Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chap004 Solutions

Caricato da

davegeekDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Chap004 Solutions

Caricato da

davegeekCopyright:

Formati disponibili

Chapter 04 - Accounting Records and Systems

CHAPTER 4

ACCOUNTING RECORDS AND SYSTEMS

Problems

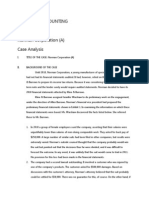

Problem 4-1

Beg. Bal.

(4)

Bal.

Cash

$900

$3,400 (3)

5,350

950 (5)

$1,900

(3)

Accounts Receivable

Beg. Bal.

$3,000

$5,350 (4)

(2)

6,350

Bal.

$4,000

Beg. Bal.

(1)

Bal.

(5)

Accounts Payable

$3,400

$3,600 Beg. Bal.

2,350 (1)

$2,550 Bal.

Notes Payable

$950

$950 Beg. Bal.

Inventory

$5,700

$4,150 (2)

2,350

$3,900

Problem 4-2

1) dr. Prepaid Rent.........................................................................................................................................................

$14,340

cr. Cash................................................................................................................................................................

$14,340

Prepaid rent is an asset.

2)

dr. Sales Discounts and Allowances...........................................................................................................................

$34,150

cr. Provision for Sales Discounts and Allowances...............................................................................................

$34,150

Sales discounts and allowances is a deduction from gross sales to arrive at net sales. The provision is

a liability.

3) dr. Interest Receivable................................................................................................................................................

$35

cr. Interest Income...............................................................................................................................................

$35

Interest receivable is an asset. Interest income would be listed as other income in this periods income

statement.

4) dr. Depreciation Expense...........................................................................................................................................

$13,660

cr. Accumulated Depreciation..............................................................................................................................

$13,660

Depreciation expense is an income statement item. Accumulated depreciation is disclosed as a

deduction from the related depreciable asset.

5) dr. Cash......................................................................................................................................................................

$2,730

cr. Deferred revenue.............................................................................................................................................

$2,730

4-1

Chapter 04 - Accounting Records and Systems

Deferred revenue is a liability.

6) dr. Stamp Expense..................................................................................................................................................................

$100

Stamp Inventory.....................................................................................................................................................................

$72

cr. Cash.............................................................................................................................................................................

$172

Stamps expense is an income statement item. Stamp inventory is an asset.

7) Bad debt expense....................................................................................................................................................................

$1,350

Allowance for doubtful accounts...............................................................................................................................

$1,350

Bad debt expense account is an expense account. Allowance for doubtful accounts is a contra asset

displayed as a deduction from the asset accounts receivable.

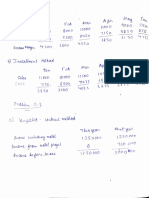

Problem 4-3

a.

1) dr. Inventory.....................................................................................................................................................................

$1,300

cr. Accounts payable....................................................................................................................................................

$1,300

2) dr. Wages Expense............................................................................................................................................................

$730

cr. Cash........................................................................................................................................................................

$730

3) dr. Cash............................................................................................................................................................................

$1,940

cr. Sales........................................................................................................................................................................

$1,940

4) dr. Accounts Receivable...................................................................................................................................................

$1,810

cr. Sales........................................................................................................................................................................

$1,810

5) dr. Overhead and Other Expenses.....................................................................................................................................

$900

cr. Cash........................................................................................................................................................................

$900

6) dr. Cash............................................................................................................................................................................

$1,510

cr. Accounts Receivable...............................................................................................................................................

$1,510

7) dr. Accounts Payable........................................................................................................................................................

$1,720

cr. Cash........................................................................................................................................................................

$1,720

8) dr. Cash............................................................................................................................................................................

$650

cr. Deferred Revenue...................................................................................................................................................

$650

9) dr. Cash............................................................................................................................................................................

$200

cr. Note Payable...........................................................................................................................................................

$200

10) dr. Cost of Goods Sold.....................................................................................................................................................

$1,280

cr. Inventory.................................................................................................................................................................

$1,280

+ Beginning inventory....................................................................................................................................................

$1,730

Additions.....................................................................................................................................................................

1,300

Total available.............................................................................................................................................................

