Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Australian Multi-ScreenReport Q2 2014

Caricato da

ChrisEUKCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Australian Multi-ScreenReport Q2 2014

Caricato da

ChrisEUKCopyright:

Formati disponibili

QUARTER 2

2014

AUSTRALIAN

MULTI-SCREEN

REPORT

2 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 c 2014 OZTAM, REGIONAL TAM, NIELSEN. ALL RIGHTS RESERVED.

TV AND OTHER VIDEO

CONTENT ACROSS

MULTIPLE SCREENS

This edition of the Australian

Multi-Screen Report (Q2 2014) updates

the take-up rates of internet-connected

devices in Australian homes as well

as the time Australians spend viewing

broadcast television on in-home

television sets, and TV and other video

content on home computers.

3 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 c 2014 OZTAM, REGIONAL TAM, NIELSEN. ALL RIGHTS RESERVED.

SNAPSHOT OF TV

VIEWING AND TECHNOLOGY

PENETRATION IN

AUSTRALIAN HOMES:

Q2 2014

Across the population, Australians

continue to watch, on average, a little

over three hours of broadcast television

each day on their in-home TV sets. This

fgure has been consistent over the past

decade.

In the second quarter of 2014 Australians

watched an average of 97 hours

and 3 minutes per month (97:03) of

broadcast television (both free-to-air and

subscription channels) on their in-home

TV sets a rise of 26 minutes per month

compared to the second quarter of 2013.

91.8 per cent of all in-home TV viewing in

the quarter was live (i.e., as the program

actually went to air) and 8.2 per cent

was viewed in playback that is, when

viewers watch broadcast TV material

they have recorded within seven days

of original broadcast time using a device

such as a PVR or DVR.

55 per cent of Australian homes have at

least one PVR and 14 per cent have two

or more. On average, Australians devoted

an average of 7 hours 58 minutes per

month in the quarter to playback viewing

(7:46 a year ago).

Four in fve Australian homes (80 per

cent) have an internet connection and

that fgure has been steady for the past

fve quarters.

During Q2 2014 Australians aged 2+

spent an average of 39 hours and 27

minutes (39:27) online on home and

work computers. Their viewing of any

online video on computers (including

broadcast TV content as well as other

video material) increased to an average

of 8 hours and 8 minutes per month (6:26

a year ago).

Tablets are now in 42 per cent of homes

steady on Q1 2014 and up from up from

33 per cent in the second quarter of 2013.

Across the Australian online population

aged 16+ people claim to spend 1:47 per

month watching any online video on a

tablet

1

.

4 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 c 2014 OZTAM, REGIONAL TAM, NIELSEN. ALL RIGHTS RESERVED.

71 per cent of Australians aged 16+ own a

smartphone, compared to 65 per cent in Q2

2013. Across the Australian online population

aged 16+, people report spending 1:56

per month watching any online video on a

smartphone

2

.

Televisions with the capability to connect to

the internet (e.g., internet-capable smart or

hybrid TVs, whether actually connected or

not) are now in 27 per cent of homes, steady

on Q1 2014 and up from 22 per cent a year

ago.

Following the switch-off of analogue free-to

air television broadcasts, since the start of

calendar 2014 free-to-air TV channels have

been delivered digitally to all Australian

television homes. Most homes (94 per cent)

can receive digital terrestrial television (DTT)

on every working TV set in the home. 6 per

cent have secondary televisions in the home

which although unable to receive digital

free-to-air channels may be used for

non-broadcast purposes such as gaming,

playing DVDs or as a computer monitor.

1

Tablet viewing gures are for Q4 2013 from the ACC report.

2

Smartphone viewing gures are for Q4 2013 from the ACC report.

5 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 c 2014 OZTAM, REGIONAL TAM, NIELSEN. ALL RIGHTS RESERVED.

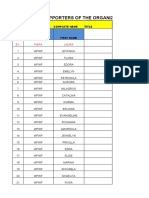

TV HOUSEHOLDS THAT RECEIVE DTT

ON EVERY WORKING TV SET

PERSONAL VIDEO RECORDER (PVR):

PENETRATION WITHIN TV HOUSEHOLDS

INTERNET CONNECTION:

HOUSEHOLD PENETRATION

TABLETS: HOUSEHOLD

PENETRATION

INTERNET CAPABLE

TV IN HOME

SMARTPHONES: PEOPLE 16+

MOBILE PHONE SUBSCRIBERS

2+ PVR: PENETRATION WITHIN

TV HOUSEHOLDS

Q2 2013 Q2 2014

54%

88%

80%

33%

22%

65%

55%

94%

80%

42%

27%

71%

14% 14%

TECHNOLOGY PENETRATION

6 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 c 2014 OZTAM, REGIONAL TAM, NIELSEN. ALL RIGHTS RESERVED.

