Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

IFS1 (Project reportNBFC)

Caricato da

Prateek AggarwalTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

IFS1 (Project reportNBFC)

Caricato da

Prateek AggarwalCopyright:

Formati disponibili

Page | 1

Submitted By:

Abhishek Sachdeva UM10801

Arashdeep Singh UM10804

Class : IT(BE-MBA) 9

th

sem

Non Banking Finance

Company

Page | 2

Table of Contents

CHAPTER 1

Introduction to NBFC ...................................................................................................... 4

CHAPTER 2

NBFCs Global Scenario ................................................................................................ 4

CHAPTER 3

NBFCs Indian Scenario .................................................................................................... 4

CHAPTER 4

Literature Review ........................................................................................................... 4

CHAPTER 5

Research Methodology ................................................................................................... 4

CHAPTER 6

Hypothesis...................................................................................................................... 4

CHAPTER 7

Analysis .......................................................................................................................... 4

Page | 3

CHAPTER 8

Suggestions ................................................................................................................................. 4

References ............................................................................................................................ 1

Page | 4

Aim: To study the Non Banking Finance Companies

Chap

Introduction:

The Indian economy has been witnessing high rates of growth in the last few years. Financing

requirements have also risen commensurately and will continue to increase in order to support

and sustain the tremendous economic growth.

NBFCs have been playing a complementary role to the other financial institutions including

banks in meeting the funding needs of the economy. They help fill the gaps in the availability of

financial services that otherwise occur in bank-dominated financial systems. The gaps are in

regards the product as well customer and geographical segments.

NBFCs over the years have played a very vital role in the economy. They have been at the

forefront of catering to the financial needs and creating livelihood sources of the so-called

unbankable masses in the rural and semi-urban areas. Through strong linkage at the grassroots

level, they have created a medium of reach and communication and are very effectively serving

this segment. Thus, NBFCs have all the key characteristics to enable the government and

regulator to achieve the mission of financial inclusion in the given time.

Global Scenario:

Global credit crisis followed by increase in interest rates in October and November 2008 resulted

widespread crisis of confidence.Chain of events after the collapse of Lehman Brothers is still

fresh in the minds of investors. Non-Banking Finance Companies (NBFCs) worldwide were

severely impacted due to economic slowdown coupled with fall in demand for financing as

several businesses deferred their expansion plan. Stock prices of NBFCs crashed on the back of

rising non-performing assets and several companies closed their operations. International NBFCs

still continue to close down. The positive news however is that, this crisis has forced NBFCs to

improve their operations and strategies. Industry experts opine that they are much more mature

today than they were during the last decade.

The recent global financial crisis has however highlighted the importance of widening the

focus of NBFC regulations to take particular account of risks arising from regulatory gaps, from

arbitrage opportunities and from the inter-connectedness of various activities and entities

comprising the financial system. The regulatory regime for NBFCs is lighter and different in

many respects from that for the banks.

Page | 5

The most drastic change that has been seen recently in the NBFC segment is that of the big

international companies setting shop in the NBFC sector. Till sometime back, no big company

would have even thought about investing and trading in this sector. We have Siemens,

Caterpillar, GE and many more industries taking steps towards establishing their foothold in

this market.

Indian Scenario:

What is a Non-Banking Financial Company (NBFC)?

A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act,

1956 engaged in the business of loans and advances, acquisition of

shares/stocks/bonds/debentures/securities issued by Government or local authority or other

marketable securities of a like nature, leasing, hire-purchase, insurance business, chit business

but does not include any institution whose principal business is that of agriculture activity,

industrial activity, purchase or sale of any goods (other than securities) or providing any services

and sale/purchase/construction of immovable property. A non-banking institution which is a

company and has principal business of receiving deposits under any scheme or arrangement in

one lump sum or in installments by way of contributions or in any other manner, is also a non-

banking financial company (Residuary non-banking company).

