Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ch-3 - Make or Buy

Caricato da

radhika.bansalTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Ch-3 - Make or Buy

Caricato da

radhika.bansalCopyright:

Formati disponibili

Outsourcing: Make versus Buy

3

Learning Objectives

How do firms take make-versus-buy decisions?

What is the underlying theoretical logic for make-versus-buy decisions?

What are the costs and benefits of outsourcing?

What should be the nature of the relationship with vendor firms?

How can a firm design its sourcing strategy based on the purchase-portfolio matrix?

How has the internet affected the sourcing decisions of a firm?

Make versus Buy: The Strategic Approach

Make vs Buy represents two extremes along the continuum of possibilities.

Once a firm has decided to buy a certain set of activities/ items, not all items are sourced

using the same approach

What activities should be carried out by the firm and what activities should be outsourced?

Core competence of the firm In house

Core processes of the firm In house

Others - Outsource

How to select the entities/partners to carry out outsourced activities and what should be

the nature of relationship with those entities?

Should the relationship be transactional in nature or should it be a long term partnership?

What Activities Can be Outsourced?

Business Process Route

Identify high-level business process of importance

Customer relationship: acquiring new customers and maintaining/building

good relations with the existing ones. E.g., Nike and Benetton

Product and service innovation: Developing new products/services. E.g., HP

and Pharmaceutical Industry

Supply Chain Management: Fulfilment of Customer Orders. E.g., Dell and

Wal-Mart

Outsource activities which are of commodity type. E.g., Warehousing or Transportation

At least one of the Core processes retained within firm must provide strategic power to the

firm within the chain

A firm must ensure that it has higher bargaining power within the chain.

What Activities Can be Outsourced?...

Product Architecture Route

The focus here is on sub-systems and components and the make/buy decisions are made at

that level.

A sub-system is strategic if it involves:

Technologies that change rapidly

If it requires specialized skills and technologies, and

If it has significant impact on the performance of the important product attributes

Ability to offer differentiated product

Technological leadership

Identification of strategic subsystems, components

Even for outsourced subsystem firm must keep architecture knowledge in-house

E.g., e-retailers are sometimes not able to deliver products on time due to their dependency

on their logistics partners, especially during festive seasons

Virtual Corporations

Virtual corporations outsource all supply chain activities to either one party or a combination

of parties and just focus on brand building

Is virtual corporation a hollow corporation (?)

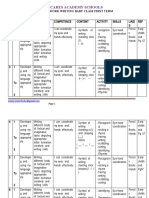

Strategic Outsourcing Process

Make or Buy

Decisions

Market

vs

Hierarchy

Economies

of Scale

Agency

Cost

Transaction

Cost

Incomplete

Contracts

Market versus Hierarchy: The Economic Perspective

1. Economies of Scale

Higher volume allows a firm to spread its fixed cost over larger volume of operations

Higher volume allows a firm to choose more efficient technologies

Pooling of buffer capacities and inventories

Due to steadily rising costs, the firms are more and more availing 3P services for

manufacturing and Logistics

e.g., Outsourcing of IT operations to IBM and Wipro

Indo Nissin Foods Ltd. (Top Ramen) o/s distribution operations to Marico

Outsourcing of warehouses and transportation is also very common

If a firm has larger demand can have internal manufacturing

e.g., Wal-Mart would prefer its own fleet of vehicles for transportation

Market versus Hierarchy: The Economic Perspective

2. Agency Cost

Cost of Control and Coordination of internal supply

Usually termed as Cost Centers, insulated from competitive pressures

3. Transaction Cost

Search and Information cost

Bargaining and contracting cost

Policing and enforcement cost

Cost incurred because of loss of control

Market versus Hierarchy: The Economic Perspective

4. Incomplete Contracts

In practice, it is impossible to write complete contracts

Reasons why contracts are not complete:

Bounded rationality

Difficulties in specifying /measuring performance

Asymmetry of information

Inability to write complete contract increases transaction cost in following situations:

Presence of relationship-specific assets: Results in Hold-up problem for suppliers

Poor coordination affecting supply chain performance: O/s slows down the speed in non-

routine operations, results in increased transaction costs

Leakage of strategic information resulting in adverse supply chain performance. E.g.,

Textile industry

Relationship-specific Assets: Illustrations

Maruti Suzuki has

asked several of

its suppliers to

locate either

finishing

operations or

stock points close

to its Gurgaon

plant.

