Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Mumbai Itat On Service of Notice by Affixture Section 282

Caricato da

hvdatar88980 valutazioniIl 0% ha trovato utile questo documento (0 voti)

145 visualizzazioni15 pagineMumbai ITAT Annuls the assessment for failure to serve the notice under section 143 (2) of Income Tax Act as prescribed under section 282 of Income Tax Act

Titolo originale

MUMBAI ITAT ON SERVICE OF NOTICE BY AFFIXTURE SECTION 282

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoMumbai ITAT Annuls the assessment for failure to serve the notice under section 143 (2) of Income Tax Act as prescribed under section 282 of Income Tax Act

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

145 visualizzazioni15 pagineMumbai Itat On Service of Notice by Affixture Section 282

Caricato da

hvdatar8898Mumbai ITAT Annuls the assessment for failure to serve the notice under section 143 (2) of Income Tax Act as prescribed under section 282 of Income Tax Act

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 15

,

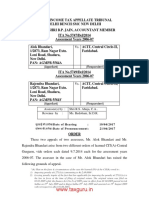

IN THE INCOME TAX APPELLATE TRIBUNAL E, BENCH MUMBAI

,

BEFORE SHRI H.L.KARWA, PRESIDENT

&

SHRI R.C.SHARMA, AM

SA No.216/Mum/2014

(Arising out of ITA No.5221/Mum/2014)

( Assessment Years:2008-09)

Shri Sanjay Badani, C/o Jayesh

Sanghrajka & Co Chartered

Accountants, Unit No.405 Hind

Rajasthan Centre, D.S.Phalke

Road, Dadar (E), Mumbai-14

Vs. DCIT-10(3), Mumbai -20

PAN/GIR No. : AABPB 9926 B

( Appellant)

..

( Respondent)

AND

SA No.215/Mum/2014

(Arising out of ITA No.5222/Mum/2014)

( Assessment Years:2008-09)

Shri Nilesh Badani, C/o Jayesh

Sanghrajka & Co Chartered

Accountants, Unit No.405 Hind

Rajasthan Centre, D.S.Phalke

Road, Dadar (E), Mumbai-14

Vs. DCIT-10(3), Mumbai -20

PAN/GIR No. : AABPB 9926 B

( Appellant)

..

( Respondent)

AND

ITA Nos. 5221/Mum/2014)

( Assessment Years:2008-09)

Shri Sanjay Badani, C/o Jayesh

Sanghrajka & Co Chartered

Accountants, Unit No.405 Hind

Rajasthan Centre, D.S.Phalke

Road, Dadar (E), Mumbai-14

Vs. DCIT-10(3), Mumbai -20

PAN/GIR No. : AABPB 9926 B

( Appellant)

..

( Respondent)

SA Nos.216 & 215/2014

& ITA Nos.5221 & 5222/14

2

AND

ITA Nos.5222/Mum/2014)

( Assessment Years:2008-09)

Shri Nilesh Badani, C/o Jayesh

Sanghrajka & Co Chartered

Accountants, Unit No.405 Hind

Rajasthan Centre, D.S.Phalke

Road, Dadar (E), Mumbai-14

Vs. DCIT-10(3), Mumbai -20

PAN/GIR No. : AABPB 9926 B

( Appellant)

..

( Respondent)

/Assessee by : Shri Harshvardhana Datar

/Revenue by : Ms. Amrita Misra

Date of Hearing : 9

th

September, 2014

Date of Pronouncement : 9

th

September, 2014

O R D E R

BY BENCH :

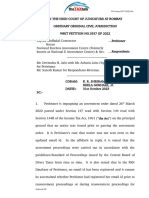

These Stay Applications arose out of the appeals filed by the

assessee before ITAT in ITA No.5222 & 5221/Mum/2014, in the matter

of order passed u/s.143(3) r.w.s. 147 of the I.T. Act for the assessment

year 2008-09.

2. In these stay applications, the assessee has basically argued

legality of the assessment framed u/s.143(3) r.w.s.147 in view of the

fact that there was no service of notice u/s.143(2). It was contended by

learned AR that in respect to notice u/s.148 dated 30-8-2011, the

assessee has filed return of income on 10-10-2011. The statutory time

limit to serve notice u/s.143(2) was till 30-9-2012, ie. six months from

end of the financial year in which return was furnished. As per learned

SA Nos.216 & 215/2014

& ITA Nos.5221 & 5222/14

3

AR no notice u/s.143(2) has ever been issued and served on the

assessee before completion of assessment. Due to non-compliance of

statutory notice u/s.143(2), the assessee has filed objection against the

jurisdiction, vide letter dated 10-10-2012 submitted at the office of AO

on 2-11-2012 in accordance with the provisions of Section 292BB of

the Act. As per learned AR the objection raised by the assessee has

not been disposed by the AO and he proceeded with the assessment.

The basic thrust of learned AR to substantiate the prima facie case in

assessees favour for grant of stay was non-service of notice

u/s.143(2), which goes to the root of validity of the assessment so

framed.

