Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Comparing The Informativeness of Two Income Smoothing PDF

Caricato da

Isni AmeliaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Comparing The Informativeness of Two Income Smoothing PDF

Caricato da

Isni AmeliaCopyright:

Formati disponibili

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.

,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, <

Comparing The Informativeness Of Two Income Smoothing

Measures

Faello, Joseph

Lakehead University

ABSTRACT

This study compares the informativeness of two income smoothing measures used extensively in

accounting research (i) Albrecht and Richardson (AR); and (ii) Tucker and Zarowin (TZ).

Researchers that have used either of these two income smoothing measures in their studies

include Bao and Bao (2004), Carlson and Bathala (1997), Grant et al. (2009), Sun (2009), and

Mascarenhas et al. (2010). Informativeness is defined as the association between earnings and

one period ahead operating cash flows. Researchers in prior studies define informativeness in a

similar manner (e.g., Kim and Kross 2005). Results indicate the TZ measure strengthens the

earnings association with one period ahead operating cash flows to a greater extent than the AR

measure, and thus, is more informative. Accounting researchers would find these results useful

because they can more effectively match the objectives of their income smoothing studies (i.e.,

either deceptive or informative income smoothing purpose)with the appropriate income

smoothing measure (i.e., either AR or TZ measure).

Keywords: Income smoothing, Informativeness, Earnings management, Quality of financial

reporting

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, =

INTRODUCTION

Academics have studied income smoothing from both informative and deceptive perspectives.

On the informative side, firms managers smooth income to inform financial statement users

about the firms financial prospects. On the deceptive side, income smoothing is a form of

earnings management, utilized by managers to further their own interests at the shareholders

expense.

Firms income smoothing behavior cannot be observed directly, but must be implied by a

descriptor variable. Two descriptor variables used extensively in the literature are the Albrecht

and Richardson (1990) and Tucker and Zarowin (2006) income smoothing measures. The

Albrecht and Richardson (AR) approach uses the ratio of coefficients of variation between

changes in earnings and changes in sales respectively. If the ratio is less than one, then managers

are smoothing income because the variability of income is less than the variability of sales. Prior

studies that have used this approach include Albrecht and Richardson (1990), Bao and Bao

(2004), Carlson and Bathala (1997), Michelson et al. (1995 and 2000), and Faello (2012). The

Tucker and Zarowin (TZ) approach is an accrual-based measure and measures income smoothing

by the negative correlation of a firms change in discretionary accruals with its change in pre-

managed earnings. A greater degree of income smoothing is indicated by a more negative

correlation. Income smoothing studies utilizing the TZ approach include Tucker and Zarowin

(2006), Mascarenhas et al. (2010), Grant et al. (2009), Sun (2009) and Faello (2012).

Using data and results from Faello (2012), the purpose of this study is to compare the

informativeness of the two approaches and to determine which approach has a greater

association with the informative role of income smoothing in financial reporting. Accounting

academics would find this study beneficial because they can more effectively match the

objectives of their income smoothing studies (i.e., either informative or deceptive income

smoothing purpose) with the appropriate income smoothing measure (i.e., either AR or TZ

measure).

Defining the Income Smoothing Measures

Albrecht and Richardson (AR) Income Smoothing Measure

The AR method uses the relationship between earnings and sales revenue variability to develop

their income smoothing criterion (i.e., coefficient of variation ratio). Their income smoothing

criterion is calculated as follows:

(1.0)

Where: !I = one period change in income;

!S = one period change in sales;

CV = coefficient of variation

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, >

CV = ______"Variance_______

Estimated Expected Value

If the ratio of coefficients of variation is less than one, then managers are considered income

smoothers because the variability of income is less than the variability of sales. This method

represents a dichotomous classification of firms into two categories that is, firms are classified

as either income smoothers or income non-smoothers.

The AR method uses four measurements of income:

Operating income: sales minus cost of sales and operating expenses (excluding

depreciation and amortization);

Income from operations: operating income minus depreciation and amortization;

Income before extraordinary items; and

Net income.

In applying their methodology, AR decided that if the ratio is less than one for any one of the

four income measures, then the firm is considered an income smoother. AR (1990), Bao and

Bao (2004), Carlson and Bathala (1997), and Michelson et al. (1995 and 2000) apply the ratio in

this manner. However, degrees of income smoothing exist as some firms may smooth income to

a greater extent than other firms. Faello (2012) uses this income smoothing measure from the

perspective that income smoothing is a continuum; that is, degrees of income smoothing exist

and firms that score lower on the measure (i.e., lower variability) exhibit a higher degree of

income smoothing. By ranking firms along degrees of income smoothing for the four

measurements of income separately, additional information can be deduced about income

smoothing behavior (e.g., smoothing earnings before or after deducting depreciation and

amortization; before or after deducting an extraordinary loss). Rankings should not result in a

significant loss in explanatory power instead of using the raw statistics (Aczel 2002, p. 676).

This study follows the Faello (2012) approach in determining the AR income smoothing statistic.

The AR statistic accounts for accrual and cash-based transactions because it is an income-based

measure. That is, both accrual and cash-based transactions are included in ARs four income

measures (i.e., operating income; income from operations; income before extraordinary items;

and net income). Although accrual accounting is typically associated with income smoothing,

emerging evidence highlights the use of cash-based transactions to smooth income in a deceptive

manner. Murphy (2000) finds an association between accounting-based measures used in

performance contracts and income smoothing. Murphy (2000, p. 262) states:

Most studies of income smoothing in the accounting literature have

focused on discretionary accruals, reflecting accounting choices

managers can make to shift reported earnings from one period to

another. The implicit rationale for this approach is that managers

have more control over accounting phenomena than they have over

the timing of the organizations actual cash flows. Although

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, ?

resolving what may ultimately be an empirical issue is beyond the

scope of this paper, I conjecture that focusing on accruals while

ignoring direct manipulation of cash flows underestimates the

resourcefulness of clever managers.

Roychowdhury (2006) provides evidence of earnings management through manipulation of real

cash transactions. He finds firms use temporary price discounts to increase sales, overproduce to

reduce cost of sales, and reduce discretionary expenses to increase profit margins. Graham et al.

(2005) survey firms executives and find managers have multiple objectives and use accrual and

cash-based transactions for deceptive income smoothing purposes.

The case of Bristol-Myers Squibb Company (BMS) highlights the use of accruals and cash-based

transactions to manage and smooth earnings. From the first quarter of its fiscal year 2000 to the

fourth quarter of its fiscal year 2001 (U.S. SEC v. BMS 2004), the Securities and Exchange

Commissions (SEC) investigation found, The Controller told his assistant controllers that he

wanted no surprises, smooth earnings, and no unusual gains or losses that BMS would have to

explain to investors (U.S. SEC v. BMS 2004, para. 60). On the accrual-based side, BMS

created reserves on divestiture transactions to reduce the current periods earnings.

Subsequently, the reserves could be reversed if needed to increase the next accounting periods

operating income. On the cash-based side, BMS paid wholesalers cash incentives to take excess

inventory. The incentives paid were significant and cost BMS millions of dollars each quarter

(U.S. SEC v. BMS 2004, para. 32). Clearly, the use of cash-based transactions, the sole purpose

of which is to smooth income, cannot increase shareholders wealth. This type of expenditure is

unlike an investment in a factory that provides the firm with a stream of positive cash inflows

and positive net present value. Thus, the AR statistic with its ability to include cash-based

transactions in its measure possesses an additional feature to capture deceptive income

smoothing that is not present under the TZ approach.

The AR approach has been used extensively by researchers in support of informative (e.g.,

Michelson et al. 1995) and deceptive (e.g., Carlson and Bathala 1997) income smoothing.

