Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Broader Perspectives 2013 06 Compre Answers

Caricato da

nej200695Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Broader Perspectives 2013 06 Compre Answers

Caricato da

nej200695Copyright:

Formati disponibili

COMPREHENSION 2013 BROADER PERSPECTIVES The Money Issue

COMPREHENSION

CONTENT

NAME CLASS

/35M /15M /50M

LANGUAGE TOTAL

Choice Is a Messy Business

Comprehension Answers available at www.broaderperspectives.com.sg & www.twitter.com/ThinkTankMags

QUESTIONS ATTACHED

Homo

economicus,

not his fallible

counterpart,

is the oddity.

Adapted from The Economists The Debt of Pleasure

COMPREHENSION 2013 BROADER PERSPECTIVES The Money Issue

SOVEREIGN in tastes, steely-eyed and point-on in perception of risk, and relentless in

maximisation of happiness. This was Daniel McFaddens memorable summation, in 2006, of

the idea of Everyman held by economists. That this description is unlike any real person was Mr

McFaddens point. The Nobel prizewinning economist at the University of California, Berkeley,

wryly termed homo economicus (economic human) a rare species. In his latest paper* he

outlines a new science of pleasure, in which he argues that economics should draw much more

heavily on felds such as psychology, neuroscience and anthropology. He wants economists to

accept that evidence from other disciplines does not just explain those bits of behaviour that do

not ft the standard models. Rather, what economists consider anomalous is the norm. Homo

economicus, not his fallible counterpart, is the oddity.

The lack of realistic congruence begins with how the people in economic models have fxed

preferences, which are taken as given. Yet a large body of research from cognitive psychology

shows that preferences are in fact rather fuid. People value mundane things much more highly

when they think of them as somehow their own: they insist on a much higher price for a coffee

cup they think of as theirs, for instance, than for an identical one that isnt. This endowment

effect means that people hold on to shares well past the point where it makes sense to sell them.

Cognitive scientists have also found that people dislike losing something much more than they

like gaining the same amount. Such loss aversion can explain why people often pick insurance

policies with lower deductible charges even when they are more expensive. At the moment of an

accident a deductible feels like a loss, whereas all those premium payments are part of the status

quo.

Another area where orthodox economics fnds itself at sea is the role of memory and experience

in determining choices. Recollection of a painful or pleasurable experience is dominated by how

people felt at the peak and the end of the episode. In a 1996 experiment Donald Redelmeier

and Daniel Kahneman, two psychologists, showed that deliberately adding a burst of pain at the

end of a colonoscopy that was of lower intensity than the peak made patients think back on the

experience more favourably. Unlike homo economicus, real people are strongly infuenced by

such things as the order in which they see options and what happened right before they made

a choice. Incorporating these fndings into models of consumer behaviour should improve their

power to predict everything from which loans people choose to which colleges they apply for.

Orthodox economics has always incorporated the element of trust in their models in predicting the

way markets and economies function. However, trust turns out to be not just a function of history

and interactions, as dismal scientists tend to think, but also a product of brain chemistry. Pumping

Choice Is a Messy Business

A Nobel prizewinner argues for an overhaul of the theory of consumer choice

1

2

3

4

1

5

10

15

20

25

30

Adapted from The Economists The Debt to Pleasure,

for the purposes of the A level General Paper

COMPREHENSION 2013 BROADER PERSPECTIVES The Money Issue

people with oxytocin, the so-called love hormone, has been found to make them much more

generous in games where they have to decide how much of their money to entrust to another

person who has no real incentive to return any of it. Sovereign, indeed.

Much of this may be alien to modern-day economists, but it is in line with the conception that other

disciplines have of human decision-making. Psychologists have long known that peoples choices

and preferences are infuenced by others. Biologists have a much clearer understanding of charity

and kindness, whether to kin or strangers, than economists, who typically emphasise the dogged

pursuit of self-interest. This way of thinking would also have been recognisable to their intellectual

forefathers. Adam Smith - the father of modern economics and the theory of The Invisible Hand

- wrote extensively about the central role of altruism and regard for others as motivators of human

behaviour. The idea of loss aversion would have made sense to Jeremy Bentham, the founder

of utilitarianism: he spoke of increased pleasure and reduced pain as two distinct sources of

happiness.

