Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Concept of Residence

Caricato da

Jason DunlapCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Concept of Residence

Caricato da

Jason DunlapCopyright:

Formati disponibili

Concept of Residence Under Income Tax Act, 1961

AishwaryaPadmanabhan

*

In India, as in many other countries, the charge of income tax and the scope of taxable income varies

with the factor of residence. Thus, identification and classification of the residence of a person is one

of the first steps carried out in order to proceed with assessing the liability of an individual. There are

two categories of taxable entities viz. (1) residents and (2) non-residents. Residents are further

classified into two sub-categories (i) resident and ordinarily resident and (ii) resident but not

ordinarily resident. Section 6 of the Income Tax Act deals with residence. This article aims to clarify

and elucidate the concept of residence under the IT Act and to show how there are different types of

statuses applicable and consequently, different incidences of tax liability on individuals respectively.

Concept of Residence under Income Tax Act

Tax incidence and imposition on an assessed is dependent on his residential status. For example, whether

an income, accrued to an individual out of India, is taxable in India is dependent upon the residential

status of an individual in India. Likewise, whether an income secured by a foreign national in India (or

out of India) is taxable in India is dependent on the residential status of an individual, rather than his

citizenship. Consequently, the determination of the residential status of the person is very important to

ascertain his tax liability

1

. One can affirmatively conclude that taxation of the assessee is dependent on his

residence. As a result, the first question is always towards appropriate establishment of the residential

status of an assessee.

In the case of the Resident, the entire income is taxable, oblivious to the fact that it is earned in India or

outside India. In the situation of a Non-resident, only the income earned in India is taxed. There should

be a basis for the government for taxing any income of an indivudual. Indian Government has taken 3

conditions for levy of income-tax in India

2

:

1. Residence.

2. Source of Income.

3. Receipt of Income.

*

Aishwarya Padmanabhan Vth Year, B.A.LLB (Hons.) National University of Juridical Sciences (NUJS), Kolkata

1

Taxman, Students Guide to Income Tax, Tans Prints (India) Pvt. Ltd., 33

rd

Ed., 2005-06, p-27

2

Ibid.

For the charge of income-tax, Indian Government can tax the total income of Indian tax residents; or the

Indian sourced income & income earned in India of tax non-residents of India.

Fundamental rules for determining residential status of an Assessee:

Section 6

3

lays down the tests of territorial correlation amounting for residence for all taxable entities.

Two different tests are provided for individuals, two for companies, and one for Hindu undivided

families, firms, associations of persons and other assessable units. The tests are mock - staying for a day

more or less may make a difference- but they make for exactitude and accuracy, and they were held

legitimate and inter vires under the 1922 Act

4

.

Residential status: Three types of residential status are envisaged for an assessee under the Act. He may

be-

1. Resident (also known as resident and ordinarily resident)

2. Non resident or not resident.

3. Resident but not ordinarily resident (a category of residential status) only valid for individuals and

Hindu undivided families.

5

The following essential rules must be kept in mind while determining the residential status

6

;

Residential status is established by each category of persons disjointedly e.g., there are distinct set

of rules for establishing the residential status of an individual and distinct rules for companies etc.

Residential status is always established for the previous year because one has to establish the total

income of the previous year only.

Residential status of person is established for every previous year because it may change to year to

year. For example, A, who is resident of India in the previous year 2004-05, may become a non-

resident in the previous year 2005-06.

3

See Section 6, Income Tax Act, 1961.

4

Kanga, Palkhivala and Vyas, The Law and Practice of Income Tax, Lexis Nexis Buttersworths, I Vol, IX

Ed.,2004, p-348.

5

Supra at n. 3.

6

Girish Ahuja and Ravi Gupta. Concise Commentary on Income Tax, Bharat Law House Pvt. Ltd., 6

th

Ed., 2005,

pp-60.

If a person is resident in India in a previous year applicable to assessment year in respect of any

source of income, he shall considered to be resident in India in previous year applicable to the

assessment year with regard to each of his other source(s) of his income.

