Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Configure Automatic Postings

Caricato da

mkumarshahiCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Configure Automatic Postings

Caricato da

mkumarshahiCopyright:

Formati disponibili

Configure Automatic Postings

In this step, you enter the system settings for Inventory Management and Invoice Verification transactions

for automatic postings to G/L accounts. You can then check your settings using a simulation function.

Under Further information there is a list of transactions in Materials Management and their definitions.

What are automatic postings?

ostings are made to G/L accounts automatically in the case of Invoice Verification and Inventory

Management transactions relevant to !inancial and "ost #ccounting.

$%ample&

osting lines are created in the follo'ing accounts in the case of a goods issue for a cost center&

(tock account

"onsumption account

How does the system find the relevant accounts?

)hen entering the goods movement, the user does not have to enter a G/L account, since the $* system

automatically finds the accounts to 'hich postings are to +e made using the follo'ing data&

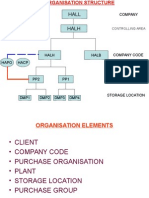

Chart of accounts of the company code

If the user enters a company code or a plant 'hen entering a transaction, the $* system

determines the chart of accounts 'hich is valid for the company code.

You must define the automatic account determination individually for each chart of accounts.

Valuation grouping code of the valuation area

If the automatic account determination 'ithin a chart of accounts is to run differently for certain

company codes or plants ,valuation areas-, assign different valuation grouping codes to these

valuation areas.

You must define the automatic account determination individually for every valuation grouping code

'ithin a chart of accounts. It applies to all valuation areas 'hich are assigned to this valuation

grouping code.

If the user enters a company code or a plant 'hen entering a transaction, the system determines

the valuation area and the valuation grouping code.

Transaction/event ey !internal processing ey"

osting transactions are predefined for those inventory management and invoice verification

transactions relevant to accounting. osting records, 'hich are generali.ed in the value string, are

assigned to each relevant movement type in inventory management and each transaction in

invoice verification. /hese contain keys for the relevant posting transaction ,for e%ample, inventory

posting and consumption posting- instead of actual G/L account num+ers.

You do not have to define these transaction keys, they are determined automatically from the

transaction ,invoice verification- or the movement type ,inventory management-. #ll you have to do

is assign the relevant G/L account to each posting transaction.

Account grouping ,only for offsetting entries, consignment lia+ilities, and price differences-

(ince the posting transaction 01ffsetting entry for inventory posting0 is used for different

transactions ,for e%ample, goods issue, scrapping, physical inventory-, 'hich are assigned to

different accounts ,for e%ample, consumption account, scrapping, e%pense/income from inventory

differences-, it is necessary to divide the posting transaction according to a further key& account

grouping code.

1

#n account grouping is assigned to each movement type in inventory management 'hich uses the

posting transaction 01ffsetting entry for inventory posting0.

Under the posting transaction 01ffsetting entry for inventory posting0, you must assign G/L

accounts for every account grouping, that is, assign G/L accounts.

If you 'ish to post price differences to different price difference accounts in the case of goods

receipts for purchase orders, goods receipts for orders, or other movements, you can define

different account grouping codes for the transaction key.

Using the account grouping, you can also have different accounts for consignment lia+ilities and

pipeline lia+ilities.

Valuation class of material or !in case of split valuation" the valuation type

/he valuation class allo's you to define automatic account determination that is dependent on the

material. for e%ample& you post a goods receipt of a ra' material to a different stock account than if

the goods receipt 'ere for trading goods, even though the user enters the same transaction for

+oth materials.

You can achieve this +y assigning different valuation classes to the materials and +y assigning

different G/L accounts to the posting transaction for every valuation class.

If you do not 'ant to differentiate according to valuation classes you do not have to maintain a

valuation class for a transaction.

#e$uirements

2efore you maintain automatic postings, you must o+tain the follo'ing information&

3. Valuation level , plant or company code-

$sta+lish 'hether the materials are valuated at plant or at company code level

)hen valuation is at plant level, the valuation area corresponds to a plant.

)hen valuation is at company code level, the valuation area corresponds to a company code.

%efine valuation level

4. "hart of accounts and valuation grouping code per valuation area

!ind out 'hether the valuation grouping code is active.

