Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

China Food and Drinks Industry Market Report

Caricato da

Krystal NavarroCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

China Food and Drinks Industry Market Report

Caricato da

Krystal NavarroCopyright:

Formati disponibili

1

Food and Drinks

in China

Updated December 2009

Complimentary Summary Version

© 2009 Schmittzehe & Partners. All rights reserved.

For all enquiries please contact : enquiries@SandPconsulting.com

2

Published by Schmittzehe & Partners, June 2009

Objective & Methodology:

Schmittzehe & Partners, an exclusively China-focused boutique management

consultancy, undertook extensive, broad research on the food and beverage industry in

China in 2008. Thus the data in this report mainly refers to 2007 figures unless stated

otherwise. In the interests of comparability and consistency, for market sizing and

growth we used figures from Access Asia /National Bureau of Statistics China. Other

data is available, such as Euromonitor, and indeed caution should be used with regard

to all data as for some segments, variations in values can be particularly large,

especially with Dairy, Bakery, Dried and Baby Foods. Our definition of the ‘Food and

Beverage Market’ excludes tobacco, alcohol, salt and sugar. Our definition for

‘Packaged Foods’ is ‘Food and Beverage Market’ less fresh foods.

These summary reports, as well as its full version, cover the findings of the above

research. These reports were written by Schmittzehe & Partners Shanghai-based

company analyst Sean Coyle with the collaboration and significant input of colleagues

David Guo and Benjamin Schmittzehe. For a fuller understanding of the subject, to

order the full report or for more in-depth analysis, please contact Schmittzehe &

Partners at: enquiries@SandPconsulting.com.

Disclaimer:

Schmittzehe & Partners strives to ensure the accuracy of all information contained in

this report. However, due to the fact that not all data can be verified, and that the

majority of the information is based on secondary sources or individual primary

sources, it is possible that errors or omissions may occur. Schmittzehe & Partners does

not accept responsibility for such errors or omissions. Details supplied by Schmittzehe

& Partners in this document should only be used as an aid to assist the making of

business and investment decision, not as the sole basis for such decisions.

Copyright:

All rights reserved to Schmittzehe & Partners, 2009.

For all questions:

Please contact Schmittzehe & Partners:

Email: enquiries@SandPconsulting.com

Telephone: +44 208 995 0886

Website: www.SandPconsulting.com

© 2009 Schmittzehe & Partners. All rights reserved.

For all enquiries please contact : enquiries@SandPconsulting.com

3

Contents:

Page

1. Overview, Trends and Tastes 4

2. Fresh Food 6

3. Frozen Food 7

4. Chilled Processed Foods 8

5. Canned Food 9

6. Dried Food 10

7. Bakery 11

8. Dairy 12

9. Ice Cream 13

10.Baby Foods 14

11.Confectionary 15

12.Sweet and Savoury Snacks 16

13. Sauces, Dressings and 17

Condiments

14.Non-alcoholic Beverages 18

15.Concluding Remarks 19

16.About Schmittzehe and Partners 20

© 2009 Schmittzehe & Partners. All rights reserved.

For all enquiries please contact : enquiries@SandPconsulting.com

4

Food and Beverage

Total food and non-alcoholic beverage sales in 2007 were RMB1,082bn, up from

RMB449bn in 2001. That is a year on year growth of 14.8%, which is more than twice

the Asia-pacific average for that period.

Growing presence of supermarkets improving market access for packaged

foods

Much of the packaged food sold is done so through supermarkets and discounters,

which account for 35% of all packaged food sales. The distribution of packaged food

relies to a great extent on the existence of organized retail networks; hence cities with

more developed distribution chains see better sales of such goods.

Rising incomes creating more demand for packaged foods

As middle class income growth continues to outstrip lower income growth, China’s food

consumption is also becoming more divergent. However, incomes are rising

everywhere, and as they do consumers continue to ‘trade-up’, spending more money

on packaged, value added goods.

Health consciousness is growing

Health is becoming a growing issue for consumers. Growing health awareness due to

advertising, government programs and numerous health scares about the food supply

has meant consumers pay strict attention to the reputed healthiness of a brand or

producer. This also explains somewhat the keen uptake of shopping in supermarkets,

as food sold there is seen to be more standardized and safer. Increased health

consciousness has also bolstered the demand for healthy foods, particularly

fortified foods.