3. As the issue of notice u/s.143(2) goes to the root of validity of the

assessment so framed, the bench considered it appropriate to hear this

issue and decide the appeals on merits. Accordingly, learned DR was

directed to produce the assessment records. The case was adjourned

to 9-9-2014 for allowing DR to produce the necessary assessment

records. Assessment records were produced by learned DR on 9-9-

2014 which were examined by the Bench and matter is now decided on

legality of the assessment so framed u/s.143(3) r.w.s.147 without

service of notice u/s.143(2) of the I.T.Act.

4. The assessee in its appeals, has taken the following grounds :-

1. On the facts and circumstances of the case and leg Ld.

Commissioner of Income Tax (Appeals) erred in confirming the

reopening the assessment in absence of reason to believe and

SA Nos.216 & 215/2014

& ITA Nos.5221 & 5222/14

4

material on records and such reopening of the assessment is bad

law and erroneous in facts and it is liable to be quashed.

2. On the facts and circumstances of the case and leqal

propositions; Hon'ble Commissioner of Income Tax (Appeals) erred

in confirming the assessment/reassessment order in spite of the fact

that notice under section 143(2) of "Income Tax Act, 1961 was not

served to the assessee. Hence, the assessment .is bad in law and

liable to be annulled.

3. On the given facts: circumstances and judicial pronouncements

Ld. Assessing Officer erred in making addition of loan/advances

between M/s Nishotech Systems Pvt Ltd and M/s Sanitech

Engineering Pvt Ltd. by treating the same as deemed dividend u/s

2(22)( e), ignoring the fact that such addition is bad in law and

erroneous in facts and liable to be deleted.

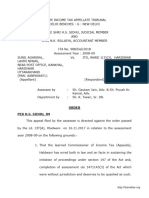

5. Learned AR vehemently argued that neither there was service of

notice u/s.143(2) by postal authorities nor there was proper service by

affixtures.

6. On the other hand, the contention of learned DR was that since

notice sent u/s.143(2) by postal authorities were returned unserved,

therefore, the Inspector served the notice through affixtures. Our

attention was also invited to the Inspectors report placed in the paper

book wherein vide letter dated 27-7-2012, the Inspector has reported to

DCIT-10(3) that he has visited assessees premises on 27-7-2012 to

service the notice u/s.143(2) for the A.Y. 2008-09 in the case of Sanjay

Badani. As per the Inspector, on reaching the said premises, it was

found that the said premises was locked. Therefore, the said notice

was served on assessee by affixture on 27-7-2012.

7. It was argued by the learned AR that in spite of asking under

Right to Information, the department has not served proof of dispatch

of notice nor the mode of service through affixtures nor the report of

SA Nos.216 & 215/2014

& ITA Nos.5221 & 5222/14

5

Inspector for such service through affixation. Accordingly, copy of the

Inspectors report was provided to the learned AR indicating service of

notice through affixation on 27-7-2012. It was vehemently argued by

learned AR that as per the Inspectors report dated 27-7-2012, there

was no valid service by affixtures insofar as neither there is mention of

any name and address of the witnesses who have identified the house

of the assessee and in whose presence the notice was affixed. He

contended that in case of service of notice by affixtures, the serving

officer should state in his report the name and address of the person by

whom house or premises were identified and in whose premises copy

of summon was affixed and these facts should also be verified by an

affidavit of serving officer, otherwise such service should not be

accepted to be legally valid service of notice u/s.143(2). For this

purpose, reliance was placed on the decision of Honble Supreme

Court in the case of CIT Vs. Ramendra Nath Ghosh, 82 ITR 888.

8. In view of the above factual position, we have to decide whether

there was service of notice u/s.143(2) much less a proper service as

per Rule 17 of Order V of CPC, which requires that before service of

notice by affixture, notice server/service officer must make diligent

search for person to be served and, he, therefore must take pain to find

him and also to make mention of his efforts in report. The serving

officer should also state in his report the circumstances under which he

did so and the name and address of the person by whom house or

SA Nos.216 & 215/2014

& ITA Nos.5221 & 5222/14

6

premises were identified and in whose premises copy of summon was

affixed, otherwise such service could not be accepted to be a legally

valid service of notice u/s.143(2).

9. We have considered rival contentions, carefully gone through the

orders of the authorities below. The Scheme of the Act broadl y

permi ts the assessment in three formats; (i) acceptance of the

returned income;(ii) acceptance of r et ur ned i nc ome s ubj ec t

t o per mi s s i bl e adjustments u/s.143(l) of the Act by issuance

of i nti mation; and (i i i) scrutiny assessment under section

143(3) of the Act. This Scheme was originally introduced by Direct

Tax Laws (Amendment) Act,1989 with effect from 1.4.1989. The

issuance of notice under section 143(2) of the Act is in the

course of assessment in the third mode, namely, scrutiny

assessment. Section 143(2) of the Act requires that where return has

been fi l ed by an assessee, i f the Assessi ng Of f i cer

consi ders i t necessary or expedient to ensure that the assessee

has not understated the i ncome, or has not computed

excessi ve loss, or has not under -paid tax i n any manner, he

shal l serve on the assessee a not i ce r equi r i ng hi m ei t her t o

at t end hi s office, or to produce, or cause to be produced there,

any evidence on which the assessee may rely in support of the

return. Therefore, the l anguage of t he mai n pr ovi si on

r equi r es Assessi ng Of f i cer t o pr i ma f aci e arr i ve at

SA Nos.216 & 215/2014

& ITA Nos.5221 & 5222/14

7

sati sfacti on of exi stence of any one of the three conditions.