Modern-day economists would do well to take into consideration the observations and fndings of

other disciplines. Mr McFadden believes that economists need to do things differently if they are

truly to understand how people make decisions. Manipulating brain activity is one way of delving

into where economic choices really come from. Analysing the information people get through

social networks would help them understand the role of infuence and identity in decision-making.

Such tools have implications for policy. Plenty of poor people in America are wary of programmes

like the Earned Income Tax Credit (EITC) because the idea of getting a handout from the

government reinforces a sense of helplessness. Dignity is not something mainstream economics

has much truck with. But creating a sense of dignity turns out to be a powerful way of affecting

decisions. One study by Crystal Hall, Jiaying Zhao and Eldar Shafr, a trio of psychologists, found

that getting poor people in a soup kitchen to recall a time when they felt successful and proud

made them almost twice as likely to accept leafets that told them how to get an EITC refund than

members of another group who were merely asked about the last meal they had eaten.

Taking the path Mr McFadden urges might also lead economists to reassess some articles of

faith. Economists tend to think that more choice is good. Yet people with many options sometimes

fail to make any choice at all: think of workers who prefer their employers to put them by default

into pension plans at preset contribution rates. Explicitly modelling the process of making a choice

might prompt economists to take a more ambiguous view of an abundance of choices. It might

also make them more skeptical of revealed preference, the idea that a persons valuation of

different options can be deduced from his actions. This is undoubtedly messier than standard

economics. So is real life.

5

6

7

35

40

45

50

55

60

65

Adapted from The Economists The Debt to Pleasure,

for the purposes of the A level General Paper

CHOICE IS A MESSY BUSINESS 2013 BROADER PERSPECTIVES The Money Issue

Comprehension Questions

1 Sovereign in tastes, steely-eyed and point-on in perception of risk, and relentless in

maximisation of happiness. (lines 1-2)

Explain what Daniel McFadden is saying by bringing out the meaning of the italicised words. [2]

2 Why is homo economicus (economic human), a rare species? (lines 5-6)

Use your own words as far as possible. [2]

3 Why are the words their own (line 15) in inverted commas? [1]

4 How does the role of memory and experience affect choices? (lines 24-25) [1]

CHOICE IS A MESSY BUSINESS 2013 BROADER PERSPECTIVES The Money Issue

5 Why is the power to predict everything about consumer behaviour desirable? (line 33) [2]

6 Explain the authors use of the statement Sovereign, indeed. (line 41)[2]

7 What are the similarities between the understandings of modern scientists and Adam Smith?

(lines 43-50) Use your own words as far as possible [2]

8 Why would the idea of loss aversion have made sense to Jeremy Bentham? [1]

9 Why would modern-day economists do well to take into consideration the observations and

fndings of other disciplines? (lines 53-54) Use your own words as far as possible. [2]

CHOICE IS A MESSY BUSINESS 2013 BROADER PERSPECTIVES The Money Issue

10 How does a sense of dignity affect decision-making? (lines 62-63) [1]

11 What do the articles of faith in line 70 refer to? [1]

12 Summarise the differences between expected model human behaviour under orthodox

economics and that which takes place in real life. [8]

13. In this article, the author presents an overview of new realisations about how people make

choices. How applicable do you fnd his observations to yourself and your own society? [10]

CHOICE IS A MESSY BUSINESS 2013 BROADER PERSPECTIVES The Money Issue

Comprehension Answers

1 Sovereign in tastes, steely-eyed and point-on in perception of risk, and relentless in

maximisation of happiness. (lines 1-2)

Explain what Daniel McFadden is saying by bringing out the meaning of the italicised words. [2]

He is saying that the description of the Everyman held by economists is one in which the person is

totally in control of what he desires (1/2), highly determined (1/2), perfectly accurate in his assessment

of uncertainty (1/2) and absolutely tenacious (1/2) in his pursuit of the greatest amount of happiness

possible.