Activate split valuation

If it is not active, determine the chart of accounts assigned to each valuation area ,via the company

code-.

If it is active, determine the chart of accounts and the valuation grouping code assigned to each

valuation area.

&roup valuation areas

You must define a separate account determination process for chart of accounts and each

valuation grouping code.

5. Valuation class per material type

If you 'ish to differentiate the account determination process for specific transactions according to

valuation classes, find out 'hich valuation classes are possi+le for each material type.

%efine valuation classes

6. #ccount grouping for offsetting entries to stock accounts

Under %efine account grouping for movement types, determine for 'hich movement types an

account grouping is defined for the transaction/event keys GG2 ,offsetting entry to stock posting-,

718 ,consignment lia+ilities- and *9 ,price differences-.

%efault settings

G/L account assignments for the charts of accounts '(T and the valuation grouping code )))* are (#

standard.

Activities

3. "reate account keys for each chart of accounts and each valuation grouping code for the

individual posting transactions. /o do so, proceed as follo's&

a- "all up the activity Configure Automatic Postings.

2

/he $* system first checks 'hether the valuation areas are correctly maintained. If, for

e%ample, a plant is not assigned to a company code, a dialog +o% and an error message

appear.

!rom this +o%, choose Continue ,ne%t entry- to continue the check.

"hoose Cancel to end the check.

/he configuration menu Automatic postings appears.

+- "hoose Goto -> Account assignment.

# list of posting transactions in Materials Management appears. !or further details of the

individual transactions, see Further information.

The Account determination indicator sho's 'hether automatic account determination is

defined for a transaction.

c- "hoose a posting transaction.

# +o% appears for the first posting transaction. :ere you can enter a chart of accounts.

You can enter the follo'ing data for each transaction&

o *ules for account num+er assignments

)ith Goto -> Rules you can enter the factors on 'hich the account num+er assignments

depend&

; de+it/credit indicator

; general grouping ,< account grouping-

; valuation grouping

; valuation class

o osting keys for the posting lines

8ormally you do not have to change the posting keys. If you 'ish to use ne' posting

keys, you have to define them in the "ustomi.ing system of !inancial #ccounting.

o #ccount num+er assignments

You must assign G/L accounts for each transaction/event key ,e%cept 72(-. You can

assign these accounts manually or copy them from another chart of accounts via Edit ->

Copy.

If you 'ant to differentiate posting transactions ,e.g. inventory postings- according to

valuation classes, you must make an account assignment for each valuation class.

Using the posting transaction 01ffsetting entry for inventory posting0, you have to make an

account assignment for each account grouping

If the transaction *9 ,price differences- is also dependent on the account grouping, you

must create three account assignments&

; an account assignment 'ithout account grouping

; an account assignment 'ith account grouping *!

; an account assignment 'ith account grouping *#

If the transaction 718 ,consignment and pipeline lia+ilities- is also dependent on the

account grouping, you must create t'o account assignments&

; an account assignment 'ithout account grouping ,consignment-

; an account assignment 'ith account grouping ,pipeline-

d- (ave your settings.

4. /hen check your settings 'ith the simulation function.

)ith the simulation function, you can simulate the follo'ing&

o Inventory Management transactions

o Invoice Verification transactions

)hen you enter a material or valuation class, the $* system determines the G/L accounts 'hich

are assigned to the corresponding posting transactions. 9epending on the configuration, the (#

system checks 'hether the G/L account e%ists

In the simulation you can compare the field selection of the movement type 'ith that of the

individual accounts and make any corrections.

If you 'ant to print the simulation, choose Simulation ;= Report.

/o carry out the simulation, proceed as follo's&

a- "hoose Settings to check the simulation defaults for

; the application area ,Invoice Verification or Inventory Management-

3

; the input mode ,material or valuation class-

; account assignment

'nstructions

+- "hoose Goto -> Simulation.

/he screen for entering simulation data appears.

c- 9epending on the valuation level, enter a plant or a company code on the screen.

d- )hen you simulate Inventory Management transactions, goods movements are

simulated. /he $* system suggests the first movement type for simulation. If several

movements are possi+le 'ith this movement type, you can select a line.

