Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Barth Beilage 2013

Caricato da

Hércules Aristóteles ZuninoDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Barth Beilage 2013

Caricato da

Hércules Aristóteles ZuninoCopyright:

Formati disponibili

The Barth-Haas Group and Germain Hansmaennel present

Market Leaders and their Challengers

in the Top 40 Countries in 2012

Beer Production

The Barth-Haas Hops Academy

It is well known that hops are a prime flavour component in

beer, but their remarkably high impact on the final product

is often overlooked. The closer one looks at hops, the more

revealing their importance to beer becomes. Hops have see-

mingly inexhaustible potential not only in terms of aroma and

bitterness, but also in the other attributes they provide in the

brewing process and finished beer.

Understanding the complexities of hops and tapping into

their full potential is why we brought the BARTH-HAAS HOPS

ACADEMY into being. Having an acute knowledge of the usage,

effects and impact of this special brewing ingredient will help

the brewer optimize process efficiencies and develop distinctive

high-quality beers.

The Hop Aroma Compendium a whole new experience of hops!

Just discover the Hop Aroma Compendium, a unique description

of the aromas of hop varieties, constituting a further element

in Barth-Haas projects designed to increase hop expertise in

the brewing industry and in other sectors. A purely technical

analysis does not do justice to the hops and is of only little

help to the brewer when it comes to developing new recipes.

In particular the skilful use of flavour hops produced unique

and individual beers, which was the main reason for that unique

project.

At the end of 2013 Volume 3 of the Hop Aroma Compendium

will be published presenting further hop varieties. Together

with Volume 1 and 2 there are now more than 130 hop

varieties which were tasted by two world champion beer

sommeliers and a perfumist and a Barth-Haas expert panel.

The 2013 winners are:

The Barth-Haas Grants your hops research opportunity

Since 2007 the Barth-Haas Group has awarded five grants of

2,000 EUR each year to support research ideas that focus on

hops and hop products in brewing. Our grants have become so

successful that hop research is now experiencing a revival. The

ideas funded so far reveal just the tip of the iceberg concerning

the unknown properties of hops. The previously funded research

projects looked into

hop derived anti-foams

dry hopping techniques

hop aroma utilisation during brewing

the role of hops in flavour stability

instrumental bitterness detection

hops and gushing

hop derived flavour active compounds

While these research projects have answered many questions, as

is often the case in the world of science, they have also gene-

rated many more interesting questions at the same time. Like in

the previous year, we have decided to support six research ideas

with our grants in order to meet with the increasing number of

applications.

A list of the research projects that were supported with the

Barth-Haas Grants since 2007 can be found on our website:

www.barthhaasgroup.com

2

More about hops

University/Institute Research Supervisor Student Title

1 KU Leuven, Belgium Prof. Guy Derdelincks Zhara Shokribousjein Hop antifoam, fractions of hop antifoam

as well as hop aid antifoam regarding

gushing surpression and application in the

brewing process

2 KaHo St. Lieven, Belgium Prof. Luc de Cooman Tatiana Praet Chemical-analytical and sensorial

characterisation of the kettle hoppy

aroma of beer

3 TU Berlin, Germany Prof. Frank-Juergen Methner Fabian Gtz Development and optimization of a fast

and easy-to-handle dry-hopping technique

for the usage of pelletized hops

4 UC Davis, USA Dr. Anita Oberholster Brad Titus Determination of the effectiveness of dry

hopping on flavor stability of beer

5 UC Louvain, Belgium Prof. Sonia Collin Hadrien Massart Study of new hop glucosylic compounds:

flavor potential of theaspiran derived

molecules

6 UC Louvain, Belgium Prof. Sonia Collin Emilie Vercruysse S-conjugates precursors of thiols in hop,

a resource for increasing the beer hoppy

aroma shelf life

Explanation

RANKING

The ranking of the countries is based on production volume.

The number on the left of the country indicates its world beer

production ranking.

POPULATION (POP): Million inhabitants.

GROSS NATIONAL PRODUCT (GNP): in billion US-dollars.

PRODUCTION (PROD): Beer in million hectolitres.

PER CAPITA CONSUMPTION (PCC): Beer in litres.

MARKET SHARE (MS): Market share based on the breweries dome-

stic sales. The breweries are mentioned in the national ranking

either if their market share is higher than 10 % with a minimum

volume of 1 million hl or if they appear in the top 40 brewery list

having more than 5 % market share in the respective country.

FINANCIAL PARTICIPATION

If the group behind the domestic brewery is written in capital

letters it means the group has a participation over 50 %. If it is writ-

ten in lower case it means the group has a participation below 50 %.

BREWERY GROUPS - ABBREVIATIONS

ABI AB INBEV

SABM SAB-MILLER

HEI HEINEKEN

CAR CARLSBERG

MOCO MOLSON-COORS

KIR KIRIN

SOURCES

Barth-Report 2012/2013, United Nations and World Bank Statistics

EDITION NOTICE

Publisher: Joh. Barth & Sohn GmbH & Co. KG

Freiligrathstrasse 7/9, 90482 Nuremberg, Germany

Project responsibility:

Stephan Barth, Managing Partner, Nuremberg

Editor: Heinrich Meier, Georgensgmuend

Layout: Buero Alexander Froede, Cologne

Printer: Pinsker Druck und Medien GmbH, Mainburg

ABOUT THE FRONT COVER

Beer flavour through dry hopping. The picture shows a fully loaded

hop kiln with freshly harvested hops in the process of being dried.