VIDEO VIEWING, AVERAGE TIME SPENT PER MONTH,

TV / PC / SMARTPHONE / TABLET

97:03

8:08

PC/

LAPTOP

1:56

SMARTPHONE

1:47

TABLET

7:58

WATCHING

PLAYBACK TV

ON THE TV SET

89:05

WATCHING

LIVE TV

*ppl 2+

*ppl 16+

Q4 2013

*ppl 16+

Q4 2013

7 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 c 2014 OZTAM, REGIONAL TAM, NIELSEN. ALL RIGHTS RESERVED.

WATCHING TV

IN THE HOME

WATCHING ANY

ONLINE VIDEO ON A

SMARTPHONE (P16+)

Q4 2013

WATCHING ANY

ONLINE VIDEO

ON A TABLET (P16+)

Q4 2013

WATCHING ANY

ONLINE VIDEO ON

PC/LAPTOP (P2+)

KIDS TEENS P18-24 P25-34 P35-49 P50-64

6

9

:

4

9

7

:

2

0

4

6

:

4

4

6

:

3

3

8

:

4

8

2

:

2

6

4

5

:

5

0

1

3

:

0

2

4

:

0

9

3

:

3

0

7

7

:

5

6

9

:

4

9

4

:

0

9

2

:

5

6

1

0

3

:

0

5

8

:

1

5

1

:

2

1

1

:

5

1

1

3

0

:

2

1

7

:

0

0

0

:

2

5

0

:

5

1

P65+

1

5

2

:

2

0

3

:

1

3

0

:

0

8

0

:

3

0

9

7

:

0

3

8

:

0

8

1

:

5

6

1

:

4

7

ALL PEOPLE

MONTH IN A LIFE

TV / PC / LAPTOP / SMARTPHONE / TABLET

While viewing of television and other video

varies by age group, all people, regardless

of age, spend the majority of their screen

time watching broadcast television on

in-home TV sets, as the following chart

illustrates:

8 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 c 2014 OZTAM, REGIONAL TAM, NIELSEN. ALL RIGHTS RESERVED.

12.1% 11.7% 11.7%

0.9%

1.0%

1.0%

3.5% 3.8% 4.0%

Q3 2011 - Q2 2012 Q3 2012 - Q2 2013 Q3 2013 - Q2 2014

LIVE PLAYBACK OTHER TV SCREEN USAGE

Q1

Q1

2013 2012

PVRs:

TECHNOLOGY

53% 47%

2+PVRs: 13% 11%

Smart TVs: 21% 15%

16.5% 16.5% 16.7% 12.5%

0.7%

2.9%

Q3 2010 - Q2 2011

16.1%

Australians total use of the TV set

has grown year-on-year, averaging

out at 16.7 per cent TARP across the

whole day (Q3 2013 Q2 2014). This

compares to 16.5 per cent TARP in the

corresponding period a year earlier.

Live and playback viewing have been

steady for the past two years (at 11.7

per cent TARP and 1.0 per cent TARP,

respectively), with other screen use

rising that is, when people use their

TV screens for purposes such as

gaming, viewing over-the-top (OTT)

internet-delivered services, internet

browsing, or watching playback

material they have recorded beyond

seven days from original broadcast.

The growth in total TV screen use

refects the progressive take-up of

new devices attached to the TV set

(e.g., games consoles, PVRs and OTT

services) as well as the take-up of TVs

with the capability to connect to the

internet: now in an estimated 27 per

cent of homes compared to 22 per cent

in Q2 2013.

Interestingly such secondary TV screen

usage has not come at the expense

of live or playback viewing in the past

year. Rather, more people are in front of

the TV set, and increasing their use of

it reinforcing the big screens position

as the household main screen.

