Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

A Survey of Capital Budgeting Methods Used by The Restaurant Indu

Caricato da

Oladipupo Mayowa Paul0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

16 visualizzazioni10 pagineCAPITAL BUDGETING

Titolo originale

A Survey of Capital Budgeting Methods Used by the Restaurant Indu

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCAPITAL BUDGETING

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

16 visualizzazioni10 pagineA Survey of Capital Budgeting Methods Used by The Restaurant Indu

Caricato da

Oladipupo Mayowa PaulCAPITAL BUDGETING

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 10

Journal of Hospitality Financial Management

Te Professional Refereed Journal of the Association of Hospitality Financial

Management Educators

Volume 8

|

Issue 1 Article 1

1-1-2000

A Survey of Capital Budgeting Methods Used by

the Restaurant Industry

Robert A. Ashley

Stanley M. Atkinson

Stephen M. LeBruto

Follow this and additional works at: htp://scholarworks.umass.edu/jhfm

Tis Refereed Article is brought to you for free and open access by ScholarWorks@UMass Amherst. It has been accepted for inclusion in Journal of

Hospitality Financial Management by an authorized administrator of ScholarWorks@UMass Amherst. For more information, please contact

scholarworks@library.umass.edu.

Recommended Citation

Ashley, Robert A.; Atkinson, Stanley M.; and LeBruto, Stephen M. (2000) "A Survey of Capital Budgeting Methods Used by the

Restaurant Industry," Journal of Hospitality Financial Management: Vol. 8: Iss. 1, Article 1.

Available at: htp://scholarworks.umass.edu/jhfm/vol8/iss1/1

The Journal of Hospitality Financial Management. Volume 8, Number 1,2000

A SURVEY OF CAPITAL BUDGETING METHODS

USED BY THE RESTAURANT INDUSTRY

Robert A. Ashley

Stanley M. Atkinson

and

Stephen M. LeBruto

ABSTRACT

The purpose of this study was to determine what capital budgeting and cost of

capital procedures are being used in the food service segment of the hospitality

industry and to compare the responses, where possible, with those reported in the

previous studies of capital budgeting techniques in the hospitality industry. The

most popular primary capital budgeting techniques selected were the sophisti-

cated or discounted cash flow methods, such as net present value and internal rate

of return. The payback method was selected as a secondary technique.

Introduction

The food service segment of the hospitality industry is rapidly growing. Entry by

:

hospitality industry firms and others into these lines of business is not without risk. It is

j

expected that such expansion will make winners out of the companies that acquire the

best locations and create the most innovative facilities. It is also expected that companies

i

1 lacking the resources to adapt and grow are likely to be hurt by the onslaught of competi-

:

tion (Value Line, 1994). This expansion of the hospitality industry into food service,

which is fixed asset intensive, has required firms specializing in this area to make capital

investment decisions. It is therefore important to determine the capital budgeting prac-

j tices of these firms.

Many studies have been performed on the capital budgeting practices of major U.S.

firms. Gitman and Forrester (1977), Gitman and Mercurio (1982), Brigham (1975), and

Fremgen (1973) are examples of published research on capital budgeting techniques

employed by Fortune 5001 1000 U.S. corporations. However, there have been relatively

fewer studies determining the capital expenditure and capital acquisition policies of

firms in the hospitality industry. Eyster and Geller (1981) compared the development of

capital budgeting techniques employed by firms between 1975 and 1980.Their study

included both lodging and food service companies. Eyster and Geller concluded that

even though the industry used more sophisticated methods in 1980 than it did in 1975,

the capital budgeting techniques used in the hospitality industry were misleading and

naive as compared to other industries. Schmidgall and Damitio (1990) concluded that in

1990, more hospitality industry firms used discounted cash flow measures in their deci-

sion making than they did in 1980. However, Schmidgall and Damitio noted that many

hotel chains still did not use formal risk analysis in their decision-making processes. The

48 The Journal of Hospitality Financial Management

Schmidgall and Damitio study was limited to large lodging chains. Atkinson and

LeBruto (1997) studied the capital budgeting of casino/gaming firms and found IRR

most frequently for their calculations; however, 43% of those responding indicated they

used no technique to adjust for risk other than already incorporated in NPV or IRR.