Infrastructure improvement helping market access

Improving infrastructure means that more varieties of food are reaching inland 2nd , 3rd

tier cities and beyond. The improving infrastructure is simultaneously raising incomes

while also providing more goods to spend that income on. This combined with a decline

in self-sufficiency in rural areas, as more leave agriculture to work in industry, means

that while eastern markets are maturing, new markets are being opened inland.

The increase in food sales has been mainly benefiting organized retailers, with small

independents losing out on much of the growth. That said, regional markets are still

very fragmented. There is no efficient national distribution network in China, so many

national producers have to have regional production facilities and often rely on their

own distribution network. A poor cold-chain infrastructure also means frozen and

chilled foods and a lot of dairy cannot reach much of China. Many segments have a

huge number of local producers, meaning that a national market leader may only have

5-10% of the market. Another cause of this fragmentation is the importance of local

business relationships as opposed to quality and price.

Even segments with relatively high consolidation remain very competitive, due to the

prevalence of price-based competition. A majority of Chinese consumers, even ones

who have money to spare, tend to have very little brand loyalty and will substitute

products quite easily.

Tastes differ by region

In the more developed regions, i.e. the eastern seaboard, consumers are becoming

more particular in their tastes, demanding more differentiated products tailored to

their local pallet. The growing importance of regional variation in demand is felt by

many foreign companies, who in response are opening up R&D facilities in China.

© 2009 Schmittzehe & Partners. All rights reserved.

For all enquiries please contact : enquiries@SandPconsulting.com

5

The east coast with their higher incomes tend to spend more on indulgent foods

such as confectionery, as well as being more demanding of quality and healthiness

and more adventurous in the foods they try -tea flavouring is a popular additive at

the moment. Due to these factors, the east tends to be where most international

companies launch their new products in China. PepsiCo for example have their only

non-US research centre in Shanghai.

In the south west, growth of packaged food sales are strong, but the higher value

added products are out of the reach of most, so staple crops are the biggest

selling, while in the cities dairy products have been especially strong, including

yogurt.

In the south, products with multiple flavours and or long shelf-life tend to perform

strongest. Local producers tend to be the most trusted when it comes to freshness,

which is particularly important in bakery and dairy. However there is a shift in

consumer tastes in baked goods towards packaged biscuits, benefiting

international brands such as Oreos. Advertising is also of growing importance in

rural areas as consumers begin to move away from making purchasing decisions

solely on price. Consumers are very receptive to television advertising.

In central China, like in the west, consumers are quite poor so staple packaged

products are the most popular. Flavour is also particularly important in the region,

with traditional spicy and sour flavours usually winning out against anything else.

Packaging too, runs in accordance with tradition, bright and simple colours are

popular while red, violet, black and white are very unpopular. The value added

products tend to be dominated by national and international companies, while local

firms are mainly focused on the budget range. Despite this, brand loyalty is very

strong in key products such as condiments, were local producers sell more than

international brands.

Northwest China has the lowest consumption of packaged foods, as it has the

lowest consumer incomes. A majority of the packaged foods are sold in the main

cities like Urumqi. Baby foods have also seen strong growth, but it is still the lowest

in China.

© 2009 Schmittzehe & Partners. All rights reserved.

For all enquiries please contact : enquiries@SandPconsulting.com

6

Fresh Food

Definition:

Chilled deli meats and fish as well as more staple foodstuffs such as pulses,

vegetables, starchy roots, fruits, nuts, eggs and sugar and sweeteners

Overview:

The proportionally large amount of per capita consumption of fresh food represents

a lack of refrigeration in many homes. Many buy meat and vegetables to cook and

eat on the day of purchase.

Fresh meat is the biggest seller in the segment, with 48.78% of sales. Fresh and

dry vegetables are also of considerable size with 33.56% of sales. Fresh fruit and

fresh seafood are much smaller at 11.1% and 6.56% respectively.

