Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Credit Competition Affect Small-Firm Finance PDF

Caricato da

Thach BunroeunDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Credit Competition Affect Small-Firm Finance PDF

Caricato da

Thach BunroeunCopyright:

Formati disponibili

THE JOURNAL OF FINANCE

VOL. LXV, NO. 3

JUNE 2010

Does Credit Competition Affect

Small-Firm Finance?

TARA RICE and PHILIP E. STRAHAN

ABSTRACT

While relaxation of geographical restrictions on bank expansion permitted banking

organizations to expand across state lines, it allowed states to erect barriers to branch

expansion. These differences in states branching restrictions affect credit supply.

In states more open to branching, small rms borrow at interest rates 80 to 100

basis points lower than rms operating in less open states. Firms in open states also

are more likely to borrow from banks. Despite this evidence that interstate branch

openness expands credit supply, we nd no effect of variation in state restrictions on

branching on the amount that small rms borrow.

RELAXATION OF GEOGRAPHICAL restrictions on bank expansion was completed

in 1997, when the Interstate Banking and Branching Efciency Act (IBBEA)

permitted banks and bank holding companies to expand across state lines.

This legislation seemingly ended the era of geographical restrictions on bank

expansion that date back to the 19th century (Kroszner and Strahan (2007)).

In 1994, while most states allowed out-of-state bank holding companies to own

in-state banks (interstate banking), there were almost no interstate branches.

IBBEA, which was passed in 1994, allowed both unrestricted interstate bank-

ing (effective in 1995) and interstate branching (in effect in 1997). Allowing

interstate branching was the watershed event of IBBEA.

However, the interstate branching provisions contained in IBBEA granted

states the right to erect roadblocks to branch expansion, and some states took

advantage of these provisions by forbidding out-of-state banks from opening

newbranches or acquiring existing ones, by mandating age restrictions on bank

branches that could be purchased, or by limiting the amount of total deposits

any one bank could hold. State exercise of such powers restricted entry by large,

national banks and distorted their means of entry. This recent history continued

Rice is from the Board of Governors, Division of International Finance, and Strahan is from

Boston College, Wharton Financial Institutions Center and NBER. The views expressed in this

paper are solely those of the authors and should not be interpreted as reecting the views of

the Board of Governors or the staff of the Federal Reserve System. We thank Ron Borzekowski,

Courtney Carter, Diana Hancock, Traci Mach, Richard Porter and John Wolken for providing

data and research support, and acknowledge the helpful comments of Robert DeYoung, Campbell

Harvey, Mitchell Petersen, the associate editor, an anonymous referee, and seminar participants

at the Federal Reserve Bank of Chicago, the Federal Reserve Board, the 2008 Federal Reserve

Bank of Chicago Conference on Bank Structure and Competition, and the 2009 American Finance

Association Meetings.

861

862 The Journal of Finance

R

a long political struggle that had been playing out between large, expansion-

minded banks (who have favored removing barriers to expansion) and small,

insulated banks (the typical beneciaries of these regulatory constraints).

In this paper, we use differences in regulatory barriers to interstate branch-

ing as an instrument to test how credit competition affects credit supply and,

in turn, small-rm nancial decisions. Our approach shares some similari-

ties with the bank lending literature from macroeconomics, which began with

Bernanke (1983). These studies exploit variation in the amount of credit avail-

able due to changes in monetary policy (e.g., Bernanke and Blinder (1988),

Kashyap and Stein (2000)), variation from exogenous shocks to bank capi-

tal (Peek and Rosengren (2000), Ashcraft (2005), Chava and Purananadam

(2008)), or variation in bank liquidity (Khwaja and Mian (2008), Paravisini

(2008), Loutskina and Strahan (2009)). Most authors nd that declines in loan

supply translate into less debt for nonnancial rms, and early evidence sug-

gests that the Financial Crisis of 2007 to 2008 led to very sharp declines in new

loan originations (Ivashina and Scharfstein (2009), Strahan (2009)). Our strat-

egy differs from this literature, however, because the instrument varies credit

competition. We rst tie changes in competition to credit supply conditions, and

then tie these changes to rm capital structure choices.

In our rst tests, we show that in states where restrictions on out-of-state

entry are tight, rms pay higher rates for loans than similar rms operating

where restrictions are loose. The difference in rates translates into a savings of

80 to 100 basis points, comparing rms in states most open to branching with

those instates least open. We also nd that small rms are more likely to borrow

from banks where branching is less restricted. Together these results indicate

that more vigorous competition between banks expands the supply of capital

frombanks. Our ndings are robust to inclusion of credit demand controls such

as time-varying industry effects, local economic growth, the relative importance

of small rms in the state, the importance of small banks in the state, as well

as state xed effects. We nd some evidence that both interest group and

economic growth help explain states choices about branching restrictions, but

these factors do not subsume our key result: credit competition leads to lower

loan rates.

We next test whether branching reform affects capital structure. Do the de-

clines in borrowing rates frombetter competition translate into more borrowing

and less binding credit constraints? To our surprise, we nd no signicant in-

crease in any measure of the quantity of credit. More rms use bank debt

in states open to interstate branching (consistent with greater competition

across banks), but this does not translate into more total borrowing, higher

rates of credit approval, or changes in debt maturity. We nd some evidence

of an increase in the use of expensive trade credit where interstate branch-

ing is unfettered, suggesting that competition may actually increase credit

rationing even as prices fall. These nonresults help validate the identica-

tionassumption that our instrument is not correlated withcredit demand (since

quantity should rise with demand). Moreover, the result lines up with earlier in-

stances of intrastate (as opposed to interstate) branching reform. Jayaratne and

Does Credit Competition Affect Small-Firm Finance? 863

Strahan (1996) nd that economic growth accelerated after reform because the

banking system became more efcient and competitive, allowing greater en-

try of small business (e.g., Black and Strahan (2002), Cetorelli and Strahan

(2006), Kerr and Nanda (2009)). Their evidence points to better quality lending

and lower loan prices (e.g., lower loan losses and lower rates of bank loans)

after reform as the key to better growth performance, rather than an increase

in credit demand. Similarly, Bertrand, Schoar, and Thesmar (2007) nd that

banks in France improve loan quality by reducing credit to poorly performing

rms when government subsidies were reduced following reform in 1985.

Our study extends earlier research on intrastate branching reform because

the more recent deregulation allows us to use the Survey of Small Business

Finance (SSBF), which includes data on borrowing costs, nonprice loan terms,

and measures of capital structure. By studying nancial policy, we extend

the new literature linking credit supply to capital structure. Several of these

papers link leverage to credit ratings. For example, Faulkender and Petersen

(2006) nd that rms with a credit rating have higher leverage than those

without; Kisgen (2009) nds that rms adjust leverage to maintain a good

credit rating; and Su (2009) nds that rms receiving newly introduced bank

loan ratings increase leverage. While these studies suggest that credit supply

affects leverage, they all face the challenge of separately identifying credit

supply from credit demand. Zarutskie (2006) tests how interstate branching

reform affected capital structure, nding some evidence of declines in the use

of debt for very young rms and increases for more seasoned rms. However,

her data do not allow her to test how small-rm loan pricing, nonprice terms

(collateral, guarantees, and maturity), and loan denial rates change following

reform, and thus she is unable to trace out how the regulatory reform affected

competitive conditions within the banking industry and how those changes

affected credit constraints for borrowers.

