Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Code of Ethics - ICAI

Caricato da

udoshi_1Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Code of Ethics - ICAI

Caricato da

udoshi_1Copyright:

Formati disponibili

Code of Ethics for Members Recent Decisions of the Ethical Standards Board

CA K.Raghu

Vice Chairman-

Ethical Standards Board

Issue

Whether an auditor of a Subsidiary Company can be a Director of its Holding Company

Decision

The auditor of a Subsidiary Company cannot be a Director of its Holding Company, as it

will affect the independence of an auditor

Issue

Whether a practicing member can print ISO mark in his professional letterheads and

other papers.

Decision

A member can get ISO 9001:2000 certification, but he cannot use the expression ISO

certified on his professional documents.

Issue

Whether a practicing member can form an HUF.

Decision

A practicing member cannot form an HUF to carry out business activities.

Issue

What is the meaning of expression Director Simplicitor?

Decision

Director Simplicitor shall be constructed as ordinary / non-executive Director.

Issue

Whether members of ICAI practicing as an Advocate, can use CA Logo on his

professional stationary.

Decision

It is not permissible, as it appears to be unethical.

Issue

Whether a member in industry can print his letterhead for communication with ICAI or

any other person.

Decision

It is permissible, however such member using the designation of Chartered Accountant

cannot use any other designation, whether in addition or in substitution thereof.

Issue

Whether a CA Director of a Company should participate in a Board Meeting when the

item relating to his client(s) is being considered by the Board.

Decision

Based on an ethical point of view, the member should withdraw himself from such a

meeting.

Issue

Whether a member holding Certificate of Practice can own Agricultural Land and

continue agricultural activity.

Decision

Owning Agricultural Land and carrying out Agricultural activities by a member holding

Certificate of Practice is covered under activities Permission Generally Granted under

Appendix (9) of the Chartered Accountants Regulations, 1988, and is, therefore

permitted.

Issue

Whether a Chartered Accountant firm can accept Branch Audit of a Bank when a partner

has taken a loan from any other Branch of the same bank.

Decision

Independence of Auditors can neither be diluted nor any scope be left for dilution in the

perception of stakeholders. The term indebtedness must continue to be a qua an entity

and not qua branch.

Issue

Whether a firm of Chartered Accountant can print special words celebrating 75 years in

profession on the letter heads and envelopes.

Decision

No, as it will lead to the solicitation of professional work and result in violation of clause

(6) & (7) of Part 1 of First Schedule to the CA Act, 1949.

Issue

Whether the CA Logo can be used on professional letter head as header for the

presentation material put before the prospective investors.

Decision

It is not permissible as it amounts to solicitation of professional work.

Issue

Printing of Rotary visiting card and the use of the designation (District Governor)

therein.

Decision

The member who is in practice cannot use the designation of District Governor in his

Rotary visiting card along with the term Chartered Accountant.

Issue

Whether a member can take up the membership of Association of Mutual Funds in India

(AMFI).

Decision

The member may pursue such course and become a member of the Association but he

cannot register with it. This restriction will be applicable to the members who are

holding COP, whether part-time or full- time.

Issue

Whether a Member or firm is allowed to design its own Logo? If not, can the name of

the firm/ 1

st

initial of the name of the firm be written in a different style.

Decision

This kind of stylish Initials is prohibitive as it will deem to be a logo, since the logos have

already been prohibited by the Council.

Issue

Whether a Member can get his firm listed with a telephonic service provider, if the

service provider is not charging anything for the listing.

Decision

Members may avail the Just Dial services within the guidelines laid down by the

Council.

Issue

Whether a member while conducting an Internal Audit of a client can also do accounting

for the same client.

Decision

It is prohibitive to undertake the assignments of Internal Audit of a client and accounting

simultaneously, being violative of the provisions of the Guidance Note on Independence

of Auditors.

Issue

Whether concurrent auditor of a bank can also undertake quarterly review of the same

Bank.