Main Producers:

Company Produce Website

Chaoda Modern Fresh Food www.chaoda.com

Agriculture

China Green Fresh and Processed (frozen, canned, www.greenfood.org.c

pickled) Foods n

N.B. Illustrative examples only. Most fresh food in China is sold through wet

markets. The above companies sell to supermarkets and wholesalers as well as wet

markets.

© 2009 Schmittzehe & Partners. All rights reserved.

For all enquiries please contact : enquiries@SandPconsulting.com

7

Frozen Food

Definition:

Red meat, poultry, fish/sea food, vegetables, potatoes, bakery products, desserts,

ready meals

Overview:

The segment is 17.45% of total packaged food sales, being worth RMB81.80bn in

2007. The CAGR for 2001-7 was 17.2%.

Some estimate that by 2017, the entire packaged food market will be fuelled 75%

by second and third tier cities, and to properly exploit these areas, a dependable

and efficient cold chain supply is sorely needed. Indeed there is huge waste due to

the lack of adequate storage and distribution. According to Cargonews, USD10bn is

wasted annually in the distribution of farm produce with 30% of all fruits and

vegetables being discarded.

Main Producers:

Company Produce Website

China Yurun Food Group Meat products, particularly pork. www.yurun.com.h

Company k

Daying Duck Company Frozen duck www.dy-duck.com

Henan Shuanghui Industry Frozen and Chilled foods www.shuanghui.n

Group et

Zhengzhou Sanquan Foods Frozen dumplings, frozen glutinous rice www.sanquan.co

Company Ltd. balls, frozen noodles etc. m

© 2009 Schmittzehe & Partners. All rights reserved.

For all enquiries please contact : enquiries@SandPconsulting.com

8

Chilled Processed Foods

Definition:

All chilled processed foods, as opposed to fresh or frozen

Overview:

The market for chilled food is worth 3.69% of all food and beverage retail, or

RMB17.3bn in 2007. The CAGR was 16.8% for 2001-7, and is actually the highest in

the world.

However, compared to the growth of other segments in the Chinese food and

beverage market, growth is not above average. The segment suffers from the

same distributional problems as the frozen food sector, or possibly even worse as

the temperature band in which chilled food needs to be kept is narrower. The

market leader is chilled fish. This is primarily due to the fact that chilled fish in

China is actually quite a mature market, predating modern refrigeration, so the

market itself is not restrained by the same issues as the rest of chilled foods.

Main Producers:

Company Produce Website

China Yurun Food Group Meat products, particularly pork. www.yurun.com.hk

Company

DaChan Food Chicken meat products www.dachanfoodasia.co

m/

Henan Shuanghui Industry Frozen and Chilled foods www.shuanghui.net

Group

Hormel Deli meat, Ethnic foods, Pantry http://www.hormel.com/

foods, SPAM

Pacific Andes Group Frozen and Chilled Seafood www.pacificandes.com/

Canned Food

Definition:

Canned or preserved food, like meat, fish, vegetables, ready meals, soup, pasta

and fruit

Overview:

The market represents 7.16% of all packaged food, worth RMB33.54bn in 2007.

The segment enjoyed the highest CAGR of all segments with 21.4%, 2001-7.

Part of the reason that canned food has been growing so fast, especially in

comparison to frozen food and chilled food, is that it does not need to be

refrigerated. Growing supermarket expansion inland, while also extending the cold

chain, also helps distribute canned food. However in poorer areas consumers are

unlikely to have the means to refrigerate at home, so the first foods to be bought

will be in fresh or canned form. Canned fruit is the clear leader in the segment,

while canned meat as a proportion of the segment has declined slightly in recent

years.

Main Producers:

Company Produce Website

Hailong Foodstuff Company Seafood and vegetables www.hailongfoods.com

Shanghai Maling Food Canned Fruits, Vegetables and www.rcmaling.com

© 2009 Schmittzehe & Partners. All rights reserved.

For all enquiries please contact : enquiries@SandPconsulting.com

9

Company Seafood

© 2009 Schmittzehe & Partners. All rights reserved.

For all enquiries please contact : enquiries@SandPconsulting.com

10

Dried Food

Definition:

Rice, Dessert Mixes, Ready Meals, Dehydrated Soup, Instant Soup, Dried Pasta,

Plain Noodles, Instant Noodles.

