Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Dow Jones-UBS Commodity Index PDF

Caricato da

Lucero GarciaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Dow Jones-UBS Commodity Index PDF

Caricato da

Lucero GarciaCopyright:

Formati disponibili

Hard Red Winter Wheat and Soybean Meal Futures Contracts Added to the Index

NEW YORK (Oct ober 24, 2012) S&P Dow J ones Indices and UBS Investment Bank announced today new

target weightings for the Dow J ones-UBS Commodity Index and the addition of the Hard Red Winter Wheat

and Soybean Meal futures contracts as new components of the Index. Changes to the Index are scheduled to

be effective in J anuary 2013.

The Dow J ones-UBS Commodity Index Supervisory Committee cited several factors for adding the two

additional futures contracts to the Index. For the Hard Red Winter Wheat contract, which is traded on the

Kansas City Board of Trade, the increase in dollar volume traded on both an absolute and relative basis

contributed to its inclusion in the Index. The inclusion of the Soybean Meal futures contract now puts the entire

soybean complex into the Index. The addition of both contracts contributes to the diversification of the Index,

one of the core principles underlying its design and construction.

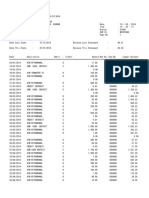

Target weightings of all Dow J ones-UBS Commodity Index components for 2013, as well as their comparative

weights in 2012, are listed below:

2013 Target Weights 2012 Target Weights

Natural Gas 10.4235920% 10.7651090%

WTI Crude Oil 9.2058850% 9.6871640%

Brent Crude 5.7941150% 5.3128360%

Unleaded Gasoline 3.4613410% 3.4059820%

Heating Oil 3.5193580% 3.4595290%

Live Cattle 3.2834170% 3.6349880%

Lean Hogs 1.8997650% 2.1126600%

Wheat 3.4332700% 4.9618090%

KCBT Wheat 1.3206450% 0.0000000%

Corn 7.0531450% 6.6705200%

Soybeans 5.4947720% 7.0841970%

Soybean Oil 2.7426180% 3.3723860%

Soy Meal 2.6066650% 0.0000000%

Aluminum 4.9131960% 5.8767470%

Copper 7.2773320% 7.0639490%

Zinc 2.5192160% 3.1187350%

Nickel 2.2436190% 2.5798400%

Gold 10.8186130% 9.7936330%

Silver 3.8975030% 2.7691330%

Sugar 3.8839680% 3.7583900%

Cott on 1.7658200% 2.0000000%

Coff ee 2.4421460% 2.5723950%

The target weights are determined in accordance with construction rules described in the Dow J ones-UBS

Commodity Index Handbook. These rules generally account for liquidity and production data in a 2:1 ratio,

subject to further requirements for diversification and minimum weightings. The Supervisory Committee decided

to relax the rule limiting the weight reduction to no lower than 2% due to the liquidity ratio constraint application.

The commodities with target weights for 2013 falling under 2% are Lean Hogs, KCBT Wheat, and Cotton. The

resulting weights will be used to determine the Dow J ones-UBS Commodity Index Multipliers for 2013. These

Multipliers, computed once a year in J anuary, are factors used to express the percentage weights in U.S.

dollar-denominated terms when calculating the Index.

Launched in 1998, the Dow J ones-UBS Commodity Index family includes the benchmark Dow J ones-UBS

Commodity Index, 28 single commodity indices and indices for various commodity sectors, as well as indices

Awards (20)

Component Change (375)

Event (3)

Index Launch (135)

Index Review (80)

Methodology Change (5)

Notices (1)

Partnership (19)

Press Release (349)

Product Announcement (96)

Email: media@djindexes.com

New York

T: +1 212 597 5720

F: +1 212 301 4708

London

T: +44 203 379 3804

F: +44 203 379 3888

Home 2013 Weights for the DowJ ones-UBS Commodity IndexAnnounced by S&P DowJ ones Indices and UBS Investment Bank

Dow Jones Indexes Press Room| 2013 Weights for the Dow Jones-UBS ... http://press.djindexes.com/index.php/2013-weights-for-the-dow-jones-ub...

