Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

The Nigerian Hotel Industry December 2013

Caricato da

Oladipupo Mayowa PaulTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

The Nigerian Hotel Industry December 2013

Caricato da

Oladipupo Mayowa PaulCopyright:

Formati disponibili

The Nigerian Hotel Industry

December 2013

1

THE NIGERIAN HOTEL INDUSTRY

Historical Background

The origins of the modern Nigerian hotel industry date back to 1942 with the opening of

the Lagos Airport Hotel, then a small pub with rooms operation but today one of the

largest hotels in the city. The 1950s saw the opening of hotels such as the Bristol Hotel

(1956) and the Federal Palace (where Nigerias Declaration of Independence was signed)

amongst others. More hotels opened across the nation in the 1960s and 1970s, including

the Hotel Presidential in Port Harcourt in 1963, the Eko Holiday Inn (1976), the adjacent

Eko Hotel in 1977, the Festac 77 Hotel in 1977 and the three Gateway Hotels in

Abeokuta, Ijebu-Ode and Ota in 1979. Most were developed by the government, in the

absence of capacity in the private sector of this new nation.

The oil boom of the 1980s brought high demand for hotel rooms, and three significant

hotels opened in this period, the Sheraton Ikeja in1985, the Hilton Abuja in 1987 and the

Sheraton Abuja in 1988. No other branded hotels opened for over a decade, when the

Accor group opened its first hotel in Lagos, the 44-room Sofitel Moorhouse, in 1999.

After the oil-related boom, demand dropped considerably in the mid-1990s, as Nigerias

military government was isolated from the international community. The countrys

return to democratic rule in 1999 saw a resurgence in demand, as improved economic and

political stability resulted in an improved business environment, and encouraged foreign

and local investment in infrastructure, oil & gas and telecommunications, amongst other

sectors. Beginning in 2001 there was an influx of regional and international chains,

commencing with Protea, who now have 12 hotels open and under development in

Nigeria.

The Nigerian hotel industry was not significantly affected by the 2008/2009 global

economic crisis. Regional and internationally branded hotels continued to open,

primarily in Lagos but also in Abuja and Port Harcourt, three of the largest cities the

commercial, political and oil capitals, respectively. However, regardless of the growth in

the travel and tourism industry, and the great potential it has for contributing to Nigerias

economy, specifically job creation, the nation is yet fully to embrace the industry as a

major economic player and a source of national income. Presently, the travel & tourism

accounts for just 3 per cent of GDP, while the hotel & restaurant sub-sector contributes a

mere 0.55 per cent.

The Economy and Geo-Political Structure of Nigeria

The Federal Republic of Nigeria is a coastal state situated in West Africa on the shores of

the Gulf of Guinea. It is Africas most populous nation, with an estimated population of

170 million, according to recent estimates, up from 140 million at the time of the 2006

National Census. Nigeria comprises 36 States, plus the Federal Capital Territory, where

Abuja is located.

The Nigerian Hotel Industry

December 2013

2

Each State has a capital city, an elected Governor, and a system of local ministries,

headed by Commissioners. Within the States there are 774 Local Government Areas

which, along with the State governments, are the primary regulators of the hotel industry.

As well as the State capitals, some States have other major cities that are economically or

historically significant.

Federal Republic of Nigeria

States, Capitals & Other Major Cities

State Capital City (Other Major Cities)

Abia Umuahia (Aba)

Adamawa Yola

Akwa Ibom Uyo (Eket)

Anambra Awka (Onitsha)

Bauchi Bauchi

Bayelsa Yenagoa

Benue Makurdi

Borno Maiduguri

Cross River Calabar

Delta Asaba (Warri)

Ebonyi Abakaliki

Edo Benin City

Ekiti Ado-Ekiti

Enugu Enugu

Federal Capital Territory Abuja

Gombe Gombe

Imo Owerri

J igawa Dutse

Kaduna Kaduna (Zaria)

Kano Kano

Katsina Katsina

Kebbi Birnin Kebbi

Kogi Lokoja

Kwara Ilorin

Lagos Ikeja (Victoria Island)

Nasarawa Lafia

Niger Minna (Suleja)

Ogun Abeokuta (Ijebu-Ode)

Ondo Akure (Ondo)

Osun Oshogbo (Ife)

Oyo Ibadan (Ogbomosho)

Plateau J os

Rivers Port Harcourt

Sokoto Sokoto

Taraba J alingo

Yobe Damaturu

Zamfara Gusau

The Nigerian Hotel Industry

December 2013

3

Of the 36 States, Lagos is the smallest in terms of geographical area, but has the highest

share of the nations economy, and is effectively a city state, Ikeja, Victoria Island,

Lagos Island and Ikoyi having merged into one metropolitan area.

The nations economy, in terms of government revenue and foreign exchange earnings, is

dominated by the oil and gas sector, which is centred on the oil-producing States in the

south of the country. Exports from the energy sector account for more than 95 per cent of

export earnings and some 80 per cent of the Federal Governments revenue.

The oil and gas sector represents approximately 30 per cent of the countrys GDP. It has

been projected that within the next two years, Nigeria will become Africas largest

economy after the anticipated rebasing of its Gross Domestic Product (GDP)

measurement, better to reflect the structure of the economy. According to the IMFs

World Economic Outlook, the Nigerian economy is expected to grow by 7.2 per cent in

2013, benefiting from favourable government policies and ongoing reforms in the power

sector. Due to operational problems, the oil and gas sector is growing slower than

average, with the greater part of economic growth generated by the non-oil sectors,

particularly banking, telecommunications and the retail trade. With foreign direct

investment (FDI) of US$11.23 billion in 2012, the country is the top FDI destination in

sub-Saharan Africa.

Nigerias ambition of being one of the top 20 economies is encapsulated in the Vision

20:2020 programme. The key objectives are to stimulate Nigerias economic growth and

launch the country onto a path of sustained and rapid socio-economic development, and

to place Nigeria in the bracket of the top 20 largest economies of the world by 2020, with

GDP of not less than US$900 billion (currently cUS$262 billion) and per capita income

of US$4,000 (currently cUS$1,700).

The Nigerian Hotel Industry

Whilst there has been rapid growth in the Nigerian hotel industry in the last decade, it is

still in its infancy. Virtually all of the growth, specifically in branded hotel products, has

been in Lagos, and the second wave is likely to be more focused on other cities. Best

Western and Protea already have hotels outside of the Big Three cities, and Park Inn by

Radisson, Four Points by Sheraton and Hilton Garden Inn are due to open in Abeokuta,

Owerri, Benin City, Ibadan and Uyo over the next few years.

The countrys return to democracy in 1999 brought stability and new FDI, as well as

local capital investment, thereby generating greater demand for hotel services. In the

2000s, demand increased faster than supply, and the main players in the industry enjoyed

very high occupancies (with a peak of over 80 per cent in 2008) and average daily rates

(ADR), with STR Global ranking Lagos second only to Paris in terms of ADR.

