Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Withholding Tax Overview

Caricato da

PhilipGandleCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Withholding Tax Overview

Caricato da

PhilipGandleCopyright:

Formati disponibili

...

-

I_WHAT IS WITHHOLDIN,G TAX?

This is a method whereby, on Agency basis, the

payer of certain incomes deducts tax at sourceJrom

payments due to certain payees and then remit the

tax so deducted to the Commissioner, Domestic

Taxes Department. Withholding Tax is mainly

subjected to payment made to irregularearners and

non-payroll earners.

-WHATINCOMESARESUBJECTEDTO

WITHHOLDING TAX?

Quite a wide range of incomes received by both

Residents and Non Residents are subjected to

Withholding Tax operations. Also different Forms

are used to operate this system. The form also acts

as both Return of information and/ also as

pay-in-slip. Eachtype of WithholdingTaxhas been

assigned a specificaccount.

Appended beloware the range of income subject to

WithholdingTax, correspondingTaxcodes, form in

use and rates of Withholding Tax applicable in

each:-

RATES OF TAX

--, RESIDENTSI NON-

RESIDENTS

(10%-30%)I 5% Pension/Retirement Annuity

Shippingor Aircr,d't BUsiness

(carriage)-NonResident

Rent(fortheuse. of immovilblepr()perty)

Leaserentals(foruseof propertyother

than.irnmovableproperty-e.g machinery)

Management or Professional orTrainingfee

Contractual fees:-building,civil or

engineeringworks.

Royalty

General Interest

Interest earned fromlongtermbearer

bondsof10years andabove.

Dividends

Commission paidorcredited. byan

Insurance Company to:

.Brokers

.Others

Commission paidtoTicketingAgents

Transmittingmessages - NonResident

14 DPerformance for purposeof entertaining,

Instruction,etc-- NonResident

3%

5%

3%

5%

15%

10%

5%

5%

10%

5%

2.5%

30%

15%

20%

20%

20%

15%

10%

10%

5%

20%

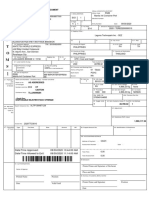

TAX CODES AND FORMS USED

WITHHOLDING TAX FORMSUSED

-'._,&._-".'

WithholdingTaxonDividends

Wl

.WithholdingTaxonGeneral Interest

W2andW2C

WithholdingTaxonRoyalties

W3andW3C

WithholdingTaxonManagement or

Professional orTrainingandContractual Fees

( Non- Resident)

IW3andW3C

WithholdingTaxonRentpayable

I(Non-Resident) I Wll,W12,W13

WithholdingTaxonPension/Annuities

payableto NonResidents

W25andW27

ShippingTax

Wl00

WithholdingTaxonInsurance W40,W41,W42,W43,

Commissions andBrokerage

W44

WithholdingTaxin respect of Qualifying

InterestpayablebyBanksandFinancial

Institutionto Residents ndW8B

88

I WithholdingTaxonPension, Provident

Fund,Lumpsumspayableto Residents.

IW25A

1190

IManagement or Professionalor Training I

IW8FandW9F andContractual fees- (Residents)

I

THE OBLIGATIONS OF THE

TAX AGENTS (INDIVIDUALS,

PARTNERSHIP) DEDUCTING

-WHAT ARE CONSEQUENCES OF

NON-COMPLIANCE BY THE AGENT?

The consequences of compliance the

Agent :-

which should have been recovered

the income of the payee, will

recovered from the income of the payer

and interest incurred on the

now be borne by the Agent.

-WHEN ISWITHHOLDINGTAXA FINALTAX?

All Withholding Taxes deducted from

made to Non-Residentpersons

of Withholding Tax

individuals becomes

on qualifyingInterest.

on qualifyingDividend.

-WHEN IS WITHHO~DING TAXAVAILABLEFOR

OFF-SETTING AGAINST AN ASSESSMENT?

Where deducted from incomes of Residents, the

following types of WithholdingTaxes are available

for off-settingagainst assessment,

(i) Withholding Tax charged on

Non-qualifying Dividends.

(ii) Withholding Tax charged

Non-qualifying Interest

(iii) Withholding Tax charged on Management

or Professional or Training Fees

and Contractual fees

(iv) Withholding Tax charged

Insurance/Brokerage commission,

(v) Withholding Tax on Pension/Provident

fund, or lump sum payable to residents.

