Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Business Valuation Report of A Listed Company1

Caricato da

Renold DarmasyahTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Business Valuation Report of A Listed Company1

Caricato da

Renold DarmasyahCopyright:

Formati disponibili

GENERAL INSTRUCTIONS

There have been minor changes to the Form 11 & 11A for 2006. These forms must be completed on a computer. Figures should

be entered as positive or negative. The formulas have been adjusted to accommodate a positive or negative figure. All totals will

be calculated automatically. Cells with formulas have been locked and manual entry will not be allowed. There are two (2) places

that will need to be filled in with ink after you print the form. One is the name of your county at the top on the front of the form.

The other is the certification block located at the bottom on the back of the form. A line has been added on the front of the form to

include a subtotal of all other personal property. The format on the back of the form(s) is the same as 2005.

PLEASE COMPLETE THE BACK SIDE OF THE FORM(S) FIRST

Administrative Secretary

State Tax Commission of Missouri

P.O. Box 146

Jefferson City, MO 65102-0146

Since the forms must have an original seal and signature, they must be sent to the Commission through the mail to the following

address:

Lines 1, 2, 3, 6, 7 and 8 on the front of the form should include the base value and the incremental increase value of Tax Increment

Finance (TIF) property. Please report the incremental increase value only on the lines provided on the back side of the form. The

total number of vehicles and historic vehicles/aircraft will automatically be transferred from the back of the form to the front of the

form on lines 20 and 23. The cells where these two totals are transferred are locked and you cannot enter the number of vehicles or

historic vehicles/aircraft.

INSTRUCTIONS FOR COMPLETING FORM 11

1 This form is to be completed by the county Clerk (Assessor in St. Louis City) and forwarded to the State Tax Commission on or

before June 20. (Sections 137.245, 137.375, 137.515, RSMo)

2. The assessed valuations reported on this form must agree with the value appearing on the real estate book and personal property

assessment book.

3. All appropriate lines and columns must be completed.

4. NUMBER OF ASSESSMENTS - REAL PROPERTY column is to contain the total number of assessments of the subclass of

property identified on a given line.

5. NUMBER OF UNITS - TANGIBLE PERSONAL PROPERTY column is to contain the total number of head of livestock,

vehicles, etc. of the property identified on a given line.

6. Valuations on this form must be entered on lines provided for each class or subclass of property. Any subclass of personal property

for which a specific description does not appear is to be reported on line 25 - ALL OTHER TANGIBLE PERSONAL PROPERTY

ON ASSESSMENT BOOK.

7. All locally assessed items of real or personal Railroad and Utility property are to be included in the totals on lines 1, 2, 3, 6, 7, 8,

20 and 25. The exact valuation should be identified in the blanks provided on the reverse side of the form. Property centrally

assessed by the State Tax Commission should not be reported on this form.

8. Line 18 - SUBTOTAL - Livestock is the total of lines 12 through 17.

9. Line 26 - SUBTOTAL - All Other Personal Property is the total of lines 19 through 25.

10. Line 27 - TOTAL Locally Assessed Valuation - Tangible Personal Property is the total of lines 18 & 26.

11. Line 28 - TOTAL Locally Assessed Valuation - Taxable Property is the total of lines 11 & 27.

13. Any changes or corrections to assessed valuations that may be discovered following the original submission of this form to the

State Tax Commission must be corrected by submitting another completed form that includes the changes in the total figures. The

resubmitted form should be marked in the upper right-hand corner with the word "REVISED" and the revised form should be

accompanied by a cover letter outlining the changes and the reasons for the change. Section 138.445 RSMo, provides that the State

Tax Commission shall not accept amendments or modifications to this form after December 31 of the tax year.

14. Contact the Administrative Secretary of the State Tax Commission if you have any questions concerning the information required

on this form.

All assessed values entered on the Form 11 will automatically be carried over to the first column of the Form 11A. The cells in the

first column on the Form 11A are locked so you cannot manually enter the Form 11 values.

12.

INSTRUCTIONS FOR COMPLETING FORM 11A

1. This form is to be completed by the County Clerk (Assessor in St. Louis City) and forwarded to the State Tax Commission after

adjournment of the County Board of Equalization.