Decision

The Concurrent Audit and the assignment of Quarterly review of the same entity cannot

be taken simultaneously, since Concurrent Audit is in the nature of an internal audit and

the Quarterly review is in the nature of a Statutory Audit. A member cannot undertake

simultaneously since it is prohibited under the provisions of Guidance Note on

Independence of Auditors.

Issue

What role can a Statutory auditor and Internal auditor undertake from amongst:- Tax

Audit, Tax representation, Consulting, Advisory, IFRS conversion, Sox Certification,

designing of system, resource raising, day to day support to sourced business processes.

Decision

Tax Audit and Sox Certification can be done only by the Statutory auditor

Designing of internal control systems and day to day support to outsourced

business processes can be done only by internal auditor.

Tax Representation, Consultancy, Advisory, IFRS Conversion and resource

raising can be done by both.

Issue

Can the Institute ban the Quotations/Bids invited from Chartered Accountants regarding

empanelment for Audit work by Govt. Companies/Organizations/ PSUs/ Corporations.

Decision

Institute cannot interfere as the C A Amendment Act, 2006, has specifically allowed

Chartered Accountants in practice to respond to the tenders vide proviso(ii) to clause 6

of Part I of schedule to the Chartered Accountants Act, 1949.

Issue

Whether Concurrent audit of one of the branches of a nationalized bank can be accepted

by an auditor who has conducted statutory audit of 3 different branches of the same bank.

Decision

In line with the principle of strict independence as adopted in the earlier decisions, it is

not permissible to accept Concurrent audit of one of the branches of a nationalized bank

who has conducted Statutory audit of 3 different branches of the same bank.

Issue

Whether internal auditor of an entity can be appointed as Tax Consultant of the same

entity for a particular year.

Decision

An internal auditor of an entity may be appointed as Tax Consultant of the same entity

for a particular year.

Potrebbero piacerti anche

- Letter of Intent For Purchase of Computer EquipmentDocumento2 pagineLetter of Intent For Purchase of Computer EquipmenttewngomNessuna valutazione finora

- Incident Summary Report: Florida Fish and Wildlife Conservation Commission 8535 Northlake BLVD West Palm Beach, FLDocumento5 pagineIncident Summary Report: Florida Fish and Wildlife Conservation Commission 8535 Northlake BLVD West Palm Beach, FLAlexandra RodriguezNessuna valutazione finora

- No Touch Torture by Cheryl Welsh 2008Documento22 pagineNo Touch Torture by Cheryl Welsh 2008Stan J. Caterbone100% (1)

- University of Pangasinan Faculty Union v. University of PangasinanDocumento2 pagineUniversity of Pangasinan Faculty Union v. University of PangasinanIldefonso HernaezNessuna valutazione finora

- AseanDocumento33 pagineAseanJohn Hendrick M. Dimafelix100% (2)

- DoctrineDocumento5 pagineDoctrineRonan SibbalucaNessuna valutazione finora

- Divinagracia Vs Consolidated Broadcasting System, Inc., GR No. 162272, April 7, 2009Documento27 pagineDivinagracia Vs Consolidated Broadcasting System, Inc., GR No. 162272, April 7, 2009Noreen Joyce J. Pepino100% (2)

- CA Final Standards On Auditing Question and AnswerDocumento47 pagineCA Final Standards On Auditing Question and AnswerAmar Shah100% (8)

- Heidegger: Concept of TimeDocumento30 pagineHeidegger: Concept of Timejrewinghero100% (1)

- 07) Yao Kee Vs Sy-GonzalesDocumento1 pagina07) Yao Kee Vs Sy-GonzalesJenell CruzNessuna valutazione finora

- Audit Icap Chapterwise Past Paper With Solution Prepared by Fahad Irfan PDFDocumento113 pagineAudit Icap Chapterwise Past Paper With Solution Prepared by Fahad Irfan PDFShaheryar Shahid100% (1)