The Nigerian Hotel Industry

December 2013

4

Alongside the development of new branded hotels, such as the Southern Sun and

Radisson Blu in Lagos, and the Hawthorn Suites in Abuja, a plethora of substandard

hotels and guest houses also entered the market, a symptom of an immature but growing

market, with an evident lack of professional know-how in both the development and

operation of these properties. With a few exceptions, the unbranded hotels offer lower

product quality and service standards than the branded hotels, which have noticeably

raised the bar.

Rack rates at the countrys hotels are high, with the lowest published rates in the leading

hotels quoted at US$555 (Sheraton) in Lagos, US$419 (Transcorp Hilton) in Abuja and

US$381 (Le Meridien) in Port Harcourt.

Demand for hotel accommodation in Nigeria is generated mostly by the corporate sector,

with conference and meetings demand a close second. Whist there is some (mainly

seasonal) domestic leisure tourism, there is very little international tourism, the exception

being the Nigerian Diaspora returning to the country during school holidays and other

periods.

The main market sectors for hotel accommodation are:

Corporate travel: whilst in Lagos, Abuja and Port Harcourt there is a significant

amount of demand generated by international travellers (and all three cities have

European and other international flights), the majority countrywide is domestic

business travellers. In Abuja, the main reason to travel is to do business with

government.

Meetings & Conferences: The meetings and conference market in Nigeria is

predominantly domestic, with some international delegates attending events in

Abuja and Lagos. Demand is generated by the professional associations (of

which there are many, organized and generating demand on a national and

regional level), government, companies (especially those in the financial, oil &

gas and education sectors), NGOs and the social sector, with events ranging from

music concerts, fashion shows, award ceremonies and weddings.

Domestic leisure tourism: during holidays and the festive season, demand is

generated by Nigerians in the Diaspora, as well as those resident in Nigeria

travelling to their home town. There is an increasing trend for this market to use

hotel accommodation, rather than staying with friends and relatives. There are

only a very few destination resorts in Nigeria, with an estimated total of fewer

than 1,000 rooms between them.

Cultural festivals: Nigeria has several well-known festivals such as the Eyo

festival in Lagos, the Osun-Oshogbo festival in Oshogbo, the Igue festival in

Benin, the Argungu Fishing festival in Kebbi State, the Katsina Durbar, Riv-fest

in Rivers State and the Calabar Festival, amongst others. A small number of

international visitors attend these events.

The Nigerian Hotel Industry

December 2013

5

Religious tourism: The Nigerian Tourism Development Corporation (NTDC) has

highlighted the growing number of people who travel to and within Nigeria to

attend the annual conventions of the mega-churches. A survey carried out by the

NTDC revealed that the large evangelical churches such as Redeemed Christian

Church of God and Mountain of Fire Ministries attract more than 15 million

people to their prayer grounds during their December congresses.

The Lagos Hotel Market

Introduction

Lagos is Nigerias most commercially important city, with much of the nation's personal

wealth and economic activities located there, as well as the nations main companies and

two of the largest seaports in Africa. Lagos also hosts the country's largest banks and

financial institutions, including the Nigerian Stock Exchange. Murtala Mohammed

International Airport (MMIA), Nigerias largest international and domestic airport, is also

located in Lagos.

Lagos is typically the first point of entry for visitors to Nigeria and therefore the

substantial market created has attracted significant investment in the hotel sector.

Passenger numbers at MMIA have increased significantly in the last decade:

Murtala Mohammed International Airport - Lagos

Domestic & International Passenger Movements

-

1,000,000

2,000,000

3,000,000

4,000,000

5,000,000

6,000,000

7,000,000

8,000,000

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

2

*

2

0

1

3

*

* January - June

Source: FAAN

The growth in both domestic and international air passenger traffic at MMIA is evidence

of the economic growth that the city is experiencing.

The Nigerian Hotel Industry

December 2013

6

Lagos is, increasingly, a major West African hub, which brings increased demand for

hotel accommodation and other services as traffic volumes grow. The decrease in

passenger numbers in 2013 (J anuary to J une) is primarily due to a reduction in the

number of domestic carriers, and frequent schedule interruptions it was therefore a

supply-led reduction, and not a reduction in demand.

Current Supply

The number of hotel rooms in Lagos has more than tripled in the last ten years:

Hotel Room Supply, Lagos

-

2,000

4,000

6,000

8,000

10,000

12,000

Total Rooms 2,994 3,630 3,867 4,330 4,968 5,500 5,791 7,302 8,005 8,263 9,567

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Source: W Hospitality Group research

The total of almost 9,600 rooms represents the mainstream hotel industry in the city,

which we define as those with a published tariff of US$100 and above. There are many

small, independent hotels and guest houses (many operating with very poor standards)

that are not included. The total also does not include those lodging establishments which

are occupied solely by one company (mostly those in the oil & gas and the

telecommunications sectors).

2010 and 2011saw the opening of several new hotels, notably internationally-branded

hotels such as the Radisson Blu, Four Points by Sheraton and Best Western. There was

no major branded or unbranded hotel added to the supply in 2012 - the increase of 450

rooms from the previous year is in small-scale properties that have opened, mainly in

Lekki and Ikeja.

J uly 2013 saw the partial opening (with c210 rooms available) of the 358-room

InterContinental hotel in Victoria Island, the largest hotel to open in Lagos since the

Sheraton in 1985, and the 165-room Ibis in central Ikeja.

The Nigerian Hotel Industry

December 2013

7

There are approximately 20 major hotels in Lagos, being those with an international or

regional (African) brand as well as large unbranded hotels such as the Eko Hotel and

Suites.

Lagos Hotel Market

Branded and Major Unbranded Hotels 2013

Hotels District Rooms Positioning

Protea Oakwood Lekki 65 Midscale

Best Western VI Victoria Island 89 Midscale

Eko Hotel & Suites Victoria Island 654 Mid to Upscale

Federal Palace (Sun Intl.) Victoria Island 150 Deluxe

InterContinental Victoria Island 358 Deluxe

Radisson Blu Victoria Island 170 Upscale

Protea VI Victoria Island 58 Midscale

Four Points by Sheraton Victoria Island Annex 234 Upscale

Protea Kuramo Victoria Island Annex 60 Midscale

Oriental Victoria Island Annex 64 Upscale

Legacy Wheatbaker Ikoyi 65 Deluxe

Moorhouse M Gallery Ikoyi 90 Upscale

Southern Sun Ikoyi 195 Upscale

Protea Westwood Ikoyi 56 Midscale

Amber (African Sun) Ikeja GRA 39 Midscale

Best Western Plus Ikeja Ikeja GRA 112 Midscale

Best Western Starfire Ikeja GRA 38 Midscale

Ibis Lagos Airport Ikeja MMIA 200 Economy

Ibis Ikeja Ikeja 165 Economy

Protea Ikeja Ikeja GRA 92 Upper Midscale

Protea Leadway Ikeja 49 Midscale

Sheraton Ikeja 332 Upscale

Swiss International Westown Ikeja 85 Midscale

Golden Tulip Festac 476 Upscale

Total 3,896

Source: W Hospitality Group research

Demand

The business sector is the largest hotel accommodation demand generator in Lagos,

accounting for approximately 75 per cent of total demand. Demand from this sector

originates mostly from the oil and gas industry, financial services (banking),

telecommunications and the government, although the FMCG sector has increased in

recent years, alongside the expansion of the retail sector. The second largest demand

generator is the conference sector, generated by the corporate sector, government,

professional organizations and associations, NGOs and for social activities.

