Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Functions: Commercial Bank

Caricato da

supriyakharadeDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Functions: Commercial Bank

Caricato da

supriyakharadeCopyright:

Formati disponibili

COMMERCIAL BANK

A commercial bank is a type of bank that provides services such as accepting deposits, making

business loans, and offering basic investment products.

Commercial bank can also refer to a bank or a division of a bank that mostly deals with deposits and

loans from corporations or large businesses, as opposed to individual members of the public (retail

banking).

In the US the term commercial bank was often used to distinguish it from an investment bank due to

differences in bank regulation. After the great depression, through theGlassSteagall Act, the U.S.

Congress required that commercial banks only engage in banking activities, whereas investment banks

were limited to capital marketsactivities. This separation was mostly repealed in the 1990s.

Functions[edit]

Commercial banks perform many functions. They satisfy the financial needs of the sectors such as

agriculture, industry, trade, communication, so they play very significant role in a process of economic

social needs. The functions performed by banks, since recently, are becoming customer-centred and are

widening their functions. Generally, the functions of commercial banks are divided into two categories:

primary functions and the secondary functions. The following chart simplifies the functions of commercial

banks.

Commercial banks perform various primary functions, some of them are given below:

Commercial banks accept various types of deposits from public especially from its clients, including

saving account deposits, recurring account deposits, and fixed deposits. These deposits are payable

after a certain time period

Commercial banks provide loans and advances of various forms, including an overdraft facility, cash

credit, bill discounting, money at call etc. They also give demand and demand and term loans to all

types of clients against proper security.

Credit creation is most significant function of commercial banks. While sanctioning a loan to a

customer, they do not provide cash to the borrower. Instead, they open a deposit account from which

the borrower can withdraw. In other words, while sanctioning a loan, they automatically create

deposits, known as a credit creation from commercial banks.

Along with primary functions, commercial banks perform several secondary functions, including many

agency functions or general utility functions. The secondary functions of commercial banks can be divided

into agency functions and utility functions.

The agency functions are the following:

To collect and clear cheque, dividends and interest warrant.

To make payments of rent, insurance premium, etc.

To deal in foreign exchange transactions.

To purchase and sell securities.

To act as trustee, attorney, correspondent and executor.

To accept tax proceeds and tax returns.

The utility functions are the following:

To provide safety locker facility to customers.

To provide money transfer facility.

To issue traveller's cheque.

To act as referees.

To accept various bills for payment: phone bills, gas bills, water bills, etc.

To provide merchant banking facility.

To provide various cards: credit cards, debit cards, smart cards, etc.

Regional Rural Bank

From Wikipedia, the free encyclopedia

Regional Rural Banks are the banking organizations being operated in different states of India. They have

been created to serve the rural areas with banking and financial services. However, RRB's may have branches

set up for urban operations and there area of operation may include urban areas too.

Functions[edit]

The main purpose of RRB's is to mobilize financial resources from rural / semi-urban areas and grant

loans and advances mostly to small and marginal farmers, agricultural laborers and rural artisans. The

area of operation of RRBs is limited to the area as notified by Government of India covering one or more

districts in the State. RRB's also perform a variety of different functions. RRB's perform various functions

in following heads Providing banking facilities to rural and semi-urban areas. Carrying out government

operations like disbursement of wages of MGNREGA workers, distribution of pensions etc. Providing

Para-Banking facilities like locker facilities, debit and credit cards.

History[edit]

Regional Rural Banks were established under the provisions of an Ordinance passed on 26 September

1975 and the RRB Act. 1976 to provide sufficient banking and credit facility for agriculture and other rural

sectors. These were set up on the recommendations of the Narsimha Committee during the tenure of

Indira Gandhi's government with a view to include rural areas into economic mainstream since that time

about 70% of the Indian Population was of Rural Orientation. The development process of RRBs started

on 2 October 1975 with the with forming the first RRB, the Prathama Grameen Bank. Also on 2 October

1975, five regional rural banks were set up on with a total authorised capital of Rs. 100 crore ($ 10

Million) which later augmented to 500 crore ($ 50 Million). There were five commercial banks, Punjab

National Bank, State Bank of India, Syndicate Bank, United Bank of India and United Commercial Bank,

which sponsored the regional rural banks. Earlier Reserve Bank of India had laid down ceilings on the

rate of interest to be charged by these RRBs. However from August 1996 the RRBs have been granted

freedom to fix rates of interest, which is usually in the range of 14-18% for advances.