Proviso under the said sub-section requires that no notice shal l

be ser ved on t he assessee after the expiry of six months from

the end of the rel evant fi nanci al year i n whi ch the return i s

furnished. On a plain reading of the language in which the

proviso is couched it is apparent t hat t he l i mi t at i on

pr escr i bed t her ei n i s mandatory, t he format of provi si on

bei ng i n negati ve terms. The posi ti on i n l aw i s wel l settled

that if the requirements of a statute which prescribes the

manner in which something i s t o be done ar e expr essed i n

negat i ve language, that is to say, if the statute enacts that it

shall be done in such a manner and in no other manner, such

requirements are, in all cases absolute and neglect to attend to such

r e q u i r e me n t wi l l i n v a l i d a t e t h e wh o l e proceeding.

10. The Hon bl e Apex Cour t i n t he case of Assi st ant

Commissioner of Income-tax vs. Hotel Blue Moon reported in

[2010] 321 ITR 362 has considered the very issue. The Apex Court

held that the Assessing Officer has to necessarily follow the provisions

of section 142 and sub-sections (2) and (3) of section 143. It did not

accept the submission of the Revenue that the requi rement of the

noti ce under secti on 143(2) can be di spensed wi t h and t he

same i s mer e pr ocedur al irregularity. In the words of the Apex

Court, it is held as under:

SA Nos.216 & 215/2014

& ITA Nos.5221 & 5222/14

8

" 16. The case of t he r evenu e i s t hat t he expression

' so far as may be apply' indicates t h a t i t i s n o t

e x p e c t e d t o f o l l o w t h e provisions of section 142, sub-

sections(2) and (3) of section 143 strictly for the purpose of

bl ock assessment s. We do not agree wi t h t he

submi ssi ons of t he l earned counsel f or t he revenue,

si nce we do not see any reason t o r e s t r i c t t h e

s c o p e a n d me a n i n g o f t h e expression ' so far as may

be apply' . In our v i e w , w h e r e t h e A s s e s s i n g

Of f i c e r i n repudiation of the return filed under section

158BC(a) proceeds to make an enquiry, he has necessarily to

follow the provisions of section 142, sub-sections (2) and (3) of

section 143."

11. During the course of hearing, the Bench specifically asked the

learned AR with regard to the requirements of Section 292BB

introduced w.e.f. 1-4-2008 with retrospective effect. In reply, learned

AR contended that as per proviso to Section 292 BB, where the

assessee has raised objection regarding issue of notice before the

completion of such assessment or reassessment, the provisions

contained u/s.292BB will not be applied. We found that provisions of

Section 292BB was introduced w.e.f. 1-4-2008 relevant to A.Y. 2008-

09 under consideration, according to which, where an assessee has

appeared in any proceeding or co-operated in any inquiry relating to an

assessment or reassessment, it shall be deemed that any notice under

any provision of this Act, which is required to be served upon him, has

been duly served upon him in time in accordance with the provisions of

this Act and such assessee shall be precluded from taking any

objection in any proceeding or inquiry under this Act that the notice was

(a) not served upon him; or (b) not served upon him in time; or (c)

served upon him in an improper manner. We found that in the instant

SA Nos.216 & 215/2014

& ITA Nos.5221 & 5222/14

9

case, assessee has filed his objection before the AO and such

objection has also been noted by the AO in his assessment order to

the effect that assessee has objected non service of notice u/s.143(2)

during the course of assessment proceedings itself. Thus, participation

of assessee in the assessment proceedings will not disentitle the

assessee his right to object to the service of notice u/s.143(2) of the

I.T. Act, 1961.

12. After going through the assessment records, we found that notice

issued u/s.143(2) dated 17-7-2012 returned unserved by postal

authorities. Thereafter notice was affixed by the Inspector on 28-7-

2012. For such service by fixture the Inspector has given his report

vide letter dated 27-7-2012 which reads as under :-

In connection with the subject matter it is brought to your kind

notice that the undersigned visited the assessees premises at

23/24, Vora CHS ltd., Plot No.52, U.B.Lane, Ghatkopar(E),

Mumbai-400 077 on 27.07.2012 to serve the notice u/s.143(2) for

A.Y.2008-09 in the case of Shri Sanjay Badani bearing PAN

AABPB 9926B. However, on reaching the said premises it was

found that the said premises was locked. Therefore, the said notice

was served on the assessee by affixture by me on 27.07.2012.