2 Why is homo economicus (economic human), a rare species? (lines 5-6)

Use your own words as far as possible. [2]

Line Lifted Paraphrased

8-11 He wants economists to accept that

evidence from other disciplines (1/2)

does not just explain those bits of

behaviour that do not ft the standard

models (1/2). Rather, what economists

consider anomalous (1/2) is the norm

(1/2).

There is a cornucopia of proofs from other

felds of studies (1/2) demonstrating that

the theory put forward by economists

that human beings are sorely economic

is not true (1/2), and what economists have

been thinking is deviant (1/2) is actually the

more common case (1/2).

3 Why are the words their own (line 15) in inverted commas? [1]

They are in inverted commas because people may not actually/necessarily own the item in question

and this highlights how the feelings/sense of possession and attachment are just/primarily perceptions.

4 How does the role of memory and experience affect choices? (lines 24-25) [1]

How people remember their frst or prior experiences directly impacts the range of choices and fnal

decisions they arrive at in similar circumstances.

5 Why is the power to predict everything about consumer behaviour desirable? (line 33) [2]

Having the ability to foresee (1/2) how people behave will beneft companies as they will then be able

to understand and capitalise (1) (inferred) on the consumption patterns of consumers in every area

(1/2) of choice they encounter .

Or

Any other sensible answer.

6 Explain the authors use of the statement Sovereign, indeed. (line 41)[2]

The author was being sarcastic in his evaluation of human beings abilities to be in charge of our choices,

and is actually making a statement/giving emphasis to how we do not act independently in reality (1) as

we are unaware of how our brain chemistry exerts a huge unseen effect on our choices. (1)

CHOICE IS A MESSY BUSINESS 2013 BROADER PERSPECTIVES The Money Issue

7 What are the similarities between the understanding of modern scientists and Adam Smith?

(lines 43-50) Use your own words as far as possible [2]

Line Lifted Paraphrased

43-46 Psychologists have long known that

peoples choices and preferences are

infuenced (1/2) by others. Biologists

have a much clearer understanding of

charity and kindness, whether to kin or

strangers (1/2), than economists,

In line with psychologists and biologists

understanding that what humans decide

on and their inclinations are very much

swayed (1/2) by other people as well as

humans capacities for acts of goodness to

both relatives and unknown people (1/2),

Adam Smith also wrote a lot on the pivotal

(1/2) role of charity and care for others as

the impetus (1/2) for human behaviour.

48-50 Adam Smith - the father of modern

economics and the theory of The Invisible

Hand - wrote extensively about the

central (1/2) role of altruism and regard

for others as motivators (1/2) of human

behaviour.

8 Why would the idea of loss aversion have made sense to Jeremy Bentham? [1]

It would have made sense to him because he understood the different kinds of happiness that

increased pleasure and reduced pain would bring, and loss aversion is about people favouring the

latter over the former.

9 Why would modern-day economists do well to take into consideration the observations and

fndings of other disciplines? (lines 53-54) Use your own words as far as possible. [2]

Line Lifted Paraphrased

54-55 economists need to do things

differently (1/2) if they are truly to

understand how people make decisions

(1/2).

Modern economists should take into

consideration the observations and fndings

of other disciplines because they have to

do things using new methods (1/2) if they

are genuinely to have a grasp on how

humans choose (1/2).

58-59 Such tools have implications (1/2) for

policy (1/2).

Furthermore, it is important that they do so

because a through consideration of how

human beings choose will have possible

profound political impact (1/2) on

legislation of rights (1/2).

10 How does a sense of dignity affect decision-making? (lines 62-63) [1]

If people are reminded of previous empowering associations, they will be more encouraged and hence

receptive to new ideas and possibilities, even to charitable acts.

CHOICE IS A MESSY BUSINESS 2013 BROADER PERSPECTIVES The Money Issue

11 What do the articles of faith in line 70 refer to? [1]

They refer to the beliefs/theories that economists believe to be true refections of pattern of human

behaviour.