Carlson and Bathala (1997) examine the effect of ownership differences on income smoothing.

They find lower proportions of inside ownership, higher proportions of institutional ownership,

higher proportion of debt financing, the existence of executive compensation plans tied to stock

performance, and wider dispersion of stock ownership, are all related to a higher probability of

income smoothing. The authors results support the deceptive role of income smoothing and

conclude: The findings presented in this paper imply that factors such as agency costs,

informational asymmetry, and incentive motives impact income smoothing behavior in firms

(Carlson and Bathala 1997, p. 194).

Bao and Bao (2004) examine the effect of income smoothing and earnings quality on value

relevance. Value relevance in accounting research is represented by the association of an

accounting amount (e.g. earnings) with equity market values (Barth et al. 2001a). The greater

the degree of association, then the more value relevant the accounting amount is. The authors

categorize firms along earnings quality (using Sloan [1996]) and income smoothing (using the

AR approach) lines, resulting in the following categories: quality earnings smoothers, quality

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, @

earnings non-smoothers, non-quality earnings smoothers, and non-quality earnings non-

smoothers. When controlling for earnings quality, Bao and Bao find quality earnings income

smoothers have a significantly higher price-earnings multiple than non-quality non-smoothers.

Thus, income smoothing provides additional information for higher earnings quality firms by

strengthening the price-earnings ratio.

Michelson et al. (1995) examine the relationship between income smoothing and stock returns.

They use the AR approach to identify income smoothing firms and examine the differences

between income smoothing and non-income smoothing firms mean stock returns, beta, and

market value of equity. The authors find income smoothing firms have lower annualized stock

returns, lower betas, and higher market values of equity. The combination of lower betas (risk)

and lower returns is appropriate in the context of market efficiency and supports the informative

role of income smoothing.

Michelson et al. (2000) test the firms in the S & P 500 for the association between cumulative

average abnormal returns and degrees of income smoothing using the AR income smoothing

approach. The authors find income smoothers have higher cumulative average abnormal returns

than non-smoothers. Also, firms in the transportation, communications, and mining segments

smooth income to a greater degree than firms in other industry segments.

Tucker and Zarowin (TZ) Income Smoothing Measure

The TZ method measures income smoothing by the negative correlation of a companys change

in discretionary accruals with its change in pre-managed earnings. A greater degree of income

smoothing is indicated by a more negative correlation. The authors assume that there is an

underlying pre-managed income series and that managers use discretionary accruals to make the

reported series smooth (Tucker and Zarowin 2006, p. 254). Discretionary accruals are

measured by a modified cross-sectional version of the Jones Model which is used by TZ to

estimate discretionary accruals as follows:

Accruals

t

= a(1 / Assets

t-1

) + b #Sales

t

+ cPPE

t

+ d ROA

t

+ $

t

(2.0)

Where:

Accruals

t

= total accruals in year t; that is, net income minus cash flows from operations

scaled by total assets at (t 1);

#Sales

t

= sales in year t minus sales in year (t 1) scaled by total assets

at (t 1);

PPE

t

= gross property, plant and equipment in year t scaled by total assets at (t 1);

Assets

t-1

= total assets at (t 1); and

ROA

t

= return on assets in year t (net income

t

/ total assets

t-1

).

The non-discretionary accruals are the fitted values generated from regression equation (2.0).

The discretionary accruals are the deviations between actual accruals and non-discretionary

accruals. Pre-managed earnings are determined by subtracting discretionary accruals from net

income. TZ use five observations (i.e., including the current years observation) to construct the

income smoothing measure.

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, A

TZ use a fractional ranking of firms each year within its industry (Tucker and Zarowin 2006, p.

255). A more negative correlation between a companys change in discretionary accruals and its

change in pre-managed earnings implies a higher degree of income smoothing (Tucker and

Zarowin 2006, p. 255). TZ use four regression models to relate earnings, income smoothing, and

stock returns. These models are additive in nature, beginning with regressing stock returns on

the difference between annual realized and expected earnings and the change in expected

earnings (Collins et al. 1994) and then, extend the model by adding income smoothing as a

standalone variable and as an interaction variable with past, current, and future earnings and

future returns. TZs purpose of developing the regression models in this manner is to illustrate

the added information content of income smoothing. First, the standalone coefficients for

current and future earnings in the initial model are positive and significant indicating earnings

information gets impounded in stock returns (Tucker and Zarowin 2006, p. 259). Second, the

authors find the coefficient for the interaction variable between income smoothing and current

earnings significant meaning income smoothing strengthens earnings persistence (Tucker and

Zarowin 2006, p. 259). Next, the coefficients for the interaction variables between income

smoothing and prior earnings, income smoothing and current earnings, and income smoothing

and future earnings are significant, but the coefficient for future earnings by itself is no longer

significant. These results indicate stock returns impound future earnings information only when

income smoothing is present. Taken together, TZ provide evidence of strong support for the

informative role of income smoothing in financial reporting.

Sun (2011) examines whether income smoothing improves earnings informativeness to a greater

extent for firms with high analyst coverage versus firms with low analyst coverage. The author

adopts TZs income smoothing and modeling methodologies (Tucker and Zarowin 2006). First,

stock returns are regressed on prior, current, and future earnings. Next, income smoothing is

added as a standalone and interaction variables. Then, an analyst coverage variable is included

in the model (i.e., standalone and interaction formats) along with various control variables (Sun

2011, p. 340, model 4). Sun finds the interaction variable of future earnings, income smoothing,

and analyst coverage significant. Thus, the author concludes income smoothing improves

earnings informativeness to a greater extent for firms with higher analyst coverage.

Mascarenhas et al. (2010) examine whether audit specialists restrict the discretionary accruals of

their clients to a greater extent than non-specialist auditors. Discretionary accruals can be

informative or deceptive and the authors hypothesize that audit industry specialists can reduce

opportunistic behavior and make earnings more informative. The authors use the TZ approach to

identify income smoothing firms and TZs regression modeling to test informativeness (Tucker

and Zarowin 2006). The authors replicate TZs results; that is, income smoothing is informative

as the two-way earnings-income smoothing variables are significant in the regression model.

However, when the standalone audit industry specialist variable is added to the model, the three-

way interaction term of audit industry specialist-income smoothing-earnings is not significant.

The authors conclude clients discretionary accruals of audit industry specialists are not more

highly related to stock returns and thus, are not more informative than clients discretionary

accruals of non-specialist auditors.

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, B

Grant et al. (2009) use the TZ approach in determining income smoothing firms to examine the

relation between chief executive officers (CEOs) risk-taking incentives and income smoothing.

The authors consider risk-taking incentives as an endogenous variable in explaining its relation

with income smoothing. Consequently, risk-taking incentives is a dependent variable in a

regression model whose predicted values are then used as an independent variable in an income

smoothing model. Results show higher risk-taking incentives is significant and positive in the

income smoothing model. The authors conclude income smoothing is used by CEOs to reduce

the appearance of firms risk.

Faello (2012) examines the link between income smoothing and corporate governance using the

AR and TZ approaches. His results indicate a weak link between a higher degree of income

smoothing and strong corporate governance measures, but only under the TZ approach. No

significant results were found under the AR measure.

Once the income smoothing measures are calculated for each firm under the AR and TZ

methods, then the firms ranking determines its degree of smoothing under the respective income

smoothing method. Ranking firms by income smoothing measures, results in five income

smoothing rankings:

Firms rankings under the AR approach using operating income: sales minus cost of

sales and operating expenses (excluding depreciation and amortization) as the

measure of income;

Firms rankings under the AR approach using income from operations: operating

income minus depreciation and amortization as the measure of income;

Firms rankings under the AR approach using income before extraordinary items as

the measure of income;

Firms rankings under the AR approach using net income as the measure of income;

and

Firms rankings under the TZ approach.

