Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Yamaha's Position in Indian Two Wheeler Industry

Caricato da

anshnathani28Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Yamaha's Position in Indian Two Wheeler Industry

Caricato da

anshnathani28Copyright:

Formati disponibili

INDEX

Chapter-1 INTRODUCTION 07

Chapter-2 CRITICAL REVIEW OF LITERATURE 12

Chapter-3 CORPORATE INTRODUCTION 16

Company profile 17

Industry profile 22

Products of Yamaha 23

SWOT checklist 38

Chapter-4 RESEARCH METHODOLOGY 40

Research problem and objective 41

Research process 41

Research design 42

Scope of study 44

Chapter-5 DATA COLLECTION AND PRESENTATION 45

Chapter-6 GRAPHICAL DATA ANALYSIS AND ITS INTERPRETATION 47

Chapter-7 FINDINGS OF THE RESEARCH 63

Chapter-8 GAPS IN LITERATURE REVIEW 67

Chapter-9 SCOPE OF STUDY 69

Chapter-10 PROBLEM IDENTIFICATION 71

Chapter-11 CONCLUSION 73

Chapter-12 SUGGESTIONS 75

Chapter-13 LIMITATIONS 77

Chapter-14 ANNEXTURE 79

Chapter-15 BIBLIOGRAPHY 83

EXECUTIVE SUMMARY

OBJECTIVE:

To Study the satisfaction level of customers for two wheelers industries.

RESEARCH METHODOLOGY:

The research had to be conducted through a survey based on questionnaires

Sample Size

47 Respondents

Brands Covered

Hero Honda

Bajaj

Honda

Tvs

Suzuki

Yamaha

Sampling Used

Simple random

Scaling Used

5 point likert scale

DATA ANALYSIS:

Analysis was done on the basis of 22 parameters. Bar charts were developed on these

parameters which compare different brands in the 2 wheeler industry with the help of these

charts. Yamaha's position in the market is found and analysed.

CHAPTER 1

INTRODUCTION

INTRODUCTION

Research means detailed study of a problem. Here, the details of the marketing problem are

collected and studied, conclusions are drawn and suggestions are made to solve the problem

quickly, correctly and systematically. In MR, specific marketing problem is studied in depth

by collecting and analyzing all relevant information and solution are suggested to solve the

problem which may be related to consumers, product, market competition, sales promotion

and so on.

MR is special branch of marketing management. It is comparatively of recent in origin. MR

acts as an investigative arm of a marketing manager. It suggests solution on marketing

problem for the consideration and selection by a marketing manager. MR also acts as an

important tool to study by behaviour, changes in consumer life-style and consumption

patterns, brand loyalty and forecast market changes.

In brief, MR facilitates accurate marketing decisions for consumer satisfaction on the one

hand and sales promotion other hand. It is rightly treated as soul of modern marketing

management. MR suggests possible solution on marketing problem to marketing manager for

his consideration and final selection. It is rightly said that the beginning and end of marketing

management is marketing research. It is primarily used to provide information needed to

guide marketing decision, market mix. It acts as a support system to marketing management.

INCREASING NEED OF MARKETING RESEARCH

1) Growth and complexity of markets: - Markets are no more local in character.

They are now national and even global in character. The marketing activity is becoming

increasingly complex and broader in scope as more firms operate in domestic and global

markets. Manufactures find it difficult to establish close contact with all markets and

consumers directly. Similarly, they have no control on the marketing system once the goods

are sold out.

2) To middlemen:- This situation creates new problem before the manufacturers which

can be faced effectively through MR as it acts as a feed-back mechanism to ascertain first-

hand information, reaction, etc. of consumers and middleman. Marketing activities can be

adjusted accordingly.

3) Wide gap between producers and consumers: - marketing research is needed as

there is a wide gap between producers and consumers in the present marketing system. Due to

mass scale production and distribution, direct contact between producers and consumers.

Producers do not get dependable information as regards needs, expectation and reactions of

consumers; they are unable to adjust their products, packaging, prices, etc. as per the needs of

consumers. The problem created due to information gap can be solved only through MR as it

possible to establish contact with consumers and collect first-hand information about their

needs, expectation, likes, dislikes, preferences and special features of their behaviour. Thus,

MR is needed for removing the wide communication gap between producers and consumers.

4) Changes in the composition of population and pattern of consumption: -

In India, many changes are taking place in the composition of population. There is a shift of

population from rural to urban areas. There have been considerable changes in the

consumption and expenditure patterns of consumers in India. The incomes of the people, in

general, are rising. This brings corresponding increase in their purchasing capacity and buying

needs and habits. The demand for consumer durables is fast increasing. The market are now

flooded with consumer durable like TV sets and so on. Manufacturers are expected to know

such qualitative and quantitative change in the consumer preferences and their consumption

pattern. For achieving this objective, MR activities are necessary and useful. In brief, MR is

needed for the study of changes in the pattern of consumption and corresponding adjustment

in the marketing planning, policies strategies.

5) Growing importance of consumers in marketing:-Consumers occupy key

position in modern marketing system. They are now well informed about market trends,

goods available, consumer rights and protection available to them through consumer

protection acts, the growth of consumerism has created new challenges before manufacturers

and traders.

Even growing customer expectations create situation when manufacturers have to understand

such expectations and adjust the production policies accordingly. Indifference towards

consumer expectations may lead to loss of business. In the present marketing system,

consumers cannot be taken for granted. Marketing research particularly consumer research

gives valuable data relating to consumers. It is possible to use such data fruitfully while

framing marketing policies. Thus, marketing decisions can be made pro consumer through

marketing research activities.

6) Shift of competition from price to non-price factors: - Cut-throat competition

is unavoidable in the present marketing field. Such competition may be due to various factors

such as price, quality, and packaging, advertising and sales promotion techniques. Entry of

new competitors creates new problems in the marketing a goods and services. In addition,

market competition is no more restricted to price factor alone. There are other non-price

factors such as packaging, branding, after-sales and advertising which create severe market

competition. Every producer has to find out the extent of such non-price competition and the

manner in which he can face it with confidence. MR is needed as it offers guidance in this

regards. A manufacturer can face market competition even by using certain non-price factors.

The shifting of competition from price to non-price factors has made marketing of consumer

goods more complicated and challenging. This challenge can be faced with confidence by

using certain measures through marketing research.

7) Need of prompt decision making: - In competitive marketing, marketing executive

have to take quick and correct decision. Companies have to develop and market new products

more quickly than ever before. However, such decision is always difficult. Moreover, wrong

decisions may bring loss to the organization. For correct decision making, marketing

executive need reliable data and up to date market information. Here, MR comes to the rescue

of marketing manager. Problems in marketing are located, defined, analyzed and solved

through MR techniques. This suggests its need as a tool for decision making. MR is needed as

a tool for reasonably accurate decision making in the present highly competitive market

system.

CHAPTER-2

CRITICAL REVIEW OF

LITERATURE

LITERATURE REVIEW

'Consumer buyer behaviour refers to the buying behaviour of final consumers individuals

and households who buy goods and services for personal consumption.' (Philip Kotler)

'To understand the buyer, and to create a customer out of him, through this understanding, is

the purpose of buyer behaviour.' (Ramaswamy and Namakumari)

It needs to be specified at the outset that there is no unified tested and universally established

theory of buyer behaviour. What is available today, are certain ideas of buyer behaviour.

FACTORS INFLUENCING BUYER BEHAVIOUR

A number of factors influence buyer behaviour. They can be grouped under three broad

categories.