Lemmon and Roberts (2009) and Leary (2009) use natural experiments to

trace out credit supply shocks, similar to our empirical strategy. Lemmon and

Roberts nd that debt issuance and investment fell for speculative-grade rms

in the wake of the Drexel failure, suggesting that a negative supply shock

reduced access to capital. However, they nd no change in leverage ratios

junk bond rm issuance of both debt and equity declined with the demise

of Drexel, leaving leverage ratios unchanged. Leary exploits two shocks to

the banking system during the 1960sthe introduction of CDs in the early

1960s (a positive supply shock) and the 1966 Credit Crunch (a negative supply

shock). He nds that rms substituted into (away from) bank debt following

the positive (negative) supply shock, leading to increased leverage.

1

Our study differs from the existing literature in two important ways. First,

we study small rms (the largest rm has 500 employees) rather than large

1

Additionally, Kliger and Sarig (2000) and Tang (2009) exploit the increase in information

content from Moodys 1982 ratings renement (adding 1, 2, or 3 to the letter-grade ratings

bins). Kliger and Sarig nd that yields fell for rms near the top of the ratings bins, while Tang

(2006) shows that this change reduced the cost of capital and led to more borrowing, higher

leverage, and greater investment.

864 The Journal of Finance

R

ones (e.g., Compustat rms). Introducing adverse selection or moral hazard

problems, which likely matter most for small and private rms, may complicate

how credit supply affects capital structure. If lenders restrict quantity under

asymmetric information (e.g., Stiglitz and Weiss (1981), Holmstrom and Tirole

(1997)), then a lower cost of debt (from supply shocks) may not translate to

higher leverage. Second, our instrument varies credit supply by changing the

degree of competition across lenders. Much of the existing literature focuses

on changes in banks access to funds. For example, Khwaja and Mian (2008)

exploit bank runs following Pakistans unexpected nuclear test in 1998; they

show that rms borrowed less from banks experiencing greater runs and more

from banks experiencing smaller runs. Paravisini (2008) nds that protable

lending expands following an infusion of liquidity by the Argentine government

into banks. Both studies nd big changes in the amount of credit, especially for

small rms, while we nd no change in quantity but a large change in price.

Our study extends the existing literature by demonstrating that branching

indeed expands competition and credit supply (loan prices fall), and by showing

that the expanded supply does not translate into more borrowing (loan terms

do not loosen). Increased competition may actually worsen nancial contract-

ing problems at the same time that it forces prices down. Entry can worsen

adverse selection (Marquez (2002)), while declines in market power may harm

relationship formation (Petersen and Rajan (1995)). So, lower loan prices re-

duce borrowing costs but banks continue to limit credit to solve contracting

problems, which may even worsen somewhat with greater competition.

2

As

noted above, we nd some (limited) evidence that credit rationing increases in

states most open to interstate branching. In conjunction with the earlier liter-

ature, the results imply that the effects of credit supply on capital structure

depend on what caused the expansion in supply.

The remainder of the paper is structured as follows. In Section I, we discuss

the relaxation of restrictions on bank expansion through interstate banking

and branching, both prior to and following IBBEA. In Section II, we present

our data, empirical design, and results. Finally, in Section III we conclude.

I. Relaxation of Restrictions on Bank Expansion

A. Toward Interstate Banking and Branching

Restrictions on banks ability to expand geographically date back to colo-

nial times (see Kroszner and Strahan (2007)). Federal legislation formalizing

state authority to regulate in-state branching became law with the adoption

of the 1927 McFadden Act. Economides, Hubbard, and Palia (1996) examine

the political economy behind the passage of the McFadden Act and nd results

consistent with a triumph of the numerous small and poorly capitalized banks

over the large and well-capitalized banks.

2

Credit constraints in the smallest rms may be reected in areas other than capital structure,

such as in labor productivity (Garmaise (2008)) or leasing versus purchasing decisions (Eisfeldt

and Rampini (2009)).

Does Credit Competition Affect Small-Firm Finance? 865

Although there was some deregulation of branching restrictions in the 1930s,

about two-thirds of the states continued to enforce restrictions on in-state

branching well into the 1970s. Only 12 states allowed unrestricted statewide

branching in 1970, and another 16 states prohibited branching entirely. Be-

tween 1970 and 1994, however, 38 states eased their restrictions on branching.

Kroszner and Strahan (1999) show that the timing of this state-level deregu-

lation reected the political clout of interest groups within nancial services,

particularly large-bank and small-bank interests. States dominated by well-

capitalized large banks tended to reform branching restrictions early.

The reform of restrictions on intrastate branching typically occurred in a

two-step process. First, states permitted multibank holding companies (MB-

HCs) to convert subsidiary banks (existing or acquired) into branches. MBHCs

could then expand geographically by acquiring banks and converting them into

branches. Second, states began permitting de novo branching, whereby banks

could open new branches anywhere within state borders.

In addition to branching limitations, states also prohibited cross-state own-

ership of banks and bank branches. Following passage of the McFadden

Act, banks had begun to undermine state branching restrictions by building

MBHCs with operations in many states. The Douglas Amendment to the 1956

Bank Holding Company (BHC) Act ended this practice by prohibiting a BHC

from acquiring banks outside the state where it was headquartered unless the

target banks state permitted such acquisitions. Since all states chose to bar

such transactions, the amendment effectively prevented interstate banking.

The rst step toward interstate banking came in 1978, when Maine passed a

law allowing entry by out-of-state BHCs if, in return, banks from Maine were

allowed to enter those states.

3

No state reciprocated, however, so the interstate

deregulation process remained stalled until 1982, when Alaska and New York

passed laws similar to Maines. Other states then followed suit, and state

deregulation of interstate banking was nearly complete by 1992, by which time

all states but Hawaii had passed similar laws. These state changes, however,

did not permit banks to open branches across state lines.

4

The transition to full

interstate banking was completed with passage of the Interstate Banking and

Branching Efciency Act of 1994 (IBBEA), which effectively permitted bank

holding companies to enter other states without permission and to operate

branches across state lines.

B. Interstate Branching after IBBEA

Despite the passage of IBBEA, the struggle over bank expansion continued

as some states exercised their authority under the new law to restrict or limit

3

Entry in this case means the ability to purchase existing whole banks; entry via branching was

still not permitted.

4

Eight states (Alaska, Massachusetts, NewYork, Oregon, Rhode Island, Nevada, North Carolina

and Utah) allowed limited interstate branching. However, interstate branching was not exercised

in these states except in a few cases prior to the passage of IBBEA in 1994.

866 The Journal of Finance

R

interstate branching. While IBBEA opened the door to nationwide branching,

it allowed the states to have considerable inuence over the manner in which it

was implemented. States that opposed entry by out-of-state banks could use the

provisions contained in IBBEA to erect barriers to some forms of out-of-state

entry, to raise the cost of entry, and to distort the means of entry. From the time

of enactment in 1994 until the branching trigger date of June 1, 1997, IBBEA

allowed states to employ various means to erect these barriers. States could set

regulations on interstate branching with regard to four important provisions:

(1) the minimum age of the target institution, (2) de novo interstate branching,

(3) the acquisition of individual branches, and (4) a statewide deposit cap.