In summary, the TZ and AR income smoothing measures have been used in prior research to

examine firms income smoothing behavior. Ranking firms for degrees of income smoothing

and then determining the informativeness of the measures will provide researchers with useful

insights in developing their income smoothing studies.

Hypotheses Development

Comparing the informativeness of the TZ and AR income smoothing rankings requires a four-

step process:

1. Define informativeness;

2. Determine the informativeness of the TZ and AR measures;

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, C

3. Compare the informativeness of the two measures; and

4. Conclude which measure is the most informative.

First, informativeness is defined as the association between earnings and one period ahead cash

flows from operations. Greater positive association between the two indicates a higher degree of

informativeness. Prior researchers have defined in a similar manner the information content of

earnings (including its components such as accruals) to predict cash flows (e.g., Barth et al.

2001b; Dechow and Dichev 2002; Kim and Kross 2005). Second, the informativeness of each

measure is determined by the additional explanatory power that the particular measure (either TZ

or AR) gives to earnings in explaining the operating cash flows. Third, the informativeness

comparison involves determining the difference in explanatory power (i.e., adjusted R

2

) under

the two income smoothing approaches and finally, drawing a conclusion from the results.

The TZ approach is accrual-based and does not include the effect of cash-based transactions.

Under the AR approach, deceptive cash-based transactions used to smooth earnings are

embedded in the measure and are predicted to reduce informativeness. In effect, these cash-

based transactions mask the AR measures degree of informativeness. Thus, the TZ income

smoothing ranking is expected to capture a stronger relationship between current earnings and

one period ahead operating cash flows than the AR income smoothing ranking. This studys

hypothesis is stated as follows:

H1: The TZ income smoothing rankings capture a stronger relationship between firms

current earnings and one period ahead operating cash flows than the AR income

smoothing rankings.

If the results support the hypothesis, then this study would provide academics with greater

insights in designing their research and it would make a valuable contribution to the income

smoothing literature stream.

Research Methodology

The methodology used to test H1 is similar to that of TZ (Tucker and Zarowin, 2006). First, one

period ahead cash flows are regressed on earnings and control variables. Next, the income

smoothing rankings (i.e., TZ or AR) are included as independent variables. In this manner, the

additional explanatory power of income smoothing can be determined by examining the

significance of the coefficients for the income smoothing variables and comparing the adjusted

R

2

for the regression models. Comparing adjusted R

2

between models is justified when the

dependent variable and sample size are the same across all models (Gujarati 2003, p. 219).

There should not be a significant loss in explanatory power by using ranks instead of the raw

statistic (Aczel 2002, p. 676).

The process of adding each income smoothing variable to the research models as a standalone

variable and as an interactive variable with earnings, will lead to insights as to whether or not

income smoothing enhances the informativeness of earnings vis--vis cash flows. If income

smoothing enhances informativeness, then the coefficients for the income smoothing variables

should be positive and significant. The models for determining the informativeness of the TZ

and AR measures are stated as follows:

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, D

CF

it

= % + &

1

EARN

i,t-1

+

' (&

j

CONTROLVAR

ji,t-1

) + (

it

(3.0)

CF

it

= % + &

1

EARN

i,t-1

+ &

2

TZRank

i,t-1

+ &

3

(EARN

i,t-1

*

TZRank

i,t-1

) +

' (&

j

CONTROLVAR

ji,t-1

) + (

it

(3.1)

CF

it

= % + &

1

EARN

i,t-1

+ &

2

ARRank

mi,t-1

+ &

3

(EARN

i,t-1

*

ARRank

mi,t-1

) +

' (&

j

CONTROLVAR

ji,t-1

) + (

mit

(3.2)

Where:

CF

it

= the dependent variable representing the firms next period cash flows from

operations;

TZRank

i,t-1

= firm is ranking as an income smoother under the Tucker-Zarowin

approach with a ranking of 1 indicating the highest degree of income

smoothing and n indicating the lowest degree of income smoothing in year

t-1 (1997 to 2000);

ARRank

mi,t-1

= the dependent variable, is firm is ranking as an income smoother under

the m

th

version of the Albrecht-Richardson approach with a ranking of 1

indicating the highest degree of income smoothing and n indicating the

lowest degree of income smoothing in year t-1 (1997 to 2000);

m = 1 to 4, each representing a different version of income under the

Albrecht)Richardson approach: (1) Operating income, (2) Income from

operations, (3) Income from extraordinary items, and (4) Net income;

EARN

i,t-1

= the firms earnings at t -1;

CONTROLVAR

i,t-1

= explanatory variables representing control variables (described below);

The control variables are as follows:

SIZE = firms total assets to control for the effect of firm size;

GROWTH = market-to-book ratio as measured by the market value divided by the

book value of equity;

LEVERAGE = debt to assets ratio;

SEGNUM = number of operating segments reported by the firm; and

INDUSTRY = indicator variables, numbered one through eight representing the two-

digit Standard Industrial Classification (SIC) code for industry types and

change in classification over the study period. The numbering is as

follows: (1) Division A: agriculture, forestry, and fishing; (2) Division B:

mining; (3) Division C: construction; (4) Division D: manufacturing; (5)

Division E: transportation, communications, electric, gas, and sanitary

services; (6) Division F: wholesale trade; (7) Division G: retail trade; and

(8) change in SIC code classification over the study period; and

(

it

, (

mit

= error term.

Bao and Bao (2004) include control variables for SIZE and LEVERAGE in their study. Tucker

and Zarowin (2006) control for SIZE and GROWTH. SEGNUM proxies for the role of the

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, <E

firms organizational structure in influencing income smoothing behavior. Lee et al. (2007) find

highly intrarelated divisions are associated with earnings management. SEGNUM is expected to

be negatively associated with the dependent variable. For INDUSTRY, there are eight

categories as described on the Occupational Safety & Health Administration website of the

Department of Labor (OSHA, 2011). Model specification requires (m 1) dummy variables for

m categories (Gujarati 2003, p. 302). Thus, the first seven dummy variables denote the different

industry categories and the eighth category denotes whether or not a firm changed categories

over the study period. No prediction is given for INDUSTRY because Albrecht and Richardson

(1990) did not find particular industries or sectors of the economy statistically significant with

income smoothing behavior. Michelson et al. (2000) find firms in the Mining and Transportation

and Communications segments possess a higher likelihood of being classified as an income

smoother rather than a non-smoother.

Both the TZ and AR income smoothing measures have been used in prior research to highlight

the informative aspects of income smoothing (e.g., Tucker and Zarowin 2006; Bao and Bao

2004). However, the TZ measure is expected to have a greater association with informativeness

because it does not include deceptive cash-based transactions in its measure. In assessing

whether the link between earnings and cash flows is strengthened with the two income

smoothing measures present, any increase in adjusted R

2

from the TZ or AR models provides the

necessary evidence of additional explanatory power. Comparing adjusted R

2

between models is

justified when the models have the same dependent variable and sample size (Gujarati 2003, p.

219). The TZ and AR regression models are represented by equations 3.1 and 3.2. Including

both measures in equation 3.0 results in equation 3.3 below and provides the basis for testing H1:

CF

it

= % + &

1

EARN

i,t-1

+ &

2

TZRank

i,t-1

+ &

3

(EARN

i,t-1

* TZRank

i,t-1

)

+

&

4

ARRank

mi,t-1

+ &

5

(EARN

i,t-1

* ARRank

mi,t-1

)

+

' (&

j

CONTROLVAR

ji,t-1

) + (

mit

(3.3)

Where:

CF

it

= the dependent variable representing the firms next period cash flows

from operations;

TZRank

i,t-1

= firm is ranking as an income smoother under the Tucker-Zarowin

approach with a ranking of 1 indicating the highest degree of income

smoothing and n indicating the lowest degree of income smoothing in year

t-1 (1997 to 2000);

ARRank

mi,t-1

= the dependent variable, is firm is ranking as an income smoother under

the m

th

version of the Albrecht-Richardson approach with a ranking of 1

indicating the highest degree of income smoothing and n indicating the

lowest degree of income smoothing in year t-1 (1997 to 2000);

m = 4, representing the net income version of income under the Albrecht-

Richardson approach;

CONTROLVAR

i,t-1

= explanatory variables representing control variables (described above);

and

(

mit

= error term.