1. Factors that are part of buyer as an individual.

2. Buyer's social environment (group influence).

3. Information from a variety of sources.

1. Factors that are part of the Buyer as an individual:- An individual's religion

and cultural background, his personality traits, self-concept, his general endowments, his

upbringing in short, his overall bio data play a crucial role in his conduct as a

buyer/consumer. These factors can be grouped broadly into three categories.

i. Personal factors

ii. Cultural factors

iii. Psychological factors

I. Personal Factors Age, Education, Economic Position, Self-concept An individual,

age, level of education, his occupation, overall economic position and lifestyle all influence

his role as a buyer. They decide what products he will buy and consume. A person's self-

concept and his concern about his status also influence his buying decisions. In fact today

people are very concerned about their image and status in society. Its a direct outcome of

their material prosperity. The desire for self-expression and self-advancement is closely linked

with social status. Even if a product that constitutes a status symbol is beyond their immediate

reach, their aspiration to possess it will influence their decision making process.

II. Cultural Factors Religion, Language etc. Every culture, every language and every

religion group dictates its own unique patterns of social conduct. Within each religion, there

may be several sects and sub sects; there may be orthodox groups and cosmopolitan groups.

In dress, food habits or marriage in almost all matters of individual life religion and

culture exercise an influence on the individual, though the intensity may vary from society to

society. The do's and don'ts listed out by religion and culture impacts the individual's lifestyle

and buying behaviour.

III. Psychological Factors Beliefs, Attitudes, Motivation, Perception Just like the

economic and social conditions, a man's disposition too has a close bearing on his purchase

decisions. Individuals coming under the same economic and social groups can be vastly

different when it comes to certain personal beliefs, faith and attitudes. One may be timid and

plain, while another may be outgoing and aggressive. One may be traditional in the overall

view of life, while another may be modern. One may be east innovative, while another may

welcome anything new. In fact, the maximum variations are seen here and in the matter of

analysis and assessment too, this area poses maximum problem to the marketer.

2. Buyer's Social Environment (group influence) the buyer living in a society is influenced by

it and is in turn influencing its course of devebpment. He is a member of several organizations

and groups, both formal and informal. He belongs 22 families, he works for a certain firm, he

may be a member of a professional forum, he may belong to a particular political group, or a

cultural body. There is constant interaction between the individual and the groups to which he

belongs. And all these interactions leave some imprint on him, which influences him in his

day to day life and consequently, his buying behaviour.

There are two broad types of group Influences:

i. Influence of intimate group.

ii. Influence of the broad social class.

i. Influence of Intimate Group: - Examples of intimate groups are family, friends,

close colleagues and closely knit organizations. These groups exercise a strong influence on

the lifestyles and the buying behaviour of its members. Arnong these groups the most

influential and primary groups are the family and peer groups. The peer groups are closely

knit groups composed of individuals, who have a common social background and who

normally belong to the same age group. The peer group has the greatest influence on the

individual member as a stabilizer of styles and behaviour patterns. In any intimate group,

there is likely to be an informal group leader. Te group respects him and looks up to him.

Though the leader may not directly influence every member in his day to day purchases, his

judgment on men and matters, and facts and fashion is respected by the group; and his views

and lifestyle influences their buying decisions. He is normally the innovator in the group, who

first tries new products and new ideas, and then, he becomes the propagator of those products

and ideas. These opinion leaders or influencers play a key role in marketing. Marketers often

try to reach these leaders first through advertisements and other means of communication.

And if the leaders are convinced, their groups are likely to follow suit.

ii. Influence of the Broad Social Class: - Structurally, the social class is a larger group

than the intimate groups. The constitution of a social class is decided by the income,

occupation, place of residence, etc. of the individual members. The members of a social class

enjoy more or less the same status or prestige in the community. They share a common

lifestyle and behaviour pattern. And they normally select a product or brand that caters to their

class norms. Often they even do their shopping in the same shopping are and patronize

selected shops, which befit their class image. This does not mean that all the members of a

given social class will buy the same products and the same brands or conform to the same

style, amounting to a sort of regimentation. Differential liking may exist among the members.

But, in a buying situation in which objective standard are not available to guide them, they

may conform to the 'class norms'. Studies have shown that the extent of influence the social

class has on its members will depend on the extent of attractiveness of the group holds out to

them. The greater the attractiveness, the larger is the behavioural conformity.

Study of group influence on the individual buying behaviour will help the marketers to

devebp right strategies for different customer segments. It is not feasible for them to appeal to

the fancies of every individual buyer. They can find 'commonalities' or 'pattern' among

specific groups of buyers and work on them.

iii. Information from various sources: - The buyer today is exposed to a veritable

flood of information, unleashed on him from different sources. These sources inform him

about new products and services, improved versions of existing product new uses for existing

products and so on. The information sources that persuade people to try a product include:

advertising, samples and trials, display in shops and salesmen's suggestions. Each of these

sources provides some information to the buyer about the products. When the buyer sees an

advertisement for a product, he is informed about the existence of the products. Later on, he

may develop a positive or negative attitude towards the product or he may remain neutral. The

availability of the product in the shop itself acts as an information source to the buyer. The

buyer may evince an interest in the product and may inquire about it. The product advertises

itself. Often salesmen serve as a source of information to buyers. The salesmen may inform

the prospects about a product explain its advantages and may even suggest a trial purchase.

1. Problem recognition-The process of buying normally starts with the recognition of a

need by the consumer. He recognizes a problem and develops a perception of the problem.

Then he seeks information for solving his problem.

2. Awareness- The customer turns to his environment /world of information around him. It

makes him aware of the existence of the product that would solve his problem.

3. Comprehension- (Evaluation, Comprehension comes out of his ability to reason with

the information. The awareness and comprehension stages represent the information

processing stage. These two stages constitute the cognitive field of the purchase process.

4. Attitude- It is the sum total of the individual's faith and feelings towards a product. As a

result of his awareness and comprehension, the consumer develops an attitude favourable

or unfavourable towards the product. The purchase process will continue only if he

develops a favourable attitude or a liking for the product.

5. Legitimization- The buyer must be convinced that the purchase of the product is the

legitimate course of action. This stage often stands as a barrier between a favourable attitude

towards the product and actual purchase. Only if the buyer is convinced about the correctness

of the purchase decision, will he proceed. At this stage, he may seek further information

regarding the product, or attempt to assess the information already available. Attitude and

legitimization constitute the attitude field of the purchase process.

6. Trial- Conviction leads the consumer to try the product on a small scale: he may buy a

sample. He tries to evaluate the product from his own experience.

7. Adoption- A successful trial leads him to buy/adopt the product Trial and Adoption

constitute the behavioural field in the buying process.

8. Post-Purchase Behaviour- The purchase leads to specific post purchase behaviour.

Usually, it creates some restless ness in the mind of the individual. He is not sure about the

product. He may feel that 'the other brand' would have been better. He may even feel that the

salesman has taken him for a ride. As this dissonance is uncomfortable, the individual, by

himself will seek all means to recover his conviction and poise. He well seed reassuring

advertisements of the product or he may deliberately avoid positive stories of the competing

brand.

THE YAMAHA STRATEGY IN INDIA

Yamaha has shifted its focus from the lower end segments to the premium segment of bikes.

It aims to provide its customers the full range of its engineering marvels that make Yamaha

the company that it is. Yamaha has aim. To become the No.1 in customer satisfaction and is

looking forward to providing the customer with an 'experience' with its products.

The target market of India Yamaha Motors is the young and enthusiastic 18-25 yr. olds who

are willing to try taking the not so much tread. Path of buying the 'sports bike' rather than a

'utility two wheeler'. The young guns are very conscious of the style quotient and look

forward to their ride being a personality statement.

With the increasing dispensable income in India and growing middle and upper middle class

segment Yamaha is sure to find many prospective customers. With news of India becoming

the breeding ground for millionaires Yamaha has certainly identified opportunity and has

grabbed it hands down.

THE 4 P'S FOR INDIA YAMAHA MOTORS

Product: India Yamaha Motors has recently launched its sports bike R15 and FZS in the

150cc.Yamaha is bringing its latest technologies to India and aims to come up with a new

product for the Indian market every quarter. The reliability and riding quality of a Yamaha

have already been established through its earlier products.