There is a high propensity to hold conferences, meetings, retreats, training seminars and

annual general meetings.

The Nigerian Hotel Industry

December 2013

8

Lagos Hotel Demand

Market Mix 2012

75%

15%

10%

Business

Conference

Other

Source: W Hospitality Group research

Data obtained from STR Global (who commenced data collection in 2009) shows the

performance of a sample of chain-managed hotels in Lagos:

Lagos Hotel Market

Hotel Performance Data - 2010 - 2013

Occupancy Average Daily Rate (US$) Revenue per Available Room (US$)

2010 2011 2012 2013 2010 2011 2012 2013 2010 2011 2012 2013

59.3% 64.7% 64.6% 300 289 298 178 187 193

Jan-Oct 63.6% 66.6% Jan-Oct 296 295 Jan-Oct 188 196

Source: STR Global

Despite major increases in supply (c33 per cent in three years), occupancies increased

significantly in 2011, and have been stable since. ADRs have, however, come under

pressure.

Future Supply

There are an estimated 3,400 branded hotel rooms currently planned or under

construction in Lagos, with opening dates between 2014 and 2017, and at least another

1,200 with no brand. Of the total (c4,600), approximately 43 per cent are still in the

planning stage, and the remainder are actively under construction (31 per cent) or have

had work undertaken but are currently stalled (26 per cent).

To date, the majority of new supply in Lagos has been at the top end of the market, in the

upscale and deluxe categories. The mid-market, budget and economy sectors, however,

represent the greatest opportunity for new entrants.

The Nigerian Hotel Industry

December 2013

9

Agreements have been signed for 21 new additions, as listed in the table below - only

those shown in bold are actively under construction.

Lagos Hotel Market

Future Branded Supply Signed Agreements

Group Name Brand District Rooms

Scheduled

Opening Year

Protea Protea Select Ikeja 126 2014

Mantis Mantis Ikoyi 64 2014

Mantis Mantis Ikeja GRA 65 2015

Wyndham Ramada Lekki Ikota 164 2015

Marriott Marriott Victoria Island 150 2017

African Pride African Pride Ikeja 200 2014

IHG Holiday Inn Ikeja MMIA 300 2014

IHG Crown Plaza Ikeja MMIA 275 2014

Louvre Golden Tulip Ikoyi 42 2014

Louvre Tulip Inn Ikeja 100 2014

Legacy Hotels & Resorts Wheatbaker (extension) Ikoyi 41 2015

Carlson Rezidor Park Inn by Radisson Apapa 150 2015

Sun International Sun International Victoria Island 200 2015

Best Western Best Western Premier Ikeja GRA 65 2016

Hilton Hilton Ikeja MMIA 250 2017

Hilton Hilton Ikoyi 350 2017

IHG Holiday Inn Victoria Island 300 2017

Starwood Four Points by Sheraton Ikeja GRA 191 2017

Hilton Hilton Garden Inn Ikeja 120 2017

Hilton Hilton Ikoyi 350 2017

Starwood Luxury Collection Ikoyi 441 2017

Fairmont Fairmont Victoria Island 230 2017

Source: W Hospitality Group research

In addition to the branded future supply, there are a number of unbranded projects

underway, such as the extension to the Oriental Hotel (104 rooms), and the new hotel on

the site of the Eko Hotel, the 171-room Eko Signature (the fourth separate operation on

the same site). Both were expected to open in 2013, but at the time of writing, neither is

operational.

The Abuja Hotel Market

Introduction

Abuja is Nigerias capital city and is the administrative and political heart of the country.

Commercial activity in the city is very limited compared to Lagos. As the centre of

Federal government activity, with some 285 government bodies based there, the majority

of the workforce - about 70 per cent - are civil servants.

The Nigerian Hotel Industry

December 2013

10

Private sector employment is mostly in construction and in the service industries, which

constitute about 25 per cent of the total.

Nnamdi Azikiwe International Airport is Nigerias second major airport. Although

Abujas international flight operations are limited compared to Lagos, there has been

substantial growth in the past few years.

Nnamdi Azikiwe International Airport - Abuja

Domestic & International Passenger Movements

-

500,000

1,000,000

1,500,000

2,000,000

2,500,000

3,000,000

3,500,000

4,000,000

4,500,000

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

2

*

2

0

1

3

*

*January - June

Source: FAAN

Current Supply

There are approximately 5,300 hotel rooms available in Abuja:

Hotel Room Supply, Abuja

-

1,000

2,000

3,000

4,000

5,000

6,000

Total Rooms 3,263 3,478 3,715 3,878 4,200 4,330 4,736 4,788 4,892 5,271

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Source: W Hospitality Group research

The Nigerian Hotel Industry

December 2013

11

Unlike Lagos, there have been very few new rooms entering the Abuja market, an

increase of only 9 per cent since 2010 and, currently, there are no new hotels under

construction with an international brand affiliation.

The hotel supply of relevance in Abuja can be divided into four categories:

Two large internationally-branded hotels Hilton and Sheraton;

Five smaller internationally-branded hotels, of which three are managed by

Protea;

Large locally-managed hotels such as NICON Luxury, Bolingo and Rockview;

Small boutique hotels such as the Summerset, The Bentley, Valencia,

Immaculate Suites, Nordic Villa and Nordic Residence

The market is dominated by the first three categories.

There are 22 major hotels in Abuja, being those with an international or regional

(African) brand as well as locally managed hotels.