Bharti would

preferred

Ericsson to build

network capacity

on the basis of its

demand

projections.

Microsoft

expected its

introduction of

Xbox 360 to be a

huge success and

has asked its

contract

manufacturers to

build additional

capacity for the

same.

Marico would like

all its dealers to

work with MIDAS

(Distributor

application

software

developed by

Marico).

Wal-Mart has

made RFID

mandatory for its

top 100 suppliers.

All supply from

2005 onwards is

supposed to be

RFID tagged.

Integrative

Framework

Of Make

Versus Buy

Two extreme positions in Make-versus buy continuum:

Make an input or buy an input using the market

Vertical integration versus market, where, buyer has an

arms length relationship with the suppliers.

The Make-versus-buy Continuum

The Make-versus-buy Continuum

There are several alternate ways in which the exchange can be organized:

Two important alternatives:

1. Tapered integration, where a firm both makes and buys a given input.

Its a mixture of market & vertical integration.

Firms like Pizza corner & Madura garments fall in this category , wherein they own

some retail outlets & depend on franchisee or other models for the rest of their sales.

This helps them to better understand the costing and the pricing

Helps them negotiating better deals with suppliers.

Able to keep up the pressure on internal supply group to innovate.

Pressure on market supplier as well.

Looks as if it allows a firm the best of both worlds, if not managed properly, might end

up getting the worst of both.

2. Collaborative relationship- which could be a formal contractual relation or a

long-term informal relationship, based on trust. In some cases, it can lead to

alliances or joint ventures.

The supplier is an extension of the firm. Can be strategic partners.

Firm doesnt indulge in competitive bidding every year.

Doesnt change its supplier for a small price reduction.

Usually the supplier gets involved early at the product design stage & price

paid is based on actual cost incurred.

Major concern is ensuring supplier works on innovation.

Firms should periodically benchmark the partners costs and technology with

the market so as to ensure the supplier remains competitive.

Concept Of Keiretsu

Japanese companies have subcontractor networks called keiretsu.

This involves vendors, bankers & distributors.

Firms within a keiretsu are linked by informal personal relationships.

They share long term relations, so they avoid most of the problems associated

with market exchange relationship, are willing to invest in higher relationship-

specific assets.

This allows keiretsu to focus on its core competence & all get the necessary

economies of scale.

The portfolio approach developed by Kraljic classifies items based on the

importance of the item in terms of value of purchase ( high versus low) &

associated supply risk in the supply market.

Supply risk captures 2 dimensions:

1. No of suppliers in the market.

2. The demand supply gap in the supply market.

If an item has very few suppliers who have monopolythe buyer faces a

significant supply risk.

In supply markets where there are large no of players & there is surplus capacity in

the market, the items bought will be low supply risk category.

Diesel engine , diesel fuel & proprietary technologies have few suppliers.

Sourcing Strategy: Portfolio Analysis

Sourcing Strategy: Portfolio Analysis

Supply Risk

L

o

w

H

i

g

h

Purchasing Value

Low High

Source: Purchasing and Business Strategy

Purchase Portfolio Analysis

Routine: Significant opportunity, focuses on reducing the no of parts & no of suppliers, reduce

administrative & logistics complexity. Focus on moving to system buying rather than component

buying.

Leverage: High value, standard products. Large no of suppliers & switching cost are low. Focus

should be on operations level integration so that not only purchasing but administrative efforts

can also be reduced.

Strategic: High value products with high supply risks, strategic items, firm should look for

collaborative , long term relationships with suppliers, should create opportunities for mutual cost

reduction.

Bottleneck: Low value, focus on securing supply, & should keep looking at alternative sources of

supply, even look at substitutes.

Routine products are products which are readily available (low purchasing risk) and have a low

impact on the financial result of a company.