The purpose of this study was to determine what capital budgeting and cost of capi-

tal procedures are being used in the food service segment of the hospitality industry and

to compare the responses with those reported in the previous studies of capital budget-

ing techniques in the hospitality industry, where such a comparison was possible. The

food service segment is growing rapidly as a result of recent opportunities for growth.

Food service operations normally require large investments in capital expenditures.

Therefore, the expectation is that these firms would use more sophisticated capital budg-

eting procedures than the hospitality industry in general and would closer mirror the

capital budgeting practices of major U.S. firms.

Sample Selection and Data Collection

The firms surveyed for this study were identified as being in the restaurant industry

by the Kwik Index of Leading Companies. A questionnaire was mailed to the Top 100

firms listed on the Kwik Index with a stamped return envelope in order to collect the

individual responses.

A second mailing was sent three weeks later. A total of 28 responses of the question-

naires were returned with 21 being usable. The 1990 study by Schmidgall and Damitio

mailed questionnaires to the 150 largest lodging chains. They received 46 usable

responses for a response rate of 31% (Schmidgall and Damitio, 1990). Eyster and Geller

(1981) mailed questionnaires to 1,071 companies and received 120 responses for a

response rate of 11%. The Atkinson and LeBruto (1997) study received only seven usable

responses out of the 14 possible respondents. Measured by total assets, the firms in this

study are quite large, as shown in Table 1 below. Nineteen of the 21 responding firms

have assets greater than $100 million, while the other two responding firms have assets

less than $100 million.

Table 1

Asset size of responding firms

--

I Asset Size 1 Number 1 Percent 1

, Less Than $100 Million 2 10%

$100 Million to $500 Million 1 12 1 57% 1

$500 Million to $750 Million ~ 2 10% 1

1 Over $750 Million 1 5 1 24% 1

1 Total Responses 1 21 1 100% 1

A Survey of Capital Budgeting Methods Used by the Restaurant lndustry

To determine the extent of the capital budgets in the sample, three questions were

asked of the respondents. First, the respondents were asked about the size of their annual

capital budget. Table 2 summarizes these results. Seven of the responding firms reported

having annual capital budgets in excess of $50 million. Two of the firms reported an

annual capital budget of less than $10 million and 12 companies had an annual capital

budget between $10 and $50 million. These results support the fact that this segment of

the hospitality industry is in a growth mode.

Table 2

Size of annual capital budget

1 Annual Capital Budget 1 Number Percent 1

1 Less Than $10 Million 1 2 1 10%

I

$ 1 0 0 $20 Million

I

5 i

$20 Million to $50 Million 1 7 1 33% 1

I Over $50 Million I 7 1 33% 1

1 Total Responses I 21 I 100% I

The survey instrument asked the respondents to provide the size of a project that

would require a formal analysis. Five firms (24%) indicated that the minimum project

size was less than $100,000 to require formal analysis, while one (5%) established a

threshold of over $1,000,000 before formal analysis would be required. The remaining

fifteen respondents (71%) have established guidelines between $100,000 and $1,000,000.

These findings are summarized in Table 3. Interestingly, 40% of the respondents to the

1990 study by Schmidgall and Damitio reported that expenditures in excess of $100,000

were considered major, and presumably would require formal analysis. The study by

Eyster and Geller (1981) reported significantly lower thresholds of project size to deter-

mine whether an analysis was required, which seems to indicate that minimum project

sizes requiring formal analysis grew larger between the study dates. Atkinson and

LeBruto (1997) found that five firms (71%) had formal analysis on projects of half a mil-

lion or less.