A person may be resident of more than a country in any previous year.

Citizenship of a country and residential status of that country are disconnect concepts. An

individual may be an Indian national/citizen, but may not be a resident in India. Conversely, a

person may be a foreign national/citizen, but may be a resident in India.

7

It is the obligation of the assessee to place all relevant facts before the assessing officer to

facilitate him to establish his exact residential status.

8

The tests of residence provided in Clause (1) for individuals are substitutes and not collective. Each of the

tests needs the personal attendance of assessee in India for the said period in the duration of the

accounting year. If the assessed is incessantly out of India during whole of a year, even though, he may

be, in the non-technical sense, normally resident in India.

9

The term India means the geographical territories and the territorial waters of the country, and does not

involve Indian ships operating beyond the Indian territorial waters. Thus, for counting the days, for

which a person is in India, his stay in Indian ship abroad is not considered.

10

The Finance Act 1990 gave

statutory recognition to this aspect with an amendment to the explanation to Section 6(1) which ensured

that the Indian seamen working on board an Indian ship would be seen as resident in India for any year,

only if the sojourn in India is for 182 days and more in that year.

11

A Hindu undivided family, firm or other association of persons are classified as residents in India in any

previous year in every case excluding where during that year the control and administration of its affairs is

entirely outside India.

12

Additionally, the existence of one of the partners in India who keep himself

7

A.C. Sampath Iyengar, The Law of Income Tax, Bharat Law House Private Limited, 1994, p-869.

8

Ibid.

9

Supra at n. 7.

10

CIT v. Avtar Singh,247 ITR 260

11

Kanga, Palkhivala and Vyas, The Law and Practice of Income Tax, Lexis Nexis Buttersworths, I Vol, IX

Ed.,2004, pp-354-357.

12

Girish Ahuja and Ravi Gupta. Concise Commentary on Income Tax, Bharat Law House Pvt. Ltd., 6

th

Ed., 2005,

p-78.

abreast with the affairs of the business will not comprise a second centre of management in India. It has

been constantly held by the Courts that just mere presence of partners in India would not lead to a

supposition that the running and supervision of the firm had been exercised in India.

13

An Indian company is considered always to be resident in India, where it may have its business.

Additionally, if the company is not an Indian company, it shall be deal with as resident in India in any

previous year, if throughout that year, the control and running of its affairs are positioned completely in

India. Direction and administration is one thing but the carrying of business operation of a company is

quite another.

14

By management of affairs means not running and supervision of the daily affairs of the

business performed through agents, employees and servants. In interpreting the expression control and

management, it is compulsory to keep in mind the difference between doing of business and control and

management of the business. Business and the whole of it may be carried outside and yet, the control and

management of the business is entirely within India.

15

In case of non- companies entities such as firms and associations of persons, if throughout the previous

year, the control and management is located partially in India, they become resident in India.

16

In

situations of non- Indian Companies, such part situation of control and management of its affairs is not

adequate to consider it a resident in India. This is the concept of residence as envisaged in the Income

Tax Act, 1961.

As has been seen, foreign- earned income of the Indian residents becomes taxable in India. Equally,

foreign earned income of the non- residents are not taxable in India. Thus, a person will always attempt

to become a non- resident in India for the purpose of taxation.

17

Consequently, it is very imperative to

appreciate when a person becomes resident in India. Likewise its vital to recognize the conception of

resident and not ordinarily resident in terms of Hindu undivided family (HUFs) and companies under the

Income Tax Act, 1961.

13

Ibid.

14

Supra at n. 10.

15

Supra at n. 10

16

Ajoy Halder, Residence with respect to Artificial entities, Taxman, Feb 28- March 5, 2004.

17

Sampath Iyenger. Law of Income Tax: A commentary on Income Tax Act, 1961, Bharat Law House Pvt. Ltd., p-

848.

