Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Print (CBTP)

Caricato da

Rafael JamesDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Print (CBTP)

Caricato da

Rafael JamesCopyright:

Formati disponibili

JIMMA UNIVERSITY

INSTITUTE OF TECHNOLOGY

DEPARTMENT OF COMPUTER

SCIENCE

COMMUNITY BASED TRAINING

PROGRAM (CBTP) PHASE ONE

DEMOGRAPHIC SURVEY AND

COMMUNITY PROBLEM IDENTIFICATION

Group members

Name ID no

1. Mihireteab Thomas 02425/05

2. Tegene Beshada 02486/05

3. Abel Fikre 02243/05

4. Ariest Abiy 022

5. Roman Getachew 02458/05

6. Mihiret Berasa 02426/05

7. Yemisrach Tadewos 02512/05

8. Biniyam Alemu 02304/05

9. Deressa Geremew 02330/05

10. Assefa Getaneh 022

11. Melishew Awoke 024

12. Meseret Tesfaye 02419/05

Table of content

content page

1. Acknowledgement..

2. Introduction

3. Objective of the project.

4. Background.

5. Hirmata-Mentina kebele tax desk (office)..

6. Objective of the office

7. Function of the office.

8. Vision and mission ..

9. Organizational structure..

10. Statement of problems..

11. Objective (Claim) after Identifying problems.. .

a) General objective

b) Specific objective.

12. Methodology ..

13. Tools used

14. Scope of the project

AKNOWLEDGEMENT

We would like to give our best gratitude to all those who helped us to complete this project

successfully.

We want to thanks:-

Jimma town Hirmata Mentina kebele administration

Hirmata Mentina tax desk office

Hirmata Mentina kebeles employee

Traders and individual tax payers

Our advisor Gemechu

Our Bus Driver

All group members

Introduction

In this project we tried to identify the specific problems of the society and list out those

solutions in every possible way. The objective of this Community based Training Program (CBTP)

phase one is identifying problems that exists in the community and providing the appropriate

techniques in order to solve them.

Having 12 members in our group we were able to identify those problems existing in jimma

town hirmita -menitna kebele during tax collection of the kebeles tax desk. So our main

objective concentrated on solving the identified problems using Information Communication

Technology (ICT).Finally we would like to mention that all those listed solutions are ICT based.

Objective of the project

As we know our community has many problems. Students have a responsibility to solve those

problems of the society.

As a result, we claimed to gather information about those problems and how they are prior,

frequent and affects many people. After collecting information

We need to analyze and suggest (try) to solve problems that will be solved using Information

Communication Technology (ICT). Generally, the objective of this project is to identify societies

problems and to solve those problems using Information Communication Technology (ICT).

Background

Our project area is Hirmata Mentina kebele tax desk which is found in Jimma town. In this

kebele there are different offices such as; health extension office, OPDO office, kebele

administration office, kebele IMX office, kebele trade and industry office and kebele tax desk.

The kebele is north of Merkato kebele, south of mentina kebele, east of hirmata kebele and

west of seqa kebele. The number of population of hirmata mentina kebele is 11,731

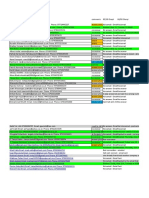

population Number of population

Women 2,593

House holder 2,444

Under five 1,924

Under one 411

Pregnant 446

Non pregnant 2,147

Total 11,731

map of Hirmata Mentina Kebele

fig1:-map of hirmata mentina kebele

Fig2:-population chart of hirmata mentina kebele

When we arrive at Hirmata mentina kebele administration office, we have observed a queue of

people and some of them are angry and murmuring in front of kebeles tax desk office. We

approach to them and asked them for what they are waiting they told us they came to pay tax,

but they are not satisfied by the service of the office. Thus we decided to identify what a

matter is there.

Hirmata Mentina kebele Tax desk

This office separated from the administration office in 2002. It has seven (7) employees. Four of

them are graduated in diploma and three of them are trained in certificate from different

colleges.

Hirmata mentina kebele human resource chart

0

2000

4000

6000

8000

10000

12000

14000

Population of the area

Fig3.a

Fig3.a and fig3.b:-human resource chart

0

1

2

3

4

5

diploma cirtificate

Education status graph

0

1

2

3

4

5

6

male female

Employee gender graph

Objective of the office

The objective of the office is increasing the income of the country by collecting legal tax from

the kebeles tax payers.

The function of the office

The function of the office is laying tax and collecting tax from the tax payers.

The office laid a tax depending on the annual income of the tax payers. Once laid tax will serve

for three year. Depending on their income tax payers divided in to three groups. Namely Group

A, group B and group C.

