco,

Ocwen Financial, Altisource Solutions, Home Loan Servicing

Solutions, Sberbank, Bank VTB, Gazprombank, Russian Agricultural

Bank, Agency for Housing Mortgage Lending, Vnesheconombank,

Alfa-Bank, Moscow, St. Petersburg, SUE Vodokanal of St.

Petersburg, OOO Vodokanal Finance, OJSC Western High-Speed

Diameter, Detroit and Omaha, and upgraded Catalent Pharma

Solutions and Industrial Bank of Korea, among other rating actions.

Research Highlights 41

Last week we published on European transport infrastructure,

global oil and gas, US corporate defaults, Russian corporates, loss

given default assessments, ESPN, Turner Broadcasting, Chinese

corporates, US apparel and footwear, global infrastructure, frac

sand, European cable operators, Canadian banks, German life

insurers, UAE takaful, CITIC Securities, People's United Financial,

Canada, Belgium, Russia, US RMBS, US ABS and the Mexican

mortgage market, among other reports.

RECENTLY IN CREDIT OUTLOOK

Articles in Last Thursdays Credit Outlook 46

Go to Last Thursdays Credit Outlook

NEWS & ANALYSIS

Credit implications of current events

2 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

Corporates

Retailers Data Security Breaches Will Delay NCRs De-Leveraging

Last Monday, NCR Corporation (Ba2 negative) cut its earnings guidance for full-year 2014, citing

challenges in its retail segment and driven in part by the fallout from customer-data security breaches at

major retailers. The company said it now expects full-year earnings of $2.60-$2.70 a share and revenue of

$6.58-$6.63 billion, down from its previous earnings guidance of $3.00-$3.10 a share and revenues of

$6.75-$6.85 billion.

The revised forecast is credit negative for NCR because lower-than-expected orders in its retail sector will

delay the pace of its de-leveraging throughout 2014 and 2015 by as much as half a turn. We now expect

NCR to de-leverage to 5.0x adjusted debt/EBITDA by year-end 2014, versus our earlier expectation of 4.6x

adjusted debt/EBITDA.

The announcement could also portend a shift in capex spending by retailers as they evaluate data security

and their hardware spending decisions in the wake of well-publicized customer data breaches. This could

result in a shift in their capex spending to more secure credit card readers and to enable the technology to

accept mobile payments and away from other possible IT upgrades. This would benefit companies such as

VeriFone, Inc. (Ba3 stable) and Ingenico Group (unrated), which provide payment terminals, and further

delay upgrade orders for the registers, self-checkout consoles and other hardware that NCR sells.

Still, we expect NCR to continue growing its revenue and cash flow, aided by the strengthening

performance of its largest division, financial services, and by operating margin improvements. The company

has demonstrated its ability to contain costs and slightly improve profitability in the wake of its January

2014 Digital Insight acquisition. NCR reported an adjusted operating margin of 10.3% for the 12 months

ended 30 June 2014, compared with an adjusted operating margin of 10.0% a year earlier.

Duluth, Georgia-based NCR had more than $6.3 billion in revenue for the 12 months ended June 2014. It

has leading market positions in the automatic teller machine, retail point-of-sale equipment, hospitality and

related supplies and services markets.

Gerald Granovsky

Senior Vice President

+1.212.553.4198

gerald.granovsky@moodys.com

This publication does not announce

a credit rating action. For any

credit ratings referenced in this

publication, please see the ratings

tab on the issuer/entity page on

www.moodys.com for the most

updated credit rating action

information and rating history.

NEWS & ANALYSIS

Credit implications of current events

3 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

Infrastructure

Exelons Nuclear Reactor Operating Extension Is Credit Positive

On Monday, the US Nuclear Regulatory Commission (NRC) renewed the operating licenses of the

Limerick Generating Station Units 1 and 2 (2,311 megawatts of capacity) for another 20 years. These are

the first NRC license extensions after a two-year licensing suspension following the 2011 Fukushima reactor

disaster in Japan. The renewed licenses, which now expire in 2044 for Unit 1 and 2049 for Unit 2, are

credit positive for Exelon Generation Company, LLC (Baa2 stable) because they open the door for an

additional 400,000 gigawatt-hours of electricity sales and $20 billion in revenues over the

20-year extension.

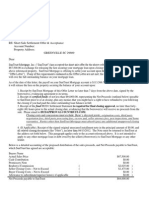

The exhibit below illustrates the estimated revenue streams from Limerick Units 1 and 2 before and after

the license extension. As a simplifying assumption, revenues are based on a power price of $50 per

megawatt-hour and a capacity factor of 90% until the original expiration (2024 for Unit 1 and 2029 for

Unit 2). Thereafter, we assumed a step-up in power prices to $70 per megawatt-hour. Because the nuclear

reactors were originally designed to run for 40 years, not 60, we lowered the capacity factor to 70% for the

remaining 20 years to account for potential plant repairs and increased outage times. Based on our

assumptions, the company will receive an additional $20 billion of revenue, or $5 billion in present value,

assuming a 6.5% discount rate.

Present Value of Limericks Units 1 and 2 Forecasted Revenues

Source: Moodys Investors Service

Limericks license extension also benefits local and state governments, including Limerick, Pennsylvania

(unrated), Montgomery County, Pennsylvania (general obligation Aa1 negative), and the Spring-Ford Area

School District (general obligation Aa2). The school district receives approximately 2% of its operating

revenues from the Limerick reactors. Limerick also employs about 860 people between the two reactors,

with a roughly $75 million payroll, and paid about $2.7 million in property taxes in 2013. Approximately

85% of the property taxes are allocated to the school district, 10% to the county and 5% to the township,

making the Limerick reactors a significant contributor to the states local economy.

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$

M

i

l

l

i

o

n

s

2024 & 2029 Shutdown 2044 & 2049 Shutdown

Susan Lam

Associate Analyst

+1.212.553.4351

susan.lam@moodys.com

Jim Hempstead

Associate Managing Director

+1.212.553.4318

james.hempstead@moodys.com

NEWS & ANALYSIS

Credit implications of current events

4 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

Banks

U.S. Bancorps Commercial Loan Pricing Strategy Is Squeezing Its Profitability

Last Wednesday, during U.S. Bancorps (A1 stable) quarterly investor call, Chief Executive Officer Richard

Davis stated that his bank was part of the problem with respect to intense pricing competition on

commercial loans. By reducing the rate it charges borrowers on commercial loans, U.S. Bancorp is

expanding more rapidly than its peers and gaining market share. However, the strategy also puts pressure on

U.S. Bancorps profitability, which is credit negative. In addition, its growth strategy in commercial lending

raises questions about whether it is undermining its credit underwriting.

In making his remark, Mr. Davis also advertised the competitive strengths that have allowed U.S. Bancorp

to more easily withstand the resultant profitability pressure, specifically its lower cost structure, including

low funding costs, as well as its capital advantage.

Exhibit 1 shows that U.S. Bancorps commercial loan growth has been the highest among its major US

banking peers over the past year. Specifically, the chart shows the rate of growth in average commercial loan

balances from the third quarter of 2013 to the third quarter of 2014, when U.S. Bancorps balances

grew 12%.

EXHIBIT 1

Large US Banks Commercial Loan Balance Growth, Third-Quarter 2013 to Third-Quarter 2014

All large banks are growing their commercial loans, but U.S. Bancorp leads the pack

Note: USB = U.S. Bancorp (A1 stable); STI = SunTrust Banks, Inc. (Baa1 stable); WFC = Wells Fargo & Company (A2 stable); KEY = KeyCorp (Baa1

stable); HBAN = Huntington Bancshares Incorporated (Baa1 stable); CMA = Comerica Incorporated (A3 stable); FITB = Fifth Third Bancorp

(Baa1 stable); PNC = PNC Financial Services Group Inc. (A3 stable); RF = Regions Financial Corporation (Ba1 positive); MTB = M&T Bank

Corporation (A3 negative); BAC = Bank of America Corporation (Baa2 stable); BBT = BB&T Corporation (A2 stable).