)hen you simulate Invoice Verification transactions, a list appears on the screen of the

possi+le transaction types. (elect a line.

e- /hen choose Goto -> Account assignments.

# list appears of the posting lines 'hich can +e created +y the selected transaction. !or

each posting line, the G/L account for the de+it posting as 'ell as the G/L account for the

credit posting are displayed.

f- !rom this screen, choose Goto -> Movement+ to get a list of the posting lines for the

ne%t movement type or transaction type.

If you 'ork 'ith valuation classes, choose Goto -> Valuation class+ to receive the

simulation for the ne%t valuation class. /his function is not possi+le 'hen simulating 'ith

material num+ers.

"hoose Goto -> Chec screen layout to compare the movement type 'ith the G/L

accounts determined +y the system and make any necessary corrections.

(ote

/he simulation function does 81/ o+viate the need for a trial posting>

Further notes

/he follo'ing list sho's the individual transactions 'ith e%amples of ho' they are used. /he

transaction/event key is specified in +rackets.

+,pense/revenue from consumption of consignment material !A-."

/his transaction is used in Inventory Management in the case of 'ithdra'als from consignment

stock or 'hen consignment stock is transferred to o'n stock if the material is su+?ect to standard

price control and the consignment price differs from the standard price.

+,penditure/income from transfer posting !A/0"

/his transaction is used for transfer postings from one material to another if the complete value of

the issuing material cannot +e posted to the value of the receiving material. /his applies +oth to

materials 'ith standard price control and to materials 'ith moving average price control. rice

differences can arise for materials 'ith moving average price if stock levels are negative and the

stock value +ecomes unrealistic as a result of the posting. /ransaction #UM can +e used

irrespective of 'hether the transfer posting involves a transfer +et'een plants. /he

e%penditure/income is added to the receiving material.

/he re+ate income generated in the course of 0su+se@uent settlement0 ,end;of;period re+ate

settlement- is posted via this transaction.

1upplementary entry for stoc !21%"

/his account is posted 'hen closing entries are made for a cumulation run. /his account is a

supplementary account to the stock accountA that is, the stock account is added to it to determine

the stock value that 'as calculated via the cumulation. In the process, the various valuation areas

,for e%ample, commercial, ta%-, that are used in the +alance sheet are ta%ed separately.

Change in stoc !21V"

4

"hanges in stocks are posted in Inventory Management at the time goods receipts are recorded or

su+se@uent ad?ustments made 'ith regard to su+contract orders.

If the account assigned here is defined as a cost element, you must specify a preliminary account

assignment for the account in the ta+le of automatic account assignment specification ,"ustomi.ing

for "ontrolling- in order to +e a+le to post goods receipts against su+contract orders. In the

standard system, cost center (";3 is defined for this purpose.

1toc posting !213"

/his transaction is used for all postings to stock accounts. (uch postings are effected, for e%ample&

In inventory management in the case of goods receipts to o'n stock and goods issues from

o'n stock

In invoice verification, if price differences occur in connection 'ith incoming invoices for

materials valuated at moving average price and there is ade@uate stock coverage

In order settlement, if the order is assigned to a material 'ith moving average price and the

actual costs at the time of settlement vary from the actual costs at the time of goods

receipt

2ecause this transaction is dependent on the valuation class, it is possi+le to manage materials

'ith different valuation classes in separate stock accounts.

Caution

/ake care to ensure that&

# stock account is not used for any transaction other than 2(B

ostings are not made to the account manually

/he account is not changed in the productive system +efore all stock has +een +ooked out of it

1ther'ise differences 'ould arise +et'een the total stock value of the material master records and

the +alance on the stock account.

Purchase account!+'("4 purchase offsetting account !+-&"4 freight purchase account !F#+"

/hese transactions are used only if Purchase Account 0anagement is active in the company

code.

(ote

9ue to special legal re@uirements, this function 'as developed specially for certain countries

,2elgium, (pain, ortugal, !rance, Italy, and !inland-.

2efore you use this function, check 'hether you need to use it in your country.

Freight clearing !F#*"4 provision for freight charges !F#5"4 customs duty clearing !F#6"4

provision for customs duty !F#7"

/hese transactions are used to post delivery costs ,incidental procurement costs- in the case of

goods receipts against purchase orders and incoming invoices. )hich transaction is used for 'hich

delivery costs depends on the condition types defined in the purchase order.