Price: The Yamaha range of products has been very competitively priced and the prices of

its products like the R15 has also been priced optimally looking at the specifications of the

bike. The bike despite being only 150 cc provides around 22 BHP of power, more than any

other bike in the 150-220cc. bracket. The bike has also brought the liquid cooled engine

technology to India and other features like the styling etc. are also quite new for the Indian

market and hence considering what it gives you it is a bargain at Rs.97, 500.

Promotion: Yamaha has been constantly losing market share over the last few years and

has thus decided to change its brand image with change in its market strategy. The company

now wants to be known for its style and speed. It looks to be known as a sports bike

manufacturer and not as an economy bike segment player. Taking these factors into

consideration the company has started a complete makeover of its image. The recent R15 and

FZS ads on numerous channels on N and other ads on both electronic and print media

vindicate the point. The company has also opened. 'Yamaha bike stations' which are company

owned showrooms and completely symbolize the brand image that Yamaha wants to achieve

in India.

Place: India Yamaha Motors has adopted a two tier marketing channel consisting of the

Primary dealers at tier1 and the secondary dealers or retailers at tier2. In addition to these two

tiers there are also the 'company owned showrooms' and the multibrand outlets.

CHAPTER 3

CORPORATE INTRODUCTION

INDUSTRY/COMPANY PROFILE

COMPANY PROFILE

About YAMAHA motor India sales Pvt. Ltd

Yamaha made its initial foray into India in 1985. Subsequently, it entered into a 50:50 joint

venture with the Escorts Group in 1996. However, in August 2001, Yamaha acquired its

remaining stake as well, bringing the Indian operations under its complete control as a 100%

subsidiary of Yamaha Motor Co., Ltd, Japan.

India Yamaha Motor operates from its state-of-the-art-manufacturing units at Faridabad in

Haryana and Surajpur in Uttar Pradesh and produces motorcycles both for domestic and

export markets. With a strong workforce of 2000 employees, India Yamaha Motor is highly

customer-driven and has a countrywide network of over 400 dealers.

INDUSTRY PROFILE

The Indian automotive industry consists of five segments: commercial vehicles; multi-utility

vehicles & passenger cars; two-wheelers; three-wheelers; and tractors. With 5,822063 units

sold in the domestic market and 453,591 units exported during the first nine months of

FY2005 (9MFY2005), the industry (excluding tractors) marked a growth of 17% over the

corresponding previous. The two-wheeler sales have witnessed a spectacular growth trend

since the mid-nineties.

Two-wheelers: Market Size & Growth

In terms of volume, 4,613,436 units of two-wheelers were sold in the country in 9MFY2007

with 256,765 units exported. The total two-wheeler sales of the Indian industry accounted for

around 77.5% of the total vehicles sold in the period mentioned.

Demand Drivers

The demand for two-wheelers has been influenced by a number of factors over the past five

years. The key demand drivers for the growth of the two-wheeler industry are as follows:

Inadequate public transportation system, especially in the semi-urban and rural areas;

Increased availability of cheap consumer financing in the past 34 years;

Increasing availability of fuel-efficient and low-maintenance models;

Increasing urbanization, which creates a need for personal transportation;

Changes in the demographic profile;

Difference between two-wheeler and passenger car prices, which makes two-wheelers

the entry level vehicle;

Steady increase in per capita income over the past five years; and

Increasing number of models with different features to satisfy diverse consumer needs.

HIERARCHICAL STRUCTURE

Managing Director and CEO

Senior Vice President

Vice President Top management

Associate Vice President

Chief General Manager

General Manager Senior Management

Deputy General Manager

Chief Manager

Manager Middle Management

Assistant Manager

Senior Superintendent

Senior Officer

Officer Operational Staff

Assistant Officer

YAMAHA PRODUCTS

Yamaha Motor Company Limited

A Japanese motorized vehicle-producing company (whose HQ is at 2500 Shanghai, Iwata,

Shizuoka), is part of the Yamaha Corporation. After expanding Yamaha Corporation into the

world, biggest piano maker, then Yamaha CEO Genichi kawakami took Yamaha into the field

of motorized vehicles on July 1, 1955. The company's intensive research into metal alloys for

use in acoustic pianos had given Yamaha wide knowledge of the making a lightweight, yet

sturdy and reliable metal constructions. This knowledge was easily applied to the making of

metal frames and motor parts for motorcycles. Yamaha Motor is the world's second largest

producer of motorcycles (after Honda). It also produces many other motorized vehicles such

as all-terrain vehicles, boats, snowmobiles, outboard motors, and personal watercraft.

The Yamaha corporate logo is comprised of three tuning forks placed on top of each other in

a triangular pattern.

In 2000, Toyota and Yamaha Corporation made a capital alliance .ere Toyota paid Yamaha

Corporation 10.5 billion yen for a 5 per cent share in Yamaha Motor Company while Yamaha

and Yamaha Motor each bought 500,000 shares of Toyota stock in return.

RACING HERITAGE

Yamaha has a long racing heritage where it has had its machines and team win many different

competitions in many different areas, for example both road and off road racing, also Yamaha

has had great success with riders such as Bob Hannah, Heike Mildcola, Kenny Roberts, Chad

Reed, Jeremy McGrath, Stefan Merriman, Wayne Rainey, and the latest, Valentino Rossi.

Yamaha is known to those who are older in age as the designer of the modem motocross bike,

as they were the first to build a production mono-shock motocross bike (1975 for 250 and

400, 1976 for 125) and one Of the first to have a water-cooled motocross production bike

(1,81, but 1,77 in works bike).

Since 1962, Yamaha produced production road racing grand prix motorcycles that any

licensed road racer could purchase. In 1970, Non-factory "privateer" teams dominated the

250cc World Championship with Great Britain's Rod, Gould winning the title on a Yamaha

TD2.

MOTORCYCLE MODELS

YAMAHA FZ-S

Yamaha FZ-S 150cc , a recently launched bike by the industry giant Yamaha. After the grand

success of FZ-16 Yamaha has finally launched its modified version (FZ-S) in India. This

fabulous bike is equipped with all the necessary features one may think of. It stands ahead in

style and performance not only in its segment but beyond. This bike is best suitable for those

who want elegance and power in one. It is design and engineered with the capacity for active

and aggressive enjoyment of around-town street riding and styling, bringing a sense of pride

for the owner of the bike. It is especially designed to satiate riders' desire for style and

fashion. It is popularly referred as the 'Stylish Macho Street Fighter.' (Lord of the Streets).

The primary features of Yamaha F7-S include

Stainless steel body

Aerodynamic muscular design

High torque rate

Disk brakes

Electric start starting system

Electronic fuel injection system

YAMAHA YZF R15

This is the latest offering from the Yamaha stable. The YZF R15 is the first truly sports bike

launched in India. The looks and design have been done keeping the bigger R1 in mind and

hence the resemblance. The bike is priced at Rs.97500 (ex-showroom) across India. It boasts

of the first liquid coo. 4 valve engine in the two wheeler category which gives it better

performance and power. It is a 150cc bike having enough power to bring chills to the rider

when he revs up the accelerator.

MARKET CHARACTERISTICS

DEMAND SEGMENTAL CLASSIFICATION AND CHARACTERISTICS

The three main product segments in the two-wheeler category are scooters, motorcycles and

mopeds. However, in response to evolving demographics and various other factors, other sub

segments emerged, viz. scooterettes, gearless scooters, and 4-stroke scooters. While the first

two emerged as a response to demographic changes, the introduction of stroke scooters has

followed the imposition of stringent pollution control norms in the early 2000. Besides, these

prominent sub-segments, product groups within these sub-segments have gained importance

in the recent years. Examples include 125cc motorcycles, 100-125 cc gearless scooters, etc.

The characteristic of each of the three broad segments are discussed in Table 1.

