Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Macroeconomic Study Review Sheet

Caricato da

janellennui0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

101 visualizzazioni8 paginemacro

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentomacro

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

101 visualizzazioni8 pagineMacroeconomic Study Review Sheet

Caricato da

janellennuimacro

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 8

MACROECONOMIC STUDY REVIEW SHEET

1. Bond prices move in the ____________ direction of interest rates.

2. When interest rates fall, price level __________ because _____ shifts ______.

3. When interest rates rise, price level __________ because _____ shifts ______.

4. Open Market Operations that involve _________ bonds raise interest rates.

5. Open Market Operations that involve _________ bonds lower interest rates.

6. When the FED sells bonds, the __________ interest rate rises, the price level ____________, and the

Real Interest Rate ___________.

7. When the FED buys bonds, the __________ interest rate falls, the price level ____________, and the

Real Interest Rate ___________.

8. When the FED __________ the Money Supply, Real Wages will _____ because of inflation.

9. When the FED __________ the Money Supply, Real Wages ______ because of deflation.

10. During a recession, the Federal Budget experiences a ____________.

11. Compared with an increase in Government Spending of $1 Billion, a decrease in Federal Taxes by the

same amount will have a _____________ effect on Aggregate Demand.

12. An increase in Government Spending will __________ the Real Interest Rate in the ________ ______

Market.

13. A lower Real Interest Rate will shift ______ outward, increasing the growth rate of the economy.

14. The two major subaccounts of payments accounts are the ____________________ and the

__________________________.

15. When a U.S. resident buys a foreign good, the U.S. __________ account is a _____________ and the

U.S. _________________ account is a _______________.

16. When a foreign resident buys a U.S. good, the U.S. __________ account is a _____________ and the

U.S. _________________ account is a _______________.

17. An increase in U.S. foreign investment will cause the value of the dollar to _________ in the Foreign

Currency Exchange Market.

18. When ______ shifts either in or out, the SRPC will experience a movement along its curve.

19. When ______ shifts in, the SRPC will shift _____.

20. When ______ shifts out, the SRPC will shift _____.

21. In order to finance the increase in government spending, the government borrows money from the

__________.

22. When U.S. residents demand more money, the ____________ Interest Rate will ____________.

23. If the economy is experiencing less than full employment, the Passive Approach will eventually involve

_____ shifting outward because _________ & _________ within the economy will eventually

_________.

24. If the economy is experiencing an inflationary gap, the Passive Approach will eventually involve the

__________ shifting inward because ___________ & _________ within the economy will eventually

rise.

25. Capital Flight will involve investors (both domestic & foreign) moving their money _______ the

country. This will cause the Real Interest Rate in the Domestic Loanable Funds Market (i.e. the

country experiencing the flight) to __________ because the ________ curve will shift ___________.

Additionally, it will cause the Real Exchange Rate to ______________ in the domestic country.

26. Assume a 20% Reserve Requirement: When the FED buys $100 million in bonds, the maximum

increase in the money supply will be ______________ million. The maximum change in new loans

will be ____________ million.

27. Assume a 20% Reserve Requirement: When Sarah Miller deposits $50,000 from her pocket into her

banking account, the maximum increase in the money supply will be _______________. The

maximum change in demand deposits will be _____________.

28. A ____________ in personal tax rates will shift AD out.

29. Assume a 20% Reserve Ratio: If the FED sells $50 million in government securities on the open

market, the total change in reserves in the banking system will be _________________, while the

maximum possible change in the money supply will be _________________.

30. An increase in AD will cause Price Level to _________ , Real Output to _______, and unemployment

to __________.

31. A decrease in AD will cause Price Level to __________, Real Output to _______, and unemployment

to ___________.

32. An increase in AS will cause Price Level to __________, Real Output to _______, and unemployment

to ____________.

33. A decrease in AS will cause Price Level to ___________, Real Output to _______, and unemployment

to _____________.

34. The GDP Deflator is found by dividing __________________ by the _________________ and then

multiplying by 100.

35. During an inflationary period, a borrower with a fixed loan would be ________ off while the

corresponding lending institution would be _________ off.