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, <<

Overall, this study will provide researchers with unique insights in developing their own income

smoothing studies.

Data and Empirical Results

Firms financial data come from Compustats annual combined industrial data bases for the

period 1992 to 2001. Although the study covers the 1998 to 2001 period, financial data has to be

extracted from 1992 to 2001 because the income smoothing measures require five years of data

to construct the test statistics. Financial institutions (SIC codes 6000 to 6999) are excluded from

the analysis because of their unique accounting. Another restriction on the sample relates to

firms financial year-ends. Prior studies show firms manage earnings during the last fiscal

quarter (Oyer 1998). Including firms in the sample with a break in the continuity of fiscal

quarters because of a merger or acquisition would bias the sample. Thus, these firms are

excluded from the study.

The final sample size is 125 firms (n = 125). An alphabetical list of sample firms is presented in

Appendix A, Table A.1. Industry representation of these firms is presented in Table 1 and

follows the classification system of the Standard Industrial Classification (SIC) code (OSHA,

April 24, 2011). The sample consists predominantly of manufacturing firms (64% of total

sample, see Table 1) and is similar to that of prior studies (e.g., Michelson et al. 2000). The

samples descriptive statistics are presented in Table 2. Over the period 1997 to 2001, firms

average earnings increased over the first four years (i.e., 1997 to 2000) and then declined in

2001. These results reflect the business activities of the general economy as a recession

commenced and ended during the first and fourth quarters of 2001 respectively (National Bureau

of Economic Research, 2008). From an accounting perspective, these conditions present

opportunities for firms to manage earnings by income smoothing. During a period of earnings

growth (i.e., 1997 to 2000 period), firms have an incentive to smooth earnings downward. Kieso

et al. (2008, p. 128) explain the incentive using W.R. Grace Company as an example:

Managing earnings up or down adversely affects the quality of

earnings. For example, W.R. Grace managed earnings down by

taking excess cookie jar reserves in good earnings years. During

the early 1990s, Grace was growing fast, with profits increasing 30

percent annually. Analysts targets had Grace growing 24 percent

each year. Worried about meeting these growth expectations,

Grace began stashing away excess profits in an all-purpose reserve

(a cookie jar). In 1995, when profits fell below expectations,

Grace wanted to reduce this reserve and so increase income. The

SEC objected, noting this violated generally accepted accounting

principles.

Thus, the descriptive statistics provide evidence that the conditions exist for firms to smooth

income in an informative or deceptive manner. From an informative point of view, firms attempt

to align earnings with one period ahead operating cash flows. From a deceptive point of view,

firms manage earnings to achieve earnings targets.

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, <=

Table 1 Industry Representation

SIC Code

Description

No. of Firms /

%

00 to 09 Division A: Agriculture, Forestry and Fishing 1 / 1%

10 to 14 Division B: Mining 5 / 4%

15 to 17 Division C: Construction 1 / 1%

20 to 39 Division D: Manufacturing 80 / 64%

40 to 49 Division E: Transportation, Communications,

Electric, Gas and Sanitary Services

6 / 5%

50 to 51 Division F: Wholesale Trade 9 / 7%

52 to 59 Division G: Retail Trade 5 / 4%

70 to 99 Divisions I and J: Services and Public Administration 18 / 14%

125/ 100%

Reproduced from: Faello, J., Is Strong Corporate Governance Associated With Informative

Income Smoothing? ProQuest LLC., 2012, Table 4.1 Panel A, p. 57.

Table 2 Descriptive Statistics (n = 125)

Mean (in millions) 1997 1998 1999 2000 2001

Assets 7,018.66 7,933.94 9,976.57 11,577.30 11,697.83

Sales 4,792.40 4,895.92 5,558.92 6,226.60 6,097.11

Operating cash flows 579.67 628.92 772.79 844.11 959.19

Income before

extraordinary items

282.27

317.79

366.27

402.15

335.24

Net income 280.61 313.46 377.81 399.21 333.41

Reproduced from: Faello, J., Is Strong Corporate Governance Associated With Informative

Income Smoothing? ProQuest LLC., 2012, Table 4.2, p. 59

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, <>

Tucker and Zarowin (TZ) Income Smoothing Measure

The TZ income smoothing method measures income smoothing by the negative correlation of a

companys change in discretionary accruals with its change in pre-managed earnings.

Discretionary accruals are measured by a modified version of the Jones Model (see model 2.0).

The non-discretionary accruals are the fitted values generated from model 2.0. The discretionary

accruals are the deviations between actual accruals and non-discretionary accruals. Pre-managed

earnings are determined by subtracting discretionary accruals from net income. The results for

the modified Jones Model are contained in Table 3.

A comparison of this studys Jones Model results with those of TZ (2006) follows. For TZs

1988 2000 study period, TZ reported the mean for each coefficient and R

2

. These results are:

a = 0.112, b = 0.013, c = 0.074, d = 0.457 and R

2

= 0.642 (Tucker and Zarowin 2006, p. 259).

On the one hand, the results in Table 3 are similar to TZs results. The coefficient c pertains to

gross property, plant and equipment and is negative. This is the expected result because gross

property, plant and equipment is negatively related to the accrual of depreciation expense (Jones

1991, p. 213). The coefficient d relates to return on assets and is positive. Again, this is an

expected result because total accruals increase with net income. TZs R

2

is higher for six of the

nine years of this study. On the other hand, the coefficient b is not consistently positive or

negative whereas TZs result is positive on average. This expected sign is more difficult to

predict because revenue increases affect accruals both positively and negatively. Jones (1991, p.

213) states, The expected sign for the change in revenues coefficient is not as obvious because a

given change in revenue can cause income-increasing changes in some working capital accounts

(e.g. increases in accounts receivable) and income-decreasing changes in others (e.g. increases in

accounts payable).

The TZ income smoothing rankings for each firm included in the sample are presented in

Appendix A, Table A.2. Using the results from the Jones Model to construct the correlations

between change in discretionary accruals and change in pre-managed earnings, rankings from

most negative (i.e., highest degree of income smoothing) to least negative (i.e., lowest degree of

income smoothing) are compiled for the years 1997 to 2001. Individual firms rankings span the

spectrum with some firms consistently ranked in the top quartile (i.e., ranking between 1 and 35,

e.g. Universal Health Services), others consistently ranked in the bottom quartile (e.g. Georgia

Pacific Corp.), and the majority of the firms possessing rankings within each of the four

quartiles. TZ do not present results on an individual firm basis, meaning there is no basis of

comparison with this study. However, disclosure of this data should provide useful information

for future studies.

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, <?

Table 3 Estimation of Discretionary Accruals

Statistics by Year:

a

b

c

d

R

2

1993 0.464 -0.082 -0.091 0.509 0.523

1994 -0.070 0.126 -0.094 0.432 0.666

1995 0.662 0.055 -0.095 0.500 0.542

1996 0.723 -0.028 -0.072 0.251 0.428

1997 -0.273 0.031 -0.085 0.511 0.426

1998 2.637 0.016 -0.088 0.373 0.525

1999 -1.374 -0.071 -0.064 0.417 0.722

2000 1.087 0.083 -0.104 0.548 0.519

2001 -0.570 0.011 -0.112 0.422 0.867

The Modified Jones Model:

Accruals

t

= a(1 / Assets

t-1

) + b #Sales

t

+ cPPE

t

+ d ROA

t

+ $

t

The table presents the statistics for the estimated coefficients and R

2

of the annual regressions.

