Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Faysal Internship Report

Caricato da

DileepHarani0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

47 visualizzazioni16 pagine.

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documento.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

47 visualizzazioni16 pagineFaysal Internship Report

Caricato da

DileepHarani.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 16

DEDICATION

I dedicate all my efforts and struggles of the educational life of my dear

PARENTS who help support and guide the course of my educational

life, without them Im meaningless.

Also I devote the work of this internship report on FAYSAL BANK

LTD, as respectable and honorable teachers who teach and support me

develop my personality as a competent professional.

And also this internship report on bank dedicated to all STUDENTS.

ACKNOWLEDGMENT

By the grace of ALLAH almighty, who has enabled me to do this entailing hard work. It is a matter of

pleasure and privilege for me to complete the internship and also to complete this internship report on

Faysal Bank, Mirpur Khas Branch.

I would like to thank Mr. Murtaza Jamali Manager of Faysal Bank Mirpur Khas Branch who allowed me

to work with their team. I am most humbly thankful to all the employees of Faysal Bank Mirpur Khas

Branch and especially to these personalities for their continuous support and precious time with me.

Mr. Muhammad Asif Malik(OM)

Mr. Muhammad Ayaz

Mr. Parvaiz Rajpal

Mr. Karan Kumar

Mr. Bahadur Lashari

Mr. Naeem

Mr. Qalb-e-Hussain

Ms. Tanya Lateef

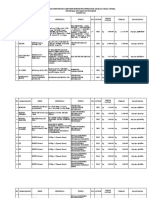

TABLE OF CONTENTS

CONTENTS PG:NO

Executive Summary

CHAPTER # 1 : INTRODUCTION OF BANKING SECTOR

Introduction of bank

Meaning of bank

History of banking in pakistan

CHAPTER # 2 : INTRODUCTION OF ORGANIZATION

Introduction of faysal bank ltd

History of faysal bank ltd

Vision of faysal bank ltd

Mission of faysal bank ltd

Capital and ownership

Conformity to islamic shariaa

Board of director

CHAPTER # 3: ORGANIZATIONAL STRUCTURE

Organization structure of faysal bank

General profile of fbl

Structural dimension

Formalization

Specialization

Standardization

Hierarchy of authority

Centralization

Complexity

professionalism

Orgranogram at the head office level

Orgranogram at the branch level

Different department of fbl

Operations department

Agri-financ department

Credit administration department

Marketing department

Consumer & finance department

Documentary credit and foreign trade department

Clearing department

CONTENTS PG:NO

CHAPTER # 4: PRODUCTS AND SERVICES

Products offering

Deposite product (Accounts)

1. Faysal saving account

2. Rozana munafa plus account

3. Basic banking account

4. Faysal moavin

5. Faysal premium

6. Faysal izafa

7. Mahfooz sarmaya

8. FCY saving plus

Consumer finance products

1. Faysal car financing

2. Faysal house finance

3. Faysal financ

Coroperate and investment banking

1. Coroperate financing

2. Sme financ

3. Trade financing

4. Treasury and capital market

5. Investment banking

6. Agriculture financing

7. Cash management

Service offering

Pocket mate visa debit card

Travellers cheques

Transfer of funds

Safe deposite locker

Non stop banking

Chapter # 5 : SWOT ANALYSIS

Strenghts

Weakness

opportunities

threats

CHAPTER # 6 : MAJOR ACTIVITIES PERFORM DURING INTERNSHIP

Experience of working on different

General banking account opening

1. Bills abd remittance

2. Deposite deparment

3. Cash department

Credits and advance department

Agriculture department

Western union and locker service department

Housing department

Auti department

Card department

CONCULSION

RECOMENDATION

BIBLIOGRAPHY

EXECUTIVE SUMMARY

Pakistan after getting its independence, did not inherit a strong banking industry andsince then saw a

number of events in the industry, like the nationalization of banks in the1970s. However today, the

banking industry of Pakistan has been growing over the past fewyears, mainly because of the consistent

policies implemented by the Government of Pakistan,including the privatization of banks in Pakistan.

Also the State Bank of Pakistans, monetary policy has been very friendly toward the banking industry.

There are a number of different banks established in Pakistan, including localincorporated commercial

banks, foreign incorporated commercial banks, development financialinstitutions, investment banks,

housing finance companies, micro finance banks and Islamic banks.Faysal Bank Limited (FBL) started its

operations in 1995 as a local bank of Pakistan.On January 1, 2002, Al Faysal Investment Bank Limited,

another group entity in Pakistan,merged into Faysal Bank Limited which resulted in a larger institution.