Abuja, Federal Capital Territory

Branded and Major Unbranded Hotels 2013

Hotels District Rooms Positioning

Mediterranean Hotel Asokoro 25 Midscale

Protea Hotel Asokoro Asokoro 83 Midscale

Bolingo Hotel & Tower CBD 350 Midscale

Chelsea Hotel CBD 38 Midscale

Nanet Suites CBD 52 Midscale

Reiz Continental CBD 86 Midscale

Hawthorn Suites Garki 110 Midscale

Protea Apo Apartment Garki 32 Midscale

NICON Luxury Hotel Garki 253 Midscale

Best Western Plus Ajuji Hotel Gudu 104 Midscale

Ibeto Hotel Gudu 100 Midscale

Nordic Residence/Villa J abi 32 Midscale

Protea Maitama Maitama 28 Upscale

Summerset Maitama 26 Midscale

Transcorp Hilton Abuja Maitama 670 Upper Upscale

Chelsea Hotel Wuse 2 124 Midscale

Denis Hotel Wuse 2 84 Midscale

Immaculate Suites & Apartment Wuse 2 86 Midscale

Rockview Royale Wuse 2 210 Midscale

Sheraton Hotel Wuse 2 540 Upscale

Valencia Hotel Wuse 2 60 Midscale

The Bentley Utako 60 Midscale

Total 3,153

Source: W Hospitality Group research

The Nigerian Hotel Industry

December 2013

12

Demand

The corporate sector is the largest demand generator in Abuja (approximately 80 per cent

of total demand in 2012, up from approximately 70 per cent in previous years). This

sector is almost exclusively doing business directly or indirectly with government. A

level of overnight accommodation demand is also created by the embassies and high

commissions located in Abuja. Corporate demand exhibits a traditional seasonal pattern

with reduced levels of demand at weekends and during holiday periods. There are few

leisure activities to be enjoyed in Abuja, and although some long stay guests will stay

over the weekend, the majority will leave the city on Friday (as do many politicians and

other residents).

Abuja Hotel Demand

Market Mix 2012

80%

15%

5%

Business

Conference

Other

Source: W Hospitality Group research

On a macro basis, corporate demand is particularly affected by peaks and troughs in

government activity. Prior to the terrorist threats and attacks in 2011, conference and air

crew demand was growing for Abujas hotels due to the extensive facilities that exist in

hotels and other venues, the prestige of the hotels and the volume of rooms available, the

central location of Abuja in Nigeria, and the increasing number of national and

international flights serving the city. The countrys 2006 Tourism Master Plan identified

Abuja as the conference capital of Nigeria, but if this potential is to be realised, the city

needs more rooms, and needs to have an organised approach to the sector.

Tourist demand is almost non-existent due to the lack of attractions and activities in

Abuja. One of the main initiatives by the city in the tourism sector is the annual Abuja

Carnival, but it is believed that this is primarily attended by city residents, with few

guests from out of town.

The Abuja hotel market recorded a mixed performance in 2011 and 2012. The chart

overleaf shows the performance of a sample of branded hotels in Abuja:

The Nigerian Hotel Industry

December 2013

13

Abuja Hotel Market

Hotel Performance Data 2010 - 2013

Occupancy Average Daily Rate (US$) Revenue per Available Room (US$)

2010 2011 2012 2013 2010 2011 2012 2013 2010 2011 2012 2013

61.6% 60% 51% 260 280 289 161 163 153

Jan-Oct \50.7% 53.3% Jan-Oct 288 335 Jan-Oct 155 180

Source: STR Global

In 2011 and 2012, Abuja suffered from terrorist threats, actual attacks (on the World

Bank building and on the Eagle Square parade ground) and negative international travel

advisories, which severely impacted normal travel volumes to the city, and also

resulted in the cancellation of various conferences and other events which were due to be

held there. Room occupancies were down in nine months out of 12 in 2012, and for the

year as a whole was 51 per cent, compared to 59 per cent in 2011, a reduction in rooms

sold of approximately 13 per cent. Of note, however, is that the Transcorp Hilton

represents 50 per cent of the STR sample in terms of available rooms and, together with

the Sheraton, over 85 per cent of the sample, the others being two of the Protea properties

and the Hawthorn Suites. It was the Hilton, apparently singled out as an American

target, that was the most affected by the terrorism threats in 2011 and 2012, with their

occupancy dropping from approximately 75 per cent in 2011 to around 50 per cent in

2012. The main hotels were also affected by the withdrawal of international aircrew

business from Abuja, due to the security issues.

The change in the business mix of the hotels in the sample, particularly the Hilton and the

Sheraton fewer aircrew and conference groups resulted in an increase in the ADRs.

Future Supply

There are several hotels under construction in Abuja, none of which is affiliated to an

international brand. Typically, the quality of design, construction and finishing of many

of these hotels is poor. Further, construction on several has been suspended for some

time. Notwithstanding the lack of progress in new hotel development in Abuja, the city

has been visited on a number of occasions by several of the international hotel chains,

seeking opportunities for management, and some major announcements are expected in

2014 regarding new deals there. Abujas status as a national and regional capital makes it

an appealing location for many of the international operators. It is therefore inevitable,

that new branded hotels will be developed there at some time. However, these

international chains are not investors, and therefore signed management contracts are

only one part of the development process, not the conclusion.

The table overleaf lists the future branded supply in Abuja:

The Nigerian Hotel Industry

December 2013

14

Abuja Hotel Market

Future Branded Supply Signed Agreements

Group Name Brand District Rooms

Scheduled

Opening Year

Best Western Best Western J abi 84 2015

Carlson Rezidor Park Inn by Radisson Kaura 150 2015

Carlson Rezidor Park Inn by Radisson Maitama 125 2017

Carlson Rezidor Radisson Blu Maitama 200 2017

Marriott Courtyard CBD 250 2017

Marriott MEA CBD 100 2017

Source: W Hospitality Group research

None of these hotels is currently under construction, although the Park Inn by Radisson

in Kaura is a half-completed structure, but with no work active at the time of writing.

The Port-Harcourt Hotel Market

Introduction

Port Harcourt is the capital of Rivers State, the commercial centre of the Niger Delta

region, and one of Nigerias leading industrial centres, almost entirely related to the oil

and gas industry. The city is also the location of various manufacturing plants for tyres,

aluminium products, glass bottles, paper, steel structural products, paints, plastics,

cement, concrete products and several other items, as well as truck and bicycle assembly

plants.

Port Harcourt has two airports the international airport at Omagwa, northwest of the

city, and the NAF Base in the centre of the city. The closure of the international airport

in mid-2006 (until early 2008) for runway repairs brought about the cessation of the

international flights and the diversion of some domestic services to the NAF Base (not

captured in the FAAN data in the graph overleaf). By 2012, passenger traffic at Port

Harcourt airport had increased by 36 per cent from 2005.The decrease in passenger

numbers in 2012 is primarily due to a reduction in the number of domestic carriers, and

frequent schedule interruptions. Similar to Lagos, this was a supply-led reduction, and

not a reduction in demand.

The Nigerian Hotel Industry

December 2013

15

Port Harcourt International Airport - Port Harcourt

Domestic & International Passenger Movements

-

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

1,600,000

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

2

*

2

0

1

3

*

* January - June

Source: FAAN

Current Supply

The Port Harcourt hotel market comprises various classes of hotels, many of which have

standards lower than one would expect in a modern hotel. There are a small number of

internationally-branded hotels that offer a much higher level of product and service than the

non-branded hotels, but the market is dominated by unbranded, owner-operated hotels.