For each year, n = 125. Variable definitions are:

Accruals

t

= total accruals in year t, that is net income minus cash flows from operations;

Assets

t-1

= total assets at (t 1);

#Sales

t

= sales in year t minus sales in year (t 1) scaled by total assets at (t 1);

PPE

t

= gross property, plant and equipment in year t scaled by total assets at (t 1); and

ROA

t

= return on assets in year t.

Reproduced from: Faello, J., Is Strong Corporate Governance Associated With Informative

Income Smoothing? ProQuest LLC., 2012, Table 4.3, p. 61.

Albrecht and Richardson (AR) Income Smoothing Measure

The AR method uses the relationship between sales revenue and earnings variability to develop

their smoothing criterion (i.e., coefficient of variation ratio). Four measurements of income are

used because firms can choose to smooth various components of the income statement. The four

measurements of income are:

Operating income: sales minus cost of sales and operating expenses (excluding

depreciation and amortization);

Income from operations: operating income minus depreciation and amortization;

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, <@

Income before extraordinary items; and

Net income.

In prior research, if a firms ratio of coefficients of variation is less than one for any one of the

four income measures, then the firm is considered an income smoother. AR use their income

smoothing statistic to determine whether income smoothing is associated with particular

industries or economic sectors. They find no statistically significant association between sectors

and income smoothing behavior, but their classification of economic sectors relied on a system

developed in 1970 and is outdated in todays economy.

In this study, degrees of income smoothing are considered by ranking firms under each income

smoothing measure with the highest ranking indicating the highest degree of income smoothing.

This methodology provides additional information as to how firms smooth income (e.g. before or

after deducting depreciation and amortization; before or after deducting an extraordinary loss).

The results for the AR income smoothing rankings for the net income definition of earnings are

presented in Appendix A: Table A.3. The rankings for the remaining earnings definitions (i.e.,

operating income before depreciation and amortization; operating income after depreciation and

amortization; income before extraordinary items) are available from the author upon request.

From these results, firms can exhibit a greater (lesser) degree of income smoothing in the early

years of the study period and then a lesser (greater) degree of income smoothing in the latter

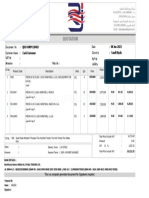

years of the study period (e.g. Flowserve Corp.). Further, firms may use a specific tool to

smooth earnings. For example, Ashland Inc.s average income smoothing rankings change

dramatically between the operating income before depreciation and amortization and operating

income after depreciation and amortization definition of earnings (see Figure 1.0). Ashlands

income smoothing behavior indicates its use of depreciation and amortization to smooth

earnings.

Overall, the TZ and AR income smoothing rankings provide useful insights into firms income

smoothing behavior.

Figure 1.0 Ashland Inc.s Average Income Smoothing Rankings

Reproduced from: Faello, J., Is Strong Corporate Governance Associated With Informative

Income Smoothing? ProQuest LLC., 2012, Figure 4.2, p. 63.

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, <A

Results of Tucker-Zarowin (TZ) Income Smoothing Approach

Hypothesis 1 predicts the use of income smoothing as captured in the TZ income smoothing

rankings leads to a stronger relationship between current earnings and one period ahead

operating cash flows than the AR income smoothing rankings. This hypothesis is

operationalized by equations 3.0, 3.1, 3.2, and 3.3. First, equation 3.0 links current earnings to

one period ahead operating cash flows. Second, the additional power (if any) provided by the TZ

income smoothing measure in explaining the variation in operating cash flows is determined by

including the TZ income smoothing ranking as an explanatory variable (i.e., equation 3.1 is the

resulting equation). Next, the AR income smoothing rankings under each definition of earnings

(i.e., operating income before depreciation and amortization; operating income after depreciation

and amortization; income before extraordinary items; net income) are individually added as an

explanatory variable to equation 3.0 (i.e., equation 3.2 is the resulting equation) to determine the

additional power (if any) provided by the AR income smoothing measure. Then, a comparison

of the TZs and ARs informativeness is operationalized by including the two measures together

in one equation (i.e., equation 3.3 is the resulting equation) and examining the differences in

explanatory power between equation 3.3 and 3.2 (AR approach) or 3.1 (TZ approach).

Table 4 provides the results for equation 3.0, the association between earnings and one period

ahead operating cash flows. The model is significant (F = 510.814, Adjusted R

2

= 0.930) with

the earnings coefficient significant at the 0.01 level of significance (&

1

= 1.009, t-statistic =

17.525). Also, significant are the size (&

2

= 0.040, t-statistic = 22.099), Mining industry segment

(&

7

= 426.358, t-statistic = 2.238), and Transportation, Communications, Electric, Gas and

Sanitary Services industry segment (&

10

= 1,405.151, t-statistic = 7.404).

For the earnings (&

1

) and total assets (&

2

) coefficients, a $1,000,000 increase in net income or

total assets results in $1,009,000 and $40,000 increases in one period ahead operating cash flows

respectively. The strong positive relation between earnings, assets, and operating cash flows is

expected because larger firms are expected to have larger earnings that translate into larger cash

flows. For the industry segments with significant coefficients (&

7

and &

10

), their significance

means the intercepts for firms in these segments increase by $426.358 million and $1,405.151

million respectively. The lack of significance for the remaining industry segments coefficients

(&

6

, &

8

,

&

9

, &

11

,

&

12

,

and &

13

) indicates these segments all have the same intercept of $141.908 (%).

The Services and Public Administration segment serves as the benchmark for the regression

model. Overall, the results for equation 3.0 indicate current net income is significantly

associated with one period ahead operating cash flows.

Table 5 shows the results for equation 3.1. This equation includes the TZ income smoothing

ranking as an explanatory variable, separately and in interaction form. The overall model (F =

463.494, Adjusted R

2

= 0.933) and the earnings-income smoothing interaction variable (&

3

) are

significant; however, the coefficient for income smoothing (&

2

) is not significant. This latter

result indicates income smoothing adds explanatory power to the model only when combined

with earnings. Essentially, income smoothing is a component of earnings that possesses an

informational content in explaining one period ahead operating cash flows. Overall, these results

support the body of academic literature of income smoothings informational usefulness (e.g.s

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, <B

Tucker and Zarowin 2006; Subramanyam 1996; Bao and Bao 2004). Also, the adjusted R

2

increases from 0.930 (see Table 4) to 0.933 (see Table 5). This result provides additional

evidence supporting the benefits of income smoothing in explaining one period ahead operating

cash flows.