Group A:

This group is called Value Added Tax (VAT) registered group. The annual income of this group is

greater than 500,000 birr and they pay tax monthly.

Group B:

This group is called sale tax payers. This group record each and every of their pension (such as

water, electricity and others) and they pay the tax once in three month two percent (2%) from

their net profit. This group has annual income greater than 100,000 birr.

Group C:

This group tax will laid by guess from the observation of the office worker. Their annual income

is less than 100,000 birr and they pay their tax annually.

Also the office will put some punishment rules if the tax payer didnt paid on the time. If the tax

payer didnt paid on time, the amount of the tax will increase by five percent (5%) in the first

month and increase by two percent (2%) each month until he/ she didnt paid. The office collect

tax up to 1000 birr in office and greater than 1000 birr in back account of the office and receive

the receipt from the bank.

Vision

By implementing modern and fair taxation system, to see that the need of the tax payers

fulfilled and the tax payers pays the tax by their own interest.

Mission

By implementing modern taxation system to get educated and experienced man power, by

providing good service, teaching tax payers and enforce the tax law, preventing tax evasion,

making the tax payers to pay different taxes on time and collect the government tax by good

ethics.

Organizational structure

As expressed previously the office has seven employees.

=>Manager (head)

=>Cashier

=>Two accountant and

=>other three regular workers

Head of the office which manage the office, sign and stamp on different receipt and papers of

office

Two accountants work on searching for document and calculate the amount of tax with the tax

payer him/herself.

The cashier collects the tax (money) and gives the receipt.

Manager (head)

Cashier

Other

workers

Two

accountants

Statement of problems

1. Documentation system is manual.

This causes many problems such as:-

One person can have more than one trade license by the relatives name without

erasing (canceling) the first license.

Hard, consume more time and bulky to retrieve documents because they are kept

manually.

Needs much resource (money, manpower).

Documents may be lost.

Retired the office inelegancy.

Occupy large space.

Fig1a.

Fig1b

Fig1a and fig1b:- the way in which they store customer data.

2. Week interconnection between the main offices (Jimma town)

Waste of time to send letter or they have to go to there and here physically to

exchange information.

This made the service not to be fast and intelligence.

Customers had faced problems/waste time while some errors occurred in order to solve it. 3.Lack

of fairness during laying tax

Makes the tax payers not to pay by their own interest.

4. Tax evasion

Some vat registered tax payers are individuals are not use VAT machine properly

5. Lack of awareness

Leads the tax payers for more punishment

Affect the economy of the country

6. Lack of Educated man power, budget and resources (materials such as computer)

Objective

General objective

Implement computerized documentation system

Connecting the office with main office by network to give effective, efficient, fast

and fair taxation system.

Specific objective

Make document organization computerized with the futures like update, delete,

online conversation, sending a massage to customer, calculate amount of tax and

punishment depending on time interval.

Make a system to register new tax payer and notice if the tax payer didnt paid the

tax on time.

Methodology

Interview

=> Interview with the head of office and tax payers (customers)

=>interview with workers of the office

Observation

=>observation of actual working environment of the office

=>observation of the tax payers actual working condition

Analysis of documents

=>analysis of the documents of the tax payers in office

Tools used

Mobile Camera

Map

Papers

Different documents of the office

Scope

Create a system that calculates the amount of tax for group A, B and C, monthly, by

three month and annually respectively.

The system send a text message to the tax payer before five days for the end of the

time interval that the amount of tax she/he should pay (accumulated) for the time.

Systems calculates or increment the amount of tax by five percent (5%) on the first

month and increment by two percent (2%) after a period of one month and also

sends notice (warning) text message to the customer with the amount of tax

/punishment laid/ increased monthly until he/she pays the tax.

After the customer paid the tax the system will update the document of the

customer (tax payer).

Connecting hirmata mentina kebeles tax desk with the main office by

network/internet using video call and online discussion in order to exchange

information rapidly.

All the above stated solutions will help the office to give effective, fair and efficient service to

the customers. This system will solve (decrease) the rate of occurrence of problems such as loss

of files, wasting time of the customer during paying tax.

