Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

YTP

Caricato da

Ye Phone0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

34 visualizzazioni37 pagineTower and Fibre Construction

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoTower and Fibre Construction

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

34 visualizzazioni37 pagineYTP

Caricato da

Ye PhoneTower and Fibre Construction

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 37

U Myint Oo

Deputy Chief Executive Officer

Yatanarpon Teleport Public Co., Ltd

11 March 2014

CONTENTS

About Myanmar

Infrastructure Construction : Tower & Fiber

Telecom and New Emerging Economy

About Myanmar

MYANMAR AT A GLANCE

Land : More than 670,000sq.km

Population : 60 millions

Urban, rural ratio : 30:70

Capital : Naypyitaw

Land borders : China, India, Bangladesh, Thailand, Laos

Nay Pyi Taw,

the new capital

China

B

a

y

o

f

B

e

n

g

a

l

Andaman Sea

The Next Asian Telecommunications Greenfield ?

Myanmar has high potential for rapid growth and development

given its rich natural resources, abundant labor force and strategic

location between the regions two economic giants the People

Republic of China and India.

Myanmar possesses a great deal of opportunities for further

development

Nonetheless, there are benefits to having a relatively clean slate to

build on. First, with no preexisting networks, infrastructure roll out can

be more efficient fiber cables could be laid when new electrical lines

are laid, saving money (MGI, 2013). Myanmar should be able to better

tailor their infrastructure to fit current needs of different areas, be they

rural or urban, while still maintaining flexibility for future upgrades.

Rural areas may only need 2G networks initially, but infrastructure can

be tailored to allow for easier future upgrades to 3G or 4G networks.

The greenfield advantage involves planning - a holistic design that

anticipates service needs and integrates ICTs into the overall plan.

Source : World Bank, MPT

It is only for illustrative adoption rate only and may not be representative of the actual excepted adoption rate

80 %

100 %

Source : World Bank, MPT

Month

1

Investment Planning

Vender Selection

Network Planning

Site Acquisition

Define Teams

Singing Contract

Site preparation

Begin to deployment

System Setup

Test Run

Optimization

Ready to launching

into commercial

Launching Service

in 3 main cities

Launching Service

in middle cities

1M subscriber

Month

2

Month

3

Month

4

Month

5

Month

6

Month

7

YTP Mobile Network Roll-out Planning

Subscription Developing Forecast

2014E 2015E 2016E 2017E

Myanmar

Population

60,384,144 61,024,216 61,677,175 62,343,288

Penetration 10.00% 40.00% 60.00% 80.00%

National

Subscribers

6,038,414 24,409,686 37,006,305 49,874,630

Market Share of

YTP

0.50% 16.00% 21.00% 26.00%

Subscribers of YTP 300,000 4,000,000 8,000,000 13,000,000

New Adds 300,000 3,000,000 4,000,000 5,000,000

Network Capacity 1,000,000 5,000,000 10,000,000 20,000,000

3G

OCS, Prepaid

3G

iVAS Platform

Platform Layer

Call Center

Dealers

Business Hall

Distribution Layer

MMS

WAP Color ring

back Tone

Missing Call

alert

VMS

(Voice mail)

Short

Message

App Layer

Service Delivering Platform

3G

WCDMA

LTE

GSM

Bearer Layer

YTP Value added Services Planning

INDUSTRIAL STRUCTURE

41.2%

21.7%

37.1%

56%

11%

33%

Primary Industries

Secondary Industries

Tertiary Industries

Population

: Agriculture, Mining, Fishery

: Oil/Gas refining

: Telecom, Banking, etc

Source: Yangon Institute of Economics

Production

46.40%

34.51%

6.85%

4.45%

2.59% 2.57%

0.79% 0.76%

0.47% 0.44%

0.09% 0.06%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

30.00%

35.00%

40.00%

45.00%

50.00%

-

4,000.0

8,000.0

12,000.0

16,000.0

20,000.0

24,000.0

Approved Amount

%

Foreign Investment of Permitted Enterprises as of (31/8/2012)