Although IBBEA expressly permits interstate branching through interstate

bank mergers, IBBEA preserves state age laws with respect to such acquisi-

tions. Under IBBEA, states are allowed to set their own minimum age require-

ments with respect to how long a bank must have been in existence prior to its

acquisition in an interstate bank merger, although the state law cannot impose

an age requirement of more than 5 years. If a newly established subsidiary

ofce is located in a state that mandates a minimum age requirement, then the

BHC has to wait to convert the subsidiary to a branch until the subsidiary has

met the necessary age requirement. Many states set their age requirement at

5 years, but several states implemented a lower age requirement (3 years or

less) or required no minimum age limit at all.

While interstate branching done through an interstate bank merger (e.g., the

purchase and conversion of an existing bank to a branch ofce) is nowpermitted

in every state, de novo interstate branching is only permitted under IBBEA

if a state expressly opts-in. A bank thus may only open a new interstate

branch if state law expressly permits it to do so. A de novo branching rule

subjects existing banks to more new competition by out-of-state institutions by

making it easier for an entering bank to locate its branches in markets with

the greatest demand for nancial services. Without de novo branching, entry

into a particular out-of-state market becomes more difcult, because it is only

possible via an interstate whole-bank merger, and it also potentially distorts

or limits the entering banks choice of where to locate within the state.

IBBEA species a statewide deposit concentration limitation of 30% with

respect to interstate mergers that constitute an initial entry of a bank into

a state. IBBEA protects the right of each state to cap, by statute, regulation,

or order, the percentage of deposits in insured depository institutions in the

state that is held or controlled by any single bank or BHC. A state is free to

relax the concentration limitation to above 30% or to impose a deposit cap on

an interstate bank merger transaction below 30% and with respect to initial

entry. The obvious impact of such a statute would be to prevent a bank from

entering into a larger interstate merger in the state. For example, if a state

had set a deposit cap of 15%, a bank could not enter into an interstate merger

transaction with any institution that held more than 15% of the deposits in

that particular state.

IBBEA dictates that an interstate merger transaction may involve the ac-

quisition of a branch (or number of branches) of a bank without the acquisition

Does Credit Competition Affect Small-Firm Finance? 867

of the entire bank, only if the state in which the branch is located permits such

a purchase. Like de novo branching, states must explicitly opt-in to this pro-

vision. Permitting acquisition of individual branches lowers the cost of entry

for interstate banks. Rather than being required to enter the market by buying

an entire bank, a bank may instead pick and choose those interstate branches

that it wants to acquire.

We use these four state powers to build a simple index of interstate branching

restrictions. The index is set to zero for states that are most open to out-

of-state entry. We add one to the index when a state adds any of the four

barriers just described. Specically, we add one to the index: if a state imposes

a minimumage of 3 years or more on target institutions of interstate acquirers;

if a state does not permit de novo interstate branching; if a state does not permit

the acquisition of individual branches by an out-of-state bank; and if a state

imposes a deposit cap less than 30%. The index therefore ranges from zero to

four. Table I describes in detail how each state chose to deal with the possibility

of interstate branching following IBBEA. States such as Illinois (since 2004),

Massachusetts, and Ohio have the most open stance toward interstate entry;

states such as Arkansas, Colorado, and Montana have the most restrictive

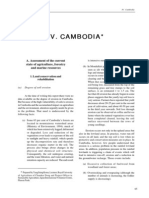

stance toward interstate entry. Figure 1 depicts the deregulatory history with

a simple timeline. Intrastate branching began in the 1970s and was completed

by the early 1990s; cross-state expansion through MBHCs began in the early

1980s, and grewsteadily through the middle of the 1990s. Interstate branching

(our focus here) began in earnest following passage of IBBEA in 1997 and

expanded into the early 2000s.

C. Latter-Day Branching Restrictions Continue to Bind

Interstate branching has made dramatic inroads in many states. By 2004,

almost half of all branches in the United States were owned by banks with

branch operations in more than one state. Yet, the actual degree of entry by

interstate banks has been constrained in many states by state authority to

erect barriers to entry. We have already described the tools that IBBEA gives

states to reduce or distort the means by which banks may enter. Johnson and

Rice (2008) build a data set of the share of interstate branches as a percentage

of total branches in each state-year from 1994 to 2005. They show that, indeed,

states with greater restrictions in fact have fewer interstate branches as a

share of total branches.

II. Data, Empirical Design, and Results

A. Data

We combine data fromthe Survey of Small Business Finance (SSBF) with the

state-level branching restrictions index dened above. The SSBF is a survey

by the Federal Reserve of the nancial condition of rms with fewer than

868 The Journal of Finance

R

Table I

State Interstate Branching Laws: 19942005

This tables lists the index of interstate branching restrictions, the effective date of interstate

branching regulation changes, and each of the following four provisions: the minimum age of

the institution for acquisition, allowance of de novo interstate branching, allowance of interstate

branching by acquisition of a single branch or portions of an institution, and statewide deposit cap

on branch acquisitions. The index is set to zero for states that are most open to out-of-state entry.

We add one to the index when a state adds any of the four barriers just described. Specically, we

add one to the index: if a state imposes a minimum age of 3 or more years on target institutions

of interstate acquirers; if a state does not permit de novo interstate branching; if a state does not

permit the acquisition of individual branches by an out-of-state bank; and if a state imposes a

deposit cap less than 30%. The index ranges from zero to four. Source: Johnson and Rice (2008).

Minimum Age Interstate Branching Statewide

of Institution Allows by Acquisition of Deposit

Branching (Bank or de novo Single Branch Cap on

Restrictivness Effective Branch) for Interstate or Portions of Branch

State Index Date Acquisitions Branching an Institution Acquisitions

Alabama 3 5/31/1997 5 years No No 30%

Alaska 2 1/1/1994 3 years No Yes 50%

Arizona 2 8/31/2001 5 years No Yes 30%

Arizona 3 9/1/1996 5 years No No 30%

Arkansas 4 6/1/1997 5 years No No 25%

California 3 9/28/1995 5 years No No 30%

Colorado 4 6/1/1997 5 years No No 25%

Connecticut 1 6/27/1995 5 years Yes Yes 30%

Delaware 3 9/29/1995 5 years No No 30%

DC 0 6/13/1996 No Yes Yes 30%

Florida 3 6/1/1997 3 years No No 30%

Georgia 3 5/10/2002 3 years No No 30%

Georgia 3 6/1/1997 5 years No No 30%

Hawaii 0 1/1/2001 No Yes Yes 30%

Hawaii 3 6/1/1997 5 years No No 30%

Idaho 3 9/29/1995 5 years No No None

Illinois 0 8/20/2004 No Yes Yes 30%

Illinois 3 6/1/1997 5 years No No 30%

Indiana 1 7/1/1998 5 years Yes Yes 30%

Indiana 0 6/1/1997 No Yes Yes 30%

Iowa 4 4/4/1996 5 years No No 15%

Kansas 4 9/29/1995 5 years No No 15%

Kentucky 3 3/22/2004 No No No 15%

Kentucky 3 3/17/2000 No No No 15%

Kentucky 4 6/1/1997 5 years No No 15%

Louisiana 3 6/1/1997 5 years No No 30%

Maine 0 1/1/1997 No Yes Yes 30%

Maryland 0 9/29/1995 No Yes Yes 30%

Massachusetts 1 8/2/1996 3 years Yes Yes 30%

Michigan 0 11/29/1995 No Yes Yes None

Minnesota 3 6/1/1997 5 years No No 30%

Mississippi 4 6/1/1997 5 years No No 25%

Missouri 4 9/29/1995 5 years No No 13%

Montana 4 10/1/2001 5 years No No 22%

(continued)