Different types/categories of NBFCs registered with RBI

NBFCs are categorized

a) in terms of the type of liabilities into Deposit and Non-Deposit accepting NBFCs,

b) non deposit taking NBFCs by their size into systemically important and other non-deposit

holding companies (NBFC-NDSI and NBFC-ND)

c) by the kind of activity they conduct. Within this broad categorization the different types of

NBFCs are as follows:

i. Asset Finance Company(AFC) : An AFC is a company which is a financial institution

carrying on as its principal business the financing of physical assets supporting

productive/economic activity, such as automobiles, tractors, lathe machines, generator

sets, earth moving and material handling equipments, moving on own power and general

purpose industrial machines. Principal business for this purpose is defined as aggregate of

financing real/physical assets supporting economic activity and income arising therefrom

is not less than 60% of its total assets and total income respectively.

Page | 6

ii. Investment Company (IC) : IC means any company which is a financial institution

carrying on as its principal business the acquisition of securities,

iii. Loan Company (LC): LC means any company which is a financial institution carrying

on as its principal business the providing of finance whether by making loans or advances

or otherwise for any activity other than its own but does not include an Asset Finance

Company.

iv. Infrastructure Finance Company (IFC): IFC is a non-banking finance company a)

which deploys at least 75 per cent of its total assets in infrastructure loans, b) has a

minimum Net Owned Funds of Rs. 300 crore, c) has a minimum credit rating of A or

equivalent d) and a CRAR of 15%.

v. Systemically Important Core Investment Company (CIC-ND-SI): CIC-ND-SI is an

NBFC carrying on the business of acquisition of shares and securities which satisfies the

following conditions:-

(a) it holds not less than 90% of its Total Assets in the form of investment in equity

shares, preference shares, debt or loans in group companies;

(b) its investments in the equity shares (including instruments compulsorily convertible

into equity shares within a period not exceeding 10 years from the date of issue) in group

companies constitutes not less than 60% of its Total Assets;

(c) it does not trade in its investments in shares, debt or loans in group companies except

through block sale for the purpose of dilution or disinvestment;

(d) it does not carry on any other financial activity referred to in Section 45I(c) and 45I(f)

of the RBI act, 1934 except investment in bank deposits, money market instruments,

government securities, loans to and investments in debt issuances of group companies or

guarantees issued on behalf of group companies.

(e) Its asset size is Rs 100 crore or above and

(f) It accepts public funds

vi. Infrastructure Debt Fund: Non- Banking Financial Company (IDF-NBFC) : IDF-

NBFC is a company registered as NBFC to facilitate the flow of long term debt into

infrastructure projects. IDF-NBFC raise resources through issue of Rupee or Dollar

denominated bonds of minimum 5 year maturity. Only Infrastructure Finance Companies

(IFC) can sponsor IDF-NBFCs.

vii. Non-Banking Financial Company - Micro Finance Institution (NBFC-MFI): NBFC-

MFI is a non-deposit taking NBFC having not less than 85%of its assets in the nature of

qualifying assets which satisfy the following criteria:

a. loan disbursed by an NBFC-MFI to a borrower with a rural household annual income

not exceeding Rs. 60,000 or urban and semi-urban household income not exceeding Rs.

1,20,000;

Page | 7

b. loan amount does not exceed Rs. 35,000 in the first cycle and Rs. 50,000 in subsequent

cycles;

c. total indebtedness of the borrower does not exceed Rs. 50,000;

d. tenure of the loan not to be less than 24 months for loan amount in excess of Rs.

15,000 with prepayment without penalty;

e. loan to be extended without collateral;

f. aggregate amount of loans, given for income generation, is not less than 75 per cent of

the total loans given by the MFIs;

g. loan is repayable on weekly, fortnightly or monthly instalments at the choice of the

borrower

viii. Non-Banking Financial Company Factors (NBFC-Factors): NBFC-Factor is a non-

deposit taking NBFC engaged in the principal business of factoring. The financial assets

in the factoring business should constitute at least 75 percent of its total assets and its

income derived from factoring business should not be less than 75 percent of its gross

income.

What is systemically important NBFC?

Size Based Classification

In 2006, non-deposit taking NBFCs with assets of Rs. 100 crore and above were labelled as

Systemically Important Non-Deposit taking NBFCs (NBFCs-ND-SI)

-depository companies, mean companies holding assets of Rs 100

crore or more as per last balance sheet

total assets

it as per last balance sheet? A 4thJuly 2009 circular makes a departure. Says as and when

NBFCs attain asset size of Rs 100 crore, they may start complying with the norms.

may be a profit on sale of an asset, which may be used to pay off liabilities. Asset size

does go up temporarily

obtained from the RBI.