There are 16 major hotels in Port Harcourt.

Port Harcourt Hotel Market

Branded and Major Unbranded Hotels 2013

Hotel Rooms Positioning

Le Meridien 87 Upper-Upscale

Novotel 117 Upper Midscale

Presidential Hotel 305 Upper Midscale

Golden Tulip 102 Upscale

Best Western Premier 89 Midscale

J uanita 65 Midscale

Beverly Hills 130 Midscale

Bougainvillea 58 Midscale

Dannic Hotel 46 Midscale

Everyday Check-Inn 31 Midscale

Landmark 120 Midscale

Maas Central 30 Midscale

Rachael Hotel 62 Midscale

Sasun 125 Midscale

Vee Hotel 72 Midscale

Swiss International Mabisel 117 Midscale

TOTAL 1,556

Source: W Hospitality Group research

The Nigerian Hotel Industry

December 2013

16

Demand

The main demand for hotel rooms in Port Harcourt is generated by the corporate sector,

and the majority of that by the oil & gas industry and by the State government. The

second largest demand is for conferences and meetings, many of which are also generated

by the hydrocarbons industries, as well as by NGOs and by government. Other

demand includes leisure and aircrew.

Port Harcourt Hotel Demand

Market Mix 2012

55%

29%

16%

Business

Conference

Other

Source: W Hospitality Group research

STR Global do not collect data from Port Harcourt. The following are estimates based on

our research.

Port Harcourt Hotel Market 2010 - 2013

Hotel Performance Data

Occupancy Average Daily Rate (US$) Revenue per Available Room (US$)

2010 2011 2012 2013 2010 2011 2012 2013 2010 2011 2012 2013

63.8% 64.6% 64.7% 93 95 100 60 62 65

Jan - Oct 60% 65% Jan - Oct 98 105 Jan - Oct 59 69

Source: W Hospitality Group research

Prior to the onset of the Niger Delta crisis in 2009, Port Harcourts hotels experienced

high demand for their rooms and suites, as the oil & gas sector flourished. There was a

marked reduction in demand as security became an issue and companies moved their

operations out of Port Harcourt. Relative peace and security has returned to the city with

renewed optimism, as the State government implements numerous infrastructure projects

to promote the city as a healthy environment for residents, investors and visitors alike.

The oil and gas companies have gradually returned to Port Harcourt, and in line with the

construction activities going on, there has been an in increase in the presence of

construction companies such as Reynolds Construction Company and Bandini, as well as

the increase of banking and financial activities in the city.

The Nigerian Hotel Industry

December 2013

17

Future Supply

Due to various factors, most notably the security issues that affected the city and the

wider Niger-Delta area in the last decade, there has been no large addition to the supply

of quality hotels in Port Harcourt in recent years. There are a number of stalled

construction projects in the GRA district, as well as planned projects in other parts of the

city. These hotels, if all proceed, will add approximately 800 rooms to the existing

supply.

Three of the new hotels, with approximately 500 rooms, are branded:

Port-Harcourt Hotel Market

Future Branded Supply Signed Agreements

Group Name Brand City Rooms

Scheduled

Opening Year

African Sun African Sun Port Harcourt 76 2015

African Sun Amber Port Harcourt 196 2015

Carlson Rezidor Radisson Blu Port Harcourt 206 2016

Source: W Hospitality Group research

The Radisson Blu hotel is to be constructed on the site of the former Olympia Hotel,

which has been demolished.

Secondary Cities in Nigeria

The hotel supply in Nigerias secondary cities comprises mostly small unbranded hotels.

There are a few secondary cities with branded supply:

Nigerian Hotel Market

Secondary Cities - Branded Supply

Hotels Location Rooms Positioning

Best Western Homeville Benin City 80 Midscale

Protea Hotel Select Emotan Benin City 95 Midscale

Protea Hotel Select Ekpan Warri 95 Midscale

Le Mridien Ibom Hotel & Golf Resort Uyo 130 Upper-Upscale

Source: W Hospitality Group research

Demand for these hotels is mostly from domestic travellers.

The following table lists the agreements that the chains have signed elsewhere in Nigeria;

those marked in bold are actively under construction:

The Nigerian Hotel Industry

December 2013

18

Nigerian Hotel Market, Secondary Cities

Future Branded Supply Signed Agreements

Group Name Brand City Rooms

Scheduled

Opening Year

Best Western Best Western Plus Asaba 90 2014

Best Western Best Western Plus Makurdi 135 2014

Carlson Rezidor Park Inn by Radisson Abeokuta 173 2014

Louvre Golden Tulip Ibadan 80 2014

Hilton Hilton Garden Inn Uyo 240 2015

African Sun African Sun Warri 100 2014

Louvre Golden Tulip Warri 192 2014

African Sun African Sun Owerri 170 2015

Louvre Tulip Inn Owerri 79 2016

Starwood Four Points by Sheraton Ibadan 150 2017

Starwood Four Points by Sheraton Benin City 188 2017

Hilton Hilton Garden Inn Owerri 150 2017

Source: W Hospitality Group research

Of these hotels, only the Park Inn by Radisson, Hilton Garden Inn, the two Best Western

Plus and Golden Tulip are actively under construction.

The interest being shown by the international chains in expanding in Nigeria is evidence

of the opportunities in the country. Some chains have Nigeria as their primary focus on

the continent. There is no doubt that the nation is in need of quality hotels, particularly to

serve the increasing domestic market, as the economy grows. Of the new hotels listed

above, all except the Four Points by Sheraton hotels in Benin City and Ibadan are at the

midscale level, where the greatest opportunities lie.

Operating Factors

Hotel operations in Nigeria, particularly those in the three major cities experience, in

general, higher profitability levels than elsewhere, with Gross Operating Profits of 50 per

cent and higher of revenue not unusual. This is partly due to high ADRs, and partly due

to low payroll costs. Basic salaries are low, but these are supplemented by the

distribution of the 10 per cent service charge which is added to guests bills.

Energy costs are high, 10 per cent or more of revenue not unusual, but the inclusion in

the development planning of energy-saving devices, and building in sustainable energy

sources such as solar panels and heat exchangers, can reduce the bills.

Taxation and other charges, from the various levels of government, can add to operating

costs some States, including Lagos, impose a 5 per cent consumption tax on all hotel

services, and local governments are often to seen to be unfair on the hotel industry due to

the number of licences that have to be obtained.

The Nigerian Hotel Industry

December 2013

19

With poor infrastructure, hotels need to be self-sufficient in everything, generating their

own power when the mains supply is cut (which happens frequently each day), drawing

their own water from boreholes, and treating it, and providing their own sewage

treatment plants onsite.