Scooter Motorcycle Moped

Price*(Rs. As in

January 2008)

>22000 >30,000 >12,000

Stroke 2-stroke,4-stroke Mainly 4-stroke 2-stroke

Engine capacity (cc) 90-150 100,125 >125 50,60

Ignition Kick/Electric Kick/Electric Kick/Electric

Engine power(bhp) 6.5-9 7-8 and above 2-3

Weight(kg) 90-100 >100 60-70

Fuel Efficiency (km

per litre)

50-75 50-80+ 70-80

Load carrying High Highest Low

SEGMENT MARKET SHARE

The Indian two-wheeler industry has undergone a significant change over the past 10 years

with the preference changing from scooters and mopeds to motorcycles. The scooters segment

was the largest till FY 1998, accounting for around 42% of the two-wheeler sales

(motorcycles and mopeds accounted for 37% and 21 % of the market respectively, that year).

However, the motorcycles segment that had witnessed high growth (since FY1994) became

larger than the scooter segment in terms of market share for the first time in FY1999. Between

FYI 996 and 9MFY2007, the motorcycles segment more than doubled its share of the two-

wheeler industry to 79% even as the market shares of scooters and mopeds stood lower at

16% and 5%, respectively.

Over the past 10-15 years the demographic profile of the typical two-wheeler customer has

changed. The customer is likely to be salaried and in the first job. With a younger audience,

the attributes that are sought of a two-wheeler have also changed. Following the opening up of

the economy and the increasing exposure levels of this new target audience, power and styling

are now as important as comfort and utility. The marketing pitch of scooters has typically

emphasized reliability, price, comfort and utility across various applications. Motorcycles, on

the other hand, have been traditionally positioned as vehicles of power and style, which are

rugged and more durable. These features have now been complemented by the availability of

new designs and technological innovations. Moreover, higher mileage offered by the

executive and entry-level models has also attracted interest of two-wheeler customer. Given

this market positioning of scooters and motorcycles, it is not surprising that the new set of

customers has preferred motorcycles to scooters. With better ground clearance, larger wheels

and better suspension offered by motorcycles, they are well positioned to capture the rising

demand in rural areas .ere these characteristics matter most.

Scooters are perceived to be family vehicles, which offer more functional value such as

broader seat, bigger storage space and easier ride. However, with the second-hand car market

developing, a preference for used cars to new two-wheelers among vehicle buyers cannot be

ruled out. Nevertheless, the past few years have witnessed a shift in preference towards

gearless scooters (that are popular among women) within the scooters segment. Motorcycles

offer higher fuel efficiency, greater acceleration and more environment-friendliness. Given

the declining difference in prices of scooters and motorcycles in the past few years, the

preference has shifted towards motorcycles. Besides a change in demographic profile,

technology and reduction in the price difference between motorcycles and scooters, another

factor that has weighed in favour of motorcycles is the high re-sale value they offer. Thus, the

customer is willing to pay an up-front premium while purchasing a motorcycle in exchange

for lower maintenance and a relatively higher resale value.

Manufacturer

As the following graph indicates the Indian two-wheeler industry is highly concentrated, with

three players-Hero Honda Motors Ltd (HHML), Bajaj Auto Ltd (Bajaj Auto) and TVS Motor

Company Ltd (TVS) - accounting for over 80% of the industry sales as in FY2007. The other

key players in the two-wheeler industry are Kinetic Motor Company Ltd (KMCL), Kinetic

Engineering Ltd (KEL), and LML Ltd

(LML), Yamaha Motors India Ltd (Yamaha), Majestic Auto Ltd (Majestic Auto), Royal

Enfield Ltd (REL) and Honda Motorcycle & Scooter India (P) Ltd (HMS!).

Although the three players have dominated the market for a relative long period of time, their

individual market shares have undergone a major change. Bajaj Auto was the undisputed

market leader till FY2000, accounting 32% of the two-wheeler industry volumes in the

country that year. Bajaj Auto dominance arose from its complete hold over the scooter

market. However, as the demand started shifting towards motorcycles, the company witnessed

a gradual erosion of its market share.HTML, which had concentrated on the motorcycle

segment, was the man beneficiary, and almost doubled its market share from 20% in FY2000

to 50% in FY2007 to emerge as the market leader. TVS, on the other hand, witnessed an

overall decline in market share from 22% in FY2000 to 17% FY2007. The share of TVS in

industry sales Fluctuated on a year on year basis till FY2003 as it changed its product mix but

has declined since then.

Technology

Hitherto, technology transfer to the Indian two-wheeler industry took place mainly through:

licensing and technical collaboration (as in the case of Bajaj Auto and LML); and joint ven.es

(HHML).

A third form - that is, the 100% owned subsidiary route - found favour in the early 2000s. A

case in point is HMSI, a 100% subsidiary of Honda, Japan. Table 2 details the alliances of

some major two-wheeler manufacturers in India. Besides the below mentioned technology

alliances Suzuki Motor Corporation has also followed the strategy of joint ven.es (SMC

reportedly acquired equity stake in Integra Overseas Limited for manufacturing and marketing

Sum. motorcycles in India).

Nature of

Alliance

Company Product

Bajaj

Auto

Technological

tie-up

Kawasaki Heavy

industries Ltd, Japan

Motorcycles

Technological

tie-up

Tokyo R&D Co Ltd,

Japan

Two-wheelers

Technological

tie-up

Kubota Corp, Japan Diesel Engines

KEL Tie up for

manufacturing

and

distribution

Italjet, Italy Scooters

LML Technological

tie-up

Daelim Motor Co Ltd Motorcycles

Hero

Motors

Technological

tie-up

Aprilla of Italy Scooters

With the two-wheeler market, especially the motorcycle market, becoming extremely

competitive and the life cycle of products getting shorter, the ability to offer new models to

meet fast changing customer preferences has become imperative. In this context, the ability to

deliver newer products calls for sound technological backing and this has become one of the

critical differentiating factors among companies in the domestic market. Thus, the players

have increased their focus on research and development with some having indigenously

developed new models as well as improved technologies to cater to the domestic market.

Further, with exports being one of the thrust areas for some Indian two-Wheeler companies,

the Indian original equipment manufacturers (OEMs) have realized the need to upgrade their

technical capabilities. These relate to three main areas: fuel economy, environmental

compliance, and performance. In India, because of the cost-sensitive name of the market, fuel

efficiency had been an interest area for manufacturers.

It is not only that the OEMs are increasing their focus on in-house R&D; they also provide

support to the vendors to upgrade the technology and also assist those striking technological

alliances.

TRENDS IN THE TWO-WHEELER INDUSTRY

Companies raising capacity to meet the growing demand

All the major two-wheeler manufacturers, viz. Bajaj Auto, HHML, YMIL, TYS, HMSI and

others, have increased their manufacturing capacities in the recent past. Most of the players

have either expanded capacity, or converted their existing capacities for scooters and mopeds

into those for manufacturing motorcycles. The move has been prompted by the rapid growth

reported by the motorcycles segment since FY1995.

Niche markets also witnessing intense competition

A significant trend witnessed over the past five years is the inclination of consumers towards

products with superior features and styling. Better awareness about international models has

raised expectations of consumers on some key attributes, especially quality, styling, and

performance. High competitive intensity has prompted players to launch vehicles with

improved attributes at a price less than the competitive models. In an effort to satisfy the

distinct need of consumers, producers are identifying emerging consumer preferences and

developing new models. For instance, in the motorcycles segment, motorcycles with engine

capacity over 150cc, is a segment that has witnessed significant new product launches and

hence, become more competitive. The indigenously launched Pulsar 150 had met with success

on its launch and thereafter, a host of models have been launched in this segment by various

players. While Bajaj Auto launched the Pulsars (180 cc, 200cc and 220cc) with digital twin

spark technology (DTSFi) that offers a powerful engine and fuel efficiency of 125 cc models.

Moreover, in the recent past, the motorcycle segment has witnessed launch of vehicles with

higher engine capacity (higher .n 150cc) and power (higher than 15bhp). These include

models such as Bajaj Auto Eliminator and Royal Enfield's Thunderbird followed by HHML's

Karizma and Yamaha R15 and other sports bikes. The products in this segment cater for style

conscious consumers. Quite a players are developing models combining features such as

higher engine capacity", optimum mix of power and performance, and superior styling.

