Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Amalgamation and Joint Venture

Caricato da

lubzmerchant0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

179 visualizzazioni15 paginemcom part I sem I project on amalgamation and joint venture of companies

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentomcom part I sem I project on amalgamation and joint venture of companies

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

179 visualizzazioni15 pagineAmalgamation and Joint Venture

Caricato da

lubzmerchantmcom part I sem I project on amalgamation and joint venture of companies

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 15

ACKNOWLEDGEMENT

I take this opportunity to express my gratitude to all those who

encouraged and guided me in completing my present research work.

First and foremost, I would like to thank Dr. K.P.S. Mahalwar, Head and

Dean, Faculty of Law, M .D. University, Rohtak, who is my supervisor, for his

valuable guidance, constructive help and whole hearted support given to me

from time to time during my research work.

I am also thankful to all the faculty members, for their valuable advice

and support in completing my thesis.

I have no words to express my gratitude for the valuable guidance by

my father, Shri Satish Kumar and by my mother Smt. Kamlesh, who helped me

a lot in choosing subject to complete research work. When I decided to join the

research work, they encouraged me to join the research work from this

esteemed University.

Apart from the, above I would like to thank all my colleagues and

Library Staff of my University who have helped me a lot and cooperated me in

providing relevant books and material from time to time.

It would be unjust if I fail to express my gratefulness to my younger

brother Nishant and my husband Mr. Nitesh Sandhu and my son Gunaditya

who inspired me a lot and assisted me in writing this thesis without their

cooperation, it was not possible to complete this work.

Place : Rohtak (Komal)

Date :

AMALGAMATION OF COMPANY IN INDIA

INTRODUCTION

Amalgamation is defined as a simple arrangement or reconstruction of business. It is a

process that involves combining of two or more companies as either absorption or as blend.

Two or more companies can either be absorbed by an entirely new firm or a subsidiary

powered by one of the basic firm. In such cases all the shareholders of the absorbed

company automatically become the shareholders of the ruling company as the amalgamating

company loses its existence. All the assets and liabilities are also transferred to the new

entity.

Amalgamation has given different forms to different actions in due course of the merger

taking place. It can either be classified in the nature of merger or in the nature of purchase. If

the process takes place in the nature of merger then the all assets, liabilities, and

shareholders holding not less than 90% of equity shares are automatically transferred to the

new company or the holding company by virtue of the amalgamation.

When amalgamation takes place in nature of purchase then the assets and liabilities of the

company are taken over by the ruling company. All the properties and characteristics of

amalgamating company should vest with the other company. Even the shareholders holding

shares not less than 75% should transfer their shares to the transferee company. In such a

case any company does not purchase the business resulting in a takeover, the transferor

company does not completely lose its existence.

Normally, there are two types of amalgamations. The first one is similar to a merger where all

the assets and liabilities and shareholders of the amalgamating companies are combined

together. The accounting treatment is done using the pooling of interests method. It involves

laying down a standard accounting policy for all the companies and then adding their relevant

accounting figures like capital reserve, machinery, etc. to arrive at revised figures.

The second type of amalgamation involves acquisition of one company by another company.

In this, the shareholders of the acquired company may not have the same equity rights as

earlier, or the business of the acquired company may be discontinued. This is like a purchase

of a business. The accounting treatment is done using a purchase method. It involves

recording assets and liabilities at their existing values or revaluating them on the basis of

their fair values at the time of amalgamation

AMALGAMATION GROUP

COMPANY PROFILE

The Amalgamations seed was sown in 1938 with one man's vision for a prosperous, industrialised India. Shri. S.

Anantharamakrishnan, or J as he was fondly known as, was a visionary who dared challenge the impediments

to India's Industrial future. He pioneered many ventures and spearheaded the quest for sourcing the finest

technologies in the world.

The Amalgamations saga was born when it took over the 100 year old Simpsons in 1941. Amalgamations soon

brought under its shade some of the oldest companies in Southern India like Higginbothams, Associated Printers,

Associated Publishers, Addison & Co., SRVS, George Oakes, T.Stanes, The United Nilgiri Tea Estates and

Stanes Amalgamated Estates.