You can also enter your o'n transactions for delivery costs in condition types.

+,ternal service !F#8"

/he transaction is used for goods and invoice receipts in connection 'ith su+contract orders.

5

If the account assigned here is defined as a cost element, you must specify a preliminary account

assignment for the account in the ta+le of automatic account assignment specification ,"ustomi.ing

for "ontrolling- in order to +e a+le to post goods receipts against su+contract orders. In the

standard system, cost center (";3 is defined for this purpose.

+,ternal service4 delivery costs !F#("

/his transaction is used for delivery costs ,incidental costs of procurement- in connection 'ith

su+contract orders.

If the account assigned here is defined as a cost element, you must specify a preliminary account

assignment for the account in the ta+le of automatic account assignment specification ,"ustomi.ing

for "ontrolling- in order to +e a+le to post goods receipts against su+contract orders. In the

standard system, cost center (";3 is defined for this purpose.

.ffsetting entry for stoc posting !&22"

1ffsetting entries for stock postings are used in Inventory Management. /hey are dependent on the

account grouping to 'hich each movement type is assigned. /he follo'ing account groupings are

defined in the standard system&

o #U#& for order settlement

#U!& for goods receipts for orders ,'ithout account assignment-

and for order settlement if #U# is not maintained

#UI& (u+se@uent ad?ustment of actual price from cost center directly

to material ,'ith account assignment-

2(#& for initial entry of stock +alances

o I8V& for e%penditure/income from inventory differences

o V#B& for goods issues for sales orders 'ithout

account assignment o+?ect ,the account is not a cost element-

o V#Y& for goods issues for sales orders 'ith

account assignment o+?ect ,account is a cost element-

o V21& for consumption from stock of material provided to vendor

o V2*& for internal goods issues ,for e%ample, for cost center-

o V7#& for sales order account assignment

,for e%ample, for individual purchase order-

V7& for pro?ect account assignment ,for e%ample, for individual 1-

V8G& for scrapping/destruction

VC& for sample 'ithdra'als 'ithout account assignment

o VCY& for sample 'ithdra'als 'ith account assignment

o D12& for goods receipts 'ithout purchase orders ,mvt type EF3-

o D1!& for goods receipts 'ithout production orders

,mvt types E43 and E53-

6

You can also define your o'n account groupings. If you intend to post goods issues for cost

centers ,mvt type 4F3- and goods issues for orders ,mvt type 4G3- to separate consumption

accounts, you can assign the account grouping DDD to movement type 4F3 and account grouping

YYY to movement type 4G3.

Caution

If you use goods receipts 'ithout a purchase order in your system ,movement type EF3-, you have

to check to 'hich accounts the account groupings are assigned 9.2

If you e%pect invoices for the goods receipts, and these invoices can only +e posted in #ccounting,

you can enter a clearing account ,similar to a G*/I* clearing account though 'ithout open item

management-, 'hich is cleared in #ccounting 'hen you post the vendor invoice.

8ote that the goods movement is valuated 'ith the valuation price of the material if no e%ternal

amount has +een entered.

#s no account assignment has +een entered in the standard system, the assigned account is not

defined as a cost element. If you assign a cost element, you have to enter an account assignment

via the field selection or maintain an automatic account assignment for the cost element.

Account determination of valuated sales order stoc and pro:ect stoc

8ote that for valuated sales order stock and pro?ect stock ,special stock $ and C- and for the

transaction/event keys 213 and &22, you must maintain an account determination to avoid

receiving 'arning messages 'hen entering data ,purchase order or transfer posting- for valuated

stock.

9uring data entry, the system attempts to e%ecute a provisional account determination for G22 for

valuated stock. /he system 'ill only replace the provisional account determination for G22 'ith the

correct account determination for the stock account ,2(B-, in the +ackground, if you enter the data

for valuated stock at a later point in time.

Purchase order with account assignment !-21"

You cannot assign this transaction/event key to an account. It means that the account assignment

is adopted from the purchase order and is used for the purpose of determining the posting keys for

the goods receipt.