Recapitalization of Regional Rural Banks (RRBs)[edit]

Subsequent to review of the financial status of RRBs by the Union Finance Minister in August, 2009, it

was felt that a large number of RRBs had a low Capital to Risk weighted Assets Ratio (CRAR). A

committee was therefore constituted in September, 2009 under the Chairmanship of Or K C Chakrabarty,

Deputy Governor, RBI to analyse the financials of the RRBs and to suggest measures including re-

capitalisation to bring the CRAR of RRBs to at least 9% in a sustainable manner by 2012. The Committee

submitted its report in May, 2010. The following points were recommended by the committee:

RRBs to have CRAR of at least 7% as on 31 March 2011 and at least 9% from 31 March 2012

onwards. recapitalisation requirement of Rs. 2,200.00 crore for 40 of the 82 RRBs. This amount is to

be released in two installments in 2010-11 and 2011-12. .

The remaining 42 RRBs will not require any capital and will be able to maintain CRAR of at least 9%

ifs on 31 st March 2012 and thereafter on their own.

A fund of Rs. 100 crore to be set up for training and capacity building of the RRB staff.

The Government of India recently approved the recapitalization of Regional Rural Banks (RRBs) to im-

prove their Capital to Risk Weighted Assets Ratio CRAR) in the following manner:

Share of Central Government i.e. Rs.1, 100 crore will be released as per provisions made by the

Department of Expenditure in 2010-11 and 2011-12. However, release of Government of India share

will be contingent on proportionate release of State Government and Sponsor Bank share.

A capacity building fund with a corpus of Rs.100 crore to be set up by Central Government with

NABARD for training and capacity building of the RRB staff in the institution of NABARD and other

reputed institutions. The functioning of the Fund will be periodically reviewed by the Central

Government. An Action Plan will be prepared by NABARD in this regard and sent to Government for

approval.

Additional amount of Rs. 700 crore as contingency fund to meet the requirement of the weak RRBs,

particularly those in the North Eastern. and Eastern Region, the necessary provisioh will be made in

the Budget as and when the need arises.

Mergers[edit]

Currently, RRB's are going through a process of merger and consolidation 25 RRBs have been merged in

January 2013 into 10 RRBs this counts 67 RRBs till 1st week of June 2013. On 31 March 2006, there

were 133 RRBs (post-merger) covering 525 districts with a network of 14,494 branches. On RRBs were

originally conceived as low cost institutions having a rural ethos, local feel and pro poor focus. However,

within a very short time, most banks were making losses. The original assumptions as to the low cost

nature of these institutions were belied.This may be again merged in near future.At present there are 67

RRB's in India.

Legal Existence and Protection[edit]

RRB's are recognized by the law and they have legal significance.The Regional Rural Banks Act, 1976

Act No. 21 Of 1976 [9 February 1976.] reads

"For the incorporation, regulation and winding up of Regional Rural Banks with a view to developing the

rural economy by providing, for the purpose of development of agriculture, trade, commerce, industry and

other productive activities in the rural areas, credit and other facilities, particularly to the small and

marginal farmers, agricultural laborers, artisans and small entrepreneurs, and for matters connected

therewith and incidental thereto".

RRB's are therefore created with a view to develop rural economy.

It is important to know about the Credit Control measures of RBI for those who are preparing for

competitive exams. Its a very popular topic of competitive exams, interviews, group discussions

and of general discussion. Those interested to know about it in simple language can go through

this post.

You will also understand about the definitions of CRR, Bank Rate, SLR, Repo Rate, Reverse

Repo Rate and other credit control methods.

What is Credit Control: Credit Control is an important tool used by the Reserve Bank ofIndia,

a major weapon of the monetary policy used to control the demand and supply of money

(liquidity) in the economy.