Table 4 Current Earnings Association With One Period Ahead Operating Cash Flows

Parameter

Estimate

t-stat

Parameter

Estimate

t-stat

Parameter

Estimate

t-stat

% 141.908 0.998 &

5

-12.820 -0.777 &

10

1,405.151 7.404

***

&

1

1.009 17.525

***

&

6

-24.770 -0.065 &

11

-46.148 -

0.290

&

2

0.040 22.099

***

&

7

426.358 2.238

**

&

12

-8.095 -

0.042

&

3

0.062 0.068 &

8

172.138 0.448 &

13

40.986 0.207

&

4

-96.225 -0.624 &

9

-42.076 -0.422

CF

it

= % + &

1

EARN

i,t-1

+ &

2

SIZE

it-1

+ &

3

GROWTH

i,t-1

+ &

4

LEVERAGE

i,t-1

+ &

5

SEGNUM

i,t-1

+ &

6

D

1i-t-1

+ &

7

D

2i,t-1

+ &

8

D

3i,t-1

+ &

9

D

4i,t-1

+ &

10

D

5i,t-1

+ &

11

D

6i,t-1

+ &

12

D

7i,t-

1

+ &

13

D

8i,t-1

+ (

it

n = 500 Adj. R

2

= 0.930 Durbin-Watson = 2.032 F-statistic = 510.814***

* Significant at the % = .10 level of significance

** Significant at the % = .05 level of significance

*** Significant at the % = .01 level of significance

CF = the dependent variable, representing firms next period annual cash flow

from operations (millions $) for the periods 1998 to 2001

SIZE = firms total assets (millions $)

EARN = firms current net income (millions $)

GROWTH = market-to-book ratio as measured by the market value divided by the

book value of equity

LEVERAGE = firms debt to assets ratio

SEGNUM = number of operating segments reported by the firm

INDUSTRY = indicator variables representing the two-digit SIC code for industry types

and change in classification over the study period, otherwise = 0: (D1) 00 to 09,

Agriculture, Forestry and Fishing; (D2) 10 to 14, Mining; (D3) 15 to 17, Construction;

(D4) 20 to 39, Manufacturing; (D5) 40 to 49, Transportation, Communications, Electric,

Gas and Sanitary Services; (D6) 50 to 51, Wholesale Trade; (D7) 52 to 59, Retail Trade;

(D8) change in two-digit SIC code over the study period

Reproduced from: Faello, J., Is Strong Corporate Governance Associated With Informative

Income Smoothing? ProQuest LLC., 2012, Table 4.10, p. 81.

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, <C

Table 5 TZ Income Smoothing Measure Association With One Period Ahead Operating

Cash Flows

Parameter

Estimate

t-stat

Parameter

Estimate

t-stat

Parameter

Estimate

t-stat

% 145.403 0.994 &

6

-128.920 -0.842 &

12

1,091.401 5.543

***

&

1

0.653 6.685

***

&

7

-25.293 -1.546 &

13

-27.836 -0.178

&

2

0.784 0.795 &

8

-66.615 -0.176 &

14

-44.635 -0.238

&

3

0.004 4.408

***

&

9

393.635 2.105

**

&

15

34.271 0.177

&

4

0.047 20.260

***

&

10

89.301 0.237

&

5

0.035 0.039 &

11

-41.312 -0.423

CF

it

= % + &

1

EARN

i,t-1

+ &

2

TZRANK

i,t-1

+ &

3

(EARN

i,t-1

* TZRANK

i,t-1

) +&

4

SIZE

it-1

+

&

5

GROWTH

i,t-1

+ &

6

LEVERAGE

i,t-1

+ &

7

SEGNUM

i,t-1

+ &

8

D

1i-t-1

+ &

9

D

2i,t-1

+ &

10

D

3i,t-1

+ &

11

D

4i,t-1

+ &

12

D

5i,t-1

+ &

13

D

6i,t-1

+ &

14

D

7i,t-1

+ &

15

D

8i,t-1

+ (

it

n = 500 Adj. R

2

= 0.933 Durbin-Watson = 2.005 F-statistic = 463.494***

* Significant at the % = .10 level of significance

** Significant at the % = .05 level of significance

*** Significant at the % = .01 level of significance

CF = the dependent variable, representing firms next period annual cash flow

from operations (millions $) for the periods 1998 to 2001

TZRANK = firms annual rankings as an income smoother under the Tucker-Zarowin

approach with a ranking of 1 indicating the highest degree of income smoothing

EARN = firms current net income (millions $)

SIZE = firms total assets (millions $)

GROWTH = market-to-book ratio as measured by the market value divided by the book

value of equity

LEVERAGE = firms debt to assets ratio

SEGNUM = number of operating segments reported by the firm

INDUSTRY = indicator variables representing the two-digit SIC code for industry types

and change in classification over the study period, otherwise = 0: (D1) 00 to 09,

Agriculture, Forestry and Fishing; (D2) 10 to 14, Mining; (D3) 15 to 17, Construction;

(D4) 20 to 39, Manufacturing; (D5) 40 to 49, Transportation, Communications, Electric,

Gas and Sanitary Services; (D6) 50 to 51, Wholesale Trade; (D7) 52 to 59, Retail Trade;

(D8) change in two-digit SIC code over the study period

Reproduced from: Faello, J., Is Strong Corporate Governance Associated With Informative

Income Smoothing? ProQuest LLC., 2012, Table 4.11, p. 82.

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, <D

Results of Albrecht-Richardson (AR) Income Smoothing Approach

Using the same methodology as that for the TZ statistic, equation 3.0 is determined for the four

definitions of earnings used under the AR approach. These results are shown in Tables 6

(operating income before depreciation and amortization), 7 (operating income after depreciation

and amortization), 8 (income before extraordinary items), and 4 (net income).

Under each definition of earnings, the coefficient &

1

for the particular definition of earnings (i.e.,

operating income before depreciation and amortization; operating income after depreciation and

amortization; income before extraordinary items; and net income) has a positive and significant

association with one period ahead operating cash flows. Further, the size coefficient (&

2

) and

coefficients for the Mining (&

7

) and Transportation, Communications, Electric, Gas and Sanitary

service (&

10

) industry segments are significant and positive.

The significant difference across the four measures of earnings pertains to the number of

operating segments coefficient (&

5

). For the operating income before / after depreciation and

amortization definitions of earnings, coefficient &

5

is positive and significant; for the income

before extraordinary items and net income definitions the coefficient &

5

signs are negative and

insignificant.

These results are interpreted as follows. First, current earnings possess significant explanatory

power of one period ahead operating cash flows as evidenced by the significant &

1

coefficients.

Second, larger firms (i.e., proxied by the &

2

coefficients) possess strong association with one

period ahead cash flows. That is, larger firms are expected to have larger cash flows. Third, the

Mining (&

7

) and Transportation, Communications, Electric, Gas and Sanitary Services (&

10

)

industry segments possess a stronger association with one period ahead operating cash flows

than with firms in the Services and Public Administration segment. This is evidenced by the

increase in the intercepts in the amount of the respective coefficient terms &

5

and &

10

. Note that

the one industry segment not assigned an indicator variable (i.e., Services and Public

Administration) serves as the benchmark for these regression models. Fourth, firms

organizational structure (i.e., proxied by the number of operating segments) is positively

associated with one period ahead operating cash flows, but only under the operating income

before / after depreciation and amortization definitions of earnings. This result indicates non-

recurring or unusual items found in the lower half of the income statement offset the income

smoothing effects of the association between organizational structure and operating income.

Overall, the results for equation 3.0 for the four definitions of earnings under the AR income

smoothing approach indicate current earnings are significantly associated with one period ahead

operating cash flows.

