Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Minings Thirst For Liquids PDF

Caricato da

Luis Alejandro Godoy Ordenes0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

8 visualizzazioni8 pagineThe iron ore industry in Western Australia consumes in excess of a 3 million litres of diesel each day. This diesel is delivered to the mine sites either by rail up to the site load-out, or by a combination of rail and road. This paper presents the case for the use of stranded gas to meet the power requirements of the mines located in their neighborhood.

Descrizione originale:

Titolo originale

Minings_Thirst_For_Liquids.pdf

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThe iron ore industry in Western Australia consumes in excess of a 3 million litres of diesel each day. This diesel is delivered to the mine sites either by rail up to the site load-out, or by a combination of rail and road. This paper presents the case for the use of stranded gas to meet the power requirements of the mines located in their neighborhood.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

8 visualizzazioni8 pagineMinings Thirst For Liquids PDF

Caricato da

Luis Alejandro Godoy OrdenesThe iron ore industry in Western Australia consumes in excess of a 3 million litres of diesel each day. This diesel is delivered to the mine sites either by rail up to the site load-out, or by a combination of rail and road. This paper presents the case for the use of stranded gas to meet the power requirements of the mines located in their neighborhood.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 8

The iron ore industry in Western Australia consumes in excess of a 3 million litres of diesel each day.

This diesel is delivered to

the mine sites either by rail up to the site load-out, or by a combination of rail and road. The use of mine transport corridors for

transport of fuel adds not only significant costs, but also has a considerable safety impact.

This paper presents the case for the use of stranded gas not only to meet the power requirements of the mines located in their

neighborhood, but also the significant liquid fuel requirements of the mines. This can be achieved through small-scale conversion

of natural gas to diesel fuel through the well-understood Gas-To-Liquid (GTL) process. The construction of a GTL facility as a

collaborative venture between a large operator and a stranded gas developer could result in cost savings of nearly 85% in actual

fuel costs with a positive return on investment within ten years. At the very least a dialogue is required between the major miners

and stranded gas developers.

Australia is currently heavily dependent on road transport for the movement of goods across the country. The primary fuel that

drives this aspect of the economy is diesel. Diesel too is the lifeblood of the mining industry from providing power to facilities and

accommodation to heavy haulage and everything in between. It is predicted that diesel fuel usage will continue to grow with the

global demand for Australian resources and domestic consumption.

Australia currently imports about a third of its liquid fuels; a continued increase in fuel imports is neither sustainable nor

acceptable. It may be argued that Australias access to International Markets suggests that energy security may be good; however

Figure 1 shows that Australias self-sufficiency is reducing. There is therefore a real opportunity to grow local industry and

increase energy security.

Australian natural gas reserves (including Coal Seam Methane and Shale Gas) are significant and new discoveries are being

made. Gas reserves close to the coast and major infrastructure hubs can be transported and processed relatively cheaply to LNG or

other products. Stranded gas reserves on the other hand are stranded by virtue of being economically too far away from gas

processing and transfer infrastructure.

The Exxon Energy Outlook (2011) predicts a 60% increase in demand for heavy fuels (diesel primarily) from 2010 to 2040.

While the major growth demand will be from India, Africa and China, the local demand cannot be overlooked as the local resources

will be required by these developing economies.

1

Corresponding Author

In the Australian context, some new shale and tight gas locations are potentially stranded; however, these reserves are close to

or overlap some of the active mining tenements. In Western Australia for instance potential shale gas reserves are located close to

the Pilbara where most of Australias iron ore is being produced.

The iron ore industry in Western Australia consumes in excess of 3 million litres of diesel each day. This diesel is delivered to

the mine sites either by rail up to the site load-out, or by a combination of rail and road. The use of mine transport corridors for

transport of fuel adds not only a significant cost impost, but also adds significant potential safety issues.

