Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Tax Planning For A.Y. 2014-15

Caricato da

Bhavin Nilesh Pandya0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

27 visualizzazioni37 pagineNICE ONE

Titolo originale

Tax Planning for a.Y. 2014-15

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoNICE ONE

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

27 visualizzazioni37 pagineTax Planning For A.Y. 2014-15

Caricato da

Bhavin Nilesh PandyaNICE ONE

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 37

Tax Planning

For A.Y. 2014-15

- A LawCrew Presentation

What are the

deductions that I

can claim on my

income?

Everyone is talking

about 80C,

80DD###

deductions what are

they?

What is the

maximum amount

that I can save on

my tax?

What are the

best tax

planning's for

me this year?

PPF,

investments and

savings in banks

accounts?

In what slab

of income tax

do I come in?

How much tax

I have to pay

this year?

If you are seeking answers for all these questions then this presentation is for you.

INCOME TAX SLAB FOR ASSESSMENT YEAR 2014-15

Particulars Individuals

(<60 years)

Senior Citizens

(>60 years)

Super Senior Citizens

(>80 years)

Upton 2,00,000 Nil Nil Nil

2,00,000- 2,50,000 10% Nil Nil

2,50,000-5,00,000 10% 10% Nil

5,00,000-10,00,000 20% 20% 20%

Above 10,00,000 30% 30% 30%

There are no separate slabs for males and females.

The first step for tax planning is to know how much tax you need to pay?

Tax credit of Rs. 2,000 for the individuals whose income does not exceeds Rs. 5,00,000/-.

Surcharge of 10% on income more than Rs. 1 Crore.

http://law.incometaxindia.gov.in/DIT/Xtras/income_taxcalc.aspx

Calculate your tax here

How much Tax you need to Pay?

Salary includes many of the components that are chargeable to tax.

Some are fully taxable some partially and some are tax free.

The detailed list of the components is given below:-

Basic Salary

Dearness Allowance(DA)

Special Allowance

Bonus

Food Allowance

Furniture Allowance

Band Pay

Overtime

Arrears

Personal Pay

Shift Allowance

Leave Travel Allowance (LTA)

Vehicle maintenance

House Rent Allowance

Medical Reimbursement up to Rs. 15000 per

year.

Transport allowance up to Rs. 800 per month

and Rs. 1600 per month for orthopedic person.

Uniform Allowance- Amount up to Rs. 24,000

per annum is tax free.

Children education Allowance (Rs. 100 per

month per child and Rs. 300 for Hostel

Expenditure ) maximum for 2 children.

Telephone Allowance

Meal Coupons

Newspaper/ Journal Allowance up to Rs.

12,000 per annum is tax free.

100% taxable

Partially Taxable/ Tax

free

SALARY COMPONENTS ON WHICH TAX IS CHARGED

The deduction for HRA can be claimed for least of the following:-

Actual HRA received

40% (50% for metro cities) of Basic + Dearness Allowance

Excess of rent paid over 10 percent of salary.

You need to submit proof of rent paid through rent receipts, duly signed and stamped,

along with other details such as the rented residence address, name of the owner, period of

rent , PAN card number of landlord in case annual rent exceeds Rs. 1,80,000 etc..

If the company provides you the car for personal and official purposes and reimburses the

fuel, insurance, maintenance and drivers salary the taxable value will be:-

the car is between 0-1600 CC- Rs. 1,800 per month.

the car is above 1600CC Rs. 2,400 per month.

Also Rs. 900 in case the company provides driver.

In case the car is owned by you, the reimbursement of maintenance and running is up to-

for car less than 1600CC- Rs. 1,800 per month.

for car more than 1600CC Rs. 2,400 per month.

HOUSE RENT ALLOWANCE (HRA)

CAR MAINTENANCE ALLOWANCE

PARTIALLY TAXABLE SALARY COMPONENTS

LTA exemption can be claimed where the employer provides LTA to employee for leave to

any place in India taken by the employee and their family. Such exemption is limited to the

extent of actual travel costs incurred by the employee.

The meaning of family for the purposes of exemption includes spouse and children and

parents, brothers and sisters who are wholly or mainly dependent on you

The tax rules provide for an exemption only in respect of two journeys performed in a

block of four calendar years. The current block runs from 2010-2013

Travel cost means the cost of travel and does not include any other expenses such as

food, hotel stay etc.

There is no maximum limit for LTA and is decided by the employer.

LEAVE TRAVEL ALLOWANCE (LTA)

Here is the list of the sections for Tax Savings available for Individuals in India

I

n

v

e

s

t

m

e

n

t

s

&

E

x

p

e

n

d

i

t

u

r

e

H

e

a

l

t

h

&

W

e

l

l

B

e

i

n

g

Maximum deduction

of 1 Lakh on taxable

salary combining

these 3 sections

80C

(Details

Discussed later)

80CC

(Pension Items )

80CCD

(Central Govt.