Source: The banks quarterly earnings releases

Exhibit 2 verifies U.S. Bancorps aggressive commercial loan pricing. Among the large US banks that

disclosed the data, U.S. Bancorp had the second-lowest commercial loan yield (the rate of interest that U.S.

Bancorp earns on its portfolio of commercial loans) in both the third quarters of 2013 and 2014.

Furthermore, the gap between its commercial loan yield and that of Bank of America Corporation (Baa2

stable) narrowed to four basis points from 12 basis points. The narrower gap speaks to one of U.S.

Bancorps competitive advantages: as the largest US bank not deemed to be systemically important on a

global basis, U.S. Bancorp has lower capital requirements than its larger peers, which translates into a higher

return on capital relative to those bigger banks for a similarly priced loan.

12.0%

11.4%

10.5%

9.8%

8.3%

8.0%

7.5%

6.6%

6.2%

5.8%

4.0%

3.7%

0%

2%

4%

6%

8%

10%

12%

14%

USB STI WFC KEY HBAN CMA FITB PNC RF MTB BAC BBT

Allen Tischler

Senior Vice President

+1.212.553.4541

allen.tischler@moodys.com

NEWS & ANALYSIS

Credit implications of current events

5 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

EXHIBIT 2

Large US Banks Commercial Loan Yields, Third-Quarter 2013 to Third-Quarter 2014

Commercial loan yields of large US banks continue to compress

Note: USB = U.S. Bancorp (A1 stable); STI = SunTrust Banks, Inc. (Baa1 stable); WFC = Wells Fargo & Company (A2 stable); KEY = KeyCorp (Baa1

stable); HBAN = Huntington Bancshares Incorporated (Baa1 stable); CMA = Comerica Incorporated (A3 stable); FITB = Fifth Third Bancorp

(Baa1 stable); PNC = PNC Financial Services Group Inc. (A3 stable); RF = Regions Financial Corporation (Ba1 positive); MTB = M&T Bank

Corporation (A3 negative); BAC = Bank of America Corporation (Baa2 stable); BBT = BB&T Corporation (A2 stable).

Source: The banks quarterly earnings releases

At the same time, compared with regional banks that also benefit from lower capital requirements, U.S.

Bancorps main competitive advantage is its efficiency, as illustrated in Exhibit 3, which shows banks

overhead ratios. The ratio relates non-interest expenses to net revenue for the first nine months of 2014. At

52%, U.S. Bancorp holds an eight-percentage-point advantage over its nearest regional bank competitor,

M&T Bank Corporation (A3 negative). Being a low-cost producer gives U.S. Bancorp a larger buffer to

absorb net-interest margin compression. U.S. Bancorp also has lower market funding costs than its peers,

which will take on greater importance if loan growth outstrips deposit growth in a rising interest

rate environment.

EXHIBIT 3

Large U.S. Banks Non-Interest Expense as a Percentage of Net Revenue as of Third-Quarter 2014

U.S. Bancorps low-cost structure is its greatest competitive advantage

Note: USB = U.S. Bancorp (A1 stable); STI = SunTrust Banks, Inc. (Baa1 stable); WFC = Wells Fargo & Company (A2 stable); KEY = KeyCorp (Baa1

stable); HBAN = Huntington Bancshares Incorporated (Baa1 stable); CMA = Comerica Incorporated (A3 stable); FITB = Fifth Third Bancorp

(Baa1 stable); PNC = PNC Financial Services Group Inc. (A3 stable); RF = Regions Financial Corporation (Ba1 positive); MTB = M&T Bank

Corporation (A3 negative); BAC = Bank of America Corporation (Baa2 stable); BBT = BB&T Corporation (A2 stable).

Source: The banks quarterly earnings releases

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

4.5%

BAC USB CMA PNC FITB KEY MTB WFC BBT HBAN STI RF

Q32013 Q32014

20bps

28bps 14bps

45bps

24bps

26bps

21bps

34bps

23bps

23bps 35bps

23bps

52%

58%

60% 61%

62%

63%

64% 66%

67% 67%

71%

92%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

USB WFC MTB PNC FITB CMA RF STI HBAN BBT KEY BAC

NEWS & ANALYSIS

Credit implications of current events

6 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

U.S. Bancorps diversified business mix also provides additional advantages. Compared with regional peers,

it is less reliant on net interest income since fee revenue accounts for more than 45% of its total revenue.

All these advantages explain why U.S. Bancorp consistently generates the highest return on assets and equity

among the major US banks. Nevertheless, because of lower loan yields, its returns like the rest of the peer

group slipped in the latest quarter compared with a year earlier.

Yet, despite the immediate profitability pressure, U.S. Bancorps grab for commercial loan market share has

the potential to become credit positive once short-term interest rates increase. In that scenario, the yield on

these largely floating-rate loans will rise, resulting in more profitable relationships, assuming the customers

that U.S. Bancorp is currently attracting prove to be both sticky and of sound credit quality.

NEWS & ANALYSIS

Credit implications of current events

7 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

Colombias Creation of Deposit-Taking and Transfer Companies Is Credit Positive

for Banks

Last Tuesday, Colombia President Juan Manuel Santos signed the Law for Financial Inclusion, which

permits the creation of Sociedades Especializadas en Depsitos y Pagos Electrnicos (SEDPEs), or lightly

regulated specialized financial entities that will provide payment services and take deposits. The new law is

credit positive for Colombian banks because it will generate a new source of deposit funding and expand the

pool of eligible borrowers.

SEDPEs target customers will be individuals in remote areas without bank branches and individuals

currently using money transfer services. SEDPEs will provide individuals with secure and economical

savings products. These entities will be guaranteed by the Fondo de Garantas de Instituciones Financieras,

the governments deposit insurance fund, and deposits will be exempt from Colombias 0.4% tax

on withdrawals.

The banks that will benefit the most are those that have been most focused on capturing the transactions of

new entrants into formal employment, including Banco Davivienda S.A. (Baa3 stable, D+/ba1 stable

1

) and

the governments Banco Agrario de Colombia (unrated), both of which already handle the governments

direct subsidy payments to lower-income individuals. Davivienda has actively sought to establish itself in

this market segment by creating the DaviPlata mobile phone system to handle money orders, through

which it recently began to offer microinsurance as well.

Because they will be subject to fewer regulatory requirements than banks, SEDPEs will have lower operating

costs. However, SEDPEs will not directly compete with banks because they will not be allowed to offer

loans and will have to place deposited funds either at the central bank or at commercial banks. Banks would

use SEDPE deposits to finance their lending operations. Commercial banks will be allowed to invest in and

own SEDPEs, so the new law will allow them to establish less expensive operations in remote areas and

extend their reach to currently unbanked segments of the population.

Notwithstanding a relatively high level of credit/GDP for the region, Colombia continues to exhibit a low

level of bank penetration, with retail deposits accounting for just 24% of total deposits system-wide as of

June 2014. We expect that the new law will capture and bring into the regulated financial system a large

share of the money orders that today are outside of the banking system, and which the Commission for

Regulation of Communications estimated totaled around $3 billion in 2011. In turn, we expect a large

portion of those flows to remain in the banking system as deposits.

The creation of SEDPEs complements a recent proposal by the Ministry of Finance and Public Credits

Unit for Financial Regulation to provide banks with greater flexibility in how they assess the credit strength

of applicants for short-term small-loans.

2

We expect that the information that the SEDPEs will gather will

contribute to these new credit policies.

1

The bank ratings shown in this report are the banks deposit ratings, their standalone bank financial strength ratings/baseline credit

assessments and the corresponding rating outlooks.

2

For up to two current legal minimum monthly salaries, or about $600.