This paper presents the case for the use of this stranded gas not only to meet the power requirements of the mines located in

their neighbourhood, but also the significant liquid fuel requirements of the mines. This can be achieved through small-scale

conversion of natural gas to diesel fuel through the well-understood gas to liquid (GTL) process. While the focus of this paper is the

use of stranded resources to provide a reliable and secure fuel for the mining industry, the authors acknowledge the big picture

view of energy demand as discussed in Exxons Energy Outlook. The case is not just about economics, the cost of GTL diesel may

not be so very different from purchased diesel once the cost of financing for the project has been factored in but the financial

model used doesnt take into account accurate costs for transporting the diesel from storage to the site, these are expected to add

significant benefit to the economic equation. Synthetic diesels are reputed to be cleaner, and so require less engine maintenance,

than conventional diesel this would represent significant savings to mining operations.

Australia has a number of shale/tight gas basins such as Cooper, Amadeus, and Georgina amongst others. The Amadeus Basin is

the closest to the Pilbara mining infrastructure, and companies are beginning exploration activity in this basin. A portion of the

Amadeus Basin has already been explored and there is a pipeline to NT. Other shale/tight gas deposits are to be explored (e. g.

Central Petroleums reserves).

Central Petroleums stake in the Amadeus Basin for instance has an estimated 26 trillion cubic feet of gas (the Probabilistic Mean

Unrisked Prospective Recoverable) - a potentially significant resource.

The iron ore mines are located almost midway between the coast and the shale gas basins to the east. Until the global supply of

LNG exceeds demand, economics favour export over domestic use. Existing gas processing infrastructure on the coast may have

insufficient capacity to process additional gas. Should processing capacity exist in infrastructure on the coast, the cost of laying a

new pipeline across several active mine sites may be cost prohibitive.

Gas geographically close to Pilbara mine sites increases the potential for commercial exploitation by both the miners and gas

producers/explorers.

Gas to liquid (GTL) in the context of this paper refers to the conversion of natural gas to a hydrocarbon liquid fuel (crude) that

can be converted to diesel or other final fuel.

The gas to liquid process is an established process with a long history. The figure below depicts the process. Natural gas

(primarily methane) is reformed with steam to produce synthesis gas (molar ratio of hydrogen to carbon monoxide of 2 to 1). The

synthesis gas is then converted by Fischer Tropsch (FT) reaction to synthetic crude oil that is further refined to produce middle

distillates or diesel.

The FT process produces a liquid fuel that can, depending on the catalyst and operating conditions, be tweaked to produce

diesel. The FT process invented in 1922 has been the backbone of South Africas oil production (SASOL) and continues to be used

today. The Pearl GTL plant, the largest in the world has recently been inaugurated and has had first shipment. It cost between

US$18 and 19 billion and produces 140,000 barrels/day of liquids and 120 barrels/day equivalent of NGL (natural gas liquids) and

ethane (Pearl GTL and overview, 2011).

The details of the Fischer-Tropsch process are covered by a significant body of knowledge spanning several decades that is

available in journals and books.

There are a number of current research projects aimed at reducing the costs of the GTL process. For example, CSIRO in Australia

have research projects aimed at reducing the energy usage in the synthesis gas formation step of the process and aimed at finding a

catalyst to target diesel production over other hydrocarbon formation, both projects (if successful) will reduce the costs of the

plant (CSIRO report).

Another approach is to use the natural gas to form methane, and then in a subsequent step to convert the methane to Di-Methyl

Ether (DME). DME can be used as a diesel substitute with similar environmental positives as per synthetic diesel. There would be a

modification cost however on all users of the product. A US-based company does claim to have a working process scheme however

to convert natural gas to methanol using a catalyst only (i.e. without the syngas step), if proven this could potentially mean a

significant reduction in CAPEX and OPEX requirements.

