Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Role of Financial Market and Securities Market in Economic Growt1

Caricato da

Aparna RajasekharanCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Role of Financial Market and Securities Market in Economic Growt1

Caricato da

Aparna RajasekharanCopyright:

Formati disponibili

Securities Market and its Role in economic growth

A securities market is a place where the suppliers and users of capital meet to share one

anothers views, and where a balance is sought between diverse market participants. This is a

subset of financial market. It allows people to utilize their savings in a better manner as it

provides a linkage between the savings and the preferred investment across the entities by

channelizing them through securities into preferred enterprises. The securities market also

provides a market place for purchase and sale of securities and thereby ensures transferability of

securities, which is the basis for the joint stock enterprise system. It benefits both the enterprise

for capital and the investors for liquidity. The securities market enables a person to allocate his

savings among different enterprises as investments so as to diversify the risks among many

enterprises, which increases the likelihood of long term overall gains.

The securities market has two independent segments namely:

Primary market ( new issues) which provides the channel for the creation and sale of

new securities and and issued by public limited companies or by government agencies.

Secondary market (stock market) which deals with securities which are previously

issued and once issued in the primary market, it is traded in the stock market

Securities Market and Economic Growth

Savers and investors are not constrained by their individual capabilities, but enabled by the

economys capability to invest and save, which inevitably enhances savings and investments of

the economy. Thus the securities market converts a given stock of resources into a larger flow of

goods and services which augments the economic growth.

The securities market fosters economic growth to the extent it augments the quantities of real

savings and capital formation from a given level of national income and it raises productivity of

investment by improving allocation of investible funds. The extent depends on the quality of the

securities market. In order to improve the quality of the market, that is, to improve market

efficiency, enhance transparency, prevent unfair trade practices and bring the Indian market up to

international standards, a package of reforms consisting of measures to liberalize, regulate and

develop the securities market was implemented in 1990.

The securities market enlarges the financial sector, promoting additional and more sophisticated

financing; it increases opportunities for specialization, division of labour and reductions in costs

in financial activities. The securities market and its institutions help the user in many ways to

reduce the cost of capital. They provide a convenient market place to which investors and issuers

of securities go and thereby avoid the need to search a suitable counterpart. The market provides

standardized products and thereby cuts the information costs associated with individual

instruments.

There are also other developmental benefits associated with the existence of a securities market.

First, the securities market provides a fast-rate breeding ground for the skills and judgement

needed for entrepreneurship, risk bearing, portfolio selection and management. Second, an active

securities market serves as a tool for general financial development and in particular, accelerates

the integration of informal financial systems with the institutional financial sector. Securities

directly displace traditional assets such as gold and stocks of produce or, indirectly, may provide

portfolio assets for unit trusts, pension funds and similar financial institutions that raise savings

from the traditional sector. Third, the existence of securities market enhances the scope, and

provides institutional mechanisms, for the operation of monetary and financial policy.

Conclusion

A well-developed financial market and securities market lead to better decision making. This

results in efficient and effective allocation of resources. This leads to economic growth.

Economic growth creates demand for financial instruments, and, where enterprise leads, finance

follows.

Potrebbero piacerti anche

- Dupont Analysis of Pharma CompaniesDocumento8 pagineDupont Analysis of Pharma CompaniesKalyan VsNessuna valutazione finora

- 1131 MDocumento11 pagine1131 MAparna RajasekharanNessuna valutazione finora

- 467 488Documento22 pagine467 488Aparna RajasekharanNessuna valutazione finora

- 39 77 1 PBDocumento11 pagine39 77 1 PBAparna RajasekharanNessuna valutazione finora

- Role of Financial Market and Securities Market in Economic GrowthDocumento2 pagineRole of Financial Market and Securities Market in Economic GrowthAparna Rajasekharan100% (1)

- 872 First Term 2014 2843Documento1 pagina872 First Term 2014 2843Aparna RajasekharanNessuna valutazione finora

- The Secrets To Successful Strategy ExecutionDocumento3 pagineThe Secrets To Successful Strategy ExecutionAparna RajasekharanNessuna valutazione finora

- SCM RGRTGDocumento38 pagineSCM RGRTGMas Roy TambbachEleggNessuna valutazione finora

- 5.documentary Letter of CreditDocumento14 pagine5.documentary Letter of CreditAparna RajasekharanNessuna valutazione finora

- Order2Cash in Telecom MMI A Nov08 073Documento11 pagineOrder2Cash in Telecom MMI A Nov08 073Aparna RajasekharanNessuna valutazione finora

- Smarter Order To Cash Processes Tamifang Complexity To Unlock Value Across The EnterpriseDocumento39 pagineSmarter Order To Cash Processes Tamifang Complexity To Unlock Value Across The EnterpriseAparna RajasekharanNessuna valutazione finora

- SEB Course Plan B 22Documento13 pagineSEB Course Plan B 22Aparna RajasekharanNessuna valutazione finora

- Smarter Order To Cash Processes Tamifang Complexity To Unlock Value Across The EnterpriseDocumento39 pagineSmarter Order To Cash Processes Tamifang Complexity To Unlock Value Across The EnterpriseAparna RajasekharanNessuna valutazione finora