Felipe Carvallo

Vice President - Senior Analyst

+52.55.1253.5738

felipe.carvallo@moodys.com

NEWS & ANALYSIS

Credit implications of current events

8 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

European Resolution Funds Will Weigh on Bank Profitability, a Credit Negative

Last Tuesday, the European Commission published a delegated act on contributions to national resolution

funds that European banks would pay annually through December 2024. This legislation follows Article

102 of the Capital Requirement Regulation (CRR), which directs European member states to set up

national resolution funds. The funds will total as much as 55 billion, which will weigh on banks

profitability and is credit negative.

The resolution funds aim to facilitate bank resolution via the Bank Recovery and Resolution Directive

(BRDD) and, in the euro area, the Single Resolution Mechanism (SRM). Under the new framework, the

resolution of banks should first involve private money, including through the bail-in of senior creditors, if

needed. Contributions from the resolution funds would be a last resort and conditional on the involvement

of a minimum amount of private money equal to 8% of a banks total liabilities. The national resolution

funds will progressively merge into a single European Union-wide resolution fund that the Single

Resolution Board would activate based on need. The board plans to be operational in 2015.

Resolution funds can greatly help resolve weak banks in an orderly manner insofar as they maintain

distressed yet viable banks as going concerns. However, this mechanism has negative implications for banks

creditors because it makes it easier to resolve a bank through means that will trigger burden-sharing.

The size of the national resolution funds must reach at least 1% of the amount of covered deposits. Once

the fund has been fully loaded in 2024, it will fall on national resolution authorities to determine how

banks will contribute to the fund in accordance with the delegated acts provisions. In the interim, the exact

contribution of each member country and individual banks will be finalized by the end of the year.

Banks contributions will be calibrated based on two factors. The first is the size of a banks balance sheet,

which, because the resolution targets large banks rather than small ones, is a proxy for the likelihood of the

bank needing the funds support. The second factor is the banks risk profile, which will be based on a range

of regulatory metrics such as core equity Tier 1 capital, leverage and liquidity coverage ratios and

assessments that include the importance of trading activities and complexity. These metrics will be

combined in a formula described in the delegated act. A scale ranging from 80% to 150% will apply to the

contribution estimate based on the banks balance sheet size so as to account for banks relative risk profile.

The application of a risk-based system will not apply to small banks because it is unlikely to meaningfully

differentiate the risks they pose to banking systems owing to their size. Therefore, lump sums of 1,000 to

50,000 will be applied to most, if not all, banks with total balance sheets of less than 1 billion.

Because large banks will pay most of the levies, the bulk of the costs involved with the funds will be

concentrated on a rather small number of banks. Based on preliminary estimates, banks constituting 85% of

banking assets could pay up to 90% of all contributions. Yet, it is too soon to assess the effect on individual

banks, given the importance of the risk-adjustment factor. Furthermore, the cost borne by banks could be

materially higher if national authorities do not recognize the tax deductibility of this expense.

Alain Laurin

Associate Managing Director

+33.1.5330.1059

alain.laurin@moodys.com

NEWS & ANALYSIS

Credit implications of current events

9 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

Russias Large Private Banks Would Benefit from Central Bank Capital Injections

Last Tuesday, Russian Deputy Minister of Finance Alexey Moiseev said that the government is considering

a law that would allow the Central Bank of Russia (CBR) to inject capital into banks, subject to a limit of

15% of the CBRs reported profits.

3

These capital injections would be credit positive for the banks receiving

them, although they would not significantly boost the capital ratios of the largest state-owned Russian

banks, given the proposed limit on the total amount of capital injection available via this measure.

However, if capital injections focussed on private-sector banks, which tend to be much smaller than state-

owned institutions, this initiative could prove an effective tool for banks in need of capital.

Many details of the proposal are unclear. Aspects yet to be clarified include the process for determining

bank eligibility for capital support; how much capital an individual bank might receive within the total

15% limit; whether the capital injection would qualify as Tier 1 or Tier 2 capital; and whether the CBR or

other government bodies would directly inject the funds.

We believe systemically important banks (SIBs) would receive capital, and that foreign bank subsidiaries

would not, given that their parents have the financial resources to support them if necessary. We estimate

that 15% of the CBR profit will total RUB30-RUB50 billion for 2014. This is less than 1% of total

banking-sector capital of RUB7.5 trillion at 1 September 2014, and a small portion of the governments

RUB780 billion capital assistance to its largest state-owned banks so far this year.

4

In contrast, the RUB30-RUB50 billion additional capital injection would amount to a material 4%-7% of

privately owned SIBs aggregate capital. Although the list of SIBs is not public (the regulator has only stated

that it has classified 19 banks as SIBs), based on the criteria the regulator disclosed earlier this year, we think

these privately owned institutions qualify as SIBs: Alfa-Bank (Ba1 negative, D/ba2 stable

5

), Bank Otkritie

Financial Corporation OJSC (Ba3 stable, D-/ba3 stable), Promsvyazbank (Ba3 review for downgrade, D-

/ba3 review for downgrade), Credit Bank of Moscow (B1 stable, E+/b1 stable) and Russian Standard Bank

(B2 negative, E+/b2 stable).

Russian banks ability to generate capital internally has diminished recently owing to increased loan-loss

provisioning charges and funding costs. These reflect stagnant economic growth and a tighter liquidity

situation following European Union and US sanctions on Russias state-owned banks in connection with

the political crisis in Ukraine. In the first nine months of 2014, 191 banks (of the 859 banks in Russia)

were loss-making, compared with 55 loss-making banks in 2013. As a result of banks reduced profitability,

3

The CBR is required by law to pay 75% of its reported profit to the government, leaving 25% of profits available for other

purposes.

4

See Russias Capital Injection into Two Banks Subject to US and EU Sanctions Is Credit Positive, 1 September 2014.

5

The bank ratings shown in this report are the banks deposit rating, its standalone bank financial strength rating/baseline credit

assessment and the corresponding rating outlooks.

Olga Ulyanova

Vice President - Senior Analyst

+7.495.228.6078

olga.ulyanova@moodys.com

Polina Krivitskaya

Associate Analyst

+7.495.228.6062

polina.krivitskaya@moodys.com

NEWS & ANALYSIS

Credit implications of current events

10 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

Basel III statutory total capital adequacy ratio (the so-called N1.0 ratio) for the sector declined to 12.6% at

1 September 2014, from 12.9% at 1 February 2014 (see exhibit below).

Russian Banks Aggregate Capital Ratios and Year-to-Date Profitability, 2014 versus 2013

Note: 1 February 2014 is the starting point for capital ratio dynamics because this was the first date under which banks reported their capital ratios

under the CBRs implementation of Basel III rules that year.

Source: Central Bank of Russia

0

100

200

300

400

500

600

700

0%

2%

4%

6%

8%

10%

12%

14%

1 Feb 1 Apr 1 Jul 1 Aug 1 Sept

R

U

B

B

i

l

l

i

o

n

Profits 2013 - right axis Profits 2014 - right axis

Total CAR (N1.0) - left axis Tier 1 Ratio (N1.2) - left axis

NEWS & ANALYSIS

Credit implications of current events

11 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

Kazakhstan Plan to Recapitalize Two Large Banks Is Credit Positive

Last Wednesday, the National Bank of Kazakhstan announced that it will buy a minimum of $1.4 billion

of problem assets from Kazkommertsbank (KKB, B2 stable, E/caa1 stable

6

) and its recently acquired

subsidiary BTA Bank (B3 positive, E/caa2 stable), effectively recapitalizing the two banks. The purchase is

credit positive for KKB and BTA, and for other banks in Kazakhstan because it signals the Kazakh

authorities increased willingness to support banks. In the resolution of several failed Kazakh banks in 2009-

13, the governments support was limited to protecting depositors, and did not include any significant

recapitalizations, resulting in foreign creditors taking large losses.