In Australia 40 reporting EEO (Energy Efficiency Opportunity) companies in the mining sector consumed 52.5 Peta Joules (PJ) of

diesel equivalent in 2008-09 (Australian Government, EEO case study, 2010). The heating value of diesel ranges between 44 and

48 Mega Joules (MJ) per kilogram and density ranges from 820 to 860 kg/m3. Assuming a mid-value for heating value and density,

this energy represents 8.9 million barrels consumed in 2008-09 for mine production including 342 million tonnes of iron ore in

Australia. The current production of iron ore is 408 million tonnes and simple extrapolation would indicate a diesel consumption

of about 10 million barrels. However, personal communication with a senior mine executive indicated that 1 million litres of diesel

is consumed each day to meet a production target of nearly 15% of overall iron ore output (this is consistent with published

literature). This equates to about 42,000 barrels of fuel consumption a day. As no mining operation will provide exact data on fuel

consumption, it is reasonable to assume that diesel consumption will be somewhere between 10 and 15.3 million barrels each year.

By 2020 the Australian iron ore industry output is expected to more than double to nearly 1 billion tonnes.

This would imply an annual diesel requirement in excess of 25 million barrels. Currently there is a shortage in excess of 40%

for diesel; the shortfall is primarily made up from Singapore.

Over 2011, the base cost of diesel has hovered between 70 and 80 cents a litre; with shipping costs this increased to between

$1.20 and $1.30 a litre. With other additions, the final retail price of diesel (including all costs and taxes) varied between $1.30 and

$1.60 (http://www.aip.com.au/pricing/facts/Weekly_Diesel_Prices_Report.htm). It is understood that this final retail cost is based

on import pricing parity and large mining customers and the agricultural sector could get discounts of the order of 30 per cent.

Therefore, cost at source (gate) is assumed to be $1.45 (average of high and low retail) discounted by 30% to $1.015 a litre. The

actual transportation costs to the point of use, sometimes several hundred kilometres away are not known. The past year has seen

the steady increase in fuel prices and in early December 2011, West Texas Intermediate crude is selling around $100 a barrel.

The current cost of diesel in terms of energy is about $27 per GJ (this may or may not include transportation costs to site and is

the gate price). The cost of gas delivered to the Sino Iron Ore project for example is between $11 and $13 per GJ (ACIL Tasman

Report, 2010). Thus inclusive of pipeline costs, cost of gas appears to be between 2 and 2.5 times less than that of diesel.

The delivery of diesel fuel to the point of use often requires the use of other infrastructure road and rail primarily. The use of

road infrastructure implies sharing of roads with other users, light vehicles, heavy haul trucks (some up to five cars), and sometime

dump trucks. Segregation of traffic is not always possible and in a mine environment a major hazard is the non-segregation of

traffic that could lead to vehicle interactions. From a rail perspective, the need to send a fuel rake on a shared line is in itself not a

problem as most rail operations in Australia are very tightly regulated, however, it does bring in a scheduling constraint, as most

mining operations are poised to grow significantly. Increased traffic on lines would have the potential to create a safety issue.

The scheduling of fuel transport either by rail or road reduces overall capacity available for resource transfer, and based on

current expansion plans it appears that existing infrastructure will be used to near capacity.

Large operators such as Rio Tinto and BHP Billiton have gas supply infrastructure to some of their facilities; for example, the

Goldfields Gas Transmission (GGT) pipeline delivers gas to Rios operations in Paraburdoo. This gas is presently consumed to

produce power for the mines and local communities.

There are significant environmental benefits to producing GTL (synthetic) diesel close to the point of use. The environmental

impact of transporting diesel from Singapore to Australia, and then onwards to the mining areas will be significantly lessened.

Catalyst from the FT process plant is recyclable, and the resulting water product can be used for irrigation or within the mining

process.

GTL diesel will have a better environmental and performance profile than conventional diesels derived from crude oil. The

diesel is characterized by a high cetane number (at least 70), low sulphur (less than five parts per million), low aromatics (less than

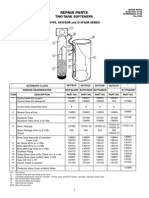

1%) and good cold flow characteristics (less than 5 -10 C). The following image is taken from Hobbs (Qualifying Synthetic Fuels

for Military Applications, presented at the 2005 DoD Standardization Conference, and report to the Southern States Energy Board,

Georgia titled American Energy Security).