- Literature ReviewDocumento7 pagineLiterature ReviewAparna RajasekharanNessuna valutazione finora

- Macro Econmics Slow Learner PatialaDocumento12 pagineMacro Econmics Slow Learner PatialaAparna RajasekharanNessuna valutazione finora

- Itm 2013 Itm Course Plan v15Documento14 pagineItm 2013 Itm Course Plan v15Aparna RajasekharanNessuna valutazione finora

- Assignment IDocumento3 pagineAssignment IAparna RajasekharanNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5782)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- BBM-DH47ISB-03 - Saragam Aluminium Limited - 4usDocumento36 pagineBBM-DH47ISB-03 - Saragam Aluminium Limited - 4usNguyet Tran Thi ThuNessuna valutazione finora

- Determine working capital policies ROI and cash conversion cyclesDocumento2 pagineDetermine working capital policies ROI and cash conversion cyclesGreys Maddawat MasulaNessuna valutazione finora

- Matching Supply With Demand An Introduction To Operations Management 3rd Edition Cachon Solutions ManualDocumento7 pagineMatching Supply With Demand An Introduction To Operations Management 3rd Edition Cachon Solutions Manualoctogamyveerbxtl100% (33)

- Wondering Why California Foreclosure Victims Never Win in Court? Judges Retirement Investments Loaded With MBS and ABSDocumento285 pagineWondering Why California Foreclosure Victims Never Win in Court? Judges Retirement Investments Loaded With MBS and ABS83jjmackNessuna valutazione finora

- Sip On Mutual FundsDocumento69 pagineSip On Mutual FundsBharat Agarwal100% (1)

- DTC Points of ContactsDocumento3 pagineDTC Points of Contactsdouglas jonesNessuna valutazione finora

- CSE corruption exposedDocumento2 pagineCSE corruption exposednotaNessuna valutazione finora

- A Framework For Investment SuccessDocumento8 pagineA Framework For Investment SuccesskarzinomNessuna valutazione finora

- Ratio Analysis: Profitability Ratios Basic FinanceDocumento20 pagineRatio Analysis: Profitability Ratios Basic FinanceEloisa Karen MonatoNessuna valutazione finora

- Seasonality Effect in Indian Stock Market With Reference To BSE SENSEX IndexDocumento5 pagineSeasonality Effect in Indian Stock Market With Reference To BSE SENSEX IndexRamasamy VelmuruganNessuna valutazione finora

- Kinfo Import TemplateDocumento4 pagineKinfo Import Templatemaik practiceNessuna valutazione finora

- Financial Markets and Net Present Value: First Principles of FinanceDocumento17 pagineFinancial Markets and Net Present Value: First Principles of FinanceraymondNessuna valutazione finora

- Module 1 Conceptual FrameworkDocumento5 pagineModule 1 Conceptual FrameworkKen AshleyNessuna valutazione finora

- FinalDocumento30 pagineFinalLajja ShahNessuna valutazione finora

- Islamic Financial Instruments: Definition and Types : ReviewDocumento16 pagineIslamic Financial Instruments: Definition and Types : ReviewIsha MughalNessuna valutazione finora

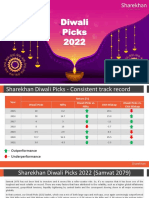

- DiwaliPicks2022 131022Documento22 pagineDiwaliPicks2022 131022tranganathanNessuna valutazione finora

- Assignment On: World Bond Market Vs Bangladesh Bond MarketDocumento14 pagineAssignment On: World Bond Market Vs Bangladesh Bond Marketswapnil swadhinataNessuna valutazione finora

- MP2 CalculatorDocumento20 pagineMP2 Calculatorangelo.tambadocNessuna valutazione finora

- The Role of Finance To The EconomyDocumento4 pagineThe Role of Finance To The EconomyNasrudiinNessuna valutazione finora

- Lobj19 - 0000055 CR 1907 02 A PDFDocumento28 pagineLobj19 - 0000055 CR 1907 02 A PDFqqqNessuna valutazione finora

- SEBI as a Regulator of Capital MarketsDocumento71 pagineSEBI as a Regulator of Capital MarketsAlisha MohapatraNessuna valutazione finora

- 316 ch1Documento36 pagine316 ch1katherineNessuna valutazione finora

- Cost Accounting Cost AccountingDocumento4 pagineCost Accounting Cost AccountingDalia ElarabyNessuna valutazione finora

- Bond Yields and PricesDocumento11 pagineBond Yields and PricesRahmatullah MardanviNessuna valutazione finora

- Bodie Investments 12e PPT CH12Documento24 pagineBodie Investments 12e PPT CH12黃浩瑋Nessuna valutazione finora

- TrailersDocumento6 pagineTrailersRamalNessuna valutazione finora

- Accounting EquationDocumento30 pagineAccounting EquationGladzangel Loricabv100% (2)

- Financial PlanDocumento54 pagineFinancial PlanTeku ThwalaNessuna valutazione finora

- Presentation On Stock MarketDocumento25 paginePresentation On Stock Marketsunil pancholi85% (47)

- Equity Valuation Dissertation TopicsDocumento5 pagineEquity Valuation Dissertation TopicsSomeoneToWriteMyPaperForMeEvansville100% (1)