Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

PWC Which Market Ipo Brochure 08 2012

Caricato da

Mohamed Younis0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

54 visualizzazioni8 pagineIPO brochure

Titolo originale

Pwc Which Market Ipo Brochure 08 2012

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoIPO brochure

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

54 visualizzazioni8 paginePWC Which Market Ipo Brochure 08 2012

Caricato da

Mohamed YounisIPO brochure

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 8

Which market?

A guide for companies

considering an initial

equity listing in New York,

London or HongKong

September 2012

A publication from

PwCs Deals practice

At a glance

The process of selecting

the most appropriate

exchange for your

business to list its shares

is challenging and

complex.

Understanding the

differences among

global exchanges and

determining the

exchange that best fts

the unique needs of your

business are key aspects

of a successful listing.

Working closely with

an advisor can help

anticipate business risks

and develop programs to

manage these risks early

in the offering process.

www.pwc.com/us/ipo

2 Which market?

Introduction

In recent years, a number of factors have been driving an upward trend in global debt and equity issuance. As markets and

businesses become increasingly global, the decision of choosing the right exchanges becomes more challenging. A number of

factors must be considered to reveal the best options, and planning early can help your company comply with listing

requirements and alignment of stakeholder timelines.

Having decided that a public offering is an appropriate next step in your companys development, one of your frst important decisions is

to determine which stock exchange best fts your short- and long-term goals. The listing options typically are:

Domestic markets

Dual locations: your companys domestic and another market

One of the larger international stock exchanges

Choosing the most appropriate market may not be straightforward and will depend on your own IPO objectives, relevant merits and

requirements of each market and how they ft your overall situation. To help you determine which option is best for your company, weve

highlighted some of the factors for you to consider and explained some of the high-level differences among the largest stock exchanges in

the three international markets located in New York, London and Hong Kong.

Some factors to consider include:

Valuation Certain industries and types of companies may achieve favorable valuations in certain markets, due

to competitors and other recent listings of peer companies.

Location and trading

operations of your company

The companys core business locations may affect the appetite for its equity, often driving

a domestic listing.

The stage of development of your business may make it more suitable for a particular market. A

company wishing to enter a new market or gain greater recognition in that market may choose to

list in that market as a way to get exposure to new customers, vendors and shareholders.

Market and stakeholder

relations

Investor and analyst briefngs, as well as interest in the business, can vary in different locations.

Expectations of other stakeholders, such as bankers and employees, can affect the decision.

Initial listing Admission/eligibility criteria may be diffcult to achieve as the pre-listing regulatory review

requirements vary by market.

Costs of listing vary in each market.

Continuing obligations Differences exist in post-listing compliance obligations among markets and may have varying cost

implications, for instance, requirements related to XBRL, interim and semi-annual reporting and

reporting on internal controls.

Markets regulatory frameworks, including corporate governance requirements, may have

business implications.

Other factors Acquisition currency may be required for business development in certain locations.

In certain locations there is more than one market. Which one is most suitable for your company?

If inclusion in market indices is important, this may restrict the market choices available.

Employees may desire options in a particular market.

Which market? 3

The typical IPO timetable

At a high level, the process of preparing your business to operate as a public company is similar in New York, London and Hong Kong.

However, irrespective of the market(s) you choose, planning early will help you ensure the alignment of the respective timelines of all

stakeholders. As an example, the following timeline describes the key elements that are common to the listing process and appropriate

timing in each of the markets. Keep in mind that the actual timeline could vary signifcantly from this example and will be unique to each

company and depend on a number of factors, such as size of offering, industry sector, organizational structure and type of listing.

Where to fnd more information

The following PwC publications can provide you with additional information on the capital markets within these locations:

New York Roadmap for an IPO: A guide to going public

Executing a successful IPO

London A guide to a primary listing on the main market

A guide to secondary listing of equity and a listing of depositary receipts

A guide to fotation on AIM

Hong Kong Going public

General

Month 1 Month 2 Month 3 Month 4 Month 5/6

Financial

Reporting

Underwriting

and Diligence

Regulation and

Documentation

Marketing

Being Public

Prepare investor story

Begin general planning, preparation and setting of timetable

Finalize transaction, shareholders and debt structure

Appoint key advisors and underwriters

Prepare historical and other nancial information

Conduct audits and reviews

Review nancial reporting procedures (if applicable)