Problems occurred during data collection

Unwillingness of tax payers to give information

Weather condition

Absence of workers in their office in work time

Conclusion

We have

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Colibri - DEMSU P01 PDFDocumento15 pagineColibri - DEMSU P01 PDFRahul Solanki100% (4)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Mcqs in Wills and SuccessionDocumento14 pagineMcqs in Wills and Successionjudy andrade100% (1)

- The Website Design Partnership FranchiseDocumento5 pagineThe Website Design Partnership FranchiseCheryl MountainclearNessuna valutazione finora

- Tax Accounting Jones CH 4 HW SolutionsDocumento7 pagineTax Accounting Jones CH 4 HW SolutionsLolaLaTraileraNessuna valutazione finora

- Consultancy Services For The Feasibility Study of A Second Runway at SSR International AirportDocumento6 pagineConsultancy Services For The Feasibility Study of A Second Runway at SSR International AirportNitish RamdaworNessuna valutazione finora

- Emco - Unimat 3 - Unimat 4 LathesDocumento23 pagineEmco - Unimat 3 - Unimat 4 LathesEnrique LueraNessuna valutazione finora

- Relay Interface ModulesDocumento2 pagineRelay Interface Modulesmahdi aghamohamadiNessuna valutazione finora

- Eclipsecon MQTT Dashboard SessionDocumento82 pagineEclipsecon MQTT Dashboard Sessionoscar.diciomma8446Nessuna valutazione finora

- How To Unbrick Tp-Link Wifi Router Wr841Nd Using TFTP and WiresharkDocumento13 pagineHow To Unbrick Tp-Link Wifi Router Wr841Nd Using TFTP and WiresharkdanielNessuna valutazione finora

- Minas-A6 Manu e PDFDocumento560 pagineMinas-A6 Manu e PDFJecson OliveiraNessuna valutazione finora

- Fin 3 - Exam1Documento12 pagineFin 3 - Exam1DONNA MAE FUENTESNessuna valutazione finora

- SPIE Oil & Gas Services: Pressure VesselsDocumento56 pagineSPIE Oil & Gas Services: Pressure VesselsSadashiw PatilNessuna valutazione finora

- LISTA Nascar 2014Documento42 pagineLISTA Nascar 2014osmarxsNessuna valutazione finora

- Ril Competitive AdvantageDocumento7 pagineRil Competitive AdvantageMohitNessuna valutazione finora

- Sappi Mccoy 75 Selections From The AIGA ArchivesDocumento105 pagineSappi Mccoy 75 Selections From The AIGA ArchivesSappiETCNessuna valutazione finora

- Double Inlet Airfoil Fans - AtzafDocumento52 pagineDouble Inlet Airfoil Fans - AtzafDaniel AlonsoNessuna valutazione finora

- Strength and Microscale Properties of Bamboo FiberDocumento14 pagineStrength and Microscale Properties of Bamboo FiberDm EerzaNessuna valutazione finora

- CW February 2013Documento60 pagineCW February 2013Clint FosterNessuna valutazione finora

- 16 Easy Steps To Start PCB Circuit DesignDocumento10 pagine16 Easy Steps To Start PCB Circuit DesignjackNessuna valutazione finora

- MPPWD 2014 SOR CH 1 To 5 in ExcelDocumento66 pagineMPPWD 2014 SOR CH 1 To 5 in ExcelElvis GrayNessuna valutazione finora

- For Email Daily Thermetrics TSTC Product BrochureDocumento5 pagineFor Email Daily Thermetrics TSTC Product BrochureIlkuNessuna valutazione finora

- Tecplot 360 2013 Scripting ManualDocumento306 pagineTecplot 360 2013 Scripting ManualThomas KinseyNessuna valutazione finora

- Province of Camarines Sur vs. CADocumento8 pagineProvince of Camarines Sur vs. CACrisDBNessuna valutazione finora

- Sem 4 - Minor 2Documento6 pagineSem 4 - Minor 2Shashank Mani TripathiNessuna valutazione finora

- Revenue Management Session 1: Introduction To Pricing OptimizationDocumento55 pagineRevenue Management Session 1: Introduction To Pricing OptimizationDuc NguyenNessuna valutazione finora

- Opel GT Wiring DiagramDocumento30 pagineOpel GT Wiring DiagramMassimiliano MarchiNessuna valutazione finora

- Chapter 1.4Documento11 pagineChapter 1.4Gie AndalNessuna valutazione finora

- Inspection and Test Plan Piling: 1. Document ReviewDocumento3 pagineInspection and Test Plan Piling: 1. Document ReviewZara BhaiNessuna valutazione finora

- WWW - Manaresults.co - In: Internet of ThingsDocumento3 pagineWWW - Manaresults.co - In: Internet of Thingsbabudurga700Nessuna valutazione finora

- Learner Guide HDB Resale Procedure and Financial Plan - V2Documento0 pagineLearner Guide HDB Resale Procedure and Financial Plan - V2wangks1980Nessuna valutazione finora