Synthetic GTL diesel is compatible with existing fuel distribution infrastructure. In addition, GTL diesel can be used in both

current and envisaged future diesel engines, along with their exhaust gas after-treatment technologies; meaning few (if any)

modifications to existing equipment and infrastructure are required to realise the benefits.

A typical operation would consume about 1 million litres of diesel each day (~6,000 barrels) and some of the larger operations

would consume a little over 1.6 million litres of diesel each day (~10,300 barrels); therefore a gas to liquids facility to produce

10,000 barrels of diesel per day is considered for this analysis. Based on a material balance (Marano and Ciferno, 2001), a 17,000

barrel per day GTL facility will produce approximately 10,000 barrels of diesel per day.

Data was gathered from both GHD internal sources as well as published information to develop a cost model for this evaluation.

This in-house cost model is the basis of this analysis and can be easily adapted for use on actual case studies if requested.

There are three recent world-scale GTL projects for which cost data has been used (Sourced from industry websites);

Palm GTL, built in 2007 in Qatar, produces 154,000 barrels per day and cost US$ 18.0 Billion

Pearl GTL, built in 2011 in Qatar, produces 140,000 barrels per day and cost $US$ 19.0 Billion

Escravos GTL, built in 2011 in Nigeria, produces 34,000 barrels per day and cost US$ 8.4 Billion

Pacific GTLs proposed GTL of 17,000 barrels per day was estimated to cost $1.5 Billion in 2010, and was to have been located in

Brisbane. Assume therefore that this size plant built in the Pilbara will cost $2.0 Billion. With constant advances in catalyst

technology and the use of clever modularised design and construction it would be hoped that this cost could be reduced.

Factors that need to be taken into consideration are lead times required for design and construction and the need for speed of

delivery to match planned growth. It may be worth considering off-the-shelf technologies that would be suited to a range of

production capacities ranging from 200 to 5,000 barrels per day.

A 17,000 barrels/day GTL plant would require about 9 TJ/day of gas; based on pricing for which data is available ($11/GJ) this

would equate to $100,000 a day for gas, or $10 per barrel of diesel. The cost of producing the diesel is estimated (internal

calculations) to be about US$23 a barrel which equates to about 15 cents per litre, or based on 10,000 barrels a day equals

$230,000 per day

The current cost of purchasing commercial diesel at gate prices is estimated to be about US$1.6 million a day (based on 10,000

barrels a day @ $1.015 per litre) and over a year US$ 584 million. This cost does not include the cost of transport to site, safety

costs, scheduling costs and additional infrastructure required such as large tank farms and distribution facilities. For the purposes

of the calculation an additional 10c per litre have been added, actual data is required to improve this accuracy.

The cost analysis considered the construction of 17,000 barrels per day gas-to-liquid facility. The model assumed three years

for the design and construction of the facility. No credit is taken for either electric power produced by the GTL process or for the

LPG/gasoline that is produced. For ease of calculation (as this indicative only), the price of fuel and operating costs remain

unchanged over ten years. Under these conditions the break-even point is reached ten years from the time the funds are

sanctioned. At the end of twenty years, the IRR is 10%.

The GTL process produces other saleable hydrocarbon products as well as diesel. The potential revenue from these has not been

taken into account in the economic analysis for this paper; it would be expected to have a positive impact on the returns from the

project however.

The objective of the paper has been to present a case for the mining giants to consider the use of stranded gas to offset their

energy costs and achieve security of supply. The calculations are based on real world data; however, exact costs are seldom

available. Therefore, the results should be treated as strongly indicative and should be investigated on a case-by-case basis

The construction of a GTL facility as a collaborative venture between a large operator and a stranded gas developer could result

in cost savings of nearly 85% in actual fuel costs and a positive return on investment in less than 10 years. When the significant

amount of research into this technology begins to bear fruit, it is likely that the economic returns from the investment will be

greatly increased.