2. The assessed valuations reported on this form must agree with the valuation as equalized by the County Board of Equalization.

3. All appropriate lines and columns must be completed.

4. VALUATION REPORTED ON FORM 11 column must be the same as the valuation reported to the State Tax Commission on

"Form 11 - Aggregate Abstract". The figures for this column will carry over from the saved Form 11. The column has been

locked so you cannot manually enter the Form 11 values.

5. VALUATION ADDED BY THE COUNTY BOARD OF EQUALIZATION column is to contain any valuation increases made by

the Board of Equalization.

6. VALUATION DEDUCTED BY THE COUNTY BOARD OF EQUALIZATION column is to contain any valuations reduced by

the Board of Equalization and should be entered on the form as a negative "-" figure.

7. OTHER VALUATION CHANGES column should include valuations added or deducted pursuant to orders of the State Tax

Commission. Valuations deducted should be entered on the form as a negative "-" figure.

8. NUMBER OF ASSESSMENTS column is to contain the total number of assessments, head of livestock, vehicles, etc. of the

property identified on a given line after all changes by local authorities.

9. ASSESSED VALUATION column is the assessed valuation of all locally assessed property following action of the Board of

Equalization. The value in this column must reflect the value from the Form 11 with the additions or deductions reported after

adjournment of the BOE. A formula is in place to add and subtract if figures are entered correctly.

10. Valuation on this form must be entered on lines provided for each class or subclass of property. Any subclass of personal property

for which a specific description does not appear is to be reported on Line 25 - ALL OTHER TANGIBLE PERSONAL

PROPERTY ON ASSESSMENT BOOK.

11. All locally assessed items of real or personal Railroad and Utility property are to be included in the totals on lines 1, 2, 3, 6, 7, 8,

20 and 25. The exact valuation should be identified in blanks provided on the form. Property centrally assessed by the State Tax

Commission should not be reported on this form.

12. Line 18 - SUBTOTAL - Livestock is the total of lines 12 through 17.

13. Line 26 - SUBTOTAL - All Other Personal PropertyLivestock is the total of lines 19 through 25.

14. Line 27 - TOTAL Locally Assessed Valuation - Tangible Personal Property is the total of lines 18 & 26.

15. Line 28 - TOTAL Locally Assessed Valuation - Taxable Property is the total of lines 11 & 27.

16. Any changes or corrections to assessed valuation that may be discovered following the original submission of this form to the State

Tax Commission must be corrected by submitting another completed form that includes the changes in the total figures. The

resubmitted form should be marked in the upper right-hand corner with the word "REVISED" and the revised form should be

accompanied by a cover letter outlining the changes and the reasons for the change. Section 138.445 RSMo 1994, provides that the

State Tax Commission shall not accept amendments or modifications to this form after December 31 of the tax year.

17.

Contact the Administrative Secretary of the State Tax Commission if you have any questions concerning the information required

on this form.

REAL PROPERTY SUBCLASSES DEFINITIONS

RESIDENTIAL: "Residential Property", all real property improved by a structure which is used or intended to be used for

residential living by human occupants, vacant land in connection with an airport, land used as a golf course, and manufactured

home parks, but residential property shall not include other similar facilities used primarily for transient housing. (Section

137.016.1(1) RSMo) Manufactured homes, as defined in Section 700.010 RSMo, which are actually used as dwelling units shall

be assessed at the same percentage of true value as residential real property for the purpose of taxation. A manufactured home

located in a manufactured home rental park, rental community or on real estate not owned by the manufactured home owner shall

be considered personal property. A manufactured home located on real estate owned by the manufactured home owner may be

considered real property. (Section 137.115.6 RSMo)

AGRICULTURAL: "Agricultural and Horticultural Property", all real property used for agricultural purposes and devoted

primarily to the raising and harvesting of crops; to the feeding, breeding and management of livestock which shall include breeding

and boarding of horses; to dairying, or to any other combination thereof; and buildings and structures customarily associated with

farming, agricultural, and horticultural uses. Agricultural and horticultural property shall also include land devoted to and

qualifying for payments or other compensation under a soil conservation or agricultural assistance program under an agreement

with an agency of the federal government. (Section 137.016.1(2) RSMo)

