Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

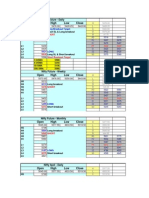

EMA 20 Rule

Caricato da

Anupam MTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

EMA 20 Rule

Caricato da

Anupam MCopyright:

Formati disponibili

Om Sree Ganeshaya namah.

Basic Rule:

Long:

Creation of white candle above 20 ema line which

a) is not touching 20 ema line

b) does not have a black candle starting formation just after it.wait for the starting

line of the ne!t candle being formed)

c) Is not created parallel to a few black"white candles above"on 20 ema line. i.e.

sideways movement). #eed to wait for a white candle forming as a breakout from

this $one.

EXIT: Pivot resistance/PSAR proxiit!/"andle pattern showing reversal/SS

Short:

Creation of black candle below 20 ema line which

d) is not touching 20 ema line

e) does not have a white candle starting formation just after it.wait for the starting

line of the ne!t candle being formed)

f) Is not created parallel to a few black"white candles below "on 20 ema line. i.e.

sideways movement). #eed to wait for a black candle forming as a breakdown

from this $one.

EXIT: Pivot support/PSAR proxiit!/"andle pattern showing reversal/SS#slow

stochastic$/ea % and &' relative position

A (ew conditions:

%) &n the first '0()0 minutes* better not any trade. +round %% am better time to start

off.

,efore that if -&.O/ crossover the mid 0oint) ha00ens then trades can be initiated

after at least first 10 minutes)* considering supportive PSAR and ea %/&' relative

positions and SS/RSI not near the e!tremes)

2) +lways be alert of PSAR crossing

1) Check 0osition of ea % line wrt ea &' line always.

2) /o check trend use )'/*'%' ema 0ositions.

') check out for nearest 0ivot Su00ort or 3esistance stations.

4) ignore small bodyalmost do$i) candles for ema 20 signalling.

Special steps (or special openings and (irst hour+s trade

*$ gap up or down: *,/%' inute rule - &' ea rule - supportive PSAR and SS

#slow stochastic$

&$ In the (irst hour #-. soe tie$ i( ar/et creates iediate top and 0otto

0! one /ore swings: Then high chance that the ar/et will reain range

0ound (or ost o( the tie with a chance o( sudden 0rea/out/0rea/down

0ased on soe awaiting event/(oreign ar/et reaction/ or last 1, inute+s trade2

Strateg!: 3se SS#Slow Stochastic:4'/&' gae plan$ - PSAR (or ultiple

trades within those iediate top and 0otto range2

Reain alert (or sudden range 0rea/out or 0rea/down 0e!ond the

iediate range #a0ove the topost value or 0elow the 0ottoost$2 5atch

A6R #advance decline ratio$2 7n this 0rea/out or 0rea/down: ta/e proper

position2

%$ 7pening near pivot (ulcru2 8ood chance (or 0ig trend2

a$ I( (irst hour#s$ reain/s (lat: wait (or a good 0rea/out or 0rea/down: target

R*/S*

9use ea &' rule2

99:ust chec/ current ni(t! whether its a0ove or 0elow pivot (ulcru2 6epending

on that get 0iased (or the oveent #i2e2 0rea/out or 0rea/down$2

0$ I( in the (irst hour ni(t! oves up and down in a range creating iediate

top and 0otto: then ight 0e it will 0e a chopp! da! with chance o(

sudden 0rea/out or 0rea/down2 3se SS and PSAR as discussed in previous

point nu0er &

EXIT: Pivot support/PSAR proxiit!/"andle pattern showing

reversal/SS#slow stochastic$/ea % and &' relative position

1$ I( opening at R* or S* #gap up or down$2 Then consolidation (or soe tie

expected2 Brea/out/0rea/down can ta/e !ou to R&/S& respectivel!2

Strateg!: *,/%' inute rule - &' ea rule - supportive PSAR and SS #slow

stochastic$2

;ote:

The Pull0ac/ Trade

a$ &f the bias is u0 and 0rice is above 0ivot fulcrum* then wait for the market to 0ass

through 3% and then 0ull back.

+n entry order is 0laced above resistance* which in this case was the most recent high

before the 0ullback.

+ sto0 is then 0laced below the 0ullback the most recent low) and a target set for 32.

0$ &f the bias is down and 0rice is below 5-* the market 0asses through S% and then 0ulls

back.

+n entry order is 0laced below su00ort* which in this case was the most recent low before

the 0ullback.