36. The Investment component of GDP includes ___________, ______________ and ______________.

37. If Countries A & B are trading partners and Country A is in a recessionary gap, Country Bs AD will

shift _____________, causing its Price Level to _______________, and its Real Output to

__________. Additionally, Country Bs currency will _____________ because _________ will shift

_______.

38. A tax credit for business is meant to increase ______________. In the Loanable Funds Market, the

ripple effect of the tax credit is that ______________ shifts ____ and the Real Interest Rate

__________.

39. Due to an adverse supply shock such as an increase in the world price of oil, the U.S. experiences

_____________. Since the U.S. and Japan are trading partners, this situation causes the value of the

Dollar, in comparison to the Yen, to ________________ as the U.S. Real Interest Rate has ________.

40. If the government increases the incentive to save by enacting a lower tax rate on personal savings,

the effect in the Loanable Funds Market is that ___________ will shift ________, _________ the

Real Interest Rate. Ultimately, this ________ interest rate will lead to _____________ investment.

41. The Crowding Out Effect is when the government competes with domestic firms & residents for the

countrys _____________________. This governmental action ____________ the ________ interest

rate.

42. The ________ Run Phillips Curve is vertical because changes in the _______ _______ & _______

______ do not affect ____________ variables such as unemployment and real output. This theory is

based on the concept of __________ ___________. Therefore, there is no relationship between the

unemployment rate and the inflation rate in the long run.

43. The Nominal Interest Rate will differ from the Real Interest Rate in the economy when __________

is present.

44. The Open Market Operation of buying bonds will cause a movement along the SRPC in the

____________ direction. If the FED sold bonds, then there would be a movement along the SRPC in

the _____________ direction.

45. ______________________ or ___________________ would be Fiscal Policy initiatives that would

cause a movement along the SRPC in the upward direction.

46. If the U.S. increases its national savings, the Nominal Interest Rate will __________, AD will shift

______ causing Price Level to ______________. As a result, the Real Interest Rate will

_________________. This new Real Interest Rate in the U.S. will cause imports to ___________ and

exports to _____________.

47. Assume a 10% Reserve Requirement: If the FED buys $100,000 in bonds, the maximum increase in

the money supply will be ___________. If banks keep an additional 10% in excess reserves at all

times, the maximum increase in the money supply will be _____________.

48. Assume a MPC of 90%: Which Fiscal Policy Initiative will have a greater impact in moving AD

outward, a $10 billion increase in government spending or a $10 billion tax cut in the nation? Why?

49. The Multiplier Effect _______________ the initial increase in government spending while the

Crowding Out Effect works in the opposite direction, reducing the maximum increase in AD due to

the fact that _____ _____ _____ are driven up in the economy.

50. Unanticipated inflation causes a family with a fixed-rate Certificate of Deposit to ________ while a

business repaying a long-term, fixed rate loan will _______.

51. At Full Employment Output, the economys long-run unemployment rate is equal to

__________________________________________________________.

52. Trade between two countries is based on _____________ _________________.

53. A drop in inflationary expectations will cause AS to shift _________________. As a result, Price Level

will __________, Real Output will ____________, and unemployment will __________. This will

impact the SRPC by causing a ___________________________.

54. If the U.S. is experiencing a high rate of unemployment, what Fiscal Policy Initiative could Congress

initiate to decrease the unemployment rate?

55. When AD shifts out, the Nominal Interest Rate in the Money Market ______________ because

__________ shift out.

56. If the Central Bank continues to ___________ bonds over time, the long-run effect on inflation will

be that the Price Level ____________ and the countrys currency ________________.

57. If the government elects to replace the current income tax with a national sales tax, domestic

consumption will _____________, while domestic savings will _________________.

58. An increase in Government Spending leads to the _____________ ______ ____________ whereby

the government competes for the available ________ _________, increasing the _________ for or

decreasing the _________ of loanable funds. This causes the Real Interest Rate to _________.

59. If Congress decides to decrease the taxes on corporate profits, the economys production

possibilities curve will ______________ _____________.

60. An increase in Net Investment will cause AD and LRAS to __________ ________.

61. In a closed economy, a decrease in the money supply will cause the Nominal Interest Rate to _____,

Consumption to ________, Investment to ________ and Government Spending to _______ in the

short run.

62. To shift AD outward, the FED buys bonds. This action causes the Nominal Interest Rate to _______.

Furthermore, the price of bonds within the financial system will ______.