Page | 8

Economic role that the NBFCs fulfill?

NBFCs have been operating various businesses under sound economics. Many businesses

started by the sector have later been taken up by banks and become regular banking services.

For instance, car financing, which was started by NBFCs has now become one of the larger

revenue streams for banks. The NBFCs themselves have now moved on to financing second

hand cars. Other businesses, namely, infrastructure finance, asset finance, hire purchase and,

in the recent past, microfinance have been the major areas of operations for NBFCs.

Additionally, NBFCs play a supportive role in the economy and also in financial inclusion and

therefore need to be encouraged. Some of the economic roles played by NBFCs are:

2.2.1 Infrastructure financing

While the RBI doesnt have any specific sector exposure limits, it has asked the banks to

formulate internal policies for exposure to the infrastructure sector. The banking sectors

exposure to infrastructure was Rs. 5,50,178 crore as on May 2011, which was 15% of

total non-food bank credit of the banks. In comparison, the Infrastructure Finance NBFCs had an

outstanding infrastructure loan book size of Rs.1,96,158 crore. Banks

further exposure to infrastructure is constrained by prudential internal limits (which

typically are 12-15%) and asset liability mismatch due to long tenure of assets and short

tenure of liabilities.

Given the projected capital requirement for infrastructure sector in the 12th five-year plan,

NBFCs will play a part in supplying capital to the sector. However, proper credit rating,

accounting and financial norms have to be ushered in for greater transparency and

soundness of the sector as also operating in the NBFC sector.

2.2.2 Serving unbanked customer segments

NBFCs have traditionally focused on customer segments which were not served by

banks like micro, small and medium enterprises (MSMEs), funding of commercial

vehicles including old vehicles, farm equipments viz. tracking, harvesters, etc. loan

against shares, funding of plant and machinery; etc.

NBFCs typically are specialized vehicles both in terms of products and the geographies

in which they operate. This specialization provides them a unique framework to assess

the risk in the undertaken business. A much closer market awareness provides them the

ability to rate borrowers, monitor them, price the relative credit suitably and effect

recoveries from them.

NBFCs also provide credit for certain sectors which are not served by banks and

Financial Institutions because Banks/FIs do not have adequate market relationships and

infrastructure for the same. Some of these sectors are:

(a) Used Trucks

(b) Used passenger vehicles

(c) Consumer durable loans

(d) Personal Loans

(e) Funding to the Small & Medium Enterprises (SME Sector) which do not have access to

institutionalized funding, etc.

Traditionally, these sectors were financed entirely by the unorganized financiers at

exorbitant high interest rates. In the last 10 years, with their retail strength, NBFCs have

rendered significant service by extending credit to these sectors. Now banks and

Page | 9

financial institutions are availing of the reach and expertise of NBFCs for employing

funds in these sectors through NBFCs. This has brought in lot of funds into these

sectors, thereby reducing interest rates.

2.2.3 Strong understanding of customer segments and ability to deliver customized

products

The ability of NBFCs to produce innovative products in consonance with needs of their

clients is well recognized. This, in addition to the proximity to the clients, makes the NBFCs

distinct from its banking sector counterparts. In a short period of time, NBFCs

have become market leaders in most of the retail finance segments like commercial

vehicles, car financing and personal loans. In the last decade or so, the Indian retail

finance markets have seen several new products being developed and introduced by

NBFCs. The following are some cases in point - Used vehicle financing, Small ticket

personal loans (ST-PL), Three-wheeler financing, Loan against shares, Promoter

funding, Public issue financing (IPO financing) and Finance for tyres and fuel.

NBFCs have a significant economic role, especially servicing the under-banked and unbanked

populace and geographies. Bringing the diverse set of NBFCs under regulation rather than

curtailing their operations, would help orderly growth of the sector.

Indian NBFCs Facts and Figures:

Mahindra Financial Services - one of Indias premier non-banking finance companies (NBFC)

- largest NBFC operating in rural India. We have offices in the areas we

- employ over 16,000 people

The number of NBFCs has decreased from 13,014 in FY06 to 12,409 in FY11 however the

sector has grown by 2.6 times between FY06 and FY11 at a CAGR of 21%.