Here we have to examine as to whether service of notice by affixture

was proper in terms of provisions of Order V, Rule 17 to 20 of CPC. As

per provisions of Section 282 of the I.T. Act, 1961, notice under the Act

is to be served either by post or as if it is summoned under the Code of

Civil Procedure. Notice dated 17-7-2012 has been claimed to have

been served through affixture on 27-7-2012 as provided in Code of

Civil Procedure. Here provisions of Order V Rules 17 to 20 of CPC are

SA Nos.216 & 215/2014

& ITA Nos.5221 & 5222/14

10

relevant. After taking notice of above statutory provisions. their

Lordships of Supreme Court in the case of CIT v. Ramendra Nath

Ghosh [1971] 82 ITR 888, held (pages 890 & 891) as under : -

Admittedly, the assessees have not been personally served

in these cases. Therefore, we have to see whether the alleged

service by affixation was in accordance with law. It is necessary to

mention that, according to the assessees, they had no place of

business at all. They claim that they have closed their business

long before the notices were issued. Hence, according to them, Mr.

Neogi must have gone to a wrong place. This contention of the

assessees has been accepted by the Appellate Bench of the High

Court. Bearing these facts in mind, let us now proceed to consider

the relevant provisions of law. Section 63(1) of the Act reads:

A notice or requisition under this Act may be served on the

person therein named either by post or, as if it were a summons

issued by a court, under the Code of Civil Procedure, 1908 (V of

1908).

9. Rule 17 of Order V of the Civil Procedure Code reads:

Where the defendant or his agent or such other person as

aforesaid refuses to sign the acknowledgment, or where the serving

officer, after using all due and reasonable diligence, cannot find the

defendant, and there is no agent empowered to accept service of

the summons on his behalf, nor any other person on whom service

can be made, the serving officer shall affix a copy of the summons

on the outer door or some other conspicuous part of the house in

which the defendant ordinarily resides or carries on business or

personally works for gain, and shall then return the original to the

court from which it was issued, with a report endorsed thereon or

annexed thereto stating that he has so affixed the copy, the

circumstances under which he did so, and the name and address of

the person (if any) by whom the house was identified and in whose

presence the copy was affixed. (emphasis applied)

As seen earlier the contention of the assessees was that at

the relevant time they had no place of business. The report of the

serving officer does not mention the names and addresses of the

person who identified the place of business of the assessees. That

officer does not mention in his report nor in the affidavit filed by him

that he personally knew the place of business of the assessees.

Hence, the service of notice must be held to be not in accordance

with the law. The possibility of his having gone to a wrong place

cannot be ruled out. The High Court after going into the facts of the

case very elaborately, after examining several witnesses, has come

to the conclusion that the service made was not a proper service.

Hence, it is not possible to hold that the assessees had been given

SA Nos.216 & 215/2014

& ITA Nos.5221 & 5222/14

11

a proper opportunity to put forward their case as required by

Section 33B.

13. As per sub-section (1) of section 282, the notice is to be served

on the person named therein either by post or as if it was a summons

issued by Court under the Code of Civil Procedure, 1908 (V of 1908).

The relevant provision for effecting of service by different modes are

contained in rules 17, 19 and 20 of Order V of CPC. Rules 17, 19 and

20 of Order Vof CPC lay down the procedure for service of

summons/notice and, therefore, the procedure laid down therein

cannot be surpassed because the intention of the legislature behind

these provisions is that strict compliance of the procedure laid down

therein has to be made. The expression after using all due and

reasonable diligence' appearing in rule 17 has been considered in

many cases and it has been held that unless a real and substantial

effort has been made to find the defendant after proper enquiries, the

Serving Officer cannot be deemed to have exercised 'due and

reasonable diligence'. Before taking advantage of rule 17, he must

make diligent search for the person to be served. He therefore, must

take pain to find him and also to make mention of his efforts in the

report. Another requirement of rule 17 is that the Serving Officer should

state that he has affixed the copy of summons as per this rule. The

circumstances under which he did so and the name and address of the

person by whom the house or premises were identified and in whose

SA Nos.216 & 215/2014

& ITA Nos.5221 & 5222/14

12

premises the copy of the summon was affixed. These facts should also

be verified by an affidavit of the Serving Officer.

14. The reason for taking all these precautions is that service by

affixture is substituted service and since it is not direct or personal

service upon the defendant, to bind him by such mode of service the

mere formality of affixture is not sufficient. Since the service has to be

done after making the necessary efforts, in order to establish the

genuineness of such service, the Serving Officer is required to state his

full action in the report and reliance can be placed on such report only

when it sets out all the circumstances which are also duly verified by

the witnesses in whose presence the affixture was done and thus the

affidavit of the Serving Officer deposing such procedure adopted by

him would also be essential. In the instant case, the whole thing had

been done in one stroke. It was not known as to why and under which

circumstances another entry for service of notice by affixture was made

on 27-7-2012 when sufficient time was available through normal

service till 30-9-2012. Nor there is any entry in the note-sheet by the

AO directing the Inspector for service by affixture and had only

recorded the fact that the notice was served by the affixture. It appears

that the report of the Inspector was obtained without issuing any prior

direction for such process or mode. However, the fact remained that

Serving Officer had not set out reason for passing subsequent entry

nor for adopting the mode for service by affixture and without stating

SA Nos.216 & 215/2014

& ITA Nos.5221 & 5222/14

13

the reasons for doing so, the adoption of the mode of substituted

service could not be legally justified. Notice was served by affixture.