63. The two approaches to measuring GDP are the ____________ approach and the _______________

approach. Both approaches will equal each other because there are 2 sides to every transaction.

64. The study of how individual households and firms make decisions and how they interact with one

another is referred to as ______________________.

65. The study of the economy as a whole is called ________________. The goal is to explain the

economic changes that affect households, firms and markets simultaneously.

66. GDP is the __________ value of the total ________ goods & services produced ___________ in a

given ____________ period. GDP doesnt include _____________ goods or goods that were sold

new in a ___________ year.

67. GDP is actually understated because it fails to include ______________ activities, _____________

activities, ______________ market activity, ___________ activities and the _____________ of the

nations income.

68. _____ __________ GDP is found by dividing GDP by the Total Population.

69. Savings, Taxes and Imports are considered _____________ while Investments, Government

Purchases, Transfer Payments and Exports are considered ______________.

70. ___________ ____________ are not included in GDP because they do not represent a 2-sided

transaction (i.e. there is not an exchange that takes place).

71. In calculating Real GDP, prices are affixed to a _____ year in order to analyze changes in real output.

In calculating Nominal GDP, the equation uses ________ year prices to determine total output.

72. The CPI can be used to find the inflation rate by subtracting base year prices from current year prices

and then dividing the answer by _______ year prices.

73. If a country or firm doubles its inputs, which causes its output to double, they are experiencing

____________ __________ to scale.

74. If a country or firm doubles its inputs, and output increases by more than double, they are

experiencing _________ ________ to scale.

75. If a country or firm doubles its inputs, and output increases by less than double, they are

experiencing _________ ________ to scale.

76. _______ __________ Investment occurs when a foreign company enters a country to builds and

operate a factory, while _______ ____________ investment is when an investment within a country

is financed by foreign money, but operated domestically.

77. The _______ __________ encourages the flow of capital to poor countries as a way of promoting

economic prosperity around the globe.

78. The ________ _________ hypothesis is the theory that asset prices of stocks, bonds, and mutual

funds reflect all publicly available information about the value of an asset. As new information

becomes available, the market reacts accordingly and adjusts asset prices either up or down to

reflect the new information.

79. ___________ must always = ______________ in a closed economy.

80. ___________ = _____________ + __________ in an open economy.

81. The ________ of _________ __________ is responsible for calculating unemployment in the U.S.

82. The Labor Force includes those __________ and those __________, _____ ___________ ________.

83. The unemployment rate is found by diving the _______ ___ _______ by the ___________ _______

and then multiplying the quotient by 100.

84. The _____ ___________ _______ is found by dividing the Labor Force by the Adult Population and

then multiplying x 100.

85. Two problems associated with the unemployment rate are that it ignores the fact that it fails to

include __________ _____________ in the unemployment rate and also counts ________________

(i.e. those who are working part-time when they would like to work full-time) workers as working

and not unemployed.

86. Even at Full Employment, there will always be _________________ unemployment.

87. _________________ unemployment results when the skills in demand do not match those of the

unemployed or that the unemployed do not live where there is a demand for their skills.

88. _______________ unemployment is caused by changes in demand for certain kinds of labor at

different times during the year.

89. _______________ unemployment results due to short-run fluctuations in SRAS & AD.

90. The ___________ __ ___________ ______ pertains to the situation when firms pay above

equilibrium wages in order to attract better applicants that will be more productive.

91. _____ Money is when a countrys currency is backed only by the full faith of the issuing countrys

government.

92. M1 includes __________, __________, and __________.

93. M2 includes M1 and ________, ___________, ______________ and ______________.

94. The FED Board of Governors consists of _______ members who are __________ by the President

and ________ by the Senate. Each governor serves a _______ year term.

95. The Federal Reserve System has ____ regional banks.

96. The ________ _____ __________ ___________is made up of 12 members, 7 of which are the Board

of Governors. The five remaining positions are for regional bank presidents. The New York FED

President is always on the committee because this person is responsible for the daily trading in the

NY Bond Market.

97. The _________ Multiplier is the amount of money the banking system generates with each dollar of

reserves. It is found by dividing 1 by the Reserve Requirement and then multiplying by the amount

of money inserted or removed from the economy.

98. The _________ Multiplier is describes a process by which an initial increase of one

economic aggregate is amplified and provokes an increase in the same or/and other aggregate(s)

larger than the initial raise. It is found by dividing 1 by (1-MPC) and then multiplying by the initial

increase of one economic aggregate (AD for example).