- Calalas V CA DigestDocumento2 pagineCalalas V CA DigestGil Aldrick Fernandez100% (1)

- CHAPTER 18 Professional EthicsDocumento66 pagineCHAPTER 18 Professional EthicsDeepsikha maitiNessuna valutazione finora

- Amazon Corp. GovDocumento5 pagineAmazon Corp. Govdalila.youssraNessuna valutazione finora

- Introduction To AuditingDocumento7 pagineIntroduction To AuditingNishani WimalagunasekaraNessuna valutazione finora

- Week 4Documento5 pagineWeek 4Anonymous rkhiSdNessuna valutazione finora

- Independent Directors Appointment LetterDocumento6 pagineIndependent Directors Appointment LetteranupamNessuna valutazione finora

- Corporate Governance GuidelineDocumento7 pagineCorporate Governance GuidelineAlejandro MNessuna valutazione finora

- Super Summary AuditinigDocumento43 pagineSuper Summary AuditinigCA Rama Krishna E V100% (3)

- Regulation of Audit and Assurance Services Learning ObjectivesDocumento5 pagineRegulation of Audit and Assurance Services Learning ObjectivesdayoNessuna valutazione finora

- Solutions Manual: 1st EditionDocumento21 pagineSolutions Manual: 1st EditionJunior Waqairasari100% (1)

- Department of Accounting Acc 316: Principles & Practice of AuditingDocumento7 pagineDepartment of Accounting Acc 316: Principles & Practice of AuditingFreeman AbuNessuna valutazione finora

- Audit Top 70 Questions by CA VIDHI CHHEDADocumento64 pagineAudit Top 70 Questions by CA VIDHI CHHEDAManoj VenkatNessuna valutazione finora

- Adv Audit 100 Important Questions Notes 1Documento133 pagineAdv Audit 100 Important Questions Notes 1shubhamworkNessuna valutazione finora

- I1.4 Auditing-AnswDocumento16 pagineI1.4 Auditing-Answjbah saimon baptisteNessuna valutazione finora

- Suggested Answers Compiler May 2018 To July 2021Documento113 pagineSuggested Answers Compiler May 2018 To July 2021rabin067khatriNessuna valutazione finora

- Paper - 3: Advanced Auditing and Professional Ethics: (5 Marks)Documento18 paginePaper - 3: Advanced Auditing and Professional Ethics: (5 Marks)Suryanarayan RajanalaNessuna valutazione finora

- AUDIT AND INTERNAL REVIEW SolutionsDocumento13 pagineAUDIT AND INTERNAL REVIEW SolutionsBilliee ButccherNessuna valutazione finora

- Auditors and Audit Committee 2022Documento47 pagineAuditors and Audit Committee 2022Sherry LaiNessuna valutazione finora

- Clause - 49Documento18 pagineClause - 49Manish AroraNessuna valutazione finora

- Chapter FourDocumento24 pagineChapter FourMelat TNessuna valutazione finora

- Rule S Regulations 2Documento11 pagineRule S Regulations 2Taimur ShahidNessuna valutazione finora

- CA Ethics PlusDocumento16 pagineCA Ethics PlusBharati BhutadaNessuna valutazione finora

- Naresh Chandra Committee Report On Corporate Audit andDocumento20 pagineNaresh Chandra Committee Report On Corporate Audit andHOD CommerceNessuna valutazione finora

- Chapter 4 GEDocumento12 pagineChapter 4 GEYenny Torro100% (1)

- Innovative Ideas To Remember The ActDocumento23 pagineInnovative Ideas To Remember The Actsai sandeepNessuna valutazione finora

- Indian Are SH Chandra Execs UmDocumento28 pagineIndian Are SH Chandra Execs UmAshutosh SinghNessuna valutazione finora

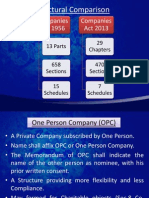

- Structural Comparison: Companies Act 1956 Companies Act 2013Documento52 pagineStructural Comparison: Companies Act 1956 Companies Act 2013Sudhaker PandeyNessuna valutazione finora