Why Credit Control is required: The basic and important needs of Credit Control in the

economy are:

To encourage the overall growth of the priority sector i.e. those sectors of the economy

which is recognized by the government as prioritized

To keep a check over the channelization of credit so that credit is not delivered for

undesirable purposes.

To achieve the objective of controlling Inflation as well as Deflation.

To boost the economy by facilitating the flow of adequate volume of bank credit to different

sectors.

What are the methods of Credit Control?

There are two methods that the RBI uses to control the money supply in the economy-

(1) Qualitative Method: By qualitative methods means the control or management of the uses

of bank credit or manner of channelizing of cash and credit in the economy. Tools used under

this method are:

Marginal Requirement: Marginal Requirement of loan can be increased or decreased to control

the flow of credit for e.g. a person mortgages his property worth Rs. 1,00,000 against loan. The

bank will give loan of Rs. 80,000 only. The marginal requirement here is 20%. In case the flow

of credit has to be increased, the marginal requirement will be lowered.

Rationing of credit: Under this method there is a maximum limit to loans and advances that can

be made, which the commercial banks cannot exceed.

Publicity: RBI uses media for the publicity of its views on the current market condition and its

directions that will be required to be implemented by the commercial banks to control the unrest.

Direct Action: Under the banking regulation Act, the central bank has the authority to take strict

action against any of the commercial banks that refuses to obey the directions given by Reserve

Bank ofIndia.

Moral Suasion: This method is also known as Moral Persuasion as the method that the

Reserve Bank of India, being the apex bank uses here, is that of persuading the commercial

banks to follow its directions/orders on the flow of credit.

The main functions of commercial banks are accepting deposits from the public and advancing them

loans.

However, besides these functions there are many other functions which these banks perform. All

these functions can be divided under the following heads:

1. Accepting deposits

2. Giving loans

3. Overdraft

4. Discounting of Bills of Exchange

5. Investment of Funds

6. Agency Functions

7. Miscellaneous Functions

1. Accepting Deposits:

The most important function of commercial banks is to accept deposits from the public. Various

sections of society, according to their needs and economic condition, deposit their savings with the

banks.

For example, fixed and low income group people deposit their savings in small amounts from the

points of view of security, income and saving promotion. On the other hand, traders and

businessmen deposit their savings in the banks for the convenience of payment.

Therefore, keeping the needs and interests of various sections of society, banks formulate various

deposit schemes. Generally, there ire three types of deposits which are as follows:

(i) Current Deposits:

The depositors of such deposits can withdraw and deposit money whenever they desire. Since banks

have to keep the deposited amount of such accounts in cash always, they carry either no interest or

very low rate of interest. These deposits are called as Demand Deposits because these can be

demanded or withdrawn by the depositors at any time they want.

Such deposit accounts are highly useful for traders and big business firms because they have to make

payments and accept payments many times in a day.

(ii) Fixed Deposits:

These are the deposits which are deposited for a definite period of time. This period is generally not

less than one year and, therefore, these are called as long term deposits. These deposits cannot be

withdrawn before the expiry of the stipulated time and, therefore, these are also called as time

deposits.

These deposits generally carry a higher rate of interest because banks can use these deposits for a

definite time without having the fear of being withdrawn.

(iii) Saving Deposits:

In such deposits, money upto a certain limit can be deposited and withdrawn once or twice in a week.

On such deposits, the rate of interest is very less. As is evident from the name of such deposits their

main objective is to mobilise small savings in the form of deposits. These deposits are generally done

by salaried people and the people who have fixed and less income.

2. Giving Loans:

The second important function of commercial banks is to advance loans to its customers. Banks

charge interest from the borrowers and this is the main source of their income.

Banks advance loans not only on the basis of the deposits of the public rather they also advance loans

on the basis of depositing the money in the accounts of borrowers. In other words, they create loans

out of deposits and deposits out of loans. This is called as credit creation by commercial banks.

Modern banks give mostly secured loans for productive purposes. In other words, at the time of

advancing loans, they demand proper security or collateral. Generally, the value of security or

collateral is equal to the amount of loan. This is done mainly with a view to recover the loan money

by selling the security in the event of non-refund of the loan.