Table 3

Project size required for formal analysis

1 Project Size Required for Formal Analysis 1 Number 1 Percent I

1 Less Than $100,000 I 5 1 24% I

1 $500,000 to $1 Million 1 2 1 9% 1

1 Greater Than $1 Million 1 1 1 5% 1

I Total Responses 1 21 1 100% I

The Journal of Hospitality Financial Management

Table 4 presents the project acceptance rate of those projects that are formally ana-

lyzed. None of the firms reported an acceptance rate of less than 10%. Three of the food

service companies (14%) accepted projects between 10% and 25% of the time, six of the

firms (29%) accepted vroiect between 25% and 50% of the time, and 12 of the firms (57%)

- .

expected due to the growth of the gaming segment of the industry. Of the previous stud-

57% of gaming firms accepted over 50% of their capital budgeting projects.-

Table 4

Percent of projects accepted

1 Percent of Projects Accepted I Number I Percent 1

1 Less Than 10% 1 0 1 0% I

Capital Budgeting Procedures

and the most important stage of the capital budgeting process. The results are shown in

Table 5. As far as the most difficult stage in the capital budgeting process was concerned,

52% (11) indicated that project definition and cash flow estimation was the most difficult

stage. Three respondents (14%) indicated that financial analvsis and project selection was

implementation as the most difficult stage, and three (14%) selected project review.

As far as the most important stage in the capital budgeting process was concerned,

the most important stage. Five respondents (24%) indicated that financial analysis and

1

A Survey of Capital Budgeting Methods Used by the Restaurant Industry

Table 5

The most difficult and the most important stages of the capital budgeting process

The Most Difficult and The Most Most Most Most

Important Stages of the Capital Difficult Difficult Important Important

Budgeting Process Number Percent Number Percent

Mi-

Project Definition & Cash Flow ~st i mat i onl 11 1 52% 1 8 1 38%

Financial Analysis and Project Selection 1 3 1 14% 5 1 24%

Project Implementation 2 10% 3 14%

Project Review 3 14% 2 10%

Both 1 & 2 1 5% 0 0%

Both 2 & 3

I 1 1 5 % I 1 1 5 %

Both 2 & 4 1 0 1 1 1 1 5%

Both 3 & 4 0

0

Total Responses 1 21 I 100% I 21 1 100%

Capital Budgeting Techniques

One of the purposes of this study was to determine which capital budgeting tech-

- -

niques firms in the food service segment of the hospitality industry use. ~ h e s e results

could then be compared with results of previous studies on the capital budgeting tech-

niques employed in the hospitality industry. The choices offered in this survey instru-

ment were identical to the options provided by Eyster and Geller in their 1981 study and

Schmidgall and Damitio in their 1990 study. Respondents were given the opportunity to

choose a primary and a secondary capital budgeting technique. None of the companies

indicated-that no capital budgeting techniques wereemployed. The 1990 study reported

that 15% of the lodging chains did not use capital budgeting techniques (Schmidgall and

Damitio, 1990). Table 6 displays the results of the preferred capital budgeting techniques

for this study.

The Journal of Hospitality Financial Management

Primary and Secondary Eyster & Schmidgall Atkinson & Current

Capital Budgeting Techniques Geller & Damitio LeBruto Study

in Use 1980 1990 1997 1998

Internal Rate of Return 33% 74% 74% 86%

Average Rate of Return 71 % 66% 0% 19%

Net Present Value 36% 55% 62% 76%

Payback Period 0% 32% 64% 48%

Benefit / Cost Ratio

0% 0% 0% 33%

Other 0% 0% 0% 0%

A Survey of Capital Budgeting Methods Used by the Restaurant Indust y 53

option to write in a third, and the opportunity to indicate that no risk adjustment proce-

dures are used. The food service companies were asked to select the primary technique

used by their firm. Table 8 summarizes the responses. Seven of the 15 responses to this

question readjusted cash flows for each project to incorporate risk. Six of the responses

use risk-adjusted cost of capital to incorporate risk. The other two firms use both risk-ad-

justed methods. Schmidgall and Damitio (1990) reported that lodging chains were con-

sistent with other firms in accounting for risk.