Page | 10

However, the total number of NBFCs registered with Reserve Bank of India declined to 12,385

as at end March, 2012 from 12,409 as at end March 2011.There was also a decline in NBFCs-D

in 2011-12.This decline was mainly for:

of NBFCs

-deposit taking companies

Page | 11

Procedure for application to the Reserve Bank for Registration?

The applicant company is required to apply online and submit a physical copy of the application

along with the necessary documents to the Regional Office of the Reserve Bank of India. The

application can be submitted online by accessing RBIs secured website

https://cosmos.rbi.org.in . At this stage, the applicant company will not need to log on to the

COSMOS application and hence user ids are not required.. The company can click on CLICK

for Company Registration on the login page of the COSMOS Application. A window showing

the Excel application form available for download would be displayed. The company can then

download suitable application form (i.e. NBFC or SC/RC) from the above website, key in the

data and upload the application form. The company may note to indicate the correct name of the

Regional Office in the field C-8 of the Annex-Identification Particulars in the Excel

application form. The company would then get a Company Application Reference Number for

the CoR application filed on-line. Thereafter, the company has to submit the hard copy of the

application form (indicating the online Company Application Reference Number, along with the

Page | 12

supporting documents, to the concerned Regional Office. The company can then check the status

of the application from the above mentioned secure address, by keying in the acknowledgement

number.

Can all NBFCs accept deposits?

All NBFCs are not entitled to accept public deposits. Only those NBFCs to which the Bank had

given a specific authorisation are allowed to accept/hold public deposits.

deposit and public deposit:

The term deposit is defined under Section 45 I(bb) of the RBI Act, 1934. Deposit includes

and shall be deemed always to have included any receipt of money by way of deposit or loan or

in any other form but does not include:

i. amount raised by way of share capital, or contributed as capital by partners of a firm;

ii. amount received from a scheduled bank, a co-operative bank, a banking company,

Development bank, State Financial Corporation, IDBI or any other institution specified

by RBI;

iii. amount received in ordinary course of business by way of security deposit, dealership

deposit, earnest money, advance against orders for goods, properties or services;

iv. amount received by a registered money lender other than a body corporate;

v. amount received by way of subscriptions in respect of a Chit.

Paragraph 2(1)(xii) of the Non-Banking Financial Companies Acceptance of Public Deposits (

Reserve Bank) Directions, 1998 defines a public deposit as a deposit as defined under

Section 45 I(bb) of the RBI Act, 1934 and further excludes the following:

i. amount received from the Central/State Government or any other source where

repayment is guaranteed by Central/State Government or any amount received from local

authority or foreign government or any foreign citizen/authority/person;

ii. any amount received from financial institutions specified by RBI for this purpose;

iii. any amount received by a company from any other company;

iv. amount received by way of subscriptions to shares, stock, bonds or debentures pending

allotment or by way of calls in advance if such amount is not repayable to the members

under the articles of association of the company;

v. amount received from shareholders by private company;

vi. amount received from directors or relative of the director of an NBFC;

vii. amount raised by issue of bonds or debentures secured by mortgage of any immovable

property or other asset of the company subject to conditions;

viii. the amount brought in by the promoters by way of unsecured loan;

ix. amount received from a mutual fund;

x. any amount received as hybrid debt or subordinated debt;

xi. any amount received by issuance of Commercial Paper.

xii. any amount received by a systemically important non-deposit taking non-banking

financial company by issuance of perpetual debt instruments

Page | 13

xiii. any amount raised by the issue of infrastructure bonds by an Infrastructure Finance

Company

Thus, the directions exclude from the definition of public deposit, amount raised from certain set

of informed lenders who can make independent decision.

It is said that rating of NBFCs is necessary before it accepts deposit? Is it true? Who rates

them?