$3,030

Ending inventory.........................................................................................................................................................

1,750

Cost of goods sold.......................................................................................................................................................

$1,280

4-2

Chapter 04 - Accounting Records and Systems

11) Dr. Depreciation Expense....................................................................................................................................

$300

Cr. Accumulated Depreciation................................................................................................................

$300

b.

(1)

Accounts Payable

$1,720

$3,070

1,300 (1)

Accounts Receivable

$2,160

1,510 (6)

(4)

1,810

Accumulated Depreciation

$2,800

300 (11)

(2)

(5)

(10)

(11)

(3)

(1)

(8)

(9)

Cash

$1,440

$ 730 (2)

1,940

900 (5)

1,510

1,720 (7)

650

200

(1)

Inventories

$1,730

$1,280 (10)

1,300

Allowance for Doubtful Accounts

$70

Fixed Assets (cost)

$6,200

Notes Payable

$600

200 (9)

Owners Equity

$7308

Wages

$4,990

Overhead

900

1,940 Sales (3)

COGS

1,280

1,810 Sales (4)

Depreciation

300

Deferred Revenue

$650 (8)

See above

d.

LUFT CORPORATION

Balance Sheet

Assets

Liabilities

Cash..............................................................................................................................................................................

$2,390

Accounts payable......................................................................

$2,650

Accounts receivable (net)..............................................................................................................................................

2,390

Deferred revenue.......................................................................

650

Inventories....................................................................................................................................................................

1,750

Current liabilities..................................................................

3,300

Current assets...........................................................................................................................................................

$6,530

Notes payable.......................................................................

800

Total liabilities......................................................................

4,100

Fixed assets...................................................................................................................................................................

$6,200

Owners equity

Accumulated depreciation.............................................................................................................................................

(3,100)

Owners equity..........................................................................

5,530

Total liabilities

Total assets...............................................................................................................................................................

$9,630

and owners equity................................................................

$9,630

4-3

Chapter 04 - Accounting Records and Systems

e.

LUFT CORPORATION

Income Statement

Sales.........................................................................................................................................................

$3,750

Cost of goods sold....................................................................................................................................

1,280

Gross margin............................................................................................................................................

2,470

Wages.......................................................................................................................................................

730

Overhead..................................................................................................................................................

900

Depreciation.............................................................................................................................................

300

Net income...............................................................................................................................................

$ 540

Problem 4-4

a.

Cash and Equivalents

$119,115

$119,115

Accounts Receivable

$162.500

$162,500

Store Equipment

$215,000

$215,000

Merchandise Inventory

$700,680

$302,990

$397,690

Supplies Inventory

$15,475

$10,265 (3)

$5,210

Prepaid Insurance

$38,250

$4,660 (4)

$33,590

Selling Expense

$24,900

24,900 (a)

(6)

(1)

(3)

Cost of Goods Sold

$302,990

$302,990 (h)

Sales Salaries

$105,750

3,575

109,325 (b)

Depreciation Expense

(2)

$12,750

$12,750 (i)

Supplies Expense

$10,265

$10,265 (j)

(4)

Accrued Interest

$3,730 (5)

$3,730

(7)

(1)

Insurance Expense

$4,660

$4,660 (k)

Accrued Sales Salaries

$3,575 (6)

$3,575

Interest Receivable

390

390

(l)

4-4

Interest Income

390

390 (7)

Chapter 04 - Accounting Records and Systems

Miscellaneous General Expenses

$31,000

31,000 (c)

(5)

(d)

Interest Expense

$9,300

3,730

$13,030 (e)

Social Security Taxes

$9, 600

$9,600 (f)

Accumulated Depreciation

$37,300

12,750 (2)

$50,050

Accounts Payable

$118,180

$118,180

Notes Payable

$143,000

$143,000

Common Stock

$300,000

$300,000

Retained Earnings

$122,375

192,585 (m)

$314,960

(a)

(b)

(c)

(d)

(e)

(f)

(h)

(i)

(j)

(k)

(m)

Sales Discounts

6,220

$6,220

(g)

Sales

$716,935

$716,935

Profit and Loss

24,900

716, 935 (g)

109,325

390 (l)

31,000

6,220

13,030

9,600

302,990

12,750

10,265

4,660

192,585

Adjusting entries are:

(1) dr. Cost Of Goods Sold......................................................................................................................................