Does Credit Competition Affect Small-Firm Finance? 869

Table IContinued

Minimum Age Interstate Branching Statewide

of Institution Allows by Acquisition of Deposit

Branching (Bank or de novo Single Branch Cap on

Restrictivness Effective Branch) for Interstate or Portions of Branch

State Index Date Acquisitions Branching an Institution Acquisitions

Montana 4 9/29/1995 N/A N/A N/A Increases

1% per year

from 18%

to 22%

Nebraska 4 5/31/1997 5 years No No 14%

Nevada 3 9/29/1995 5 years Limited Limited 30%

New Hampshire 0 1/1/2002 No Yes Yes 30%

New Hampshire 1 8/1/2000 5 years Yes Yes 30%

New Hampshire 4 6/1/1997 5 years No No 20%

New Jersey 1 4/17/1996 No No Yes 30%

New Mexico 3 6/1/1996 5 years No No 40%

New York 2 6/1/1997 5 years No Yes 30%

North Carolina 0 7/1/1995 No Yes Yes 30%

North Dakota 1 8/1/2003 No Yes Yes 25%

North Dakota 3 5/31/1997 No No No 25%

Ohio 0 5/21/1997 No Yes Yes 30%

Oklahoma 1 5/17/2000 No Yes Yes 20%

Oklahoma 4 5/31/1997 5 years No No 15%

Oregon 3 7/1/1997 3 years No No 30%

Pennsylvania 0 7/6/1995 No Yes Yes 30%

Rhode Island 0 6/20/1995 No Yes Yes 30%

South Carolina 3 7/1/1996 5 years No No 30%

South Dakota 3 3/9/1996 5 years No No 30%

Tennessee 1 3/17/2003 3 years Yes Yes 30%

Tennessee 1 7/1/2001 5 years Yes Yes 30%

Tennessee 2 5/1/1998 5 years No Yes 30%

Tennessee 3 6/1/1997 5 years No No 30%

Texas 2 9/1/1999 No Yes Yes 20%

Texas 4 8/28/1995 N/A N/A N/A 20%

Utah 1 4/30/2001 5 years Yes Yes 30%

Utah 2 6/1/1995 5 years No Yes 30%

Vermont 0 1/1/2001 No Yes Yes 30%

Vermont 2 5/30/1996 5 years No Yes 30%

Virginia 0 9/29/1995 No Yes Yes 30%

Washington 1 5/9/2005 5 years Yes Yes 30%

Washington 3 6/6/1996 5 years No No 30%

West Virginia 1 5/31/1997 No Yes Yes 25%

Wisconsin 3 5/1/1996 5 years No No 30%

Wyoming 3 5/31/1997 3 years No No 30%

500 employees.

5

The survey was rst conducted in 1987 and repeated in 1993,

1998, and 2003. It contains details on small businesses income, expenses,

assets, liabilities, and characteristics of the rm, rm owners, and the small

businesses nancial relationships with nancial service suppliers for a broad

5

For complete documentation of the SSBF, see http://federalreserve.gov/pubs/oss/oss3/SSBFtoc.

htm.

870 The Journal of Finance

R

V

e

r

m

o

n

t

b

e

g

i

n

s

s

t

a

t

e

-

l

e

v

e

l

m

o

v

e

s

t

o

l

o

w

e

r

b

a

r

r

i

e

r

s

t

o

i

n

t

r

a

s

t

a

t

e

b

r

a

n

c

h

i

n

g

M

a

i

n

e

b

e

c

o

m

e

s

t

h

e

f

i

r

s

t

s

t

a

t

e

t

o

p

e

r

m

i

t

o

u

t

-

o

f

-

s

t

a

t

e

b

a

n

k

o

w

n

e

r

s

h

i

p

,

w

i

t

h

r

e

c

i

p

r

o

c

i

t

y

N

e

w

Y

o

r

k

j

o

i

n

s

M

a

i

n

e

,

b

e

g

i

n

n

i

n

g

t

h

e

i

n

t

e

r

s

t

a

t

e

b

a

n

k

i

n

g

e

r

a

M

o

s

t

s

t

a

t

e

s

l

o

w

e

r

b

a

r

r

i

e

r

s

t

o

i

n

t

r

a

s

t

a

t

e

b

r

a

n

c

h

i

n

g

a

n

d

i

n

t

e

r

s

t

a

t

e

b

a

n

k

o

w

n

e

r

s

h

i

p

(

1

9

8

2

-

1

9

9

2

)

F

i

r

s

t

S

S

B

F

(

p

l

a

c

e

b

o

)

s

a

m

p

l

e

I

B

B

E

A

p

a

s

s

e

s

,

p

e

r

m

i

t

t

i

n

g

c

r

o

s

s

-

s

t

a

t

e

b

r

a

n

c

h

i

n

g

s

t

a

r

t

i

n

g

i

n

1

9

9

7

I

n

t

e

r

s

t

a

t

e

b

r

a

n

c

h

i

n

g

i

n

e

f

f

e

c

t

f

o

r

a

l

l

s

t

a

t

e

s

S

e

c

o

n

d

S

S

B

F

s

a

m

p

l

e

T

h

i

r

d

S

S

B

F

s

a

m

p

l

e

3 0 0 2 8 9 9 1 7 9 9 1 4 9 9 1 3 9 9 1 2 9 9 1 2 8 9 1 8 7 9 1 0 7 9 1

Figure 1. Timeline of intra- and interstate branching deregulation, 19702003.

set of products and services. The sample is randomly drawn but stratied to

ensure geographical representation across all regions of the United States. The

SSBF also oversamples relatively large rms (conditional on having fewer than

500 workers).

Given the above data, we can measure assets, liabilities, prots, rm age,

and the length of time rms have established relationships with banks and

other lenders. We also know the location of rms, so we can control for local

market conditions, and we can use the state of the rm to merge our branching

restrictions variable to the data set. The SSBF also asks about sources of debt.

We use these survey responses to build an indicator equal to one for rms

borrowing from banks.

6

Note, however, that each survey contains a different

sample of rms, so we cannot follow rms over time. Moreover, there are small

differences in variable denitions, so we are somewhat constrained in the way

we construct variables to make sure we have comparability in the results across

over time.

Berger and Udell (1995) and Petersen and Rajan (1994) were the rst to

use these data from the 1987 survey. These papers both nd that banking

relationships expand credit availability for small rms. Other authors have also

used these data to study whether bank size affects credit allocation decisions

(Cole (1998), Jayaratne and Wolken (1999), Cole, Goldberg, and White (2004),

Berger et al. (2005)).