Overview:

Dried food is worth 0.96% of the total packaged foods market, or RMB4.51bn in

2007. The market has the lowest CAGR at 12.6%.

One of the reasons for the low growth of the market is that it is an inferior good to

canned and frozen food, that is as income rises spending on dried food decreases.

The largest consumer group is likely to be those who are too busy to prepare fresh

meals. China is the world’s largest instant noodles market, with USD5 spent per

capita per year. Dried noodles are not viewed as particularly healthy, given that

deep frying is part of the manufacturing process. However more healthy variants

are coming on the market and are spurring much of the growth.

Main Producers:

Company Produce Website

Nissin Food Products Co Ltd Instant noodles www.nissinfoods.com

Tingyi Holding Corp. (Master Kong Instant noodles, beverages, www.tingyi.com

brand) bakery

Uni-President Food Co Instant noodles, drinks, dairy www.uni-president.com

© 2009 Schmittzehe & Partners. All rights reserved.

For all enquiries please contact : enquiries@SandPconsulting.com

11

Bakery

Definition:

Baked goods, biscuits and cereals

Overview:

In 2007, the market segment represented 2.88% of total packaged food, hence

worth RMB13.48bn. Despite its small market share, the segment has a CAGR of

18.0%, making it the second fastest growing segment in China, and making China

the second fastest growing bakery and cereals market in the world.

The small market size is because bread in China is not a staple of the Chinese diet,

where in the south consumers are more accustomed to eating rice, and in the

north they are more accustomed to steamed buns and noodles.

Biscuit have been the fastest growing part of this segment, making China the third

largest market in the world next to the US and India. 70% of the consumers are

female, with sandwich biscuits and chocolate coated biscuits being most popular.

Small packs coming in 100-200g sell best. Sweet biscuits are by far the most

popular with a 60% market share and savoury with a decent 39% market share as

of 2005. Cereal bars in the same period were a mere 1%.

Main Producers:

Company Produce Website

Cereal Partners Worldwide (Nestle and General Breakfast Cereals www.cerealpartners.co.uk

Mills)

Kraft Foods Inc. Food www.kraftfoods.com

Conglomerate

Lotte Confectionary Confectionary www.lotte.co.kr/english

Orion Food Co. Confectionary ir.orionworld.com

The Garden Company Ltd. Baked Foods www.garden.com.hk/

© 2009 Schmittzehe & Partners. All rights reserved.

For all enquiries please contact : enquiries@SandPconsulting.com

12

Dairy

Definition:

Drinking milk products (milk, flavoured milk, soy milk, powdered milk), Cheese,

Yogurt, and some other dairy products.

Overview:

It represents 6% of the total packaged food, worth RMB28.29bn in 2007. With a

CAGR of 19.1% over 2001-7, the segment is the second fastest growing in the food

and beverages market (joint with bakery foods and condiments) and it is growing

much faster than the global average. Sales in 2007 were over two and a half times

as much as in 2001, meaning that China is now the third biggest producer of milk

in the world, next only to the U.S and India. Most of the sales in dairy were made

through supermarkets, ringing-up 57.1% of all dairy sales, a vast increase from

almost nothing a decade ago.

Daily dairy consumption is overwhelmingly made up of liquid milk, accounting for

97.8% of consumption, while powdered milk only makes up 2.2%. Yogurt has quite

a large target market, 10-50 year olds, and it is seen as an 'introductory' product

for many Chinese to dairy products. Meanwhile the cheese market is quite narrow,

aiming at 20-30 year olds, but the demand is increasing impressively with 2005

sales being 3.6 times that of 2001, and imports of cheese increasing 56% year on

year to 7,241 tons in 2005. Butter is aimed at 20-40 year olds.

Main Producers:

Company Produce Website

China Mengniu Dairy Co.. Milk and Ice-cream www.mengniuir.com

Inner Mongolia Yili Group Co Milk, Yoghurt and Cheese www.yili.com

Shanghai Bright Dairy Milk and Yoghurt www.brightdairy.com/

© 2009 Schmittzehe & Partners. All rights reserved.