Table 8

Risk adjustment procedures

Risk Adjustment Procedure Number Percent

1 Risk-Adjusted Cash Flow 1 7

1 Risk-Adjusted Cost of Capital I 6

I Other I 2 1 13% I

1 No Risk-Adjusted Procedures Used I 0 I 0% I

I Total Responses 1 15

Cost of Capital

The cost of capital for 16 of the firms in the study was reported as being between 10

and 20%. Eleven of the firms (52%) revise their cost of capital annually while six (29%)

reported that their cost of capital is revised when economic conditions warrant.

Knowledge and Use of Theory

The final question was intended to assess the firm's knowledge and use of 11 finan-

cial techniques. The respondents were asked to evaluate their knowledge and use of

these financial techniques. Table 9 summarizes these responses. Restaurant firms

reported average or above average knowledge with risk-adjusted discount rates, sensi-

tivity analysis, zero based budgeting, and capital asset pricing model approaches. The

other seven techniques were below average in knowledge.

Sensitivity analysis and risk-adjusted discount rate are the only techniques that are

moderately used. The firms responding classified the other nine techniques as being

used less than moderately. Since the firms selected for this study are from a finite group

of large companies with extensive capital budgets, the expectation was that the knowl-

edge and use of these financial techniques would be much higher than reported.

The Journal of Hospitality Financial Management

Table 9

Knowledge and use of various financial techniques

/ Financial Technique 1 Knowledge I Use 1

1 Formal Risk Analysis 1 13 1 4 1

1 Risk Adjusted Discount Rate 1 8 I 10 1

1 Certainty Equivalents 1 3 I 0 1

Beta 7 6

Capital Market Line 3 0

1 Security Market Line I 3 1 0 1

1 Sensitivity Analysis I 8 1 14 1

1 Simulation I 6 1 1 I

1 Linear Programming 1 8 1 3 I

I Zero Based Budgeting I 14 I 14 I

I Capital Asset Pricing Model I 11 1 20 I

Summary and Conclusions

The purpose of this study was to provide a comparison of the capital budgeting prac-

tices in the food service segment of the hospitality industry with those of the hospitality

industry from previous studies. In the area of capital budgeting statistics, it was reported

that the majority of restaurant firms had annual capital budgets over $50 million, as

opposed to previous studies where the majority had less than $100,000. This allocation of

resources to capital projects can be interpreted as an indication of the size of the firms in

this survey as compared to the previous research. The size of the planned expenditures

also reflects the growth of the food service segment of the hospitality industry. With capi-

tal budgets of this magnitude it is expected that the most sophisticated capital budgeting

practices would be employed.

As far as using capital budgeting techniques, the firms surveyed indicated that they

used the sophisticated discounted cash flow techniques, with internal rate of return

being the one most frequently used.

When questioned about knowledge and use of theory this study showed that firms

are aware of the various techniques available in capital budgeting. However, this study

did not show that this segment of the hospitality industry is using the techniques avail-

able to them any more than they did in 1990.

References

Atkinson, S. M., & Labruto, S. M. (1997). A survey of capital budgeting used by the

hotellgaming indusrty. The Journal of Hospitality Financial Management, 5 (I), 23-31.