Our paper is the rst to use these data to test whether credit availability

depends on openness to interstate branching. To test this notion, we focus

on the data from the 1993, 1998, and 2003 surveys. The 1993 survey re-

ects credit conditions just before passage of IBBEA and thus represents a

clean control group for our empirical design. To run a falsication test, we

assign the 2003 branching index to the 1993 data. Since deregulation had

not yet occurred, we should observe no relationship between the hypothetical

branching restrictions and credit conditions in 1993. The 1993 survey repre-

sents a better control sample than 1987 because unobservable economic and

6

The SSBF makes it difcult to construct the share of total assets nanced by bank debt because

the balance sheet date is not the same as the date at which rms report their borrowing by type

of lender. Hence, we use a simple indicator variable to test whether the quantity borrowed from

banks increases as barriers to entry fall.

Does Credit Competition Affect Small-Firm Finance? 871

technological factors are more similar to the post-interstate banking sample

during the latter period compared to the earlier one. The last two surveys

(1998 and 2003) occur after passage of IBBEA; thus, if interstate branching

matters for credit supply, we should observe the state-imposed constraints af-

fecting rms operating in different states in those years. These last 2 years can

be thought of as the treatment group in our empirical design.

We focus on small business data because bank credit supply matters most

for rms without access to national and international equity and debt mar-

kets. Moreover, the survey contains enough detail for us to explore the price

and nonprice terms of loans as well as various measures of rms use of debt

nance.

B. Interest Rate Regression

We begin by testing how loan interest rates vary with interstate branching

restrictions. Our interest rate regressions have the following structure:

Y

i, j,t

=

t

Branching Restrictions

j,t

+Interest rate, lender, rmandmarket controls

i, j,t

+

i, j,t

for t = 1993, 1998, and 2003,

(1)

where i is an index across rms, j is an index across states, and t is an index

across years. We estimate equation (1) separately for each of the three sample

years (therefore allowing each coefcient to vary by year). We report weighted

least squares coefcients, using the survey weights provided in the SSBF data

that account for the disproportionate sampling of larger rms and unit nonre-

sponse. The estimated effects of interstate branching restrictions in these WLS

models are larger than those estimated with OLS (see the Internet Appendix

available at http://www.afajof.org/supplements.asp), although the statistical

signicance (or lack thereof) is consistent across either statistical approach.

The dependent variable is the interest rate on the most recent loan. This

variable is only available for about 40% of the rms in the sample. Our state

branching restriction index is Branching Restrictions, which varies between

zero and four. Note that the branching restriction index does not vary across

rms operating in the same state. Since there may be a common element to

the regression error across all rms operating in the same state, we cluster

by state in constructing our standard errors. We have also estimated robust

standard errors without clustering. These standard errors are very close to

those reported here, which suggests that the error term does not contain an

important state-wide component.

7

7

For example, the robust standard error without clustering is 0.078 in the 1998 regressions,

0.070 in the 2003 regression. The robust standard error with clustering is 0.07 in both 1998 and

2003. We thank Mitchell Petersen for suggesting that we compare the state-clustered standard

errors with un-clustered standard errors.

872 The Journal of Finance

R

C. Control Variables

Following Petersen and Rajan (1994), we include a large number of control

variables in our reported specications, including interest rate variables ob-

served during the month in which the loan was approved, borrower and lender

characteristics, relationship characteristics, and market characteristics. For

interest rate controls, we include the prime rate, a corporate bond default

spread equal to the difference between the corporate bonds rated BAA and the

yield on the 10-year government bonds, and a term structure spread equal to

the difference between the yield on the same 10-year government bonds minus

the 3-month constant maturity Treasury bill yield.

8

We include an indicator if

the lender is a bank and another indicator if the lender is a nonnancial rm.

For loan terms, we include an indicator for oating rate loans.

As additional controls for market structure (beyond the branching restric-

tions), we include an indicator for urban markets, a measure of concentration

in the local market, and the growth rate of local output during the 5 years prior

to the survey year. The concentration measure equals the Herndahl index

(HHI) from deposits in the local market, which has been used for antitrust

enforcement in bank mergers. Local output is measured by the average lagged

per capita personal income growth rate during the preceding 5 years. Urban

markets are dened as Metropolitan Statistical Areas (MSAs), rural markets

are dened by county, and for consistency across the 3 survey years, we use the

2003 market denitions from the U.S. Census Department.

For borrower control variables, we include rm size (log of assets) and rm

age (in years), the lenders risk assessment of the borrower, an indicator for

corporations, indicators for the two-digit SIC code of the borrower (this adds

upward of 50 variables to the model), return on assets (net income/assets),

the length of the relationship between the borrower and lender (in years),

the number of information- and noninformation-based services that come

from the lender, the number of unique relationships the borrower has with

all of its lenders, and an indicator equal to one if the borrower has a deposit

account with the lender. Information services are dened as those services that

the borrower can purchase from the lender that can be used by the lender to

monitor the rm (such as cash management services or credit card processing).

Noninformation services are those services, also purchased by the borrower,

that arguably do not give the lender additional information with which to mon-

itor the borrower (Petersen and Rajan (1994)). Finally, we include the credit

risk rating of the borrower, which varies from one to ve, with one indicating

the safest type of borrower and ve the riskiest.

9

This credit risk rating is de-

rived from the Dun and Bradstreet credit score of the company and is available

in all survey years.

8

The rate on the most recently approved loan is as of the month of the approval. We match this

rate to the monthly observations on the interest rate controls.

9

In the 2003 survey, the risk rating varies from 1 to 6, with 6 being least risky, while the ratings

for the 1993 and 1998 surveys vary from 1 to 5, with 5 being the most risky. For comparability over

time, we recalibrate the 2003 rating to lie between 1 and 5, with 5 being the most risky.

Does Credit Competition Affect Small-Firm Finance? 873

D. Summary Statistics

Table II reports the summary statistics on the interest rate on the most

recent loan, the branching restrictions index, and all of the control variables.

The average interest rate on loans ranged from8.5%in 1993, to 9.0%in 1998, to

5.8% in 2003. In each year, these rates exceed the prime interest rate because

the sample contains small and risky rms. The variation over time reects

mainly the change in the overall level of interest rates, although the average

spread over the prime rate does fall in 1998 relative to the other two survey

years. Many of the variables are quite stable over time (e.g., borrower risk

rating, market characteristics), although we see a spike in the frequency of xed

rate borrowing and loan maturity during the 1998 sample, probably because

of the relatively at term structure during that year. We do see the incidence

of collateral decline across all three samples, from 72% of loans in 1993 to just

55% by 2003.

Firmsize and rmage both decline sharply between 1993 and 1998, and then

both increase again in 2003. We also see a drop in the importance of banks as

lenders in 1998, which again rebounds in 2003. These patterns likely reect

the large number of start-up rms entering the economy during the boom of

the second half of the 1990s, along with the growth of nontraditional nanciers

such as venture capitalists during those years. This change in the structure of

the economy also shows up in the average relationship length between rms

and lenders, which falls from 8.1 to 5.5 years between 1993 and 1998, and

then increases to more than 10 years by 2003. While the sample size in 1998

is smaller than in the other 2 years, the mean rm characteristics are similar

other than rm size and age.