The reasons for service through affixture has not been noted by the AO

in the notesheet nor he has issued any direction for issuing notice

through affixtures. The next entry of note sheet dated 28-7-2012 just

indicates that letter was filed by the Inspector regarding service of

notice by affixtures, dated 17-7-2012. Thus, on 17-7-2012, the first

entry was made and without recording any apprehension about the

delay by such mode second entry for affixation was made on 28-7-

2012 without showing justification for the same. Thus, it is clear that

report of the Inspector was obtained without issuing any prior direction

for such process or mode. Thus, the adoption of mode of substituted

service was not legally justified. It is also clear from the Inspectors

report that there is no mention of name and address of the person who

had identified the house of the assessee and in whose presence the

notice u/s.143(2) was affixed. There is no evidence or indication in the

report of Inspector that he had personal knowledge of the place of the

business of the assessee and was, thus, in a position to identify the

same. Therefore, neither the procedure laid down under order V. rule

17 had been followed nor that laid down under order V rules 19 and 20

had been adhered to. Neither before taking recourse to service by

affixture, the Assessing Officer or the concerned officer had recorded

the findings to justify the service by this mode nor afterwards called for

the affidavit or certificate of service by affixture from the Serving

SA Nos.216 & 215/2014

& ITA Nos.5221 & 5222/14

14

Officer. He had not certified that the service had been effected by

adopting this course.

15. In view of the above, it is clear that there was no valid service of

notice u/s.143(2) by way of affixation. Since in the instant case, the

department has not been able to demonstrate that notice u/s.143(2)

was served within the statutory time limit, the assessment made on the

basis of such invalid notice could not be treated to be valid assessment

and, hence, such assessment order deserves to be treated as null and

void and liable to be quashed and annulled. Accordingly, we allow

assessees appeal on legal issue regarding non-service of notice

u/s.143(2). As we have already allowed assessees appeal on legal

issue, we are not going to discuss the merits of the addition made on

account of deemed dividend u/s.2(22)(e) of the Act.

16. As the facts and circumstances in the case of another assessee-

Shri Nilesh Badani (ITA No.5222/Mum/2014) are pari materia,

therefore, our observation made in the case of Shri Sanjay Badani (ITA

No.5221/Mum/2014) will be applied mutatis mutandis to the appeal

filed by Shri Nilesh Badani.

17. Since we have allowed the above appeals, the stay applications

filed by the assessees have become infructuous.

18. In the result, ITA No.5221/Mum/2014 and ITA

No.5222/Mum/2014 are allowed in terms indicated hereinabove,

whereas the stay applications No.216/Mum/2014 & 215/Mum/2014 are

hereby dismissed.

SA Nos.216 & 215/2014

& ITA Nos.5221 & 5222/14

15

Order pronounced in the open court on this 9

th

Sept.2014.

9

th

Sept,2014

Sd/- Sd/-

( )

(H.L.KARWA)

( )

(R.C.SHARMA)

/ PRESIDENT

/ ACCOUNTANT MEMBER

Mumbai; Dated 09/09/2014

/pkm, PS

Copy of the Order forwarded to :

/ BY ORDER,

(Asstt. Registrar)

/ ITAT, Mumbai

1. / The Appellant

2. / The Respondent.

3. / The CIT(A), Mumbai.

4. / CIT

5.

/ DR, ITAT, Mumbai

6. Guard file.

//True Copy//

Potrebbero piacerti anche

- Written Arguments 138Documento7 pagineWritten Arguments 138rohitnaagpal100% (2)

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintDa EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintValutazione: 4 su 5 stelle4/5 (1)

- Telecommunication ProjectDocumento23 pagineTelecommunication ProjectabhirajNessuna valutazione finora

- 148d 50 LAC Cost ImposedDocumento36 pagine148d 50 LAC Cost ImposedNeena BatlaNessuna valutazione finora

- Rajasthan HC Rampal Samdani - 148 - Change of Opinion - After 4 YearsDocumento10 pagineRajasthan HC Rampal Samdani - 148 - Change of Opinion - After 4 YearsSubramanyam SettyNessuna valutazione finora

- High Court of Judicature For Rajasthan Bench at Jaipur: Mr.R.B.Mathur (SR - Advocate) Through VCDocumento4 pagineHigh Court of Judicature For Rajasthan Bench at Jaipur: Mr.R.B.Mathur (SR - Advocate) Through VCParasNessuna valutazione finora

- Alok Bhandari Anr. vs. ACIT ITAT DelhiDocumento7 pagineAlok Bhandari Anr. vs. ACIT ITAT DelhivedaNessuna valutazione finora

- Indo Office Solutions (P) Ltd. Versus ACIT, Central Circle-17, New DelhiDocumento6 pagineIndo Office Solutions (P) Ltd. Versus ACIT, Central Circle-17, New DelhiAshish GoelNessuna valutazione finora

- Maruti Suzuki India LTD 0Documento97 pagineMaruti Suzuki India LTD 0AMAN KUMAR 20213009Nessuna valutazione finora