The title is a word play with Hop drying which is the necessary

process to prevent hops from spoiling, being turned into Dry hopping

the process of imparting wonderful flavour into great beers.

3

WEYERMANN

SPECIALTY MALTS

Specialty Malting Company

Brennerstrasse 17-19 96052 Bamberg - Germany www.weyermannmalt.com

Mexico 6

USA 2

Canada 19

6 Mexico

POP 114.8

GNP 1,207.8

PROD 82.500*

PCC 60

MS 99 %

MODELOABI (MS 56 %)

CUAUHTEMOC FEMSAHEI

2 USA

POP 311.9

GNP 15,752.8

PROD 229.314

PCC 75

MS 81 %

AB INBEVABI (MS 47 %)

MILLERCOORSSABM/moco

CROWN IMPORTS

19 Canada

POP 34.5

GNP 1,804.6

PROD 19.525

PCC 65

MS 80 %

LABATTABI (MS 41 %)

MOLSON-COORSMOCO

North and Central America

The Americas: Total Beer production 571.2m hl (compared to 2011 +5.8m hl)

4

Quick Helper

POP: Million inhabitants

GNP: Gross National Product

in billion US-dollars

PROD: Production of beer in

million hectolitres

* Estimate

PCC: Per Capita Consumption

of beer in litres

MS: Market Share

ABI AB INBEV

SABM SAB-MILLER

HEI HEINEKEN

CAR CARLSBERG

MOCO MOLSON-COORS

KIR KIRIN

South America

18 Venezuela

17 Columbia

29 Peru

3 Brazil

39 Chile

27 Argentina

40 Ecuador

3 Brazil

POP 196.7

GNP 2,449.8

PROD 132.800

PCC 62

MS 99 %

AMBEVABI (MS 69 %)

KIRIN BRAZIL KIR

PETROPOLIS

KAISERHEI

17 Columbia

POP 46.9

GNP 378.7

PROD 22.550

PCC 43

MS 98 %

BAVARIA SABM (MS 98 %)

29 Peru

POP 29.4

GNP 184.9

PROD 13.200

PCC 49

MS 94 %

BACKUS&JOHNSTONSABM

(MS 94 %)

AMBEV PERU ABI

18 Venezuela

POP 29.3

GNP 337.5

PROD 21.470

PCC 75

MS 99 %

POLAR (MS 76 %)

REGIONAL

27 Argentina

POP 40.8

GNP 472.8

PROD 16.700*

PCC 44

MS 96 %

QUILMESABI (MS 77 %)

CCU ARGhei

39 Chile

POP 17.3

GNP 272.1

PROD 6.000

PCC 40

MS 99 %

CCUhei (MS 88 %)

CIA CHILEABI

40 Ecuador

POP 14.7

GNP 72.5

PROD 5.925

PCC 40

MS 95 %

CERVEZA NAC.SABM

(MS 95 %)

5

Quick Helper

POP: Million inhabitants

GNP: Gross National Product

in billion US-dollars

PROD: Production of beer in

million hectolitres

* Estimate

PCC: Per Capita Consumption

of beer in litres

MS: Market Share

ABI AB INBEV

SABM SAB-MILLER

HEI HEINEKEN

CAR CARLSBERG

MOCO MOLSON-COORS

KIR KIRIN

Answers for industry.

siemens.com/brewery

Always the same

taste worldwide.

BRAUMAT makes it easier to reproduce recipes

How your beer can always taste the same: with our

BRAUMAT process control system, which seamlessly

controls and monitors the brewing process, therefore

securing absolute reproducibility of a brew.

Or with the Interspec MES module, which simplifies the

exchange and implementation of recipe data at various

brewing locations. Our portfolio keeps the taste

consistent.

E

2

0

0

0

1

-

F

2

1

0

-

T

1

1

0

-

V

1

-

7

6

0

0

20 India

POP 1,241.6

GNP 1,943.1

PROD 19.500*

PCC 2

MS 79 %

UNITED BR.hei (MS 54 %)

SAB INDIASABM

Asia

Beer production 688.2m hl (compared to 2011 +8.4m hl)

1 China

POP 1,345.2

GNP 7,991.7

PROD 490.200

PCC 36

MS 60 %

CRE SNOWsabm (MS 22 %)

TSINGTAOasahi

AB INBEV CHINAABI

YANJING

7 Japan

POP 127.3

GNP 6,193.3

PROD 55.465

PCC 48

MS 99 %

ASAHI (MS 37 %)

KIRINKIR

SUNTORY

SAPPORO

28 Philippines

POP 94.8

GNP 241.4

PROD 15.800*

PCC 18

MS 93 %

SAN MIGUELkir (MS 93 %)

16 Thailand

POP 69.5

GNP 377.1

PROD 23.700

PCC 32

MS 95 %

SINGHA CORP (MS 67 %)

THAIBEV CHANG

22 South Korea

POP 49.0

GNP 1,166,7

PROD 18.875

PCC 39

MS 100 %

ORIENTAL BR. (MS 53 %)

HITE

7 Japan

22 South Korea

1 China

20 India

13 Vietnam

16 Thailand

28 Philippines

13 Vietnam

POP 87.8

GNP 135.4

PROD 29.800

PCC 37

MS 80 %

SAIGON BR. (MS 40 %)