From the mid 1950s, the auto component manufacturing companies of the Group have worked with practically

every major OEM in the country, to bolster their import substitution requirements. Strong collaborations with

international market leaders have influenced the technology advancements. These, combined with technological

innovations and strong initiatives on new product development, have contributed substantially to a strong equity

in the After-markets as well, ably supported by vibrant national distribution networks. The Group's overseas

presence and distribution have over time, moved from strength to strength.

The Group's R&D facilities have focused on proactive product development and have cemented a strong base in

the domestic and overseas markets. In fact, several of the Group Companies have obtained ISO, QS, TS and

other international certifications for quality and environmental management systems.

As a business philosophy, the Group companies maintain their leadership status by focusing on new generation

technologies. A carefully calibrated strategy of the product-market matrix has enabled sharp focus on the product

range, R&D capabilities and new technologies, besides sales and distribution. These initiatives have enabled the

Group to build a sound technology platform, with strong in-house capabilities.

Today, the Group is one of India's largest Light Engineering Conglomerates It has 47 companies and 50

manufacturing plants with presence in Manufacturing, Trading & Distribution, Plantations and Services.

DEFINATIONS OF AMALGAMATION

Amalgamation

Nowhere in the Companies Act is the term amalgamation defined. It is said to be a

term of art without any clear or precise legal meaning. However Halsbury has

attempted a definition which reads, Amalgamation is the blending of two or more

existing undertaking into one undertaking with the shareholder of each blending

company becoming substantially the shareholders in the company which is to carry

on the blended undertakings14

.

Weinberg defines Amalgamation in his book on the Takeovers and

Amalgamations 2nd edition as, ...an arrangement whereby the assets of two

companies become vested in or under the control of one company (which may or

may not be one of the original companies) which has its two shareholders all or

substantially all the shareholders of the two companies. In essence under a merger

two or more companies are merged either de-jure by consolidation of their

undertakings or de-facto by the acquisition of a controlling interest in the share

capital of one by the other or of the capital of both by a new company. This is the

view of Gower.

15

According to Mitras Legal and Commercial Dictionary the term amalgamation

means merger16

.

14 Halsbury Laws, Third Edition, Vol. 6, Pg.764

15 Gower, Principles of Modern Company Law, Third edition, Pg. 61

16 Mitras Legal and Commercial Dictionary as quoted.6

According to Websters Dictionary amalgamation means to compound, consolidate

or combine the interest of firms.

Oxford Economic Papers defines amalgamation as uniting of two companies, the

shareholders in each unit emerging as shareholders in the resultant organization. The

companies are often of similar size. Thus, the success of the consumer co-operative

movement depends upon the extent to which the smaller units are amalgamated with

similar neighbouring primary consumers stores to secure the benefits of economics

of scale and provide diversified services to cater to the tastes and needs of

consumers.17

According to the Concise Law Dictionary it means merging of two or more business

concerns into one.

The English Oxford Dictionary defines amalgamation as combining to form a new

corporate or structure.

There may be amalgamations either by the transfer of two or more undertakings to

a new company or by the transfer of two or more undertakings to an existing

company

18

.

The meaning of the term given in Section 2 (1B) of Income Tax Act, 1961 which

has peculiar characteristics to be found in a transaction to be covered under the

definition due to a) vesting of all properties of amalgamating company in the

amalgamated company, b) vesting of all liabilities of amalgamating company in the

amalgamated company and c) the shareholder of the amalgamating company

holding not less that 90% of the shares should become shareholders of the

amalgamated company19

.

In Heavy Head and co-Vs. Roprer Holdings Ltd., it is stated that, The effect of an

arrangement would be one of the companies involved to absorb the business and all

17 Acquisition Objectives and Policies, Oxford Economic Papers, Vol.49, No.3, July 1997.

18 Magnus & Estrin, Companies Law and Practice, Fourteenth Edition, Pg. 216

19 Section 2(1B) Income Tax Act, 1961, 7

assets and liabilities of the other, the latter being then dissolved, or alternatively,

both companies might be absorbed into a new company formed for that purpose.20

Not only this the Andhra Pradesh High Court held in S.S. Somajulu vs. Hope

Pradhomme and Co,21 that the word amalgamation has no definite legal meaning. It

contemplates a state of things under which tow companies are so joined as to form a

third entity or one company is absorbed or blended with another company.