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, =E

Table 6 Current Earnings Association With One Period Ahead Operating Cash Flows

(Operating Income Before Depreciation and Amortization)

Parameter

Estimate

t-stat

Parameter

Estimate

t-stat

Parameter

Estimate

t-stat

% -9.486 -0.058 &

5

55.076 3.010

***

&

10

1,752.393 8.041

***

&

1

0.218 10.609

***

&

6

1.610 0.004 &

11

-73.668 -

0.402

&

2

0.050 26.439

***

&

7

410.220 1.870

*

&

12

126.253 0.575

&

3

0.291 0.277 &

8

195.770 0.443 &

13

0.178 0.001

&

4

-199.699 -1.126 &

9

-94.775 -0.825

CF

it

= % + &

1

EARN

i,t-1

+ &

2

SIZE

it-1

+ &

3

GROWTH

i,t-1

+ &

4

LEVERAGE

i,t-1

+ &

5

SEGNUM

i,t-1

+ &

6

D

1i-t-1

+ &

7

D

2i,t-1

+ &

8

D

3i,t-1

+ &

9

D

4i,t-1

+ &

10

D

5i,t-1

+ &

11

D

6i,t-1

+ &

12

D

7i,t-

1

+ &

13

D

8i,t-1

+ (

it

n = 500 Adj. R

2

= 0.907 Durbin-Watson = 2.149 F-statistic = 376.333***

* Significant at the % = .10 level of significance

** Significant at the % = .05 level of significance

*** Significant at the % = .01 level of significance

CF = the dependent variable, representing firms next period annual cash flow

from operations (millions $) for the periods 1998 to 2001

SIZE = firms total assets (millions $)

EARN = firms current operating income before depreciation and amortization

(millions $)

GROWTH = market-to-book ratio as measured by the market value divided by the

book value of equity

LEVERAGE = firms debt to assets ratio

SEGNUM = number of operating segments reported by the firm

INDUSTRY = indicator variables representing the two-digit SIC code for industry types

and change in classification over the study period, otherwise = 0: (D1) 00 to 09,

Agriculture, Forestry and Fishing; (D2) 10 to 14, Mining; (D3) 15 to 17, Construction;

(D4) 20 to 39, Manufacturing; (D5) 40 to 49, Transportation, Communications, Electric,

Gas and Sanitary Services; (D6) 50 to 51, Wholesale Trade; (D7) 52 to 59, Retail Trade;

(D8) change in two-digit SIC code over the study period

Reproduced from: Faello, J., Is Strong Corporate Governance Associated With Informative

Income Smoothing? ProQuest LLC., 2012, Table 4.12, p. 85.

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, =<

Table 7 Current Earnings Association With One Period Ahead Operating Cash Flows

(Operating Income After Depreciation and Amortization)

Parameter

Estimate

t-stat

Parameter

Estimate

t-stat

Parameter

Estimate

t-stat

% -14.728 -0.086 &

5

63.856 3.346

***

&

10

2,138.889 9.709

***

&

1

0.226 7.895

***

&

6

-8.767 -0.019 &

11

-82.472 -0.431

&

2

0.054 26.937

***

&

7

442.934 1.933

*

&

12

143.455 0.625

&

3

0.371 0.338 &

8

233.577 0.506 &

13

-0.810 -0.003

&

4

-210.580 -1.136 &

9

-94.068 -0.784

CF

it

= % + &

1

EARN

i,t-1

+ &

2

SIZE

it-1

+ &

3

GROWTH

i,t-1

+ &

4

LEVERAGE

i,t-1

+ &

5

SEGNUM

i,t-1

+ &

6

D

1i-t-1

+ &

7

D

2i,t-1

+ &

8

D

3i,t-1

+ &

9

D

4i,t-1

+ &

10

D

5i,t-1

+ &

11

D

6i,t-1

+ &

12

D

7i,t-

1

+ &

13

D

8i,t-1

+ (

it

n = 500 Adj. R

2

= 0.899 Durbin-Watson = 2.116 F-statistic = 341.611***

* Significant at the % = .10 level of significance

** Significant at the % = .05 level of significance

*** Significant at the % = .01 level of significance

CF = the dependent variable, representing firms next period annual cash flow

from operations (millions $) for the periods 1998 to 2001

SIZE = firms total assets (millions $)

EARN = firms current operating income after depreciation and amortization

(millions $)

GROWTH = market-to-book ratio as measured by the market value divided by the

book value of equity

LEVERAGE = firms debt to assets ratio

SEGNUM = number of operating segments reported by the firm

INDUSTRY = indicator variables representing the two-digit SIC code for industry types

and change in classification over the study period, otherwise = 0: (D1) 00 to 09,

Agriculture, Forestry and Fishing; (D2) 10 to 14, Mining; (D3) 15 to 17, Construction;

(D4) 20 to 39, Manufacturing; (D5) 40 to 49, Transportation, Communications, Electric,

Gas and Sanitary Services; (D6) 50 to 51, Wholesale Trade; (D7) 52 to 59, Retail Trade;

(D8) change in two-digit SIC code over the study period

Reproduced from: Faello, J., Is Strong Corporate Governance Associated With Informative

Income Smoothing? ProQuest LLC., 2012, Table 4.13, p. 86.

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, ==

Table 8 Current Earnings Association With One Period Ahead Operating Cash Flows

(Income Before Extraordinary Items)

Parameter

Estimate

t-stat

Parameter

Estimate

t-stat

Parameter

Estimate

t-stat

% 138.541 0.966 &

5

-11.553 -0.695 &

10

1,440.214 7.541

***

&

1

1.022 17.147

***

&

6

-23.850 -0.062 &

11

-45.573 -0.284

&

2

0.040 21.359

***

&

7

426.963 2.222

**

&

12

-3.117 -0.016

&

3

0.058 0.064 &

8

212.040 0.548 &

13

41.392 0.208

&

4

-98.819 -0.635 &

9

-46.267 -0.460

CF

it

= % + &

1

EARN

i,t-1

+ &

2

SIZE

it-1

+ &

3

GROWTH

i,t-1

+ &

4

LEVERAGE

i,t-1

+ &

5

SEGNUM

i,t-1

+ &

6

D

1i-t-1

+ &

7

D

2i,t-1

+ &

8

D

3i,t-1

+ &

9

D

4i,t-1

+ &

10

D

5i,t-1

+ &

11

D

6i,t-1

+ &

12

D

7i,t-1

+ &

13

D

8i,t-1

+ (

it

n = 500 Adj. R

2

= 0.929 Durbin-Watson = 2.033 F-statistic = 501.760***

* Significant at the % = .10 level of significance

** Significant at the % = .05 level of significance

*** Significant at the % = .01 level of significance

CF = the dependent variable, representing firms next period annual cash flow

from operations (millions $) for the periods 1998 to 2001

SIZE = firms total assets (millions $)

EARN = firms current income before extraordinary items (millions $)

GROWTH = market-to-book ratio as measured by the market value divided by the

book value of equity

LEVERAGE = firms debt to assets ratio

SEGNUM = number of operating segments reported by the firm

INDUSTRY = indicator variables representing the two-digit SIC code for industry types

and change in classification over the study period, otherwise = 0: (D1) 00 to 09,

Agriculture, Forestry and Fishing; (D2) 10 to 14, Mining; (D3) 15 to 17, Construction;

(D4) 20 to 39, Manufacturing; (D5) 40 to 49, Transportation, Communications, Electric,

Gas and Sanitary Services; (D6) 50 to 51, Wholesale Trade; (D7) 52 to 59, Retail Trade;

(D8) change in two-digit SIC code over the study period

Reproduced from: Faello, J., Is Strong Corporate Governance Associated With Informative

Income Smoothing? ProQuest LLC., 2012, Table 4.14, p. 87.

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, =>

Any additional explanatory power provided by the AR regression models in explaining the

variation in operating cash flows will be shown in the results for equations 3.2. Tables 9 to 12

show the results for equation 3.2 for the four definitions of earnings under the AR approach. For

the operating income before depreciation and amortization definition of earnings (Table 9, the

overall model is significant F = 340.968; Adjusted R

2

= 0.911) and the interaction variable

between earnings and income smoothing is negative and significant (&

3

= -0.001; t-statistic = -

4.628). The adjusted R

2

increases from 0.907 (see Table 6) to 0.911 (see Table 9). The negative

sign on &

3

indicates income smoothing (as measured by the operating income before depreciation

and amortization definition of earnings) is less informative. That is, this particular AR measure

captures less informative income smoothing behavior. Also, the separate income smoothing

coefficient (&

2

) is not significant indicating income smoothing provides informational value in

explaining operating cash flows only when earnings are present. Income smoothing is a

component of earnings and these results support the strong earnings-income smoothing link.