At limes, banks give loan on the basis of personal security also. Therefore, such loans are called as

unsecured loan. Banks generally give following types of loans and advances:

(i) Cash Credit:

In this type of credit scheme, banks advance loans to its customers on the basis of bonds, inventories

and other approved securities. Under this scheme, banks enter into an agreement with its customers

to which money can be withdrawn many times during a year. Under this set up banks open accounts

of their customers and deposit the loan money. With this type of loan, credit is created.

(iii) Demand loans:

These are such loans that can be recalled on demand by the banks. The entire loan amount is paid in

lump sum by crediting it to the loan account of the borrower, and thus entire loan becomes

chargeable to interest with immediate effect.

(iv) Short-term loan:

These loans may be given as personal loans, loans to finance working capital or as priority sector

advances. These are made against some security and entire loan amount is transferred to the loan

account of the borrower.

3. Over-Draft:

Banks advance loans to its customers upto a certain amount through over-drafts, if there are no

deposits in the current account. For this banks demand a security from the customers and charge

very high rate of interest.

4. Discounting of Bills of Exchange:

This is the most prevalent and important method of advancing loans to the traders for short-term

purposes. Under this system, banks advance loans to the traders and business firms by discounting

their bills. In this way, businessmen get loans on the basis of their bills of exchange before the time of

their maturity.

5. Investment of Funds:

The banks invest their surplus funds in three types of securitiesGovernment securities, other

approved securities and other securities. Government securities include both, central and state

governments, such as treasury bills, national savings certificate etc.

Other securities include securities of state associated bodies like electricity boards, housing boards,

debentures of Land Development Banks units of UTI, shares of Regional Rural banks etc.

6. Agency Functions:

Banks function in the form of agents and representatives of their customers. Customers give their

consent for performing such functions. The important functions of these types are as follows:

(i) Banks collect cheques, drafts, bills of exchange and dividends of the shares for their customers.

(ii) Banks make payment for their clients and at times accept the bills of exchange: of their customers

for which payment is made at the fixed time.

(iii) Banks pay insurance premium of their customers. Besides this, they also deposit loan

installments, income-tax, interest etc. as per directions.

(iv) Banks purchase and sell securities, shares and debentures on behalf of their customers.

(v) Banks arrange to send money from one place to another for the convenience of their customers.

7. Miscellaneous Functions:

Besides the functions mentioned above, banks perform many other functions of general utility which

are as follows:

(i) Banks make arrangement of lockers for the safe custody of valuable assets of their customers such

as gold, silver, legal documents etc.

(ii) Banks give reference for their customers.

(iii) Banks collect necessary and useful statistics relating to trade and industry.

(iv) For facilitating foreign trade, banks undertake to sell and purchase foreign exchange.

(v) Banks advise their clients relating to investment decisions as specialist

(vi) Bank does the under-writing of shares and debentures also.

(vii) Banks issue letters of credit.

(viii) During natural calamities, banks are highly useful in mobilizing funds and donations.

(ix) Banks provide loans for consumer durables like Car, Air-conditioner, and Fridge etc.

Principles of Tax-Exemption of Investments12 Stability in the Value of Investments Saleability of

Securities Diversity Safety or Security Profitability LiquidityInvestment Policy

Principles of Tax-Exemption of Investments12 Stability in the Value of Investments Saleability of

Securities Diversity Safety or Security Profitability LiquidityInvestment Policy

The modern banks perform a variety of functions.These can be broadly

divided into two categories: (a)Primary functions and (b) Secondary

functions.7 Commercial banks have to perform a variety offunctions which

are common to both developed anddeveloping countries. These are known

as GeneralBanking functions of the commercial banks.Functions of

CommercialBanks

8. Contd8

Income-tax Consultancy 9 Acts as Correspondent Collection of

Dividends on Shares Purchase and Sale of Securities Collection and

Payment of Credit Instruments Banks also perform certain Agency

Functions forand on behalf of their customers. The agency servicesare of

immense value to the people at large. Thevarious agency services

rendered by banks are asfollows:9. Contd

Underwriting Securities and Merchant Banking10 Acting Referee

Collection of Statistics Letter of Credit Travellers Cheques and Credit

Cards Locker Facility Acts as Trustee and ExecutorGeneral Utility

Services Execution of Standing Orders10. Contd

Nationalisation of Banks in India - Introduction

After independence the Government of India (GOI) adopted planned economic development for the country (India).