1 de 2 20/12/2012 10:13 a.m.

that exclude one or more sectors. Also available are multiple modified-roll indices, including forward-month

indices and the Dow J ones-UBS Roll Select Commodity Index. Each of these indices is available in both excess

return and total return versions, and select indices are available in multiple currencies and currency hedged

versions. The series also includes the Dow J ones-UBS Commodity Spot Index and spot indices for each of the

commodity sectors. As of December 31, 2011, an estimated $74.2 billion in assets tracked the Dow

J ones-UBS Commodity Index family.

###

Journalists may e-mail questions regarding this press release to or contact Dow Jones Indexes press

office:

New York: +1-212-597-5720

London: +44-20-7796-7247

About Dow J ones Indexes

Dow J ones Indexes is a leading full-service index provider that develops, maintains and licenses indexes for use

as benchmarks and as the basis of investment products. Best-known for the Dow J ones Industrial Average,

Dow J ones Indexes offers more than 130,000 equity indexes as well as fixed-income and alternative indexes,

including measures of hedge funds, commodities and real estate. Dow J ones Indexes employs clear, unbiased

and systematic methodologies that are fully integrated within index families. Dow J ones Indexes is the

marketing name for CME Group Index Services LLC, a joint venture company which is owned 90 percent by

CME Group Inc. and 10 percent by Dow J ones & Company, Inc., a News Corporation company (NASDAQ:

NWS, NWSA; ASX: NWS, NWSLV).

"DowJ ones," "DowJ ones Indexes," and all other indexnames listed above are service marks of DowJ ones Trademark Holdings

LLC ("DowJ ones"), and have been licensed for use by CME Group IndexServices LLC ("CME Indexes").

About UBS

UBS draws on its 150-year heritage to serve private, institutional and corporate clients worldwide, as well as

retail clients in Switzerland. We combine our wealth management, investment banking and asset management

businesses with our Swiss operations to deliver superior financial solutions and manage CHF 2.2 trillion in

invested assets. UBS is present in all major financial centers worldwide. It has offices in over 50 countries, with

about 37% of its employees working in the Americas, 37% in Switzerland, 16% in the rest of Europe and 10%

in Asia Pacific. UBS employs about 65,000 people around the world. Its shares are listed on the SIX Swiss

Exchange and the New York Stock Exchange (NYSE).

Posted in: Press Release

Tagged as: commodity, UBS, UBS Commodity Index

Contact Us Terms & Conditions Privacy Policy For Advertisers Help/FAQ Home

Copyright 2012 by S&P/DowJ ones Indices LLC, a subsidiary of The McGraw-Hill Companies. All rights reserved.

Dow Jones Indexes Press Room| 2013 Weights for the Dow Jones-UBS ... http://press.djindexes.com/index.php/2013-weights-for-the-dow-jones-ub...

2 de 2 20/12/2012 10:13 a.m.

Potrebbero piacerti anche

- JPM Weekly MKT Recap 7-23-12Documento2 pagineJPM Weekly MKT Recap 7-23-12Flat Fee PortfoliosNessuna valutazione finora

- JPM Weekly MKT Recap 3-05-12Documento2 pagineJPM Weekly MKT Recap 3-05-12Flat Fee PortfoliosNessuna valutazione finora

- JPM Weekly MKT Recap 2-27-12Documento2 pagineJPM Weekly MKT Recap 2-27-12Flat Fee PortfoliosNessuna valutazione finora

- JPM Weekly Commentary 01-02-12Documento2 pagineJPM Weekly Commentary 01-02-12Flat Fee PortfoliosNessuna valutazione finora