BTA had the highest proportion of problem loans among rated Kazakh banks at 92% as of the end of June

2014.

7

KKB, the countrys largest bank, acquired BTA earlier this year from national welfare fund JSC

Samruk-Kazyna. Although KKB and BTA together account for around 60% of total problem loans in the

Kazakh banking system as of the end of June 2014, asset-quality problems in the country, to a large extent a

legacy of pre-2008 real estate lending, are not limited to these two banks. For the system as a whole, we

estimate that problem loans accounted for 47% of total loans as of year-end 2013 (see exhibit).

Kazakhstans Largest Banks Problem Loans as Percent of Gross Loans at Year-End 2013

Source: Moodys Banking Financial Metrics

The central bank is not ruling out extending similar support to other Kazakh banks that report high levels

of problem loans, although it did not provided additional details. The central bank has made improving

banks asset quality a top priority and aims to bring the proportion of nonperforming loans to below 10%

by the end of 2015.

Under the proposed recapitalization scheme, the National Distressed Fund, 100%-owned by the central

bank, will buy problem assets from the banks under a repurchase agreement that is secured by a pledge of

the banks shares and obligates the banks to buy back the assets after 10 years. The scheme will improve

banks asset quality immediately, while simultaneously incentivising them to make recoveries on the assets.

Unlike problem loans that are not generating cash flow for the bank, the additional capital can be invested

6

The bank ratings shown in this report are the banks deposit rating, its standalone bank financial strength rating/baseline credit

assessment and the corresponding rating outlooks.

7

BTA over the past five years has twice undergone restructurings after defaulting on its debt. It has had almost no new loan

origination, which has left the bank with a loan portfolio predominantly composed of problem loans as the performing portion of

its portfolio amortized. Loan-loss reserves at the end of June 2014 were 81% of gross loans and covered 88% of these problem

loans.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Semyon Isakov

Assistant Vice President - Analyst

+7.495.228.6061

semyon.isakov@moodys.com

NEWS & ANALYSIS

Credit implications of current events

12 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

in yielding assets, thereby improving the banks revenues. Also, removing the problem assets from the

banks balance sheet reduces the banks need for additional loan-loss reserves beyond what they have

already provisioned.

It is not yet clear how the $1.4 billion will be allocated between the two banks. We expect that the effect on

the banks reported capital could be somewhat less than $1.4 billion, depending on the banks already-

provisioned loan-loss reserves on loans to be transferred to the National Distressed Fund. Nonetheless, we

expect the positive effect to be substantial, considering that the combined shareholders equity base of the

two banks totaled $2.5 billion at the end of June 2014.

NEWS & ANALYSIS

Credit implications of current events

13 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

Bank Permatas Issuance of Basel III-Compliant Subordinated Debt Is Credit Positive

Last Thursday, Bank Permata TBK (P.T.) (Baa3 stable, D/ba2 stable

8

) raised IDR700 billion ($58 million)

through the issuance of Basel III-compliant Tier 2 subordinated debt in the onshore market. This capital

raise is credit positive because it will boost Permatas loss-absorbing buffer ahead of further loan expansion.

After taking into account the newly raised subordinated debt, and assuming Permata achieves its targeted

14%

9

loan and risk-weighted asset growth in 2014, while keeping its profitability metrics and earnings

retention in line with last year, we estimate that Permatas capital adequacy ratio will increase to 14.5% by

the end of 2014 from 13.9% reported as of June 2014, as shown in the exhibit. Our estimated capital

adequacy ratio for Permata is much higher than the 9.5% minimum required for Indonesian banks under

Basel III rules. The 9.5% capital includes a common equity Tier 1 capital ratio of 4.5%, a 2.5% capital

conservation buffer and a 2.5% countercyclical buffer.

Permatas Capital Ratios Exceed the Required Minimum under Basel III Rules

Sources: Bank Permatas financial reports and Moodys Investors Service

This capital raise is also positive because it is only the third issuance of a Basel III-compliant security in

Indonesia, and will help create a market for these instruments and open up new channels for Indonesian

banks to maintain high capital adequacy ratios. At the end of August 2014, Indonesian banks reported an

average 19.7% capital adequacy ratio. The banks will start reporting Basel III capital starting with first-

quarter 2015 reporting. The new capital will also better shield senior creditors in a stress scenario.

The Basel III instrument requires the debt to be written down at the point of non-viability (PONV), which

is determined at the discretion of Otoritas Jasa Keuangan (OJK), the Indonesian financial services authority.

Under the terms and conditions of the debt, the PONV occurs if OJK notifies the bank that without such

write-downs, the bank would become non-viable. The security can be written down by an amount deemed

necessary by the OJK to restore viability to the bank. The write-down is permanent and does not allow the

bank to return the debt to the original face amount and interest payment if it recovers.

In a stress situation, the PONV debt will benefit senior creditors. PONV debt will increase in size over

time, driven by the need to issue more PONV debt to replace old-style subordinated debt. A thick layer of

8

The ratings shown are the banks deposit rating, its standalone bank financial strength rating/baseline credit assessment and the

corresponding rating outlooks.

9

The banks loan target for this year is between 12%-14%.

9.4% 9.3% 9.3%

4.5% 4.4% 4.4%

New PONV = 0.7%

0%

2%

4%

6%

8%

10%

12%

14%

16%

Reported as of June 2014 Estimated Capital at End-2014,

Without Subdebt

Estimated Capital at End-2014, After

Issuing Subdebt

Tier 1 Ratio Tier 2 Ratio New PONV Tier 2 Securities

CAR = 13.9% CAR = 13.8%

CAR = 14.5%

Falemri Rumondang

Associate Analyst

+65.6398.8330

falemri.rumondang@moodys.com

Alka Anbarasu

Assistant Vice President - Analyst

+65.6398.3712

alka.anbarasu@moodys.com

NEWS & ANALYSIS

Credit implications of current events

14 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

PONV is credit positive because it will increase the banks loss buffer and can better shield creditors from

losses in the event the bank reaches the PONV.

Permata is the first Indonesian bank we rate to issue PONV subordinated debt and the third bank in the

market to do so. Bank UOB Indonesia (unrated) and Bank Internasional Indonesia (unrated), a subsidiary

of Malayan Banking Berhad (A3 stable, C/a3 stable), have also issued PONV subordinated debt.

Permatas capital raise follows the implementation of Basel III rules in Indonesia. Starting 1 January 2014,

the OJK required Tier 2 subordinated debt to have the PONV language to receive a capital credit.

NEWS & ANALYSIS

Credit implications of current events

15 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

Insurers

Health Insurers Gain Little with Affordable Care Act Opt-Out Clause

On Wednesday, CNBC reported

that an added provision in the 2015 contract between health insurers that

are selling policies on the federal exchange and the Centers for Medicare and Medicaid Services (CMS)

would allow insurers to terminate their health plans if the subsidies being provided to enrollees are no

longer permitted. The termination provision seemingly allows insurers to limit their risk if at some point

during 2015 federal subsidies are no longer available. However, because the provision is subject to

applicable state and federal laws, the benefit to the insurers is limited because it is unlikely that insurers

would be allowed to cancel polices already sold.

According to the report, the wording of the clause is as follows:

CMS acknowledges that [a health plan issuer] has developed its products for [HealthCare.gov]

based on the assumption that [subsidies for premiums and out-of-pocket expenses] will be

available to qualifying enrollees. In the event that this assumption ceases to be valid during the

term of this agreement, CMS acknowledges that an issuer could have cause to terminate this

agreement subject to applicable state and federal law.

The added contract provision is clearly the result of several ongoing court cases, one of which has been

appealed to the US Supreme Court. At question in all these cases is the legality of subsidies for polices

purchased on the federal exchange based on the wording in the Affordable Care Act (ACA), which states

that federal premium tax credits (subsidies) are available to individuals who purchase insurance policies on a

state-operated exchange. If the Supreme Court decides to hear the case, its decision would likely be

announced in mid-2015, well after the open enrollment period that begins 15 November 2014 and ends 15

February 2015.