Accordingly, five year plans came into existence since 1951. This economic planning basically aimed at social

ownership of the means of production. However, commercial banks were in the private sector those days. In 1950-51

there were 430 commercial banks. The Government of India had some social objectives of planning. These

commercial banks failed helping the government in attaining these objectives. Thus, the government decided to

nationalize 14 major commercial banks on 19th July, 1969. All commercial banks with a deposit base over Rs.50

crores were nationalized. It was considered that banks were controlled by business houses and thus failed in catering

to the credit needs of poor sections such as cottage industry, village industry, farmers, craft men, etc. The second

dose of nationalisation came in April 1980 when banks were nationalized.

Objectives Behind Nationalisation of Banks in India

The nationalisation of commercial banks took place with an aim to achieve following major objectives.

1. Social Welfare : It was the need of the hour to direct the funds for the needy and required sectors of the indian

economy. Sector such as agriculture, small and village industries were in need of funds for their expansion and

further economic development.

2. Controlling Private Monopolies : Prior to nationalisation many banks were controlled by private business houses

and corporate families. It was necessary to check these monopolies in order to ensure a smooth supply of credit to

socially desirable sections.

3. Expansion of Banking : In a large country like India the numbers of banks existing those days were certainly

inadequate. It was necessary to spread banking across the country. It could be done through expanding banking

network (by opening new bank branches) in the un-banked areas.

4. Reducing Regional Imbalance : In a country like India where we have a urban-rural divide; it was necessary for

banks to go in the rural areas where the banking facilities were not available. In order to reduce this regional

imbalance nationalisation was justified:

5. Priority Sector Lending : In India, the agriculture sector and its allied activities were the largest contributor to the

national income. Thus these were labeled as the priority sectors. But unfortunately they were deprived of their due

share in the credit. Nationalisation was urgently needed for catering funds to them.

6. Developing Banking Habits : In India more than 70% population used to stay in rural areas. It was necessary to

develop the banking habit among such a large population.

Demerits, Limitations - Bank Nationalisation in India

Though the nationalisation of commercial banks was undertaken with tall objectives, in many senses it failed in

attaining them. In fact it converted many of the banking institutions in the loss making entities. The reasons were

obvious lethargic working, lack of accountability, lack of profit motive, political interference, etc. Under this backdrop it

is necessary to have a critical look to the whole process of nationalisation in the period after bank nationalisation.

The major limitations of the bank nationalisation in India are:-

1. Inadequate banking facilities : Even though banks have spread across the country; still many parts of the

country are unbanked. Especially in the backward states such as the Uttar Pradesh, Madhya Pradesh,

Chhattisgarh and north-eastern states of India.

2. Limited resources mobilized and allocated : The resources mobilized after the nationalisation is not sufficient if

we consider the needs of the Indian economy. Some times the deposits mobilized are enough but the resource

allocation is not as per the expansions.

3. Lowered efficiency and profits : After nationalisation banks went in the government sector. Many times political

forces pressurized them. Banking was not done on a professional and ethical grounds. It resulted into lower

efficiency and poor profitability of banks.

4. Increased expenditure : Due to huge expansion in a branch network, large staff administrative expenditure, trade

union struggle, etc. banks expenditure increased to a dangerous levels.

5. Political and Administrative Inference : Many public sector banks badly suffered due to the political interference.

It was seen in arranging loan meals. It ultimately resulted in huge non-performing assets (NPA) of these banks and

inefficiency.

These are several limitations faced by the banks nationalisation in India.

Apart from this there are certain other limitations as well, such as weak infrastructure, poor competitiveness, etc.

But after Economic Reform of 1991, the Indian banking industry has entered into the new horizons of

competitiveness, efficiency and productivity. It has made Indian banks more vibrant and professional organizations,

removing the bad days of bank nationalisation.