Amalgamation doesnt involve a formation of new company to carry on the business

of old company.

According to S.C. Sen the term amalgamation which is used in relation to companies

has no technical meaning and thus falls on one or other of the following heads (a)

Transfer of undertaking of an existing company to another existing company, of

which all the members of the transferring company become members, and the

subsequent dissolution of the transferring company. (b) The transfer of undertaking

of two or more existing companies to a new company formed to takeover the same,

of which all the members of the transferring company become or have the right to

become members, and the subsequent dissolution of transferring company. (c) the

acquisition by one company of the whole of or a controlling interest in the shares of

another company. S.Shiva Ramu has given similar definition for the

merger/amalgamation. He defines in amalgamation a new corporation is created by

uniting companies voluntarily.

According to Brookfields Lawyers Commercial Tax an amalgamation involves the

blending of business of one company with the business of one or more companies to

form an amalgamated company. Shareholders of each blending company become the

shareholders in the amalgamated company. The result of amalgamation is that each

of the amalgamated company ceases to exist. If company A amalgamates with

company B and Company A is the amalgamated company, company A survives

and company B doesnt. Alternatively, it might be desirable to establish a new

company. Company C, to be the amalgamated (surviving) company to which the

20 Hooper vs. Western Countries and South Western Telephone Co., 41 WR 84 (PC).

21 (1963) 2 Comp. LJ 61(AP) 8

business of company A and company B are to be transferred. In that case both

companies A and B would strike off and ceases to exist.22 Their business would

continue to operate through company C.

After all these definitions a new question arises. Are amalgamations and mergers

synonymous?

Very often, the two expressions Merger and amalgamation are taken as

synonymous but in fact, a difference, merger is a restricted to a case where the assets

and liabilities of the companies get vested in another company, the company which

is merged losing its identity and its shareholders becoming shareholders of other

company. On the other hand, amalgamation is an arrangement, whereby the assets

and liabilities of two or more companies become vested in another company (Which

may or may not be one of the original companies) and which would have as its

shareholders substantially, all the shareholder of the amalgamating companies.

It is submitted that they are not. Merger is the whole of which amalgamations is a

part. When companies coalesce or firms unite in some form the result is variously

described as an absorption, amalgamation, fusion, merger, or takeover.

Although the word amalgamation is commonly used by businessmen, of recent, the

word merger has been preferred because it covers a wide range of ways and means

by which the union is achieved23

.

To Weston24 merger covers acquisitions, absorptions, amalgamations and

combinations. There for the reader is advised that the term merger used in this and

subsequent chapters includes amalgamations in absence of specific reference of the

term amalgamation.

Mergers or amalgamations result in the combination of two or more companies into

one, wherein the merging entities lose their identities. No fresh investment is made

through this process. However an exchange of shares takes place between the

22 Brookfields Lawyers, Tax Issues Merger and Acquisition, Brookfields Lawyers-Commercial/Tax,

2002, Pg.57.

23 Ronald W Moon, Business Mergers and Takeovers,

24 JF Weston, Role of Mergers in Growth of Large Firms, , Pg.59

entities involved in such a process. Generally, the company that survives is the buyer

which retains its identity and the seller company is extinguished.

A merger can also be defined as an amalgamation if all assets and liabilities of one

company are transferred to the transferee company in consideration of payment in

the form of equity shares of the transferee company or debentures or cash or a mix

of above modes of payment

Reasons and motivations for merger and acquisitions:

Companies undertake merger and acquisition to achieve certain strategic and

financial objectives. In modern finance the shareholder wealth maximisation theory

and managerial utility theory is being considered as a rational criterion as to what

fundamentally derives acquisitions and mergers.