However, the extent of shift to these products would depend on the positioning of such

products in terms of price.

In the scooters segment, the market for plastic-bodied aromatic scooters continues to witness

growth in the scenario of overall decline in scooter volumes. Higher volumes and growth are

especially true for certain scooter models, such as Honda Activa, that brought in new

technology (besides aromatic transmission) to further differentiate themselves. Thus, the need

to differentiate and create a niche has led to companies strengthening their research &

development (R&D) capabilities and reducing the development time for new models.

SWOT ANALYSIS

Strengths

Yamaha Motor products extend from land to sea and even into the skies, with manufacturing

and business operations that include everything from motorcycles, PSA electro-hybrid bikes,

marine and power products to automotive engines.

Continuously does product improvement in accordance with demanding customers.

The distribution network of Yamaha Motors is very wide and spread across the country.

Probably the best in terms of R&D facility.

Has great brand name and commands lot of respect among bikers community.

Weakness

Narrow product line in terms of motorcycles.

Yamahas strategy for Indian market was on right alleyway, but somewhere down the lane,

they are still relying on conventional model which no longer in use.

Yamaha despite the promise has failed to deliver and is still an underdog in the race to top.

A series of unsuccessful and flop bikes have eroded the legacy of RXl00 and RD350.

Opportunities

The motorcycle market has been growing at a phenomenal rate and there has been a shift in

the consumer preference from 2 stroke bike. Yamaha motors have recognized this and are

bringing out new models of 4 stroke bikes quite regularly to cater the needs of the customers.

Consumers have become technology conscious and Yamaha Motors have best R&D

facilities. So they can tap new customers with innovative technology in motorcycle design and

manufacturing.

There lies lot of potential in 150cc and above segment and Yamaha has not made enough

inroads in this segment.

Threats

Continuous divisions of customer segment have made conventional bikes which was the

strength of Yamaha motors.

Constant demand for price reduction from customers.

Bajaj Auto and TVS have taken large part of the market share from Yamaha.

Growing competition in the industry, both in the terms of new models and price

undercutting, too is a matter of concern as both the sales realization and operation margins

may come under pressure.

CHAPTER 4

RESEARCH TECHNOLOGY

RESEARCH PROBLEM AND OBJECTIVE

Research in common parlance refers to search for Knowledge. Research is an academic

activity and as such it is used in a technical sense. According to Clifford Woody, research

comprises defining and redefining problems, formulating hypothesis or suggesting solutions,

collecting, organizing and evaluating data, making deductions and research conclusions to

determine whether they fit the formulating hypothesis.

Primary objective

The research encompasses the prim, objective of comparison and analysis of Yamaha bikes

with respect to other brands prevailing in the market i.e., Hero Honda, Honda, Bajaj, TVS and

Suzuki.

The primary aim is to interpret the satisfaction level of customers using Yamaha, bikes and to

find out the areas in which it needs to improve to develop a better perception in the mind of its

customers. It entails as to suggest Yamaha how to become a no. 1 customer oriented company

Secondary objective

To go in detail, the research includes the study of comparative satisfaction level of customers

using different bike brands; the various areas where competitors supersede and the areas

where the competitors lack.

Furthermore the research aims to find out the relative market capitalization of Yamaha in the

two wheeler industry and to suggest some concrete and absolute measures to give a rise to its

share in the two wheeler segment.

Research Process

Extensive Literature Survey: Before starting the research in-depth study of the topic

was done to form a clear picture of %that and how research is to be done.

Formulating the Research Problem: The next step was to find out the problem of

the case. Then the problem was understood thoroughly and rephrasing the same into

meaningful terms from analytical point of view. This step is of greatest importance in the

entire research.

Design of Questionnaire: A questionnaire was developed f he survey. The

questionnaire is of structured type.

Determining the Sample S.: Next step is to determine the number of to be targeted

from various ages, monthly salary, and gender. So a total of 47 people were surveyed.

Collecting the data: The data was collected from various class of people based on age,

s., income, location.

Analysis of Data: The data collected from various people was segregated into various

categories in order to analyze it. Analysis was done based on 20 different parameters.

Generalization and Interpretation: Data was tested and upheld several times, and

then generalizations welt drawn from the analysis.

Preparation for the report: Lastly report about the research is made.

Research Design

Exploratory Research design

Focus Group

Primary data analysis

Collection of Data

Qualitative Data

Survey

Questionnaires

Sampling

Non-Probability Sampling

Judgmental Sampling

Simple Random

Sample Design

Sampling may be defined as the selection of the some part of an aggregate or totality on the

basis of which a judgment or interference about the aggregate or totality is made. It is the

process of obtaining information about entire population by examining only a part of it in

which generalizations or influences are drawn based on the sample about the parameter of

population from which samples are taken.

Sample Size: A total of 47 people have been questioned for the purpose of filling up the

questionnaire.

Details of the Survey Conducted

Sample size 47

Target Population

20 25 years

25 30 years

30 and above

Area covered Raipur (C.G.)

Sampling Judgemental Simple Random

Type of Questionnaire Structured 5 point bipolar liker

scale

Type of Questions Close ended Questions

CHAPTER 5

DATA COLLECTION AND

INTERPRETATION

DATA COLLECTION AND INTERPRETATION

The research required collection of first hand prim, data from the respondents. The

respondents necessarily were to be bike users. They were exposed to a questionnaire

containing different parameters for the evaluation of their satisfaction level. The broad

parameters were:

During sales evaluation.

During vehicle delivery.

After sales evaluation.

It was expected that the respondents were honest while answering the questions with pro,

consideration of the brand image of the bike they were currently using. The questionnaire

contained liker sealing to rate various parameters.

The respondents were so selected that they were representative of various segments of bike

users. The respondents were questioned on:

Petrol pumps

Service stations

Educational institutes

Vehicle showrooms

Malls

Residential areas, and

Factories

The results and responses were recorded on a SPSS data viewer (Statistical Package Social

Sciences) parameters were defined on a SPSS variable viewer. The next step was to run the

SPSS and acquire specific results pertaining to the research done.

The findings and analysis complementing to results are discussed in the chapters to follow.

CHAPTER - 6

GRAPHICAL DATA ANALYSIS

DATA ANALYSIS

The data analysis portion is the backbone of any primary or secondary research. There are

various tools of data analysis that helps the researcher to interpret his data into final results.

the data collected in this research was analyzed using the most effective tool of market

research i.e.,SPSS(statistical package for social sciences) The parameters were set up giving

preference to non-demographic factors more than demographic factors. The data was analyzed

on the total of 20 parameters as mentioned below:

i. customer's age

ii. marital status

iii. profession

iv. education

v. attitude of dealer

vi. Explanation of product features by the dealer.

vii. sales terms and conditions

viii. product display in the showroom

ix. cleanliness in showroom and service station

x. atmosphere

xi. cleanliness of purchased bike

xii. time taken in delivery

xiii. explanation of bike functions

xiv. PDI and checks made

xv. Time taken in documentation

xvi. Salesman follow up

xvii. Reminder of first service

xviii. Action to complains

xix. Replacement condition

GRAPHICAL DATA INTERPRETATION

1. Which age group of customer prefer bike most?

Age Group

18 25 25 - 35 35 45 Above 45

Percentage 65% 20 % 10 % 5 %

Interpretation

65% age group of 18-25 preferred a motor bike, 20% age group of 25-35, 10% of age group

35-45 and the rest of age groups are above 45 years old.

2. How do professional/Occupational people show there preference

towards motor bike?

Student 45%

Service 40%

Business 5%

Self-Employed 5%

Others 5%

Interpretation

Occupationally and professional the motor bike has been used i.e. 45% preferred by student,

the service level it is used 40% and the rest of used in business, self-employed and for other

purpose used.