99. With the _______________ Rate, member banks of the Federal Reserve system borrow directly from

the Fed Window (i.e. the FED itself), while with the ____________________ Rate, member banks

borrow from each other on overnight loans.

100. In T Account format, when a deposit is made by a customer, the bank enters the amount as a

______ to Checkable Deposits and ____________ Reserves.

101. The rate at which money changes hands within the economy during the year is referred to as the

__________________ of money.

102. The Classical Dichotomy is represented by _______________ x ____________ =

___________________ x ___________________.

103. Within the Classical Dichotomy, because Velocity is stable and Real Output is not influenced by

changes in the money supply, when the money supply is changed, it directly influences the

________ ________.

104. _______________ _____________ ______________ states that as long as exchange rates are

flexible, the exchange rate between two countries will adjust in the long-run to reflect price level

differences between the two countries. As a result, a given basket goods that is traded

internationally should sell for about the same price around the world.

105. When the Domestic Real Interest Rate increases, NCO _______________.

106. When the Domestic Real Interest Rate decreases, NCO ______________.

107. Budget Deficits ___________ the Real Interest Rate, _______ NCO, _______ _____ Domestic

Investment, cause the Dollar to _______________, and pave the way for a ____________ Deficit.

108. Using the 45 Degree Line and an intersecting Aggregate Expenditure (AE) Line, if the 45 Degree Line

is above AE, then ____________ > _____________. If the 45 Degree Line is below the AE Line, then

_______________ < ______________. Remember, there can only be one point where the two

lines intersect and, at that point, Real GDP and Real Expenditure will equal.

109. A Recession is ____________ or ______ ________ _________ of negative group in Real Output.

110. There are three reasons why the Aggregate Demand Curve is downward sloping. They are

_____________________, __________________ and ________________________.

111. The LRAS is also called ___________ _____________, ____________ __________________

_____________ or _________ _______________ _________.

112. SRAS & LRAS will only shift when one of the __________ __ ___________________ change.

113. The SRAS is upward sloping because of ____________ _____________ and ___________

______________. Both are rigid in the downward direction.

114. Prices are sticky downward because of ______________ ________.

ANSWERS

(PAGE 1: 1-27)

1. Opposite

2. Rise, AD, out

3. Falls, AD, in

4. Selling

5. Buying

6. Nomimal, falls, rises

7. Nominal, rises, falls

8. Increases, fall

9. Decreases, rise

10. Deficit

11. Smaller

12. Raise, Loanable Funds

13. AD

14. Current account, capital account

15. Current account is a deficit, capital account is a surplus

16. Capital account is a deficit, current account is a surplus.

17. Depreciate

18. AD

19. AS, out

20. AS, in

21. Public

22. Nominal, rise

23. AS, wages & prices, fall

24. AS, wages & prices, rise

25. Out of, Rise, supply shift in or demand shift out, depreciate

26. $500, $400

27. $200,000, $250,000

(PAGE 2: 28-46)

28. Decrease

29. $50 million, $250 million

30. Rise, rise, fall

31. Fall, fall, rise

32. Fall, rise, fall

33. Rise, fall, rise

34. Nominal GDP, Real GDP

35. Better, worse

36. New spending on capital goods, new inventories, and new housing construction.

37. In, fall, fall, depreciate, demand, in

38. Investment or AD are acceptable, demand, out, rises

39. stagflation, appreciate, risen due to NCO shifting inward. Note: Well import more from Japan b/c their

products are cheaper than U.S. products. The Current Account is a deficit while the Capital Account is a

surplus.

40. supply, out, lowering, lower, increased

41. Domestic savings, raises, Real

42. Long, money supply, price level, Real, monetary neutrality

43. present

44. upward, downward

45. increase government spending, lowering taxes

46. fall, out, rise, fall, decrease, increase

(PAGE 3: 47-68)

47. $1 million, $500,000

48. The $10 billion dollar increase in government spending immediately is entered into the economy. AD

will shift outward by $10 billion and since the spending multiplier is 10, it could increase out to $100 billion.

Of the $10 billion saved in taxes, only 90% ($9 billion) of that will initially find its way into the economy as

the other $1 billion will be saved. Using the spending multiplier, the maximum that AD could shift out

would be $90 billion ($9 billion x 10).