12 Summarise the differences between expected model human behaviour under orthodox

economics and that which takes place in real life. [8]

Using material from paragraph 1-4, write your summary in no more than 120 words, not counting the

opening words which are given below. Use your own words as far as possible.

While orthodox economics claims that people are

Line Lifted Paraphrased

1-2 From para 1:

Sovereign in tastes, steely-eyed

and point-on in perception of risk,

and relentless in maximisation of

happiness.

From para 1:

In charge of their choices, determined,

accurate in their judgment of dangers,

and tenacious in their pursuit of as much

satisfaction as possible,

12-15 From para 2:

the people in economic models have

fxed preferences, which are taken as

given.

Yet a large body of research from cognitive

psychology shows that preferences are in

fact rather fuid.

People value mundane things much

more highly when they think of them as

somehow their own:

From para 2:

in real life peoples desires are less rigid

than usually assumed according to

research. They much prefer banal things

that they perceive belong to them.

19-20 Cognitive scientists have also found that

people dislike losing something much

more than they like gaining the same

amount.

and they abhor giving up something far

more than they enjoy benefting from the

same amount.

24-26 From para 3:

memory and experience in determining

choices.

From para 3:

Also, while orthodox economics does not

include a role for recollection and past

encounters, in reality these things and the

sequence in which people view choices

30-32 Unlike homo economicus, real people are

strongly infuenced by such things as the

order in which they see options and what

happened right before they made a choice.

have a great impact on how they decide.

CHOICE IS A MESSY BUSINESS 2013 BROADER PERSPECTIVES The Money Issue

35-38 From para 4:

Orthodox economics has always the

element of trust in their models in

predicting the way markets and

economies function.

However, trust turns out to be not just a

function of history and interactions, but

also a product of brain chemistry.

From para 4:

Whereas orthodox economics has only

included the concept of believing in

other people in their theories forecasting

behaviours of buying and selling, in real life,

in addition to faith in others, brain chemistry

also plays a role in determining human

behaviour.

Award full marks for 16-18 key phrases.

13. In this article, the author presents an overview of new realisations about how people make

choices. How applicable do you fnd his observations to yourself and your own society? [10]

This passage is about a new understanding of what governs human choice and behaviour through

incorporating other felds of disciplines besides mere economic assumptions about human beings.

It challenges our conventional understanding of human nature and the sovereignty of people as

autonomous economic agents, by revealing a myriad of ways in which we can be infuenced by

external factors. Candidates will fnd ample material to voice their views and opinions concerning

matters of choice and human behaviour.

Key arguments/threads of thoughts that students can consider are:

Are human beings entirely driven by self-interests and therefore explainable through an economic

model where human consumeristic behaviour is solely accounted for by self-interests alone?

Or is it more realistic to review our conventional and ingrained understanding of human motivations

with a view to revising our economic theories and models?

How does your society view the relationship between human nature and choice?

How feasible are the new ideas discussed in the article and what are the chances of your society

buying into them in the long run?

How much does social/historical memory impact our choices as individuals and as a society?

How does our Singapore context of an Asian country with a western outlook impact the choices

Singaporeans make?

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Navi Mumbai MidcDocumento132 pagineNavi Mumbai MidcKedar Parab67% (15)

- H2 MATHEMATICS PAPER 1 SOLUTIONSDocumento15 pagineH2 MATHEMATICS PAPER 1 SOLUTIONSnej200695Nessuna valutazione finora

- AJC H2 Math 2013 Prelim P2Documento6 pagineAJC H2 Math 2013 Prelim P2nej200695Nessuna valutazione finora

- AJC H2 Math 2013 Prelim P2Documento6 pagineAJC H2 Math 2013 Prelim P2nej200695Nessuna valutazione finora

- RI H2 Maths 2013 Prelim P1 SolutionsDocumento13 pagineRI H2 Maths 2013 Prelim P1 Solutionsnej200695100% (1)