- Audit IndependenceDocumento19 pagineAudit IndependenceTanviNessuna valutazione finora

- Audit Bomb 2.0 (New) by Ca Ravi AgarwalDocumento138 pagineAudit Bomb 2.0 (New) by Ca Ravi Agarwalkopip97614Nessuna valutazione finora

- Auditing Chapter 2Documento127 pagineAuditing Chapter 2Kingsuk BiswasNessuna valutazione finora

- R60 Ethics Application IFT NotesDocumento41 pagineR60 Ethics Application IFT NotesMD.HOSSNEE JAMILNessuna valutazione finora

- Auditing Assurance - Assign2Documento3 pagineAuditing Assurance - Assign2Arman JoseNessuna valutazione finora

- Ocean ManufacturingDocumento5 pagineOcean ManufacturingАриунбаясгалан НоминтуулNessuna valutazione finora

- 2010-07!18!215513 Why Do Audit Partners Struggle With Making Tough Accounting Decisions That May Be Contrary To Their ClientDocumento1 pagina2010-07!18!215513 Why Do Audit Partners Struggle With Making Tough Accounting Decisions That May Be Contrary To Their ClientKim NguyenNessuna valutazione finora

- Standards On Auditig Q& ADocumento27 pagineStandards On Auditig Q& Ageetha sai bodapatiNessuna valutazione finora

- For Ca Final: Audit BombDocumento159 pagineFor Ca Final: Audit Bombsri valliNessuna valutazione finora

- Paper 3 - Audit - TP-1Documento7 paginePaper 3 - Audit - TP-1Suprava MishraNessuna valutazione finora

- 5 6197308886647570711 PDFDocumento20 pagine5 6197308886647570711 PDFB GANAPATHYNessuna valutazione finora

- R03 Guidance For Standards I-VII IFT NotesDocumento48 pagineR03 Guidance For Standards I-VII IFT NotesVernon VellozoNessuna valutazione finora

- 1688916348fundamental Ethical and Professional PrinciplesDocumento19 pagine1688916348fundamental Ethical and Professional PrinciplesChamil SureshNessuna valutazione finora

- Tugas Mata Kuliah Etika Bisnis (Daniel Edy Mulyono 1651901)Documento6 pagineTugas Mata Kuliah Etika Bisnis (Daniel Edy Mulyono 1651901)Daniel Edy MulyonoNessuna valutazione finora

- Auditing Lecture Week 2 & 3Documento60 pagineAuditing Lecture Week 2 & 3Kokou GbeganNessuna valutazione finora

- Icap Chargeout RatesDocumento5 pagineIcap Chargeout RatesMuhammad KhanNessuna valutazione finora

- Naresh Chandra Committee ReportDocumento118 pagineNaresh Chandra Committee Reportrahul_singh1288544360% (1)

- Code of Corporate Governance For Public Sector OrganisationDocumento6 pagineCode of Corporate Governance For Public Sector OrganisationDanish SarwarNessuna valutazione finora

- E.G. Financial Services Companies or Companies Listen On A Stock ExchangeDocumento6 pagineE.G. Financial Services Companies or Companies Listen On A Stock ExchangeFatemah MohamedaliNessuna valutazione finora

- CMPCir1656 12Documento95 pagineCMPCir1656 12sunilNessuna valutazione finora

- Audit Bab 4Documento3 pagineAudit Bab 4M Noor KholidNessuna valutazione finora

- Audit EssayDocumento3 pagineAudit EssayJaneth NavalesNessuna valutazione finora

- Tugas AuditDocumento5 pagineTugas Auditsofwan_ariadi5347Nessuna valutazione finora

- Know Your EthicsDocumento2 pagineKnow Your EthicssmNessuna valutazione finora

- Clause 49 Listing AgreementDocumento6 pagineClause 49 Listing AgreementRajesh GangulyNessuna valutazione finora