- 10348632004520708481351refno4550-4553 14 Dcit vs. New Delh Hotels LTDDocumento15 pagine10348632004520708481351refno4550-4553 14 Dcit vs. New Delh Hotels LTDPrakhar MishraNessuna valutazione finora

- Shashi Finance Corporation Vs Super Shine Abrasivea030989COM408805Documento3 pagineShashi Finance Corporation Vs Super Shine Abrasivea030989COM408805RAJPAL SINGH RATHORENessuna valutazione finora

- Ajeet Seeds LTD Vs K Gopala Krishnaiah Issuance of Notice 138Documento5 pagineAjeet Seeds LTD Vs K Gopala Krishnaiah Issuance of Notice 138RajeshPandeyNessuna valutazione finora

- Amrendra Singh Vs State of U.P.And AnotherDocumento8 pagineAmrendra Singh Vs State of U.P.And AnotherJason BalakrishnanNessuna valutazione finora

- Vijendra Singh Vs State of UP and Ors 13012014 ALU140164COM96243 PDFDocumento5 pagineVijendra Singh Vs State of UP and Ors 13012014 ALU140164COM96243 PDFManu chopraNessuna valutazione finora

- Adjudication Order in Respect of Dighe Electronics Ltd. in The Matter of Non Redressal of Investor GrievanceDocumento7 pagineAdjudication Order in Respect of Dighe Electronics Ltd. in The Matter of Non Redressal of Investor GrievanceShyam SunderNessuna valutazione finora

- In The Income Tax Appellate Tribunal "A" Bench: Bangalore Before Shri N. V. Vasudevan, Vice President and Shri Jason P Boaz, Accountant MemberDocumento12 pagineIn The Income Tax Appellate Tribunal "A" Bench: Bangalore Before Shri N. V. Vasudevan, Vice President and Shri Jason P Boaz, Accountant MemberKushwanth Soft SolutionsNessuna valutazione finora

- Adjudication Order in Respect of Golden Soya Ltd. (In The Matter of Non Redressal of Investor Grievances and Non Obtaining of SCORES Authentication)Documento7 pagineAdjudication Order in Respect of Golden Soya Ltd. (In The Matter of Non Redressal of Investor Grievances and Non Obtaining of SCORES Authentication)Shyam SunderNessuna valutazione finora

- Cta 3D CV 09446 D 2021mar12 RefDocumento23 pagineCta 3D CV 09446 D 2021mar12 RefFirenze PHNessuna valutazione finora

- CIT Vs BaldwinDocumento8 pagineCIT Vs BaldwinshashankNessuna valutazione finora

- 1 Judgment-WPL 11293-21.odtDocumento30 pagine1 Judgment-WPL 11293-21.odtAlok SinghNessuna valutazione finora

- Before Shri P.M. Jagtap, AMDocumento14 pagineBefore Shri P.M. Jagtap, AMPriyanka Porwal JainNessuna valutazione finora

- SH - Charashni Kumar Talwani v. M/s Malhotra Poultries, Naraingarh Road, BarwalaDocumento16 pagineSH - Charashni Kumar Talwani v. M/s Malhotra Poultries, Naraingarh Road, BarwalaDeepakPanwarNessuna valutazione finora

- Gurvinder Kaur Bhatia Indore Vs PR Cit 2 Indore On 18 December 2019Documento27 pagineGurvinder Kaur Bhatia Indore Vs PR Cit 2 Indore On 18 December 2019praveen chokhaniNessuna valutazione finora

- Alchemist Infra Realty LimitedDocumento3 pagineAlchemist Infra Realty LimitedShyam SunderNessuna valutazione finora

- Versus: 2023:BHC-OS:12955-DBDocumento4 pagineVersus: 2023:BHC-OS:12955-DBkumarhealthcare2000Nessuna valutazione finora

- Case Note of SIMRANPAL SINGH SURI VDocumento3 pagineCase Note of SIMRANPAL SINGH SURI VSubodh AsthanaNessuna valutazione finora

- 1614060815-5446 Bhupendra JainDocumento8 pagine1614060815-5446 Bhupendra Jainakhil layogNessuna valutazione finora

- 441709Documento11 pagine441709Ajay K.S.Nessuna valutazione finora

- 151-Reopening-Sanction ITAT IMPDocumento31 pagine151-Reopening-Sanction ITAT IMPNeena BatlaNessuna valutazione finora

- Kusum Gupta v. ITO (Delhi HC)Documento6 pagineKusum Gupta v. ITO (Delhi HC)Avar LambaNessuna valutazione finora

- CIR V MINDANAO SANITARIUM AND HOSPITAL INCDocumento4 pagineCIR V MINDANAO SANITARIUM AND HOSPITAL INCAlexis Anne P. ArejolaNessuna valutazione finora

- Bharatbhai Ganpatlal Suthar Vs State of Gujarat 10GJ202223022216382289COM564350Documento3 pagineBharatbhai Ganpatlal Suthar Vs State of Gujarat 10GJ202223022216382289COM564350John JacobsNessuna valutazione finora