Employees

pension schemes)

Section 80D Section 80DD

Section 80DDB

Section 80U

Medical Insurance

for family & Parents

Maintenance &

medical treatment of

disabled dependent

Treatment of certain

diseases/Ailment

Physically Disabled

Assessee

Deductions up to

Rs. 40,000

Deductions up to

Rs. 1,00,000

Deductions up to

Rs. 60,000

Deductions up to

Rs. 1,00,000

Continued.

TAX SAVING SECTIONS

Continued

SECTION 80G SECTION 80GGA SECTION 80GGC

Donation to certain charitable

funds, charitable trusts, etc,

Donation to scientific research

institutions or rural development.

Donation to political parties

Deduction subject to 10% of the

adjusted gross total income.

Deduction up to Rs. 1,00,000 Deduction up to 100% of the

donation made to the parties

SECTION 24 SECTION 80 EE SECTION 80 E

Interest payable on Housing Loan

or Home Improvement Loan

Interest payable on housing Loan

(for first time home buyers)

Interest payable on Educational

Loan

Deduction up to Rs. 1.5 Lakh for

Housing loan & Rs. 30,000 for

Home Improvement Loan

Additional Deduction up to Rs. 1

Lakh.

No limit for deduction.

SECTION 80GG SECTION 80CCG SECTION 80TTA

For paying Rent in case of no HRA Rajiv Gandhi Equity Savings

Scheme (RGESS)

Interest received in Saving Bank

Accounts

Deduction subject to certain limits Deduction up to Rs. 25,000 (50%

of amount invested)

Deduction up to Rs. 10,000

D

o

n

a

t

i

o

n

s

L

o

a

n

s

O

t

h

e

r

s

Details of the above mentioned sections are provided later in the presentation

Following are the deductions available under section 80C/80CC/80CCD.

The maximum deduction combining all these investments/ expenditures is Rs. 1 Lakh.

I

N

V

E

S

T

M

E

N

T

O

P

T

I

O

N

S

(

D

E

B

T

)

I

N

V

E

S

T

M

E

N

T

O

P

T

I

O

N

S

(

O

T

H

E

R

S

)

E

X

P

E

N

D

I

T

U

R

E

S

Provident

Fund

EPF/VPF

Public

Provident

Fund (PPF)

National

Saving

Certificate

(NSC)

Senior Citizen

Savings Scheme

(SCSS)

Tax savings

Fixed

Deposits (for

5 years)

Life

Insurance

Premium

New Pension

Schemes

(NPS)

Pension Plans

from

Insurance

Companies

Tax Savings

Mutual Funds

(ELSS)

Tuition fees

of 2 children

Stamp duty and

registration cost

of the house

Principal

payment on

Home Loan

Central Govt.

Employees

Pension Schemes

All these options have been further

discussed In the subsequent slides.

SECTION 80C /80CC /80CCD

EPF is mandatory for salaried employees working in the companies having more than 20

employees.

Under EPF rules, you need to contribute 12% of your Basic Pay + DA to EPF.

The employer matches with this EPF contribution.

Also you have the option to put up 100% of Basic + DA to provident fund, this is called VPF

(Voluntary Provident Fund).

The employer generally does not matches with this contribution.

Money is locked till your retirement.

The EPF interest rates are market linked

an set by EPFO every year.

The withdrawal of EPF takes time.

The option is only available to salaried

employees only.

The interest on EPF/VPF is tax free.

Can take loan against EPF and also do

partial withdrawal under certain conditions.

convenient to invest as the amount is

directly deducted from salary.

You can opt for VPF by giving request to your company at the start of

every financial year.

Only YOUR contribution in EPF & VPF is considered for Tax Deduction.

If you withdraw your EPF before 5 years the amount is taxable and the

earlier tax deduction claimed is nulled.

EPF/VPF (EMPLOYEE PROVIDENT FUND)

PPF can be opened at any Post Offices, 24 Nationalized Banks and ICICI Bank.

PPF has a mandatory locking period of 15 years an can be extended for further 5 years at a time.

Maximum Investment allowed : 1 Lakh in year.

Minimum investment of Rs. 500 is required every year to keep the account active.

Interest rates on PPF are market linked hence would vary every year. The current interest rate is

8.7% since April 1, 2013.

The interest on PPF is Tax free.

After opening PPF account investment

can be done online (only in some banks).

It cannot be attached with court

orders.

Highest Security- backed by Govt. of

India.

Money is locked for longer period.

Interest rates are market linked

hence would vary every year.

HUFs and NRIs cannot open a PPF

account.

Investment till 5th of the month earns interest for the month. So deposit

your interest before the date to entertain the interest benefit.

PPF can be opened in the name of the minor with either parents as

guardian.

The total investment in your PPF account and that of the minor child (for

whom you are guardian) should not exceed Rs. 1 Lakh in a financial year.

PPF (PUBLIC PROVIDENT FUND)

NSC is a Tax Saving Fixed Deposit Scheme directed by India Post.

It is available for 5 years and 10 years tenure, (NSC VIII) & (NSC IX) respectively.