Potrebbero piacerti anche

- Regional Rural BankDocumento3 pagineRegional Rural BankSagar A. Barot100% (1)

- Function, Recapitalization and Importance of Regional Rural BankDocumento2 pagineFunction, Recapitalization and Importance of Regional Rural BankMitali KheskwaniNessuna valutazione finora

- Regional Rural BankDocumento4 pagineRegional Rural BanksrikanthuasNessuna valutazione finora

- Regional Rural BankDocumento4 pagineRegional Rural BankRekha Raghavan NandakumarNessuna valutazione finora

- Regional Rurual BankDocumento3 pagineRegional Rurual BanksherrysherryNessuna valutazione finora

- Regional Rural Bank - WikipediaDocumento28 pagineRegional Rural Bank - WikipediaMahesh KhairnarNessuna valutazione finora

- Final PPT of Concept of RRBsDocumento27 pagineFinal PPT of Concept of RRBsManali ShahNessuna valutazione finora

- Miscellaneous Important Points-1Documento21 pagineMiscellaneous Important Points-1bhavishyat kumawatNessuna valutazione finora

- A Study On Credit Appraisal Process On Lotak Mahindra Bank (Draft)Documento54 pagineA Study On Credit Appraisal Process On Lotak Mahindra Bank (Draft)Rhea SrivastavaNessuna valutazione finora

- RRBDocumento27 pagineRRBajaikg07Nessuna valutazione finora

- Credit Appraisal SystemDocumento54 pagineCredit Appraisal SystemÂShu KaLràNessuna valutazione finora

- MathDocumento9 pagineMathADITYA DESHMUKHNessuna valutazione finora

- Credit Appraisal SystemDocumento58 pagineCredit Appraisal Systemsatapathy_smruti12100% (10)

- Banking & InsuranceDocumento79 pagineBanking & InsuranceMonashreeNessuna valutazione finora

- Banking System in IndiaDocumento9 pagineBanking System in IndiaBhavesh LimaniNessuna valutazione finora

- BankingDocumento37 pagineBankingTanya GoelNessuna valutazione finora

- T-6 Banking FormsDocumento39 pagineT-6 Banking FormsNamanNessuna valutazione finora

- Banking PPT Group 1 - Structure of Indian Banking SystemDocumento53 pagineBanking PPT Group 1 - Structure of Indian Banking Systemrohit75% (4)

- Corporate BankingDocumento39 pagineCorporate Bankingpoojaguptainida1Nessuna valutazione finora

- Interview QuestionDocumento73 pagineInterview Questionaditya0004Nessuna valutazione finora

- RRBsDocumento2 pagineRRBssindhuja singhNessuna valutazione finora

- Financial Institutions & MarketsDocumento62 pagineFinancial Institutions & MarketsSaurav UchilNessuna valutazione finora

- Regional Rural BanksDocumento4 pagineRegional Rural BanksSiddhartha BindalNessuna valutazione finora

- Symbi Banking Lecture NotesDocumento21 pagineSymbi Banking Lecture NotesPankaj GahlawatNessuna valutazione finora

- Introduction of Banking SystemDocumento10 pagineIntroduction of Banking SystemMasy1210% (1)

- Sarswat Bank in ShortDocumento22 pagineSarswat Bank in ShortKrishan BhagwaniNessuna valutazione finora

- Project Cash Flow Statement Analysis of AXIS BankDocumento44 pagineProject Cash Flow Statement Analysis of AXIS BankShubashPoojari100% (1)

- Higher Financing InstitutionsDocumento10 pagineHigher Financing InstitutionsApeksha GuruwadeyarNessuna valutazione finora

- Ibs F y B.com (H) Unit 1Documento18 pagineIbs F y B.com (H) Unit 1Nikunj PatelNessuna valutazione finora

- State Bank of IndiaDocumento14 pagineState Bank of IndiaMahadevan KrishnamurthyNessuna valutazione finora

- Ppt. Regional Rural BanksDocumento13 paginePpt. Regional Rural BanksRuchi Arora Arora73% (11)

- Development and ApprochDocumento25 pagineDevelopment and ApprochVyshnavNessuna valutazione finora

- Functions of The RbiDocumento13 pagineFunctions of The RbidgvdfrjixcvNessuna valutazione finora

- Vsit Rohit ProjectDocumento10 pagineVsit Rohit ProjectNaresh KhutikarNessuna valutazione finora