The majority shareholding of Faysal Bank Limited is held by Ihtmaar Bank B.S.C an investment bank

listed inBahrain, while it has one subsidiary i.e. Faysal Management Services (Pvt.) Limited (FMSL).The

company is committed to its clients' best interests as well as preserving a goodrelationship

by defining realistic objectives. Faysal Bank is continuously innovating, deliverycreative and high-quality

solutions which fit best its clients needs.It maintains a high ethical standards and unconditional

compliance with regulations andlaws

It values its integrity and actively promotes the know your customer policy

amongstFaysal employees to ensure that the company is not involved in any money laundry

operation.Hi r i ng and r et ai ni ng t he bes t peopl e whi l e r es pec t i ng di ver s i t y, enc our

agi ng s el f improvement, recognizing and rewarding merit are the key values of Faysal Bank.

CHAPTER # 1

INTRODUCTION OF

BANKING SECTOR

INTRODUCTION OF BANKING SECTOR

INTRODUCTION OF BANK:

A bank is a financial institution which deals with deposit and advances and other related services. It

receives money from those who want save it the form of deposit and it lends money to those who need

it.

MEANING OF BANK:

The word bank is of a European ori gi n and is driven from Italian word BANCO which

means a table or a counter.

HISTORY OF BANKING IN PAKISTAN:

History of Banking in Pakistan starts from the partition of Indo-Pakistan sub continent in August, 1947.

At that time, the areas consisting Pakistan had 631 offices of 45 scheduled banks out of which 487 were

located in West Pakistan and 114 in East Pakistan which was also served by 500 offices of small and non-

scheduled banks. There were 19 branches of foreign banks in Pakistan but they had a very limited role to

play.

Just after the partition, the Indian bankers started immigrating and shifting the head offices of their banks

and capital to India. It caused a great set back to the banking field in Pakistan, and resulted in decline in

the number of offices in schedule bank from 631 to 195 by 30th June, 1948. The West Pakistan the

number fell from 487 to 81 in East Pakistan from 144 to 69 by 30th June, 1951. Among these Habib Bank

Ltd., with 25 offices and Australia Bank Ltd. with 19 offices were institutions run by Muslims who shifted

their head offices to Pakistan.

after the consultation of two government the Reserve Bank of India was asked to finish the agreement

from 30th June instead of from 30th September,1948. So the Government of Pakistan decided to

establish the State Bank of Pakistan as its central bank from 1st July, 1948.

The State Bank of Pakistan's policy encouraged expansion in established banks, establishment of new

banks, and weeding out of unsound banks just to faster the growth of banking system in the country.

On January 1, 1974 the Government of Pakistan nationalize all the Pakistani scheduled banks including

State Bank of Pakistan, industrial bank of Pakistan, Agricultural Development bank of Pakistan through

the bunk- nationalization act, 1974 to achieve the desired objectives.

The federal Government also set up a Pakistan Banking Council on March 21, 1974 to look after the

organizational and operational matters including evaluation and progress of the nationalized commercial

banks.

CHAPTER # 2

INTRODUCTION OF

ORGANIZATION

INTRODUCTION OF ORGANIZATION

INTRODUCTION OF FAYSAL BANK LIMITED:

Faysal Bank Limited (Bank) was incorporated in Pakistan on October 03, 1994 as a public quoted

company listed on Karachi & Lahore stock Exchanges. The six Pakistan branches of Faysal Islamic Bank of

Bahrain E.C. amalgamated with the Bank when it commenced business operations effective January

01,1995.

HISTORY OF FAYSAL BANK LIMITED:

Faysal Bank started operations in Pakistan in 1987, first as a branch set-up of FaysalIslamic Bank of

Bahrain and then in 1995 as a locally incorporated Pakistani bank under the present name of Faysal Bank

Limited. On January 1, 2002, Al Faysal Investment Bank Limited, another group entity in Pakistan,

merged into Faysal Bank Limited which resulted in alarger, stronger and much more versatile

institution.Faysal Bank Limited is a full service banking institution offering consumer, corporateand

investment banking facilities to its customers. The Bank's widespread and growing network of branches

in the four provinces of the country and Azad Kashmir, together with its corporateoffices in major cities,

provides efficient services in an effective manner.The strength and stability of Faysal Bank Limited is

evident through the Credit Ratingassigned by JCR-VIS Credit Rating Company Limited of "AA" (Double

A) for long to mediumterm and "A-1+" (A One Plus) for short term.The majority share holding of Faysal

Bank Limited is held by Ithmaar Bank B.S.C aninvestment bank listed in Bahrain.