Deliver comfort letters to underwriters

Review working capital (if applicable)

Conduct business and nancial due diligence

Conduct legal due diligence

Draft legal documents

Prepare and verify registration statement/prospectus

Prepare underwriting agreement

Begin pre-marketing

Conduct broker research

Prepare investors

Prepare for roadshow

Finalize the offering price

Issue press release

Announce possible listing

Verify and draft registration statement/prospectus including

regulatory review

Vet, approve and print registration statement/prospectus

Conrm eligibility

Prepare the organization to operate as a public company

I

P

O

R

e

a

d

i

n

e

s

s

A

s

s

e

s

s

m

e

n

t

R

o

a

d

s

h

o

w

L

a

u

n

c

h

4 Which market?

1 As of the printing of this publication, Hong Kong Exchange rules do not permit companies domiciled solely in the

United States to list on Hong Kong exchanges. To list on the Hong Kong Exchanges a company may need to consider

re-domiciling in a country listed as an accepted jurisdiction.

2 The Jumpstart Our Business Act (JOBS Act) was enacted on April 5, 2012 and may result in changes in the Nasdaq

and NYSEs listing standards to accommodate emerging growth companies.

3 NASDAQ Global Select (NASDAQ) is the market with the most stringent initial listing requirements among the three

markets comprising The NASDAQ Stock Market.

4 In certain circumstances, fewer years may be allowed if companies have not been in existence for three years.

The major markets

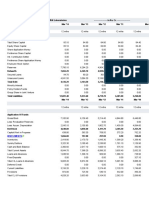

at a glance

Although each of the exchanges

across the three markets has

comprehensive listing requirements,

the purpose of our table is to give you

a high-level overview of the

minimum initial equity listing

requirements in each market.

Hong Kong

1

London New York

2

Main Board Main Market AIM NASDAQ Global Select

3

NYSE

Minimum initial equity listing criteria

Financial information

Audited track record

4

Three years of audited accounts Three years of audited accounts Three years of audited accounts Three years of audited accounts Three years of audited accounts

Revenues

5

HK$ 500 million in revenue and

HK$ 4 billion in global market

capitalization

At least 75% of the entitys business

must be supported by a revenue

earnings track record for the three-

year period

No minimum requirement $90 million in revenue and $850

million in global market capitalization

$75 million in revenue and $750

million in global market capitalization

Profts

5

Sum of last three years:

HK$ 50 million

Most recent year: HK$ 20 million

Sum of two prior years:

HK$ 30 million

No minimum requirement No minimum requirement Sum of last three years:

$11 million

Each of two most recent years:

$2.2 million

No losses in prior three years

Sum of last three years:

$10 million

Each of two most recent years:

$2 million

No losses in prior three years

Assets/Equity

5

No minimum requirement No minimum requirement No minimum requirement $80 million in total assets

$55 million in stockholders equity

$160 million in global market

capitalization

$75 million in total assets

$50 million in stockholders equity

$150 million in global market

capitalization

Financial information requirements Hong Kong FRS or IFRS

6

IFRS or equivalent GAAP

7

IFRS or equivalent GAAP

7

US GAAP or IFRS

8

US GAAP or IFRS

8

Prot forecast

Pro forma nancial information

Working capital

Capitalization and indebtedness

Investors

Minimum number 300 No minimum requirement No minimum requirement 450 round lot shareholders

9

400 round lot shareholders

9

Minimum shares traded on market 25% of class of shares listed to

be held in public hands

25% of class of shares listed to

be held in public hands

No minimum requirement 1,250 thousand 1,100 thousand

Minimum public foat HK$ 50 million 700 thousand No minimum requirement $45 million $40 million

Corporate governance

Internal control certication

Trading support structure

Difference between domestic and overseas listed companies

Ongoing requirementsfnancial information

Annual reporting

Half-year reporting

10

Quarterly reporting

10

Major transaction pre-approval

Major transaction disclosure

10

Related-party transactions disclosure

= Signicant requirements = Some requirements = Minimal requirements

If particular criteria are not met, consultation with the exchange is recommended.

Which market? 5

5 When initially listing on the exchanges, the listing applicant can fulfll either one of the minimum revenue, proft or asset/equity fnancial standard requirements.