Source: OzTAM and Regional TAM databases with overlap homes de-duplicated

Note: A TARP, or Target

Audience Rating Point,

is the typical audience

at any one period in time

expressed as a percentage

of the total potential

audience. For example, on

average at any one minute

in the period Q3 2013 Q2

2014 (far right bar, left) an

estimated 16.7 per cent of

Australians were using their

in-home TV screens.

TARP - TOTAL INDIVIDUALS

TOTAL TV SCREEN USAGE

12.1% 11.7% 11.7%

0.9%

1.0%

1.0%

3.5% 3.8% 4.0%

Q3 2011 - Q2 2012 Q3 2012 - Q2 2013 Q3 2013 - Q2 2014

LIVE PLAYBACK OTHER TV SCREEN USAGE

Q1

Q1

2013 2012

PVRs:

TECHNOLOGY

53% 47%

2+PVRs: 13% 11%

Smart TVs: 21% 15%

16.5% 16.5% 16.7% 12.5%

0.7%

2.9%

Q3 2010 - Q2 2011

16.1%

9 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 c 2014 OZTAM, REGIONAL TAM, NIELSEN. ALL RIGHTS RESERVED.

While use of the TV screen varies by age, all

main age groups spend the majority of their time

with the in-home TV set watching live broadcast

television. This behaviour is consistent with that

depicted in the month in a life video viewing

graphic on page 7.

TARP BY DEMOGRAPHIC

Q3 2013 TO Q2 2014

11.7% 10.1% 7.3% 5.7% 8.4% 13.6% 17.7%

1.0%

0.7%

0.5%

0.7%

0.9%

1.2%

1.4%

4.0%

4.3%

3.9%

4.1%

4.5%

4.1%

3.3%

ALL PEOPLE P 0-4 P 5-12 P 13-17 P 18-39 P 40-54 P 55+

LIVE PLAYBACK OTHER TV SCREEN USAGE

10 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 c 2014 OZTAM, REGIONAL TAM, NIELSEN. ALL RIGHTS RESERVED.

KEY OBSERVATIONS

Smartphones: People 16+ 65% 67% 68%

AUSTRALIAN M ULTI SC R EE N R EPO RT Q UART E R 1 2013

Q2

2013

Q3

2013

Q4

2013

Q1

2014

Q2

2014

Completely DTT: Penetration within TV households

(Homes capable of receiving DTT on each working TV within the home)

Personal video recorder (PVR): Penetration within TV households 54% 53% 53%

2+PVR: Penetration within TV households

3

14% 14% 14%

Internet Connection: Household penetration 80% 80% 80%

Tablets: Household penetration 33% 37% 40%

Internet Capable TV in home

4

22% 22% 23%

TABLE 1: TECHNOLOGY PENETRATION

Q2

2013

Q3

2013

Q4

2013

Q1

2014

Q2

2014

Watching TV in the home

5

96:37 95:51 92:39

Watching Playback TV

Online time spent per person 38:41 38:45 37:39

Watch video on Internet

7

6:26 5:18 5:52

Watching online video on a smartphone

8

8

N.A. N.A. 1:56

Watching online video on a tablet N.A. N.A. 1:47

TABLE 2: MONTHLY TIME SPENT (HH:MM)

7:46 7:10 6:47

93:16

38:41

7:48

N.A.

N.A.

7:15

88% 89% 91%

69%

54%

14%

80%

42%

27%

93%

97:03

39:27

8:08

N.A.

N.A.

7:58

71%

55%

14%

80%

42%

27%

94%

6

3

Source: Estimates for internet connection, tablet household penetration and Internet capable TV in home from combined OzTAM Metro and Regional TAM quarterly Establishment

Surveys (ES). Based on landline CATI ES prior to Q1 2014. Q1 2014 onwards, based on mobile and landline CATI ES. Estimate for internet capable TV in home refers to the capability to be

internet connected, whether connected or not.

4

Source: Nielsen Consumer & Media View national population aged 16+ (Q4 2013 onwards).

5

Source: Combined OzTAM Metro and Regional TAM databases with overlap homes de-duplicated. Average time spent viewing (ATV 0200-2600). Watching TV and Watching Playback

TV are both based on Consolidated data. Playback viewing is up to 7 days after broadcast. Includes free-to-air and subscription television viewing. Please note television viewing is

seasonal, with people watching more television in the winter months and with the end of daylight saving time.