- Project SynopsisDocumento8 pagineProject SynopsisKaushik AdhikariNessuna valutazione finora

- BII Final NOTES UNIT1Documento26 pagineBII Final NOTES UNIT1SOHAIL makandarNessuna valutazione finora

- Banking in IndiaDocumento13 pagineBanking in IndiaMurahari NANessuna valutazione finora

- Commercial BanksDocumento23 pagineCommercial Banksnisarg_Nessuna valutazione finora

- Regional Rural BankDocumento26 pagineRegional Rural BankVijayeta Nerurkar100% (1)

- A Study of Bank Operations and Loans Given by Nawanagar Co-Operative Bank Ltd''.Documento70 pagineA Study of Bank Operations and Loans Given by Nawanagar Co-Operative Bank Ltd''.Umang Vora0% (1)

- Origin of Banking and Banking Structure in IndiaDocumento32 pagineOrigin of Banking and Banking Structure in IndiaShashank TiwariNessuna valutazione finora

- Origin of Banking and Banking Structure in IndiaDocumento32 pagineOrigin of Banking and Banking Structure in IndiaShashank TiwariNessuna valutazione finora

- Training Report On: Himachal Pradesh Gramin BankDocumento25 pagineTraining Report On: Himachal Pradesh Gramin BankprishkritNessuna valutazione finora

- Type of Banks: Different Types of Banks in India & Their FunctionsDocumento15 pagineType of Banks: Different Types of Banks in India & Their FunctionscecilNessuna valutazione finora

- Overview of Banking IndustryDocumento12 pagineOverview of Banking Industrybeena antuNessuna valutazione finora

- Economics ProjectDocumento16 pagineEconomics ProjectYashvardhanNessuna valutazione finora

- Unit - 1Documento93 pagineUnit - 1Suji MbaNessuna valutazione finora

- Banking SystemDocumento2 pagineBanking SystemRANJIT KUMAR GWALIANessuna valutazione finora

- Comparitive Analysis of Public Sector and Private Sectors Banks PDFDocumento67 pagineComparitive Analysis of Public Sector and Private Sectors Banks PDFAnonymous y3E7ia100% (1)

- Geetika BankingDocumento9 pagineGeetika BankingGeetika GuptaNessuna valutazione finora

- A Presentation ON Regional Rural Bank: Hina Khan Mba Iii SemDocumento13 pagineA Presentation ON Regional Rural Bank: Hina Khan Mba Iii SemAmitNessuna valutazione finora

- Presentation Report On Loans and AdvancesDocumento20 paginePresentation Report On Loans and AdvancesHawk AujlaNessuna valutazione finora

- Regional Rural Banks of India: Evolution, Performance and ManagementDa EverandRegional Rural Banks of India: Evolution, Performance and ManagementNessuna valutazione finora

- Banking India: Accepting Deposits for the Purpose of LendingDa EverandBanking India: Accepting Deposits for the Purpose of LendingNessuna valutazione finora

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Da EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Nessuna valutazione finora

- Understand Banks & Financial Markets: An Introduction to the International World of Money & FinanceDa EverandUnderstand Banks & Financial Markets: An Introduction to the International World of Money & FinanceValutazione: 4 su 5 stelle4/5 (9)

- Marketing of Consumer Financial Products: Insights From Service MarketingDa EverandMarketing of Consumer Financial Products: Insights From Service MarketingNessuna valutazione finora

- IBS - MBS - BHIM PNB FAQs - Revised-CompressedDocumento13 pagineIBS - MBS - BHIM PNB FAQs - Revised-Compressedemraan KhanNessuna valutazione finora

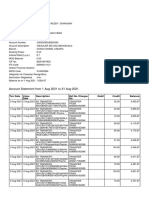

- Account Statement From 1 Aug 2021 To 31 Aug 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento6 pagineAccount Statement From 1 Aug 2021 To 31 Aug 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceChirasani Yogeshwar ReddyNessuna valutazione finora

- A Note On Interest Rates in An EconomyDocumento1 paginaA Note On Interest Rates in An EconomyAmit Kumar MandalNessuna valutazione finora

- Bank RegistrationDocumento87 pagineBank Registrationclaude olekaNessuna valutazione finora