- SWOT Analysis for Reet in QatarDocumento3 pagineSWOT Analysis for Reet in QatarMahrosh BhattiNessuna valutazione finora

- Aviation EconomicsDocumento23 pagineAviation EconomicsAniruddh Mukherjee100% (1)

- Encyclopedia of American BusinessDocumento863 pagineEncyclopedia of American Businessshark_freire5046Nessuna valutazione finora

- Session 3 - 2009 Promos Case StudyDocumento28 pagineSession 3 - 2009 Promos Case Studynej200695Nessuna valutazione finora

- RI H2 Maths 2013 Prelim P2 SolutionsDocumento10 pagineRI H2 Maths 2013 Prelim P2 Solutionsnej200695Nessuna valutazione finora

- Bmat Explanation of Results 2012Documento3 pagineBmat Explanation of Results 2012hirajavaid2460% (1)

- Session 2 - 2012 Promos Essays 3 4Documento50 pagineSession 2 - 2012 Promos Essays 3 4nej200695Nessuna valutazione finora

- RI H2 Maths 2013 Prelim P2 QNDocumento5 pagineRI H2 Maths 2013 Prelim P2 QNnej200695Nessuna valutazione finora

- Broader Perspectives 2014 03 Compre AnswersDocumento13 pagineBroader Perspectives 2014 03 Compre Answersnej200695Nessuna valutazione finora

- Broader Perspectives 2013 03 Compre Answers PDFDocumento10 pagineBroader Perspectives 2013 03 Compre Answers PDFnej200695100% (1)

- Broader Perspectives 2013 03 Compre Answers PDFDocumento10 pagineBroader Perspectives 2013 03 Compre Answers PDFnej200695100% (1)

- 2013 0405 Compre AnswersDocumento10 pagine2013 0405 Compre Answersnej200695Nessuna valutazione finora

- TED Talk TranscriptsDocumento12 pagineTED Talk Transcriptsnej200695Nessuna valutazione finora

- Broader Perspectives 2013 07 Compre AnswersDocumento13 pagineBroader Perspectives 2013 07 Compre Answersnej200695Nessuna valutazione finora

- RI H2 Maths 2013 Prelim P1Documento4 pagineRI H2 Maths 2013 Prelim P1nej200695Nessuna valutazione finora

- Liberty and Security in the Digital AgeDocumento10 pagineLiberty and Security in the Digital Agenej200695Nessuna valutazione finora

- Session 1 - 2011 Promos Essays 3 4Documento39 pagineSession 1 - 2011 Promos Essays 3 4nej200695Nessuna valutazione finora

- HCI H2 Math Prelim Paper 1 SolutionsDocumento12 pagineHCI H2 Math Prelim Paper 1 Solutionsnej200695Nessuna valutazione finora

- RI H2 Maths 2013 Prelim P1Documento4 pagineRI H2 Maths 2013 Prelim P1nej200695Nessuna valutazione finora

- AJC H2 Math 2013 Prelim P1Documento6 pagineAJC H2 Math 2013 Prelim P1nej200695Nessuna valutazione finora

- Integration and Application WorksheetDocumento1 paginaIntegration and Application Worksheetnej200695Nessuna valutazione finora

- Graphing Techniques Workshop: Turning Points, Asymptotes & IntersectionsDocumento2 pagineGraphing Techniques Workshop: Turning Points, Asymptotes & Intersectionsnej200695Nessuna valutazione finora

- Complex Numbers WorksheetDocumento1 paginaComplex Numbers Worksheetnej200695Nessuna valutazione finora

- Biomedical Admissions Test 4500/11: Section 1 Aptitude and SkillsDocumento28 pagineBiomedical Admissions Test 4500/11: Section 1 Aptitude and SkillsKerry-Ann WilliamsNessuna valutazione finora

- Rajanpur Salary Sheet June 2020Documento18.379 pagineRajanpur Salary Sheet June 2020Zahid HussainNessuna valutazione finora