Potrebbero piacerti anche

- Filling Station GuidelinesDocumento8 pagineFilling Station GuidelinesOladipupo Mayowa PaulNessuna valutazione finora

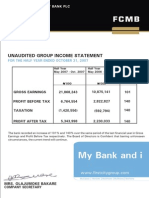

- 2007 Q2resultsDocumento1 pagina2007 Q2resultsOladipupo Mayowa PaulNessuna valutazione finora

- 9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Documento3 pagine9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Oladipupo Mayowa PaulNessuna valutazione finora

- 9M 2013 Unaudited ResultsDocumento2 pagine9M 2013 Unaudited ResultsOladipupo Mayowa PaulNessuna valutazione finora

- Amcon Bonds FaqDocumento4 pagineAmcon Bonds FaqOladipupo Mayowa PaulNessuna valutazione finora

- Dec09 Inv Presentation GAAPDocumento23 pagineDec09 Inv Presentation GAAPOladipupo Mayowa PaulNessuna valutazione finora

- 2007 Q1resultsDocumento1 pagina2007 Q1resultsOladipupo Mayowa PaulNessuna valutazione finora

- First City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsDocumento31 pagineFirst City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsOladipupo Mayowa PaulNessuna valutazione finora

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDocumento32 pagineFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulNessuna valutazione finora

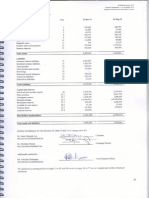

- Unaudited Half Year Result As at June 30 2011Documento5 pagineUnaudited Half Year Result As at June 30 2011Oladipupo Mayowa PaulNessuna valutazione finora

- Margin Requirement Examples For Sample Options-Based PositionsDocumento2 pagineMargin Requirement Examples For Sample Options-Based PositionsOladipupo Mayowa PaulNessuna valutazione finora

- Fs 2011 GtbankDocumento17 pagineFs 2011 GtbankOladipupo Mayowa PaulNessuna valutazione finora

- June 2011 Results PresentationDocumento17 pagineJune 2011 Results PresentationOladipupo Mayowa PaulNessuna valutazione finora

- Full Year 2011 Results Presentation 2Documento16 pagineFull Year 2011 Results Presentation 2Oladipupo Mayowa PaulNessuna valutazione finora

- 2012 Year End Results Press ReleaseDocumento3 pagine2012 Year End Results Press ReleaseOladipupo Mayowa PaulNessuna valutazione finora

- June 2012 Investor PresentationDocumento17 pagineJune 2012 Investor PresentationOladipupo Mayowa PaulNessuna valutazione finora

- 2011 Half Year Result StatementDocumento3 pagine2011 Half Year Result StatementOladipupo Mayowa PaulNessuna valutazione finora

- 2013 Year End Results Press Release - Final WebDocumento3 pagine2013 Year End Results Press Release - Final WebOladipupo Mayowa PaulNessuna valutazione finora

- Val Project 6Documento17 pagineVal Project 6Oladipupo Mayowa PaulNessuna valutazione finora

- Ratio Back SpreadsDocumento20 pagineRatio Back SpreadsOladipupo Mayowa PaulNessuna valutazione finora

- Marriott ValuationDocumento16 pagineMarriott ValuationOladipupo Mayowa PaulNessuna valutazione finora

- International Hotel Appraisers4Documento5 pagineInternational Hotel Appraisers4Oladipupo Mayowa PaulNessuna valutazione finora

- Banking Finance Sectorial OverviewDocumento15 pagineBanking Finance Sectorial OverviewOladipupo Mayowa PaulNessuna valutazione finora

- Hotels and Motels - Industry Data and AnalysisDocumento8 pagineHotels and Motels - Industry Data and AnalysisOladipupo Mayowa PaulNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- FINN 100-Principles of Finance-Mohammad Basharullah-Arslan Shahid Butt-Humza GhaffarDocumento7 pagineFINN 100-Principles of Finance-Mohammad Basharullah-Arslan Shahid Butt-Humza GhaffarHaris AliNessuna valutazione finora

- Property Transactions OutlineDocumento63 pagineProperty Transactions OutlineslcsandraNessuna valutazione finora

- Report On DisclosureDocumento15 pagineReport On Disclosuredeath_heavenNessuna valutazione finora

- Agrarian Law (Landbank vs. Alsua)Documento4 pagineAgrarian Law (Landbank vs. Alsua)Maestro LazaroNessuna valutazione finora