At stake for health insurers are approximately 5 million polices that were sold on the federal exchange with a

federal subsidy and a projected 3 million of new polices for 2015. Assuming that the percentage of renewing

individuals and new purchasers that qualify for subsidies remains in the 80%-90% range, the loss of this

financial assistance in the middle of the year would likely result in a majority of these policies lapsing.

Under this scenario, we would expect the unlapsed policies and any future exchange sales to comprise a less

healthy population because only those who most need insurance coverage would continue paying for an

unsubsidized health plan. In this event, the added contract wording would appear to protect insurers from

the small percentage of individuals who qualify to purchase an exchange policy after the open enrollment

period as a result of a qualifying event. However, insurers would still bear the risk for those polices already

sold where the individual continues to pay the full premium.

The exhibit below shows six Moodys-rated large health insurance companies that have reported sizable

enrolled membership. Although the enrollment for these six insurers accounts for more than 30% of total

ACA enrollment, this business segment comprises a relatively small portion of their total

medical membership.

Steve Zaharuk

Senior Vice President

+1.212.553.1634

stephen.zaharuk@moodys.com

NEWS & ANALYSIS

Credit implications of current events

16 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

Affordable Care Act Enrollment by Insurer

Insurer

Senior Unsecured Rating

and Outlook

ACA Individual Membership at

30 June 2014

Percent of Total

Medical Membership

WellPoint, Inc Baa2 stable 769,000 2.4%

Humana Inc. Baa3 stable 615,000 6.3%

Aetna Inc. Baa2 stable 600,000 2.6%

Health Net, Inc. Ba3 positive 313,000 5.4%

Cigna Corporation Baa2 positive 150,000 1.1%

Centene Corporation Ba2 stable 75,700 2.4%

Source: Company filings and disclosures

Although WellPoint sold the most policies of the companies in our exhibit, almost half of their policies

were sold through state-operated exchanges in New York and California, where the status of the premium

subsidies is not in question. Similarly, Health Nets exchange policies are not affected since almost all were

sold on the California exchange.

NEWS & ANALYSIS

Credit implications of current events

17 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

US Mortgage Insurers Will Benefit from Housing Finance Reforms

Last Monday, Federal Housing Finance Agency (FHFA) Director Mel Watt announced concrete steps

toward reducing the uncertainty that lenders face regarding government-sponsored enterprises (GSEs)

Fannie Maes and Freddie Macs representation and warranty framework. Mr. Watt also announced plans

to develop GSE guidelines for mortgages with loan-to-value ratios (LTVs) of 95% to 97%. Until now,

lenders have been unable to accurately gauge the risk of breaching representations and warranties, and thus

have been reluctant to lend to borrowers with less-than-pristine credit. Although it remains to be seen to

what degree the measures Mr. Watt outlined will persuade lenders to loosen underwriting standards, these

incremental housing reforms are credit positive for US private mortgage insurers (PMIs) because they will

increase the flow of new business to PMIs.

The US housing market has gradually recovered since the 2008 financial crisis. However, the recovery has

not been broad-based, and certain segments of the market are languishing. We believe this is due in part to

mortgage underwriting standards that remain very tight relative to historical norms. Current underwriting

standards exclude a segment of creditworthy borrowers from the mortgage market, including those with

less-than-pristine, complex credit profiles or limited financial resources. As Exhibit 1 shows, post-2008

mortgage originations are concentrated in the super-prime, high-FICO cohort of borrowers that accounted

for approximately 74% of Freddie Mac-guaranteed originations post-2008, versus an average of

approximately 39% from 1999 to 2004. Mortgages to borrowers with credit scores lower than 680

accounted for less than 4% of post-2008 originations, versus an average of approximately 26% from 1999

to 2004.

EXHIBIT 1

FICO Distribution of Freddie Mac Mortgages by Vintage, 1999-2013

Source: Freddie Mac single-family loan-level sample dataset

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

T

h

o

u

s

a

n

d

s

P

e

r

c

e

n

t

O

r

i

g

i

n

a

t

i

o

n

s

b

y

F

I

C

O

C

a

t

e

g

o

r

y

<620 621 - 680

681 - 740 741 - 780

781 - 850 Freddie Mac Loan Count - right axis

Brandan Holmes

Vice President - Senior Analyst

+1.212.553.6897

brandan.holmes@moodys.com

NEWS & ANALYSIS

Credit implications of current events

18 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

A key reason for this shift toward the highest quality segment of the market is that lenders have imposed

more stringent underwriting standards, or overlays, than the GSEs require, because of uncertainty about the

risks they face under the GSEs current representation and warranty framework. Lenders paid tens of

billions to settle putback claims from the GSEs. Although we consider the FHFAs actions to be a positive

step, we expect that it will take some time for lenders to digest the updated framework and begin making

meaningful changes to underwriting standards.

However, the lenders broader underwriting standards will allow PMIs to insure some currently underserved

but profitable segments of the market, because risk-based premiums compensate insurers for taking on

additional risk. The mortgage industry has made significant strides in improving upfront quality controls

and other risk management practices that should prevent the more egregious pre-crisis practices. In the

current environment, we do not expect a loosening of credit quality from a very tight starting point to result

in a spike in defaults. According to the Urban Institute,

10

the average cumulative default rate on certain

Freddie Mac loans originated in 1999-2004 is 2%.This compares favorably with PMI premiums,

11

and we

expect PMIs to remain profitable, even at more normalized default rates.

Mr. Watt also announced steps to allow the GSEs to purchase mortgages with LTVs of up to 97%.

Although lower down payments naturally imply incremental risk, risk-based premiums, and borrower credit

quality are important risk-mitigation factors. As Exhibit 2 shows, the average post-2008 credit scores of

95% LTV borrowers are within 10 points of borrowers with 80%-85% LTV loans. These expanded

underwriting parameters are occurring at a time when the GSEs are finalizing their private mortgage

insurance eligibility requirements,

12

which will impose additional pricing and underwriting discipline on

the PMIs with granular risk-based capital requirements.

EXHIBIT 2

Average FICO Score by Loan to Value and Vintage, 1999-2013

Source: Freddie Mac single-family loan-level sample dataset

10

Per calculations by the Urban Institute and Freddie Mac, the average cumulative default rate on 30-year fixed, full-documentation,

amortizing loans originated in 1999-2004 is 2%.

11

PMI (Radian BPMI) single-premiums, which are lower than the more common monthly-premiums, for loans to borrowers with

680-719 FICOs range from 141 basis points for loans with LTVs of no more than 85% to 392 basis points for loans with LTVs of

90%-95%. Assuming a 25% severity on default, a 2% default rate implies an expected loss of 50 basis points.

12

See Stringent GSE Mortgage Insurer Eligibility Requirements Would Be Credit Positive for Policyholders, 21 July 2014.

690

700

710

720

730

740

750

760

770

780

1999 2001 2003 2005 2007 2009 2011 2013

<80 LTV 80 - 85 LTV 85 - 90 LTV 90-95 LTV 95+ LTV

NEWS & ANALYSIS

Credit implications of current events

19 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

US Public Finance

Low Oil Prices Will Pressure States Reliant on Extraction Taxes

As of Friday, oil prices have been below $83 per barrel for almost two weeks, signaling weaker tax revenues

for oil-producing states. A significant drop in oil prices from Fridays $81.01 per barrel of West Texas

Intermediate would be credit negative for some of the top oil-producing US states, especially Alaska

(general obligation Aaa stable), which depends on oil tax revenues to fund virtually all of its

operating budget.