6

Source: Nielsen Online Ratings Hybrid Surng from Q2 2013 onwards. Estimate is the average of the 3 months within the calendar quarter apart from Q2 2013 which is an estimate of

May-June 2013 only. Figures are national and for People 2+. Figures include all online activities inclusive of PC applications such as iTunes, Skype etc.

7

Source: Nielsen Online Ratings Hybrid Streaming (formerly VideoCensus) from Q3 2013 onwards. Figures are national and for People 2+. Home and Work panel only. Due to a change

in methodology comparisons prior to Q4 2012 cannot be made.

8

Smartphone and tablet video source: Nielsen Australian Connected Consumer report for respondents aged 16 years and over (inclusive of total online population regardless of device

ownership or video consumption). Monthly estimate based on reported weekly time spent multiplied by average number of weeks in a month (4.3). Figure relates to online video only.

11 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 c 2014 OZTAM, REGIONAL TAM, NIELSEN. ALL RIGHTS RESERVED.

AUSTRALIAN M ULTI SC R EE N R EPO RT Q UART E R 1 2013

Q2

2013

Q3

2013

Q4

2013

Q1

2014

Q2

2014

Watching TV in the home

9

21,751 21,735 21,750

Watching Playback TV

16,979 16,744 16,193

Watch video on Internet 12,055 12,313 12,080

13

TABLE 3: OVERALL USAGE (000s), MONTHLY REACH

10,092 9,712 9,745

Online unique audience

10

11

Owning/using a mobile phone 17,530 17,504 17,303

Watching online video on smartphone N.A. N.A. 2,824

Watching online video on tablet N.A. N.A. 2,209

21,859

16,235

12,323

10,946

17,394

N.A

N.A

21,920

17,394

13,516

11,210

17,409

N.A

N.A

12

13

TABLE 4: A MONTH IN THE LIFE Q2 2014

KIDS

14

TEENS

15

P18-24 P25-34 P35-49 P50-64 P65+

ALL

PEOPLE

17

Watching TV in the home

16

69:49 45:50 77:56 103:05 130:21 152:20 97:03

Watching Playback TV 4:27 4:55 7:17 9:06 10:59 10:42 7:58

Q2 2013 4:20 4:52 7:31 9:50 10:20 8:54 7:46

Online time spent per person

17

7:27 40:00 44:18 42:50 43:57 28:26 39:27

Watch video on Internet

18

7:20 13:02 9:49 8:15 7:00 3:13 8:08

Watching online video on a

smartphone

19

N.A.

N.A.

4:09 4:09 1:21 0:25 0:08 1:56

Watching online video on tablet 3:30 2:56 1:51 0:51 0:30 1:47

Q2 2013 81:24 128.52 151:20 96:37 66:46 47:18

46:44

4:40

4:57

11:27

6:33

8:48

2:26

49:45 103:07

Q4 2013

Q4 2013

19

9

Source: Combined OzTAM Metro and Regional TAM databases with overlap homes de-duplicated. Watching TV and Watching Playback TV are both based on consolidated data (0200-

2600). Playback viewing is up to 7 days after broadcast.

10

Source: Nielsen Online Ratings Hybrid Surng from Q2 2013 onwards. Estimate is the average of the 3 months within the calendar quarter apart from Q2 2013 which is an estimate of

May-June 2013 only. Figures are national and for People 2+. Figure includes all online activities inclusive of PC applications such as iTunes, Skype etc.

11

Source: Nielsen Online Ratings Hybrid Streaming. Figures are national and for People 2+. Home and Work panel only. Due to a change in methodology comparisons prior to Q4 2012

cannot be made.

12

Mobile phone ownership and usage sourced from Nielsen Consumer & Media View (people aged 14+).

13

Smartphone and tablet video source: Nielsen Australian Connected Consumers report from 2013-2014 (February 2014 edition) - national gures produced annually citing 16% of the

online population aged 16+ for smartphone video and 8% for tablet video. Audience gure calculated using national online active audience of 14,808,513 from Nielsen Online Ratings

(January 2014).

14

Combined Metro OzTAM and Regional TAM data denes Kids aged 0-12 and Nielsen Netview aged 2-11.

15

Combined Metro OzTAM and Regional TAM data denes Teens aged 13-17, Nielsen Netview aged 12-17 and Nielsen AOC aged 16-17.

16

Source: Combined OzTAM Metro and Regional TAM databases with overlap homes de-duplicated. Watching TV and Watching Playback TV are both based on consolidated data (0200-

2600). Playback viewing is up to 7 days after broadcast.