The supply of food and drinks is improving, but import duties make much of what is

imported very costly. This is passed on, typically, through high prices to the customer,

with a buffet meal in some of the top restaurants in Lagos and Abuja costing as much as

US$50.

Challenges

Despite the opportunities, and the progress being made, the Nigerian hotel industry faces

several challenges. Whilst the economic outlook is positive, there are serious challenges

facing the country which, if not properly addressed, will restrict growth:

Political instability: creates security concerns and discouraging travel and

investment. Electioneering is already underway for the 2015 polls, which could

mean 15 months of stagnation, with the focus on politics rather than on the

economy.

Corruption: endemic throughout the system, and the poor quality of government

spending means that economic growth does not have as large an impact on per

capita income as it should.

Multiple taxation: levies and taxes by the federal, State and local governments

make business difficult and increase operating costs.

Infrastructure: the nations basic infrastructure is inadequate. This raises costs and

makes Nigeria an expensive place to do business. The electricity supply is

epileptic, and considerably below what is required to support the existing

economy and its growth. As a result, operating costs are high (due to a reliance

on alternate power supply, i.e. imported generators and diesel). Power outages

and voltage fluctuations are common and can damage equipment. Hotels have to

be self-sufficient not only in electricity, but also in water supply and waste water

treatment. Other infrastructure, such as the road networks and the countrys

airports, are in dire need of repair and expansion.

Skilled workers: there is a very limited supply of skilled labour in the industry.

As a result, existing hotels need to expend considerable resources on training and

retraining staff.

Development costs: these are high as the construction industry is underdeveloped,

with a limited number of capable contractors. The importation of construction

materials and hotel fittings also contributes to the high cost.

Financing costs the local banking industry has limited long-term funds, and the

interest rate on a local-currency loan can be above 20 per cent.

The Nigerian Hotel Industry

December 2013

20

Although dollar loans are available in certain circumstances, both from local

banks and from foreign lenders, the country risk-premium means that the interest

rate is likely to be above 10 per cent.

Classification/Grading: there is no official grading system of hotels. This is an

important factor in building up quality lodging facilities. Nigerian hotels are

presently underperforming with regards to standards, partly because there is no

quality-measurement tool in force.

Statistics: the industry lacks adequate statistics on accommodation providers, their

performance and growth rates within the sector. The absence of statistics

indicates poor policy making as there are no indicators on quality, quantity and

existing products.

Conclusion

The Nigerian hotel industry has great potential as well as challenges. However,

developers and operators are overcoming these challenges, and are moving forward with

new hotel projects, not just in the main cities but also in the some of the State capitals.

With the view of entering into or increasing their presence in high-growth markets, the

international hotel chains are increasingly venturing into Africa, with a focus on Sub

Saharan Africa; Nigeria is definitely on their radar.

Amongst the international and regional hotel chains, their largest development pipeline in

Africa is in Nigeria, with a total of 49 hotels and 7,470 rooms scheduled to open by 2017.

In sub-Saharan Africa, the next largest pipeline is in Kenya, with 11 hotels and 1,469

rooms - just 20 per cent of that planned for Nigeria.

Trevor Ward, Managing Director

Lola Udabor, Consultant

W Hospitality Group

Lagos, Nigeria

December 2013

www.w-hospitalitygroup.com

Potrebbero piacerti anche

- Doing Business in Nigeria: Basic Entry/Licensing Requirements and Permits in Selected SectorsDa EverandDoing Business in Nigeria: Basic Entry/Licensing Requirements and Permits in Selected SectorsNessuna valutazione finora

- Faqs On Doing Business in NigeriaDocumento14 pagineFaqs On Doing Business in NigeriabigpoelNessuna valutazione finora

- The Task, Challenges and Strategies For The Marketing of Tourism and Relaxation Services in NigeriaDocumento22 pagineThe Task, Challenges and Strategies For The Marketing of Tourism and Relaxation Services in Nigeriaali purityNessuna valutazione finora

- NigeriaDocumento6 pagineNigeriaomarfaruqemoonNessuna valutazione finora

- TourismDocumento84 pagineTourismmedoNessuna valutazione finora

- Nigerian Bureau of Statistics, Furniture ReportDocumento19 pagineNigerian Bureau of Statistics, Furniture ReportChike ChukudebeluNessuna valutazione finora

- Understanding Global BusinessDocumento15 pagineUnderstanding Global Businessjaya161Nessuna valutazione finora

- Shivani 6Documento28 pagineShivani 6Ravneet KaurNessuna valutazione finora

- The Economic Development in Nigeria and That of GhanaDocumento15 pagineThe Economic Development in Nigeria and That of GhanaRtr Ahmed Abidemi CertifiedNessuna valutazione finora

- Pestc Analysis NigeriaDocumento13 paginePestc Analysis NigeriaNicole G100% (2)

- Yangon (New Trend)Documento12 pagineYangon (New Trend)Nguyễn Hương LiênNessuna valutazione finora

- New Age Ad Assignment - Blog ContentDocumento28 pagineNew Age Ad Assignment - Blog ContentharshaNessuna valutazione finora

- Hospitality: Industry OverviewDocumento3 pagineHospitality: Industry OverviewJohn JebarajNessuna valutazione finora

- Which Way NigeriaDocumento3 pagineWhich Way NigeriaMorenikeji AdewaleNessuna valutazione finora

- Industry Analysis: Report On Hospitality IndustryDocumento25 pagineIndustry Analysis: Report On Hospitality IndustryRASHMI BHATT Jaipuria JaipurNessuna valutazione finora

- Lagos ICT 2017Documento32 pagineLagos ICT 2017yaduraj TambeNessuna valutazione finora

- Evaluating The Effects of Insecurity On Hospitality Industry in Northern Nigeria (2014-2019)Documento8 pagineEvaluating The Effects of Insecurity On Hospitality Industry in Northern Nigeria (2014-2019)Research Publish JournalsNessuna valutazione finora

- NIPCinvestDocumento4 pagineNIPCinvestpapaokeyNessuna valutazione finora

- Development Challenges and Humanitarian ConditionsDocumento1 paginaDevelopment Challenges and Humanitarian ConditionsHazem AbdelstarNessuna valutazione finora

- Role of Tourism Industry in Generating Foreign ExchangeDocumento84 pagineRole of Tourism Industry in Generating Foreign ExchangeJatin PahujaNessuna valutazione finora

- Leela Palace Hotel Project, BangaloreDocumento235 pagineLeela Palace Hotel Project, Bangalorejayeshvk100% (68)

- Global Perspectives October 2016: Update On AfricaDocumento8 pagineGlobal Perspectives October 2016: Update On AfricaNational Association of REALTORS®100% (1)