For all enquiries please contact : enquiries@SandPconsulting.com

13

Ice Cream

Definition:

All retail ice cream.

Overview:

The data set we used did not include Ice Cream as a segment, and so it is difficult

to compare with other segments in this report. According to some sources,

including Euromonitor, the total value of the ice cream market in China was worth

RMB31.bn in 2006, with a 2001-2006 CAGR of 6.61% - this would make it a large,

but comparatively slower growth market. When segmented by price, low-end ice

creams are less than RMB1, mid-range is RMB1-2, and high-end is anything above

RMB2. 70-80% of sales in 2006 came from the mid-range.

While ice-cream consumption is set to grow, profit margins are quite low as there is

fierce competition particularly in innovation. The higher end of the market, where

margins are higher, is dominated by foreign firms such as Nestle and Walls.

However domestic dairy brands such as Yili and Mengniu also compete. There are

also a number of smaller, regional brands which have quite strong customer

loyalty, from which they may be able to grow in the future. Innovation, too, is a

strong feature of the market, with new products taking up 20-30% of the market

every year, so Chinese consumers are clearly still shopping around.

Main Producers:

Company Produce Website

China Mengniu Dairy Co.. Milk and Ice-cream www.mengniuir.com

Inner Mongolia Yili Group Co Milk, Yoghurt and www.yili.com

Cheese

National Dairy Brands (Meadow Dairy www.meadowgold.com

Gold)

Nestle Food Conglomerate www.nestle.com

Unilever Conglomerate www.unilever.com

© 2009 Schmittzehe & Partners. All rights reserved.

For all enquiries please contact : enquiries@SandPconsulting.com

14

Baby Foods

Definition:

All baby food, which is dried foods, wet foods and formula milk

Overview:

The baby food segment is the second largest in the food and beverage market. The

CAGR was average for China, at 16.9%, but is still very high, especially when

considering the size of the market, which makes it one of the most dynamic.

Children are traditionally very important within the household in China, so in

addition to effects of the one child policy, parents are generally willing to spend a

lot of their incomes on their babies. This then coupled with increasing pressure for

parents to work longer hours or even away from their home town, and increasing

income levels, has pushed China into becoming one of the top three consumers of

baby food in the world. While in China past health scandals may have caused an

increase in demand for high quality foreign brands (which are often up to three

times as expensive) and even wet nurses, a majority of Chinese parents cannot

afford to trade up. Thus despite the impact of the Sanlu scandal, cheaper Chinese

baby formula will still be bought by their target market as they cannot afford any

alternative. The baby cereal market is small by comparison to other foods. It was

worth about USD580million in 2008. When it comes to the promotion of baby

foods, there is a need to convince the entire family of the baby of the value of the

product, not just a parent. This is because of the typically strong role family;

grandparents in particular, play in daily life.

Main Producers:

Company Produce Website

Danone (Dumex) Dairy, Baby foods, water www.dumex.com.sg

Mead Johnson Nutrition Co Baby foods http://www.mjn.com/

Nestle SA Food Conglomerate www.nestle.com

Inner Mongolia Yili Group Co Milk, Yoghurt and Cheese www.yili.com

© 2009 Schmittzehe & Partners. All rights reserved.

For all enquiries please contact : enquiries@SandPconsulting.com

15

Confectionary

Definition:

Chocolate confectionery, sugar confectionery including gum

Overview:

The growth of the domestic market (including cereal bars) is out-performing the

global market. It increased by 17.1% per year from 2001-2006, compared to global

growth of confectionery in 2006 of 3%. The sugar confectionery segment is the

largest, with 49% of confectionery market revenue, thus equal to around

RMB7.8bn. The market share of chocolate actually declined from 44% in 2001 to

42% in 2006, despite strong growth in sales. Purchases of Chocolate, mainly from

eastern regions of China, are often for gifts rather than personal consumption.

However, there are signs that chocolate is being purchased at times other than just

traditional seasons for exchanging gifts such as Chinese New Year. Chewing gum

sales in China was worth RMB4-5bn in 2006, accounting for approximately 29% to

36% of the market. A vast majority of the chewing gum market is made up of

chewing gum sold on taste, rather than chewing gum sold on function, i.e. brands

claiming to improve dental hygiene. However functional gum has been steadily

increasing as a share of the chewing gum market, from a base of just 5% in 2001,

to 40% in 2006.