- Service Area-Kannur-NewDocumento46 pagineService Area-Kannur-NewVisakh MahadevanNessuna valutazione finora

- Macroeconomics Study GuideDocumento8 pagineMacroeconomics Study GuideAustin WellsNessuna valutazione finora

- Candidates Are Required To Give Their Answers in Their Own Words As Far As Practicable. The Figures in The Margin Indicate Full MarksDocumento2 pagineCandidates Are Required To Give Their Answers in Their Own Words As Far As Practicable. The Figures in The Margin Indicate Full MarksGyan PokhrelNessuna valutazione finora

- The Importance of E-BankingDocumento2 pagineThe Importance of E-BankingAmrin FathimaNessuna valutazione finora

- REQUEST For Refund Form Version 3.03232021Documento1 paginaREQUEST For Refund Form Version 3.03232021Isape Hope Maningo-Burguite Bagaipo100% (1)

- Gen Math Topic 4 - 3Documento22 pagineGen Math Topic 4 - 3Jian Christian FerminNessuna valutazione finora

- N26 - OverviewDocumento25 pagineN26 - OverviewGajendra AudichyaNessuna valutazione finora

- Business Guide - Direct Debit v2.0Documento43 pagineBusiness Guide - Direct Debit v2.0Dimitrios PloutarchosNessuna valutazione finora

- Personal Loan AgreementDocumento1 paginaPersonal Loan AgreementLoraine Corpuz100% (2)

- My Student DataDocumento30 pagineMy Student DataSarah Valetina Hernandez PeñaNessuna valutazione finora

- Schedule of Charges Trade FinanceDocumento8 pagineSchedule of Charges Trade FinanceAnsaf AskyNessuna valutazione finora

- Dbs Ec-Banking Service Request FormDocumento2 pagineDbs Ec-Banking Service Request Form健康生活園Healthy Life GardenNessuna valutazione finora

- Extra Worksheet - Annuties, Compund and AmortizationDocumento3 pagineExtra Worksheet - Annuties, Compund and AmortizationAaryan KulkarniNessuna valutazione finora

- Icici Bank.... 2Documento93 pagineIcici Bank.... 2Kamya KandhariNessuna valutazione finora

- Petty Cash Voucher Cheques ReceivedDocumento18 paginePetty Cash Voucher Cheques ReceivedMonjurul AhsanNessuna valutazione finora

- Ali Mousa and Sons ContractingDocumento1 paginaAli Mousa and Sons ContractingMohsin aliNessuna valutazione finora

- Casil Soc 01 07 23Documento2 pagineCasil Soc 01 07 23rishisiliveri95Nessuna valutazione finora

- Exhibit D Tenant Rental Ledger Tenant Rental Ledger CardDocumento1 paginaExhibit D Tenant Rental Ledger Tenant Rental Ledger CardStephanie KaitlynNessuna valutazione finora

- Summer Internship Project HDFC Bank PDFDocumento109 pagineSummer Internship Project HDFC Bank PDFarunima100% (1)

- Axis BankDocumento20 pagineAxis BankXYZ909Nessuna valutazione finora

- Difference Between Trade Bill and Accommodation Bill:: Accommodation Bills of ExchangeDocumento5 pagineDifference Between Trade Bill and Accommodation Bill:: Accommodation Bills of ExchangeRaghuNessuna valutazione finora

- Acct Statement XX0012 25052023Documento5 pagineAcct Statement XX0012 25052023JunoonNessuna valutazione finora

- AU Finance Bank - 19 Oct-372Documento46 pagineAU Finance Bank - 19 Oct-372Chintada Netaji PraneethNessuna valutazione finora

- Swiss AutoindexDocumento6 pagineSwiss AutoindexAlex PchelyakovNessuna valutazione finora

- Contoh Print Out Neraca Saldo Jan-Feb 2018 Accurate 5Documento34 pagineContoh Print Out Neraca Saldo Jan-Feb 2018 Accurate 5Mohammad Fauzi Kushardia NovanNessuna valutazione finora

- Methods of LendingDocumento2 pagineMethods of Lendingmuditagarwal72Nessuna valutazione finora