E. Relaxing Branching Restrictions Lowers Loan Prices

Table III reports our benchmark regression result linking the interest rate

paid on the most recent loan to branching restrictiveness and the other vari-

ables. Columns 1 through 6 report these regressions for 1993, 1998, and 2003.

As noted earlier, 1993 represents the control or placebo group. We assign the

2003 branching index to each observation in the 1993 equation; if our identi-

cation strategy works, there should be no impact of this hypothetical index

in that year, since before 1994 all states prohibited interstate branching. As

shown in the table, the coefcient on branching restrictions is small and not

statistically signicant in 1993. Thus, there is no placebo effect of branching

restrictions. This is important because, if there were systematic differences

in unobservable dimensions that are correlated with a states stance toward

banking, these would bias our results.

In contrast to 1993, branching restrictions enters with a positive and statisti-

cally signicant coefcient in both 1998 and 2003. The coefcients are similar

in magnitude in the 2 years (0.21 and 0.25). The coefcient of 0.25 in 2003

suggests that in states completely open to branching, rms could borrow at

rates about 100 basis points lower than they could in states with the most

874 The Journal of Finance

R

Table II

Summary Statistics

This table reports summary statistics from the 1993, 1998, and 2003 Surveys of Small Business

Finance. Each survey contains a random sample of rms with fewer than 500 employees. Each

sample is drawn independently, so we do not follow the same rms over time. The data on loan

terms, interest rates, loan characteristics, and lender characteristics reect information from the

most recent loan by the borrower; these data are available for about 40% of the sample. The other

statistics are available for all of the respondents, but here we report the summary statistics for

the smaller sample that is included in the interest rate regressions (Tables III and V). Market

concentration equals the sum of squared share of deposits held by all banks in the borrowers local

market, where market is dened as the Metropolitan Statistical Area (MSA) or county.

1993 1998 2003

Standard Standard Standard

Mean Deviation Mean Deviation Mean Deviation

Loan terms

Interest rate on most recent loan 8.47 2.21 9.04 2.37 5.79 2.68

Share with collateral 0.72 0.45 0.63 0.48 0.55 0.50

Share guaranteed 0.56 0.50 0.56 0.50 0.60 0.49

Loan maturity (years) 3.28 4.38 4.57 5.49 3.76 4.95

Index of branching restrictions

4 is most, 0 least, restricted 1.99 1.35 2.43 1.41 2.05 1.34

Interest rates

Prime interest rate 6.00 0.00 8.35 0.27 4.13 0.12

Term structure (10-year

government bond 3-month

T-bill)

2.84 0.36 0.35 0.14 2.94 0.39

Default premium (BAA

10-year government bond)

4.91 0.42 2.31 0.35 2.75 0.29

Borrower characteristics

Log of borrower assets 13.25 2.11 12.75 2.25 13.51 2.13

Indicator if borrower is a

corporation

0.46 0.50 0.33 0.47 0.33 0.47

Borrower ROA 0.33 0.65 0.66 1.10 0.46 0.82

Borrower risk rating (1 is safest;

5 is riskiest)

2.94 1.16 3.00 1.14 2.74 1.18

Loan characteristics

Indicator if loan is oating-rate 0.58 0.49 0.34 0.47 0.55 0.50

Lender characteristics

Indicator if lender is a bank 0.88 0.33 0.77 0.42 0.87 0.34

Indicator if lender is a

nonnancial company

0.03 0.16 0.05 0.21 0.02 0.14

Indicator if loan is a line of

credit renewal

N/A 0.46 0.50

Relationship variables

Length of lenderborrower

relationship (years)

8.07 8.34 5.48 7.09 10.37 10.56

Borrower age (years) 16.27 14.24 13.90 10.95 18.32 13.08

Number of information services

from lender

0.26 0.44 0.17 0.37 0.39 0.49

(continued)

Does Credit Competition Affect Small-Firm Finance? 875

Table IIContinued

1993 1998 2003

Standard Standard Standard

Mean Deviation Mean Deviation Mean Deviation

Number of noninformation

services from lender

0.26 0.44 0.32 0.47 0.48 0.50

Indicator if borrower has a

deposit with lender

0.72 0.45 0.53 0.50 0.75 0.43

Number of relationships 1.94 1.44 2.10 1.71 2.19 1.57

Market characteristics

Local market concentration 0.16 0.09 0.17 0.09 0.17 0.10

Indicator if borrower is in an

MSA

0.77 0.42 0.74 0.44 0.93 0.26

Lagged 5-year growth rate in

the local market

0.22 0.06 0.25 0.06 0.19 0.06

restrictions on interstate branching (4 0.25 = 1.0 percentage points in the

borrowing rate).

For the control variables, we nd that size is consistently negatively related

to loan interest rates, and borrower risk rating is consistently positively related

to the rates, as one would expect. Many of the other control variables are either

insignicant or not stable across the three samples. This instability is notable

for the relationship variables in particular, where we nd that the relationship

length enters negatively in 1998 but not in the other 2 survey years.

10

Next, we pool our 3 sample years to test whether the effects of branching

restrictions changed signicantly in reaction to passage of IBBEA. In the pooled

model, we include both year and state xed effects, so the coefcient on the

branching restriction index is generated solely by within-state variation over

time. In this case, we code the branching restriction index in 1993 equal to

four, its most restrictive value, for all states. Hence, the variable does not

change over time for states like Colorado, which imposed the tightest level of

restrictions, while it falls from four to zero for states like Illinois, which were

relatively open to interstate expansion. The pooled model allows us to control

for trends by adding year effects, and for persistent differences in states by

incorporating state xed effects, as follows:

Y

i, j,t

=

t

+

j

+ Branching Restrictions

j,t

+Interest rate, lender, rm and market controls

i, j,t

+

i, j,t

, (2)

where

t

are the year-specic xed effects and

j

are the state xed effects. By

including these xed effects, we have stripped out all of the cross-state variation

10

We have tested whether the average length of bank relationships differs as states open up

to interstate branching but nd no evidence that such relationships change. This may occur be-

cause most banks typically buy existing branches when they enter new markets, thus leaving

relationships and relationship length unaffected.

876 The Journal of Finance

R

T

a

b

l

e

I

I

I

R

e

g

r

e

s

s

i

o

n

o

f

I

n

t

e

r

e

s

t

R

a

t

e

o

n

M

o

s

t

R

e

c

e

n

t

L

o

a

n

o

n

S

t

a

t

e

,

B

a

n

k

,

a

n

d

B

o

r

r

o

w

e

r

C

h

a

r

a

c

t

e

r

i

s

t

i

c

s

T

h

i

s

t

a

b

l

e

r

e

p

o

r

t

s

r

e

g

r

e

s

s

i

o

n

s

o

f

t

h

e

i

n

t

e

r

e

s

t

r

a

t

e

o

n

t

h

e

m

o

s

t

r

e

c

e

n

t

l

o

a

n

o

n

s

t

a

t

e

,

b

a

n

k

,

a

n

d

b

o

r

r

o

w

e

r

c

h

a

r

a

c

t

e

r

i

s

t

i

c

s

.