The interest rate is market linked and hence changes every year. Its 8.5% for 5 years NSC and

8.8% for 10 years NSC.

There is no maximum investment limit in the NSC but the deduction allowable is only maximum

till Rs. 1 Lakh u/s 80C.

The denominations available for NSC are in 100, 500, 1,000 , 5,000 and 10,000.

Certificates from NSC can be kept as

collateral security to take loans from

banks.

No tax deduction at source.

The interest accrued for NSC qualifies

for deduction u/s 80C in the subsequent

years.

Highest Safety- backed by Govt. of

India.

Interest earned is taxable.

There is no online investment facility

for NSC. You need to go to post office for

any investment or redemption.

Trust and HUF cannot invest in NSC.

NSC is a better Tax saving option than FD from banks ( giving same

interest) as interest accrued for NSC qualifies for deduction in section

80c.

NSC (NATIONAL SAVING CERTIFICATE)

A person attaining an age of 60 years at the time of deposit can opt for the scheme or any person

of an age of 55 years but less than 60 years retired under VRS can open the account.

The amount can be deposited in any Post office, 24 Nationalized Banks and in any branch of SBI.

Interest rate applicable on these deposits is 9%.

Minimum limit for investment is Rs. 1,000 and maximum limit is Rs. 15,00,000.

Interest payable on Quarterly Basis.

Nomination facility available.

SAS agency facility can be availed.

It can be transferred from one post

office to another.

A commission of 0.5% is payable to SAS

agents.

There can be only one deposit in the

account.

Maturity of these schemes is 5 years but can be extended for another 3

years on the option of depositor.

The balance amount will be paid after deduction, if the account is

closed

after 1 year but before 2

nd

year deducting 1.5% of the balance

amount.

after 2

nd

year deducting 1% of the balance amount.

Payment will be made at POSB rate.

Senior Citizen Saving Scheme(SCSS)

These are same as Fixed Deposits In banks but are named as Tax Saving FD while making the

deposits.

Has minimum tenure of 5 years.

Some banks offer 0.25% to 0.75% additional interest for Senior Citizens and their employees.

The current interest rate for these deposits are 8.5%- 9.5% for general public and 8.75%-9.75%

for Senior Citizens.

Convenient to invest. ICICI banks provides

online facility for Tax saving FDs.

Redemption to maturity comes directly to

your bank account.

Highest safety- FD up to Rs. 1 Lakh is

insured by RBI.

Caution should be taken while making the deposits with Cooperative

banks as they are more risky than big banks.

The Post Office Time Deposits Plan of 5 years also qualifies for

deduction u/s 80c. The current rate for these deposits is 8.4%.

The interest earned is taxable.

Amount cannot be withdrawn before

maturity

Cannot be pledged to secure loan as

security.

TAX SAVINGS FD FROM BANKS/POST OFFICES

NATIONALISED BANKS

Allahabad

Bank

IDBI Bank

State Bank Of

Bikaner & Jaipur

Canara Bank State Bank of

Patiala

Union Bank Of

India

Andhra Bank Indian Bank State Bank of

Hyderabad

Central Bank of

India

State Bank of

Travancore

United Bank of

India

Bank of India Indian Overseas

Bank

State Bank of

India

Corporation

Bank

Syndicate Bank Vijaya Bank

Bank of

Maharashtra

Punjab National

Bank

State Bank of

Mysore

Dena Bank UCO Bank Bank of Baroda

ICICI Bank Ltd.

PRIVATE SECTOR BANK

At present, Post Offices, 24 Nationalized Banks and a private sector bank are authorized

to deal with SCSS & PPF.

BANKS FOR OPENING SCSS & PPF

LIFE INSURANCE PREMIUM

Deduction for Life insurance is applicable only if the policy holder has paid or deposited the premium

during the previous year for which he is claiming the deduction.

Individuals and Hindu Undivided Family (HUF) are allowed to claim the deduction for life insurance.

The maximum amount of deduction allowable is Rs. 1,00,000 including the other investments and

expenditures u/s 80C.

The investment can be made on:-

* for Individuals - his/her own life, on the life of Spouse, on the life of any child.

* for HUF any of the member of the HUF.

How much Insurance?

Your life insurance should be adequate to replace your income.

This turns out to be 7 to 10 times of your present income.

This might vary widely base on your assets, liabilities and situation.

All the above benefits of getting deduction for life insurance premium paid

shall be reversed if the policy terminated or cease in force within 2 years after

the date of commencement of such insurance policy.

The only product you should consider with the Life Insurance Companies Is

Term Plan.

PPF along with Term Plans are better products than Endowment Plans. Also

Mutual Funds with term Plans are turn out to be better products than ULIPs.

Life Insurance Premium

Pension plans from Insurance Companies qualifies deduction u/s 80CCD.

They generally have assured return in the range of 1-2% per annum which is very low as compared

to the Saving Accounts pay which is at least 4%.

These plans give very low returns and does not invest in equities which are

very useful for creating long term wealth.

On surrendering, the tax benefit you claimed earlier gets reversed and you

would need to pay these taxes back.

