Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Finance Practice Exam 1

Caricato da

JordanVero0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

84 visualizzazioni22 paginealala

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoalala

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

84 visualizzazioni22 pagineFinance Practice Exam 1

Caricato da

JordanVeroalala

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 22

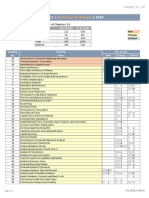

First three letters of

your last name

Finance Department

Wharton School A.Craig MacKinlay

Corporate Finance (100) Fall Term 2009

Midterm Examination I (90 Minutes)

October 12, 2009

1. (2 points) Circle the correct answer.

All investors will agree that it is optimal for the firm to use the NPV rule to select investments if:

(i) Investors preferences are such that they want their income flows at the same time.

(ii) Investors can use the capital markets to shift their income flows by borrowing or

lending at a fair interest rate.

(iii) Managers of companies cannot pay themselves large bonuses.

(iv) Investors will never agree with the firm using the NPV rule.

2. (3 points) Circle the correct answer.

Which flow has the highest future value at time 5?

(i) $2500 invested for five years at an annual rate of 29% compounded quarterly.

(ii) Starting in six months, 10 deposits of $500 every six months in an account that has an

annual yield of 30%.

(iii) $9500 to be paid at time 5.

3. (5 points; 1-2-2) You are investigating the costs of borrowing $1,000,000 for a term of 10

years. A bank has offered you a loan with a ten year term at an annual interest rate of 8.4%

compounded monthly. The loan is to have equal monthly payments.

(a) What is the annual yield for this loan rate?

(b) What would the monthly payment be for this loan?

(c) If you decided to pay off the loan immediately after making the 48

th

monthly payment, how

much would you owe?

4. (6 points; 3-1-2) Below you are given information concerning the current price and year-end

cash flows for three bonds, A, B, and C.

BOND Current Time 1 Time 2 Time 3 Time 4

Price cash flow cash flow cash flow cash flow

A 780. 35 0 0 0 1000

B 981. 75 50 1050 0 0

C 1073. 50 100 1100 0 0

(a) What is the total present value of three payments: $1700 at time 1, $400 at time 2, and $2000

at time 4? (The risk of these payments is the same as the risk of the flows of the bonds.)

(b) Given bonds A, B, and C, what would you expect to be the yield to maturity of a bond which

has two years to maturity, a coupon rate of 6%, a face value of $100, and pays interest annually?

State the yield to maturity as an annual yield (annual rate compounded annually).

(c) What is the interest rate you can lock in now for 1 year in the future with a term of 3 years

(i.e. the forward rate f

3,1

)? State your answer as an annual yield (annual rate compounded

annually).

5. (5 points; 4-1) WAW is an established company operating in a rapidly growing market. Its

earnings per share this year (at time 1) are expected to be $1.90. These earnings are currently

growing at 15% per year. After this year, this growth rate of earnings is expected to continue for

four more years (years 2, 3, 4, and 5). To support the earnings growth, the firm will retain much

of its earnings. At time 1 and time 2, the firm expects to payout 10% of its earnings as

dividends. Then, beginning at time 3, the payout ratio will increase to 20% of earnings and

remain at this level through time 5. Beginning at time 6, it is expected that the payout ratio of

the company will be 0.50. This payout ratio is expected to remain constant forever. The time 6

earnings are expected to be 8% higher than the earnings at time 5. WAW expects this 8%

growth rate of earnings to continue forever. Given its risk, the required rate of return for this

company is 13% per year.

(a) What is the current value of a share of WAW stock?

(b) What fraction of the current value of WAW can be attributed to net present value of growth

opportunities (NPVGO)?

6. (4 points) Company AAB has an unusual dividend policy. The company pays shareholders

dividends every two years. It was one year ago that the last dividend was paid. Thus, the next

dividend is expected at time 1. Then dividends are expected to be paid every two years (at time

3, time 5, etc.). You expect the dividend at time 1 to be $3.00 per share. The company is very

stable. In the future, you expect dividend growth to be constant at a rate of 12% every two years.