- FAQ Peer ReviewDocumento9 pagineFAQ Peer ReviewNaresh BudhaairNessuna valutazione finora

- Pre-Engagement ActivitiesDocumento2 paginePre-Engagement ActivitiesJustice DhliwayoNessuna valutazione finora

- AMCHAM India Comments On MCA Paper Feb Mar 2020Documento16 pagineAMCHAM India Comments On MCA Paper Feb Mar 2020RajNessuna valutazione finora

- Auditing Assurance Practical QuestionsDocumento62 pagineAuditing Assurance Practical QuestionsPriyadarshni Seenuvasan100% (1)

- The Certified Executive Board SecretaryDa EverandThe Certified Executive Board SecretaryValutazione: 5 su 5 stelle5/5 (2)

- Reading Explorer Foundations Target Vocabulary DefinitionsDocumento5 pagineReading Explorer Foundations Target Vocabulary DefinitionsKevin ChandraNessuna valutazione finora

- Access To Justice and Right To Fair HearingDocumento49 pagineAccess To Justice and Right To Fair HearingRommel Tottoc100% (1)

- Fraud &sinkin Ships in MiDocumento13 pagineFraud &sinkin Ships in Miogny0Nessuna valutazione finora

- Measurement of Unemployment in IndiaDocumento17 pagineMeasurement of Unemployment in IndiaRitika PradhanNessuna valutazione finora

- PHILO Module 3 Truth and FallaciesDocumento24 paginePHILO Module 3 Truth and FallaciesMin SugaNessuna valutazione finora

- Assignment Due Nov 13Documento3 pagineAssignment Due Nov 13minajadritNessuna valutazione finora

- Spirit of MedinaDocumento47 pagineSpirit of MedinaOsama HasanNessuna valutazione finora

- Devt Bank Vs CoaDocumento11 pagineDevt Bank Vs CoakimmyNessuna valutazione finora

- LIBERI V TAITZ (APPEAL) - Appellants' Request For Judicial Notice - 23892610-Liberi-Et-Al-v-Taitz-Et-Al-Req-for-Judicial-Notice-3rd-CircutDocumento88 pagineLIBERI V TAITZ (APPEAL) - Appellants' Request For Judicial Notice - 23892610-Liberi-Et-Al-v-Taitz-Et-Al-Req-for-Judicial-Notice-3rd-CircutJack RyanNessuna valutazione finora

- Nike 1 Bus EthicsDocumento16 pagineNike 1 Bus Ethicsa1zharNessuna valutazione finora

- Barn Burning EssayDocumento4 pagineBarn Burning EssayDrew100% (1)

- Naga Telephone V CADocumento27 pagineNaga Telephone V CAslashNessuna valutazione finora

- Ang Filipino Sa KurikulumDocumento10 pagineAng Filipino Sa KurikulumAngel Dela cruzNessuna valutazione finora

- Introduction To Wilderness First AidDocumento15 pagineIntroduction To Wilderness First AidAlex BullNessuna valutazione finora

- Reading Comprehension B1 LevelDocumento3 pagineReading Comprehension B1 LevelQuang NguyenNessuna valutazione finora

- Ethics and Earning Management PDFDocumento26 pagineEthics and Earning Management PDFAgitBastianAdhiPutraNessuna valutazione finora

- Law BooksDocumento3 pagineLaw Bookspawan455Nessuna valutazione finora

- Address by Prime Minister Syed Yusuf Raza Gilani at The Sixteeth SAARC SummitDocumento7 pagineAddress by Prime Minister Syed Yusuf Raza Gilani at The Sixteeth SAARC SummitHafiz UmairNessuna valutazione finora

- I, Mario Dimacu-Wps OfficeDocumento3 pagineI, Mario Dimacu-Wps Officeamerhussienmacawadib10Nessuna valutazione finora

- Scope of NursingDocumento2 pagineScope of NursingPraveen Jaya Kumar PNessuna valutazione finora