$302,990

cr. Merchandise Inventory.............................................................................................................................

$302,990

(2) dr. Depreciation Expense...................................................................................................................................

$12,750

cr. Accumulated Depreciation.......................................................................................................................

$12,750

(3) dr. Supplies Expense..........................................................................................................................................

$10,265

cr. Supplies Inventory....................................................................................................................................

$10,265

4-5

Chapter 04 - Accounting Records and Systems

(4) dr. Insurance Expense.....................................................................................................................................................

$4,660

cr. Prepaid Insurance..................................................................................................................................................

$4,660

(5) dr. Interest Expense.........................................................................................................................................................

$3,730

cr. Accrued Interest.....................................................................................................................................................

$3,730

(6) dr. Sales Salaries.............................................................................................................................................................

$3,575

cr. Accrued Sales Salaries...........................................................................................................................................

$3,575

(7) dr. Interest Receivable....................................................................................................................................................

$390

cr. Interest Income......................................................................................................................................................

$390

Closing entries are:

(a) dr. Profit and Loss...........................................................................................................................................................

$24,900

cr. Selling Expense.....................................................................................................................................................

$24,900

(b) dr. Profit and Loss...........................................................................................................................................................

$109,325

cr. Sales Salaries.........................................................................................................................................................

$109,325

(c) dr. Profit and Loss...........................................................................................................................................................

$31,000

cr. Miscellaneous General Expenses..........................................................................................................................

$31,000

(d) dr. Profit and Loss...........................................................................................................................................................

$6,220

cr. Sales Discounts.....................................................................................................................................................

$6,220

(e) dr. Profit and Loss...........................................................................................................................................................

$13,030

cr. Interest Expense....................................................................................................................................................

$13,030

(f) dr. Profit and Loss...........................................................................................................................................................

$9,600

cr. Social Security Taxes............................................................................................................................................

$9,600

(g) dr. Sales..........................................................................................................................................................................

$716,935

cr. Profit and Loss......................................................................................................................................................

$716,935

(h) dr. Profit and Loss...........................................................................................................................................................

$302,990

cr. Cost of Goods Sold...............................................................................................................................................

$302,990

(i) dr. Profit and Loss...........................................................................................................................................................

$12,750

cr. Depreciation Expense............................................................................................................................................

$12,750

(j) dr. Profit and Loss...........................................................................................................................................................

$10,265

cr. Supplies Expense...................................................................................................................................................

$10,265

(k) dr. Profit and Loss...........................................................................................................................................................

$4,660

cr. Insurance Expense.................................................................................................................................................

$4,660

(l) dr. Interest Income..........................................................................................................................................................

$390

cr. Profit and Loss......................................................................................................................................................

$390

4-6

Chapter 04 - Accounting Records and Systems

(m) dr. Profit and Loss..............................................................................................................................................

$192,585

cr. Retained Earnings.....................................................................................................................................

$192,585

DINDORF COMPANY

Income Statement for the year ----.

Sales.........................................................................................................................................................

$716,935

Sales discounts.........................................................................................................................................

(6,220)

Net sales...................................................................................................................................................

710,715

Cost of goods sold....................................................................................................................................

302,990

Depreciation.............................................................................................................................................

12,750

Sales salaries............................................................................................................................................

109,325

Selling expense.........................................................................................................................................

24,900

Supplies expense......................................................................................................................................

10,265

Insurance expense.....................................................................................................................................

4,660

Social Security taxes.................................................................................................................................

9,600

Miscellaneous general expenses...............................................................................................................

31,000

Interest expense........................................................................................................................................

13,030

Interest income.........................................................................................................................................

390

Net income..................................................................................................................................

$192,585

DINDORF COMPANY

Balance Sheet as of January 31, ----.

Assets

Liabilities

Cash and cash equivalent...................................................................................................................................................

$119,115

Accounts payable.....................................................................

$118,180

Accounts receivable...........................................................................................................................................................

162,500

Accrued interest.......................................................................

3,730

Merchandise inventory.......................................................................................................................................................