HANOI BR.car

APBhei

7

Quick Helper

POP: Million inhabitants

GNP: Gross National Product

in billion US-dollars

PROD: Production of beer in

million hectolitres

* Estimate

PCC: Per Capita Consumption

of beer in litres

MS: Market Share

ABI AB INBEV

SABM SAB-MILLER

HEI HEINEKEN

CAR CARLSBERG

MOCO MOLSON-COORS

KIR KIRIN

Europe

Beer production 545.2m hl (compared to 2011 -4.4m hl)

4 Russia

POP 141.6

GNP 1,307.5

PROD 97.400

PCC 74

MS 83 %

BBHCAR (MS 38 %)

EFIsabm

SUN INBEVABI

HEINEKEN RUSHEI

10 Spain

POP 46.2

GNP 1,397.8

PROD 33.000

PCC 48

MS 80 %

MAHOU - SAN MIGUEL

(MS 32 %)

HEINEKEN SPHEI

DAMM

24 Czech Rep.

POP 10.5

GNP 205.9

PROD 18.265

PCC 144

MS 77 %

PLZENSKY PRAZDROJSABM

(MS 48 %)

STAROPRAMENMOCO

HEINEKEN CZHEI

31 Turkey

POP 73.7

GNP 817.3

PROD 9.980

PCC 12

MS 99 %

EFESsabm (MS 83 %)

TURK TUBORG

37 Denmark

POP 5.6

GNP 330.8

PROD 6.600*

PCC 68

MS 69 %

CARLSBERGCAR (MS 54 %)

ROYAL UNIBREW

5 Germany

POP 80.2

GNP 3,539.5

PROD 94.618

PCC 108

MS 38 %

RADEBERGER GR (MS 13 %)

INBEV GERABI

OETTINGER

BITBURGER GP

12 Ukraine

POP 45.7

GNP 183.2

PROD 30.050

PCC 55

MS 77 %

SUN INBEVABI (MS 34 %)

BBHCAR

OBOLON

23 Belgium

POP 11.0

GNP 503.4

PROD 18.500*

PCC 78

MS 68 %

INBEVABI (MS 56 %)

ALKEN-MAESHEI

33 Austria

POP 8.4

GNP 409.5

PROD 8.927

PCC 108

MS 58 %

BRAU UNION HEI

(MS 47 %)

STIEGL

38 Hungary

POP 10.0

GNP 130.0

PROD 6.159

PCC 65

MS 87 %

BRAU UNION HEI

(MS 33 %)

DREHER SORGYARSABM

BORSODI SORGYARMOCO

8 UK

POP 62.6

GNP 2,497.8

PROD 42.049

PCC 73

MS 76 %

HEINEKEN UKHEI

(MS 24 %)

CBLMOCO

INBEV UKABI

CARLSBERG UKCAR

14 Netherlands

POP 16.7

GNP 806.8

PROD 24.272

PCC 72

MS 84 %

HEINEKEN NLHEI

(MS 45 %)

BAVARIA

GROLSCHSABM

INBEV NLABI

21 France

POP 65.2

GNP 2,778.0

PROD 19.000*

PCC 30

MS 54 %

HEINEKEN FRHEI

(MS 27 %)

KRONENBOURGCAR

34 Ireland

POP 4.5

GNP 209.6

PROD 8.197

PCC 86

MS 56 %

GUINNESS DIAGEO

(MS 34 %)

MURPHYHEI

9 Poland

POP 38.2

GNP 528.5

PROD 37.800

PCC 98

MS 94 %

KOMP. PIWOWARSKASABM

(MS 44 %)

ZYWIECHEI

OKOCIMCAR

25 Romania

POP 21.4

GNP 186.4

PROD 17.900

PCC 89

MS 80 %

SAB ROSABM (MS 38 %)

BRAU UNION ROHEI

BERGENBIERMOCO

30 Italy

POP 60.8

GNP 2,049.5

PROD 12.791

PCC 29

MS 52 %

HEINEKEN ITAHEI (MS 32 %)

PERONISABM

35 Portugal

POP 10.6

GNP 220.6

PROD 7.500

PCC 48

MS 98 %

UNICERCAR (MS 48 %)

CENTRALCERHEI

Quick Helper

POP: Million inhabitants

GNP: Gross National Product

in billion US-dollars

PROD: Production of beer in

million hectolitres

* Estimate

PCC: Per Capita Consumption

of beer in litres

MS: Market Share

ABI AB INBEV

SABM SAB-MILLER

HEI HEINEKEN

CAR CARLSBERG

MOCO MOLSON-COORS

KIR KIRIN

8

4

R

u

s

s

i

a

3

1

T

u

r

k

e

y

2

5

R

o

m

a

n

i

a

1

2

U

k

r

a

i

n

e

3

8

H

u

n

g

a

r

y

9

P

o

l

a

n

d

3

3

A

u

s

t

r

i

a

3

0

I

t

a

l

y

2

4

C

z

e

c

h

R

e

p

.