An unrated NBFC, except certain Asset Finance companies (AFC), cannot accept public

deposits. An exception is made in case of unrated AFC companies with CRAR of 15% which

can accept public deposit without having a credit rating up to a certain ceiling depending upon its

Net Owned Funds NBFC may get itself rated by any of the five rating agencies namely, CRISIL,

CARE, ICRA and FITCH, Ratings India Pvt. Ltd and Brickwork Ratings India Pvt. Ltd

Responsibilities of the NBFCs accepting/holding public deposits with regard to submission

of Returns:

The NBFCs accepting public deposits should furnish to RBI :

i. Audited balance sheet of each financial year and an audited profit and loss account in

respect of that year as passed in the annual general meeting together with a copy of the

report of the Board of Directors and a copy of the report and the notes on accounts

furnished by its Auditors;

ii. Statutory Quarterly Return on deposits - NBS 1;

iii. Certificate from the Auditors that the company is in a position to repay the deposits as

and when the claims arise;

iv. Quarterly Return on prudential norms-NBS 2;

v. Quarterly Return on liquid assets-NBS 3;

vi. Annual return of critical parameters by a rejected company holding public deposits

NBS4

vii. Half-yearly ALM Returns by companies having public deposits of Rs. 20 crore and above

or asset size of Rs. 100 crore and above irrespective of the size of deposits holding

viii. Monthly return on exposure to capital market by deposit taking NBFC with total assets of

Rs 100 crore and aboveNBS6; and

ix. A copy of the Credit Rating obtained once a year

Companies which are NBFCs, but are exempted from registration:

Housing Finance Companies, Merchant Banking Companies, Stock Exchanges, Companies

engaged in the business of stock-broking/sub-broking, Venture Capital Fund Companies, Nidhi

Companies, Insurance companies and Chit Fund Companies are NBFCs but they have been

exempted from the requirement of registration under Section 45-IA of the RBI Act, 1934 subject

to certain conditions.

Page | 14

Housing Finance Companies are regulated by National Housing Bank, Merchant Banker/Venture

Capital Fund Company/stock-exchanges/stock brokers/sub-brokers are regulated by Securities

and Exchange Board of India, and Insurance companies are regulated by Insurance Regulatory

and Development Authority. Similarly, Chit Fund Companies are regulated by the respective

State Governments and Nidhi Companies are regulated by Ministry of Corporate Affairs,

Government of India.

It may also be mentioned that Mortgage Guarantee Companies have been notified as Non-

Banking Financial Companies under Section 45 I(f)(iii) of the RBI Act, 1934.

Multi-Level Marketing companies, Direct Selling Companies, Online Selling Companies dont

fall under the purview of RBI. Activities of these companies fall under the

regulatory/administrative domain of respective state government.

A list of such companies and their regulators are as follows:

Impact of Recession on Indian NBFCs

NonBanking Finance Companies (NBFCs) in India were severely impacted due to economic

slowdown coupled with fall in demand for financing as several businesses deferred their

expansion plan. Stock prices of NBFCs crashed on the back of rising non-performing assets and

several companies closed their operations. International NBFCs still continue to close down or

sell their back end operations in India.

Recovery by Indian NBFCs:

Timely intervention of RBI helped reduce the negative effect of credit crunch on banks and

NBFCs. Infact,aggressive strategies helped LIC Housing Finance to grab new customers (including

customers of other banks) and increase its market share in national mortgage market. Surprisingly it

was able to maintain its profitability in 2009 (around 37%).

HDFC, the largest NBFC in India,however experienced a slowdown in customer growth due to stiff

competition, especially from LIC Housing Finance and tight monetary conditions.

Page | 15

Literature Review(s):

This section includes the views held by various industrialists and key figures in the industry and

research organisations about NBFCs.

According to Hemal Shah, Partner-Advisory Services, E&Y, "NBFC industry per se has

undergone a huge change both quantitatively and qualitatively, especially in the way the sector

players have managed to differentiate their functional specialisation."

According to Mr Pratap Paode, CEO, Shriram Equipment Finance, "The NBFC sector is

dominated by the construction, equipment and the commercial vehicle market and the other

assets included under this. This industry has been growing consistently at a rate of 20-25%

barring the negative fall in the year 2008, which was due to the global scenario. However, the

industry has revived very quickly and has crossed volumes of more than that of 2007. The

expected growth of return from this sector in the near future looks to be about 30-35%".