+,change #ate %ifferences 0aterials 0anagement!AV#" !-%&"

)hen you carry out a revaluation of single;level consumption in the material ledger for an

alternative valuation run, the e%change rate difference accounts of the materials are credited 'ith

the e%change rate differences that are to +e assigned to the consumption.

+,change rate differences in the case of open items !-%0"

$%change rate differences in the case of open items arise 'hen an invoice relating to a purchase

order is posted 'ith a different e%change rate to that of the goods receipt and the material cannot

+e de+ited or credited due to standard price control or stock undercoverage/shortage.

%ifferences due to e,change rate rounding4 0aterials 0anagement !-%#"

#n e%change rate rounding difference can arise in the case of an invoice made out in a foreign

currency. If a difference arises 'hen the posting lines are translated into local currency ,as a result

of rounding-, the system automatically generates a posting line for this rounding difference.

+,change #ate %ifferences from 8ower 8evels !-%V"

In multi;level periodic settlement in the material ledger, some of the e%change rate differences that

have +een posted during the period in respect of the ra' materials, semifinished products and cost

centers performing the activity used in the manufacture of a semifinished or finished product are

de+ited or credited to that semifinished or finished product.

Consignment lia;ilities !-.("

"onsignment lia+ilities arise in the case of 'ithdra'als from consignment stock or from a pipeline

or 'hen consignment stock is transferred to o'n stock.

9epending on the settings for the posting rules for the transaction/event key 718, it is possi+le to

'ork 'ith or 'ithout account modification. If you 'ork 'ith account modification, the follo'ing

modifications are availa+le in the standard system&

7

o 8one for consignment lia+ilities

o I for pipeline lia+ilities

Price differences !P#%"

rice differences arise for materials valuated at standard price in the case of all movements and

invoices 'ith a value that differs from the standard price. $%amples& goods receipts against

purchase orders ,if the 1 price differs from the standard pricedardpreis-, goods issues in respect

of 'hich an e%ternal amount is entered, invoices ,if the invoice price differs from the 1 price and

the standard price-.

rice differences can also arise in the case of materials 'ith moving average price if there is not

enough stock to cover the invoiced @uantity. In the case of goods movements in the negative

range, the moving average price is not changed. Instead, any price differences arising are posted

to a price difference account.

9epending on the settings for the posting rules for transaction/event key *9, it is possi+le to 'ork

'ith or 'ithout account modification. If you use account modification, the follo'ing modifications

are availa+le in the standard system&

o 8one for goods and invoice receipts against purchase orders

o *! for goods receipts against production orders and

order settlement

o *# for goods issues and other movements

o *U for transfer postings ,price differences in the case

of e%ternal amounts-

'nvoice reductions in 8ogistics 'nvoice Verification !#-A"

/his transaction/event key is used in Logistics Invoice Verification for the interim posting of price

differences in the case of invoice reductions.

If a vendor invoice is reduced, t'o accounting documents are automatically created for the invoice

document. )ith the first accounting document, the amount invoiced is posted in the vendor line. #n

additional line is generated on the invoice reduction account to partially offset this amount. )ith the

second accounting document, the invoice reduction is posted in the form of a credit memo from the

vendor. /he offsetting entry to the vendor line is the invoice reduction account. :ence the invoice

reduction account is al'ays +alanced off +y t'o accounting documents 'ithin one transaction.

#evenue/e,pense from revaluation !/02"

/his transaction/event key is used +oth in Inventory Management and in Invoice Verification if the

standard price of a material has +een changed and a movement or an invoice is posted to the

previous period ,at the previous price-.

+,penditure/income from revaluation !/0%"

/his account is the offsetting account for the 2(9 account. It is posted during the closing entries for

the cumulation run of the material ledger and has to +e defined for the same valuation areas.

/nplanned delivery costs !/PF"

Unplanned delivery costs are delivery costs ,incidental procurement costs- that 'ere not planned in

a purchase order ,e.g. freight, customs duty-. In the (# posting transaction in Logistics Invoice

Verification, instead of distri+uting these unplanned delivery costs among all invoice items as

hitherto, you have the option of posting them to a special account. # separate ta% code can +e used

for this account.