Merger and acquisitions are caused with the support of shareholders, managers and

promoters of combining companies. The factors which motivate shareholders,

managers and promoters to lend support to these combinations can be summarised

as follows:

cost per unit is decreased through increased production.

company will be absorbing the major competitor and thus increase its to set

prices.

a stock broker can sign up the

bank customers for brokerage account.

form of revenue enhancement and cost savings.

s tax right off i.e.

wherein a sick company is bought by giants.

results of a company, which over the long term smoothens the stock price of

the company giving conservative investors more confidence in investing in

the company. However, this does not always deliver value to shareholders..

From the viewpoint of the shareholders

It is based on the shareholders wealth maximisation theory that means a firms

decision or merger of acquisition should be based on the objective of maximising the

wealth of shareholders of the firm. This approach hypotheses that managers try to

pursue those mergers and acquisition activities which offer positive net present

value. The basic pattern of merger and acquisition activities is that the divesting

company moves from a diversifying strategy to concentrate on core activities in

order to increase competitiveness. Both patterns are based on an attempt to create

value for the shareholders.

Management buyouts help to restructure the firms, resulting in a realignment of the

interests of the shareholders and managers. Managements buyouts provide incentive

to managers (who are shareholders themselves) to maximised shareholding. The

shareholder wealth maximised criterion is satisfied when the added value created by

acquisition exceeds the cost of acquisition.

Added value from acquisition = value of acquirer and acquired after acquisition

their aggregate value before

Increase in acquirer share value = added value cost of acquisition

Cost of acquisition = acquisition transaction cast acquisition premium

Acquisition transaction cost is incurred when an acquisition is made, in the form of

various advisers fees like the stock exchange fees, cost of underwriting, regulators

fees. The acquisition premium is the excess of offer price paid to the target over the

target pre-bid-price and is also known as the control premium. Then investment

made by the shareholders in the companies subject to merger should enhance in

value. Shareholders may gain from mergers in different ways viz. from the gains and

achievements of the company through:

Diversification of product line

stment opportunities in combination

RESEARCH

Title of the Thesis: A Study of Amalgamation of

Companies in India

Abstract:

Even though mergers and acquisitions (M & A) have been an important

element of corporate sector all over the world from several decades,

research on mergers and acquisitions has not been able to provide the

complete knowledge about legal framework of Amalgamation. There is

no conclusive evidence on whether they enhance efficiency or destroy

wealth. There is thus an ongoing global debate on the effects of mergers

and acquisitions on industries.

Though mergers and acquisitions have become common in India today

but, very little appears to be known about their procedure and the legal

angle in takeovers. Our study attempts to fill this gap in knowledge about

mergers and acquisitions in India. In my first chapter there is a detail

description about meaning and definition of amalgamation, merger,

acquisition as well as takeover, I have quoted different definition, given

by major legal dictionaries and definition given by philosopher and

writer. From the perception of business organizations, there is a whole

host of different mergers. However, from an economist point of view i.e.

based on the relationship between the two merging companies, mergers

are classified into following:

1. Horizontal merger.

2. Vertical merger.3. Circular merger

4. Conglomerate merger

5. Within stream merger

6. Diagonal

On the other hand acquisition will be classified as negotiated and

friendly, open market or hostile takeover and Bailout takeover.

In our Third Chapter legal provisions related to takeover and merger from

different Acts of India are discussed. Such as the procedure

amalgamations are given in section 390 to 395 of companies Act, 1956

which deals with arrangement, amalgamation and merger. Section 5 and 6

of Competition Act, 2002 deal with combinations which defines

combination by reference to assets and turnover exclusively in India and

outside India also. The Foreign Exchange Management Act, prescribes to

foreign entities. The Foreign Exchange Management (Transfer or issue of

security by a person residing out of India) Regulation, 2000 issued by

RBI vide GSR No. 406 (e) dated 3rd may, 2000. RBI also issued detailed

guidelines on foreign investment in India vide foreign direct investment

schemes contained in schedule I of said regulation. Major question arose

after Vodafone case in last year about income tax provisions related to

cross border mergers in industry. Section 2(1B) relating to Income Tax

Act provide condition to be followed in merger process for tax liabilities

on both companies. Stamp Act provision varies from state to state in

nowadays intellectual property related provisions also taken into

consideration at the time of amalgamation of companies.Fourth chapter brings out the comparative study

between USA, UK and

Indian legal provisions. In Fifth chapter emerging trends of mergers in the

new economic scenario have been discussed.