3. How do income wise customers show their interest towards motor

bike?

10000-15000 35%

15000-20000 40%

20000-50000 15%

50000-100000 5%

Above one lack 5%

Interpretation

In the base of economically, it is used in the base of income i.e. 35% of income group 10000-

15000, 40% of 15000-20000, 15% of income group of 20000-50000 and rest of used in rarely

above income of 50,000.

4. Which companys bike customer would like to purchase?

Hero-Honda 40%

Bajaj 45%

YAMAHA 10%

TVs 3%

Honda 2%

INTERPRETATION

40% of motor Bike Company and its model liked by people of Hero-Honda, second position

of Bajaj and third position of Yamaha and rest of TVs and other companies.

5. Which features of the bike customer would like to prefer most while

purchasing?

Speed 40%

Power/BHP 5%

Mileage 30%

Design 5%

Brand 5%

Pick-up 2%

Colour 5%

Comfort 8%

INTERPRETATION

40% of the people mostly adopt bikes due to the speed factor, 30% for the mileage, and 8%

for comfort, 5% for power/BHP, design, brand and colour, 2% for pickup.

6. How do people come to know about bikes?

TV 35%

Newspaper 15%

Friend 12%

Product show 10%

Family 8%

Test ride 2%

Internet 10%

Hoarding 8%

INTERPRETATION

They are aware and know about motor bike product 35% by TV channels, 15%

newspaper/magazines, 12% by friends, 10% by product show, 10% through internet, 8% by

family and other through test riding and hoardings.

7. Why did you purchase a bike?

Brand value 80%

Design 5%

Publicity 14%

Scheme 0%

Gift 1%

INTERPRETATION

The bike has purchased according to brand value, design, publicity and other base. The

common factor, in the present firstly value is the main factor i.e. 80% people has been

purchased any motor bike and 14% has been purchased by having the main factor of publicity.

8. How was your experience after using the bike?

Excellent 75%

Good 20%

Satisfactory 5%

Not good 0%

INTERPRETATION

In the survey it has been found that 75% Excellence and 20% was telling about the Good

theme.

9. Where does customer want the servicing of his motor bike to be

done?

Showroom 95%

Road-Mechanic 5%

INTERPRETATION

The main important thing that the motor bike servicing factors where it will be better do for

95% customers attitude towards servicing of motor bike in showroom and rest of road

mechanic.

10. Are customers satisfied with the dealer services of their bikes?

Extremely well 45%

Very well 50%

Average or Not well 0%

Not at all well 5%

INTERPRETATION

Yes, 50% customers has been highlight about brands and can have a very well

CHAPTER 7

FINDINGS OF RESEARCH

INTERPRETATION

1. Out of the six brands covered the respondents of Suzuki are generally married while other

brands have unmarried customers.

2. The average age of a Yamaha customer comes out to be 26-30 years as compared to others

brands average customers age which is 21-25 years.

3. When explanation of product features com. into view; only Yamaha customers rank them

average; others says it's good.

4. Hero Honda and Honda are most favoured brands when timely delivery of bike comes into

picture.

5. Suzuki customers says that they have to run after their dealers for the documentation of the

delivery done while others say they are satisfied.

6. Yamaha is best when sales follow up after delivery is concerned.

7. The most important point that comes up after analysis is that almost every brand of

customer wants a change but Yamaha customers are generally loyal to their brand.

To conclude it can be said that almost every brand lacks in terms of sales follow up. So this is

the area where Yamaha can focus and position its bikes.

Secondly, there is huge market for bikes because almost every bike user wants to change its

bike because of some or the other reason.

Lastly, Yamaha has a good market image but a minimum number of users are new. The most

raring point is that Yamaha in spite of having a low market share is able to retain most of its

customers.

CHAPTER 8

GAPS IN LITERATURE

GAPS IN LITERATURE

The research has showed following gaps

Average age 26-30 years. The average age of Yamaha bike users was assumed to be 21-

25 years. But from the survey it was found that the average age of Yamaha bike users lie

between 26-30 years of age.

Profession Salaried; Young executives. Before research students and young executives

were considered to be the main customer of Yamaha. But our research has shown that the

salaried class is the main customer of Yamaha.

From the research it can be easily inferred that the Yamaha customers are the most loyal

customers as maximum number of Yamaha bike users are those who have already used

Yamaha bikes. While the number of new customers are much less than that of other brands.

Competitive advantage

Speed

Power

Pick-up

BHP

CHAPTER - 9

SCOPE OF STUDY

SCOPE OF STUDY

The research was carried out to find factors which influence customer satisfaction level to

maximum level. The study projects that customer satisfaction level change with change in

various factors like during sales evaluation, during delivery of title vehicle and after sales

evaluation. This research is an attempt to provide feedback to Motorcycle manufacturer

Yamaha Motors India Ltd. so that they can bring about changes in various departments of

their organization which will help them in becoming Number 1 motorcycle brand in India.

For instance during research factors such as technology, maintenance, looks, style, brand

image, behaviour of dealers, timely delivery of documents and bike and proper information

about the product were considered.

This research would give necessary details to Yamaha motors so that it could know the

various factors that affect customer satisfaction level and then initiate appropriate changes to

make it Number 1 motorcycle brand in India.

There are various conclusions that can be arrived at regarding the Indian two wheeler industry

after the execution of this research. Still the research cannot be considered as totally

exhaustive. There are various areas that are beyond the scope of this research. This arises the

need and scope of further research in this area. Some of the possible arenas can be as follows:

Forecasting the market for two wheeler industry in coming 5 years.

Study of consumer behaviour of Indian two wheeler industries.

Developing a model for success of a particular brand on the basis of arrived conclusions.

Developing a model of bike on the basis of responses of the customers to stabilize in the

market; determining the optimum combination of mileage and price.

CHAPTER - 10

PROBLEM IDENTIFICATION

PROBLEMS IN YAMAHA

Yamaha bikes have a poor mileage it needs to create a positive image in the mind of its

customers.

They lack style and innovation.

Yamaha lack in aggressive marketing strategy.

Indian customers are mainly commuters and not bikers.

Yamaha has no raring ISO cc range bike.

People having a halo image of RX-I00.

Yamaha has lost trust among Indian consumers by producing bikes like YBX, Frazer and

Libero.

High maintenance cost.

Dearer accessories.

Yamaha has no vulnerable bike to compete with high mileage bikes of TVS and Hero

Honda.

CHAPTER - 11

CONCLUSION

From the research %flowing facts about Indian two wheeler industries has

been inferred:

Age group

21-35 years

Profession

Mostly salaried

Customers are generally satisfied with attitude of dealers at the time of sales.

Every brand of bikes has a poor response in terms of sales follow up.

Hero Honda is the most famous brand.

Favoured bikes in today's date are

Hunk

Pulsar

Apache

Customers stress on quality as complimentary to looks.

Mileage is what everybody wants.

In fact, the dealership of Delhi / New Delhi is found good having with customer's attitude

and behaviour to Dealership evaluation other than found of Noida then Greater Noida.

CHAPTER 12

SUGGESTION

SUGGESTIONS

1. INTRODUCTION OF NEW BRANDS Yamaha should introduce new bikes in the

market. It will definitely make the market oligopolistic, but will improve the condition of

Yamaha.

2. BIKE IN 150 CC SEGMENT Yamaha does not have any successful bike in these

segments. Yamaha needs to introduce a bike in this segment which can compete with the

other brands on price, power, pick-up, mileage and style.

3. INTEGRATION OF MARICETING AND R & D DEPARIMENT - Yamaha has got

best R&D facilities and international design of sports bikes. It needs to integrate its efforts

together with other department more specifically marketing wing and try to give customers

what they want.

4. It has been found from the research that Yamaha has got the most loyal customers but when

it comes to Yamaha, people still talk about RX 100. Yamaha should develop a bike like RX

100, and this time mileage and style should also be considered.