Examples of routine products are computers, paper clips, staples, cleaning, etc. The

purchasing of routine products is mainly an administrative process.

The organizational costs of purchasing these goods often exceed the costs of the goods

themselves.

Many purchasing departments pay a lot of their attention to the purchasing of routine

products, as there are so many routine products and a lot of suppliers are involved. The pay off

however is low. Professional purchasing departments try to minimize the effort and time they

spend on the

purchasing of these routine products (Van Weele, 1997). Professional suppliers therefore try to

minimize the effort their customers have to do: they take care of the process for their customers.

Routine

Leverage products are products which are readily available and which have a big impact on the

financial result of the buyer. Buyers pay lots of attention to the purchasing of leverage products,

as the financial risk is high. Because leverage products are readily available, the purchasing

department scans the market.

The competition between the many suppliers will lead to a situation where some suppliers

start discounting their product. A discount for the customer on a leverage product will result into

substantial savings (in absolute terms). For the suppliers this behavior of the customer is

uncomfortable. The traditional behavior of the supplier is to push the product as much as

possible.

As all suppliers of the leverage product will do this, the job of the purchasing department of the

customer is made even easier.

Leverage

Strategic products are products with a high financial risk and a

high purchasing risk for the customer

Strategic :

Bottleneck products are products with a low financial risk and a high purchasing risk: there are

not many suppliers the customer can go to. Customers are vulnerable. Spare parts are typical

bottleneck products.

The power of the relationship lies with the supplier. Customers will try to look for substitutes:

this will lower their purchasing risk. The security of supply is a key issue for the customers.

How should the supplier differentiate his customers?

Bottleneck :

Portfolio Analysis of Indian Firms

Sourcing strategy Based on Purchase Portfolio

Classification

Classify outsourced items/processes using portfolio matrix

Design strategy for each quadrant

Focus on direct as well as indirect goods and services

Sourcing of Indirect material account for significant part of cost of goods sold

Impact of Internet on Sourcing Strategy

Advances in information technology in general, and the internet in particular, costs related

to computer-aided information search and coordination have declined, averaging 25% per

year.

Initial reactions by practitioner/researcher community:

Internet would fundamentally change sourcing practices.

Optimal number of suppliers in the consideration set increases with lower search and evaluation cost

Suppliers in the consideration set would be globally distributed and not limited to the geographical

neighbourhood of firm.

Internet fuelled a lot of electronic public-market exchanges and industry-sponsored exchanges where

information about suppliers can be obtained without much effort.

Current understanding on the part of practitioner/researcher community:

Basic logic underlying the sourcing strategy using the purchase portfolio matrix is not going to change

because of the internet.

Internet is an enabler in implementing the sourcing strategy based on the purchase portfolio matrix.

Reverse Auction

What is Reverse Auction

Unlike a typical auction, the roles of the buyers and sellers are reversed in reverse auction.

Firms use this approach to identify suppliers willing to supply specific items like steel or service

like freight at the lowest bid price. Suppliers bid electronically for a contract over a window of

about 30-60 minutes.

At the bidding stage, all suppliers have access to information about the lowest bid in real time,

and since the amount in an auction is usually large, the supplier is under tremendous pressure

to reduce his bid and usually ends up bidding a lower amount than what he would have bid

during normal circumstances.

Reverse Auction

Best Practices in Reverse Auction

Use reverse auction for items under the low supply-risk market category in the

purchase portfolio matrix, as for these items usually there are a large number of

suppliers and there is surplus capacity in the market; hence, there is enough

incentive for suppliers to reduce their bids during reverse auctions

Specifications must be clearly stated in the RFQ (Request for Quotation) document:

RFQs must be detailed and take care of all the issues including delivery lead times,

treatment of urgent orders, warranty etc.

Firms must have a robust supplier qualification process

Firms must ensure that the purchase lots in a reverse auction are large enough to

motivate suppliers.