(This is a two-year growth rate not an annual rate. You expect the dividend at time 3 to be $3.36

per share.) Given this dividend growth forecast, what is the value of a share? The required

return for companies with the risk of AAB stated as an annual yield is 10%.

First three letters of

your last name

Finance Department

Wharton School A.Craig MacKinlay

Corporate Finance (100) Fall Term 2008

Midterm Examination I

October 6, 2008

Instructions

1. This exam is administered under the Universitys rules of academic integrity.

2. Answers cannot win full credit unless you show correct supporting work

including any necessary assumptions.

3. The exam is closed book, but you may use a calculator and one 8.5 inch x 5.5

inch sheet of notes. No other notes, books, or aids are allowed. Answer all

questions for a possible 25 points. You have 1 hours.

4. Regrade requests must be submitted within one week of the date of the return of

the exam. Only written regrade requests submitted with a completely unaltered

exam paper can be considered.

Good Luck!

Your Name:

Please PRINT clearly

Please circle the section

you are registered in:

1

10:30 AM

2

12:00 PM

3

1:30 PM

1. ( 6 poi nt s) Ci r cl e t he cor r ect answer . No expl anat i on r equi r ed.

( a) The st ock pr i ce of LWA f el l by 10%l ast mont h. Ther ef or e, t he net

pr esent val ue of i t s gr owt h oppor t uni t i es ( NPVGO) must have decl i ned.

TRUE FALSE

( b) You have bor r owed $100, 000 at an annual r at e of 8%compounded

semi - annual l y and have agr eed t o r epay t he l oan i n t en equal annual

payment s. The f i r st payment i s due si x mont hs f r omt oday and t hen t he

payment s ar e due ever y 12 mont hs ( at 18 mont hs, 30 mont hs, et c. ) unt i l

t en payment s have been made. To t he near est dol l ar , each payment wi l l

be:

( i ) $13344

( i i ) $14351

( i i i ) $14433

( i v) $14925

( c) I f t he annual yi el d i s 7. 50%t hen t he annual r at e cont i nuousl y

compounded i s:

( i ) 7. 23%

( i i ) 7. 31%

( i i i ) 7. 50%

( i v) 7. 79%

2. ( 3 poi nt s) ABC has i ssued a bond wi t h 10 year s t o mat ur i t y and a

coupon r at e of 8%. The bond pays i nt er est semi annual l y and has a f ace

val ue of $1, 000. I f t he yi el d t o mat ur i t y of t he bond i s 14. 49%

( st at ed as an annual yi el d) , what i s t he pr i ce of t he bond?

3. ( 3 poi nt s) You ar e gi ven t he choi ce of t hr ee i ncome st r eams. The

st r eams ar e:

( i ) annual payment s f or 5 year s begi nni ng i n one year ( at t i me 1)

t he f i r st payment i s $5000 and t he payment s wi l l gr ow at 5%per year ;

( i i ) $26000 t o be pai d i n t wo equal payment s t he f i r st payment of

$13000 i s t o be made i mmedi at el y ( at t i me 0) and t he second payment of

$13000 t o be pai d i n 5 year s ( at t i me 5) ; and

( i i i ) a payment of $98 per mont h t hat cont i nues f or ever .

Assumi ng per f ect capi t al mar ket s, i f t he r equi r ed r at e of r et ur n on

i nvest ment s i s 5%compounded annual l y, whi ch st r eamwoul d you choose?

4. ( 6 poi nt s; 3- 2- 1) Bel ow you ar e gi ven i nf or mat i on concer ni ng t he

cur r ent pr i ce and year - end cash f l ows f or f our bonds, A, B, C, and D.

BOND Current Year 1 Year 2 Year 3 Year 4

Price cash flow cash flow cash flow cash flow

A 825. 52 0 0 1000 0

B 1019. 44 70 70 70 1070

C 87. 67 0 100 0 0

D 780. 25 0 0 0 1000

( a) What i s t he pr esent val ue of f our $900 payment s t o be r ecei ved at

t he end of year s 1, 2, 3, and 4?