8

on

on

_DISCLAIMER

This information is for guidance only.

Any omission do not absolve the Taxpayer

from making true and correct Returns and

Statement of Accounts.

~~ KENYA REVENUE

fiJ~ AUTHORITY

For further information,

Please visit the nearest KRA office

Or

Contact Taxpayer Eduction Programme

On:-

Tel: 020281201012816095/2813068

2813079/2812013

DOMESTIC TAXESDEPARTMENT

HEAD OFFICE

Times Tower Building 19th Floor

Haile Sellasie Avenue

POBox 30742 - 00100

NAIROBI

Tel: 020 310900

Website: www.kra.go.ke

KRAOnline Services Portal:

http/www.kra.go.ke/portal

DMG/REVISEDon 5th October 2009

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- I. Performance Rating Scale: 5 4 3 2 1 Quality of WorkDocumento7 pagineI. Performance Rating Scale: 5 4 3 2 1 Quality of WorkPhilipGandleNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- 3bdbf6dd-6c71-49c2-a618-4c7251a260cfDocumento2 pagine3bdbf6dd-6c71-49c2-a618-4c7251a260cfadilsgr0% (1)

- Probationary ReviewDocumento3 pagineProbationary ReviewPhilipGandle100% (2)

- Notice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäDocumento4 pagineNotice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäClaudia AttardNessuna valutazione finora

- Income Taxation:: Mamalateo, 2019 Reviewer On TaxationDocumento4 pagineIncome Taxation:: Mamalateo, 2019 Reviewer On TaxationAngelo Andro Suan100% (1)

- Constitutional Provisions Relating To TaxDocumento9 pagineConstitutional Provisions Relating To Taxrakshitha9reddy-1Nessuna valutazione finora

- June 2014Documento1 paginaJune 2014Deepak GuptaNessuna valutazione finora

- Decentralization in the Philippines: A Review of Fiscal, Political and Service Delivery AspectsDocumento13 pagineDecentralization in the Philippines: A Review of Fiscal, Political and Service Delivery AspectsDaniel Paulo MangampatNessuna valutazione finora

- TAX-311-InCOME-TAXATION-https Urios - Neolms.com Student Quiz Assignment Submissions 24706119Documento6 pagineTAX-311-InCOME-TAXATION-https Urios - Neolms.com Student Quiz Assignment Submissions 24706119Myco PaqueNessuna valutazione finora

- Performance Appraisals 2014 EngDocumento30 paginePerformance Appraisals 2014 EngPhilipGandleNessuna valutazione finora

- Short Form - SampleDocumento2 pagineShort Form - SamplePhilipGandleNessuna valutazione finora

- Selection Criteria TemplateDocumento1 paginaSelection Criteria TemplatePhilipGandleNessuna valutazione finora

- RK Template Bees or Beekeeping EquipDocumento2 pagineRK Template Bees or Beekeeping EquipPhilipGandleNessuna valutazione finora

- Plan Purchase Summary: Purchasing Your Plans..Documento1 paginaPlan Purchase Summary: Purchasing Your Plans..PhilipGandleNessuna valutazione finora

- 2841 PDFDocumento5 pagine2841 PDFPhilipGandleNessuna valutazione finora

- Shri 9016Documento1 paginaShri 9016kaateviNessuna valutazione finora

- Bee Yard Rules and Regulations MasterDocumento4 pagineBee Yard Rules and Regulations MasterPhilipGandleNessuna valutazione finora

- Genghis Capital - Daily Market Report - 4th November 2014Documento7 pagineGenghis Capital - Daily Market Report - 4th November 2014PhilipGandleNessuna valutazione finora

- Genghis Capital Daily Fixed Income & Money Market Update - 24th November 2014Documento1 paginaGenghis Capital Daily Fixed Income & Money Market Update - 24th November 2014PhilipGandleNessuna valutazione finora

- Mergetool Brochure v1 5Documento2 pagineMergetool Brochure v1 5PhilipGandleNessuna valutazione finora

- 3 MFUStaffIncenUserGuideDocumento6 pagine3 MFUStaffIncenUserGuidePhilipGandleNessuna valutazione finora

- Best Backup Software 2014Documento5 pagineBest Backup Software 2014PhilipGandleNessuna valutazione finora