397,690

Accrued sales salaries..............................................................

3,575

Supplies inventory..............................................................................................................................................................

5,210

Current liabilities.....................................................................

125,485

Prepaid insurance...............................................................................................................................................................

33,590

Interest receivable..............................................................................................................................................................

390

Notes payable..........................................................................

143,000

Current assets.....................................................................................................................................................................

718,495

Total liabilities............................................................

268,485

Owners Equity

Store equipment.................................................................................................................................................................

215,000

Common stock.........................................................................

300,000

Accumulated depreciation..................................................................................................................................................

(50,050)

Retained earnings....................................................................

314,960

Total liabilities

Total assets....................................................................................................................................................................

$883,445

and owners equity..............................................................

$883,445

4-7

Potrebbero piacerti anche

- Case 5 Joan Holtz Answer KeyDocumento5 pagineCase 5 Joan Holtz Answer KeyVira CastroNessuna valutazione finora

- Waltham Oil Lube Centre Inc - FinalDocumento10 pagineWaltham Oil Lube Centre Inc - Finalerarun2267% (3)

- Part 1 - Cutlip and Center's Effective Public Relations. 11th Ed.Documento127 paginePart 1 - Cutlip and Center's Effective Public Relations. 11th Ed.Duyen Pham75% (4)

- AHM13e Chapter - 02 - Solution To Problems and Key To CasesDocumento23 pagineAHM13e Chapter - 02 - Solution To Problems and Key To CasesGaurav ManiyarNessuna valutazione finora

- Balance Sheet and Transactions Analysis for Charles CompanyDocumento14 pagineBalance Sheet and Transactions Analysis for Charles CompanyArunesh SN100% (1)

- Accounting Case 2Documento3 pagineAccounting Case 2ayushishahNessuna valutazione finora

- Problem 4-4 Dindorf CompanyDocumento5 pagineProblem 4-4 Dindorf Companymelati50% (4)

- Solution Manual For Accounting Text andDocumento17 pagineSolution Manual For Accounting Text andanon_995783707Nessuna valutazione finora

- Cash Flow CH 11Documento2 pagineCash Flow CH 11ayush sharma75% (4)

- Accounting Text & Cases Ed 13th Case 6-3Documento1 paginaAccounting Text & Cases Ed 13th Case 6-3Ki UmbaraNessuna valutazione finora

- Chapter 8-1 Group Report - NormanDocumento6 pagineChapter 8-1 Group Report - Normanvp_zarate100% (1)

- Chemalite Income StatementDocumento10 pagineChemalite Income StatementManoj Singh0% (1)

- Problem CH 11 Alfi Dan Yessy AKT 18-MDocumento4 pagineProblem CH 11 Alfi Dan Yessy AKT 18-MAna Kristiana100% (1)

- Case Report - Grenell FarmDocumento5 pagineCase Report - Grenell Farmajsibal100% (1)

- Accounting - Text & Cases - 13 Edition Basic Accounting Concepts: The Balance SheetDocumento7 pagineAccounting - Text & Cases - 13 Edition Basic Accounting Concepts: The Balance SheetV Hemanth KumarNessuna valutazione finora

- ACCOUNTING STERN CORPORATION (A) AnswerDocumento4 pagineACCOUNTING STERN CORPORATION (A) AnswerPradina RachmadiniNessuna valutazione finora

- Grennell Farm Balance Sheet AnalysisDocumento6 pagineGrennell Farm Balance Sheet AnalysisMichael TorresNessuna valutazione finora

- AHM Chapter 4 - SolutionsDocumento24 pagineAHM Chapter 4 - SolutionsNitin KhareNessuna valutazione finora

- AHM13e Chapter 05 Solution To Problems and Key To CasesDocumento21 pagineAHM13e Chapter 05 Solution To Problems and Key To CasesGaurav ManiyarNessuna valutazione finora

- QED Electronics - Problem 3.7Documento1 paginaQED Electronics - Problem 3.7ivanyongforexNessuna valutazione finora

- Case 4-4 Waltham Oil & Lube Center, Inc.: $40,000 Deposit With NationalDocumento5 pagineCase 4-4 Waltham Oil & Lube Center, Inc.: $40,000 Deposit With NationalCyd Marie VictorianoNessuna valutazione finora