The timing is therefore right to take the first steps towards reducing imported diesel dependency, at the very least a dialogue

should be started between the major miners and stranded gas developers and the possibilities investigated.

ACIL Tasman, An assessment of Australias liquid fuel vulnerability, November 2008

ACIL Tasman, Gas prices in Western Australia, May 2010

Australian Government, Department of Energy and Tourism, EEO Case Study Analyses of diesel use for mine haul and

transport operations, 2010

Chemical Engineering, April 2011

CSIRO Report, Gas Processing and Conversion: fuel for Australia's future ,

http://www.csiro.au/en/Outcomes/Energy/Gas-Processing-Conversion-Fuel-Future.aspx, accessed, 01 February 2012

Exxon Energy, 2012, the outlook for energy: a view to 2040, 2011

Hobbs, H. H., Qualifying Synthetic Fuels for Military Applications, Presented at the 2005 DoD Standardisation Conference,

March 8 2005

http://www.aip.com.au/pricing/facts/Weekly_Diesel_Prices_Report.htm, fuel pricing details, accessed 8th Dec, 2011

http://www.shell.com/home/content/aboutshell/our_strategy/major_projects_2/pearl/overview/, Details of Pearl GTL,

accessed 13th Dec 2011

Marano, J. J. and Ciferno, J. P., Life-Cycle Greenhouse-Gas Emissions Inventory for Fischer-Tropsch Fuels, Energy and

Environmental Solutions paper for US Dept. of Energy, National Energy Testing Laboratory, June 2001

OceanEquitiesAfricanIronOreSectorResearch07072011, Iron Ore Sector update, downloaded 13th Dec 2011 from

http://www.sundanceresources.com

Rahmim, I. I., Gas to liquid technologies: recent advances, economics, prospects, 26th IAEE Annual International

Conference, June 2003

The Southern States Energy Board Norcross, Georgia, American Energy Security Building a bridge to energy

independence and to a sustainable future, July 2006

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Tunnel Blasting TechniquesDocumento25 pagineTunnel Blasting TechniquesBaga Yoice100% (1)

- Modification of Four-Section Cut Model For Drift Blast Design inDocumento8 pagineModification of Four-Section Cut Model For Drift Blast Design inLuis Alejandro Godoy OrdenesNessuna valutazione finora

- Combining RMR, Q, and RMi Classification Systems for Rock Mass EvaluationDocumento25 pagineCombining RMR, Q, and RMi Classification Systems for Rock Mass Evaluationponta10Nessuna valutazione finora

- Excavacion PDFDocumento25 pagineExcavacion PDFLuis Alejandro Godoy OrdenesNessuna valutazione finora

- Bomb Defusal ManualDocumento23 pagineBomb Defusal ManualcontactzumorioNessuna valutazione finora

- A of S and DDocumento5 pagineA of S and DRobert BrittNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Masterseal 550Documento4 pagineMasterseal 550Arjun MulluNessuna valutazione finora

- Slurry Flo BrochureDocumento4 pagineSlurry Flo BrochureChristian Andres Campa HernandezNessuna valutazione finora

- Eaton Tb09500001e PDFDocumento62 pagineEaton Tb09500001e PDFJuan E Torres MNessuna valutazione finora

- VHF Low Loss Band-Pass Helical Filter For 145 MHZ - English NewDocumento33 pagineVHF Low Loss Band-Pass Helical Filter For 145 MHZ - English NewSharbel AounNessuna valutazione finora

- College Report of Optical Burst SwitchingDocumento21 pagineCollege Report of Optical Burst Switchingimcoolsha999Nessuna valutazione finora

- Dont CryDocumento8 pagineDont CryIolanda Dolcet Ibars100% (1)