Alaska is by far the state most reliant on oil-production tax revenues, which account for 89% of its

operating budget well ahead of next most-reliant state, New Mexico (general obligation Aaa stable), at

19%. In the other major oil-producing states (those whose production is more than 300,000 barrels per

day), production-related taxes account for less than 10% of revenue, as shown in the exhibit.

State Reliance on Oil Revenue and Budgetary Price Assumptions

State

July 2014 Oil

Production

Barrels per Day

Fiscal 2014

General Fund

Revenues

Reliance on Oil

Taxes

Fiscal 2014

Oil Price

Forecast

Fiscal 2015

Oil Price

Forecast Oil Price Forecast Benchmark

Texas 3,102 8% $82.18* $80.33* West Texas Intermediate

North Dakota 1,111 6% $75.00 $80.00 West Texas Intermediate

Alaska 422 89% $106.61 $105.06 Alaska North Slope

Oklahoma 353 4% NA NA NA

New Mexico 332 19% $95.75 $92.00 New Mexico

Notes: Forecast prices are averages for the fiscal year.

* The Texas price reflects the taxable price per barrel, which is lower than the anticipated market price.

Sources: US Energy Information Administration and State Budget Information

Alaska and New Mexico both forecasted higher oil prices for their fiscal years ended 30 June 2014 and may

need to make budgetary adjustments.

13

Lower oil prices over an extended period could derail efforts to

explore and drill new wells in Alaska, which enacted tax incentives that took effect in January 2014 to spur

output. The low prices also risk decreasing the allure of tight oil deposits, which require more costly

extraction, in states such as North Dakota and Oklahoma.

Many oil-producing states built large fiscal reserves in recent years as elevated oil prices (and growing

production in some states) stoked tax collections. Their reserves mitigate a near-term oil revenue decline.

For instance, even though Alaska is the most reliant on oil tax revenues, its reserves ($26 billion) exceed

three years worth of fiscal 2013 operating revenues. Other states with large reserves include North Dakota,

with $2.5 billion, or 78% of revenues, and Texas, with $8 billion, or 16% of revenues. New Mexicos

reserve levels are slightly lower at $671 million, or 12% of revenues.

13

Alaska is scheduled to update its most-recent (April) price forecast by year-end.

John Lombardi

Associate Analyst

+1.212.553.2829

john.lombardi@moodys.com

Ted Hampton

Vice President - Senior Credit Officer

+1.212.553.2741

ted.hampton@moodys.com

NEWS & ANALYSIS

Credit implications of current events

20 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

PLUS Loan Eligibility Expansion Benefits Universities Serving Low-Income Students

Last Wednesday, the US Department of Education (DOE) implemented a rule relaxing underwriting

requirements for federal parent and graduate student loans (PLUS loans). The relaxation, which takes effect

next spring, is credit positive for US universities that serve a large number of low-income students because it

expands PLUS loan eligibility to what the DOE estimates is another 370,000 parents and

graduate students.

This is an approximate 35% increase over PLUS recipients for the 2013-14 award year, assuming all newly

eligible borrowers take out loans, and that figure is approximately 200,000 more than the recent peak of

recipients for the 2011-12 year (see Exhibit 1). It is likely that a large portion of the newly eligible

borrowers will take out PLUS loans because they have less strict credit standards and more generous

repayment options than private student loan alternatives. The increase in recipients will provide an

important stabilizing factor for these universities, many of which have declining enrollment. Some may

even record moderate enrollment increases in the 1%-2% range as a result of the relaxation.

EXHIBIT 1

PLUS Loan Recipients Will Grow Substantially with New Eligibility Criteria

Note: Financial aid award years affect the fall enrollment of the next academic year (i.e., the 2014-15 award year will affect financial aid in fall

2015). Projections are based on US Department of Education overall estimates for increased eligibility, based on 2013-14 distributions.

Sources: US Department of Education Title IV Program Volume Reports and Moodys Investors Service projections

The new rule loosens the standards around the adverse credit history criteria by which a loan could be

denied. It also outlines alternate approval methods for borrowers who are denied a loan based on adverse

credit history. Loans provided by the program accounted for only 10% of federal student loan

disbursements in the 2013 academic year, but reliance on the program varies widely by university. Of

approximately 550 rated four-year colleges and universities, only 10 institutions with ratings ranging from

Aa3 to B1 drew more than 10% of operating revenue from PLUS loans (see Exhibit 2).

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

1,600,000

2010-2011 2011-2012 2012-2013 2013-2014 2014-2015 Projection

P

L

U

S

L

o

a

n

R

e

c

i

p

i

e

n

t

s

Award Year

Public Private For-Profit

Eva Bogaty

Vice President - Senior Analyst

+1.415.274.1765

eva.bogaty@moodys.com

NEWS & ANALYSIS

Credit implications of current events

21 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

EXHIBIT 2

PLUS Loans Constitute a Meaningful Portion of Operating Revenue for 10 Rated Universities

(Fiscal 2013)

University and Senior

Unsecured Rating and

Outlook

Enrollment

Fall 2013

Plus Loans as Percent

of Operating Revenue

Tuition and Auxiliaries

as a Percent of Total

Operating Revenue

Total Operating

Revenue,

$ Thousands

Spelman College, Georgia

(A1 stable)

1

2,088 22% 59.7% $86,162

Morehouse College, Georgia

(Baa3 negative)

1

2,099 22% 59.0% $85,552

Clark Atlanta University,

Georgia (Ba1 stable)

1

3,266 19% 71.7% $83,610

Marymount Manhattan

College, New York (Baa2

stable)

2

1,714 19% 90.7% $50,652

St. John's University, New

York (A3 positive)

2

16,696 14% 88.6% $472,141

Citadel, the Military College

of South Carolina (Aa3

stable)

3

3,150 12% 64.8% $101,451

Alma College, Michigan

(Baa1 stable)

2

1,397 12% 70.7% $44,349

Wittenberg University, Ohio

(B1 negative)

2

1,796 12% 80.8% $52,249

Longwood University,

Virginia (A1 stable)

3

4,602 11% 64.8% $104,008

Central Washington

University (A1 stable)

3

10,504 10% 59.7% $191,092

1 Private historically black college or university

2 Private institution

3 Public institution

Source: Moodys Investors Service

Historically black colleges and universities, regional public universities, small local colleges and for-profit

universities will benefit most from the expanded PLUS loan eligibility because they all serve a relatively large

proportion of low-income students. Most universities that depend on PLUS loans draw the large majority

of their annual operating revenues from net tuition and typically lack the wealth to easily absorb operating

deficits or to increase scholarship aid to replace the loans. The median operating margin in the fiscal year

ended 30 June 2013 for PLUS-dependent universities was negative 1.6%, versus a median of 2.2% for

public universities and 3.7% for private universities. Although a 1%-2% increase in enrollment translates

into only approximately $1 million of additional net tuition revenue for these universities (median net

tuition revenue of $55.7 million), it would be enough to bring operations closer to break even for many.

Expanded eligibility will help stabilize enrollment for PLUS loan eligible students, thereby making net

tuition revenue more predictable. Many of these universities recorded steep enrollment declines in fall 2012

because students whose parents were declined loans based on tightened loan requirements in October 2011

were unable to enroll in fall 2012. Those enrollment declines contributed to net tuition revenue shortfalls

and ultimately operating deficits for the fiscal year ended 30 June 2013.

NEWS & ANALYSIS

Credit implications of current events

22 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

Colorado Supreme Court Upholds State and Local Government Pension Reforms, a

Credit Positive

Last Monday, the Colorado Supreme Court upheld statewide public pension reforms implemented in 2010,

reversing a state appellate court decision. The ruling is credit positive for the State of Colorado (issuer rating

Aa1 stable) and its local governments because it upholds nearly $9 billion of pension liability reductions and

solidifies the states legal ability to enact changes to cost of living adjustment (COLA) benefits. At nearly

$22 billion, Colorado had the 12th-highest Moodys-adjusted net pension liability among the 50 US states

as of fiscal 2012.