- Waltham Oil and Lube CentreDocumento5 pagineWaltham Oil and Lube CentreAnirudh Singh0% (2)

- Income Statements 2010Documento10 pagineIncome Statements 2010Shivam GoelNessuna valutazione finora

- Lewis Corporation case study: Analysis of inventory valuation methodsDocumento7 pagineLewis Corporation case study: Analysis of inventory valuation methodsSudeep ShahNessuna valutazione finora

- Case1 1,1 2,2 1,2 2,2 3,3 1,3 2,4 1,4 2,5 1 pb2 6,3 9Documento20 pagineCase1 1,1 2,2 1,2 2,2 3,3 1,3 2,4 1,4 2,5 1 pb2 6,3 9amyth_dude_9090100% (2)

- Problem 3-1Documento2 pagineProblem 3-1Omar CirunayNessuna valutazione finora

- Case 4 2Documento5 pagineCase 4 2Marjorie Morada67% (3)

- Chap 003Documento19 pagineChap 003jujuNessuna valutazione finora

- Solution ManualDocumento28 pagineSolution Manualdavegeek0% (1)

- Identifying Community Health ProblemsDocumento4 pagineIdentifying Community Health ProblemsEmvie Loyd Pagunsan-ItableNessuna valutazione finora

- Wyckoff e BookDocumento43 pagineWyckoff e BookIan Moncrieffe95% (22)

- AkuntansiDocumento3 pagineAkuntansier4sallNessuna valutazione finora

- AHM13e Chapter - 03 - Solution To Problems and Key To CasesDocumento24 pagineAHM13e Chapter - 03 - Solution To Problems and Key To CasesGaurav ManiyarNessuna valutazione finora

- Waltham Oil and Lube WorkingsDocumento5 pagineWaltham Oil and Lube WorkingsGaurav Sahu100% (1)

- Case Study 4 - 3 Copies ExpressDocumento8 pagineCase Study 4 - 3 Copies ExpressJZ0% (1)

- AHM13e - Chapter - 06 Solution To Problems and Key To CasesDocumento26 pagineAHM13e - Chapter - 06 Solution To Problems and Key To CasesGaurav ManiyarNessuna valutazione finora

- (Case 6-7) 5-1 Stern CorporationDocumento1 pagina(Case 6-7) 5-1 Stern CorporationJuanda0% (1)

- anthonyIM 06Documento18 pagineanthonyIM 06Jigar ShahNessuna valutazione finora

- Chapter 5 ProblemsDocumento7 pagineChapter 5 Problemsanu balakrishnanNessuna valutazione finora

- Basic Concepts of Accounting (Balance Sheet)Documento12 pagineBasic Concepts of Accounting (Balance Sheet)badtzmaru0506Nessuna valutazione finora

- CASE SUMMARY Waltham Oil and LubesDocumento2 pagineCASE SUMMARY Waltham Oil and LubesAnurag ChatarkarNessuna valutazione finora

- Case Study 4 3 Copies ExpressDocumento7 pagineCase Study 4 3 Copies Expressamitsemt100% (2)

- Lori Crump Accounting Case StudyDocumento1 paginaLori Crump Accounting Case StudyHarsh Anchalia100% (1)

- Final Exam Paper (C) 2020.11 OpenDocumento3 pagineFinal Exam Paper (C) 2020.11 OpenKshitiz NeupaneNessuna valutazione finora

- Stafford Press SolvedDocumento2 pagineStafford Press SolvedMurali DharanNessuna valutazione finora

- Maria HernandezDocumento2 pagineMaria HernandezUjwal Suri100% (1)

- Joan Holtz (A) Case Revenue Recognition QuestionsDocumento5 pagineJoan Holtz (A) Case Revenue Recognition QuestionsAashima GroverNessuna valutazione finora

- ARS Waltham Case TransactionsDocumento2 pagineARS Waltham Case TransactionsRajnikaanth SteamNessuna valutazione finora

- Stafford Press CaseDocumento4 pagineStafford Press CaseAmit Kumar AroraNessuna valutazione finora