Strategic Outsourcing : The Case of

Bharti Airtel

Strategic Outsourcing: Network Design

and Installation

Bharti will pay vendors according to Erlangs of installed capacity

Payment will be made when capacity is up and running and has been used by

customers

After a certain period, unused capacity will be redeployed or payment will be made to the

vendor

Adjustments to price per erlang function of demand density will be made according to a

pre-agreed formula

Bharti will build passive infrastructure

Strategic Outsourcing: Network Management

Vendors will establish NOCs (Network Operating Centers) to monitor activity

SLAs are to guarantee quality for Bhartis customers. Representative metrics:

Blocked calls in peak/non-peak hours

Dropped calls in peak/non-peak hours

Voice quality

Financial rewards and penalties

Strategic Outsourcing: IT Outsourcing

On-demand agreement with IBM for 10 years

IBM will be paid a share of Bhartis revenues

IBM modeled its revenues on a forecast of customers and employees

Adjustment for scale (IBM share will fall with growth)

SLAs (Service Level Agreements) stipulate penalties as a function of the criticality of the

system to Bhartis business

Governing body to cope with IT evolution

Bharti Airtels Experience of

Strategic Outsourcing

Bharti management pleased

Predictable cost model

Developed new managerial capabilities

Former employees satisfied with transfer

Vendors better-off

Equipment vendors pleased with the end of beauty contests.

IBM used Bharti as an example in public forums

Best Practices in Strategic Outsourcing

Ensuring goal congruence

Goal congruence ensures that control costs are low

Building professional contract management group

Developing a greatly enhanced strategic and operations information systems

Developing feedback systems to leverage and share knowledge and innovations in both

directions

Creating a mutual three-level contact system

Top management level : Break bottlenecks and ensure responsiveness

Champions on both side of the relationships

Numerous operating level personnel who develop the personal relationships and knowledge

exchanges

Shift the buyer outlook to managing what ( results) is desired rather than managing

how the result is produced

Summary-I

Traditionally, firms started with the assumption that everything should be done internally

unless there is a compelling logic for outsourcing an activity. Now, a large number of firms want

to be virtual corporations where they start with the assumption that activity must be

outsourced unless there is a compelling logic that justifies keeping activities in-house.

Since outsourcing is a strategic decision which cannot be altered in the short run, firms must

look, not at the immediate costs, but at the long-term supply chain costs and risks in making

this decision.

Firms can identify core activities from a strategic perspective either through the business

process route or by the product architecture route. When a firm decides to outsource some

core process/sub-systems, it must keep the necessary architecture knowledge in-house.

A firm has to look at the benefits as well as the costs involved in their make-versus-buy

decisions. If additional costs due to poor economies of scale plus agency costs of internal

control and coordination exceed transaction costs of market exchange, the firm should opt for

make.

Summary-II

Pure Make and pure Buy are two extreme ends of the make-versus-buy continuum. There are

many ways of managing outsourced activitiestapered integration and collaborative

partnerships, are two among several hybrid ways in which outsourced relationships can be

managed.

Not all items are sourced using same the approach. Purchase portfolio matrix is one popular

approach for classifying items into four categories: routine items, leverage items, strategic

items and bottleneck items. Purchase portfolio classifies items based on the importance of the

item in terms value of purchase and the supply risk associated with the item in the supply

market.

Firms should try and reconfigure their supply base and use new technologies like internet and

e-commerce in implementing sourcing strategies based on the purchase portfolio matrix based.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Discrete Mathematics Sets Relations FunctionsDocumento15 pagineDiscrete Mathematics Sets Relations FunctionsMuhd FarisNessuna valutazione finora

- 6 Biomechanical Basis of Extraction Space Closure - Pocket DentistryDocumento5 pagine6 Biomechanical Basis of Extraction Space Closure - Pocket DentistryParameswaran ManiNessuna valutazione finora

- Double Helix Revisited PDFDocumento3 pagineDouble Helix Revisited PDFPaulo Teng An SumodjoNessuna valutazione finora

- Guide Specification - SDP 200: GeneralDocumento10 pagineGuide Specification - SDP 200: GeneralhbookNessuna valutazione finora

- Name: Period: Date:: Math Lab: Explore Transformations of Trig Functions Explore Vertical DisplacementDocumento7 pagineName: Period: Date:: Math Lab: Explore Transformations of Trig Functions Explore Vertical DisplacementShaaminiNessuna valutazione finora