PPF/ VPF & EPF turns out to be better plans in comparison of these pension

plans.

NPS is also a better alternative for pension plans.

Why you should never go for these Pension Plans??

PENSION PLANS FROM INSURANCE COMPANIES

NPS has two types of accounts- Tier 1 and Tier 2.

Tier 2 is optional and only Tier 1 contributes to deduction u/s 80CCD.

Tier -1 requires an annual investment of Rs. 6,000 and Rs. 500 per transaction.

Salaried employee can claim deduction up to 10% of your salary [ Basic+ DA], while for self

employed it is 10% of the gross total income.

This is the lowest cost Pension Plan.

NPS can invest maximum of 50% in

selected stocks.

on the death the entire amount is paid

to the nominee.

The gain on NPS is taxable on

withdrawal.

The locking period is till you are 60

years of age.

However the contribution made by the Central Government or any other

employee to a pension scheme u/s 80CCD(2) shall be excluded from the limit

of Rs.1,00,000/- provided under this Section.

You should opt for 50% of equity investment when you are young and then

slowly move to debt as you approach your retirement.

NATIONAL PENSION SCHEME (NPS)

Smallest locking period of 3 years as

compared to other tax saving options.

Online facility available for investment

and redemption options.

Tax free funds.

Comprises of 80- 100% investment in

equities, which are highly volatile in

short term and can cause capital loss

too.

Returns are dependent on stock market

which is highly risky. You can loose the

investment in 3 years.

You should choose maximum of two funds for investing.

Research well before you invest in ELSS funds.

Never choose Dividend Reinvestment option in ELSS funds as you will the

full amount ever.

Also used as a synonym for Tax Saving Mutual Funds.

Minimum Investment in these plans is Rs. 500.

Maximum deduction for these funds is Rs. 1,00,000 every year under section 80C.

Investments can be done in lump sum or through Systematic Investment Plan (SIP).

EQUITY LINKED SAVING SCHEME (ELSS)

HOME

LOAN

PRINCIPAL

Deduction u/s 80C up to Rs. 1

Lakh

INTEREST

Deduction u/s 24 up to Rs. 1.5

Lakh

Additional deduction u/s 80EE

up to Rs. 1 Lakh

Deduction on Principal Amount of Home Loan

Deduction allowable on the repayment of principal of the housing is loan

is Rs. 1 Lakh u/s 80C.

The house should be registered on the name of the assessee or should

be one of them if it is jointly owned.

This deduction is available to also with the people having multiple properties.

The deduction is only available from the year of possession/ completion of

the house.

The deduction will be reversed if the said house is sold within 5 years from

the year of purchase of the house property.

SECTION 80C: TAX BENEFIT ON HOME LOAN (PRINCIPAL AMOUNT)

HOME LOAN : INTEREST & PRINCIPAL

Deduction on Interest Amount on Home Loan

As per Section 24, the income from house property shall be reduced by the amount of interest

paid on home loan (taken for the purpose of purchase/ construction/ repair/ renewal/

reconstruction of a residential property).

The maximum deduction allowable in this respect is Rs. 1,50,000 on a self- occupied property.

The deduction is allowable on accrual basis and hence should be claimed on yearly basis even if

no payment has been made during the year.

This tax deduction shall be available only if the construction has completed within 3 years from

the end of the financial year in which the amount is borrowed.

In case the house for which the loan has been taken is not self occupied then no

maximum limit has been specified for the interest deduction.

If the property is not acquired/ constructed within 3 years from the end of

financial year in which the loan has been taken then the interest benefit will reduce

from Rs. 1,50,000 to Rs. 30,000 only.

The Pre-EMI interest that you pay before the completion of the house can be claimed

as deduction in 5 equal annual installments starting from the year of completion.

No deduction for commission paid on arranging the loan.

Interest paid for outstanding amount is not allowed as deduction.

Please Remember

SECTION 24: INTEREST BENEFIT ON HOME LOAN

In the budget 2013, Section 80EE was inserted as new section which provides additional

deduction of Rs. 1,00,000 for the first time home buyers.

Following conditions need to be fulfilled :-

The loan is sanctioned between 01.04.2013 to 31.03.2014.

The amount of loan sanctioned should not exceed Rs. 25 Lakh.

The value of the residential property should not exceed Rs. 40lakh.

The Assessee should not own any other property on the date of

sanction of the loan.

The interest deduction on the home loan can be claimed for F.Y. 2013-14, in case you are not

able to exhaust the deduction F.Y. 2013-14, you can claim it in F.Y. 2014-15.

Please Remember

The tax deduction above (Sec. 80C, Sec 24, sec. 80EE) is per person and not per property.

So in case you have purchased a property jointly and have taken a joint home loan each

person repaying the amount would be eligible to claim whole deduction separately.

If you are living in a rented premise and are taking Tax benefit of HRA allowance, even

then you can claim the Tax benefit on home loan under Section 80C, Section 24, and

Section 80EE .