T

h

e

r

e

g

r

e

s

s

i

o

n

s

a

r

e

w

e

i

g

h

t

e

d

b

y

t

h

e

s

u

r

v

e

y

w

e

i

g

h

t

s

,

w

h

i

c

h

a

c

c

o

u

n

t

f

o

r

d

i

s

p

r

o

p

o

r

t

i

o

n

a

t

e

s

a

m

p

l

i

n

g

a

n

d

u

n

i

t

n

o

n

r

e

s

p

o

n

s

e

,

a

n

d

i

n

c

l

u

d

e

a

s

e

t

o

f

t

w

o

-

d

i

g

i

t

S

I

C

i

n

d

i

c

a

t

o

r

v

a

r

i

a

b

l

e

s

t

o

c

o

n

t

r

o

l

f

o

r

i

n

d

u

s

t

r

y

e

f

f

e

c

t

s

.

S

t

a

n

d

a

r

d

e

r

r

o

r

s

a

r

e

c

l

u

s

t

e

r

e

d

b

y

s

t

a

t

e

(

s

t

a

t

e

-

y

e

a

r

i

n

t

h

e

p

o

o

l

e

d

m

o

d

e

l

)

.

T

h

e

p

o

o

l

e

d

m

o

d

e

l

i

n

c

l

u

d

e

s

b

o

t

h

s

t

a

t

e

a

n

d

y

e

a

r

x

e

d

e

f

f

e

c

t

s

.

I

n

t

h

e

1

9

9

3

s

a

m

p

l

e

,

w

e

a

s

s

i

g

n

t

h

e

2

0

0

3

v

a

l

u

e

f

o

r

t

h

e

b

r

a

n

c

h

i

n

g

i

n

d

e

x

;

i

n

t

h

e

p

o

o

l

e

d

m

o

d

e

l

,

i

n

c

o

n

t

r

a

s

t

,

w

e

a

s

s

i

g

n

t

h

e

v

a

l

u

e

o

f

f

o

u

r

t

o

a

l

l

s

t

a

t

e

s

i

n

1

9

9

3

s

i

n

c

e

t

h

i

s

i

s

t

h

e

m

o

s

t

r

e

s

t

r

i

c

t

i

v

e

v

a

l

u

e

t

h

a

t

t

h

e

v

a

r

i

a

b

l

e

t

a

k

e

s

.

M

a

r

k

e

t

c

o

n

c

e

n

t

r

a

t

i

o

n

e

q

u

a

l

s

t

h

e

s

u

m

o

f

s

q

u

a

r

e

d

s

h

a

r

e

o

f

d

e

p

o

s

i

t

s

h

e

l

d

b

y

a

l

l

b

a

n

k

s

i

n

t

h

e

b

o

r

r

o

w

e

r

s

l

o

c

a

l

m

a

r

k

e

t

,

w

h

e

r

e

m

a

r

k

e

t

i

s

d

e

n

e

d

a

s

t

h

e

M

e

t

r

o

p

o

l

i

t

a

n

S

t

a

t

i

s

t

i

c

a

l

A

r

e

a

(

M

S

A

)

o

r

c

o

u

n

t

y

.

1

9

9

3

(

C

o

n

t

r

o

l

G

r

o

u

p

)

1

9

9

8

2

0

0

3

P

o

o

l

e

d

,

w

i

t

h

S

t

a

t

e

F

i

x

e

d

E

f

f

e

c

t

s

C

o

e

f

c

i

e

n

t

t

-

s

t

a

t

C

o

e

f

c

i

e

n

t

t

-

s

t

a

t

C

o

e

f

c

i

e

n

t

t

-

s

t

a

t

C

o

e

f

c

i

e

n

t

t

-

s

t

a

t

I

n

d

e

x

o

f

b

r

a

n

c

h

i

n

g

r

e

s

t

r

i

c

t

i

o

n

s

(

4

i

s

m

o

s

t

,

0

l

e

a

s

t

,

r

e

s

t

r

i

c

t

e

d

)

0

.

0

1

0

.

1

5

0

.

2

1

3

.

0

1

0

.

2

5

3

.

6

2

0

.

2

2

3

.

8

4

I

n

t

e

r

e

s

t

r

a

t

e

s

P

r

i

m

e

i

n

t

e

r

e

s

t

r

a

t

e

N

/

A

2

.

7

0

3

.

0

5

1

.

1

2

0

.

3

5

0

.

8

4

2

.

2

3

T

e

r

m

s

t

r

u

c

t

u

r

e

(

1

0

-

y

e

a

r

g

o

v

e

r

n

m

e

n

t

b

o

n

d

3

-

m

o

n

t

h

T

-

b

i

l

l

)

0

.

3

9

0

.

2

8

0

.

2

5

0

.

2

7

0

.

4

3

0

.

7

2

0

.

0

2

0

.

1

1

D

e

f

a

u

l

t

p

r

e

m

i

u

m

(

B

A

A

1

0

-

y

e

a

r

g

o

v

e

r

n

m

e

n

t

b

o

n

d

)

0

.

1

1

0

.

1

0

1

.

6

8

2

.

9

5

0

.

6

3

0

.

7

7

0

.

0

9

0

.

6

6

B

o

r

r

o

w

e

r

c

h

a

r

a

c

t

e

r

i

s

t

i

c

s

L

o

g

o

f

b

o

r

r

o

w

e

r

a

s

s

e

t

s

0

.

2

3

4

.

1

2

0

.

2

5

3

.

2

6

0

.

2

7

5

.

6

2

0

.

2

8

7

.

7

8

I

n

d

i

c

a

t

o

r

i

f

b

o

r

r

o

w

e

r

i

s

a

c

o

r

p

o

r

a

t

i

o

n

0

.

1

8

1

.

3

9

0

.

3

0

1

.

0

8

0

.

3

4

1

.

6

9

0

.

1

7

1

.

6

0

B

o

r

r

o

w

e

r

R

O

A

0

.

2

3

2

.

3

4

0

.

0

2

0

.

1

8

0

.

0

1

0

.

0

4

0

.

0

6

0

.

7

1

B

o

r

r

o

w

e

r

r

i

s

k

r

a

t

i

n

g

(

1

i

s

s

a

f

e

s

t

;

5

i

s

r

i

s

k

i

e

s

t

)

0

.

1

4

2

.

1

7

0

.

0

8

1

.

0

0

0

.

2

4

2

.

3

9

0

.

1

9

3

.

1

9

L

o

a

n

c

h

a

r

a

c

t

e

r

i

s

t

i

c

s

I

n

d

i

c

a

t

o

r

i

f

l

o

a

n

i

s

o

a

t

i

n

g

-

r

a

t

e

0

.

5

1

3

.

2

3

0

.

1

7

0

.

7

4

0

.

9

4

4

.

5

5

0

.

6

1

5

.

0

0

L

e

n

d

e

r

c

h

a

r

a

c

t

e

r

i

s

t

i

c

s

I

n

d

i

c

a

t

o

r

i

f

l

e

n

d

e

r

i

s

a

b

a

n

k

0

.

2

6

0

.

4

7

0

.

6

6

1

.

2

9

1

.

1

3

2

.

3

3

0

.

7

5

2

.

4

8

I

n

d

i

c

a

t

o

r

i

f

l

e

n

d

e

r

i

s

a

n

o

n

n

a

n

c

i

a

l

c

o

m

p

a

n

y

0

.