49. amplifies, real interest rates

50. lose, win

51. the natural rate of unemployment or between 4% & 6% (5% will also do)

52. comparative advantage

53. outward, fall, rise, fall, the SRPC will shift inward

54. either increase govt. spending or decrease taxes

55. increases, demand

56. buy, increases, depreciates

57. decrease, increase. The current income tax taxes both consumption and savings. A new sales tax would

only tax consumption. As a result, consumption would be lower. Furthermore, there would be a greater

incentive to save so the supply curve in the Loanable Funds Market would shift out, lowering the Real

Interest Rate.

58. Crowding Out Effect, domestic savings, demand, supply, rise

59. shift outward

60. shift outward

61. rise, fall, fall, fall (C, I & G all fall because the cost of borrowing increases)

62. fall, rise

63. income, expenditure

64. microeconomics

65. macroeconomics

66. market, goods & services, domestically, time, intermediate, prior

67. leisure, household, black, volunteer, distribution

68. per capita

(PAGE 4: 69-94)

69. leakages, injections

70. transfer payments

71. base, current

72. base

73. constant returns

74. increasing returns

75. decreasing returns

76. Foreign Direct, Foreign Portfolio

77. World Bank

78. Efficient Market

79. savings, investment

80. savings, investment, NCO

81. Bureau of Labor Statistics

82. employed, unemployed but seeking work

83. number of unemployed, labor force

84. Labor Participation Rate

85. discourages workers, underemployed

86. Frictional

87. Structural

88. Seasonal

89. Cyclical

90. Theory of Efficiency Wages

91. Fiat

92. Currency & Coin, Demand Deposits such as checking accounts, Travelers Checks

93. Savings accounts, CDs (Timed Deposits), Money Market Accounts, Money Market Mutual Funds

94. 7, appointed, confirmed, 14

(PAGE 5: 95-114)

95. 12

96. Federal Open Market Committee

97. Money

98. Spending

99. discount, federal funds

100. credit, debits

101. velocity

102. Money Supply x Velocity = Price Level x Real Output

103. Price Level

104. Purchasing Power Parity

105. decreases

106. increases

107. raise, lower, Crowd Out, appreciate, Trade

108. output > spending, output < spending

109. 6 months, 2 consecutive quarters

110. The Wealth Effect (causes C to increase), The Interest Rate Effect (Causes I to increase), The Exchange

Rate Effect (causes NX to increase)

111. Potential Output, Full Employment Output, Natural Rate of Output

112. Factors of Production

113. Sticky Wages, Sticky Prices

114. menu costs

Potrebbero piacerti anche

- Zimbabwe RBZ Dec06 PDFDocumento8 pagineZimbabwe RBZ Dec06 PDFKristi DuranNessuna valutazione finora

- Senior High School: First Semester S.Y. 2020-2021Documento6 pagineSenior High School: First Semester S.Y. 2020-2021sheilame nudaloNessuna valutazione finora

- Group Discussion ExercisesDocumento15 pagineGroup Discussion ExercisesDuyên HồngNessuna valutazione finora

- Bank Loan AgreementDocumento2 pagineBank Loan AgreementthriveinsuranceNessuna valutazione finora

- Bank Management and Financial Services 9th Edition Rose Test BankDocumento9 pagineBank Management and Financial Services 9th Edition Rose Test Banktestbankloo100% (1)

- Monetary PolicyDocumento23 pagineMonetary PolicyPooja JainNessuna valutazione finora

- Did Hayek and Robbins Deepen The Great Depression 2008Documento19 pagineDid Hayek and Robbins Deepen The Great Depression 2008profkaplanNessuna valutazione finora

- Monetary Standard (Philippines)Documento35 pagineMonetary Standard (Philippines)莎侬呂63% (8)

- Chapter 14: Money, Interest Rates, and Exchange RatesDocumento5 pagineChapter 14: Money, Interest Rates, and Exchange RateshamrijaNessuna valutazione finora

- Quiz 570Documento5 pagineQuiz 570Haris NoonNessuna valutazione finora

- Quiz 562Documento5 pagineQuiz 562Haris NoonNessuna valutazione finora

- San Sebastian College of Recoletos Financial Markets MidtermDocumento7 pagineSan Sebastian College of Recoletos Financial Markets MidtermJaira May BustardeNessuna valutazione finora