- Tourism ProjectDocumento80 pagineTourism ProjectAyush TiwariNessuna valutazione finora

- Tourism ProjectDocumento81 pagineTourism ProjectVinay Singh50% (10)

- Tamunobere HotelsDocumento34 pagineTamunobere HotelsOwunari Adaye-OrugbaniNessuna valutazione finora

- Nigeria'sDocumento3 pagineNigeria'sJoe DemienNessuna valutazione finora

- Rural Tourism Development and Economic DDocumento62 pagineRural Tourism Development and Economic DAderemi OmotayoNessuna valutazione finora

- Devlpmnt Fin1Documento28 pagineDevlpmnt Fin1shiri_farhanaNessuna valutazione finora

- Challenges of Industrialisation in NigeriaDocumento9 pagineChallenges of Industrialisation in Nigeriaolawuyi adedayoNessuna valutazione finora

- Blackbook Project On Tourism IndustryDocumento37 pagineBlackbook Project On Tourism IndustryShrimali Nirav55% (11)

- Chapter ThreeDocumento22 pagineChapter ThreewomenwingrssNessuna valutazione finora

- Strategic Marketing A Panacea For Harnessing Nigerian Tourism Potentials For Socio Economic DevelopmentDocumento9 pagineStrategic Marketing A Panacea For Harnessing Nigerian Tourism Potentials For Socio Economic DevelopmentResearch ParkNessuna valutazione finora

- Focus NigeriaDocumento14 pagineFocus NigeriaKarlen Zamora ZúñigaNessuna valutazione finora

- Tourism Development in AfricaDocumento8 pagineTourism Development in AfricaAlly MandariNessuna valutazione finora

- Seminar ReportDocumento32 pagineSeminar Reportmatthias unekuNessuna valutazione finora

- Organising in The Zimbabwe Hospitality SectorDocumento20 pagineOrganising in The Zimbabwe Hospitality SectorSimpson BiriNessuna valutazione finora

- Group 4 Midterm AssignmentDocumento17 pagineGroup 4 Midterm AssignmentMayar AbueleniinNessuna valutazione finora

- Hospitality IndustryDocumento32 pagineHospitality IndustryNikhil MehtaNessuna valutazione finora

- Tourism IndustryDocumento22 pagineTourism IndustryKrishNessuna valutazione finora

- 155 ArticleText 658 1 10 20200901Documento70 pagine155 ArticleText 658 1 10 20200901CH Rajan GujjarNessuna valutazione finora

- Chapter One 1.1 Background To The StudyDocumento34 pagineChapter One 1.1 Background To The StudyA Chat With AlexNessuna valutazione finora

- Tourism and Leisure Industry ReportDocumento10 pagineTourism and Leisure Industry ReportShakkhor HaqueNessuna valutazione finora

- Nkoro's - Persentation (1) Peace GroupDocumento8 pagineNkoro's - Persentation (1) Peace GroupikigernumbereNessuna valutazione finora

- Indian Travel, Tourism and Hospitality IndustryDocumento16 pagineIndian Travel, Tourism and Hospitality Industrysukriti2812Nessuna valutazione finora

- GoaDocumento23 pagineGoaSuman BajoriaNessuna valutazione finora

- Hotels Sector Analysis Report: SupplyDocumento7 pagineHotels Sector Analysis Report: SupplyArun AhirwarNessuna valutazione finora

- Employment News PDFDocumento24 pagineEmployment News PDFLokesh NayakNessuna valutazione finora

- Renaissance in Sub-Saharan Africa: (2nd Edition)Documento36 pagineRenaissance in Sub-Saharan Africa: (2nd Edition)Kagnew WoldeNessuna valutazione finora

- Ku 1111111 ImpoDocumento73 pagineKu 1111111 Impoام عدنانNessuna valutazione finora

- Tourism Industry in IndiaDocumento21 pagineTourism Industry in Indiaj_sachin09Nessuna valutazione finora

- Trade Openess and Economic Growth in Nigeria (1981 - 2009) An Empirical AnalysisDocumento13 pagineTrade Openess and Economic Growth in Nigeria (1981 - 2009) An Empirical AnalysisFarhan DaudNessuna valutazione finora

- The Rise of the African Multinational Enterprise (AMNE): The Lions Accelerating the Development of AfricaDa EverandThe Rise of the African Multinational Enterprise (AMNE): The Lions Accelerating the Development of AfricaNessuna valutazione finora

- Reflections on the Economy of Rwanda: Understanding the Growth of an Economy at War During the Last Thirty YearsDa EverandReflections on the Economy of Rwanda: Understanding the Growth of an Economy at War During the Last Thirty YearsNessuna valutazione finora

- National Strategies for Carbon Markets under the Paris Agreement: Current State, Vulnerabilities, and Building ResilienceDa EverandNational Strategies for Carbon Markets under the Paris Agreement: Current State, Vulnerabilities, and Building ResilienceNessuna valutazione finora

- Business Guide: Doing Business in Dubai & the United Arab Emirates: Start Your Business Now!Da EverandBusiness Guide: Doing Business in Dubai & the United Arab Emirates: Start Your Business Now!Valutazione: 4 su 5 stelle4/5 (1)

- Best Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFADocumento16 pagineBest Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFAOladipupo Mayowa PaulNessuna valutazione finora

- Amcon Bonds FaqDocumento4 pagineAmcon Bonds FaqOladipupo Mayowa PaulNessuna valutazione finora

- Filling Station GuidelinesDocumento8 pagineFilling Station GuidelinesOladipupo Mayowa PaulNessuna valutazione finora

- 9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Documento3 pagine9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Oladipupo Mayowa PaulNessuna valutazione finora

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDocumento1 paginaIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulNessuna valutazione finora

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDocumento1 paginaIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulNessuna valutazione finora

- Abridged Financial Statement September 2012Documento2 pagineAbridged Financial Statement September 2012Oladipupo Mayowa PaulNessuna valutazione finora

- 2007 Q2resultsDocumento1 pagina2007 Q2resultsOladipupo Mayowa PaulNessuna valutazione finora

- 5 Year Financial Report 2010Documento3 pagine5 Year Financial Report 2010Oladipupo Mayowa PaulNessuna valutazione finora

- First City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsDocumento31 pagineFirst City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsOladipupo Mayowa PaulNessuna valutazione finora

- FCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedDocumento4 pagineFCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedOladipupo Mayowa PaulNessuna valutazione finora

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDocumento32 pagineFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulNessuna valutazione finora

- 9M 2013 Unaudited ResultsDocumento2 pagine9M 2013 Unaudited ResultsOladipupo Mayowa PaulNessuna valutazione finora

- q1 2008 09 ResultsDocumento1 paginaq1 2008 09 ResultsOladipupo Mayowa PaulNessuna valutazione finora

- q1 2008 09 ResultsDocumento1 paginaq1 2008 09 ResultsOladipupo Mayowa PaulNessuna valutazione finora