SECTION 80EE: INTEREST BENEFIT ON HOME LOAN

(FOR FIRST TIME HOME BUYERS)

Home improvement loan can be taken for furnishing of new home or repairing, painting or

refurnishing the existing home.

Deduction is Rs. 30,000 on the interest paid for loan for house improvement.

The deduction is only allowable for self occupied house.

No deduction is allowable for the principal payment of the loan.

No deduction is allowed for rented or vacant house.

This exemption is over and above the limit of Rs. 1,50,000 that you can claim for interest on

loan for house .

If the loan for acquisition/construction is taken before 01 April 1999- then

combined limit for interest deduction will be Rs. 30,000. (interest paid on

loan for acquisition/construction and interest paid on loan taken for

repair/ renewal ).

The loan can be taken up to 80% of the valuation of home improvement

work.

Contd..

Stamp duty charges and registration charges paid while purchasing a new house are eligible for

tax deduction under Section 80C.

Amount should have been paid by the assessee only. Deductions shall not be available to any

other member within in the same family making the payment on behalf of the assessee.

The deduction can be claimed in the only year in which the payment is made.

The deduction available is up to the limit of Rs. 1,00,000.

The claim is available only on the purchase of new residential property and for the commercial

property.

The meaning of new house is; you are purchasing for the first time

and

no one stayed in that house previously. That means it is not a resold

property.

Also the assessee himself must pay such amount to claim deduction

under

section 80C and the house property should be in his/her name.

The claim is entitled only after the possession of the property.

STAMP DUTY AND REGISTRATION CHARGES

Deduction available to only Individuals and not to HUFs.

Deduction is available for only 2 children. Both husband and wife have individual exemption of 2

children each.

Deduction for tuition fees is Rs. 1,00,000 u/s 80c.

Deduction only available for Full Time courses only.

Deduction available for payment basis only and the fees can be of any period.

Following expenses are not considered under tuition

fees-

-Development fees, Transport charges, Hostel

charges, Mess charges,

Library fees, late fines, Term fees etc.

No deduction is allowable for the tuition fees of self

and spouse.

TUTION FEES

This deduction is available for both Individual and HUF :-

For individual:- premium paid for medical insurance of self or the spouse, parents or

dependent children*.

For HUF:- premium paid for any of the family member of the HUF.

for individuals below 60 years of age maximum deduction is Rs. 15,000 an for individuals above 60

years of age deduction is Rs. 20,000.

An additional deduction of Rs. 15,000 can be claimed for buying health insurance for your parents (if

either of the parent is senior citizen then deduction is Rs. 20,000) irrespective of whether your

parents are dependent on you or not.

Please remember

*Dependent children means : Children above 18 years, if employed, can not be

covered.

Male children, if not employed, but a bonafide student can be covered up to

age of 25 years. Female children, if not employed, can be covered until the time

she is married.

To claim the deduction the payment of premium should be made in any form

other than cash.

You cannot claim deduction under section 80D in respect of mediclaim

paid for your in-laws.

Also Budget 2013 provides deduction of Rs. 5000 (this is within limit of Rs. 15,000

for Health Insurance) for preventive health checkup of self, spouse, dependent

children and parents.

Section 80D: medical insurance

This deduction is available to Individual and HUF who are resident of India.

Disabled Dependent for individual includes -spouse, children, parents, brothers and sisters. And for

HUF, any members of its family.

The deduction allowed is Rs. 50,000. Deduction allowed goes up to Rs. 1,00,000 if disabled

dependant is a person with severe disability.*

Expenditure for the medical treatment (including nursing), training and rehabilitation of a

disabled dependent and money paid to Life Insurance Corporation (LIC), Unit Trust of India or any

other insurer are eligible for deductions.

Blindness &

Low vision

Leprosy-

cured

Hearing

Impairment

Loco-motor

Disability

Mental

retardation

and illness

Autism Cerebral palsy

Multiple

disability

40% or more of these disabilities are considered for deduction

* 80% or more of the above disabilities are considered as severe disability

For claiming the deduction in respect of the above, you have to furnish a medical

certificate of disability from a Government Hospital certifying the disability of the

dependant. The certificate needs to be renewed periodically.

In case your disabled dependant dies before you the amount in the policy is returned

back and treated as your income for the year and is fully taxable.

The life insurance policy should on the name of the assessee and the disabled

person as beneficiary.

Please Remember

Section 80DD: maintenance & medical treatment of dependent disabled

This section provides deduction for expenses made on medical treatment of specified ailments (like

AIDS, Cancer and Neurological diseases) for self and dependents.

The maximum deduction allowable under this section is Rs. 40,000 and Rs. 60,000 if case of senior

citizens.

The dependents (should be wholly dependent on you) are considered to be self, spouse, children,

parents, brothers and sisters.

Specified diseases for this section are described below:-

Neurological

Diseases

Parkinson's

Diseases

Malignant

Cancer

AIDS

Chronic

Renal failure

Hemophilia Thalassaemia

In order to claim this deduction, however, you will have to submit Form 10-1 from a

specialist doctor working in a government hospital in India, confirming the treatment

of the disease.