3

0

0

.

3

8

0

.

2

1

0

.

2

7

1

.

1

3

0

.

6

7

0

.

7

5

1

.

0

1

(

c

o

n

t

i

n

u

e

d

)

Does Credit Competition Affect Small-Firm Finance? 877

T

a

b

l

e

I

I

I

C

o

n

t

i

n

u

e

d

1

9

9

3

(

C

o

n

t

r

o

l

G

r

o

u

p

)

1

9

9

8

2

0

0

3

P

o

o

l

e

d

,

w

i

t

h

S

t

a

t

e

F

i

x

e

d

E

f

f

e

c

t

s

C

o

e

f

c

i

e

n

t

t

-

s

t

a

t

C

o

e

f

c

i

e

n

t

t

-

s

t

a

t

C

o

e

f

c

i

e

n

t

t

-

s

t

a

t

C

o

e

f

c

i

e

n

t

t

-

s

t

a

t

R

e

l

a

t

i

o

n

s

h

i

p

v

a

r

i

a

b

l

e

s

L

e

n

g

t

h

o

f

l

e

n

d

e

r

b

o

r

r

o

w

e

r

r

e

l

a

t

i

o

n

s

h

i

p

(

y

e

a

r

s

)

0

.

0

0

0

.

3

3

0

.

0

3

2

.

5

4

0

.

0

1

1

.

1

3

0

.

0

0

0

.

6

6

B

o

r

r

o

w

e

r

a

g

e

(

y

e

a

r

s

)

0

.

0

0

0

.

2

9

0

.

0

1

1

.

1

9

0

.

0

2

2

.

5

1

0

.

0

1

2

.

0

5

N

u

m

b

e

r

o

f

i

n

f

o

r

m

a

t

i

o

n

s

e

r

v

i

c

e

s

f

r

o

m

l

e

n

d

e

r

0

.

4

7

2

.

7

1

0

.

3

4

0

.

9

9

0

.

1

0

0

.

4

5

0

.

1

3

0

.

8

5

N

u

m

b

e

r

o

f

n

o

n

i

n

f

o

r

m

a

t

i

o

n

s

e

r

v

i

c

e

s

f

r

o

m

l

e

n

d

e

r

0

.

0

7

0

.

3

9

0

.

1

4

0

.

4

5

0

.

1

0

0

.

5

3

0

.

0

0

0

.

0

4

I

n

d

i

c

a

t

o

r

i

f

b

o

r

r

o

w

e

r

h

a

s

a

d

e

p

o

s

i

t

w

i

t

h

l

e

n

d

e

r

0

.

3

7

2

.

1

2

0

.

1

8

0

.

7

4

0

.

3

0

1

.

2

7

0

.

1

1

0

.

7

8

N

u

m

b

e

r

o

f

r

e

l

a

t

i

o

n

s

h

i

p

s

0

.

0

9

1

.

3

6

0

.

0

7

1

.

0

2

0

.

0

6

0

.

8

9

0

.

0

4

0

.

9

4

M

a

r

k

e

t

c

h

a

r

a

c

t

e

r

i

s

t

i

c

s

M

a

r

k

e

t

c

o

n

c

e

n

t

r

a

t

i

o

n

0

.

3

9

0

.

4

0

1

.

5

9

1

.

1

1

0

.

7

8

0

.

8

3

0

.

4

2

0

.

5

8

I

n

d

i

c

a

t

o

r

i

f

b

o

r

r

o

w

e

r

i

s

i

n

a

n

M

S

A

0

.

0

6

0

.

3

2

0

.

5

4

1

.

9

1

0

.

2

6

0

.

7

0

0

.

0

8

0

.

6

9

A

v

e

r

a

g

e

l

a

g

g

e

d

5

-

y

e

a

r

g

r

o

w

t

h

r

a

t

e

0

.

4

5

0

.

3

3

0

.

9

8

0

.

4

5

0

.

4

6

0

.

1

8

0

.

4

6

0

.

5

0

N

1

,

6

3

6

7

8

8

1

,

7

3

7

4

,

1

6

1

R

2

1

6

.

3

1

%

2

0

.

0

6

%

2

3

.

5

1

%

3

1

.

6

5

%

878 The Journal of Finance

R

and thus eliminated the possibility that the coefcient onbranching restrictions

is biased because it is correlated with some unmeasured state characteristic.

This model by necessity constrains the coefcients to be constant over time.

Also, because we only have variation in the branching variable across states

and over time, but not across observations within the same state-year, we

cluster the error at the state-year level in building standard errors.

Columns 7 and 8 of Table III report the pooled, xed effects results of

equation (2). Consistent with the year-by-year regressions, we nd that the

coefcient on branching restrictions is positive and statistically signicant.

The coefcient equals 0.22, which is roughly equal to the average of the ef-

fects from the 1998 and 2003 cross-sections. According to this estimate, states

that relaxed interstate branching restrictions the most enjoyed a decline in

borrowing rates for small rms of about 88 basis points (0.22 4 = 88 basis

points).

F. What Drives the Branching Index?

Deregulation occurs through a political process shaped by interest group

lobbying as well as ideological jockeying between constituents and legislators.

Thus, one concern with our results is that the forces generating variation in

a states stance toward openness to interstate branching may be correlated

with demand for credit in the state, or with other supply-side factors such as

the relative bargaining power of interest groups within the nancial services

sector. For example, if states with strong growth opportunities are more likely

to deregulate, then the branching index may be related to credit demand.

Alternatively, if states with strong allies of large banks are more likely to have

openness to branching, then the results may have to do with the structure of

banks in a state rather than with a change in competition.

We offer three pieces of evidence to rule out these alternative explanations

for our results. First, including state xed effects will strip out any persistent

differences across states. For example, differences in the structure of industry,

or differences in the relative bargaining power of large versus small banks,

will tend to be very persistent and thus will be taken out by the xed effects.

Second, we report the cross-state correlation between variables linked to the

timing of past intrastate (opposed to interstate) deregulation and our branching

index and between lagged and contemporaneous state-level economic growth

and our branching index. Third, we test whether controlling for these factors

in the interest rate model affects the year-by-year results.

In choosing the set of factors possibly related to deregulation, we follow

Kroszner and Strahan (1999), who show that the size of the insurance sector

relative to banking, the size of small banks relative to large, the capital-to-asset

ratio of small banks relative to large, and the fraction of small nonnancial

rms in the state are all related to the timing of intrastate branch reform.

Kroszner and Strahan also nd a limited role for ideologystates controlled by

Democrats were slower to deregulate intrastate restrictions, all else equal. For

the relative size of insurance, we use the ratio of value added from insurance

Does Credit Competition Affect Small-Firm Finance? 879

Table IV

Correlation between Interest Group Factors, Political Factors, and

Economic Conditions with Index of Branching Restrictions

For eachvariable described inthe far left column, this table reports its meanand its correlationwith

the branching restrictions index, where each statistic is built from 51 observations, one per state

(including DC). With the exception of the economic growth variables, all state characteristics are

measured as of 1993, the year before passage of the Interstate Banking and Branching Efciency

Act.

Denotes signicance at the 1% level.

Cross-State Correlation

with Branching Index

Mean 1998 Index 2003 Index