Then-Colorado Governor Bill Ritter in February 2010 signed into law Senate Bill 10-001, which changed

state and local government contribution rates to the Public Employees Retirement Association (PERA),

while altering certain pension benefits and retirement eligibility requirements. The changes applied to most

public employees and retirees throughout the state because the state and most local governments in

Colorado participate in PERA.

The most significant and contentious component of the states reforms were changes to COLA benefits,

which at the time provided a 3.5% annual compound increase. The legislation generally capped pension

COLA benefits at 2%, or alternatively, the lesser of 2% and the change in the Consumer Price Index (CPI)

following years where PERAs investment returns are negative.

As a result of the legislation, PERAs unfunded actuarial accrued liabilities (UAALs) fell substantially. The

systems UAAL at the end of 2009 was $16.9 billion, reflecting a 34%, or $8.9 billion, reduction as a result

of the reforms (see Exhibit 1). Of the $8.9 billion in unfunded liability reductions, $3.2 billion was

attributable to the state, nearly $5 billion to local school districts and the remainder to other miscellaneous

local governments. Despite the increase to employer contribution rates as part of the reforms, PERAs

unfunded liabilities have since grown. This partly is due to contribution rates remaining below actuarial

requirements, particularly for the state and local school district divisions.

EXHIBIT 1

Colorados Public Employees Retirement Association Unfunded Actuarial Accrued Liabilities

Note: Because of the publication timing of actuarial studies, the reforms passed in 2010 were first reflected in PERAs 2009 valuation figures.

Sources: Colorado Public Employees Retirement Association actuarial valuations and plan comprehensive annual financial reports

In September 2010, a lower court ruled in favor of the states ability to implement the COLA changes

following a legal challenge by a group of retirees that had asserted that the COLA amounts at the time of

$0

$5

$10

$15

$20

$25

$30

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

$

B

i

l

l

i

o

n

s

UAAL Additional UAAL Without Reforms

Thomas Aaron

Assistant Vice President - Analyst

+1.312.706.9967

thomas.aaron@moodys.com

NEWS & ANALYSIS

Credit implications of current events

23 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

retirement merited contractual protections, thus preventing the state from lowering the benefits. The state

Court of Appeals agreed with the retirees in October 2012, overturning the lower court decision and ruling

the previous COLA amounts were contractually protected.

The state Supreme Court overturned the appellate ruling on the grounds that the states reform legislation

did not violate a contractual protection. The court ruled that public employees in Colorados PERA system

do not enjoy a contractual protection of the COLA benefits in place when they become eligible to retire, or

actually do so. The court drew a clear distinction between vested rights to base pension benefits, and a lack

thereof related to COLAs.

Colorados high court is the latest to rule on public pension reforms since 2013, although the results vary

and consider highly nuanced issues. For example, the state supreme court in New Mexico (general

obligation Aaa stable) ruled that reductions to COLAs and increases to employee pension contributions

were legally allowable, while the Arizona (issuer rated Aa3 positive) state supreme court ruled that the states

reduction of COLA benefits violated that states constitution (see Exhibit 2).

EXHIBIT 2

State Supreme Court Rulings on Public Pension Reform Challenges in Recent Years

State Reform Description State Supreme Court Decision

Arizona 2011 reforms reduced COLA benefits Reforms violated the state constitution (2014)

Colorado 2010 reforms altered certain benefit provisions and

retirement eligibility criteria, and reduced COLA

benefits

Reforms upheld (2014)

Florida 2011 reforms lowered future benefit accruals,

increased employee contributions and eliminated

COLAs associated with future years of work

Reforms upheld (2013)

New Mexico 2013 reforms reduced COLAs and increased

employee contribution rates

Reform upheld (2013)

Washington In 2007 and 2011, the state repealed certain COLA

and other contingent benefits that included state

termination options when enacted

Reforms upheld (2014)

Wisconsin 2011 reforms related to collective bargaining and

employee shares of pension costs, including those

of a local pension system

Reforms upheld (2014)

Sources: Moody's Investors Service and state supreme court opinions

NEWS & ANALYSIS

Credit implications of current events

24 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

Securitization

New York Probe into Ocwen Is Credit Negative for Company and the RMBS It Services

Last Tuesday, the New York State Department of Financial Services (DFS) accused mortgage servicer

Ocwen Financial Corporation (B2 review for downgrade) of material deficiencies in its systems and

processes. Specifically, DFS alleged that Ocwen was backdating loss mitigation and foreclosure letters to an

unknown number of borrowers. The allegations, which expand an existing probe into the company by the

New York regulator, are credit negative for Ocwen and private-label residential mortgage-backed securities

(RMBS) that contain loans it services.

Following the regulatory accusations, we downgraded Ocwens rating to B2 from B1, with the rating on

review for further downgrade. On 22 October, we also downgraded the servicer quality assessment of

Ocwens mortgage servicer unit Ocwen Loan Servicing LLC as a primary servicer of subprime residential

mortgage loans to SQ3 from SQ3+, and as a special servicer of residential mortgage loans to SQ3 from

SQ3+. Both assessments remain on review for further downgrade.

The extent of the negative effect on Ocwen and RMBS containing Ocwen-serviced loans will largely

depend on the results of the ongoing regulatory investigation. Ocwen is the largest non-bank, residential

mortgage servicer in the US, servicing roughly 25% of the loans, with more than $180 billion in unpaid

principal balance, in US private-label RMBS. The companys business focuses mainly on the subprime

mortgage market.

Depending on the outcome of the investigation, the probe could result in monetary fines against Ocwen,

regulatory restrictions on Ocwen Loan Servicing LLC and higher compliance and monitoring costs for the

company. It will also likely result in a decrease in loans transferred to Ocwen from other servicers. The

increased likelihood that other regulators, such as the US Consumer Financial Protection Bureau and

various state attorneys general, will also begin or expand investigations into Ocwens servicing practices is

also credit negative for the company.

If regulatory action results in additional foreclosure delays or increased loan modifications, trust losses will

increase and cash flow disruptions will occur in RMBS containing Ocwen-serviced loans, with the highest

aggregate exposure in subprime, particularly transactions involving loans from Residential Funding

Company, Option One Mortgage Corp. and Ameriquest. Foreclosure delays harm bondholders because

servicers must make additional advances of delinquent principal and interest and will accrue legal and

property-related expenses that will reduce overall cash to the RMBS trusts. Mortgage modifications to

distressed borrowers increase the odds of RMBS cash flow disruptions, including missed bondholder

interest payments.

The regulatory scrutiny also slightly increases the risk of losses for Ocwen-issued servicer advance facilities,

securitizations that are backed by a mortgage servicers right to be reimbursed for advances made on behalf

of delinquent accounts to RMBS trusts. These facilities would face a higher likelihood of losses in the event

that foreclosure timelines increase or advances made by Ocwen are deemed not recoverable as a result of

regulatory scrutiny over borrower charges and fees. However, we deem this risk to be minimal because

servicer advances have very high seniority.

Gene Berman

Assistant Vice President - Analyst

+1.212.553.4139

gene.berman@moodys.com

Warren Kornfeld

Senior Vice President

+1.212.553.1932

warren.kornfeld@moodys.com

Mark Branton

Assistant Vice President - Analyst

+1.212.553.4175

mark.branton@moodys.com

NEWS & ANALYSIS

Credit implications of current events

25 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

Spanish Covered Bond Law Would Reduce Collateral, a Credit Negative

Last Wednesday, the Spanish treasury proposed a new regime for Spanish covered bonds (cdulas) that

would align the countrys covered bond practices with those of the rest of Europe and improve recoveries

for unsecured bank creditors. If these changes take effect, covered bonds would be backed by much less

collateral, instead of the issuers entire mortgage book. As a result, over-collateralisation (collateralisation

above the amount of covered bonds) risks dropping to 25% or less from current levels of more than 100%.