5. 360 degree marketing approach and need to follow aggressive promotional campaigns to

grab a larger piece of pie in the motorcycle segment.

6. Focus should be on teenagers, young and executives as they represent largest portion of the

bike user segment.

7. Provide better sales follow up which almost every brand lacks the research has showed

that the bike users of all brands are dissatisfied with their 'after sales experience' .This is a big

loop hole which Yamaha can use to improve its brand image and to gain more customers.

8. Indian customers generally do not Use bike for fashion but as a necessity so mileage should

be a concern, so it needs to create a better image in the mind of its customers regarding

mileage.

CHAPTER 13

LIMITATIONS

LIMITATIONS

1. Research was limited to only two wheeler motorcycle industry.

2. Since it is limited only to two wheeler motorcycle industry so the entire customer

satisfaction level while and after purchasing a product cannot be projected on this research.

3. Sometimes it was very difficult to get the necessary information as filling the questionnaire

required time.

4. Research could have been wider in scope if along with customer satisfaction level

consumer behaviour pattern was also studied.

CHAPTER 14

ANNEXTURE

1. Which age group of customer prefer bike most?

a. 18-25 b. 25-35 c. 35-45 d. about 45

2. How do professional/occupational people show there preference towards

motor bike?

a. Student b. Service c. Business d. Self-employed e. Others

3. How do income wise customers show their interest towards motor bike?

a. 10000-15000 b. 15000-20000 c. 20000-50000 d. 50000-100000 e. above

1 Lack

4. Which Company's bikes customer would like to purchase?

a. Hero Honda b. Bajaj c. Yamaha d. TVS e. Honda

5. Which features of a bike customer would like to prefer most while

purchasing?

a. Speed b. Power/BHP c. Mileage d. Design e. Brand f. Pick-upg.

Colour h. Comfort

6. How do people come to know about bikes?

a. T V b. Newspaper c. Friend d. Product Show e. Family

f. Test Ride g. Internet h. Hoarding

7. Why did you purchase a bike?

a. Brand Value b. Design c. Publicity d. Scheme e. Gift

8. How was your experience after using the bike?

a. Good b. Excellent c. Satisfactory d. Not Good

9. Where do customers want the servicing of his motor bike to be done?

a. Show Room b. Road Mechanics

10. Do customers get full value of money for the bike they purchased?

a. Yes b. No

11. Are customers satisfied with the performance of their bikes?

a. Yes b. No

12. Which type of brakes is mostly preferred by the customers?

a. Disk Brake b. Drum Brake

13. Which types of wheels are mostly preferred by the customers?

a. Spoke Wheel b. Alloy Wheel

14. Are customers satisfied with the dealer services of their bikes?

a. Extremely Well b. Very Well c. Average Well d. Not Well At All

Potrebbero piacerti anche

- KIA Motors at A Glance: Business Domain Global NetworkDocumento12 pagineKIA Motors at A Glance: Business Domain Global NetworkCarina ZhuNessuna valutazione finora

- Maruti Suzuki Market StrategyDocumento32 pagineMaruti Suzuki Market Strategyjpc_amr100% (2)

- Study on India's Automobile Sector with Focus on Maruti SuzukiDocumento80 pagineStudy on India's Automobile Sector with Focus on Maruti SuzukiRahul BhansaliNessuna valutazione finora

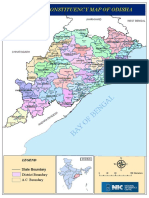

- EN GA L: Assembly Constituency Map of OdishaDocumento1 paginaEN GA L: Assembly Constituency Map of OdishaShiba SahuNessuna valutazione finora

- The Evolution and Structure of The Two-Wheeler Industry in IndiaDocumento1 paginaThe Evolution and Structure of The Two-Wheeler Industry in IndiaSuman KumarNessuna valutazione finora

- Rural Perception of SUV CarsDocumento29 pagineRural Perception of SUV CarsritusinNessuna valutazione finora

- Maruti SuzukiDocumento33 pagineMaruti SuzukiNaman Arya100% (4)

- Brand Preference Towards Honda Two-WheelersDocumento56 pagineBrand Preference Towards Honda Two-WheelersAŋoop KrīşħŋặNessuna valutazione finora

- Honda ActivaDocumento55 pagineHonda ActivaManisha KharayatNessuna valutazione finora

- Analysis of Maruti SuzukiDocumento27 pagineAnalysis of Maruti SuzukiSwati Nayak100% (2)

- Analysis of Marketing Mix of Honda Cars in IndiaDocumento25 pagineAnalysis of Marketing Mix of Honda Cars in Indiaamitkumar_npg7857100% (5)

- Two Wheelers in IndiaDocumento31 pagineTwo Wheelers in Indiasarath.nNessuna valutazione finora

- Executive Summary: A Study of Advertising and Sales Promotion of Hero Two WheelersDocumento55 pagineExecutive Summary: A Study of Advertising and Sales Promotion of Hero Two WheelersAkanksha chandrakarNessuna valutazione finora

- Marketing Strategies of Hero HondaDocumento24 pagineMarketing Strategies of Hero HondaJohn22y40% (5)

- After Sales Srevice of Maruti SuzukiDocumento54 pagineAfter Sales Srevice of Maruti SuzukiNaresh PawarNessuna valutazione finora

- Consumer PerceptionDocumento43 pagineConsumer PerceptionKunal Rajput100% (1)

- Maruti Suzuki market potential study in TrivandrumDocumento81 pagineMaruti Suzuki market potential study in TrivandrumAru.SNessuna valutazione finora

- Clean Edge QuestionsDocumento3 pagineClean Edge QuestionsDeepikaNessuna valutazione finora

- Bajaj Auto LTD FinalDocumento15 pagineBajaj Auto LTD FinalSohail QureshiNessuna valutazione finora

- Maruti SuzukiDocumento21 pagineMaruti SuzukiprabhuNessuna valutazione finora

- Customer Perception of Maruthi SuzukiDocumento9 pagineCustomer Perception of Maruthi SuzukiOm Prakash100% (1)

- Research Methodology - Kia MotorsDocumento5 pagineResearch Methodology - Kia MotorsAsh VaidyaNessuna valutazione finora

- King NARZARY BBA PROJECT 6Documento80 pagineKing NARZARY BBA PROJECT 6Sunny SinghNessuna valutazione finora

- A Study On Customer Satisfaction in Indus MotorsDocumento5 pagineA Study On Customer Satisfaction in Indus MotorsKali Pandi100% (1)

- A Study On Mapping and Profiling of Customers For MG Motors (Hector) at MG Showroom, HyderabadDocumento36 pagineA Study On Mapping and Profiling of Customers For MG Motors (Hector) at MG Showroom, HyderabadAmitSahuNessuna valutazione finora

- What Is Honda?: Chief ProductsDocumento24 pagineWhat Is Honda?: Chief ProductsAnjum hayatNessuna valutazione finora

- Hero MotoCorpDocumento14 pagineHero MotoCorpPraveen Kumar50% (2)

- HondaDocumento9 pagineHondaWasim Ahmed ChandioNessuna valutazione finora

- Royal Enfield customer perception surveyDocumento5 pagineRoyal Enfield customer perception surveyMohammad ShahidNessuna valutazione finora

- Marketing Strategies of Maruti SuzukiDocumento64 pagineMarketing Strategies of Maruti SuzukiAnonymous TD99UqSLNessuna valutazione finora

- Report On Maruti Suzaki Ltd.Documento54 pagineReport On Maruti Suzaki Ltd.rony guy100% (1)

- Kia MotorsDocumento69 pagineKia MotorsRavikumar KanniNessuna valutazione finora

- Yamaha FZ, Mini ProjectDocumento66 pagineYamaha FZ, Mini ProjectNishanth C Mohan100% (3)

- Indian Two Wheeler Industry OutlookDocumento18 pagineIndian Two Wheeler Industry OutlookPankaj Goenka100% (1)