( b) Gi ven bonds A, B, C, and D, what woul d you expect t o be t he yi el d

t o mat ur i t y of a f i f t h pur e di scount bond whi ch has one year t o

mat ur i t y and wi l l pay $10000 at mat ur i t y? St at e t he yi el d t o mat ur i t y

as an annual yi el d ( annual r at e compounded annual l y) .

( c) What i s t he i nt er est r at e you can l ock i n now f or 1 year i n t he

f ut ur e wi t h a t er mof 3 year s ( i . e. t he f or war d r at e f

3, 1

) ? St at e your

answer as an annual yi el d ( annual r at e compounded annual l y) .

5. ( 5 poi nt s) Bi g Bi r d, a f ast f ood r est aur ant , cur r ent l y does not

pay any di vi dends. I t expect s t o have ear ni ngs per shar e of $25. 00

over t he next year ( EPS

1

) . For year 2, year 3, and year 4, ear ni ngs

ar e expect ed t o gr ow at 20%per year . At t i me 4, Bi g Bi r d expect s t o

st ar t payi ng di vi dends and f or t he di vi dend at t i me 4 ( DI V

4

) wi l l have

a payout r at i o of 0. 30. For year 5, year 6, and year 7, di vi dends ar e

expect ed t o gr ow at 15%per year and f or t hose same year s, ear ni ngs

ar e expect ed t o gr ow at 12%per year . Begi nni ng at t he end of year 7

t he f i r mi s expect ed t o begi n a l ong r un st abl e phase wi t h ear ni ngs

per shar e gr owi ng at 5%per pet ual l y and wi t h t he pl owback r at i o

const ant at 0. 45. The r equi r ed r at e of r et ur n f or t hi s company i s 16%

per year . What i s t he cur r ent val ue of a shar e of st ock?

6. ( 2 poi nt s) You ar e ent i t l ed t o a per pet ual st r eamof payment s. You

wi l l r ecei ve a payment of $20 i n one year . Al l f ut ur e payment s wi l l

i ncr ease by $10 per year . ( You wi l l r ecei ve $30 at t i me 2, $40 at

t i me 3, $50 at t i me 4, et c. ) The payment s i ncr easi ng at $10 per year

wi l l cont i nue f or ever . I f t he appr opr i at e r equi r ed r et ur n t o val ue

t hese payment s i s 9%st at ed as an annual r at e compounded annual l y,

t hen what i s t he pr esent val ue of t hi s payment st r eam?

Potrebbero piacerti anche

- References For MGMT Short PaperDocumento1 paginaReferences For MGMT Short PaperJordanVeroNessuna valutazione finora

- Tobacco ControlDocumento22 pagineTobacco ControlJordanVeroNessuna valutazione finora

- Pmi 2013 Annual Report CompleteDocumento84 paginePmi 2013 Annual Report Completebookluvver212Nessuna valutazione finora

- PMI ReportDocumento20 paginePMI ReportJordanVeroNessuna valutazione finora

- Valuing Stocks, Projects, and Options Using Financial FormulasDocumento2 pagineValuing Stocks, Projects, and Options Using Financial FormulasJordanVeroNessuna valutazione finora

- Second Midterm 2010 EconDocumento7 pagineSecond Midterm 2010 EconJordanVeroNessuna valutazione finora

- Second Midterm Solutions 2010 EconDocumento14 pagineSecond Midterm Solutions 2010 EconJordanVeroNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- CEFA Examination Syllabus 2021Documento30 pagineCEFA Examination Syllabus 2021Erico Cortez Fioravante AgnelloNessuna valutazione finora

- Fin622 Solved Mcqs For Exam PreparationDocumento9 pagineFin622 Solved Mcqs For Exam PreparationLareb ShaikhNessuna valutazione finora

- Weighted Average Cost of Capital (WACCDocumento19 pagineWeighted Average Cost of Capital (WACCFahad AliNessuna valutazione finora

- Barcap Global Inflation Linked Products 2010Documento312 pagineBarcap Global Inflation Linked Products 2010linxu124Nessuna valutazione finora

- Treasury ManagementDocumento48 pagineTreasury ManagementsukshithkNessuna valutazione finora

- Orca Share Media1518781277030Documento9 pagineOrca Share Media1518781277030Zach RiversNessuna valutazione finora