- Quiz 566Documento6 pagineQuiz 566Haris NoonNessuna valutazione finora

- 26 Money and The Level of IncomeDocumento7 pagine26 Money and The Level of IncomeVikram SharmaNessuna valutazione finora

- ADAS Instructions & Review QuestionsDocumento3 pagineADAS Instructions & Review QuestionsDonald TangNessuna valutazione finora

- CH - 15 - Fiscal - Policy - Notes 2024 LectureDocumento6 pagineCH - 15 - Fiscal - Policy - Notes 2024 Lecturedosan39694Nessuna valutazione finora

- Class 6 - Feb 27Documento8 pagineClass 6 - Feb 27fjxmc9s2yfNessuna valutazione finora

- Microeconomics QuizDocumento8 pagineMicroeconomics QuizAshutosh Pandey100% (1)

- CH 7Documento67 pagineCH 7李ANessuna valutazione finora

- Class 8 - Mar 13Documento11 pagineClass 8 - Mar 13fjxmc9s2yfNessuna valutazione finora

- Exercise 1Documento6 pagineExercise 1Irvinne Heather Chua GoNessuna valutazione finora

- Quiz 2Documento5 pagineQuiz 2Taza Ilham AssidiqhiNessuna valutazione finora

- Applied Economics Quarter 1 Week 1 Activity SheetDocumento1 paginaApplied Economics Quarter 1 Week 1 Activity SheetVergel TorrizoNessuna valutazione finora

- LectureNotes ch06 CpiDocumento7 pagineLectureNotes ch06 CpiKatherine SauerNessuna valutazione finora

- Chapter 14 - Long-Term Liabilities Bonds and NotesDocumento35 pagineChapter 14 - Long-Term Liabilities Bonds and Notesanywhere1906Nessuna valutazione finora

- Econ CH 14Documento12 pagineEcon CH 14BradNessuna valutazione finora

- Business FinanceDocumento3 pagineBusiness FinanceRene Castillo JrNessuna valutazione finora

- 5 Parkin Samantha Chapter 2 - Measuring Your Financial Health and Making A PlanDocumento6 pagine5 Parkin Samantha Chapter 2 - Measuring Your Financial Health and Making A Planapi-245262597100% (1)

- Finance Activity Module1Documento3 pagineFinance Activity Module1JEANNE PAULINE OABELNessuna valutazione finora

- Student Copy Monetary PolicyDocumento6 pagineStudent Copy Monetary Policyywv22gg89jNessuna valutazione finora

- Problem Session-1 02.03.2012Documento12 pagineProblem Session-1 02.03.2012charlie simoNessuna valutazione finora

- Fin 111 Final Quiz 1 Sy 2017 2018Documento1 paginaFin 111 Final Quiz 1 Sy 2017 2018Lanther Jaze AndrewsNessuna valutazione finora

- Eco202: Principles of Macroeconomics Second Midterm Exam SPRING 2014 Prof. Bill EvenDocumento11 pagineEco202: Principles of Macroeconomics Second Midterm Exam SPRING 2014 Prof. Bill Evenbenjamin ehiNessuna valutazione finora

- Take Home TestDocumento18 pagineTake Home TestNastassja LopezNessuna valutazione finora

- MacroExam2SelfTest CH 8 - 11Documento8 pagineMacroExam2SelfTest CH 8 - 11Lola AjaoNessuna valutazione finora

- Intl. Finance Test 1 - CompleteDocumento6 pagineIntl. Finance Test 1 - CompleteyaniNessuna valutazione finora

- Loanable Funds MarketDocumento2 pagineLoanable Funds MarketJulian BeardNessuna valutazione finora

- Chapter 15 The Managent of Capital (Rose)Documento64 pagineChapter 15 The Managent of Capital (Rose)TÂM PHẠM CAO MỸNessuna valutazione finora

- Chapter 2 Workbook-2Documento8 pagineChapter 2 Workbook-2shilohsherNessuna valutazione finora

- Introduction of EconomicsDocumento3 pagineIntroduction of EconomicsCyra SandovalNessuna valutazione finora

- TOPIC 3 (Exercise 1&2)Documento2 pagineTOPIC 3 (Exercise 1&2)Ekin AiniNessuna valutazione finora