2

1

F

r

a

n

c

e

5

G

e

r

m

a

n

y

2

3

B

e

l

g

i

u

m

1

4

N

e

t

h

e

r

l

a

n

d

s

3

7

D

e

n

m

a

r

k

1

0

S

p

a

i

n

3

5

P

o

r

t

u

g

a

l

8

U

K

3

4

I

r

e

l

a

n

d

Europe

9 8

Countries with more export than import:

Production EXP-IMP Saldo MS basis PROD+IMP-EXP

Germany 94.6 8.0 86.6

Netherlands 24.3 11.5 12.8

Belgium 18.5 10.0 8.5

Countries with more import than export:

Production IMP-EXP Saldo MS basis PROD+IMP-EXP

UK 42.0 2.3 44.3

Spain 33.0 1.6 34.6

France 19.0 2.7 21.7

Italy 12.8 4.3 17.1

As the trade of beer across national borders is insignificant in most countries, the market share in the domestic market is synonymous with the

total market share with the exception of the following countries:

Fachverlag Hans Carl GmbH

P.O. Box 99 01 53

90268 Nuremberg, Germany

Phone: ++49(0)911/9 52 85-0

Web:

www.brauwelt.de

www.brauweltinternational.com

www.carllibri.com

Indispensable

Worldwide

Print Newsletter Online

Contact us now!

Australasia

Beer production 21.6m hl (compared to 2011 -0.1m hl)

Africa

Beer production 125.1m hl (compared to 2011 +12.7m hl)

11 South Africa

POP 50.7

GNP 419.9

PROD 31.500

PCC 57

MS 98 %

SABSABM (MS 87 %)

BRANDHOUSEHEI

15 Nigeria

POP 162.4

GNP 273.0

PROD 24.000*

PCC 11

MS 95 %

NIGERIAN BR.HEI

(MS 70 %)

GUINNESS NIG. DIAGEO

32 Angola

POP 19.6

GNP 108.3

PROD 9.500

PCC 54

MS 89 %

CUCA BR. - CASTELsabm

(MS 89 %)

36 Cameroon

POP 20.0

GNP 25.5

PROD 6.900

PCC 38

MS 96 %

SABC-CASTELsabm

(MS 61 %)

DIAGEO

26 Australia

POP 22.6

GNP 1,586.0

PROD 17.350

PCC 82

MS 86 %

LION NATHANKIR

(MS 44 %)

FOSTERSSABM

36 Cameroon

15 Nigeria

26 Australia

32 Angola

11 South Africa

11

Doemens Academy

educates brewmasters, foodstufftechnologists and is a reliable partner to all young people starting their career

in the beverage industry.

Doemens Savour Academy

is the world leading institute in training beer sommeliers as well as mineral water sommeliers. Doemens

associated beer sommelier courses are also available in Italy, Brasil and in the US.

Doemens Consulting and Services

provides a wide variety of specialists to help in any eld beverage-industry has

to cope with.

World Brewing Academy

offers English language courses in brewing-technology with classes in

Chicago/USA and Munich/Germany.

e in Italy, Brasil and in the US.

eld beverage-industry has

gy it withh cllasses iin

For nearly 120 years Doemens in Munich-Graefelng has proven to be a capable

and professional partner to the brewing and the beverage industry.

For further information please contact us:

mail: info@doemens.org fon: +49-89-85805-0

www.doemens.org www.worldbrewingacademy.com

Barth-Report.indd 1 05.03.13 11:40

More about hops

12

Successful people

have competent partners!

Sachon trade publications

Innovative magazines for professional decision makers

Verlag W. Sachon GmbH + Co. Schloss Mindelburg D- 87719 Mindelheim

Phone +49/ 8261/999- 0 Fax +49/ 8261/999- 391 info@sachon.de www.sachon.de

Your Sachon contacts:

BREWING AND BEVERAGE INDUSTRY Sabine Berchtenbreiter, Phone +49/ 8261/ 999- 338

INTERNATIONAL, ESPAOL and CHINA

GETRNKEINDUSTRIE

BRAUINDUSTRIE Anita Elser, Phone +49/ 8261/ 999- 331

DOEMENSIANER

GETRNKEFACHGROSSHANDEL Helga Re, Phone +49/ 8261/ 999- 332

Anzeige englisch - NEU A4 :0 11.03.2013 13:51 Uhr Seite 4

Top 40 countries 2012 - World beer production ranking

Country Beer production Beer production Beer production Beer production

2000 2010 2011 2012

1 CHINA 220.000 448.304 489.880 490.200

2 USA 232.500 228.982 226.480 229.314

3 BRAZIL 82.600 128.700 133.000 132.800

4 RUSSIA 54.900 102.930 98.140 97.400

5 GERMANY 110.429 95.683 95.545 94.618

6 MEXICO 57.812 79.889 81.500 82.500 *

7 JAPAN 70.998 58.100 56.000 55.465

8 UK 55.279 44.997 45.694 42.049

9 POLAND 24.000 36.000 36.000 37.800

10 SPAIN 26.400 33.375 33.573 33.000

11 SOUTH AFRICA 24.500 29.600 30.870 31.500

12 UKRAINE 10.270 31.000 30.510 30.050

13 VIETNAM 7.430 26.500 27.800 29.800

14 NETHERLANDS 25.072 23.936 23.647 24.272

15 NIGERIA 6.300 17.600 19.596 24.000 *

16 THAILAND 11.543 19.950 20.600 23.700

17 COLUMBIA 13.500 20.500 21.000 22.550

18 VENEZUELA 18.590 20.000 23.500 21.470

19 CANADA 23.074 19.647 19.515 19.525

20 INDIA 5.500 15.600 18.500 19.500 *

21 FRANCE 18.926 15.600 19.110 19.000 *

22 SOUTH KOREA 18.568 18.173 18.497 18.875

23 BELGIUM 14.733 18.123 18.571 18.500 *

24 CZECH REP. 17.916 17.661 17.776 18.265

25 ROMANIA 12.097 17.000 16.900 17.900

26 AUSTRALIA 17.150 17.420 17.380 17.350

27 ARGENTINA 12.000 17.500 17.000 16.700 *

28 PHILIPPINES 12.200 15.700 15.700 15.800 *

29 PERU 5.627 11.000 11.500 13.200

30 ITALY 12.575 12.370 12.510 12.791

31 TURKEY 6.903 9.670 9.800 9.980

32 ANGOLA 1.232 7.362 8.200 9.500

33 AUSTRIA 8.750 8.670 8.917 8.927

34 IRELAND 8.710 8.249 8.514 8.197

35 PORTUGAL 6.451 8.312 8.299 7.500

36 CAMEROON 3.674 5.890 6.000 6.900

37 DENMARK 7.460 6.335 6.590 6.600 *

38 HUNGARY 7.300 6.000 6.241 6.159

39 CHILE 4.193 5.680 5.960 6.000

40 ECUADOR 2.454 5.700 5.500 5.925

Total 1,279.616 1,713.708 1,770.315 1,785.582

World beer production 2012 1,951.281

Market share top 40 countries 2012 91.5 %

Quick Helper

Production of beer

in million hectolitres

* Estimate

13

Successful people

have competent partners!

Sachon trade publications

Innovative magazines for professional decision makers

Verlag W. Sachon GmbH + Co. Schloss Mindelburg D- 87719 Mindelheim

Phone +49/ 8261/999- 0 Fax +49/ 8261/999- 391 info@sachon.de www.sachon.de

Your Sachon contacts:

BREWING AND BEVERAGE INDUSTRY Sabine Berchtenbreiter, Phone +49/ 8261/ 999- 338

INTERNATIONAL, ESPAOL and CHINA

GETRNKEINDUSTRIE

BRAUINDUSTRIE Anita Elser, Phone +49/ 8261/ 999- 331

DOEMENSIANER

GETRNKEFACHGROSSHANDEL Helga Re, Phone +49/ 8261/ 9 99- 332

Anzeige englisch - NEU A4 :0 11.03.2013 13:51 Uhr Seite 4

Merger and acquisition highlights

14

WWW.HAFFMANS.NL

WWW.SUEDMO.DE

WWW.PENTAIRBEVERAGESYSTEMS.COM

YOUR PASSION FOR BEER

IS OUR MOTIVATION!

Beer Membrane Filtration

Quality Control Equipment

CO

2

Systems

Microfiltration

Process Engineering

Process Technology

Project Management

Valve Technology

Water Treatment

Merger and acquisition highlights among the

40 largest brewing groups worldwide

Major M&A activity in 2012 started off with the acquisition

of StarBev by the MolsonCoors Group expanding into Eastern

Europe and giving it exposure to emerging markets. Integration

of MolsonCoors UK unit and its newly acquired Central and

Eastern European unit is ongoing.

Later in the year tension ran high when Heineken battled for

control of Asia-Pacific Breweries, Singapore, with the owners

of Beer Thai, who had made an unsolicited offer for APB. After

a nailbiting couple of weeks Heineken emerged as the winner

and took full control of APB.

The full acquisition of Grupo Modelo by ABI had not been com-

pleted by the end of 2012 and had run into some regulatory

issues forcing ABI to make concessions in to the US anti-trust

authority. We continue to report Grupo Modelo as a separate

entity in the 2012 league table.

We have been able to obtain a consolidated production figure

for the Kirin Group for the first time and therefore no longer

include Brasil Kirin (formerly Schincariol) nor Lion in our table,

of which Kirin owns a majority.

The elemination of 5 previous entries in the table makes

room for new breweries: Krombacher of Germany, Beer Thai

of Thailand, Habeco of Vietnam, Brau Holding International of

Germany and SiPing Ginsberg Brewery.

The 40 largest brewing groups worldwide as of 31. 12. 2012

Brewery Country Production vol. Percentage of world

2012 in mill. hl beer production

1 AB InBev

1)

Belgium 352.9 18.1 %

2 SABMiller

2)