VISION OF FAYSAL BANK LIMITED:

Excellence in all that we do.

MISSION OF FAYSAL BANK LIMITED:

Faysal Bank shares its mission statement with the DMI Trust. Our mission being The introduction of a

just and equitable financial system by being a world class multi-purpose financial institution, providing a

range of specialized services, working on Shariah principles.

CAPITAL AND OWNERSHIP:

The majority share holding of faysial bank limited is owned by companies of Dar Al Maal Islami Trust

(DMI)including Shami bank of bahrain E.C. the remaining shareholder comprise of the general public,

NIT and other institution the bank share are quoted on the karachi abd lahore stock exchange.

CONFORMITY TO ISLAMIC SHARIAA:

The Holy Quran outlines for Muslims a complete code of life for dealing individually or collectively. This

is future amplified by saying and practice of Holy Profit(May be upon him) From these guidelines , an

Islamic economic system can be elaborated upon, aimed at creating a socially, economically and

politically viable and just environment supporting the universal well being of humanity

In this context all functions of the bank are performed in strict adherence to the principles of Islamic

Shariaa. In order to ensure such conformity of Shariaa, the Bank operations are checked and monitored

by its Religion Supervisory Board to whom the management reportsperiodically. In case of new

operations and activities prior approval of Religious Supervisory Board is invariably obtained by the bank

management.

The Religious Supervisory Board of the bank itself comprises eminent scholars of Islamic Shariaa from

Bahrain, Egypt, Saudi Arabia, Turkey, and Pakistan possessing in-death knowledge of the conditions in

which the Bank operates. The Groups Religion Board, composed also of many internationally renowned

Islamic Scholars, provides advice from time on issue that pertain to Group level implementation.

BOARD OF DIRECTOR:

These are member of board of director

Syed Naseem Ahmad (Chairman)

Naveed A.Khan (President & Co)

Graham Roderick Walker (Director)

Mohammad A. R. Hussain (Director)

Muhammad A Rahman Bucheerei (Director)

Farooq Rahmatullah (Director)

Tariq Iqbal Khan (Director)

Shahid Ahmad (Director).

CHAPTER # 3

ORGANIZATION

STRUCTURE

ORGANIZATION STRUCTURE

ORGANIZATION STRUCTURE OF FAYSAL BANK:

The organizatinal structure of faysal bank is functiional. Faysal bank has nation wide network of

branches. Most of the departments have been divided n the basis of structure of the organization

promotes economies of scale because all emploees are located in the same department and share the

same resources but this structure has also restricted coordination among the deparmentss and hence

lead to a lesser degree of invaction.A number of policies and procedure including the prudent risk

management have been put in place.

GENERAL PROFILE OF FAYSAL BANK LIMITED:

STRUCTURAL DIMENSION:

Structure dimension of faysal bank limited consist on,

Formalization

Specialization

Standardization

Hierarchy of authority

Centralization

Complexity

Professionalism

FORMALIZATION:

Faysal bank is highly formalized, the reason is that to have proper and quick data base of

customer,formalization is there. High formalization in faysl bank is specified o every employee in the

department but there is no rigidity found in this context, every employee is volunteer to help other.

Some rules are there, like to maintain the record of customer first or to deal customer fairly, no smoking

and the things which irriate the customers are not allowed, things are to be do in pleasant manners and

procedures are there to perform those rules.

SPECIALIZATION:

In to days dynamic environment and tough competition, bank need efficiency and have to perform

specialized tasks. There are many deparments In faysal bank and jobs are divided among the emploees

Company profile Faysal bank limited

Ticker FAYL

Exchanges LSE,KSE,ISE

2009 profit 476392000

Major industry Financial

Sub industry Commerical bank

Country Pakistan

Emploees branches 5000 approximately

Website www.faysalbank.com

of each department. As every department is performing its task separetely. The emploees are highly

efficient in performing their work in the specialized environment.

STANDARDIZATION:

In faysal bank, standardization is there. There are standard rules and procedures defined by the top

management for execution. Of the tasks. The organization of the standards keeps every employee

aware of the procedure adopted during different situations.