- CASE 8 - Norman Corporation (A) (Final)Documento3 pagineCASE 8 - Norman Corporation (A) (Final)Katrizia FauniNessuna valutazione finora

- CHAPTER 1 - Partnership - Basic Considerations and FormationDocumento11 pagineCHAPTER 1 - Partnership - Basic Considerations and FormationRominna Dela Rueda0% (1)

- CH 4 Exercises ADocumento5 pagineCH 4 Exercises AAhmed Abdel-FattahNessuna valutazione finora

- Revenue and Monetary Assets: Changes From Eleventh EditionDocumento21 pagineRevenue and Monetary Assets: Changes From Eleventh EditionMenahil KNessuna valutazione finora

- Balance Sheet and Cash Flow AnalysisDocumento8 pagineBalance Sheet and Cash Flow AnalysisAntonios FahedNessuna valutazione finora

- Warren SM - Ch.09 - Final PDFDocumento46 pagineWarren SM - Ch.09 - Final PDFFarhan FarhanNessuna valutazione finora

- Problem 1-1Documento3 pagineProblem 1-1wivadaNessuna valutazione finora

- Warren SM ch.09 FinalDocumento46 pagineWarren SM ch.09 FinalLidya Silvia RahmaNessuna valutazione finora

- Financial Accounting Chapter Exam ch2-ch3 Acdbb: Solution 1Documento2 pagineFinancial Accounting Chapter Exam ch2-ch3 Acdbb: Solution 1劉百祥Nessuna valutazione finora

- Financial and Managerial Accounting 4Th Edition Wild Solutions Manual Full Chapter PDFDocumento60 pagineFinancial and Managerial Accounting 4Th Edition Wild Solutions Manual Full Chapter PDFClaudiaAdamsfowp100% (10)

- RERectification of Error PRACTICAL PROBLEMS Q1 TO 4Documento2 pagineRERectification of Error PRACTICAL PROBLEMS Q1 TO 4Arham RajpootNessuna valutazione finora

- Accounting Warren 23rd Edition Solutions ManualDocumento47 pagineAccounting Warren 23rd Edition Solutions ManualKellyMorenootdnj100% (79)

- Accounting Texts and Cases Ch8.Documento21 pagineAccounting Texts and Cases Ch8.iniwan.sa.ere0Nessuna valutazione finora

- Chapter 2 Questions and SolutionsDocumento6 pagineChapter 2 Questions and SolutionsKhem Raj GyawaliNessuna valutazione finora

- ch08 - JADocumento12 paginech08 - JAAntonios FahedNessuna valutazione finora

- Discover CanadaDocumento68 pagineDiscover CanadaqatharyNessuna valutazione finora

- Basic Accounting Concepts: The Balance Sheet: Mcgraw-Hill/IrwinDocumento41 pagineBasic Accounting Concepts: The Balance Sheet: Mcgraw-Hill/IrwindavegeekNessuna valutazione finora

- Accounting Records and Systems: Mcgraw-Hill/IrwinDocumento28 pagineAccounting Records and Systems: Mcgraw-Hill/Irwindavegeek100% (1)

- Lecture 1Documento39 pagineLecture 1davegeekNessuna valutazione finora

- Chap001 SolutionsDocumento7 pagineChap001 SolutionsdavegeekNessuna valutazione finora

- Chap 001Documento38 pagineChap 001Daniel Alejandro Rojas LieNessuna valutazione finora

- Midterm Exam SolutionsDocumento11 pagineMidterm Exam SolutionsPatrick Browne100% (1)

- Manual Centrifugadora - Jouan B4i - 2Documento6 pagineManual Centrifugadora - Jouan B4i - 2Rita RosadoNessuna valutazione finora

- Counsel For Plaintiff, Mark Shin: United States District Court Northern District of CaliforniaDocumento21 pagineCounsel For Plaintiff, Mark Shin: United States District Court Northern District of CaliforniafleckaleckaNessuna valutazione finora

- A Study On Capital BudgetingDocumento2 pagineA Study On Capital BudgetingANKIT SINGHNessuna valutazione finora

- Basic Concept of EntrepreneurshipDocumento12 pagineBasic Concept of EntrepreneurshipMaria January B. FedericoNessuna valutazione finora