United Kingdom 190.0 9.7 %

3 Heineken Netherlands 171.7 8.8 %

4 Carlsberg Denmark 120.4 6.2 %

5 China Resource Brewery Ltd. China 106.2 5.4 %

6 Tsingtao Brewery Group China 78.8 4.0 %

7 Grupo Modelo Mexico 55.8 2.9 %

8 Molson-Coors USA/Canada 55.1 2.8 %

9 Yanjing China 54.0 2.8 %

10 Kirin Japan 49.3 2.5 %

11 Efes Group Turkey 28.4 1.5 %

12 BGI / Groupe Castel France 26.7 1.4 %

13 Asahi Japan 21.2 1.1 %

14 Gold Star China 19.7 1.0 %

15 Diageo (Guinness) Ireland 19.2 1.0 %

16 Petropolis Brazil 18.0 0.9 %

17 Polar Venezuela 17.7 0.9 %

18 San Miguel Corporation Philippines 17.3 0.9 %

19 Singha Corporation Thailand 15.9 0.8 %

20 Radeberger Gruppe Germany 13.0 0.7 %

21 Saigon Beverage Corp. (SABECO) Vietnam 12.6 0.6 %

22 Grupo Mahou - San Miguel Spain 12.3 0.6 %

23 Pearl River China 11.7 0.6 %

24 Oriental Brewery South Korea 11.7 0.6 %

25 Chongqing Beer Stock Co. Ltd. China 11.4 0.6 %

26 United Brewery India 10.1 0.5 %

27 Oettinger Germany 10.0 0.5 %

28 CCU Chile 10.0 0.5 %

29 Obolon Ukraine 9.0 0.5 %

30 Damm Spain 8.5 0.4 %

31 Sapporo Japan 8.4 0.4 %

32 Hite South Korea 8.3 0.4 %

33 Shenzhen Kingway China 7.9 0.4 %

34 Suntory Japan 7.9 0.4 %

35 Bitburger Braugruppe Germany 7.5 0.4 %

36 Krombacher Germany 6.5 0.3 %

37 Beer Thai (Chang) Thailand 6.1 0.3 %

38 Habeco Vietnam 6.0 0.3 %

39 Brau Holding International Germany 5.4 0.3 %

40 SiPing Ginsberg Brewery China 5.1 0.3 %

Total 1,607.7 82.4 %

World beer production 2012 1,951.3 100.0 %

Quick Helper

The data were taken from the

brewers own annual reports.

In other cases, the production

volume had to be estimated

after different sources had

reported differing or no figures.

1)

Without Modelo

2)

Without China

Resource Brewery Ltd.

15

www.barthhaasgroup.com

We strive

More than

200

years

of expertise.

experts

worldwide.

610

FOR YOUR SUCCESS!

8

generations.

Germain Hansmaennel

8 A rue du Maire Kuss

B.P. 48, 67068 Strasbourg, France

Phone: +33-6-08 89 57 46

Fax: +33-3-88 32 67 17

E-Mail: ghansmaennel@aol.com

www.barthhaasgroup.com

Potrebbero piacerti anche

- Brewing Grain Substitution ChartDocumento1 paginaBrewing Grain Substitution ChartCulturalmodovar Cultura CucaNessuna valutazione finora

- Annex J - Food StandardsDocumento21 pagineAnnex J - Food StandardsHevi Angelo Rios Tadena60% (10)

- Zymurgy 1985 Vol 08-02 SummerDocumento64 pagineZymurgy 1985 Vol 08-02 Summerpixtaccio100% (1)

- Kirin Case Study - 5Documento25 pagineKirin Case Study - 5Sejong Yoo100% (7)

- Beer Porter Five ForcesDocumento17 pagineBeer Porter Five ForcesGopesh Meena67% (3)

- Beer - A Global HistoryDocumento122 pagineBeer - A Global HistorycarlettoalbanmNessuna valutazione finora

- BYO 2015 Vol 21-04 July-AugustDocumento108 pagineBYO 2015 Vol 21-04 July-AugustAndoni M100% (1)

- Classic Beer Style Series #02 - Continental PilsnerDocumento106 pagineClassic Beer Style Series #02 - Continental PilsnerFred smith100% (1)

- BJCP Beer StylesDocumento124 pagineBJCP Beer StylesSlobodan Boba RadelićNessuna valutazione finora

- The New Homemade Kitchen: 250 Recipes and Ideas for Reinventing the Art of Preserving, Canning, Fermenting, Dehydrating, and MoreDa EverandThe New Homemade Kitchen: 250 Recipes and Ideas for Reinventing the Art of Preserving, Canning, Fermenting, Dehydrating, and MoreValutazione: 4.5 su 5 stelle4.5/5 (3)

- CADBURY RapportDocumento23 pagineCADBURY RapportAnonymous 6nyvzMPNessuna valutazione finora

- Pepsico Company PresentationDocumento15 paginePepsico Company PresentationVishnu Chevli100% (1)

- Classic Beer Style Series #15 - Mild Ale - History, Brewing, Techniques, Recipes - by David Sutula (1999)Documento218 pagineClassic Beer Style Series #15 - Mild Ale - History, Brewing, Techniques, Recipes - by David Sutula (1999)Lourenço AssumpçãoNessuna valutazione finora

- Make Your Own Beer: A Guide to All Things Beer & How to Brew it YourselfDa EverandMake Your Own Beer: A Guide to All Things Beer & How to Brew it YourselfNessuna valutazione finora

- Heineken Final PPTDocumento60 pagineHeineken Final PPTStefan O. Catalin0% (1)

- Sweet, Reinforced and Fortified Wines: Grape Biochemistry, Technology and VinificationDa EverandSweet, Reinforced and Fortified Wines: Grape Biochemistry, Technology and VinificationNessuna valutazione finora

- Gueuze BeerDocumento157 pagineGueuze BeerDavid Anamaria100% (1)

- Global Beer Industry ThesisDocumento38 pagineGlobal Beer Industry ThesisNguyễn Đức Tùng100% (1)

- The Handbook of Soap ManufactureDa EverandThe Handbook of Soap ManufactureValutazione: 3 su 5 stelle3/5 (1)

- EU Fruit Juice DirectiveDocumento32 pagineEU Fruit Juice DirectiveMuhsidinNessuna valutazione finora

- Research Paper On Beer Production PDFDocumento4 pagineResearch Paper On Beer Production PDFkgtyigvkg100% (1)

- Comparative Life Cycle Assessment of Malt-Based Beer and 100% Barley BeerDocumento66 pagineComparative Life Cycle Assessment of Malt-Based Beer and 100% Barley BeerWajahat WarraichNessuna valutazione finora