Indian Industry saw a spurt in outbound Merger and Acquisition in 2010

driving home the point that Indian companies are keen to make up for lost

time. The biggest transaction was Airtels $ 10.7 billion acquisition of

Zain Africa to explore new markets. The total Merger and Acquisition in

year 2010 was close to $ 50 billion mark across 623 transactions inching

towards the bench mark year of 2007.

Since liberalization, India has experienced a number of Hostile takeover

attempts. Hostile takeover of companies is a well known phenomenon in

corporate sphere. Since liberalization corporate takeover take two

forms friendly and hostile, takeover. In a friendly takeover, the

controlling group sells its controlling shares to another group of its own

accord. In a hostile takeover, an outside group launches a hostile attack to

take over the control of the company without the con-currence of existing

controlling group. This is normally done by means of an open offer for

purchase of equity shares from the shareholder of the target company.

Seventh chapter deals with various judgments related to different field of

mergers with a view to study the changing aspect in field of merger

activity. Now what kind of legal regime is suitable for India? Already

there are suitable FDI limits in various sectors. This implies the need to

look at the existing laws within the country. There are already certain

laws governing domestic mergers and there are certain tax benefits in

cases of mergers which are of a domestic nature. Suggestions related to betterment of working of mergers are

given in the concluding last

chapter.

After Foreign Direct Investment policies becoming more liberalized

Mergers, Acquisitions and alliance talks are growing and are growing

with an ever increasing cadence. They are no more limited to one

particular type of business. The list of past and anticipated mergers covers

every size and variety of business mergers are on the increase over the

whole marketplace, providing platforms for the small companies being

acquired by bigger ones. The basic reason behind mergers and

acquisitions is that organizations merge and form a single entity to

achieve economies of scale, widen their reach, acquire strategic skills,

and gain competitive advantage. In simple terminology, mergers are

considered as an important tool by companies for purpose of expanding

their operation and increasing their profits, which is faade depends on

the kind of companies being merged. Indian markets have witnessed

burgeoning trend in mergers which may be due to business consolidation

by large industrial houses, consolidation of business by multinationals

operating in India, increasing competition against imports and acquisition

activities. Therefore, it is ripe time for business houses and corporate to

watch the Indian market, and grab the opportunity

CASE STUDY

Cinemax India approves amalgamation of company with PVR Cinemax

India has informed BSE that the Board of Directors of the Company at its meeting held on June 15, 2013,

approved the amalgamation of Cinemax India Limited with PVR Limited. 1 0 0Google +0 0 Cinemax India Ltd

has informed BSE that the Board of Directors of the Company at its meeting held on June 15, 2013, approved the

amalgamation of Cinemax India Limited with PVR Limited.The Board of Directors of the Company, based on the

Joint valuers report received from Independent Valuers, M/s. Hari Bhakti & Co. and M/s. S.S.P.A. & Co. -

Chartered Accountants and further based on Fairness Opinion Report received from AXIS Capital, Category-I

Merchant Banker and as per the report received from the Audit Committee recommending the draft scheme

taking in to consideration inter-alia the aforesaid Valuation Reports, approved the Swap ratio i.e. for every 7

Equity Shares of face value of Rs. 5/- each of Cinemax India Limited, issue of 4 Equity Shares of face value of