- SAS New Syllabus From 2024 Exam FinalDocumento23 pagineSAS New Syllabus From 2024 Exam FinalManjit ThakueNessuna valutazione finora

- BondssDocumento7 pagineBondssDyenNessuna valutazione finora

- Project Based On MergerDocumento24 pagineProject Based On MergerPrince RattanNessuna valutazione finora

- The Law On Taxability of Gifts Under The IncomeDocumento26 pagineThe Law On Taxability of Gifts Under The IncomeVipul ShahNessuna valutazione finora

- UFS - Circular Dated 30 Jan 2015 P4 PDFDocumento267 pagineUFS - Circular Dated 30 Jan 2015 P4 PDFsyahrir83Nessuna valutazione finora

- Cfasmc 3040Documento13 pagineCfasmc 3040Ahmadnur JulNessuna valutazione finora

- Lundolm & Sloan. Equity Valuation and Analysis With Eval. 3rd Edition CHP 01Documento5 pagineLundolm & Sloan. Equity Valuation and Analysis With Eval. 3rd Edition CHP 01Peter Pa N0% (1)

- Material Ledgers - Actual CostingDocumento17 pagineMaterial Ledgers - Actual CostingAbp PbaNessuna valutazione finora

- Analyst/Associate Investment Banking Interview Questions: Checklist For InterviewerDocumento6 pagineAnalyst/Associate Investment Banking Interview Questions: Checklist For Interviewermanish mishraNessuna valutazione finora

- Calvares VineyardsDocumento16 pagineCalvares Vineyardsigulati23100% (6)

- Intrinsic Value of Aurobindo PharmaDocumento6 pagineIntrinsic Value of Aurobindo PharmaTirth ThakkarNessuna valutazione finora

- Value Investing With Legends (Santos, Greenwald, Eveillard) SP2015Documento6 pagineValue Investing With Legends (Santos, Greenwald, Eveillard) SP2015ascentcommerce100% (1)

- Advanced Accounting Part 1 Dayag 2015 Chapter 11Documento31 pagineAdvanced Accounting Part 1 Dayag 2015 Chapter 11Girlie Regilme Balingbing50% (2)

- Course Outline M. Com Part 1 BZU, MultanDocumento5 pagineCourse Outline M. Com Part 1 BZU, MultanabidnaeemkhokherNessuna valutazione finora

- Corporate Valuation & Financial Modelling - 2020: A Co. B CoDocumento3 pagineCorporate Valuation & Financial Modelling - 2020: A Co. B CoRakshith PsNessuna valutazione finora

- Act 201 Course OutlineDocumento4 pagineAct 201 Course Outlineapi-538665209Nessuna valutazione finora

- Stock Market - A Complete Guide BookDocumento43 pagineStock Market - A Complete Guide BookParag Saxena100% (1)

- Price Action SetupsDocumento1 paginaPrice Action Setupsgato444100% (1)

- MSR Valuation and Market Update May12 TMC WebinarDocumento45 pagineMSR Valuation and Market Update May12 TMC WebinarsinhaaNessuna valutazione finora

- Week III NVCA Valuation GuidelinesDocumento5 pagineWeek III NVCA Valuation GuidelinesIgor MinyukhinNessuna valutazione finora

- Multiple Choice Questions: Top of FormDocumento96 pagineMultiple Choice Questions: Top of Formchanfa3851Nessuna valutazione finora

- Partnership 3Documento38 paginePartnership 3kakaoNessuna valutazione finora

- 2014 Global Salary SurveyDocumento499 pagine2014 Global Salary SurveyMiguel Comino LópezNessuna valutazione finora

- Ichimoku Trading System PDFDocumento15 pagineIchimoku Trading System PDFMrugenNessuna valutazione finora

- ROI, EVA and MVA IntroductionDocumento4 pagineROI, EVA and MVA IntroductionkeyurNessuna valutazione finora