According to Mr Pradeep C Bandivadekar, COO, Tata Capital Ltd said, "The general

growth rate to be expected is more than 15-20% in the next quarter, which includes banks and

other NBFCs. There is more than three and half lakh crore non-deposits taking place in the

NBFC sector and around 85,000 crore deposits taking place."

"NBFCs have traditionally been the secondary borrowing institutes and their main source of

borrowing has been the banks, mainly the public sector banks. This is the main reason why the

borrowing rate in the NBFC sector is a few percent higher than the public sector banks. In terms

of business establishment and rate on return (RoI), NBFC have a neat 2% RoI as compared to the

1.2 - 1.4% of a public sector bank," Mr Bandivadekar.

Page | 16

Proposed Regulatory Changes

India Ratings believes that the draft guidelines proposed by the RBI in December 2012, if

implemented, will be positive for the NBFC sector in the long-term even though some of the

clauses can impact profitability in the early stages of implementation.

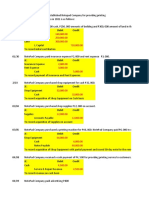

Analysis:

Page | 17

Suggestions:

Page | 18

Conclusion:

Sustainable growth is possible only with the right dynamics which suit the market demand and

requirement. Many experts feel that the bad economic phase which shadowed the world, has

taught a few valuable lessons to the players in the NBFC sector. As in the case of any sector, the

recession made it apparent that it is difficult to maintain a consistent growth pattern if the growth

is not planned.

The NBFC sector is showing great resilience for survival, sticking to the three thumb rules which

are: Getting in to the rural markets (read: the bottom of the pyramid) and tapping the wide

customer potential there. Avoid getting in direct competition with public and private sector

banks. And lastly, ticking to one particular topic/segment of expertise.

Future growth and development of NBFCs

Given the important role played by NBFCs as innovators, serving unbanked and under-banked

geographies and customer segments and services not provided by banks, it is imperative that

the growth and development of the sector be accorded some degree of priority. With adequate

regulatory oversight of systemically important NBFCs, implementation of prudential norms,

regular reporting and monitoring, etc., NBFCs may be looked at playing a larger part in the

financial services sector.

References:

http://rise.mahindrafinance.com

http://timesofindia.indiatimes.com/business/india-business/RBI-curbs-NBFC-loans-against-

shares/articleshow/40641560.cms

http://www.nbfcsoft.com/web_design/about-nbfc.html

http://www.researchand markets.com

Potrebbero piacerti anche

- What Is Stock Market: Stock Exchange Is A Place Where Trading of Shares Is Done in Terms of Sale and Purchase of StockDocumento17 pagineWhat Is Stock Market: Stock Exchange Is A Place Where Trading of Shares Is Done in Terms of Sale and Purchase of StockPrateek AggarwalNessuna valutazione finora

- 6 Weeks Training ReportDocumento48 pagine6 Weeks Training ReportPrateek AggarwalNessuna valutazione finora

- Ss Tenrofessor of Mechanical E Ineering: 1 SlibrariesDocumento0 pagineSs Tenrofessor of Mechanical E Ineering: 1 SlibrariesPrateek AggarwalNessuna valutazione finora

- Control of A Stair Climbing Wheelchair: International Journal of Robotics and Automation (IJRA)Documento11 pagineControl of A Stair Climbing Wheelchair: International Journal of Robotics and Automation (IJRA)Prateek AggarwalNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Capital Budgeting at Birla CementDocumento61 pagineCapital Budgeting at Birla Cementrpsinghsikarwar0% (1)

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocumento48 pagineAccounting Policies, Changes in Accounting Estimates and ErrorsHồ Đan ThụcNessuna valutazione finora

- ACC 211 Bonds Payable - AKDocumento4 pagineACC 211 Bonds Payable - AKglrosaaa cNessuna valutazione finora

- Bajaj Auto FSADocumento20 pagineBajaj Auto FSAVandit BhuratNessuna valutazione finora

- NPV IRR and PIDocumento12 pagineNPV IRR and PIAashima GroverNessuna valutazione finora

- Comprehensive Problem-Analysis of TransactionDocumento43 pagineComprehensive Problem-Analysis of TransactionJoanna DandasanNessuna valutazione finora