Rs. 10/- each of PVR Limited. The Board of Directors also approved the Scheme of Amalgamation for the merger

of Cinemax India Limited with PVR Limited.Source : BSE

CASE STUDY

Vodafone Indias proposed amalgamation hits a roadblock

New Delhi: Vodafone India Ltds proposed amalgamation of its operating subsidiaries has hit a roadblock with

the department of telecommunications (DoT) ruling that the merged entity would have to sign an undertaking to

migrate to the new unified licence notified by the government last week. Analysts say this will be

disadvantageous to Vodafone as under the new norms it would have to pay for the spectrum it already owns,

weakening the case it is fighting against the Indian government. The DoT has termed Vodafones proposed

amalgamation a merger and acquisition (M&A) activity. Vodafone Mobile Service Ltd shall give an undertaking to

the effect that the merged entity shall migrate to UL (Unified Licence) regime and all licencees involved in the

merger and acquisition activity will migrate to UL regime, the DoT said in a 27 August letter to Vodafone in

response to its proposal for the amalgamation. Mint has reviewed the letter. A telecom operator has to migrate to

the new unified licence if it wants to offer a new service or its existing licence is expiring, or if it is a new entity

formed as a result of a merger or acquisition. Vodafone India operates through a number of subsidiary

companies including Vodafone East Ltd, Vodafone South Ltd, Vodafone Cellular Ltd, Vodafone Digilink Ltd,

Vodafone West Ltd and Vodafone Spacetel Ltd. The telco has proposed to merge the first four entities with

Vodafone Mobile Services and the last two with Vodafone Services Ltd. DoTs reply was in reference to letters by

Vodafone dated 12 and 18 July. Vodafone first proposed the amalgamation last year in connection with an initial

public offering (IPO) of its shares. It has since dropped the plan, citing weak market conditions, regulatory

uncertainty and the ongoing Rs.20,000 crore tax issue (including penalties and interest) being fought between its

parent company and the Indian government. Analysts said Vodafone will be against migrating to the new unified

licence at this time for a number of reasons. The biggest impact will be to the licence extension case that they

are fighting in the courts. Migrating to the unified licence would mean they would have to pay for the spectrum

they have. Their main argument in court is that the spectrum they have is already liberalized and, therefore, they

do not need to pay the market price for liberalizing it again, a Mumbai-based analyst with a multinational

brokerage said, requesting anonymity. The UL essentially delinks the licence from the spectrum and to migrate

they would have to pay for the spectrum and the licences separately, while the current UASL (unified access

services licences) were allotted to them with spectrum bundled, he added. The amalgamation is also necessary

for Vodafone Group Plc, the UK-based parent, to be able to increase its holding in its Indian units to 100%, but

this can be worked around, the analyst said. Also, crossholding restrictions in the new licence norms will require

Vodafone to sell its 9.9% stake in Bharti Airtel Ltd, Indias largest telecom services provider. DoT has also asked

the telco for a break-up of its foreign equity holdings for all the companies involved in the proposed

amalgamation. A Vodafone spokesperson declined to comment for this story. People familiar with the matter said

Vodafone had adopted a wait-and-watch stance given that the Telecom Regulatory Authority of India is working

on recommendations for M&As, spectrum trading and valuation, which will have an impact on the companys

plans for an IPO later and increasing investment by its parent. Last month, the government increased the foreign

direct investment (FDI) limit in telecom to 100%, from 74% earlier. Vodafone Group owns 74% in Vodafone India

and the remaining stake is held by the Piramal family (11%) and other Indian investors. Late last year,

Vodafones attempts for an amalgamation were hindered by the tax dispute with the Indian government.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- TTX Human Trafficking With ANSWERS For DavaoDocumento7 pagineTTX Human Trafficking With ANSWERS For DavaoVee DammeNessuna valutazione finora

- 09-01-13 Samaan V Zernik (SC087400) "Non Party" Bank of America Moldawsky Extortionist Notice of Non Opposition SDocumento14 pagine09-01-13 Samaan V Zernik (SC087400) "Non Party" Bank of America Moldawsky Extortionist Notice of Non Opposition SHuman Rights Alert - NGO (RA)Nessuna valutazione finora

- Bdo Cash It Easy RefDocumento2 pagineBdo Cash It Easy RefJC LampanoNessuna valutazione finora

- Business Plan V.3.1: Chiken & Beef BBQ RestaurantDocumento32 pagineBusiness Plan V.3.1: Chiken & Beef BBQ RestaurantMohd FirdausNessuna valutazione finora