- Lessee Information StatementDocumento1 paginaLessee Information Statementmja.carilloNessuna valutazione finora

- Sahrudaya Health Care Private Limited: Pay Slip For The Month of May-2022Documento1 paginaSahrudaya Health Care Private Limited: Pay Slip For The Month of May-2022Rohit raagNessuna valutazione finora

- VectorsDocumento9 pagineVectorsdam_allen85Nessuna valutazione finora

- Offer Letter For Marketing ExecutivesDocumento2 pagineOffer Letter For Marketing ExecutivesRahul SinghNessuna valutazione finora

- Steam Turbine and Governor (SimPowerSystems)Documento5 pagineSteam Turbine and Governor (SimPowerSystems)hitmancuteadNessuna valutazione finora

- Newcomb Theodore MDocumento20 pagineNewcomb Theodore MBang Ahmad UstuhriNessuna valutazione finora

- Screenshot 2021-10-02 at 12.22.29 PMDocumento1 paginaScreenshot 2021-10-02 at 12.22.29 PMSimran SainiNessuna valutazione finora

- Supplement - 7 Procurement Manual: Democratic Socialist Republic of Sri LankaDocumento8 pagineSupplement - 7 Procurement Manual: Democratic Socialist Republic of Sri LankaDinuka MalinthaNessuna valutazione finora

- Readiness of Barangay Masalukot During TyphoonsDocumento34 pagineReadiness of Barangay Masalukot During TyphoonsJerome AbrigoNessuna valutazione finora

- Igbt Irg 4p254sDocumento9 pagineIgbt Irg 4p254sMilagros Mendieta VegaNessuna valutazione finora

- Cryptography Seminar - Types, Algorithms & AttacksDocumento18 pagineCryptography Seminar - Types, Algorithms & AttacksHari HaranNessuna valutazione finora

- Structure and Mechanism of The Deformation of Grade 2 Titanium in Plastometric StudiesDocumento8 pagineStructure and Mechanism of The Deformation of Grade 2 Titanium in Plastometric StudiesJakub BańczerowskiNessuna valutazione finora

- Cis285 Unit 7Documento62 pagineCis285 Unit 7kirat5690Nessuna valutazione finora

- CP Exit Srategy Plan TemplateDocumento4 pagineCP Exit Srategy Plan TemplateKristia Stephanie BejeranoNessuna valutazione finora

- 110 TOP Single Phase Induction Motors - Electrical Engineering Multiple Choice Questions and Answers - MCQs Preparation For Engineering Competitive ExamsDocumento42 pagine110 TOP Single Phase Induction Motors - Electrical Engineering Multiple Choice Questions and Answers - MCQs Preparation For Engineering Competitive Examsvijay_marathe01Nessuna valutazione finora

- Philippine Mango Seed Oil: An Untapped ResourceDocumento8 paginePhilippine Mango Seed Oil: An Untapped ResourceFrancis Peñaflor0% (1)

- Merging - Scaled - 1D - & - Trying - Different - CLassification - ML - Models - .Ipynb - ColaboratoryDocumento16 pagineMerging - Scaled - 1D - & - Trying - Different - CLassification - ML - Models - .Ipynb - Colaboratorygirishcherry12100% (1)

- Dues+&+Bylaws+Committee+Packet ICPI John@bestadmix Com Tholyfield@Documento52 pagineDues+&+Bylaws+Committee+Packet ICPI John@bestadmix Com Tholyfield@Greefield JasonNessuna valutazione finora

- Chilled Beam SystemsDocumento3 pagineChilled Beam SystemsIppiNessuna valutazione finora

- ID Analisis Persetujuan Tindakan Kedokteran Informed Consent Dalam Rangka Persiapan PDFDocumento11 pagineID Analisis Persetujuan Tindakan Kedokteran Informed Consent Dalam Rangka Persiapan PDFAmelia AmelNessuna valutazione finora

- R20qs0004eu0210 Synergy Ae Cloud2Documento38 pagineR20qs0004eu0210 Synergy Ae Cloud2Слава ЗавьяловNessuna valutazione finora

- Medhat CVDocumento2 pagineMedhat CVSemsem MakNessuna valutazione finora