HIERARCHY OF AUTHORITY:

Hierarchy of authority of faysal bank is short because there are so many people working

under the supervision of one person, so that span of control is wi de.

CENTRALIZATION:

In faysal bank centralization is high and the goal are set by top management and low level management

just working according to the guideline provide by top management.

COMPLEXITY:

In faysal bank vertical complexity is low and horizontal complexity is high because of varity or activities

performed and number of department are in the bank.

PROFESSIONALISM:

Professionalism is high in faysal bank. After every 3 month employee are trained under the experience

and skills researchers in the terms of eductaion, career developmet,above all,and ethics traning.

ORGRANOGRAM AT THE HEAD OFFICE LEVEL:

Board Of Director

Chief Excutive

Area Manager

South

Area Manager

North

Excutive incharge

Excutive

ORGRANOGRAM AT THE BRANCH LEVEL:

BM (M Yahya)

M Yahya

FM (Vacant)

CM (Ahsan

Iqbal Shekh

SPBO

(Ali Naqvi)

PBO

(Khalil Tahir)

PBO (Amir Ali

Dogar)

CSO 1 (Adrish

Iqtadar

CSO 2 (Rabia

Shafqat)

CSO Asset

(M Bilal Bari)

CSO 3

(Shabnam)

Raiz)

TPO (Maryam

Shazadi)

YIDER

(Yasmeen)

LOCKER OFFICER

(Faiza)

OPS SUPPORT

OFFICER (Ali)

RO

(Sadiq Ahmed)

TELLER 1

(Ehtesham)

SUB CASHER

(SORTER)

TELLER 3

(M.Umer)

TELLER 2

(Ramzan)

Anjum

MESSANGER

(vacant)

MESSANGER

(Khurshyd)

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Chestionar 2Documento5 pagineChestionar 2Alex AndruNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- BA 4722 Marketing Strategy SyllabusDocumento6 pagineBA 4722 Marketing Strategy SyllabusSri GunawanNessuna valutazione finora

- Tender Notice Latifa Bad DispensaryDocumento1 paginaTender Notice Latifa Bad DispensaryDileepHaraniNessuna valutazione finora

- Application Form For Sanction of Marriage Grant: Appendix - ADocumento5 pagineApplication Form For Sanction of Marriage Grant: Appendix - ADileepHaraniNessuna valutazione finora

- Executive Summary of Candia Milk ProjectDocumento41 pagineExecutive Summary of Candia Milk ProjectDileepHarani40% (5)

- Me Problems Chapter No.14Documento6 pagineMe Problems Chapter No.14DileepHaraniNessuna valutazione finora

- Name: Muhammad Boota ROLL NO: 2k11/BBA/21 Class: Bba-Iv Date: 04/02/2014 Submit To: Mam MehwishDocumento9 pagineName: Muhammad Boota ROLL NO: 2k11/BBA/21 Class: Bba-Iv Date: 04/02/2014 Submit To: Mam MehwishDileepHaraniNessuna valutazione finora

- Main Contours of Federal Budget 2011-2012: A Brief For ParliamentariansDocumento15 pagineMain Contours of Federal Budget 2011-2012: A Brief For ParliamentariansDileepHaraniNessuna valutazione finora

- Chapter No: 07: Cost Theory & AnalysisDocumento4 pagineChapter No: 07: Cost Theory & AnalysisDileepHaraniNessuna valutazione finora

- Threats To E-Commerce Servers-Part I: Overview of ArticleDocumento5 pagineThreats To E-Commerce Servers-Part I: Overview of ArticleDileepHaraniNessuna valutazione finora

- TQM AssignmentDocumento9 pagineTQM AssignmentDileepHaraniNessuna valutazione finora

- Name of Project Green Lines Tours & Travelers Transport Service Class AssignmentDocumento13 pagineName of Project Green Lines Tours & Travelers Transport Service Class AssignmentDileepHaraniNessuna valutazione finora

- Threats To E-Commerce Servers-Part II: Ravi DasDocumento2 pagineThreats To E-Commerce Servers-Part II: Ravi DasDileepHaraniNessuna valutazione finora

- The Consumer Decision Process: Need RecognitionDocumento10 pagineThe Consumer Decision Process: Need RecognitionDileepHaraniNessuna valutazione finora

- Ecommerce in Today'S MarketDocumento7 pagineEcommerce in Today'S MarketDileepHaraniNessuna valutazione finora