This deduction is allowed on a condition that no medical reimbursement is received

from any insurance company or employer for this amount. In case of reimbursement

the amount paid should be reduced by the amount received if any under insurance

from an insurer or reimbursed by an employer.

40% or above of disability of these diseases are considered for deduction

Please Remember.

Section 80DDB: Treatment of certain diseases/ ailment

This section provides deduction for a person who suffers from physically disability or any

diseases.

An individual who suffers from not less than 40 per cent of any below mentioned disability

is eligible for deduction to the extent of Rs. 50,000/- and in case of severe disability (80

percent of the disability) to the extent of Rs. 100,000.

To avail the above deduction the individual needs to obtain a certificate from medical

authority constituted by either the Central or the State Government, along with the

Return of Income for the year for which the deduction is claimed.

The medical authorities who are deemed to certify are:

-A Neurologist with an MD in Neurology.

-For children, a Pediatric Neurologist having an equivalent degree.

-A Civil Surgeon or Chief Medical Officer (CMO) of a government hospital.

Blindness &

Low vision

Leprosy-

cured

Hearing

Impairment

Loco-motor

Disability

Mental

retardation

and illness

Autism Cerebral palsy

Multiple

disability

Diseases to be considered for deduction-

Please Remember

Section 80U: Physically disabled assessee

The amount of interest paid on educational loan* is fully qualified for deduction under section

80E.

The deduction under this section is only available to individuals and not to HUF or any other

assessee.

The deduction is only available on the interest paid and not the payment of the principal

amount of the loan.

Loan should have been taken for the purpose of pursuing higher studies of Individual ,

Spouse, Children of Individual or of the student of whom individual is legal Guardian.

The loan should be taken from any financial institution or any approved charitable institution

for the purpose of pursuing higher education.

Deduction shall be allowed in computing the total income in respect of the

initial assessment year and seven assessment years immediately succeeding

the initial assessment year or until the interest is paid by the assessee in full,

whichever is earlier.

The loan includes not only tuition or college fees but also other incidental expenses

for pursuing such studies like hostel charges, transport charges etc.

There is no condition that the course should be in India.

Please Remember

Section 80E : Educational loan

Newly inserted Section 80CCG provides deduction w.e.f. assessment year 2013-14 in respect of

investment made under notified equity saving scheme.

The scheme has a lock-in period of 3 years.

The amount of deduction is at 50% of amount invested in equity shares. However, the amount of

deduction under this provision cannot exceed Rs. 25,000.

You can take advantages of RGESS for three consecutive years.

The assessee is a resident individual (may be ordinarily resident or not ordinarily resident)

His gross total income does not exceed Rs. 10 Lakh;

He has acquired listed shares in accordance with a notified scheme;

The assessee is a new retail investor as specified in the above notified scheme;.

The investor is locked-in for a period of 3 years from the date of acquisition in accordance

with the above scheme;

The assessee satisfies any other condition as may be prescribed.

WHO ARE ELIGIBLE TO CLAIM DEDUCTION ?

Section 80ccg: Rajiv Gandhi Equity Saving Scheme (RGESS)

If the assessee, after claiming the aforesaid deduction, fails to satisfy the

above conditions, the deduction originally allowed shall be deemed to be the

income of the assessee of the year in which default is committed.

There is a concept of flexible and fixed lock in, which makes the scheme

complex. For simplicity you should assume that your investment in RGESS is

locked-in for 3 years.

Open a

Demat

account

Designate the a/c

by RGESS a/c by

filing up relevant

forms

Buy eligible

stocks or ETFs

Submit Demat

statement as

proof to claim

tax benefit

It is very convenient because

everything is one through Demat a/c.

The gain on RGESS is tax free.

It has a short locking period of3 years.

It is tough to deal for a new investor.

The returns are dependent on stock

market , hence carries a high risk.

4 Steps to claim tax benefit in RGESS

The amount donated towards charity attracts deduction under section 80G of the Income Tax Act,

1961.

This deduction can be availed by any assessee who makes an eligible donation.

some of the donations are exempted for 100% (with and without qualifying limit) of the

amount donated, some for 50% (with and without qualifying limit) of the amount donated while

other for 10% of the adjusted gross total income.

Documentation Required for Claiming deduction U/s. 80G :-

a stamped receipt issued by the recipient trust is a must containing name, address, PAN of

the trust, name of the donor and the amount donated.

The most important requirement is the Registration number issued by the Income Tax

Department under Section 80G. This number must be printed on the receipt.

The donor must ensure that the registration is valid on the date on which the donation is

given.

The donations which are paid only in cash/cheques are eligible for deduction.

Employees can claim deduction u/s 80G provided a certificate from the

employer is received in which employer states the fact that the contribution

was made out from employees salary account.

Only deductions made to approved organizations and institutions are qualified

for deductions.