(By Sector)

Source : Directorate of Investment & Company Administration

US $ in Million

TOWER CONSTRUCTION

Tower Requirement - 10,000 in 3 years

Tower constructed - 1655

All operators to share the towers

Building and related construction for radio station

More tower sharing at near future

Source: MCIT

Strong Government interest and determination in ICT

development

Fast increase in demand on mobile service

High return of telecombusiness

New administration with new reformplan

Regional Cooperation with ASEAN, South Korea, Japan, China and

India, ETC

Strong needs for telecominfrastructure

FOCUS ON CURRENT TOWER & FIBER CONSTRUCTION

AREA DEPEND

Rural/agricultural area

Upland/hilly, mountainous area,

Delta Region

Suburban area

Urban or city

RELIABLE INFRASTRUCTURE

Strong Political commitment and Policies

Public and Private Corporation and Collaboration

Domestic and Foreign Investment

Support Program (CSR)

Effective Utilization of resources

REGULATION

Control over installation and operation of structures for roof

top/ground

Dealing with Municipal Corporations/Municipal

Council/MOH (Housing and Urban Development)

Ownership/Lease/Tenancy Right over the plot or building

Safety (health issues concerning radiation hazards)

Sign boards/Warning Signs

etc

Infrastructure Construction:

Tower & Fiber

Tower Facilities Organization (TFO) : National Tower Deployment Targets :

Q4 2014 = 6,000 total Rural & Urban Tower Sites

Q4 2015 = 10,000 total Rural & Urban Tower Sites

Q4 2016 = 13,000 total Rural & Urban Tower Sites

Q4 2020 = 20,000 total Rural & Urban Tower Sites

Wholesale Backbone Organization (WBO): Nationwide Fibre Backbone

Targets :

Q4 2014 = 10,000Kmtotal Fibre Optic Cable

Q4 2016 = 25,000Kmtotal Fibre Optic Cable

Q4 2020 = 50,000Kmtotal Fibre Optic Cable

Build Infrastructures where Competitors Fear to Tread (i.e. Rural Areas)

TOWER CONSTRUCTION

Constraint :

Quality ?

Skill Labor Issue ? / Material Availability ?

Time, Transportation, Terrain, Weather

Rules and Regulation / Adopt Clear Policies Frame Work

Public and Private Corporation and Collaboration

Electricity

Model Site Design

6 Model sites type are identified to standardize the

design process.

Special & extreme cases are excluded, special

solutions will be made on case by case basis.

Greenfield - Outdoor -45m Triangular

Greenfield - Outdoor - 60m Square Section

Tower

Greenfield - Outdoor 30m Mono Pole

Greenfield Outdoor 60m Guyed Mast

Rooftop Outdoor - 6m/9m Pole

Rooftop - Outdoor - Mast

Real Scenario

Site Clearing and Leveling

Earthworks

Tower Grounding

Cell Tower Construction & Erection

Design & Manufacture of Telecom

Towers and Monopoles

Supply and Installation of fully

equipped shelters

delivering electricity, air

conditioning and security

protection

Supply and Commissioning of

Generators

Site Fencing and Protection

TOWER INSTRALLATION

MANDATORY TOWER SHARING

Source : MCIT-2012

Harmonizing technologies is a key consideration for interoperability.

The single shared network would help the government meet its

aggressive rollout plans to be up and running in seven months,

and would avoid duplication of infrastructure.

FIBER CONSTRUCTION

Huge Requirement - 25,000 km in 3 years

Fiber constructed - 15,000 km Approx

OSP

Passive fiber Sharing ?

FIBER CONSTRUCTION

Considering the importance of creating a

nationwide robust infrastructure to support

broadband growth

Ensure No Duplication of Infrastructure

Ensure Efficient use of investments

Faster and Better coverage for customers

FIBER CONSTRUCTION

Constraint :

Civil costs vary between Rural and Urban

Skill Labor Issue ? / Material Availability ?