- Estudo Do Perfil Químico de Cervejas Brasileiras Uma Avaliação Entre As BebidasDocumento13 pagineEstudo Do Perfil Químico de Cervejas Brasileiras Uma Avaliação Entre As BebidasCaio DiasNessuna valutazione finora

- Water, Wastewater and Waste Management in Brewing IndustriesDocumento10 pagineWater, Wastewater and Waste Management in Brewing Industriesuh6VGEvdLtgItjlSNessuna valutazione finora

- Heineken Case StudyDocumento28 pagineHeineken Case Studyapi-324734052Nessuna valutazione finora

- M&A As A Driver of Global Competition in The Brewing IndustryDocumento24 pagineM&A As A Driver of Global Competition in The Brewing IndustryUtsav Raj PantNessuna valutazione finora

- Swot of AbinbevDocumento3 pagineSwot of AbinbevSanjeev Kumar SharmaNessuna valutazione finora

- Peru 2010Documento2 paginePeru 2010Rodrigo Rojas PachecoNessuna valutazione finora

- Business Analysis - MTHR BreweryDocumento13 pagineBusiness Analysis - MTHR Brewerydimitris_tsagkosNessuna valutazione finora

- CalibradorDocumento4 pagineCalibradorjuanNessuna valutazione finora

- Brewing A Better Beer: Brewing Beer Is More Than Meets The EyeDocumento2 pagineBrewing A Better Beer: Brewing Beer Is More Than Meets The EyeYerco UrquizaNessuna valutazione finora

- 2013 Vinquiry HarvestHandbookDocumento52 pagine2013 Vinquiry HarvestHandbookCojocaru GeorgeNessuna valutazione finora

- Niir Complete Technology Book On Alcoholic Non Alcoholic Beverages 2nd Revised Edition Fruit Juices Sugarcane Juice Whisky Beer Microbrewery Rum WineDocumento7 pagineNiir Complete Technology Book On Alcoholic Non Alcoholic Beverages 2nd Revised Edition Fruit Juices Sugarcane Juice Whisky Beer Microbrewery Rum WineMaayan DivakarNessuna valutazione finora

- Agenda: Company Overview Industry & Competitors Overview Ratios Future Strategy RecommendationDocumento18 pagineAgenda: Company Overview Industry & Competitors Overview Ratios Future Strategy Recommendationashish_302725481Nessuna valutazione finora

- Soft Drink ProjectDocumento54 pagineSoft Drink ProjectZubair Shaik75% (4)

- JCL Presentation OPSI June 22 06Documento31 pagineJCL Presentation OPSI June 22 06GrignionNessuna valutazione finora

- Global Forces and The European Brewing IndustryDocumento9 pagineGlobal Forces and The European Brewing IndustryMurtaza ShaikhNessuna valutazione finora

- Sigma Kit Acids OrganicsDocumento2 pagineSigma Kit Acids OrganicsNadège LiliNessuna valutazione finora

- Case SM1 Updated v1Documento15 pagineCase SM1 Updated v1Divya ChaudharyNessuna valutazione finora

- Thesis On Beer ProductionDocumento8 pagineThesis On Beer Productiontammykordeliskinorman100% (2)

- Beer Is One of The Most Popular Beverages in The WorldDocumento5 pagineBeer Is One of The Most Popular Beverages in The WorldjigneshkavybinaNessuna valutazione finora

- Analysis of Selected Hop Aroma Compounds in Commercial Lager and Craft Beers Using HS-SPME-Gc-Ms/MsDocumento17 pagineAnalysis of Selected Hop Aroma Compounds in Commercial Lager and Craft Beers Using HS-SPME-Gc-Ms/MsJuan Pablo EspinosaNessuna valutazione finora

- APUDocumento14 pagineAPUKhangal SharkhuuNessuna valutazione finora

- The Impact of Hop Bitter Acid and Polyphenol Profiles On The PerceivedDocumento9 pagineThe Impact of Hop Bitter Acid and Polyphenol Profiles On The PerceivedDavid AndrésNessuna valutazione finora

- Sdifeb11 WebDocumento61 pagineSdifeb11 WebShishir Kumar SinghNessuna valutazione finora

- Pepsi Background InfoDocumento8 paginePepsi Background Infosamuel kebedeNessuna valutazione finora

- Getting The Most From Your Hops: Patrick Jensen Spencer Tielkemeier Nick ZeiglerDocumento39 pagineGetting The Most From Your Hops: Patrick Jensen Spencer Tielkemeier Nick ZeiglerMateus MagalhãesNessuna valutazione finora

- Aqua-Fina Marketing Final ReportDocumento25 pagineAqua-Fina Marketing Final ReportValeed Ch0% (1)

- The Beer Industry-4Documento93 pagineThe Beer Industry-4tarang11Nessuna valutazione finora

- Book 2Documento20 pagineBook 2k.shaikhNessuna valutazione finora

- Research Paper On Carbonated DrinksDocumento8 pagineResearch Paper On Carbonated Drinksafnhekkghifrbm100% (1)

- Group 5 PDR DraftDocumento90 pagineGroup 5 PDR DraftArfel Marie FuentesNessuna valutazione finora

- 1121craft Brewing Is It Really About The Sensory RevDocumento4 pagine1121craft Brewing Is It Really About The Sensory RevlijiaweiNessuna valutazione finora