- BFM Assignment 2: Submitted By: Adhiraj Rathore E-02 20020441015Documento14 pagineBFM Assignment 2: Submitted By: Adhiraj Rathore E-02 20020441015Tabrej AlamNessuna valutazione finora

- Business LawDocumento11 pagineBusiness LawRiriNessuna valutazione finora

- LT 3. Finacial Management - 1399-3!21!20-02Documento72 pagineLT 3. Finacial Management - 1399-3!21!20-02jibridhamoleNessuna valutazione finora

- Daftar Pustaka: Anwar MaulanaDocumento4 pagineDaftar Pustaka: Anwar MaulanasatriawahyuNessuna valutazione finora

- Tesco 2023 Ar Primary Statements Updated 230623Documento5 pagineTesco 2023 Ar Primary Statements Updated 230623Ñízãr ÑzrNessuna valutazione finora

- HW 4Documento3 pagineHW 4TaySyYinNessuna valutazione finora

- Instruction: Prepare The Answers in Written Form Using A Clean Paper (E.g. Yellow Pad, Bond Paper, Notebook Etc.) and Submit A Snapshot in CANVASDocumento2 pagineInstruction: Prepare The Answers in Written Form Using A Clean Paper (E.g. Yellow Pad, Bond Paper, Notebook Etc.) and Submit A Snapshot in CANVASPatricia ReyesNessuna valutazione finora

- Right Issue Resolution of Board MeetingDocumento2 pagineRight Issue Resolution of Board MeetingSavoir PenNessuna valutazione finora

- Laforge Systems, Inc. Balance Sheet (In Millions) Years Ended December 31 2007 2008Documento6 pagineLaforge Systems, Inc. Balance Sheet (In Millions) Years Ended December 31 2007 2008Dina WongNessuna valutazione finora

- Compound Financial Instrument - ReviewerDocumento2 pagineCompound Financial Instrument - ReviewerLouiseNessuna valutazione finora

- Review Questions For Test 1 ACC110Documento6 pagineReview Questions For Test 1 ACC110FOREVER FREENessuna valutazione finora

- Resa Oct 2012 Pract 1 First Preboard W Answers PDFDocumento10 pagineResa Oct 2012 Pract 1 First Preboard W Answers PDFGuinevereNessuna valutazione finora

- Audit of PPEDocumento7 pagineAudit of PPEJerra MaquisoNessuna valutazione finora

- Chapter 5 - Corporate Level StrategyDocumento23 pagineChapter 5 - Corporate Level StrategyNgan NguyenNessuna valutazione finora

- Nifty PE RatioDocumento236 pagineNifty PE RatioVijayakumar SubramaniamNessuna valutazione finora

- Chapter - 2 Forms of Business Organisation: Meaning of Sole ProprietorshipDocumento10 pagineChapter - 2 Forms of Business Organisation: Meaning of Sole ProprietorshipAejaz MohamedNessuna valutazione finora

- CHAPTER 11 Statement of Cash FlowDocumento2 pagineCHAPTER 11 Statement of Cash FlowMark IlanoNessuna valutazione finora

- Management AccountingDocumento12 pagineManagement AccountingS BNessuna valutazione finora

- Companies Act 2017Documento167 pagineCompanies Act 2017muhammadnomanansari6441Nessuna valutazione finora

- Pathfinders Stock Market Training - Online Course PDFDocumento3 paginePathfinders Stock Market Training - Online Course PDFGarv JainNessuna valutazione finora

- IMPORTATION OF FirecrackersDocumento13 pagineIMPORTATION OF FirecrackersBloomy AlexNessuna valutazione finora

- Butler Lumber Case SolutionDocumento4 pagineButler Lumber Case SolutionMohammad Owais ShaikhNessuna valutazione finora

- Lyons Document Storage Corporation: Bond AccountingDocumento8 pagineLyons Document Storage Corporation: Bond AccountingAninda DuttaNessuna valutazione finora

- Vertical and Horizontal Analysis of Financial Statement of A Sole ProprietorshipDocumento35 pagineVertical and Horizontal Analysis of Financial Statement of A Sole ProprietorshipJohn Fort Edwin AmoraNessuna valutazione finora