- 7 Marketing Strategies of India Automobile CompaniesDocumento7 pagine7 Marketing Strategies of India Automobile CompaniesamritNessuna valutazione finora

- TVS Apache CHAPTER 1Documento80 pagineTVS Apache CHAPTER 1hanumanthaiahgowda100% (1)

- Project - Hero Motocorp Ltd. - Financial Analysis FinalDocumento26 pagineProject - Hero Motocorp Ltd. - Financial Analysis FinalDivakar TyagiNessuna valutazione finora

- TVS ProjectDocumento57 pagineTVS ProjectNikhil BhaleraoNessuna valutazione finora

- Project on Honda: Business functions and customer satisfactionDocumento55 pagineProject on Honda: Business functions and customer satisfactiongogetaNessuna valutazione finora

- Maruti SuzukiDocumento8 pagineMaruti SuzukiDhwani DoshiNessuna valutazione finora

- Profile of The CompanyDocumento8 pagineProfile of The Companyaryaa_stat0% (1)

- BBA Project - ForD.Documento58 pagineBBA Project - ForD.Sushant Singh100% (1)

- Customer Satisfaction Key to SuccessDocumento74 pagineCustomer Satisfaction Key to SuccessAjith KumarNessuna valutazione finora

- Customer Satisfaction For Tata MotorsDocumento18 pagineCustomer Satisfaction For Tata MotorskharemixNessuna valutazione finora

- Customer SatisfactionDocumento112 pagineCustomer Satisfactionyogesh kothariNessuna valutazione finora

- Customer Satisfaction and Service Quality at Mandovi MotorsDocumento9 pagineCustomer Satisfaction and Service Quality at Mandovi MotorsSijal KhanNessuna valutazione finora

- Marketing Strategies of Hero MotoCorpDocumento68 pagineMarketing Strategies of Hero MotoCorpVishnuNadarNessuna valutazione finora

- Kavita Final (Yamaha)Documento91 pagineKavita Final (Yamaha)onlinebaijnathNessuna valutazione finora

- Marketing Research ProjectDocumento37 pagineMarketing Research ProjectVijay100% (15)

- Consumer Behavior in Two-Wheeler Industry ResearchDocumento105 pagineConsumer Behavior in Two-Wheeler Industry ResearchKarthik K J100% (1)

- Yamaha Marketing Consumer Behaviour FinalDocumento116 pagineYamaha Marketing Consumer Behaviour FinalSami Zama50% (2)

- Research Project Report On Customer Satisfaction of Two Wheelers Industries With Special RefDocumento18 pagineResearch Project Report On Customer Satisfaction of Two Wheelers Industries With Special RefUmesh WableNessuna valutazione finora

- 167 Sample-Chapter PDFDocumento56 pagine167 Sample-Chapter PDFRenu KulkarniNessuna valutazione finora

- Market ResearchDocumento127 pagineMarket Researchsang kumarNessuna valutazione finora

- Project of Marketing ManagementDocumento55 pagineProject of Marketing ManagementRockies Kelvin100% (3)

- Unit - 7 E BOOK NEWDocumento11 pagineUnit - 7 E BOOK NEWShyam YadavNessuna valutazione finora

- Customer Satisfaction of Two Wheelers Industries Customer Satisfaction of Two Wheelers IndustriesDocumento74 pagineCustomer Satisfaction of Two Wheelers Industries Customer Satisfaction of Two Wheelers IndustriesAlok kumarNessuna valutazione finora

- CBNM JuryDocumento15 pagineCBNM JuryCHAITRALI DHANANJAY KETKARNessuna valutazione finora

- Yamaha-Marketing-ConsumerBehaviour-Final With Graphs11Documento100 pagineYamaha-Marketing-ConsumerBehaviour-Final With Graphs11Manish GuptaNessuna valutazione finora

- Sales Activities and Promotional of Yamaha BikesDocumento72 pagineSales Activities and Promotional of Yamaha BikesAbhinavParasharNessuna valutazione finora

- Planetary Travel&Hoist Drivespdf PDFDocumento9 paginePlanetary Travel&Hoist Drivespdf PDFbee140676Nessuna valutazione finora

- SSIs in Hubli-Dharwad stunted due to lack of govt supportDocumento3 pagineSSIs in Hubli-Dharwad stunted due to lack of govt supportmushtaqaralikatti5Nessuna valutazione finora

- Transmission Case StudyDocumento35 pagineTransmission Case StudyPratik AgrawalNessuna valutazione finora

- Indian Perspective on Intellectual Property RightsDocumento20 pagineIndian Perspective on Intellectual Property RightsFateh Singh RawatNessuna valutazione finora

- AppendixDocumento4 pagineAppendixGokul KrishnanNessuna valutazione finora

- ZF Transmission ZF s6 650 - 6s 750 Troubleshooting Guide PDFDocumento34 pagineZF Transmission ZF s6 650 - 6s 750 Troubleshooting Guide PDFBrenda Arnold100% (1)

- A Study On Consumer's Perception Towards Honda Activa in Lucknow CityDocumento37 pagineA Study On Consumer's Perception Towards Honda Activa in Lucknow CityChandan SrivastavaNessuna valutazione finora

- Continental Data GuideDocumento48 pagineContinental Data GuideJose FontenlaNessuna valutazione finora

- Mba 7003 20169108 72Documento27 pagineMba 7003 20169108 72N GNessuna valutazione finora

- Corporate History MRFDocumento6 pagineCorporate History MRFvampire_sushyNessuna valutazione finora

- Testers For Electric Motors and All Kinds of Windings: Product GuideDocumento29 pagineTesters For Electric Motors and All Kinds of Windings: Product GuideMohamedNessuna valutazione finora

- 1110 SahaDocumento4 pagine1110 SahaSanjeev PatilNessuna valutazione finora

- Wp220 Service ManualDocumento0 pagineWp220 Service Manualhelp3rNessuna valutazione finora

- Volvo VIMDocumento2 pagineVolvo VIMEverton OliveiraNessuna valutazione finora

- Accord Tourer Accessories 2012Documento4 pagineAccord Tourer Accessories 2012AOCUKNessuna valutazione finora

- Hyundai Universe PDFDocumento16 pagineHyundai Universe PDFMelvin Gascon33% (3)

- Michelin in The Land of The MaharajasDocumento4 pagineMichelin in The Land of The MaharajasMuhammad BilalNessuna valutazione finora

- Chap005.ppt Service Process DesignDocumento20 pagineChap005.ppt Service Process DesignSaad Khadur EilyesNessuna valutazione finora

- Kramer 880Documento2 pagineKramer 880Foromaquinas0% (1)

- Dorian Auto production model with either-or constraints optimizationDocumento1 paginaDorian Auto production model with either-or constraints optimizationyanurarzaqaNessuna valutazione finora

- Richard's CVDocumento8 pagineRichard's CVrichardtytNessuna valutazione finora

- Truck Technology:The Facts You Need (II) ChassisDocumento44 pagineTruck Technology:The Facts You Need (II) Chassismostafa100% (3)

- 2012 Jacksonville Jaguars Media GuideDocumento157 pagine2012 Jacksonville Jaguars Media GuidepauldNessuna valutazione finora

- End of Life VehiclesDocumento69 pagineEnd of Life VehiclesNatasha S.Nessuna valutazione finora

- PTT Devtool Parameter DescriptionDocumento1.383 paginePTT Devtool Parameter DescriptionHarlinton descalzi92% (12)

- Toyota's Five Forces AnalysisDocumento5 pagineToyota's Five Forces AnalysisOnalenna Tracy MaikanoNessuna valutazione finora

- JCBDocumento6 pagineJCBjohnnyjoy11Nessuna valutazione finora

- Cek MekanikDocumento118 pagineCek MekanikAsep Zaenal BudimanNessuna valutazione finora

- Electric Heating Climate Control 2012 2013Documento120 pagineElectric Heating Climate Control 2012 2013Borcan CristiNessuna valutazione finora