Section 80G: donation to charitable organizations

1. National Defense Fund.

2. Prime Ministers National Relief Fund.

3. Prime Ministers Amenia Earthquake Relief Fund.

4. Africa (Public Contributions-India) Fund.

5. National Foundation for Communal Harmony.

6. Approved University/ educational institution.

7. Chief Ministers Earthquake Relief Fund.

8. Zila Saksharta Samiti.

9. National Blood Transfusion Council.

10. Medical Relief Fund of State Government.

11. Army Central Welfare Fund, Indian Naval Ben.

Fund, Air Force Central Welfare Fund.

12. National Illness Assistance Fund.

13. Chief Ministers or Lt. Governors relief Fund.

14. National Sports Fund.

15. National Cultural Fund.

16. Govt./ Local authority/ institution/ association

towards promoting family planning.

17. Central Govt.s Fun for Technology Development &

Application.

18. National Trust for welfare of Persons with Autism,

Cerebral Palsy, Mental Retardation & Multiple

disabilities.

19. Indian Olympic Association or any other authorized

association.

20. Andhra Pradesh Chief Ministers Cyclone Relief

Fund.

1

0

0

%

D

e

d

u

c

t

i

o

n

1. Jawaharlal Nehru Memorial Fund.

2. Prime Ministers Drought Relief

Fund.

3. National Children Fund.

4. Indira Gandhi Memorial Trust.

5. Rajiv Gandhi Foundation.

6. Donations to govt./ local authority

for charitable purposes (other than

family planning) .

7. World Vision India.

8. Donations for repair/ renovations

of notified places of worship.

9. Authority corporation having

income exempt under erstwhile

section or u/s 10(26BB).

10. Udavum Karangal.

5

0

%

D

e

d

u

c

t

i

o

n

LIST OF ELIGIBLE ORGANISATIONS FOR DEDUCTION U/S 80G

The deduction allowable under this section is 100% of the donation made in the following for

scientific research :-

To a University, college or other institution to be used for research in social science

statistical research.

To a scientific research association or University, college or other institution for

undertaking scientific research.

To an association or institution, undertaking any programme for rural development.

To The National Urban Poverty Eradication Fund setup.

To a public sector company or a local authority or to an association or institution approved

by National Committee, for carrying out any project or scheme.

100% deduction is allowed for donation to the political party registered under section 29A of the

Representation of the People Act, 1951 under section 80GGC.

The maximum deduction is that you can claim under this section is 10% of the total gross annual

income.

Section 80gga: Donation to scientific research institutions or rural

development

Section 80ggc: Donation to political parties

The section is applicable with effect from April 01, 2013 and will apply from AY 2013-14 and

onwards.

Section 80TTA is proposed to be introduced to provide deduction to an individual or a HUF in respect

of interest received on deposits (not being time deposits) in a savings account held with banks,

cooperative banks and post office.

The deduction is restricted to Rs 10,000 or actual interest whichever is lower.

Under Section 80GG, an Individual can claim deduction for the rent paid even if he dont get HRA.

Such house rent deduction *is permissible subject to the following conditions :-

(a) the Individual has not been in receipt of any House Rent Allowance from his employer

specifically granted to him which qualifies for exemption under section 10(13A) of the Act;

(b) the Individual files the declaration in Form No. 10BA.

(c) You cannot claim this deduction if you or your spouse or your children own any house in India or

abroad.

*House Rent Deduction will be lower of the following three amount :-

Rs. 2,000 per month 25% of annual income

Rent paid less 10% of Annual

Income

Section 80tta: Interest on saving account

Section 80gg:deduction for house rent in case of no HRA

Drafted and Compiled by:

Pooja Choudhary

pooja.choudhary@lawcrew.in;

pjchoudhary01@gmail.com

Edited By: Shubham Garg [shubham.garg@lawcrew.in]

Our Team:

Mr. Rajat Sharma

rajat.sharma@lawcrew.in

Ph: +91 9017040100

Mr. Piyush Bansal

piyush.bansal@lawcrew.in

Ph: +91 9250584817

Mr. Rahul Matta

rahul.matta@lawcrew.in

Ph: +91 9034142888

Mr. Shubham Garg

shubham.garg@lawcrew.in

Ph: +91 8929009005

LawCrew Updates Information

Case Laws Legal Advisory

About LawCrew

LawCrew endow with a platform where each

and every professional is invited with their

extensive knowledge and experience to share

with other members. It is said that It is not

the strongest species which survive, nor

the most intelligent, but the one most

responsive to change. Therefore, we are

here to update you with current changes in

statues. Our scale does not end here, we are

always committed to lend a hand to our

members in any kind of queries they have

with most feasible and handy answer.

You can join us at www.lawcrew.in or can

connect with us on Facebook visit here:

http://www.facebook.com/lawcrew.ca

You can also drop a mail to us at

info@lawcrew.in

Disclaimer

This document has been carefully prepared, but it has been written in general terms and should be seen as

broad guidance only. This document cannot be relied upon to cover specific situations and you should not act, or

refrain from acting, upon the information contained therein without obtaining specific professional advice.