17

Source: Nielsen Online Ratings Hybrid Surng from Q2 2013 onwards. Estimate is the average of the 3 months within the calendar quarter apart from Q2 2013 which is an estimate of

May-June 2013 only. Figures are national and for people 2+. Figure includes all online activities inclusive of PC applications such as iTunes, Skype etc.

18

Source: Nielsen Online Ratings Hybrid Streaming (formerly VideoCensus) from Q3 2013 onwards. Figures are national and for People 2+. Home and Work panel only. Due to a change

in methodology comparisons prior to Q4 2012 cannot be made.

19

Smartphone and tablet video source: Nielsen Australian Connected Consumers report for respondents aged 16 years and over (inclusive of total online population regardless of device

ownership or video consumption). Monthly estimate based on reported weekly time spent multiplied by average number of weeks in a month (4.3). Figure relates to online video only.

12 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 c 2014 OZTAM, REGIONAL TAM, NIELSEN. ALL RIGHTS RESERVED.

KIDS

Q2

2013

Q3

2013

Q4

2013

Q1

2014

Q2

2014

Watching TV in the home

16

66:46 67:20 66:18

Watching Playback TV 4:20 4:11 3:42

8:04

17

Online time spent per person 7:38 6:34

Watching video on Internet

18

4:37 3:55 5:35

Watching online video on a smartphone

19

N.A. N.A. N.A.

Watching online video on a tablet N.A. N.A. N.A.

65:06

4:02

5:36

7:05

N.A.

N.A.

TABLE 4A: A MONTH IN THE LIFE BY QUARTER

TEENS

Q2

2013

Q3

2013

Q4

2013

Q1

2014

Q2

2014

Watching TV in the home

16

49:45 49:17

Watching Playback TV 4:57 4:26

14:41

17

Online time spent per person 14:47

Watching video on Internet

18

7:18 6:33

Watching online video on a smartphone

19

N.A. N.A.

Watching online video on a tablet N.A. N.A.

47:33

4:30

13:01

6:27

8:48

2:26

P18-24

Q2

2013

Q3

2013

Q4

2013

Q1

2014

Q2

2014

Watching TV in the home

16

47:18 46:37

Watching Playback TV 4:52 4:36

42:04

17

Online time spent per person 23:07

Watching video on Internet

18

13:01 10:50

Watching online video on a smartphone

19

N.A. N.A.

Watching online video on a tablet N.A. N.A.

43:24

4:22

42:29

12:23

4:09

3:30

P25-34

Q2

2013

Q3

2013

Q4

2013

Q1

2014

Q2

2014

Watching TV in the home

16

81:24 77:28

Watching Playback TV 7:31 6:41

43:57

17

Online time spent per person 43:53

Watching video on Internet

18

8:39 7:26

Watching online video on a smartphone

19

N.A. N.A.

Watching online video on a tablet N.A. N.A.

71:20

6:03

43:12

7:55

4:09

2:56

45:12

4:13

9:55

6:40

N.A.

N.A.

45:14

4:42

40:37

16:28

N.A.

N.A.

74:21

6:56

42:16

10:05

N.A.

N.A.

69:49

4:27

7:27

7:20

N.A.

N.A.

46:44

4:40

11:27

6:33

N.A.

N.A.

45:50

4:55

40:00

13:02

N.A.

N.A.

77:56

7:17

44:18

9:49

N.A.

N.A.

(Q4 2013)

(Q4 2013)

(Q4 2013)

(Q4 2013)

(Q4 2013)

(Q4 2013)

19

19

19

19

13 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 c 2014 OZTAM, REGIONAL TAM, NIELSEN. ALL RIGHTS RESERVED.

P35-49

Q2

2013

Q3

2013

Q4

2013

Q1

2014

Q2

2014

TABLE 4A: A MONTH IN THE LIFE BY QUARTER

P50-64

Q2

2013

Q3

2013

Q4

2013

Q1

2014

Q2

2014

P65+

Q2

2013

Q3

2013

Q4

2013

Q1

2014

Q2

2014

ALL PEOPLE

Q2

2013

Q3

2013

Q4

2013

Q1

2014

Q2

2014

103:07 104:26

9:50 8:46

41:33 43:42

6:02 4:53

N.A. N.A.

N.A. N.A.