- Manual Book Vibro Ca 25Documento6 pagineManual Book Vibro Ca 25Muhammad feri HamdaniNessuna valutazione finora

- China Resists Outside InfluenceDocumento1 paginaChina Resists Outside InfluenceOliver Bustamante SNessuna valutazione finora

- Compiled Midterm Study GuideDocumento9 pagineCompiled Midterm Study GuideHaseeb MalikNessuna valutazione finora

- Questionnaire Fast FoodDocumento6 pagineQuestionnaire Fast FoodAsh AsvinNessuna valutazione finora

- Chairman, Infosys Technologies LTDDocumento16 pagineChairman, Infosys Technologies LTDShamik ShahNessuna valutazione finora

- Economics 2nd Edition Hubbard Test BankDocumento25 pagineEconomics 2nd Edition Hubbard Test BankPeterHolmesfdns100% (48)

- 1511099786441enterprise Information Systems PDFDocumento396 pagine1511099786441enterprise Information Systems PDFFortune CA100% (1)

- ISLAMIYA ENGLISH SCHOOL MONEY CHAPTER EXERCISESDocumento1 paginaISLAMIYA ENGLISH SCHOOL MONEY CHAPTER EXERCISESeverly.Nessuna valutazione finora

- Shoppers Paradise Realty & Development Corporation, vs. Efren P. RoqueDocumento1 paginaShoppers Paradise Realty & Development Corporation, vs. Efren P. RoqueEmi SicatNessuna valutazione finora

- Alyansa Vs ErcDocumento44 pagineAlyansa Vs ErcrichardgomezNessuna valutazione finora

- Customer Master Data Views in CMDDocumento22 pagineCustomer Master Data Views in CMDVasand SundarrajanNessuna valutazione finora

- 2018 Farmers Market Vendor ApplicationDocumento2 pagine2018 Farmers Market Vendor Applicationapi-290651951Nessuna valutazione finora

- 01 Fairness Cream ResearchDocumento13 pagine01 Fairness Cream ResearchgirijNessuna valutazione finora

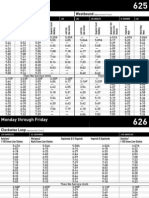

- LA Metro - 625-626Documento4 pagineLA Metro - 625-626cartographicaNessuna valutazione finora

- Sources of FinanceDocumento3 pagineSources of FinanceAero Vhing BucaoNessuna valutazione finora

- Oil Industry of Kazakhstan: Name: LIU XU Class: Tuesday ID No.: 014201900253Documento2 pagineOil Industry of Kazakhstan: Name: LIU XU Class: Tuesday ID No.: 014201900253cey liuNessuna valutazione finora

- Final Report For Print and CDDocumento170 pagineFinal Report For Print and CDmohit_ranjan2008Nessuna valutazione finora

- Cobrapost II - Expose On Banks Full TextDocumento13 pagineCobrapost II - Expose On Banks Full TextFirstpost100% (1)

- Sample Project AbstractDocumento2 pagineSample Project AbstractJyotiprakash sahuNessuna valutazione finora

- COCO Service Provider Detailed Adv. Madhya PradeshDocumento5 pagineCOCO Service Provider Detailed Adv. Madhya PradeshdashpcNessuna valutazione finora

- Extra Oligopolio PDFDocumento17 pagineExtra Oligopolio PDFkako_1984Nessuna valutazione finora

- Jia Chen - Development of Chinese Small and Medium-Sized EnterprisesDocumento8 pagineJia Chen - Development of Chinese Small and Medium-Sized EnterprisesAzwinNessuna valutazione finora

- Internship Report On An Analysis of Marketing Activities of Biswas Builders LimitedDocumento45 pagineInternship Report On An Analysis of Marketing Activities of Biswas Builders LimitedMd Alamin HossenNessuna valutazione finora

- Espresso Cash Flow Statement SolutionDocumento2 pagineEspresso Cash Flow Statement SolutionraviNessuna valutazione finora

- Costing and Control of LabourDocumento43 pagineCosting and Control of Labourrohit vermaNessuna valutazione finora