Potrebbero piacerti anche

- AuditDocumento34 pagineAuditBhavin Nilesh PandyaNessuna valutazione finora

- AuditDocumento34 pagineAuditBhavin Nilesh PandyaNessuna valutazione finora

- Final Audit - Insurance Audit Notes PDFDocumento9 pagineFinal Audit - Insurance Audit Notes PDFBhavin Nilesh PandyaNessuna valutazione finora

- Maruti SuzukiDocumento7 pagineMaruti SuzukiBhavin Nilesh PandyaNessuna valutazione finora

- Maruti SM Project Complete AnalysisDocumento48 pagineMaruti SM Project Complete AnalysisBhavin Nilesh PandyaNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- PNB ProfileDocumento7 paginePNB ProfilepriyathepopularNessuna valutazione finora

- Que. 1 Given Below Are The Cash Transaction of M/sDocumento5 pagineQue. 1 Given Below Are The Cash Transaction of M/sdeepika_naikNessuna valutazione finora

- CASE6 SolutionDocumento15 pagineCASE6 SolutionMuhammad HamidNessuna valutazione finora

- Peif Prospectus PDFDocumento54 paginePeif Prospectus PDFJopoy CapulongNessuna valutazione finora

- Assurance VieDocumento4 pagineAssurance Vievincent.reynaud.74Nessuna valutazione finora

- SQLDocumento3 pagineSQLcoke911111Nessuna valutazione finora

- International Business Law 6th Edition August Test BankDocumento21 pagineInternational Business Law 6th Edition August Test Bankchristabeldienj30da100% (33)

- TVM Assignment MBA 2013 - 27 ..... NagendraDocumento74 pagineTVM Assignment MBA 2013 - 27 ..... NagendraNaga NagendraNessuna valutazione finora

- Account StatementDocumento5 pagineAccount StatementPearls of WisdomNessuna valutazione finora

- Leverage and Capital StructureDocumento73 pagineLeverage and Capital StructureMasoom ZahraNessuna valutazione finora

- FINN 400-Applied Corporate Finance-Fazal Jawad Sayyed PDFDocumento6 pagineFINN 400-Applied Corporate Finance-Fazal Jawad Sayyed PDFAhmed RazaNessuna valutazione finora

- Banking Law CasesDocumento27 pagineBanking Law CasesAlvin JohnNessuna valutazione finora

- Central Banking in Pakistan: State Bank of PakistanDocumento59 pagineCentral Banking in Pakistan: State Bank of PakistanMuhammad Iqrash Awan87% (15)

- Business Finance Module 1 Week 1Documento22 pagineBusiness Finance Module 1 Week 1Milo Cua100% (1)

- MR - Client 7P IPSDocumento5 pagineMR - Client 7P IPSAbcNessuna valutazione finora

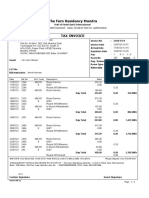

- The Fern Residency Mundra: MR - Yash VithalaniDocumento2 pagineThe Fern Residency Mundra: MR - Yash VithalaniPREM KUMAR KUSHAWAHANessuna valutazione finora

- IBDocumento11 pagineIBNishant SinghNessuna valutazione finora

- " Money and Its History": AboutDocumento13 pagine" Money and Its History": AboutHarsha ShivannaNessuna valutazione finora

- Double Entry AccountingDocumento18 pagineDouble Entry AccountingRONALD SSEKYANZINessuna valutazione finora

- Green Nature Triangles Project General ProposalDocumento3 pagineGreen Nature Triangles Project General Proposalapi-540658681Nessuna valutazione finora

- LiabilitiesDocumento5 pagineLiabilitiesAngelica MaeNessuna valutazione finora

- Operating and Financial LeverageDocumento4 pagineOperating and Financial Leveragehermandeep5Nessuna valutazione finora

- CTP BooksDocumento3 pagineCTP BooksuzernaamNessuna valutazione finora

- Chapter 08 Aggregate Demand and Supply HW Attempt 4Documento5 pagineChapter 08 Aggregate Demand and Supply HW Attempt 4PatNessuna valutazione finora

- Tax Notes On Capital GainsDocumento15 pagineTax Notes On Capital GainsGarima GarimaNessuna valutazione finora

- 968 Glass & Aluminum Co.Documento10 pagine968 Glass & Aluminum Co.Ben Carlo RamosNessuna valutazione finora

- Islamic Finance Dissertation SampleDocumento6 pagineIslamic Finance Dissertation SampleBuyLiteratureReviewPaperPaterson100% (1)

- BD20303 Topic 4 Risk and Return IDocumento42 pagineBD20303 Topic 4 Risk and Return IVanna Chan Weng YeeNessuna valutazione finora

- Analysis of Section 139 A IT Act 1961Documento13 pagineAnalysis of Section 139 A IT Act 1961padam jainNessuna valutazione finora

- Tutorial 2 - Financial EnvironmentDocumento5 pagineTutorial 2 - Financial EnvironmentShi ManNessuna valutazione finora