Taken together, these results for the operating income before depreciation and amortization

earnings definition show two distinctly different results. On the one hand, income smoothing

possesses additional informational value when combined with earnings as evidenced by the

increase in adjusted R

2

(e.g.s, see Tables 6 and 9). On the other hand, the negative sign for the

earnings-income smoothing interaction coefficient (&

3

) indicates this AR measure captures less

informative aspects of income smoothing.

For the operating income after depreciation and amortization definition of earnings results are

shown in Table 10. These results mirror the results for the operating income before depreciation

and amortization earnings definition. That is, the adjusted R

2

increases from 0.899 (see Table 7)

to 0.902 (see Table 10) and the earnings-income smoothing coefficient (&

3

) is negative when

income smoothing variables are added as explanatory variables.

The results for the income before extraordinary items and net income versions show non-

significant earnings-income smoothing interaction coefficients (i.e., coefficients &

3

in Tables 11

and 12 respectively). Also, the respective adjusted R

2

show no increases. The lack of increase in

adjusted R

2

is intriguing and suggests transactions contained in the lower half of the income

statement offset income smoothing transactions contained in the upper half of the income

statement. This matter is discussed further below.

Operating income (either before or after depreciation and amortization) is located in the upper

half of the income statement. Sales, cost of goods sold, and operating expenses are included in

this upper section. The lower section of the income statement contains non-recurring items such

as discontinued operations and extraordinary items. Transactions from the lower section are

affecting income smoothing as measured by the AR approach to such a degree that income

smoothing provides no additional explanatory power of one period ahead operating cash flows.

These results are corroborated by other researchers findings (e.g. Dechow et al. 1998 and Barth

et al. 2001b). First, Dechow et al. (1998) find earnings is a better predictor of future cash flows

than prior years cash flows. Next, the earnings information contained in the TZ and AR

measures possesses informational value as evidenced by the results in this study. However,

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, =?

earnings that are not decomposed into its components (i.e., accruals and cash based transactions)

mask information in predicting future cash flows (Barth et al. 2001b). Thus, the strength of the

TZ accruals-based model in explaining one period ahead operating cash flows is not unexpected.

Although the AR based measures include accruals as a component of each earnings definition

(i.e., operating income before depreciation and amortization; operating income after depreciation

and amortization; income before extraordinary items; and net income), these earnings

definitions also include cash-based transactions that are either noisy or deceptive. It is this

noise or deception that reduces the explanatory value of earnings.

Overall, the AR results do not support a strong informative aspect of income smoothing. The

AR approach captures transactions that do not strengthen the association between earnings and

one period ahead operating cash flows. These transactions represent either noise or deliberate

deceptive transactions.

Table 9 AR Income Smoothing Measure Association With One Period Ahead Operating

Cash Flows (Operating Income Before Depreciation and Amortization)

Parameter

Estimate

t-stat

Parameter

Estimate

t-stat

Parameter

Estimate

t-stat

% -63.312 -0.368 &

6

-175.517 -1.008 &

12

1,478.818 6.661

***

&

1

0.314 10.798

***

&

7

45.976 2.548

**

&

13

-69.884 -0.388

&

2

0.881 0.791 &

8

31.083 0.072 &

14

121.961 0.566

&

3

-0.001 -4.628

***

&

9

407.597 1.892

*

&

15

2.241 0.010

&

4

0.051 27.339

***

&

10

185.477 0.428

&

5

0.246 0.239 &

11

-83.038 -0.736

CF

it

= % + &

1

EARN

i,t-1

+ &

2

ARRANK

i,t-1

+ &

3

(EARN

i,t-1

* ARRANK

i,t-1

) +&

4

SIZE

it-1

+ &

5

GROWTH

i,t-1

+ &

6

LEVERAGE

i,t-1

+ &

7

SEGNUM

i,t-1

+ &

8

D

1i-t-1

+ &

9

D

2i,t-1

+ &

10

D

3i,t-1

+ &

11

D

4i,t-

1

+ &

12

D

5i,t-1

+ &

13

D

6i,t-1

+ &

14

D

7i,t-1

+ &

15

D

8i,t-1

+ (

it

n = 500 Adj. R

2

= 0.911 Durbin-Watson = 2.130 F-statistic = 340.968***

* Significant at the % = .10 level of significance

** Significant at the % = .05 level of significance

*** Significant at the % = .01 level of significance

CF = the dependent variable, representing firms next period annual cash flow from

operations (millions $) for the periods 1998 to 2001

ARRANK = firms annual rankings as an income smoother under the Albrecht-Richardson

approach with a ranking of 1 indicating the highest degree of income smoothing (earnings

defined as operating income before depreciation and amortization)

EARN = firms current operating income before depreciation and amortization

(millions $)

SIZE = firms total assets (millions $)

"#$%&'( #) *&+,%-./0.1(.&'%2 3$/.&,// 4+$-.,/

5#61'%.&7 +8, *&)#%6'+.9,&,//: ;'7, =@

GROWTH = market-to-book ratio as measured by the market value divided by the book value

of equity

LEVERAGE = firms debt to assets ratio

SEGNUM = number of operating segments reported by the firm

INDUSTRY = indicator variables representing the two-digit SIC code for industry types and

change in classification over the study period, otherwise = 0: (D1) 00 to 09, Agriculture, Forestry

and Fishing; (D2) 10 to 14, Mining; (D3) 15 to 17, Construction; (D4) 20 to 39, Manufacturing;

(D5) 40 to 49, Transportation, Communications, Electric, Gas and Sanitary Services; (D6) 50 to

51, Wholesale Trade; (D7) 52 to 59, Retail Trade; (D8) change in two-digit SIC code over the

study period

Reproduced from: Faello, J., Is Strong Corporate Governance Associated With Informative

Income Smoothing? ProQuest LLC., 2012, Table 4.16, p. 92.

Table 10 AR Income Smoothing Measure Association With One Period Ahead Operating

Cash Flows (Operating Income After Depreciation and Amortization)

Parameter

Estimate

t-stat

Parameter

Estimate

t-stat

Parameter

Estimate

t-stat

% -78.220 -0.435 &

6

-192.153 -1.052 &

12

1,950.088 8.802

***

&

1

0.404 7.999

***

&

7

57.569 3.057

***

&

13

-83.628 -0.442

&

2

0.992 0.844 &

8

18.412 0.041 &

14

1,447.783 0.641

&

3

-0.002 -4.261

***

&

9

429.519 1.897

*

&

15

10.274 0.044

&

4

0.052 26.422

***

&

10

217.525 0.479

&

5

0.306 0.283 &

11

-94.942 -0.803

CF

it

= % + &

1

EARN

i,t-1

+ &

2

ARRANK

i,t-1

+ &

3

(EARN

i,t-1

* ARRANK

i,t-1

) +&

4

SIZE

it-1

+ &

5

GROWTH

i,t-1

+ &

6

LEVERAGE

i,t-1

+ &

7

SEGNUM

i,t-1

+ &

8

D

1i-t-1

+ &

9

D

2i,t-1

+ &

10

D

3i,t-1

+ &

11

D

4i,t-

1

+ &

12

D

5i,t-1

+ &

13

D

6i,t-1

+ &

14

D

7i,t-1

+ &

15

D

8i,t-1

+ (

it

n = 500 Adj. R

2

= 0.902 Durbin-Watson = 2.124 F-statistic = 307.327***

* Significant at the % = .10 level of significance

** Significant at the % = .05 level of significance

*** Significant at the % = .01 level of significance

CF = the dependent variable, representing firms next period annual cash flow from

operations (millions $) for the periods 1998 to 2001