Main Producers:

Company Produce Website

Lotte Confectionary Confectionary www.lotte.co.kr/english

Mars (incl. Wrigley) Food Conglomerate www.mars.com

Nestle SA Food Conglomerate www.nestle.com

Want Want Holdings Limited Rice Crackers, Dairy and Beverages http://www.want-

want.com/en/

© 2009 Schmittzehe & Partners. All rights reserved.

For all enquiries please contact : enquiries@SandPconsulting.com

16

Sweet and Savoury Snacks

Definition:

Crisps/Chips, Extruded Snacks and Nuts

Overview:

The savoury snacks segment has a CAGR of 16.7% for 2001-7. This strong growth

is much for the same reasons as baked goods sales are growing, in that changing

urban lifestyles are resulting in larger disposable incomes and faster lifestyles with

less time to prepare food. Snacks tend to be divided into two categories: eastern-

style such as dried/preserved meats, nuts and seeds, and western-style such as

crisps, and popcorn. Eastern-style snacks are consumed more at social gatherings

whereas the western-style snacks are consumed more on individual impulse,

especially amongst younger consumers who are more focused on taste than

nutrition. Snack food, such as crisps, are more popular in China than chocolate,

primarily due to the lower prices and snack foods greater versatility when it comes

to savoury tastes which are generally more popular than sweet ones. The crisps

market, which is dominated by western companies such as PepsiCo, have

sophisticated marketing and innovation to cater for these tastes, such as Frito-

Lay's Peking Roast Duck or Spicy Crab flavours. The need for innovation also

extends to the texture, shape and packaging. Shapes, such as flat discs, round

balls, twists and cones, are more valued by young consumers, in addition to flavour

and colouring. Older consumers however are more focused on the taste quality and

texture. The Eastern style snacks are quite varied, but simple and low value-add

while the markets are quite fragmented with numerous small local producers.

Main Producers:

Company Produce Website

Kraft Foods Inc. Food Conglomerate www.kraftfoods.com

Oishi Group Drinks, noodles, snacks and www.oishigroup.com

restaurants

PepsiCo Inc. Food and Beverage Conglomerate www.pepsico.com

Tingyi Holding Corp. (Master Kong Instant noodles, beverages, bakery www.tingyi.com

brand)

© 2009 Schmittzehe & Partners. All rights reserved.

For all enquiries please contact : enquiries@SandPconsulting.com

17

Sauces, Dressings and Condiments

Definition:

Soy sauces, herbs and spices, ketchup, mayonnaise, cold sauces, tomato pastes,

spreads, meat and seafood paste, honey.

Overview:

The segment was 4.58% of total packaged food sales, or RMB21.45bn, in 2007. The

CAGR was quite high, as high as dairy and bakery products, at 17.1% for 2001-7.

Not only is the market growing quickly, but it also of considerable size globally,

accounting for nearly a third of all volume sold worldwide in 2003.

Ketchup, ironically of Chinese origin, is enjoying strong growth, primarily due to

consumers’ growing exposure to it, amongst other western sauces, through fast

food restaurants like McDonalds or KFC. In terms of tomato value added products,

China has been rapidly increasing its output both for the domestic market and

international export. By 2007 for example, China became the world’s largest

exporter of bulk tomato paste products. Most condiment sales come from Chinese

sauces, with foreign sauces mainly a niche market. Typical Chinese sauces are soy

sauce, chilli sauce and oyster sauce, each kind with its own wide array of

differentiated kinds.

Main Producers:

Company Produce Website

Lee Kum Kee Co Ltd Sauces www.lkk.com

Masterfoods (Mei Shi Fu) Sauces www.masterfoods.com

Shantou Nanfang Jiale Foodstuff Sauces, Coconut Products n/a

Co.

© 2009 Schmittzehe & Partners. All rights reserved.