- Sripati Singh v. State of JharkhandDocumento8 pagineSripati Singh v. State of JharkhandManushi SaxenaNessuna valutazione finora

- Leric Reeches Order-11.04.2024Documento6 pagineLeric Reeches Order-11.04.2024Razik MuahmmedNessuna valutazione finora

- Amendment of Section 142 NI Act Has Retrospective Effect - Chattisgarh High CourtDocumento11 pagineAmendment of Section 142 NI Act Has Retrospective Effect - Chattisgarh High CourtLive LawNessuna valutazione finora

- 1684303940-ITA No.1070-D-2022 - Havells India LTDDocumento5 pagine1684303940-ITA No.1070-D-2022 - Havells India LTDArulnidhi Ramanathan SeshanNessuna valutazione finora

- 138 Petition - Vikas Strips PVT LTDDocumento13 pagine138 Petition - Vikas Strips PVT LTDDeepanshu VermaNessuna valutazione finora

- M.manickam Vs The Secretary To Government On 2 January, 2014Documento8 pagineM.manickam Vs The Secretary To Government On 2 January, 2014sreevarshaNessuna valutazione finora

- Adjudication Order Against Chain Impex Limited in The Matter of SCORESDocumento6 pagineAdjudication Order Against Chain Impex Limited in The Matter of SCORESShyam SunderNessuna valutazione finora

- Per Rajpal Yadav, Judicial MemberDocumento5 paginePer Rajpal Yadav, Judicial MemberSrijan MishraNessuna valutazione finora

- Judgments in Ni Act & DCDocumento31 pagineJudgments in Ni Act & DCVarri Demudu Babu100% (1)

- Written ArgumentsDocumento6 pagineWritten ArgumentsHarshitha MNessuna valutazione finora

- WWW - Livelaw.In: Judgment Uday Umesh Lalit, JDocumento8 pagineWWW - Livelaw.In: Judgment Uday Umesh Lalit, JRaghav MehtaNessuna valutazione finora

- 03.06.22 - Brahmanand Construction - Synopsis and List of DatesDocumento3 pagine03.06.22 - Brahmanand Construction - Synopsis and List of DatesRahul kumarNessuna valutazione finora

- UDINDocumento5 pagineUDINKritin BahugunaNessuna valutazione finora

- Adjudication Order in The Matter of Gaurav Sarda - Research Analyst Page 1 of 12Documento12 pagineAdjudication Order in The Matter of Gaurav Sarda - Research Analyst Page 1 of 12cawojin576Nessuna valutazione finora

- 2018 PTD 314Documento8 pagine2018 PTD 314Amer AhmadNessuna valutazione finora

- Sumit Balkrishna Guptavs Assistant Commissionerof IncomDocumento3 pagineSumit Balkrishna Guptavs Assistant Commissionerof IncomjusticesharknluNessuna valutazione finora

- Anil Marda 143 2 NoticeDocumento32 pagineAnil Marda 143 2 NoticeLNessuna valutazione finora

- Tata Motors CaseDocumento12 pagineTata Motors CaseRiddhiraj SinghNessuna valutazione finora

- Manish Kumar and Ors Vs The State of West Bengal aWB2020280220162138374COM181933Documento9 pagineManish Kumar and Ors Vs The State of West Bengal aWB2020280220162138374COM181933sid tiwariNessuna valutazione finora

- Cta 2D CV 10517 R 2023may18 AssDocumento14 pagineCta 2D CV 10517 R 2023may18 AssgregmanilaNessuna valutazione finora

- CTA 2021 Ishida v. CIRDocumento8 pagineCTA 2021 Ishida v. CIRhopesgvNessuna valutazione finora

- 1 PDFDocumento7 pagine1 PDFspider rockNessuna valutazione finora

- 'CL 2021 22 (1) 3Documento24 pagine'CL 2021 22 (1) 3aakash jainNessuna valutazione finora

- If Demand Notice U - S 138 NI Act Mentions Correct Address of Accused, Question of Delivery Due To Variation in Postal Receipt To Be Decided at Trial - J&K&L HCDocumento9 pagineIf Demand Notice U - S 138 NI Act Mentions Correct Address of Accused, Question of Delivery Due To Variation in Postal Receipt To Be Decided at Trial - J&K&L HCfisaNessuna valutazione finora

- Samar-I Electric Cooperative (SIEC) v. CIRDocumento4 pagineSamar-I Electric Cooperative (SIEC) v. CIRNOLLIE CALISINGNessuna valutazione finora

- Supreme Court of India Page 1 of 6Documento6 pagineSupreme Court of India Page 1 of 6amitk96270Nessuna valutazione finora

- ..1 .. C.C.No.121/SW/2014. JudgmentDocumento12 pagine..1 .. C.C.No.121/SW/2014. JudgmentSkk IrisNessuna valutazione finora

- CTA - EB - CV - 01515 - M - 2018AUG15 - ASS Linde Phil Void Assessment Bears No FruitDocumento6 pagineCTA - EB - CV - 01515 - M - 2018AUG15 - ASS Linde Phil Void Assessment Bears No FruitAvelino Garchitorena Alfelor Jr.Nessuna valutazione finora