- JPM Weekly MKT Recap 10-1-12Documento2 pagineJPM Weekly MKT Recap 10-1-12Flat Fee PortfoliosNessuna valutazione finora

- Project 2 Mbaf 502Documento8 pagineProject 2 Mbaf 502Chukka VinayNessuna valutazione finora

- JPM Weekly Commentary 01-16-12Documento2 pagineJPM Weekly Commentary 01-16-12Flat Fee PortfoliosNessuna valutazione finora

- JPM Weekly Commentary 01-09-12Documento2 pagineJPM Weekly Commentary 01-09-12Flat Fee PortfoliosNessuna valutazione finora

- JPM Weekly MKT Recap 10-15-12Documento2 pagineJPM Weekly MKT Recap 10-15-12Flat Fee PortfoliosNessuna valutazione finora

- JPM Weekly MKT Recap 5-14-12Documento2 pagineJPM Weekly MKT Recap 5-14-12Flat Fee PortfoliosNessuna valutazione finora

- DBC Fact SheetDocumento2 pagineDBC Fact SheetLincoln WebberNessuna valutazione finora

- JPM Weekly MKT Recap 3-19-12Documento2 pagineJPM Weekly MKT Recap 3-19-12Flat Fee PortfoliosNessuna valutazione finora

- (1.1) Returns and RisksDocumento14 pagine(1.1) Returns and Riskspv007rocksNessuna valutazione finora

- JPM Weekly MKT Recap 4-23-12Documento2 pagineJPM Weekly MKT Recap 4-23-12Flat Fee PortfoliosNessuna valutazione finora

- JPM Weekly MKT Recap 9-24-12Documento2 pagineJPM Weekly MKT Recap 9-24-12Flat Fee PortfoliosNessuna valutazione finora

- Alcatel Historique TelephonieDocumento4 pagineAlcatel Historique Telephonieissam hmirouNessuna valutazione finora

- Global Aggregate Index FactsheetDocumento7 pagineGlobal Aggregate Index FactsheetAlvin JeeawockNessuna valutazione finora

- IBM2Documento16 pagineIBM2Mr Sanjay RajputNessuna valutazione finora

- 2012 Outlook: Australian Equity StrategyDocumento36 pagine2012 Outlook: Australian Equity StrategyLuke Campbell-Smith100% (1)

- UntitledDocumento47 pagineUntitledapi-228714775Nessuna valutazione finora

- Equity Research: BUY Case On UBS HOLD CSDocumento47 pagineEquity Research: BUY Case On UBS HOLD CScormacleechNessuna valutazione finora

- JPM Weekly MKT Recap 9-10-12Documento2 pagineJPM Weekly MKT Recap 9-10-12Flat Fee PortfoliosNessuna valutazione finora

- JPM Bond CDS Basis Handb 2009-02-05 263815Documento92 pagineJPM Bond CDS Basis Handb 2009-02-05 263815ccohen6410100% (1)

- Asian Economic Integration Report 2023: Advancing Digital Services Trade in Asia and the PacificDa EverandAsian Economic Integration Report 2023: Advancing Digital Services Trade in Asia and the PacificNessuna valutazione finora

- EdisonInsight February2013Documento157 pagineEdisonInsight February2013KB7551Nessuna valutazione finora

- JPM Weekly MKT Recap 10-08-12Documento2 pagineJPM Weekly MKT Recap 10-08-12Flat Fee PortfoliosNessuna valutazione finora

- Inside the Currency Market: Mechanics, Valuation and StrategiesDa EverandInside the Currency Market: Mechanics, Valuation and StrategiesNessuna valutazione finora

- Practice Essentials Understanding Commodities and The SP GsciDocumento7 paginePractice Essentials Understanding Commodities and The SP GsciPhilip LeonardNessuna valutazione finora

- Lighthouse Weekly Chart Window - 2013-07-15Documento15 pagineLighthouse Weekly Chart Window - 2013-07-15Alexander GloyNessuna valutazione finora