- Online Auction: 377 Brookview Drive, Riverdale, Georgia 30274Documento2 pagineOnline Auction: 377 Brookview Drive, Riverdale, Georgia 30274AnandNessuna valutazione finora

- KMPDU Private Practice CBA EldoretDocumento57 pagineKMPDU Private Practice CBA Eldoretapi-175531574Nessuna valutazione finora

- The Procurement Law No. 26 (2005) PDFDocumento27 pagineThe Procurement Law No. 26 (2005) PDFAssouik NourddinNessuna valutazione finora

- Cibse Lighting LevelsDocumento3 pagineCibse Lighting LevelsmdeenkNessuna valutazione finora

- 169 - CIR v. Procter and GambleDocumento5 pagine169 - CIR v. Procter and GambleBanana100% (1)

- Allied Banking Corporation V BPIDocumento2 pagineAllied Banking Corporation V BPImenforever100% (3)

- Gun Control and Genocide - Mercyseat - Net-16Documento16 pagineGun Control and Genocide - Mercyseat - Net-16Keith Knight100% (2)

- Cruz v. IAC DigestDocumento1 paginaCruz v. IAC DigestFrancis GuinooNessuna valutazione finora

- Business EthicsDocumento178 pagineBusiness EthicsPeter KiarieNessuna valutazione finora

- Combinepdf PDFDocumento487 pagineCombinepdf PDFpiyushNessuna valutazione finora

- Lesson 4the Retraction Controversy of RizalDocumento4 pagineLesson 4the Retraction Controversy of RizalJayrico ArguellesNessuna valutazione finora

- Navarro Vs DomagtoyDocumento3 pagineNavarro Vs Domagtoykvisca_martinoNessuna valutazione finora

- New Income Tax Provisions On TDS and TCS On GoodsDocumento31 pagineNew Income Tax Provisions On TDS and TCS On Goodsऋषिपाल सिंहNessuna valutazione finora

- The Micronesia Institute Twenty-Year ReportDocumento39 pagineThe Micronesia Institute Twenty-Year ReportherondelleNessuna valutazione finora

- TM-9-2350-314-10-HR Μ109Α6Documento30 pagineTM-9-2350-314-10-HR Μ109Α6Thoukididis Thoukididou100% (1)

- Presentation 2Documento35 paginePresentation 2Ma. Elene MagdaraogNessuna valutazione finora

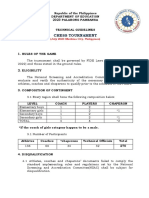

- CHESS TECHNICAL GUIDELINES FOR PALARO 2023 FinalDocumento14 pagineCHESS TECHNICAL GUIDELINES FOR PALARO 2023 FinalKaren Joy Dela Torre100% (1)

- People's Party (Interwar Romania)Documento19 paginePeople's Party (Interwar Romania)Valentin MateiNessuna valutazione finora

- Quick NSR FormatDocumento2 pagineQuick NSR FormatRossking GarciaNessuna valutazione finora

- ACTBFAR Unit 2 Partnership Part 3 Partnership Operations Study GuideDocumento3 pagineACTBFAR Unit 2 Partnership Part 3 Partnership Operations Study GuideMatthew Jalem PanaguitonNessuna valutazione finora

- Attendance 2022 2023Documento16 pagineAttendance 2022 2023Geralyn Corpuz MarianoNessuna valutazione finora

- Agra SocLeg Bar Q A (2013-1987)Documento17 pagineAgra SocLeg Bar Q A (2013-1987)Hiroshi Carlos100% (1)

- CLP Criminal Procedure - CourtDocumento15 pagineCLP Criminal Procedure - CourtVanila PeishanNessuna valutazione finora

- Annual Report 17-18Documento96 pagineAnnual Report 17-18Sajib Chandra RoyNessuna valutazione finora

- Information Assurance and Security II Lectures Quizzes and Activities Compress 1Documento26 pagineInformation Assurance and Security II Lectures Quizzes and Activities Compress 1Jireh SalinasNessuna valutazione finora

- Biography of The Chofetz ChaimDocumento2 pagineBiography of The Chofetz ChaimJavier Romero GonzalezNessuna valutazione finora