- Major Project On "A Study On Consumer Preference Towards Coca Cola With Reference To AKALTARA Town"Documento30 pagineMajor Project On "A Study On Consumer Preference Towards Coca Cola With Reference To AKALTARA Town"aksrinivasNessuna valutazione finora

- 06 Anheuser BuschDocumento13 pagine06 Anheuser Busch9874567Nessuna valutazione finora

- Presentation 2 Beer in GermanyDocumento28 paginePresentation 2 Beer in GermanySanket MedhekarNessuna valutazione finora

- Process Technology:: For The Perfect MixDocumento8 pagineProcess Technology:: For The Perfect Mixkaax1ys2b7Nessuna valutazione finora

- Camu Camu Beer - GSR 2019-LlDocumento23 pagineCamu Camu Beer - GSR 2019-Llfatima gonzalesNessuna valutazione finora

- Trade State Sustainable CoffeeDocumento198 pagineTrade State Sustainable CoffeeJose MartinezNessuna valutazione finora

- Future Success Strategies For Carbonated Soft Drinks (CSDS) 2010 EditionDocumento14 pagineFuture Success Strategies For Carbonated Soft Drinks (CSDS) 2010 EditionHrushikesh ReddyNessuna valutazione finora

- Coca-Cola in 2011: in Search of A New ModelDocumento10 pagineCoca-Cola in 2011: in Search of A New Modeldrakor drakorNessuna valutazione finora

- ChiragDocumento28 pagineChiragNitikaNessuna valutazione finora

- Good Beer Guide 2012: The Complete Guide to the UK's Best PubsDa EverandGood Beer Guide 2012: The Complete Guide to the UK's Best PubsValutazione: 5 su 5 stelle5/5 (2)

- Technology of CheesemakingDa EverandTechnology of CheesemakingBarry A. LawNessuna valutazione finora

- Handbook of Brewing: Processes, Technology, MarketsDa EverandHandbook of Brewing: Processes, Technology, MarketsHans Michael EßlingerNessuna valutazione finora

- Coffee, climate change and adaption strategies for German coffee producersDa EverandCoffee, climate change and adaption strategies for German coffee producersNessuna valutazione finora

- Beer Pilkhani DistilleryDocumento44 pagineBeer Pilkhani DistillerySunil Vicky VohraNessuna valutazione finora

- Press Release - SBL Leadership Changes - EnGDocumento2 paginePress Release - SBL Leadership Changes - EnGAnonymous FnM14a0Nessuna valutazione finora

- Sierra Nevada Pale Ale Clone - Beer Recipe - Brewer's Friend (ORIGINAL)Documento1 paginaSierra Nevada Pale Ale Clone - Beer Recipe - Brewer's Friend (ORIGINAL)Ralph Espanhol0% (1)

- Brewers InvitationDocumento2 pagineBrewers InvitationCristian Mihai DinuNessuna valutazione finora

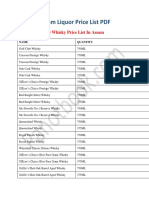

- Assam Liquor Price List PDFDocumento7 pagineAssam Liquor Price List PDFBeatrix WanwanNessuna valutazione finora

- Beer MenuDocumento2 pagineBeer MenueatlocalmenusNessuna valutazione finora

- Powerpoint Presentation MyselfDocumento9 paginePowerpoint Presentation Myselfapi-312363897Nessuna valutazione finora

- Beer Production in NigeriaDocumento5 pagineBeer Production in NigeriaMichael OlatunjiNessuna valutazione finora

- Wine Rate in AssamDocumento6 pagineWine Rate in AssamJeet Gogoi50% (10)

- All About German BeerDocumento2 pagineAll About German Beerstelis2Nessuna valutazione finora

- Spirits MenuDocumento6 pagineSpirits MenueatlocalmenusNessuna valutazione finora

- GistDocumento21 pagineGistMario JammaersNessuna valutazione finora

- Fermentation Recipe BlankDocumento10 pagineFermentation Recipe BlankDiego BalmoriNessuna valutazione finora

- PEDIDOS A DOMICILIO CR GRUPO PanDocumento3 paginePEDIDOS A DOMICILIO CR GRUPO PanOrlandoNessuna valutazione finora

- Case Study - BIRA 91Documento6 pagineCase Study - BIRA 91Rashmi BachhasNessuna valutazione finora

- Beer (Introduction, Types, Productions & Storage)Documento12 pagineBeer (Introduction, Types, Productions & Storage)RHTi BDNessuna valutazione finora

- FireBall Brown PorterDocumento1 paginaFireBall Brown PorterbrunokfouriNessuna valutazione finora

- Pricelistwef1 8 19Documento141 paginePricelistwef1 8 19JoelSamNessuna valutazione finora

- Prajay Patel Sunil Magesh Sagar ParikhDocumento50 paginePrajay Patel Sunil Magesh Sagar ParikhSunil MageshNessuna valutazione finora

- M.R.P. of LiquorDocumento9 pagineM.R.P. of LiquorRohit Gautam DwivediNessuna valutazione finora

- 2019 Diy Dog - V8Documento1 pagina2019 Diy Dog - V8esteban pedrazNessuna valutazione finora

- Limpopo Pricelist 01.03.24 With RSPDocumento2 pagineLimpopo Pricelist 01.03.24 With RSPtinnymoretiNessuna valutazione finora

- Global Forces and The European Brewing IndustryDocumento9 pagineGlobal Forces and The European Brewing IndustryMurtaza ShaikhNessuna valutazione finora