- Methodology SP GsciDocumento89 pagineMethodology SP GsciDiego PolancoNessuna valutazione finora

- ValuEngine Weekly Newsletter May 4, 2012Documento9 pagineValuEngine Weekly Newsletter May 4, 2012ValuEngine.comNessuna valutazione finora

- CIIEconomy Update Dec 215,2013Documento5 pagineCIIEconomy Update Dec 215,2013Maanendra SinghNessuna valutazione finora

- FX Daily: Enjoy The Lifestyle While It LastsDocumento7 pagineFX Daily: Enjoy The Lifestyle While It LastscaxapNessuna valutazione finora

- Market Week - September 24, 2012Documento2 pagineMarket Week - September 24, 2012Janet BarrNessuna valutazione finora

- HSBC Hedge Fund Report 2013Documento598 pagineHSBC Hedge Fund Report 2013reedsmith001Nessuna valutazione finora

- ValuEngine Weekly Newsletter April 20, 2012Documento10 pagineValuEngine Weekly Newsletter April 20, 2012ValuEngine.comNessuna valutazione finora

- JPM Weekly MKT Recap 9-17-12Documento2 pagineJPM Weekly MKT Recap 9-17-12Flat Fee PortfoliosNessuna valutazione finora

- DB Oil and NoksekDocumento5 pagineDB Oil and Noksekjoesmith25Nessuna valutazione finora

- JPM Weekly MKT Recap 5-21-12Documento2 pagineJPM Weekly MKT Recap 5-21-12Flat Fee PortfoliosNessuna valutazione finora

- The ISO BSB Electronic Billing Statement: Status, Acceptance, AFP Code UsageDocumento27 pagineThe ISO BSB Electronic Billing Statement: Status, Acceptance, AFP Code UsageSumedha SoodNessuna valutazione finora

- Asteri Capital (Glencore)Documento4 pagineAsteri Capital (Glencore)Brett Reginald ScottNessuna valutazione finora

- Summary MIG November 2022Documento36 pagineSummary MIG November 2022Avi AswaniNessuna valutazione finora

- FX Study 2022 enDocumento40 pagineFX Study 2022 enДжон ПетровичNessuna valutazione finora

- SEB Report: New FX Scorecard Sees Swedish Currency StrengtheningDocumento44 pagineSEB Report: New FX Scorecard Sees Swedish Currency StrengtheningSEB GroupNessuna valutazione finora

- V. Financial Markets: Central Banks' Actions Revive Sentiments, But Risks RemainDocumento6 pagineV. Financial Markets: Central Banks' Actions Revive Sentiments, But Risks RemainravidraoNessuna valutazione finora

- Capricorn Fxg10 Fund: Market OverviewDocumento7 pagineCapricorn Fxg10 Fund: Market OverviewShahbaz AslamNessuna valutazione finora

- Jyske Bank Jul 21 Equities DailyDocumento7 pagineJyske Bank Jul 21 Equities DailyMiir ViirNessuna valutazione finora

- January NewsletterDocumento6 pagineJanuary NewsletterhowellstechNessuna valutazione finora

- JPM Weekly MKT Recap 8-13-12Documento2 pagineJPM Weekly MKT Recap 8-13-12Flat Fee PortfoliosNessuna valutazione finora

- Me 200Documento287 pagineMe 200yasirkhalidNessuna valutazione finora

- R AechDocumento2 pagineR AechreformhazNessuna valutazione finora

- 1909 Ausbil Unitholder Report PDFDocumento32 pagine1909 Ausbil Unitholder Report PDFTonyNessuna valutazione finora

- 2010 India Nov IPDocumento3 pagine2010 India Nov IPrahulitmNessuna valutazione finora

- Low Policy Rates Even Longer: Morning ReportDocumento3 pagineLow Policy Rates Even Longer: Morning Reportnaudaslietas_lvNessuna valutazione finora