8

'nput ta,4 Purchasing !V1T"

/ransaction/event key for ta% account determination 'ithin the 0su+se@uent settlement0 facility for

de+it;side settlement types. /he key is needed in the settlement schema for ta% conditions.

.

&#/'# clearing !W#3"

ostings to the G*/I* clearing account occur in the case of goods and invoice receipts against

purchase orders. !or more on the G*/I* clearing account, refer to the (# Li+rary ,documentation

00 0aterial Valuation-.

Caution

You must set the 2alances in local currency only indicator for the G*/I* clearing account to

ena+le the open items to +e cleared. !or more on this topic, see the field documentation.

9

Potrebbero piacerti anche

- Standard Sap Reports (SD & MM)Documento15 pagineStandard Sap Reports (SD & MM)Gaurav Harimitter50% (2)

- Pravin Kumar: Fareportal India PVT LTDDocumento4 paginePravin Kumar: Fareportal India PVT LTDmkumarshahiNessuna valutazione finora

- SRN RaviDocumento8 pagineSRN RavimkumarshahiNessuna valutazione finora

- Vendor Management Quick ReferenceDocumento2 pagineVendor Management Quick ReferenceAmbrish NigamNessuna valutazione finora

- Return Delevery. 122movDocumento9 pagineReturn Delevery. 122movmkumarshahiNessuna valutazione finora

- Ware ImpDocumento30 pagineWare ImpmkumarshahiNessuna valutazione finora

- BAAN ERP Project Implementation Manufacturing Process BARCODocumento1 paginaBAAN ERP Project Implementation Manufacturing Process BARCOmkumarshahiNessuna valutazione finora

- WordsDocumento4 pagineWordsmkumarshahiNessuna valutazione finora

- Return Delevery. 161MOVDocumento9 pagineReturn Delevery. 161MOVmkumarshahiNessuna valutazione finora

- Po ReleaseDocumento15 paginePo ReleasemkumarshahiNessuna valutazione finora

- Testing 300Documento11 pagineTesting 300mkumarshahiNessuna valutazione finora

- Return Delevery. 122movDocumento9 pagineReturn Delevery. 122movmkumarshahiNessuna valutazione finora

- Imp TablesDocumento60 pagineImp TablesmkumarshahiNessuna valutazione finora

- Org STR ModDocumento18 pagineOrg STR ModmkumarshahiNessuna valutazione finora

- ModifiedDocumento11 pagineModifiedmkumarshahiNessuna valutazione finora

- MM Questions for Master Data ConfigurationDocumento8 pagineMM Questions for Master Data ConfigurationmkumarshahiNessuna valutazione finora

- ModifiedDocumento11 pagineModifiedmkumarshahiNessuna valutazione finora

- Manpower Procurement ProcessDocumento2 pagineManpower Procurement ProcessmkumarshahiNessuna valutazione finora

- Procurement Process FlowDocumento2 pagineProcurement Process FlowmkumarshahiNessuna valutazione finora

- Sap ProcurementDocumento1 paginaSap ProcurementKalyan ChakravarthyNessuna valutazione finora

- KeysDocumento6 pagineKeysmkumarshahiNessuna valutazione finora

- KluDocumento17 pagineKlumkumarshahiNessuna valutazione finora

- Construction Procurement ProcessDocumento2 pagineConstruction Procurement ProcessmkumarshahiNessuna valutazione finora

- B. Spuida - Technical Writing Made EasierDocumento17 pagineB. Spuida - Technical Writing Made EasieraeloysNessuna valutazione finora

- The A-Z Medical WritingDocumento153 pagineThe A-Z Medical WritingNikhil Mali100% (2)

- Os ErrataDocumento2 pagineOs ErratamkumarshahiNessuna valutazione finora

- NachosDocumento16 pagineNachosmkumarshahiNessuna valutazione finora

- MachDocumento32 pagineMachmkumarshahiNessuna valutazione finora

- Computer Operating SystemDocumento8 pagineComputer Operating SystemDebabrata TrivediNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Fashion UK Germany Production Order FormDocumento12 pagineFashion UK Germany Production Order FormRashidul IslamNessuna valutazione finora