The Spanish treasury is also contemplating features that would improve the credit quality of covered bonds,

such as asset quality requirements, property value updates and liquidity matching principles. Enhancements

also include improving the bankruptcy remoteness of the cover pool, an independent cover pool monitor

and transparent reporting. Nevertheless, the decline in collateral backing covered bonds makes the package

of legislative proposals credit negative for covered bonds. The Spanish treasury has requested feedback on its

proposals by 24 November.

Spanish mortgage covered bonds (cdulas hipotecarias) are now backed by the issuers entire mortgage book

and public sector covered bonds (cdulas territoriales) are backed by an issuers entire public-sector loan

book. This provides the highest over-collateralisation in Europe and compensates for weaknesses in Spains

cover bond structure. Exhibit 1 shows over-collateralisation beyond that necessary for the current rating of

covered bonds by country.

EXHIBIT 1

Weighted-Average Excess Over-Collateralisation by Country

Source: Moodys Investors Service

The proposals state that the covered bonds shall be backed by an earmarked and limited cover pool to

improve the recovery of banks unsecured creditors. If an issuer becomes insolvent, unsecured creditors

would have recourse to a greater portion of the issuers assets, which otherwise would be encumbered to

covered bondholders. Although the proposal does not specify any maximum over-collateralisation, it argues

that the current recourse to the entire mortgage book is excessive and should be lower.

Other treasury proposals would improve cdulas credit quality by strengthening the quality of their

collateral, better matching assets and liabilities, enhancing cover pools bankruptcy remoteness and

endorsing most of the European Banking Authoritys (EBA) best practices. Cdulas hipotecarias and cdulas

territoriales currently have some legal weaknesses relative to their European peers and fall short of EBA best

practices, some of which will be necessary for preferential capital treatment of covered bonds in the near

future (see Exhibit 2).

27.6%

17.5%

18.6%

23.7%

55.1%

31.1%

17.1%

32.4%

95.0%

25.4%

37.1%

39.5%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Juan Pablo Soriano

Managing Director

+34.91.768.8233

juanpablo.soriano@moodys.com

Jose de Leon

Senior Vice President

+34.91.768.8218

jose.deleon@moodys.com

NEWS & ANALYSIS

Credit implications of current events

26 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

EXHIBIT 2

Comparison of Spanish Covered Bond Laws and European Banking Authority Best Practices

European Banking Authority Best Practice Spanish Covered Bonds

Dual recourse to other issuers assets if cover pool is

insufficient

Compliant

Segregation of cover assets by identification in a cover

register or transfer to special entity

Compliant

Bankruptcy remoteness should avoid automatic

acceleration and independent manager of the cover pool

Fail: Although the law segregates cover assets and avoids

immediate acceleration, the administrator is not

independent from bankruptcy estate

Cover pool composition should remain homogenous

through the life of the bond to avoid issuers discretion

Fail: Cover pool consists of any type of mortgage loans

from the issuer

Cover assets should be located in the European economic

area, which ensures that liquidation of collateral in the case

of issuer default is legally enforceable

Compliant

Loan-to-value ratios must be updated at least yearly Fail: No obligation to update LTVs

Regulatory minimum over-collateralisation Compliant: Minimum 25% for cdulas hipotecarias and

43% for cdulas territoriales

Derivative instruments are allowed in covered bond

programmes exclusively for risk hedging purposes and

cannot be terminated upon issuer insolvency

Compliant, although there are technical issues in

implementation

Liquidity buffer to cover cumulative net outflows Fail

Stress testing of market risks, fire-sale risk and credit risk Fail

Source: Moodys Investors Service

It is not clear whether investors holding some 310 billion of existing Spanish covered bonds would be

subject to new measures retroactively or if the treasury would implement a sufficiently long transition

period that would preserve their preferential claim over the whole mortgage cover pool. Ninety percent of

existing cdulas will amortise in 10 years, according to their scheduled maturity. Cdulas have bullet

maturities and do not follow a pass-through amortisation in line with the cover pool, which the issuer

replenishes continuously.

RATING CHANGES

Significant rating actions taken the week ending 24 October 2014

27 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

Corporates

Catalent Pharma Solutions, Inc.

Upgrade

31 Jul 14 20 Oct 14

Corporate Family Rating B2 B1

Outlook Review for Upgrade Positive

The upgrade reflects Catalents recent improvement in organic revenue growth and operating profit despite

ongoing industry challenges, and significant deleveraging following the debt repayment from its recent

initial public offering.

Lockheed Martin Corporation

Outlook Change

30 Oct 09 23 Oct 14

Senior Unsecured Rating Baa1 Baa1

Short Term Issuer Rating P-2 P-2

Outlook Stable Positive

We expect Lockheed Martins credit profile to improve as the company benefits from a comparatively

protected position as the prime contractor on one of the few growing defense programs the F-35

Lightning II and our view that the risk profile of that program has reduced, and a growing amount of

cash flow likely over time related to the recovery of previously funded pension expenses from its principal

government customer.

Petroleo Brasileiro S.A. - PETROBRAS

Downgrade

4 Oct 13 21 Oct 14

Long-Term Issuer Rating Baa1 Baa2

Outlook Negative Negative

The downgrade reflects our expectation that Petrobras high financial leverage will only decline significantly

well after 2016, contrary to our original expectations, given downward pressures on oil prices and the local

currency as well as high capex commitments.

14

RATING CHANGES

Significant rating actions taken the week ending 24 October 2014

28 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

Russian Railways Joint Stock Company

Downgrade

1 Jul 14 21 Oct 14

Long-Term Issuer Rating Baa1 Baa2

Outlook Review for Downgrade Negative

The downgrade follows the weakening of Russias credit profile, as reflected by our downgrade of Russias

government bond rating to Baa2 from Baa1 on 17 October 2014. The downgrade thus incorporates our

view that Russian Railways has strong linkages with the government and continues to depend on the

governments willingness and capacity to maintain support in order to maintain financial metrics.

TeliaSonera AB

Outlook Change

25 Apr 12 22 Oct 14

Senior Unsecured Rating A3 A3

Short-Term Issuer Rating P-2 P-2

Outlook Stable Negative

The outlook change reflects our expectation that the company will incur negative free cash flow over the

next couple of years, as a result of its strategic decision to fund a major capex initiative while maintaining a

stable dividend. While the company plans to fund these investments from existing cash, its net debt

position will deteriorate, potentially putting further pressure on already weak credit metrics for the A3

rating category, if underlying business conditions do not improve.

Tesco Plc

Downgrade

23 Sep 14 23 Oct 14

Senior Unsecured Rating Baa2 Baa3

Short Term Issuer Rating P-2 P-3

Outlook Review for Downgrade Review for Downgrade

We downgraded Tescos ratings because of the materially reduced trading profit for the first half of fiscal

2015 that is affected by the rapid structural changes in the UK retail grocery market. The downgrade also

reflects the ongoing uncertainties related to the investigation by the FCA into Tescos accounting

irregularities. Even if the FCA concludes its investigation without material negative financial implications,

Tesco faces huge operational challenges, which continue to put its investment-grade rating at risk.

14

RATING CHANGES

Significant rating actions taken the week ending 24 October 2014

29 MOODYS CREDIT OUTLOOK 27 OCTOBER 2014

Infrastructure

Ancora (RCH) Pty Limited

Outlook Change

20 Jun 12 21 Oct 14

Senior Secured Ratings Baa1 Baa1

Outlook Stable Positive

The positive outlook reflects the reduction in risk and the high likelihood of a successful transition to full

operations within the next 12 to 18 months following the early completion of the Stage 2 works, which

involved demolition of existing buildings, commercial precinct construction and site reinstatement. The

project is building a new Royal Childrens Hospital in inner Melbourne.

Ostregion Investmentgesellschaft Nr.1 S.A.

Outlook Change