- Excercise 1 ECONTWODocumento6 pagineExcercise 1 ECONTWOHolly AlexanderNessuna valutazione finora

- 157957Documento18 pagine157957Hoàng Huy0% (1)

- Chapter10 2Documento15 pagineChapter10 2Elick Erick EricNessuna valutazione finora

- Chapter 22 Testbank - (MFT) Monetary and Financial TheoriesDocumento101 pagineChapter 22 Testbank - (MFT) Monetary and Financial Theoriesdongocquynh005Nessuna valutazione finora

- Chapter 16 Worksheet EconomicsDocumento5 pagineChapter 16 Worksheet EconomicsreignwingNessuna valutazione finora

- The Federal Reserve and Monetary Policy: Principles of Economics in Context (Goodwin, Et Al.)Documento14 pagineThe Federal Reserve and Monetary Policy: Principles of Economics in Context (Goodwin, Et Al.)RONALD ARTILLERONessuna valutazione finora

- Econ 102 Quiz 2 A Spring 2016-17Documento4 pagineEcon 102 Quiz 2 A Spring 2016-17e110807Nessuna valutazione finora

- Money and Monetary Policy: Chapter 11Documento18 pagineMoney and Monetary Policy: Chapter 11Ji YuNessuna valutazione finora

- Accounting. Vocabulary: Income and ExpenditureDocumento2 pagineAccounting. Vocabulary: Income and ExpenditureRolando ValenciaNessuna valutazione finora

- Role of Financial Markets and InstitutionsDocumento15 pagineRole of Financial Markets and Institutionsনাহিদ উকিল জুয়েলNessuna valutazione finora

- Worksheet 6Documento1 paginaWorksheet 6keepexploringwondersNessuna valutazione finora

- Economics Ansswers/solutionsDocumento11 pagineEconomics Ansswers/solutionsPramod kNessuna valutazione finora

- Lecture Notes - Big Mac IndexDocumento2 pagineLecture Notes - Big Mac IndexKatherine SauerNessuna valutazione finora

- Simplecompound Interest Worksheet 18 Aug 2016Documento2 pagineSimplecompound Interest Worksheet 18 Aug 2016rishiNessuna valutazione finora

- Long Test in Gen. Math QuarterBDocumento1 paginaLong Test in Gen. Math QuarterBAi RenNessuna valutazione finora

- Specialized Industry ReviewerDocumento5 pagineSpecialized Industry ReviewerKelly CardejonNessuna valutazione finora

- Quize 2Documento5 pagineQuize 2AtefNessuna valutazione finora

- Assignment 2Documento3 pagineAssignment 2Sajid RulesNessuna valutazione finora

- ASAD Slotted NotesDocumento9 pagineASAD Slotted NotesstevedaveNessuna valutazione finora

- Business Finance Week 3-4Documento12 pagineBusiness Finance Week 3-4MOST SUBSCRIBER WITHOUT A VIDEONessuna valutazione finora

- Midterms Reviewer PDFDocumento25 pagineMidterms Reviewer PDFCamille ResuelloNessuna valutazione finora

- Federal Reserve AssignmentDocumento2 pagineFederal Reserve AssignmentNatalie FinnimoreNessuna valutazione finora

- Guided Notes - Investment Risks and ReturnsDocumento4 pagineGuided Notes - Investment Risks and ReturnsrebaamoshyNessuna valutazione finora

- Should My Asset Allocation Include My Pension and Social Security?Da EverandShould My Asset Allocation Include My Pension and Social Security?Nessuna valutazione finora

- CH 6 Rev QuesDocumento2 pagineCH 6 Rev QuesjanellennuiNessuna valutazione finora

- It All Started When Husband Ventured Into Buying and Selling FingerlingsDocumento2 pagineIt All Started When Husband Ventured Into Buying and Selling FingerlingsjanellennuiNessuna valutazione finora

- Chapter 10 Outline PDFDocumento2 pagineChapter 10 Outline PDFjanellennuiNessuna valutazione finora

- Man Kiw Chapter 09 Solutions QuizzesDocumento2 pagineMan Kiw Chapter 09 Solutions QuizzesjanellennuiNessuna valutazione finora

- Inverse Functions FactsDocumento2 pagineInverse Functions FactsjanellennuiNessuna valutazione finora