- 2006 Q1resultsDocumento1 pagina2006 Q1resultsOladipupo Mayowa PaulNessuna valutazione finora

- 2007 Q1resultsDocumento1 pagina2007 Q1resultsOladipupo Mayowa PaulNessuna valutazione finora

- 5 Year Financial Report 2010Documento3 pagine5 Year Financial Report 2010Oladipupo Mayowa PaulNessuna valutazione finora

- Unaudited Half Year Result As at June 30 2011Documento5 pagineUnaudited Half Year Result As at June 30 2011Oladipupo Mayowa PaulNessuna valutazione finora

- Dec09 Inv Presentation GAAPDocumento23 pagineDec09 Inv Presentation GAAPOladipupo Mayowa PaulNessuna valutazione finora

- 9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Documento5 pagine9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Oladipupo Mayowa PaulNessuna valutazione finora

- June 2009 Half Year Financial Statement GaapDocumento78 pagineJune 2009 Half Year Financial Statement GaapOladipupo Mayowa PaulNessuna valutazione finora

- June 2012 Investor PresentationDocumento17 pagineJune 2012 Investor PresentationOladipupo Mayowa PaulNessuna valutazione finora

- Fs 2011 GtbankDocumento17 pagineFs 2011 GtbankOladipupo Mayowa PaulNessuna valutazione finora

- Full Year 2011 Results Presentation 2Documento16 pagineFull Year 2011 Results Presentation 2Oladipupo Mayowa PaulNessuna valutazione finora

- June 2011 Results PresentationDocumento17 pagineJune 2011 Results PresentationOladipupo Mayowa PaulNessuna valutazione finora

- 2011 Year End Results Press Release - FinalDocumento2 pagine2011 Year End Results Press Release - FinalOladipupo Mayowa PaulNessuna valutazione finora

- 2011 Half Year Result StatementDocumento3 pagine2011 Half Year Result StatementOladipupo Mayowa PaulNessuna valutazione finora

- Final Fs 2012 Gtbank BV 2012Documento16 pagineFinal Fs 2012 Gtbank BV 2012Oladipupo Mayowa PaulNessuna valutazione finora

- TW Series New PDFDocumento51 pagineTW Series New PDFFARID100% (1)

- Coal Facts 2008: West Virginia Coal AssociationDocumento40 pagineCoal Facts 2008: West Virginia Coal AssociationKyle LangsleyNessuna valutazione finora

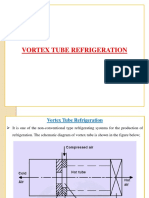

- Vortex Tube Steam Jet RefrigerationDocumento14 pagineVortex Tube Steam Jet RefrigerationDInesh KumarNessuna valutazione finora

- Generator ExcitationDocumento51 pagineGenerator ExcitationHari Krishna.M100% (5)

- Abb MNS-MCCDocumento4 pagineAbb MNS-MCCMiguel PMNessuna valutazione finora

- PJT-PDP-TLM-733 Project Document & Drawing NumberingDocumento19 paginePJT-PDP-TLM-733 Project Document & Drawing NumberingseehariNessuna valutazione finora

- Wel 23 BDocumento8 pagineWel 23 BWilly UioNessuna valutazione finora

- Tds TcsDocumento4 pagineTds TcsranveerNessuna valutazione finora

- Appendix A08: List of China's Conventional Natural Gas PipelinesDocumento10 pagineAppendix A08: List of China's Conventional Natural Gas PipelinesarapublicationNessuna valutazione finora

- Karthi CVDocumento4 pagineKarthi CVKarthi MarxNessuna valutazione finora

- Catalog Steam Turbines 2013 Engl PDFDocumento36 pagineCatalog Steam Turbines 2013 Engl PDFADKMARNessuna valutazione finora

- Photovoltaic CablesDocumento8 paginePhotovoltaic CablesShahid KhanNessuna valutazione finora

- Lead Acid Batteries in Critical ApplicationsDocumento24 pagineLead Acid Batteries in Critical Applicationsger80100% (1)

- Motor Starting Relay: 4Cr SeriesDocumento6 pagineMotor Starting Relay: 4Cr SeriesJunaid AllahabadNessuna valutazione finora

- ESG Reporting PWC PDFDocumento41 pagineESG Reporting PWC PDFNoviansyah Manap100% (1)

- Husky Group7Documento2 pagineHusky Group7Shruti Mandal80% (5)

- Samina Saqib W/O Saqib Usman Hno 22 Gulshan Rehman Society LHRDocumento1 paginaSamina Saqib W/O Saqib Usman Hno 22 Gulshan Rehman Society LHRUsman Ali Usman AliNessuna valutazione finora

- Prospects of Renewable Energy Utilisation For Electricity Generation in BangladeshDocumento39 pagineProspects of Renewable Energy Utilisation For Electricity Generation in Bangladeshnirjhor_bdsNessuna valutazione finora

- CRS Bushing CatalogueDocumento12 pagineCRS Bushing Cataloguedwas1314Nessuna valutazione finora

- SENATE HEARING, 113TH CONGRESS - S. Hrg. 113-720 NOMINATIONS OF THE 113TH CONGRESS - SECOND SESSIONDocumento874 pagineSENATE HEARING, 113TH CONGRESS - S. Hrg. 113-720 NOMINATIONS OF THE 113TH CONGRESS - SECOND SESSIONScribd Government DocsNessuna valutazione finora

- B2C Lighting - Product Explorer 2018-Vol IDocumento40 pagineB2C Lighting - Product Explorer 2018-Vol IAshish Tamang0% (1)

- Refrigerant Retrofit Kit Offering For LCU Split SystemsDocumento3 pagineRefrigerant Retrofit Kit Offering For LCU Split Systemsgeoryi castroNessuna valutazione finora

- FM Global Loss Prevention Visit Protocol - Non-USDocumento7 pagineFM Global Loss Prevention Visit Protocol - Non-USFederico MattsonNessuna valutazione finora

- Project ReportDocumento63 pagineProject ReportPramit ChhabraNessuna valutazione finora

- 10 1 1 177 6477 PDFDocumento444 pagine10 1 1 177 6477 PDFNugiNessuna valutazione finora

- Label Odner BantexDocumento4 pagineLabel Odner Bantexdana setiawanNessuna valutazione finora

- Karim Ali ElAskary Visualcv ResumeDocumento3 pagineKarim Ali ElAskary Visualcv ResumeAnonymous a3K3WgNessuna valutazione finora

- Book Review Mission IndiaDocumento7 pagineBook Review Mission IndiaBarnali N SanjeevNessuna valutazione finora

- Syntek Global Business Opportunity PresentationDocumento38 pagineSyntek Global Business Opportunity PresentationRichard BasilioNessuna valutazione finora