- DBLCI Commodity Indices: DBIQ Index GuideDocumento14 pagineDBLCI Commodity Indices: DBIQ Index GuideCarlos Alberto Chavez Aznaran IINessuna valutazione finora

- Australian Monthly Chartbook - December 2012Documento20 pagineAustralian Monthly Chartbook - December 2012economicdelusionNessuna valutazione finora

- ReportDocumento9 pagineReportOrlan GaliyNessuna valutazione finora

- Packaging & Containers World Summary: Market Values & Financials by CountryDa EverandPackaging & Containers World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Major U.K. Banks Shift Focus From Repairs To Returns: Industry Report CardDocumento21 pagineMajor U.K. Banks Shift Focus From Repairs To Returns: Industry Report Cardapi-228714775Nessuna valutazione finora

- Individual & Family Service Revenues World Summary: Market Values & Financials by CountryDa EverandIndividual & Family Service Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- FF0406 01 Current State Vs Future State Slide Template 16x9 1Documento6 pagineFF0406 01 Current State Vs Future State Slide Template 16x9 1Lucero GarciaNessuna valutazione finora

- Secrets of Chess Training. School of Future Chess Champions 1 (Mark Dvoretsky, Artur Yusupov)Documento221 pagineSecrets of Chess Training. School of Future Chess Champions 1 (Mark Dvoretsky, Artur Yusupov)Lucero Garcia96% (26)

- Libro Introduccion A La Cibernetica Ashby PDFDocumento156 pagineLibro Introduccion A La Cibernetica Ashby PDFJorge Vladimir Pachas HuaytánNessuna valutazione finora

- 7 Deadly Innocent Frauds, Warren Mosler, 2010Documento63 pagine7 Deadly Innocent Frauds, Warren Mosler, 2010Lucero Garcia100% (2)

- Brain of The Firm (Stafford Beer)Documento60 pagineBrain of The Firm (Stafford Beer)Lucero Garcia100% (1)

- Artículo. On Maturana and Varela's Aphorism of Knowing, Being and DoingDocumento9 pagineArtículo. On Maturana and Varela's Aphorism of Knowing, Being and DoingLucero GarciaNessuna valutazione finora

- Visiting Washington, DC Guide - MasterDocumentDocumento27 pagineVisiting Washington, DC Guide - MasterDocumentLucero GarciaNessuna valutazione finora

- Better Investing Magazine (September 2009, Vol. 59, No. 1)Documento60 pagineBetter Investing Magazine (September 2009, Vol. 59, No. 1)Lucero GarciaNessuna valutazione finora

- Heinz Von Foerster, The Scientist, The ManDocumento3 pagineHeinz Von Foerster, The Scientist, The ManLucero GarciaNessuna valutazione finora

- Business Week (2010-10-11 - 17)Documento108 pagineBusiness Week (2010-10-11 - 17)Lucero Garcia100% (1)

- Fooled by Randomess (Nassim Taleb)Documento217 pagineFooled by Randomess (Nassim Taleb)Lucero Garcia100% (9)

- MBA - Updated ADNU GSDocumento2 pagineMBA - Updated ADNU GSPhilip Eusebio BitaoNessuna valutazione finora

- Presentation - Prof. Yuan-Shing PerngDocumento92 paginePresentation - Prof. Yuan-Shing PerngPhuongLoanNessuna valutazione finora

- Switch CondenserDocumento14 pagineSwitch CondenserKader GüngörNessuna valutazione finora

- Vice President Enrollment Management in Oklahoma City OK Resume David CurranDocumento2 pagineVice President Enrollment Management in Oklahoma City OK Resume David CurranDavidCurranNessuna valutazione finora

- Icom IC F5021 F6021 ManualDocumento24 pagineIcom IC F5021 F6021 ManualAyam ZebossNessuna valutazione finora