+ sto0 is then 0laced above the 0ullback the most recent high 0eak) and a target set for

S2.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Oxford Math AA SL Exam Practise Additional ResourcesDocumento172 pagineOxford Math AA SL Exam Practise Additional ResourcesSıla DenizNessuna valutazione finora

- DSE4610 DSE4620 Operators ManualDocumento86 pagineDSE4610 DSE4620 Operators ManualJorge Carrasco100% (6)

- 189-Oop Java BiyaniDocumento28 pagine189-Oop Java BiyaniAnupam MNessuna valutazione finora

- Stored Procs in Java TWPDocumento19 pagineStored Procs in Java TWPAnupam MNessuna valutazione finora

- Books - SparkFun ElectronicsDocumento6 pagineBooks - SparkFun ElectronicsAnupam MNessuna valutazione finora

- or Consider Only The 1 3 Bars. If First Bar Is Too Big For The Range Don't Consider ThatDocumento1 paginaor Consider Only The 1 3 Bars. If First Bar Is Too Big For The Range Don't Consider ThatAnupam MNessuna valutazione finora

- Temboo SpreadsheetDocumento6 pagineTemboo SpreadsheetAnupam MNessuna valutazione finora

- Applet Notes For Ece605Documento28 pagineApplet Notes For Ece605Anupam MNessuna valutazione finora

- Pivot Analysis - Metastock Advisor: SymbolsDocumento3 paginePivot Analysis - Metastock Advisor: SymbolsAnupam MNessuna valutazione finora

- A PinDocumento3 pagineA PinAnupam M67% (3)

- CamarillaDocumento4 pagineCamarillaAnupam MNessuna valutazione finora

- Principles of Public ExpenditureDocumento1 paginaPrinciples of Public ExpenditureNikhil Shenai100% (1)

- Board Resolution On Assigning Signatories in The Voucher ProgramDocumento2 pagineBoard Resolution On Assigning Signatories in The Voucher ProgramavinmanzanoNessuna valutazione finora

- Safe Use of Power Tools Rev0Documento92 pagineSafe Use of Power Tools Rev0mohapatrarajNessuna valutazione finora

- BVP651 Led530-4s 830 Psu DX10 Alu SRG10 PDFDocumento3 pagineBVP651 Led530-4s 830 Psu DX10 Alu SRG10 PDFRiska Putri AmirNessuna valutazione finora

- Canon JX 500 - 200 - Service ManualDocumento154 pagineCanon JX 500 - 200 - Service ManualFritz BukowskyNessuna valutazione finora

- Social and Professional Issues Pf2Documento4 pagineSocial and Professional Issues Pf2DominicOrtegaNessuna valutazione finora

- V3 Tool Installation GuideDocumento13 pagineV3 Tool Installation GuideLeonardo Floresta NascimentoNessuna valutazione finora

- Tle7 Ict TD M2 V3Documento28 pagineTle7 Ict TD M2 V3Rowemar Corpuz100% (1)

- Autonomic Nervous SystemDocumento21 pagineAutonomic Nervous SystemDung Nguyễn Thị MỹNessuna valutazione finora

- Installation ManualDocumento16 pagineInstallation ManualJosé Manuel García MartínNessuna valutazione finora

- Zielinski AnArcheology For AnArchivesDocumento10 pagineZielinski AnArcheology For AnArchivesPEDRO JOSENessuna valutazione finora

- Downloaded From Manuals Search EngineDocumento14 pagineDownloaded From Manuals Search EngineAl AlNessuna valutazione finora

- Tcs IntroDocumento12 pagineTcs IntroRomi.Roy1820 MBANessuna valutazione finora

- Explicit Lesson PlanDocumento10 pagineExplicit Lesson PlanBanjo De Los SantosNessuna valutazione finora

- English Paper 1 Mark Scheme: Cambridge Lower Secondary Sample Test For Use With Curriculum Published in September 2020Documento11 pagineEnglish Paper 1 Mark Scheme: Cambridge Lower Secondary Sample Test For Use With Curriculum Published in September 2020ABEER RATHINessuna valutazione finora

- Amended August 8 2016Documento31 pagineAmended August 8 2016lux186Nessuna valutazione finora

- Assignment ProblemDocumento3 pagineAssignment ProblemPrakash KumarNessuna valutazione finora

- Terraform AWSDocumento1.531 pagineTerraform AWSTilted Mowa100% (1)

- GFN Cired PaperDocumento8 pagineGFN Cired PaperSukant BhattacharyaNessuna valutazione finora

- Euronext Derivatives How The Market Works-V2 PDFDocumento106 pagineEuronext Derivatives How The Market Works-V2 PDFTomNessuna valutazione finora

- Mooring OperationsDocumento5 pagineMooring OperationsHerickson BerriosNessuna valutazione finora

- 007: The Stealth Affair ManualDocumento11 pagine007: The Stealth Affair Manualcodigay769Nessuna valutazione finora

- American J Political Sci - 2023 - Eggers - Placebo Tests For Causal InferenceDocumento16 pagineAmerican J Political Sci - 2023 - Eggers - Placebo Tests For Causal Inferencemarta bernardiNessuna valutazione finora

- Character AnalysisDocumento3 pagineCharacter AnalysisjefncomoraNessuna valutazione finora

- Planting Guide For Rice 1. Planning and BudgetingDocumento4 paginePlanting Guide For Rice 1. Planning and BudgetingBraiden ZachNessuna valutazione finora

- AVR On Load Tap ChangerDocumento39 pagineAVR On Load Tap ChangerInsan Aziz100% (1)

- Fabrication Techniques of A PN Junction DiodeDocumento5 pagineFabrication Techniques of A PN Junction DiodeNida Amber100% (3)

- Pipe Support Reference 8-29-14Documento108 paginePipe Support Reference 8-29-14HITESHNessuna valutazione finora