- Introduction to Negotiable Instruments: As per Indian LawsDa EverandIntroduction to Negotiable Instruments: As per Indian LawsValutazione: 5 su 5 stelle5/5 (1)

- United States v. Goldin Industries, Inc., Goldin of Alabama, Inc., 211 F.3d 1339, 11th Cir. (2000)Documento2 pagineUnited States v. Goldin Industries, Inc., Goldin of Alabama, Inc., 211 F.3d 1339, 11th Cir. (2000)Scribd Government DocsNessuna valutazione finora

- People v. GalvezDocumento1 paginaPeople v. GalvezMayr Teruel100% (1)

- Not PrecedentialDocumento5 pagineNot PrecedentialScribd Government DocsNessuna valutazione finora

- CivPro General Principles DoctrinesDocumento4 pagineCivPro General Principles DoctrinesElaine Viktoria DayanghirangNessuna valutazione finora

- Rewa Sidhi Gramin Bank 5 FebDocumento2 pagineRewa Sidhi Gramin Bank 5 FebVimal KulshreshthaNessuna valutazione finora

- 10 Estanislao, Jr. vs. Court of AppealsDocumento10 pagine10 Estanislao, Jr. vs. Court of AppealsYaz CarlomanNessuna valutazione finora

- 19 Dimaguila Vs MonteiroDocumento1 pagina19 Dimaguila Vs MonteiroJet SiangNessuna valutazione finora

- Jeffrey Weekley v. Michael W. Moore, Department of Corrections, 244 F.3d 874, 11th Cir. (2001)Documento2 pagineJeffrey Weekley v. Michael W. Moore, Department of Corrections, 244 F.3d 874, 11th Cir. (2001)Scribd Government DocsNessuna valutazione finora

- The Indian Banking SectorDocumento4 pagineThe Indian Banking SectorShriya MehrotraNessuna valutazione finora

- CPC ProjectDocumento17 pagineCPC ProjectPrashant Mahawar100% (1)

- First. Erlinda K. Ilusorio Claimed That She Was Not Compelling Potenciano To Live WithDocumento89 pagineFirst. Erlinda K. Ilusorio Claimed That She Was Not Compelling Potenciano To Live WithKrisven Mae R. ObedoNessuna valutazione finora

- Contract 2Documento13 pagineContract 2amit singhNessuna valutazione finora

- Heirs of Tan Vs Pollescas PDFDocumento12 pagineHeirs of Tan Vs Pollescas PDFJemNessuna valutazione finora

- C N L U S I M C C: (Prosecution) (Defence)Documento28 pagineC N L U S I M C C: (Prosecution) (Defence)Aditi SoniNessuna valutazione finora

- Sexual Assault Ruling OverturnedDocumento14 pagineSexual Assault Ruling OverturnedAsbury Park Press100% (3)

- Reyes vs. HRET (Full Text, Word Version)Documento17 pagineReyes vs. HRET (Full Text, Word Version)Emir MendozaNessuna valutazione finora

- Emin Vs de LeonDocumento2 pagineEmin Vs de LeonShiva100% (1)

- 2018 JD 401 Executive Admin AssgtDocumento3 pagine2018 JD 401 Executive Admin AssgtkaiaceegeesNessuna valutazione finora

- Supreme Court of India Page 1 of 5Documento5 pagineSupreme Court of India Page 1 of 5lathacoolNessuna valutazione finora

- Manila Memorial Vs CADocumento8 pagineManila Memorial Vs CAGelo AngNessuna valutazione finora

- Inscription of Preah Vihear Temple of Cambodia For World HeritageDocumento131 pagineInscription of Preah Vihear Temple of Cambodia For World HeritageChourn ChamroeurnNessuna valutazione finora

- Hopewell Power vs. CommissionerDocumento6 pagineHopewell Power vs. CommissionerVincent Jan TudayanNessuna valutazione finora

- David V MacasioDocumento8 pagineDavid V MacasioJorela TipanNessuna valutazione finora

- Marticio Semblante and Dubrick Pilar Vs CA - GR No. 196426 - August 15, 2011Documento4 pagineMarticio Semblante and Dubrick Pilar Vs CA - GR No. 196426 - August 15, 2011BerniceAnneAseñas-ElmacoNessuna valutazione finora

- Writofsummons ForrevisionpurposesonlyDocumento7 pagineWritofsummons ForrevisionpurposesonlyNuur KhaliilahNessuna valutazione finora

- Mendoza Vs AllasDocumento2 pagineMendoza Vs AllasSamantha Ann T. TirthdasNessuna valutazione finora

- Alkaly Keita, A098 071 179 (BIA July 16, 2015)Documento6 pagineAlkaly Keita, A098 071 179 (BIA July 16, 2015)Immigrant & Refugee Appellate Center, LLCNessuna valutazione finora

- Garcia V Perez - DigestDocumento3 pagineGarcia V Perez - DigestcinfloNessuna valutazione finora

- Power of Review - Labour Courts or Industrial TribunalsDocumento19 paginePower of Review - Labour Courts or Industrial TribunalsShivam BhargavaNessuna valutazione finora