For all enquiries please contact : enquiries@SandPconsulting.com

18

Non-alcoholic Beverages

Definition:

All retail soft drinks and hot drinks

Overviews:

The compound annual growth rate was 14.4% for 2001-7, which is relatively

average for the industry in China; however its large size coupled with such a

growth rate means it is of considerable importance. Soft drink sales, RMB96.56bn

in 2007, are by far the market majority, representing 92.44% of all beverage sales.

Its 2001-7 CAGR at 14.2% is slower than hot drinks sales which are running at

16.9% for 2001-7. Sales of carbonated drinks, the largest segment of the

beverages market, have slowed down in recent years, and much of the growth has

been derived from diversified and tailored products. Ready-to-drink tea is the

second largest segment, by volume, selling 3.5m tons in 2005. Fruit juice is the

fastest growing segment with strong innovation in flavours and growing health

awareness following higher incomes.

Main Producers:

Company Produce Website

China Huiyuan Juice Beverages www.huiyuan.com.cn/e

n

Hangzhou Wahaha Group Beverages en.wahaha.com.cn

Jianlibao Group Beverages www.jianlibao.com.cn

PepsiCo Inc. Food and Beverage www.pepsico.com

Conglomerate

The Coca-cola Company Beverages www.coca-cola.com

Tingyi Holding Corp. (Master Kong Instant noodles, beverages, www.tingyi.com

brand) bakery

Uni-President Food Co Instant noodles, beverages www.uni-president.com

dairy

© 2009 Schmittzehe & Partners. All rights reserved.

For all enquiries please contact : enquiries@SandPconsulting.com

19

Concluding remarks

On the demand side, increasing household incomes are resulting in overall growth

in F&B in China. However the increasing purchasing power of consumers is creating

more mid-range markets with greater discerning tastes, meaning more

fragmentation in consumers’ tastes.

On the supply side, improving infrastructure and supermarket expansion is

improving market access around China and potentially creating freer markets. This

should result in increasing competition in all segments of packaged foods around

China, with both high-end brands diversifying down and low-end brands trading up

to cater to the middle ground, competing on price, quality and specificity. This is

not a foregone conclusion however, as regional business in China is extremely

relationship dependent, and local governments’ interests may be more allied with

local business leaders than that of the greater economy.

© 2009 Schmittzehe & Partners. All rights reserved.

For all enquiries please contact : enquiries@SandPconsulting.com

20

Schmittzehe & Partners

An affiliate of the Sustainomics Group, we are a high value-add exclusively

China-focused boutique advisory firm staffed by seasoned China business

and corporate finance professionals with offices in China (Shanghai) and

Europe (London), and affiliate offices in China (Beijing, Shanghai, Hong

Kong), Europe (Germany), and America (Chicago, Sao Paulo).

We provide the following services:

China in & outbound Investment Advisory

- Investment research and due diligence

- M&A analysis & strategy, target identification, business due diligence,

valuation & structuring

China in & outbound

Strategy

- Competitive Strategy

- Growth Strategy: market

entry, product development

pricing & positioning,

distribution channel, supply

chain

- Restructuring

China in & outbound

Business Development

- Partner identification & selection

- Interim management

- Hosted services

For more details, and to sign up for our newsletter, please visit our

website: www.SandPconsulting.com

To discuss this report or any of our services, please contact us:

Telephone: (UK) +44 208 995 0886 (China) +86 21 63211566

E-mail: enquiries@SandPconsulting.com

© 2009 Schmittzehe & Partners. All rights reserved.

For all enquiries please contact : enquiries@SandPconsulting.com

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- TAO-WEI, Dr. Wu - Hidden Secrets of Oriental Wealth-Bamboo Delight Company (N.D.) PDFDocumento43 pagineTAO-WEI, Dr. Wu - Hidden Secrets of Oriental Wealth-Bamboo Delight Company (N.D.) PDFMarlon Santos100% (2)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Fishbone and FMEA ExampleDocumento5 pagineFishbone and FMEA ExamplerscyuzonNessuna valutazione finora

- Craft Beer StylesDocumento103 pagineCraft Beer StylesManuel GonzálezNessuna valutazione finora

- Italian Wine PDFDocumento11 pagineItalian Wine PDFgolmatolNessuna valutazione finora