- EW160 AlarmsDocumento12 pagineEW160 AlarmsIgor MaricNessuna valutazione finora

- Intelligent Smoke & Heat Detectors: Open, Digital Protocol Addressed by The Patented XPERT Card Electronics Free BaseDocumento4 pagineIntelligent Smoke & Heat Detectors: Open, Digital Protocol Addressed by The Patented XPERT Card Electronics Free BaseBabali MedNessuna valutazione finora

- Question Paper: Hygiene, Health and SafetyDocumento2 pagineQuestion Paper: Hygiene, Health and Safetywf4sr4rNessuna valutazione finora

- A Religious LeadershipDocumento232 pagineA Religious LeadershipBonganiNessuna valutazione finora

- Hitt PPT 12e ch08-SMDocumento32 pagineHitt PPT 12e ch08-SMHananie NanieNessuna valutazione finora

- Mounting BearingDocumento4 pagineMounting Bearingoka100% (1)

- LT1256X1 - Revg - FB1300, FB1400 Series - EnglishDocumento58 pagineLT1256X1 - Revg - FB1300, FB1400 Series - EnglishRahma NaharinNessuna valutazione finora

- Ssasaaaxaaa11111......... Desingconstructionof33kv11kvlines 150329033645 Conversion Gate01Documento167 pagineSsasaaaxaaa11111......... Desingconstructionof33kv11kvlines 150329033645 Conversion Gate01Sunil Singh100% (1)

- Income Tax Calculator 2023Documento50 pagineIncome Tax Calculator 2023TARUN PRASADNessuna valutazione finora

- Bank Statement SampleDocumento6 pagineBank Statement SampleRovern Keith Oro CuencaNessuna valutazione finora

- Different Software Life Cycle Models: Mini Project OnDocumento11 pagineDifferent Software Life Cycle Models: Mini Project OnSagar MurtyNessuna valutazione finora

- RetrieveDocumento8 pagineRetrieveSahian Montserrat Angeles HortaNessuna valutazione finora

- Steam Source Book PDFDocumento108 pagineSteam Source Book PDFJose Levican A100% (1)

- NX CAD CAM AutomationDocumento12 pagineNX CAD CAM AutomationfalexgcNessuna valutazione finora

- MEMORANDUMDocumento8 pagineMEMORANDUMAdee JocsonNessuna valutazione finora

- UBITX V6 MainDocumento15 pagineUBITX V6 MainEngaf ProcurementNessuna valutazione finora

- Bismillah SpeechDocumento2 pagineBismillah SpeechanggiNessuna valutazione finora

- Product Manual: Panel Mounted ControllerDocumento271 pagineProduct Manual: Panel Mounted ControllerLEONARDO FREITAS COSTANessuna valutazione finora

- Outage Analysis of Wireless CommunicationDocumento28 pagineOutage Analysis of Wireless CommunicationTarunav SahaNessuna valutazione finora

- Entrep Q4 - Module 7Documento5 pagineEntrep Q4 - Module 7Paula DT PelitoNessuna valutazione finora

- Insurance Smart Sampoorna RakshaDocumento10 pagineInsurance Smart Sampoorna RakshaRISHAB CHETRINessuna valutazione finora

- Durga Padma Sai SatishDocumento1 paginaDurga Padma Sai SatishBhaskar Siva KumarNessuna valutazione finora

- DT2 (80 82)Documento18 pagineDT2 (80 82)Anonymous jbeHFUNessuna valutazione finora

- La Salle Lipa Integrated School Senior High School Community 1 Quarter Summative Assessment Earth Science AY 2021-2022 Household Conservation PlanDocumento4 pagineLa Salle Lipa Integrated School Senior High School Community 1 Quarter Summative Assessment Earth Science AY 2021-2022 Household Conservation PlanKarlle ObviarNessuna valutazione finora

- HandbookDocumento194 pagineHandbookSofia AgonalNessuna valutazione finora