Time, Transportation, Terrain, Weather

Rules and Regulation / Adopt Clear Policies Frame

Work

Public and Private Corporation and Collaboration

Electricity

FIBER CONSTRUCTION

Constraint :

The rules regarding rights of ways

Space limitations within dense cities to build larger

POPs

Larger scale compressed roll-outs do result into

disturbing the city live through traffic issues

Company A

Company B

We hire a truck to carry goods city to city

Roads are Open Access

operators have access to main highway and local roads and use them as a

platform for competition,

they pay user fees,

If A does not provide service customers move to company B,

B is not told: Build your own Road

ROAD ANALOGY : COMMON BACKBONE & FACILITIES

Source : Hon. David Butcher

WHY DO IT IN TELECOMS ?

Telecom

and

New Emerging Economy

NATIONAL DEVELOPMENT CONCERN

Alternative Employment opportunities for urban and rural areas in order to

stem the flow of the rural population to the urban areas.

Stabilize & Secure the country by improving Socio-Eco developments.

Telecom & ICT enhancements to facilitate

Providing cost effective, uniform access throughout the whole country.

Targeting Zero Kyat connection fees and low services fees.

Beyond 2015 !!!

Various Studies show that National GDP growth rates increases by around 1

to 1.2% with every 10% increase in mobile telephone penetration.

Even specific services have been proven to increase GDP, such as Mobile

Banking (estimated increase in GDP growth rate of 0.6%).

Low / No cost SIM cards will ensure the maximum number of subscribers.

A Low / No cost SIM card could lead to a 50% penetration rate in 2015,

adding Billions of USD to the annual GDP and significant tax revenues.

For every employee of the mobile network company, 8-10 jobs will be

created in support services.

In Myanmar this could add up to 300,000 mobile related jobs.

ICT DEVELOPMENTS FACILITATE NATIONAL GROWTH

THANK YOU

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Solid Waste ManagementDocumento2 pagineSolid Waste ManagementYe PhoneNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Your Phone Is Your Phone IsDocumento30 pagineYour Phone Is Your Phone IsYe PhoneNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Green Cities GGP3Documento35 pagineGreen Cities GGP3Ye PhoneNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- 4est B1G502Documento38 pagine4est B1G502Ye PhoneNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Introduction To Public Private PartnershipsDocumento25 pagineIntroduction To Public Private PartnershipsYe PhoneNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Ukuku Lodge Feasibility Study-2Documento32 pagineUkuku Lodge Feasibility Study-2Ye PhoneNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Uiwang ICD - Republic of KoreaDocumento29 pagineUiwang ICD - Republic of KoreaYe PhoneNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Yangon Land Use Building Height Zoning Plan1Documento47 pagineYangon Land Use Building Height Zoning Plan1Ye PhoneNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Presentation - ASEAN Economic Community - ImplicatiDocumento30 paginePresentation - ASEAN Economic Community - ImplicatiYe PhoneNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- PVTM SEA - Post-Show Report 1.1Documento13 paginePVTM SEA - Post-Show Report 1.1Ye PhoneNessuna valutazione finora

- Building A Network of Mobile Money AgentsDocumento11 pagineBuilding A Network of Mobile Money AgentsYe PhoneNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- PPP and Dry Port - Cambodian PresentationDocumento13 paginePPP and Dry Port - Cambodian PresentationYe PhoneNessuna valutazione finora

- Webmaster Career Starter 2nd PDFDocumento197 pagineWebmaster Career Starter 2nd PDFSparkWeb SolutionsNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Univar Chemcare SolutionsDocumento4 pagineUnivar Chemcare SolutionselirancoolNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Preamble To The Bill of QuantitiesDocumento2 paginePreamble To The Bill of QuantitiesMostafa KamelNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- CODEMagazine 2019 SeptemberOctoberDocumento76 pagineCODEMagazine 2019 SeptemberOctoberAnonymous ze7rq2QKyNessuna valutazione finora

- MIT 2016 Report of ResearchDocumento44 pagineMIT 2016 Report of ResearchMuhammad SalmanNessuna valutazione finora