- GSDP ChecklistDocumento8 pagineGSDP ChecklistKumar Rajadhyaksh0% (1)

- The Edible Oil Industry in India: A Marketing Research OverviewDocumento30 pagineThe Edible Oil Industry in India: A Marketing Research OverviewAdhiraj Singh100% (1)

- Walls ThesisDocumento47 pagineWalls ThesisAsad Mazhar50% (2)

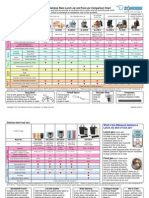

- Zojirushi Lunch Jar ChartDocumento2 pagineZojirushi Lunch Jar Chartsir3liotNessuna valutazione finora

- Amul Sip ReportDocumento46 pagineAmul Sip ReportSachin NairNessuna valutazione finora

- Model Test 3: Fundamental English Secondary 6 Atthawut TrakitthornkulDocumento17 pagineModel Test 3: Fundamental English Secondary 6 Atthawut TrakitthornkulPande Dony GumilarNessuna valutazione finora

- Shameless Snacks Brand Guidelines AdaptationDocumento26 pagineShameless Snacks Brand Guidelines AdaptationcarolinesfeltrinNessuna valutazione finora

- Jason Digeronimo ResumeDocumento2 pagineJason Digeronimo Resumeapi-308915399Nessuna valutazione finora

- Combinable Crops Passport 2011Documento2 pagineCombinable Crops Passport 2011JuanitoGuadalupeNessuna valutazione finora

- Belize Intoxicating Liquor Licensing ActDocumento54 pagineBelize Intoxicating Liquor Licensing ActCayoBuayNessuna valutazione finora

- Livestock Value Chain Analysis of Southern Sudan - Final Report 2010Documento166 pagineLivestock Value Chain Analysis of Southern Sudan - Final Report 2010James MusingaNessuna valutazione finora

- ACTIVITY Places AroundDocumento2 pagineACTIVITY Places AroundTeacherGaby AmaroNessuna valutazione finora

- Quick Start Guide & User Manual: For V3800 Series AppliancesDocumento2 pagineQuick Start Guide & User Manual: For V3800 Series AppliancesWiz OzNessuna valutazione finora

- Marketing Strategy of Organic FoodDocumento11 pagineMarketing Strategy of Organic FoodHimang Porwal100% (1)

- MTRDocumento14 pagineMTRKishore VishwanathNessuna valutazione finora

- Presentation - KSOILSDocumento73 paginePresentation - KSOILSGirdhar AdhikariNessuna valutazione finora

- KFC - WikipediaDocumento3 pagineKFC - WikipediarachuNessuna valutazione finora

- Jannat Rabbani-Services MarketingDocumento3 pagineJannat Rabbani-Services MarketingNabeela NoorNessuna valutazione finora

- Policy Brief Food Advertising To ChildrenDocumento4 paginePolicy Brief Food Advertising To Childrenapi-267120287Nessuna valutazione finora

- Malakapalli PDFDocumento6 pagineMalakapalli PDFagrya tax consultancyNessuna valutazione finora

- Sikretong MalupitDocumento6 pagineSikretong MalupitKyla de SilvaNessuna valutazione finora

- Strategic MKTG - The FounderDocumento3 pagineStrategic MKTG - The FounderWaqar HaiderNessuna valutazione finora

- Business Plan - PPTX Heaven Touch BakeryDocumento22 pagineBusiness Plan - PPTX Heaven Touch BakeryFrancez Anne GuanzonNessuna valutazione finora

- We Are Former Midwesterners Making A Positive Difference in Our Adopted Home of NevadaDocumento4 pagineWe Are Former Midwesterners Making A Positive Difference in Our Adopted Home of NevadaMary Romano FlinnNessuna valutazione finora

- Simac Pasta Ma Tic InstructionsDocumento12 pagineSimac Pasta Ma Tic InstructionsgandrakgNessuna valutazione finora

- Brochure - B2B - Trading - Globexia ProfileDocumento42 pagineBrochure - B2B - Trading - Globexia ProfileGaurav GoyalNessuna valutazione finora