98:56

7:51

40:43

5:28

1:21

1:51

128:52 127:56

10:20 9:34

41:17 40:53

3:39 3:09

N.A. N.A.

N.A. N.A.

151:20 149:15

8:54 8:41

26:36 25:17

2:06 1:58

N.A. N.A.

N.A. N.A.

148:42

9:04

26:59

2:29

0:08

0:30

96:37 95:51

7:46 7:10

38:45 38:41

6:26 5:18

N.A. N.A.

N.A. N.A.

92:39

6:47

37:39

5:52

1:56

1:47

125:19

9:13

40:27

3:23

0:25

0:51

98:06

8:13

42:48

7:17

N.A.

N.A.

150:36

9:51

28:48

2:42

N.A.

N.A.

93:16

7:15

38:41

7:48

N.A.

N.A.

124:37

9:40

43:55

5:20

N.A

N.A

103:05

9:06

42:50

8:15

N.A.

N.A.

152:20

10:42

28:26

3:13

N.A.

N.A.

97:03

7:58

39:27

8:08

N.A.

N.A.

130:21

10:59

43:57

7:00

N.A

N.A

Watching TV in the home

16

Watching Playback TV

17

Online time spent per person

Watching video on Internet

18

Watching online video on a smartphone

19

Watching online video on a tablet

Watching TV in the home

16

Watching Playback TV

17

Online time spent per person

Watching video on Internet

18

Watching online video on a smartphone

19

Watching online video on a tablet

Watching TV in the home

16

Watching Playback TV

17

Online time spent per person

Watching video on Internet

18

Watching online video on a smartphone

19

Watching online video on a tablet

Watching TV in the home

16

Watching Playback TV

17

Online time spent per person

Watching video on Internet

18

Watching online video on a mobile phone

19

Watching online video on a tablet

(Q4 2013)

(Q4 2013)

(Q4 2013)

(Q4 2013)

(Q4 2013)

(Q4 2013)

(Q4 2013)

(Q4 2013)

19

19

19

19

14 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 c 2014 OZTAM, REGIONAL TAM, NIELSEN. ALL RIGHTS RESERVED.

TABLE 5: VIDEO AUDIENCE COMPOSITION (BY AGE AND GENDER) Q2 2014

KIDS P18-24 P25-34 P35-49 P50-64 P65+ FEMALES MALES

On Traditional TV

20

12% 3% 5% 12% 22%

11% 3% 5% 22%

24% 23% 53% 47%

Q2 2013 12% 24%

22%

53% 47%

On Internet

21

2% 3% 11% 19% 30% 24% 12% 49% 51%

TEENS

EXPLANATORY NOTES

Panel install incidence rates for DTT and

PVR are based on combined OzTAM

Metro and Regional TAM panels as at

last date of each period (Q1=end of P4,

Q2=end of P7, Q3=end of P10, Q4=end

of P13).

Quarterly Establishment Survey waves

are conducted within standard calendar

quarters.

National Establishment Survey (ES)

estimates are based on combined OzTAM

Metro and Regional TAM quarterly waves.

Quarterly ES waves are conducted within

standard calendar quarters.

Broadcast television includes free-to-air

and subscription television viewing.

Playback mode is defned as television

broadcast content recorded and viewed

(played back) within seven days of the

original broadcast time.

Other Screen Usage is TV screen usage

that excludes Live and Playback viewing

of broadcast television within seven days

of the original broadcast time. It can

include non-broadcast activities such as

gaming, online activity on the TV screen

and playing back recorded TV content

outside of the seven-day consolidation

window.

Average time spent viewing (ATV) is

calculated as the daily average time

(0200-2600) within the universe across

all days in the calendar quarter multiplied

by the factor of numbers of days in the

quarter divided by three (3).

Monthly reach for TV is based on the

average of the calendar month cumulative

reach audience (0200-2600) within the

quarter.

Video content is defned as a stream

where both audio and video are

detected. Video viewership excludes

adult and advertising content, as well as

downloaded content.

Wherever possible, geographic and

demographic data have been matched for

like comparisons.

Nielsen Australian Connected Consumer

20

Source: Combined OzTAM Metro and Regional TAM databases with overlap homes de-duplicated. Watching TV and Watching Playback TV are both based on consolidated data

(0200-2600).