- Cost Confirmation Table: Final Exams Assignment ModelDocumento7 pagineCost Confirmation Table: Final Exams Assignment ModelJewelyn C. Espares-CioconNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Catálogo Safety (Junho 2010)Documento852 pagineCatálogo Safety (Junho 2010)Robison Raniere MartinsNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Review - Module I - Understanding ValueDocumento72 pagineReview - Module I - Understanding ValueRavi RakeshNessuna valutazione finora

- Pipe Spinner Mark-30Documento119 paginePipe Spinner Mark-30Bodega 3001100% (1)

- P-Mech Exhibitors ListDocumento5 pagineP-Mech Exhibitors Listsuraj pandeyNessuna valutazione finora

- BillDocumento8 pagineBillshaikhusmana5Nessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- U4E TransformersGuide 201711 FinalDocumento103 pagineU4E TransformersGuide 201711 FinalMateo A. Cortés100% (1)

- Link 2Documento4 pagineLink 2raza887Nessuna valutazione finora

- Chapter 1Documento46 pagineChapter 1Momentum Press100% (3)

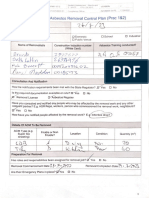

- Attachment 2 - Asbestos Removal Control Plan (Prac 182) : RiardaDocumento3 pagineAttachment 2 - Asbestos Removal Control Plan (Prac 182) : RiardaadlydhylaNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Week 10 - Nonlinear Structural Analysis - Lecture PresentationDocumento42 pagineWeek 10 - Nonlinear Structural Analysis - Lecture Presentationchavico113Nessuna valutazione finora

- Tour and Andersson MD60 SpecificationsDocumento14 pagineTour and Andersson MD60 SpecificationsblindjaxxNessuna valutazione finora

- Belts Failure Book Final CE8149Documento16 pagineBelts Failure Book Final CE8149vulpinorNessuna valutazione finora

- Software Testing FundamentalsDocumento5 pagineSoftware Testing FundamentalsSuman PravallikaNessuna valutazione finora

- Case Study Business Laundry ShopDocumento13 pagineCase Study Business Laundry ShopKrisha Ann RosalesNessuna valutazione finora

- CGD IntroductionDocumento48 pagineCGD IntroductionManav Modi0% (1)

- Cerrejón Achieves World-Class Coal Mining With End-To-End Gemcom Minex SolutionDocumento3 pagineCerrejón Achieves World-Class Coal Mining With End-To-End Gemcom Minex SolutionJorge Eliecer Acevedo SilvaNessuna valutazione finora

- Weekly Project Reporting Dash Board - Rev 1Documento7 pagineWeekly Project Reporting Dash Board - Rev 1Ajaya KumarNessuna valutazione finora

- Cemfil Sprayguide WW 12 2008 Rev1Documento32 pagineCemfil Sprayguide WW 12 2008 Rev1freidorNessuna valutazione finora

- PreviewDocumento8 paginePreviewAnh Tuan PhamNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Product Manual 02879 (Revision B) : 723PLUS Digital Speed Control For Reciprocating Engines - Analog Load SharingDocumento176 pagineProduct Manual 02879 (Revision B) : 723PLUS Digital Speed Control For Reciprocating Engines - Analog Load SharingmasudalamNessuna valutazione finora

- Shantilal Shah Engineering College, Bhavnagar: Submission of Proposal For Project/ModelDocumento7 pagineShantilal Shah Engineering College, Bhavnagar: Submission of Proposal For Project/Modelparth patelNessuna valutazione finora

- Pipeline Integrity ManagementDocumento44 paginePipeline Integrity Managementnani1983100% (4)

- BRC Food Safety and Quality Management System New Issue 7Documento29 pagineBRC Food Safety and Quality Management System New Issue 7Tiên ThủyNessuna valutazione finora

- Building Appraisal Platinum Plaza BhopalDocumento6 pagineBuilding Appraisal Platinum Plaza BhopalNiteesh Kumar Patel0% (1)