- Genghis Capital Daily Fixed Income & Money Market Update - 24th November 2014Documento1 paginaGenghis Capital Daily Fixed Income & Money Market Update - 24th November 2014PhilipGandleNessuna valutazione finora

- A Remittance Is Money Sent by A Person in A Foreign Land To His or Her Home CountryDocumento3 pagineA Remittance Is Money Sent by A Person in A Foreign Land To His or Her Home CountryPhilipGandleNessuna valutazione finora

- General QuestionnaireDocumento2 pagineGeneral QuestionnairePhilipGandleNessuna valutazione finora

- KXTS108W ManualDocumento40 pagineKXTS108W ManualNajmul H. TipuNessuna valutazione finora

- IAS 2: InventoriesDocumento6 pagineIAS 2: InventoriescolleenyuNessuna valutazione finora

- Name: Piyush Pradeep Kolte PRN: 20180302037 Subject: GST LawDocumento11 pagineName: Piyush Pradeep Kolte PRN: 20180302037 Subject: GST LawPîyûsh KôltêNessuna valutazione finora

- 3229 To 3233 Dollar Industries LimitedDocumento2 pagine3229 To 3233 Dollar Industries LimitedmanjujeejooNessuna valutazione finora

- Employee payslip for January 2019Documento3 pagineEmployee payslip for January 2019Shashank DixitNessuna valutazione finora

- Bustax Chapters 1 4Documento6 pagineBustax Chapters 1 4Naruto UzumakiNessuna valutazione finora

- 12 Fuior, Gutan PDFDocumento14 pagine12 Fuior, Gutan PDFlupita100% (1)

- Terumo - Tllu6099284 - EdDocumento2 pagineTerumo - Tllu6099284 - EdmnmusorNessuna valutazione finora

- Pre-Test 1 - ProblemsDocumento3 paginePre-Test 1 - ProblemsKenneth Bryan Tegerero TegioNessuna valutazione finora

- Barangay Seminar With TrainDocumento31 pagineBarangay Seminar With TrainMarcial BonifacioNessuna valutazione finora

- Salary slip templateDocumento1 paginaSalary slip templatePtesgNessuna valutazione finora

- PR 11 2016Documento28 paginePR 11 2016Ken ChiaNessuna valutazione finora

- Analysis of Pattern of Financial MismanagementDocumento10 pagineAnalysis of Pattern of Financial MismanagementPaul NgosaNessuna valutazione finora

- FORM-GST-RFD-08 Notice For Rejection of Application For RefundDocumento2 pagineFORM-GST-RFD-08 Notice For Rejection of Application For RefundMK KodiaNessuna valutazione finora

- Residence, Domicile and The Remittance Basis: Hmrc6Documento81 pagineResidence, Domicile and The Remittance Basis: Hmrc6Mahboob Ur-RahmanNessuna valutazione finora

- 9 EconomicsDocumento25 pagine9 EconomicsMalsawmkima Maski-aNessuna valutazione finora

- Activity 1Documento4 pagineActivity 1LFGS Finals50% (2)

- m02 Government Budget and The EconomyDocumento17 paginem02 Government Budget and The EconomyAman patidarNessuna valutazione finora

- CPAR Tax On Estates and Trusts (Batch 92) - HandoutDocumento10 pagineCPAR Tax On Estates and Trusts (Batch 92) - HandoutNikkoNessuna valutazione finora

- DAMASO, Jennalyn T. ACT191 Babustax IDocumento2 pagineDAMASO, Jennalyn T. ACT191 Babustax IAnna CharlotteNessuna valutazione finora

- Public Finance and Fiscal Policy S.6 Eco NotesDocumento43 paginePublic Finance and Fiscal Policy S.6 Eco NotesNdagire DorahNessuna valutazione finora

- Tarun Das CV For Public Financial Management ReformsDocumento13 pagineTarun Das CV For Public Financial Management ReformsProfessor Tarun DasNessuna valutazione finora

- CBE 5 Module 5 TrueDocumento8 pagineCBE 5 Module 5 TrueChristian John Resabal BiolNessuna valutazione finora

- Jemima ArmoogumDocumento10 pagineJemima Armoogumjemimasti14Nessuna valutazione finora

- Cta 2D CV 09396 D 2019apr08 Ass PDFDocumento205 pagineCta 2D CV 09396 D 2019apr08 Ass PDFMosquite AquinoNessuna valutazione finora