Potrebbero piacerti anche

- 857compendium September 2017 PDFDocumento63 pagine857compendium September 2017 PDFJason DunlapNessuna valutazione finora

- Tax Sem VIIIDocumento27 pagineTax Sem VIIIJason DunlapNessuna valutazione finora

- Cls-Corporate Tax (Honours) SyllabusDocumento3 pagineCls-Corporate Tax (Honours) SyllabusSurabhi MaheshwariNessuna valutazione finora

- Concept of ResidenceDocumento4 pagineConcept of ResidenceJason DunlapNessuna valutazione finora

- Convencao de Viena de 1978 Sobre Sucessao de Estados em Materia de TratadosDocumento24 pagineConvencao de Viena de 1978 Sobre Sucessao de Estados em Materia de Tratadosnunomm25Nessuna valutazione finora

- Insurance Project FinalDocumento17 pagineInsurance Project Finalamitkmara0% (1)

- Indian Society Structure & Processes Course OverviewDocumento2 pagineIndian Society Structure & Processes Course OverviewJason DunlapNessuna valutazione finora

- Insurance Project FinalDocumento17 pagineInsurance Project Finalamitkmara0% (1)

- Moot CaseDocumento4 pagineMoot CaseJason DunlapNessuna valutazione finora

- Government of India Law Commission of IndiaDocumento1 paginaGovernment of India Law Commission of IndiaJason DunlapNessuna valutazione finora

- Moot CaseDocumento4 pagineMoot CaseJason DunlapNessuna valutazione finora

- Moot CaseDocumento4 pagineMoot CaseJason DunlapNessuna valutazione finora

- SociologyDocumento2 pagineSociologyJason DunlapNessuna valutazione finora

- Concept of ResidenceDocumento4 pagineConcept of ResidenceJason DunlapNessuna valutazione finora

- PUBLIC POLICY PROCESSDocumento4 paginePUBLIC POLICY PROCESSJason DunlapNessuna valutazione finora

- CRPC 164: Section 164 of The Criminal Procedure Code: Recording of Confessions and StatementsDocumento2 pagineCRPC 164: Section 164 of The Criminal Procedure Code: Recording of Confessions and StatementsJason DunlapNessuna valutazione finora

- Coa Ition PoliticsDocumento25 pagineCoa Ition PoliticsJason DunlapNessuna valutazione finora

- Indian Political System: Centre-State RelationDocumento18 pagineIndian Political System: Centre-State RelationJason DunlapNessuna valutazione finora

- Family Law II SyllabusDocumento5 pagineFamily Law II SyllabusJason DunlapNessuna valutazione finora

- Arbitration Independent ClauseDocumento4 pagineArbitration Independent ClauseJason DunlapNessuna valutazione finora

- Ancient IndiaDocumento7 pagineAncient IndiayogshastriNessuna valutazione finora

- Indian Political System-SyllabusDocumento2 pagineIndian Political System-SyllabusJason DunlapNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5783)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- 2.01 Signatours Corporation V All Seasons Vacation Rentals LLC ComplaintDocumento6 pagine2.01 Signatours Corporation V All Seasons Vacation Rentals LLC ComplaintCopyright Anti-Bullying Act (CABA Law)Nessuna valutazione finora

- The American Pageant - Chapter 23 Review SheetDocumento3 pagineThe American Pageant - Chapter 23 Review SheetJoesterNessuna valutazione finora

- Legal English doublets and tripletsDocumento3 pagineLegal English doublets and tripletsMaria Do Mar Carmo CordeiroNessuna valutazione finora

- Minutes SEFDocumento3 pagineMinutes SEFMary Mae Villaruel BantilloNessuna valutazione finora

- Ispl 2Documento28 pagineIspl 2Chakradhar GunjanNessuna valutazione finora

- 02 Perena v. ZarateDocumento8 pagine02 Perena v. ZaratePaolo Enrino PascualNessuna valutazione finora

- Terms and Definitions in ObliconDocumento3 pagineTerms and Definitions in Obliconmaccy adalidNessuna valutazione finora

- Municipal Corporation of Delhi Vs Subhagwanti & Others (With ..Documento6 pagineMunicipal Corporation of Delhi Vs Subhagwanti & Others (With ..Harman Saini100% (1)