6 US GAAP allowed for secondary issuers and other accounting standards may be accepted in certain circumstances.

7 On the Main Market, equivalent includes US, Chinese, South Korean and Indian GAAP. On the AIM, equivalent includes US, Japanese and Canadian GAAP,

Australian IFRS, or national GAAP with a reconciliation to one of the aforementioned standards.

8 In the US, the SEC eliminated the requirement for Foreign Private Issuers (FPIs) to reconcile their fnancial statements to US GAAP when they have been prepared under

IFRS as published by the IASB.

9 Round lot is the term used for a normal unit of trading, which is 100 shares.

10 FPIs listing in the US can elect to follow only their home countrys rules related to half-year and quarterly reporting.

Hong Kong

1

London New York

2

Main Board Main Market AIM NASDAQ Global Select

3

NYSE

Minimum initial equity listing criteria

Financial information

Audited track record

4

Three years of audited accounts Three years of audited accounts Three years of audited accounts Three years of audited accounts Three years of audited accounts

Revenues

5

HK$ 500 million in revenue and

HK$ 4 billion in global market

capitalization

At least 75% of the entitys business

must be supported by a revenue

earnings track record for the three-

year period

No minimum requirement $90 million in revenue and $850

million in global market capitalization

$75 million in revenue and $750

million in global market capitalization

Profts

5

Sum of last three years:

HK$ 50 million

Most recent year: HK$ 20 million

Sum of two prior years:

HK$ 30 million

No minimum requirement No minimum requirement Sum of last three years:

$11 million

Each of two most recent years:

$2.2 million

No losses in prior three years

Sum of last three years:

$10 million

Each of two most recent years:

$2 million

No losses in prior three years

Assets/Equity

5

No minimum requirement No minimum requirement No minimum requirement $80 million in total assets

$55 million in stockholders equity

$160 million in global market

capitalization

$75 million in total assets

$50 million in stockholders equity

$150 million in global market

capitalization

Financial information requirements Hong Kong FRS or IFRS

6

IFRS or equivalent GAAP

7

IFRS or equivalent GAAP

7

US GAAP or IFRS

8

US GAAP or IFRS

8

Prot forecast

Pro forma nancial information

Working capital

Capitalization and indebtedness

Investors

Minimum number 300 No minimum requirement No minimum requirement 450 round lot shareholders

9

400 round lot shareholders

9

Minimum shares traded on market 25% of class of shares listed to

be held in public hands

25% of class of shares listed to

be held in public hands

No minimum requirement 1,250 thousand 1,100 thousand

Minimum public foat HK$ 50 million 700 thousand No minimum requirement $45 million $40 million

Corporate governance

Internal control certication

Trading support structure

Difference between domestic and overseas listed companies

Ongoing requirementsfnancial information

Annual reporting

Half-year reporting

10

Quarterly reporting

10

Major transaction pre-approval

Major transaction disclosure

10

Related-party transactions disclosure

= Signicant requirements = Some requirements = Minimal requirements

If particular criteria are not met, consultation with the exchange is recommended.

6 Which market?

Number of IPOs

New York London Hong Kong New York London Hong Kong

395

647

724

Offering value (US $ billions)

171

98

194

The number of IPOs and total proceeds raised during the last ve years ended

December 31, 2011

Source: PwC US IPO Watch, PwC Europe IPO Watch, PwC Greater China IPO Watch

New York

2,258

London

Hong Kong

3,266

15,641

Total domestic market capitalization of the markets at December 31, 2011

(US$ billions)

Source: World Federation of Exchanges and FESE

Number of IPOs

New York London Hong Kong Hong Kong New York London

Year ended 2009 Six months 2010

245

32

181

Offering value (US $ billions)

44

43

48

Source: PwC US IPO Watch, PwC Europe IPO Watch, PwC Greater China IPO Watch

The number of non-domestic IPOs and total proceeds raised during the last

ve years ended December 31, 2011

Some comparisons of recent

IPO market activity

Which market? 7

Source: PwC US IPO Watch, PwC Europe IPO Watch, PwC Greater China IPO Watch

Source: World Federation of Exchanges and FESE

41%

8%

4%

11%

3%

6%

23%

1%

3%

Financial Services

Technology

Health

Energy

Business Services

Consumer

Industrials

Transportation

Other

26%

19%

13%

11%

11%

8%

7%

4%

1%

15%

12%

5%

10%

8%

26%

15%

3%

6%

New York London Hong Kong Industry breakdown

London

Hong Kong

New York

A complex process

While the key considerations we have discussed in this document

will be your primary decision factors when considering which

market, there are other less tangible factors that may also play a

role, such as:

Political environment

Commercial/business environment

Location of existing stakeholders

Domestic regulatory environment

Personal preferences of current shareholders

The equity story to be told/the value proposition

Longer term plans

Taxation implications

Listing currency considerations

Because of these many and varied factors, the decision as to which

market to select can be complex. Talk to your external advisors to

determine the market that is best suited to your needs.

Conclusion

Whether your company is an emerging business or an

established company looking to raise capital through a public

debt or equity offering, you should work closely with your

advisors to understand the process of listing in the public

markets.

Discussions with your advisors are important to revealing how

they can help you anticipate business risks and develop

programs to manage those risks early in the offering process.

Advisors will also provide you with guidance through the life

cycle of a capital market transaction from helping to determine

the right entry strategy and assessing IPO readiness to assisting

with the public registration process and preparing for the

ongoing obligations as a newly public company.

Engaging experienced advisors with a global presence and

knowledge of the capital markets can help you anticipate issues,

avoid delays and otherwise navigate successfully through the

life cycle of your capital market transaction. In the event that

your company considers overseas or dual listings, the steps

involved to achieve a successful transaction may increase.

Using an advisor who is experienced with the multiple elements

of the transaction process, along with having the ability to

advise on technical accounting and fnancial reporting

complexities associated with the going public process, will

allow you to focus more time on the marketing phase of the deal

and ongoing management of your business.

To talk more about your companys capital market needs, please

contact your PwC relationship partner or learn more at

www.pwc.com/us/IPO

Sector split of listings during last ve years

ended December 31, 2011

2012 PwC. All rights reserved. PwC and PwC US refer to PricewaterhouseCoopers LLP, a Delaware limited liability partnership, which is a member rm of PricewaterhouseCoopers International Limited,

each member rm of which is a separate legal entity. This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisers. NY 12 0562

North America

Midwest

Mike Gould

Partner, Transaction Services

312 298 3397

mike.gould@us.pwc.com

West

Joseph Dunleavy

Partner, Transaction Services

713 356 4034

joseph.p.dunleavy@us.pwc.com

Bryan McLaughlin

Partner, Transaction Services

408 817 3760

bryan.mclaughlin@us.pwc.com

East

Scott Gehsmann

Partner, Transaction Services

646 471 8310

scott.j.gehsmann@us.pwc.com

Mike Poirier

Partner, Transaction Services

617 530 5573

michael.d.poirier@us.pwc.com

New York Metro

Howard Friedman

Partner, Transaction Services

646 471 5853

howard.m.friedman@us.pwc.com

Europe

Clifford Tompsett

Partner, Global IPO Centre Leader

+44 (0) 20 780 44703

clifford.tompsett@uk.pwc.com

Asia

Kennedy Liu

Partner, Head of China/Hong Kong

Capital Market Services

+852 2289 1881

kennedy.liu@hk.pwc.com

For a deeper conversation of how fnance considerations impact your deal, please contact one of our PwC specialists in

our Deals practice or your local PwC Deals partner:

Martyn Curragh

Partner,

US Practice Leader,

Transaction Services

646 471 2622

martyn.curragh@us.pwc.com

Henri Leveque

Practice Leader, Capital Markets and

Accounting Advisory Services

678 419 3100

h.a.leveque@us.pwc.com

Neil Dhar

Partner, Transaction Services- Capital

Markets Leader

646 471 3700

neil.dhar@us.pwc.com

www.pwc.com/us/deals

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- M and A Jargon Demystified PDFDocumento80 pagineM and A Jargon Demystified PDFMohamed YounisNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- New York Listings and IPOs PLC Magazine DecembeDocumento10 pagineNew York Listings and IPOs PLC Magazine DecembeMohamed YounisNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- IPO ComparingglobalstockexchangesDocumento84 pagineIPO ComparingglobalstockexchangesMohamed YounisNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Q1 2011 Investor PresentationDocumento31 pagineQ1 2011 Investor PresentationMohamed YounisNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Initial Public Offerings An Issuers GuideDocumento105 pagineInitial Public Offerings An Issuers GuideMohamed YounisNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Solutions To Recommended Questions - Chapter 1Documento16 pagineSolutions To Recommended Questions - Chapter 1David Terran TangNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- AP Review LiabDocumento10 pagineAP Review LiabTuya DayomNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Ch12 Excel ModelDocumento23 pagineCh12 Excel ModelDan Johnson50% (2)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- 01-02-2013 Term Sheet - Wednesday, January 2318Documento5 pagine01-02-2013 Term Sheet - Wednesday, January 2318Sri ReddyNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- Mastering the Art of Tape ReadingDocumento2 pagineMastering the Art of Tape ReadingAnupam Bhardwaj100% (1)

- Book Value Per Share Problem 1Documento3 pagineBook Value Per Share Problem 1XXXXXXXXXXXXXXXXXXNessuna valutazione finora

- OptionsDocumento44 pagineOptionskamdica100% (1)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Icici PruDocumento14 pagineIcici PruMubeenNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Capital Structure Slides Plus QuestionsDocumento22 pagineCapital Structure Slides Plus QuestionsDishAnt PaTelNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Analyst, Asian Equities Ex Japan (Property Sector) Job With Lion Global Investors Limited 9052176Documento3 pagineAnalyst, Asian Equities Ex Japan (Property Sector) Job With Lion Global Investors Limited 9052176cryellow8Nessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Financial Analysis and ReportingDocumento5 pagineFinancial Analysis and ReportingHoneyzelOmandamPonce100% (1)

- Investment AlternativesDocumento19 pagineInvestment AlternativesJagrityTalwarNessuna valutazione finora

- USJR Integrated2018 CostofCapital 09.15.18Documento13 pagineUSJR Integrated2018 CostofCapital 09.15.18Rona LuarNessuna valutazione finora

- BA Lufthansa Case 2007 PDFDocumento10 pagineBA Lufthansa Case 2007 PDFFeitengNessuna valutazione finora

- MBA 3rd Semester Investment Analysis Case StudiesDocumento5 pagineMBA 3rd Semester Investment Analysis Case StudiesChandru ChanduNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Mindtree 08 09Documento3 pagineMindtree 08 09muthusubaNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- Workbook On BCSM by BSEDocumento242 pagineWorkbook On BCSM by BSEavijit_saha007Nessuna valutazione finora

- MSN BalacesheetsDocumento16 pagineMSN BalacesheetsnawazNessuna valutazione finora

- Corporate Bonds and Valuation MCQ AnswersDocumento9 pagineCorporate Bonds and Valuation MCQ AnswersJenelle Acedillo ReyesNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Investment in Equity - MCDocumento5 pagineInvestment in Equity - MCLeisleiRago100% (1)

- SynopsisDocumento4 pagineSynopsispriya68kNessuna valutazione finora

- ZCCM-IH - Professional Misconduct Archive 08 - 13Documento4 pagineZCCM-IH - Professional Misconduct Archive 08 - 13Zambia InvestorNessuna valutazione finora

- Platform Acquisition ProspectusDocumento128 paginePlatform Acquisition Prospectusathompson14Nessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- HDFC Bank Shareholders 2013 Promoter, FII, Individual OwnershipDocumento1 paginaHDFC Bank Shareholders 2013 Promoter, FII, Individual OwnershipRahul LuharNessuna valutazione finora

- HVS-How To Test Hotel FeasibilityDocumento3 pagineHVS-How To Test Hotel FeasibilityNikul JoshiNessuna valutazione finora

- Nordea TaaDocumento25 pagineNordea Taaintel74Nessuna valutazione finora

- Stock Valuation: Answers To Concept Questions 1Documento15 pagineStock Valuation: Answers To Concept Questions 1Sindhu JattNessuna valutazione finora

- Summer Internship ReportDocumento43 pagineSummer Internship Reportnikhil yadavNessuna valutazione finora

- Assets Liabilities and EquityDocumento2 pagineAssets Liabilities and EquityArian Amurao50% (2)

- Valuasi Saham MppaDocumento29 pagineValuasi Saham MppaGaos FakhryNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)