- OB11 - 01st What Is Organizational BehaviorDocumento25 pagineOB11 - 01st What Is Organizational BehaviorDileepHaraniNessuna valutazione finora

- Letter of CreditDocumento30 pagineLetter of CreditDileepHarani100% (1)

- Information Systems in Business: SoftwareDocumento38 pagineInformation Systems in Business: SoftwareDileepHaraniNessuna valutazione finora

- Transposable Elements - Annotated - 2020Documento39 pagineTransposable Elements - Annotated - 2020Monisha vNessuna valutazione finora

- Key Performance Indicators - KPIsDocumento6 pagineKey Performance Indicators - KPIsRamesh Kumar ManickamNessuna valutazione finora

- AAR Shell ProgrammingDocumento13 pagineAAR Shell ProgrammingMarimuthu MuthaiyanNessuna valutazione finora

- Malling DemallingDocumento25 pagineMalling DemallingVijay KumarNessuna valutazione finora

- Economizer DesignDocumento2 pagineEconomizer Designandremalta09100% (4)

- STARCHETYPE REPORT ReLOADED AUGURDocumento5 pagineSTARCHETYPE REPORT ReLOADED AUGURBrittany-faye OyewumiNessuna valutazione finora

- Advanced Physiotherapeutic SyllabusDocumento1 paginaAdvanced Physiotherapeutic SyllabusAnup SharmaNessuna valutazione finora

- Physico-Chemical Properties of Nutmeg (Myristica Fragrans Houtt) of North Sulawesi NutmegDocumento9 paginePhysico-Chemical Properties of Nutmeg (Myristica Fragrans Houtt) of North Sulawesi NutmegZyuha AiniiNessuna valutazione finora

- IPS PressVest Premium PDFDocumento62 pagineIPS PressVest Premium PDFLucian Catalin CalinNessuna valutazione finora

- Wins Salvacion Es 2021Documento16 pagineWins Salvacion Es 2021MURILLO, FRANK JOMARI C.Nessuna valutazione finora

- Electromagnetism WorksheetDocumento3 pagineElectromagnetism WorksheetGuan Jie KhooNessuna valutazione finora

- ICU General Admission Orders: OthersDocumento2 pagineICU General Admission Orders: OthersHANIMNessuna valutazione finora

- AMO Exercise 1Documento2 pagineAMO Exercise 1Jonell Chan Xin RuNessuna valutazione finora

- Learning TheoryDocumento7 pagineLearning Theoryapi-568999633Nessuna valutazione finora

- SXV RXV ChassisDocumento239 pagineSXV RXV Chassischili_s16Nessuna valutazione finora

- SahanaDocumento1 paginaSahanamurthyarun1993Nessuna valutazione finora

- Medabots-Rokusho Version (European) - Medal Codes (Part 1) (GBA Cheats) - CodeTwink ForumsDocumento5 pagineMedabots-Rokusho Version (European) - Medal Codes (Part 1) (GBA Cheats) - CodeTwink Forumsdegraded 4resterNessuna valutazione finora

- Report-Smaw Group 12,13,14Documento115 pagineReport-Smaw Group 12,13,14Yingying MimayNessuna valutazione finora

- Instruction Manual 115cx ENGLISHDocumento72 pagineInstruction Manual 115cx ENGLISHRomanPiscraftMosqueteerNessuna valutazione finora

- Mangement of Shipping CompaniesDocumento20 pagineMangement of Shipping CompaniesSatyam MishraNessuna valutazione finora

- Rab Sikda Optima 2016Documento20 pagineRab Sikda Optima 2016Julius Chatry UniwalyNessuna valutazione finora

- Hydraulics and PneumaticsDocumento6 pagineHydraulics and PneumaticsRyo TevezNessuna valutazione finora

- BSDDocumento26 pagineBSDEunnicePanaliganNessuna valutazione finora

- RevlonDocumento13 pagineRevlonSarosh AtaNessuna valutazione finora

- ArrowrootDocumento8 pagineArrowrootSevi CameroNessuna valutazione finora

- Ransomware: Prevention and Response ChecklistDocumento5 pagineRansomware: Prevention and Response Checklistcapodelcapo100% (1)

- Icici PrudentialDocumento52 pagineIcici PrudentialDeepak DevaniNessuna valutazione finora

- 2.1 DRH Literary Translation-An IntroductionDocumento21 pagine2.1 DRH Literary Translation-An IntroductionHassane DarirNessuna valutazione finora