21

Source: Nielsen Online Ratings - Hybrid Streaming (formerly VideoCensus), from Q3 2013 onwards. Figures are national and for people 2+. Home and Work panel only. Due to a

change in methodology comparisons prior to Q4 2012 cannot be made.

15 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 c 2014 OZTAM, REGIONAL TAM, NIELSEN. ALL RIGHTS RESERVED.

report 2014 (ACC) based on online national

population aged 16+.

Mobile phone ownership and usage sourced

from Nielsen Consumer & Media View

(people 14+).

PVR Penetration within TV households in

Table 1 is based on install levels from the

Combined OzTAM Metro and Regional TAM

panels as at the last date of each period.

TAM data defnes 'Kids' as panel members

aged 0-12, 'Teens' aged 13-17 and 'Male' /

'Female' as total individuals aged 0+.

Nielsen Netview defnes 'Kids' as panel

members aged 2-11, 'Teens' aged 12-17 and

'Male' / 'Female' as individuals aged 2+.

Nielsen Australian Connected Consumer

report defnes 'Teens' as respondents aged

16-17 and 'Male' / 'Female' respondents

aged 16+.

Nielsen has implemented page crediting

improvements in the measurement of web

pages and time spent across all online

activities, driving a trend break for May 2013

data onwards for time spent online. As part

of these improvements, the previous metric

of PC time spent has been retired and

replaced with the new metric of online time

spent. Online time spent is inclusive of all

online activities including PC applications

(e.g. iTunes, Skype, etc).

March 2014 constituted a trend break

for all key audience metrics from Nielsen

Online Ratings - Hybrid. Nielsen, guided

by its collaboration with IAB Australias

Measurement Council, transitioned to a new

data processing platform and implemented a

tightening of panel rules for online audience

measurement. These new rules resulted in

the removal of inactive panelists and this

has reset and stabilised the online universe

metric which is so critical to how we ensure

accurate measurement of Australian internet

consumption.

16 AUSTRALIAN MULTI-SCREEN REPORT QUARTER 2 2014 c 2014 OZTAM, REGIONAL TAM, NIELSEN. ALL RIGHTS RESERVED.

This report and all data within it is Copyright Nielsen,

OzTAM, Regional TAM, 2014. All rights reserved.

The document as-a-whole may be shared and redistributed

freely, and users are welcome to quote from it with appropriate

sourcing: Australian Multi-Screen Report Q2, 2014.

Please contact one of the people listed above for permission

to re-use contents of the report in any other manner, including

reproduction of tables, graphics or sections within it.

FOR MORE INFORMATION

Should you require more information

about any content in this report, please

refer to:

DOUG PEIFFER

Chief Executive Offcer, OzTAM

doug.peiffer@oztam.com.au

or MARGARET FEARN

Principal, Fearnace Media

margaret@fearnacemedia.com

DEBORAH WRIGHT

Chairperson, Regional TAM

dwright@nbntv.com.au

ERICA BOYD

Senior Vice President

Cross Platform Audience Measurement

SEANAP, Nielsen

erica.boyd@nielsen.com

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Rocket Internet Prospectus 2014Documento379 pagineRocket Internet Prospectus 2014w24nyNessuna valutazione finora

- Audio Unlimited Wireless Speakers ManualDocumento6 pagineAudio Unlimited Wireless Speakers ManualMinh Long ĐỗNessuna valutazione finora

- Crossroads 2015Documento85 pagineCrossroads 2015David FarahiNessuna valutazione finora

- Life On DemandDocumento36 pagineLife On DemandChrisEUKNessuna valutazione finora

- Expanding Australia's Economy Apr14Documento12 pagineExpanding Australia's Economy Apr14ChrisEUKNessuna valutazione finora

- The Future of NewspapersDocumento94 pagineThe Future of NewspapersChrisEUKNessuna valutazione finora

- Iab PWC Q1 2014Documento4 pagineIab PWC Q1 2014ChrisEUKNessuna valutazione finora

- Chapter 19: Space Race: The Story of GoogleDocumento4 pagineChapter 19: Space Race: The Story of GoogleChrisEUKNessuna valutazione finora

- Accenture Mobility ReportDocumento23 pagineAccenture Mobility ReportChrisEUKNessuna valutazione finora

- AdEx2013 Interact Paris FINALDocumento41 pagineAdEx2013 Interact Paris FINALChrisEUKNessuna valutazione finora