- TAFJ-AS JBossInstall v5.2 EAP PDFDocumento33 pagineTAFJ-AS JBossInstall v5.2 EAP PDFrameshNessuna valutazione finora

- Planetary DescriptionsDocumento6 paginePlanetary DescriptionsshellymaryaNessuna valutazione finora

- Researchpaper Parabolic Channel DesignDocumento6 pagineResearchpaper Parabolic Channel DesignAnonymous EIjnKecu0JNessuna valutazione finora

- Module 1: Introduction To VLSI Design Lecture 1: Motivation of The CourseDocumento2 pagineModule 1: Introduction To VLSI Design Lecture 1: Motivation of The CourseGunjan JhaNessuna valutazione finora

- Articles of Confederation LessonDocumento2 pagineArticles of Confederation Lessonapi-233755289Nessuna valutazione finora

- Mock Test: Advanced English Material For The Gifted 2020Documento13 pagineMock Test: Advanced English Material For The Gifted 2020Mai Linh ThânNessuna valutazione finora

- An Integrative Review of Relationships Between Discrimination and Asian American HealthDocumento9 pagineAn Integrative Review of Relationships Between Discrimination and Asian American HealthAnonymous 9YumpUNessuna valutazione finora

- Jump in A Teachers BookDocumento129 pagineJump in A Teachers BookShei QuinterosNessuna valutazione finora

- Siddique, Tashfeen Coverletter 20170320Documento1 paginaSiddique, Tashfeen Coverletter 20170320Anonymous liUNtnyNessuna valutazione finora

- Mini Test PBD - SpeakingDocumento4 pagineMini Test PBD - Speakinghe shaNessuna valutazione finora

- BDS PDFDocumento5 pagineBDS PDFRobinsonRuedaCandelariaNessuna valutazione finora

- Norman Perrin-What Is Redaction CriticismDocumento96 pagineNorman Perrin-What Is Redaction Criticismoasis115100% (1)

- Geometric Tracking Control of A Quadrotor UAV On SEDocumento6 pagineGeometric Tracking Control of A Quadrotor UAV On SEnaderjsaNessuna valutazione finora

- Performance in MarxismDocumento226 paginePerformance in Marxismdeanp97Nessuna valutazione finora

- Rebecca Wilman 17325509 Educ4020 Assessment 3Documento6 pagineRebecca Wilman 17325509 Educ4020 Assessment 3api-314401095Nessuna valutazione finora

- Change Sequence's Current Value (CURRVAL) Without Dropping It OraExplorerDocumento6 pagineChange Sequence's Current Value (CURRVAL) Without Dropping It OraExplorerIan HughesNessuna valutazione finora

- Build Web Application With Golang enDocumento327 pagineBuild Web Application With Golang enAditya SinghNessuna valutazione finora

- Talon Star Trek Mod v0.2Documento4 pagineTalon Star Trek Mod v0.2EdmundBlackadderIVNessuna valutazione finora

- Scheme of Work Writing Baby First TermDocumento12 pagineScheme of Work Writing Baby First TermEmmy Senior Lucky100% (1)

- Sequential StatementDocumento12 pagineSequential Statementdineshvhaval100% (1)

- Filed: Patrick FisherDocumento43 pagineFiled: Patrick FisherScribd Government DocsNessuna valutazione finora

- 2 Gentlemen of VeronaDocumento12 pagine2 Gentlemen of VeronaAaravNessuna valutazione finora

- The Entrepreneurial Spirit From Schumpeter To Steve Jobs - by Joseph BelbrunoDocumento6 pagineThe Entrepreneurial Spirit From Schumpeter To Steve Jobs - by Joseph Belbrunoschopniewit100% (1)

- PROII Data Transfer System User GuideDocumento91 paginePROII Data Transfer System User Guidemfruge7Nessuna valutazione finora

- A Typical "Jyotish - Vedic Astrology" SessionDocumento3 pagineA Typical "Jyotish - Vedic Astrology" SessionMariana SantosNessuna valutazione finora