- Inflation Indexed Bonds.Documento81 pagineInflation Indexed Bonds.Mythili InnconNessuna valutazione finora

- Expected Return On A One-Year Bond With An Adjustment For Default ProbabilityDocumento83 pagineExpected Return On A One-Year Bond With An Adjustment For Default ProbabilitySyed Ameer Ali ShahNessuna valutazione finora

- Corporate Finance 5E 2020-1-2Documento2 pagineCorporate Finance 5E 2020-1-2Emanuele GennarelliNessuna valutazione finora

- Financial Management-Kings 2012Documento2 pagineFinancial Management-Kings 2012Suman KCNessuna valutazione finora

- Bhu Mba 2v Financial Management NotesDocumento248 pagineBhu Mba 2v Financial Management NotesJayanth Samavedam100% (1)

- RISK MANAGEMENT MCQSDocumento28 pagineRISK MANAGEMENT MCQSahamedd AhamedNessuna valutazione finora

- Quizlet - Corporate Finance Final ExamDocumento15 pagineQuizlet - Corporate Finance Final ExamGriselda de BruynNessuna valutazione finora

- Essentials of Investments 9Th Edition by Zvi Bodie Full ChapterDocumento41 pagineEssentials of Investments 9Th Edition by Zvi Bodie Full Chapteredward.wiggins427100% (27)

- The Blue Book of Real Estate SyndicationDocumento90 pagineThe Blue Book of Real Estate SyndicationLeague Assets91% (22)

- CFA Level 1 - Changes Outline 2024Documento27 pagineCFA Level 1 - Changes Outline 2024esha100% (1)

- September 30, 2021, Quarter-To-Date Statement: Do Not Use For Account Transactions PO BOX 3009 MONROE, WI 53566-8309Documento10 pagineSeptember 30, 2021, Quarter-To-Date Statement: Do Not Use For Account Transactions PO BOX 3009 MONROE, WI 53566-8309vagabondstar100% (1)

- Valuation ReportDocumento151 pagineValuation ReportHeba S. Al-saudi100% (1)

- What Moves Housing Markets - A Variance Decomposition of The Rent-Price RatioDocumento13 pagineWhat Moves Housing Markets - A Variance Decomposition of The Rent-Price RatioEdivaldo PaciênciaNessuna valutazione finora

- Understanding Financial Instrument Duration ConceptsDocumento24 pagineUnderstanding Financial Instrument Duration ConceptsFarhan MamasarayaNessuna valutazione finora

- Fin304 1midterm2Documento5 pagineFin304 1midterm2darkhuman343Nessuna valutazione finora

- S SA Saif SAR Saturns SB SBD SC Scap SCR SD SDD SDR SE Seaq SEC SED Sehk SEK SHP Siac SIC SimexDocumento64 pagineS SA Saif SAR Saturns SB SBD SC Scap SCR SD SDD SDR SE Seaq SEC SED Sehk SEK SHP Siac SIC SimexleenajaiswalNessuna valutazione finora

- 10 The Cost of Capital XXDocumento53 pagine10 The Cost of Capital XXAnonymous z6NCP5JlPnNessuna valutazione finora

- Convexity and Volatility PDFDocumento20 pagineConvexity and Volatility PDFcaxapNessuna valutazione finora

- Gitman Chapter11Documento20 pagineGitman Chapter11Hannah Jane UmbayNessuna valutazione finora

- Kotak Bank Edel 220118Documento19 pagineKotak Bank Edel 220118suprabhattNessuna valutazione finora

- Chap 010Documento16 pagineChap 010Xeniya Morozova KurmayevaNessuna valutazione finora

- Investment in Debt Securities Discussion With Investment in Bonds FvociDocumento17 pagineInvestment in Debt Securities Discussion With Investment in Bonds FvociKristine Kyle AgneNessuna valutazione finora

- TEST 5 PreparationDocumento8 pagineTEST 5 PreparationAna GloriaNessuna valutazione finora

- Financial Statement Analysis NestleDocumento16 pagineFinancial Statement Analysis NestleRialeeNessuna valutazione finora