- AOL WayDocumento58 pagineAOL WayChrisEUKNessuna valutazione finora

- Mass Media (Topic)Documento5 pagineMass Media (Topic)Екатерина ПриходькоNessuna valutazione finora

- Simulative Analysis of OFDMA System Under Pervasive EnvironmentDocumento5 pagineSimulative Analysis of OFDMA System Under Pervasive EnvironmentliiNessuna valutazione finora

- Divinagracia Vs Consolidated Broadcasting System, Inc., GR No. 162272, April 7, 2009Documento27 pagineDivinagracia Vs Consolidated Broadcasting System, Inc., GR No. 162272, April 7, 2009Noreen Joyce J. Pepino100% (2)

- Taarak MehtaDocumento1 paginaTaarak MehtaKneerdipNessuna valutazione finora

- Hybrid Spread Spectrum TechniquesDocumento3 pagineHybrid Spread Spectrum TechniquesKrishanu ModakNessuna valutazione finora

- NDTV StrategyDocumento24 pagineNDTV StrategySwapnil JainNessuna valutazione finora

- Samsung Lnt4065f TVDocumento178 pagineSamsung Lnt4065f TVabbycanNessuna valutazione finora

- Jadwal Metro TVDocumento12 pagineJadwal Metro TVafifahpipikNessuna valutazione finora

- P.R. NAMELIST OF VIPS AMBASSADOR 4 PEACE Isabela ConferenceDocumento73 pagineP.R. NAMELIST OF VIPS AMBASSADOR 4 PEACE Isabela ConferenceJoan CabacunganNessuna valutazione finora

- Basic Signalcommunication 2ND Semester S.Y. 2022 2023Documento14 pagineBasic Signalcommunication 2ND Semester S.Y. 2022 2023Nerlyn Gallego ParNessuna valutazione finora

- ELX 121 - Digital Television MultiplexingDocumento22 pagineELX 121 - Digital Television MultiplexingClark Linogao FelisildaNessuna valutazione finora

- MIL Lesson 4 PDFDocumento1 paginaMIL Lesson 4 PDFELMSSNessuna valutazione finora

- Centurion Luka VacDocumento244 pagineCenturion Luka VacAnonymous 4Altbm6Nessuna valutazione finora

- Amplitude ModulationDocumento10 pagineAmplitude ModulationjaindevanshNessuna valutazione finora

- Madda Walabu University Institute of Engineering and TechnologyDocumento61 pagineMadda Walabu University Institute of Engineering and TechnologyTolera Tamiru67% (9)

- TVLuarDocumento6 pagineTVLuarRaitei NdutNessuna valutazione finora

- Decca Navigator SystemDocumento15 pagineDecca Navigator SystemJb BascoNessuna valutazione finora

- Unit 1Documento81 pagineUnit 1Saiyma Fatima RazaNessuna valutazione finora

- NN6-T2Gateway DatasheetDocumento2 pagineNN6-T2Gateway DatasheetCharlie TNNessuna valutazione finora

- Worldwide Navtex and NavareasDocumento22 pagineWorldwide Navtex and NavareasRahulNairNessuna valutazione finora

- Antenna Engineering by HaytDocumento4 pagineAntenna Engineering by HaytKhajavali ShaikNessuna valutazione finora

- Ece 401quizzDocumento4 pagineEce 401quizzSaraswathi AsirvathamNessuna valutazione finora

- Satellite Instructional Television ExperimentDocumento57 pagineSatellite Instructional Television ExperimentmariarunaNessuna valutazione finora

- AISG Antenna Port Color Coding v3.1Documento23 pagineAISG Antenna Port Color Coding v3.1sidney TeahNessuna valutazione finora

- CMP 203 BrosurDocumento9 pagineCMP 203 BrosurHeri PurwantoNessuna valutazione finora

- Huawei WLAN AP Antenna DatasheetDocumento38 pagineHuawei WLAN AP Antenna DatasheetJacob JacobNessuna valutazione finora

- Harris Stratex Truepoint 4000Documento2 pagineHarris Stratex Truepoint 4000Lucas YeniddinNessuna valutazione finora

- Televes Lte InfoDocumento28 pagineTeleves Lte InfoMladen BulatovicNessuna valutazione finora

- Code Division DuplexingDocumento39 pagineCode Division DuplexingVinayKumarSingh100% (5)