- Ref Paper 2Documento4 pagineRef Paper 2Subhanjali MyneniNessuna valutazione finora

- Plotting in AutoCAD - A Complete GuideDocumento30 paginePlotting in AutoCAD - A Complete GuideAdron LimNessuna valutazione finora

- Paint Color Comparison ChartDocumento132 paginePaint Color Comparison ChartCarlos Rubiños AlonsoNessuna valutazione finora

- Report On Corporate Communication Strategy Analysis ofDocumento38 pagineReport On Corporate Communication Strategy Analysis ofNAFISA ISLAMNessuna valutazione finora

- Nazneen Wahab CVDocumento5 pagineNazneen Wahab CVRavi MittalNessuna valutazione finora

- NETWORK ANALYSIS Chap.8 TWO PORT NETWORK & NETWORK FUNCTIONS PDFDocumento34 pagineNETWORK ANALYSIS Chap.8 TWO PORT NETWORK & NETWORK FUNCTIONS PDFsudarshan poojaryNessuna valutazione finora

- JupaCreations BWCGDocumento203 pagineJupaCreations BWCGsoudrack0% (1)

- UCID Number Request FormDocumento1 paginaUCID Number Request FormOmar AwaleNessuna valutazione finora

- MCQ in Services MarketingDocumento83 pagineMCQ in Services Marketingbatuerem0% (1)

- Aksin Et Al. - The Modern Call Center - A Multi Disciplinary Perspective On Operations Management ResearchDocumento24 pagineAksin Et Al. - The Modern Call Center - A Multi Disciplinary Perspective On Operations Management ResearchSam ParkNessuna valutazione finora

- Star S07FS32DR Water Softener Repair PartsDocumento1 paginaStar S07FS32DR Water Softener Repair PartsBillNessuna valutazione finora

- Quarter 1 Week 8Documento3 pagineQuarter 1 Week 8Geoffrey Tolentino-UnidaNessuna valutazione finora

- Zhao PeiDocumento153 pagineZhao PeiMuhammad Haris HamayunNessuna valutazione finora

- Data Visualization Q&A With Dona Wong, Author of The Wall Street Journal Guide To Information Graphics - Content Science ReviewDocumento14 pagineData Visualization Q&A With Dona Wong, Author of The Wall Street Journal Guide To Information Graphics - Content Science ReviewSara GuimarãesNessuna valutazione finora

- Designing The Marketing Channels 13Documento13 pagineDesigning The Marketing Channels 13Gajender SinghNessuna valutazione finora

- Analytic DeviceDocumento4 pagineAnalytic DeviceuiuiuiuNessuna valutazione finora

- Guide: Royal Lepage Estate Realty BrandDocumento17 pagineGuide: Royal Lepage Estate Realty BrandNazek Al-SaighNessuna valutazione finora

- INFRARED BASED VISITOR COUNTER TECHNOLOGYDocumento21 pagineINFRARED BASED VISITOR COUNTER TECHNOLOGYRahul KumarNessuna valutazione finora

- D72140GC10 46777 UsDocumento3 pagineD72140GC10 46777 UsWilliam LeeNessuna valutazione finora

- Oracle SCM TrainingDocumento9 pagineOracle SCM TrainingVishnu SajaiNessuna valutazione finora

- Amptec Issue 7Documento8 pagineAmptec Issue 7Linda Turner-BoothNessuna valutazione finora

- GRC Fiori End User Guide Final - V2Documento75 pagineGRC Fiori End User Guide Final - V2Subhash BharmappaNessuna valutazione finora

- Artikel Jurnal - Fundamental Differences of Transition To Industry 4.0 From Previous Industrial RevolutionsDocumento9 pagineArtikel Jurnal - Fundamental Differences of Transition To Industry 4.0 From Previous Industrial RevolutionsJohny DoelNessuna valutazione finora

- Chap1-Geometrical Optics - ExercisesDocumento3 pagineChap1-Geometrical Optics - ExercisesReema HlohNessuna valutazione finora