- A Revolutionary Gamble - Architecting The Boeing 747 Jumbo JetDocumento35 pagineA Revolutionary Gamble - Architecting The Boeing 747 Jumbo Jetanon_370706846Nessuna valutazione finora

- Audit of Inventory ProblemsDocumento2 pagineAudit of Inventory ProblemsZeeNessuna valutazione finora

- Oracle SCM Course ContentDocumento5 pagineOracle SCM Course ContentPoorna Chandra GaralapatiNessuna valutazione finora

- Lista de Empresas Activas Actualizadas PANAMADocumento8 pagineLista de Empresas Activas Actualizadas PANAMANazareth Onaixy CordidoNessuna valutazione finora

- Sale of Goods Act, 1930Documento28 pagineSale of Goods Act, 1930Vineeth GopalNessuna valutazione finora

- Carriage by Road ActDocumento22 pagineCarriage by Road ActPRADEEP MK100% (1)

- Gujarat Sea PortsDocumento46 pagineGujarat Sea PortsDivyang K Chhaya0% (1)

- VAT-Exempt Transactions Under TRAIN LawDocumento2 pagineVAT-Exempt Transactions Under TRAIN LawFabiano JoeyNessuna valutazione finora

- Lean Supply Chain & Logistics ManagementDocumento8 pagineLean Supply Chain & Logistics ManagementjosegarreraNessuna valutazione finora

- Linguistic Pecularities of Contracts in EnglishDocumento41 pagineLinguistic Pecularities of Contracts in EnglishMichael Zagorschi100% (1)

- International LogisticsDocumento9 pagineInternational Logisticsmvlg26Nessuna valutazione finora

- ACAFA Consignment SalesDocumento8 pagineACAFA Consignment SalesMerr Fe PainaganNessuna valutazione finora

- Tan Chiong V InchaustiDocumento17 pagineTan Chiong V InchaustiPat PatNessuna valutazione finora

- BHP-Vessel Nomination Guide PDFDocumento3 pagineBHP-Vessel Nomination Guide PDFPrashant BhardwajNessuna valutazione finora

- DuettoDocumento3 pagineDuettoAnonymous qR62w85eNessuna valutazione finora

- Fork Truck For - Paper Roll Press DeliveryDocumento1 paginaFork Truck For - Paper Roll Press Deliveryservice9046Nessuna valutazione finora

- Indian Business DatabasesDocumento66 pagineIndian Business DatabasesSunil JoshiNessuna valutazione finora

- IndiaMines International Iron Ore Fines Purchase Inquiry 63.5% FeDocumento2 pagineIndiaMines International Iron Ore Fines Purchase Inquiry 63.5% FePSNYCNessuna valutazione finora

- The Best Laid Incentive PlanDocumento6 pagineThe Best Laid Incentive Planamishaa13Nessuna valutazione finora

- SCM AssignmentDocumento7 pagineSCM AssignmentRahil singhNessuna valutazione finora

- That Execrable Sum of All Villainies, Commonly Called The Slave Trade.Documento17 pagineThat Execrable Sum of All Villainies, Commonly Called The Slave Trade.Sueli do Carmo OliveiraNessuna valutazione finora

- Warehousing and PurchasingDocumento49 pagineWarehousing and PurchasingIrene100% (1)

- Import Guidelines, Procedures and Documentation Requirements Under The Destination Inspection Scheme in NigeriaDocumento13 pagineImport Guidelines, Procedures and Documentation Requirements Under The Destination Inspection Scheme in Nigeriasonatrade100% (1)

- BailmentDocumento5 pagineBailmentRajeevNessuna valutazione finora

- Cement Contract SAMPLEDocumento16 pagineCement Contract SAMPLEsashka521100% (11)

- Armature NDocumento2 pagineArmature Nseeralan_1986Nessuna valutazione finora

- Supply-Chain-Control Tower PDFDocumento11 pagineSupply-Chain-Control Tower PDFRADHA1200% (1)

- 100 Kilograms Spot - 011814Documento7 pagine100 Kilograms Spot - 011814Jojo Aboyme CorcillesNessuna valutazione finora

- Logistics Industry: Make in IndiaDocumento4 pagineLogistics Industry: Make in IndiaSanthosh Chandran RNessuna valutazione finora