- SCH k-1 of 1120s Case StudyDocumento1 paginaSCH k-1 of 1120s Case StudyHimani SachdevNessuna valutazione finora

- Gliceria Marella Vs ReyesDocumento1 paginaGliceria Marella Vs ReyesLinus ReyesNessuna valutazione finora

- 4 Allado Vs DioknoDocumento12 pagine4 Allado Vs DioknoBryne BoishNessuna valutazione finora

- 4 PP v. EvaristoDocumento4 pagine4 PP v. EvaristoryanmeinNessuna valutazione finora

- Pemberontakkan Komunis Di Selatan Thailand 1965Documento9 paginePemberontakkan Komunis Di Selatan Thailand 1965Nur Husna RemiNessuna valutazione finora

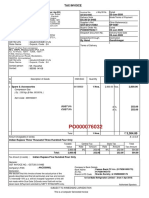

- Tax Invoice: Ice Make Refrigeration Limited - (From 1-Apr-2019)Documento1 paginaTax Invoice: Ice Make Refrigeration Limited - (From 1-Apr-2019)Sunil PatelNessuna valutazione finora

- COLDPLAY - A Head Full of Dreams Tour - 1 PDFDocumento3 pagineCOLDPLAY - A Head Full of Dreams Tour - 1 PDFVicky WardhanaNessuna valutazione finora

- Service Contract Agreement TemplateDocumento3 pagineService Contract Agreement Templateanon_84814261675% (4)

- DMLCIIDocumento2 pagineDMLCIIVu Tung LinhNessuna valutazione finora

- Lake County Sex Offender StatementDocumento1 paginaLake County Sex Offender StatementNewsNation DigitalNessuna valutazione finora

- KWASEKO CBO ConstitutionDocumento7 pagineKWASEKO CBO ConstitutionSharon Amondi50% (2)

- People v. Sayo y Reyes, G.R. No. 227704, (April 10, 2019)Documento25 paginePeople v. Sayo y Reyes, G.R. No. 227704, (April 10, 2019)Olga Pleños ManingoNessuna valutazione finora

- Ben GuetDocumento25 pagineBen GuetMalibog AkoNessuna valutazione finora

- Escritura PublicaDocumento4 pagineEscritura PublicaluisaNessuna valutazione finora

- Philippines Supreme Court Rules Against Lumber Company's Claim to Offset Reforestation Charges Against Forest Charges OwedDocumento4 paginePhilippines Supreme Court Rules Against Lumber Company's Claim to Offset Reforestation Charges Against Forest Charges OwedElle BaylonNessuna valutazione finora

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocumento11 pagineBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledMaya TolentinoNessuna valutazione finora

- Persons and Family Law NotesDocumento10 paginePersons and Family Law NotesMaria Dana BrillantesNessuna valutazione finora

- BBA Vs Union of India 2011 PDFDocumento22 pagineBBA Vs Union of India 2011 PDFPrashant SharmaNessuna valutazione finora

- Warren H. Wheeler, an Infant, and J. H. Wheeler, His Father and Next Friend, and C. C. Spaulding, Iii, an Infant, and C. C. Spaulding, Jr., His Father and Next Friend v. Durham City Board of Education, a Body Politic in Durham County, North Carolina, 309 F.2d 630, 4th Cir. (1962)Documento5 pagineWarren H. Wheeler, an Infant, and J. H. Wheeler, His Father and Next Friend, and C. C. Spaulding, Iii, an Infant, and C. C. Spaulding, Jr., His Father and Next Friend v. Durham City Board of Education, a Body Politic in Durham County, North Carolina, 309 F.2d 630, 4th Cir. (1962)Scribd Government DocsNessuna valutazione finora

- Joint UltimoDocumento32 pagineJoint UltimoNoemi Livia VaraNessuna valutazione finora

- Child Abuse LawDocumento3 pagineChild Abuse LawbaimonaNessuna valutazione finora