- Transformations Sin CosDocumento4 pagineTransformations Sin CosjanellennuiNessuna valutazione finora

- Wa0001.Documento83 pagineWa0001.Tanisha AgarwalNessuna valutazione finora

- Lecture 7Documento23 pagineLecture 7CHUA WEI JINNessuna valutazione finora

- 2017-18 Macroeconomic and Social IndicatorsDocumento3 pagine2017-18 Macroeconomic and Social IndicatorsYohannes MulugetaNessuna valutazione finora

- CHAPTER 7 ECO531 The Theory of Money Demand Edit27dis2020Documento33 pagineCHAPTER 7 ECO531 The Theory of Money Demand Edit27dis2020Nasuha MusaNessuna valutazione finora

- EconomicsDocumento12 pagineEconomicsASMARA HABIBNessuna valutazione finora

- Monetary Policy WorksheetDocumento9 pagineMonetary Policy WorksheetTony KimNessuna valutazione finora

- Lecture Notes - Topic 4 - Money Banking and Financial SectorDocumento8 pagineLecture Notes - Topic 4 - Money Banking and Financial SectorMadavaan KrisnamurthyNessuna valutazione finora

- Examples Questions With Guided AnswersDocumento32 pagineExamples Questions With Guided AnswersnguyenhonghanhNessuna valutazione finora

- Powerpoint Lectures For Principles of Macroeconomics, 9E by Karl E. Case, Ray C. Fair & Sharon M. OsterDocumento33 paginePowerpoint Lectures For Principles of Macroeconomics, 9E by Karl E. Case, Ray C. Fair & Sharon M. OsterMohamed magdyNessuna valutazione finora

- Research in Economics: Arkadiusz Siero NDocumento10 pagineResearch in Economics: Arkadiusz Siero NJózsef PataiNessuna valutazione finora

- Causes of InflationDocumento15 pagineCauses of Inflationkhalia mowattNessuna valutazione finora

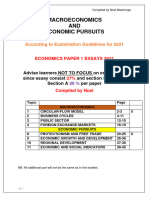

- Macro and Economic Pursuits Essays 2021 OnlyDocumento45 pagineMacro and Economic Pursuits Essays 2021 Onlylsibeko288Nessuna valutazione finora

- Eco 531 - Chapter 3Documento22 pagineEco 531 - Chapter 3Nurul Aina IzzatiNessuna valutazione finora

- Macroeconomics: Chapter 3: Money and LM CurveDocumento39 pagineMacroeconomics: Chapter 3: Money and LM CurveJosephThomasNessuna valutazione finora

- Extra Note-Bank (Eco211)Documento6 pagineExtra Note-Bank (Eco211)Amsyar AmsNessuna valutazione finora

- Econ 1102Documento118 pagineEcon 1102Q VanichaNessuna valutazione finora

- 1 - The Monetary Approach ToDocumento54 pagine1 - The Monetary Approach TohalhoshanNessuna valutazione finora

- Final Exam Correction 2020-2021Documento8 pagineFinal Exam Correction 2020-2021Ahmed KharratNessuna valutazione finora

- Clep Exam Fact Sheet Principles MacroeconomicsDocumento6 pagineClep Exam Fact Sheet Principles MacroeconomicsMohamed IbrahimNessuna valutazione finora

- Fundamental AnalysisDocumento27 pagineFundamental AnalysisMuntazir HussainNessuna valutazione finora

- Classical Theory of Income & Employment (Lecture - 6)Documento18 pagineClassical Theory of Income & Employment (Lecture - 6)Salman HaiderNessuna valutazione finora

- EcoSurvey 20130905024213Documento520 pagineEcoSurvey 20130905024213Pramod Pyara ShresthaNessuna valutazione finora

- DeudaPublica BalanzaPagosDocumento21 pagineDeudaPublica BalanzaPagosMartin VallejosNessuna valutazione finora

- Fundamentals of Multinational Finance 5th Edition Moffett Solutions ManualDocumento26 pagineFundamentals of Multinational Finance 5th Edition Moffett Solutions ManualDaleQuinnwnbx100% (57)

- Unit 14 - Monetary & Fiscal Policy & EconomyDocumento41 pagineUnit 14 - Monetary & Fiscal Policy & EconomySyeda WasqaNessuna valutazione finora