COMMERCIAL: "Utility, Industrial, Commercial, Railroad and Other Real Property", all real property used directly or indirectly,

for any commercial, mining, industrial, manufacturing, trade, professional, business, or similar purpose, including all property

centrally assessed by the State Tax Commission, but shall not include floating docks, portions of which are separately owned and

the remainder of which is designated for common ownership and in which no one person or business entity owns more than five

individual units. This category also includes any real property not defined as residential or agricultural. (Section 137.016.1(3)

RSMo)

FOREST CROPLANDS: Real property granted partial tax relief when proper certification is received from the Department of

Conservation. (Chapter 254, RSMo)

PERSONAL PROPERTY SUBCLASSES DEFINITIONS

GRAIN AND OTHER AGRICULTURAL CROPS: Under Section 137.080, RSMo, grain and other agricultural crops in an

unmanufactured condition constitute a subclass of tangible personal property. This subclass is defined as grains and feeds

including, but not limited to, soybeans, cow peas, wheat, corn, oats, barley, kafir, rye, flax, grain sorghums, cotton and such other

products as are usually stored in grain and other elevators and on farms; but excluding such grains and other agricultural crops after

being processed into products of such processing when packaged or sacked. (Section 137.010(1) RSMo) See Section 137.115.3

RSMo for valuation thereof.

LIVESTOCK: Under Section 137.080 RSMo, livestock is a separate subclass of tangible personal property. Livestock includes

horses, cattle, swine, sheep, goats, ratite birds including but not limited to ostrich and emu, aquatic products as defined in section

277.024, RSMo, llamas, alpaca, elk documented as obtained from a legal source and not from the wild and raised in confinement

for human consumption or animal husbandry, poultry and other domesticated animals or birds. (Section 267.565(11) RSMo)

FARM MACHINERY: Under Section 137.080 RSMo, farm machinery is a separate subclass of tangible personal property.

MANUFACTURED HOMES: See definition under "RESIDENTIAL" on page one of this supplement.

VEHICLES: Section 137.080 RSMo, lists "vehicles, including recreational vehicles" as a separate subclass of personal property.

Section 137.225.3 requires a separate column for each type of property assessed.

A. Motor Vehicle, Truck, Motorcycle, Bus and Recreational Vehicle, see definitions in Section 301.010 RSMo.

B. Boat, see definition in Section 306.010 RSMo for a general definition of "watercraft".

C. Aircraft, see definition in Section 305.120 RSMo for general definition of "aircraft".

D. All Other Vehicles, see the definition of "vehicle" in Section 301.010 RSMo.

HISTORIC MOTOR VEHICLES: Section 137.080 RSMo, establishes that motor vehicles, which are eligible for registration and

are registered as historic motor vehicles under Section 301.131 RSMo, is a separate subclass of tangible personal property.

HISTORIC AIRCRAFT & AIRCRAFT BUILT FROM KIT: Section 137.115.3(4) RSMo, establishes an assessment of 5% for

aircraft which are at least twenty-five (25) years old and which are used solely for noncommercial purposes and are operated less

than fifty (50) hours per year or aircraft that are home built from a kit.

POLLUTION CONTROL TOOLS & EQUIPMENT: Section 137.115.3(6) RSMo, establishes an assessment of 25% for tools and

equipment used for pollution control and tools and equipment used in retooling for the purpose of introducing new product lines or

used for making improvements to existing products by any company which is located in a state enterprise zone and which is

identified by any standard industrial classification number cited in subdivision (6) of Section 135.200, RSMo.

ALL OTHER TANGIBLE PERSONAL PROPERTY: Section 137.080 RSMo, lists all taxable tangible personal property not

included in the other subclasses as a separate subclass of tangible personal property.

GENERAL DEFINITIONS

ASSESSED VALUATION: The valuations on the Assessor's Books and the valuation equalized by the Board of Equalization are

required to be assessed at the following percentages of true value in money: residential real property at 19% of true value;

agricultural real property at 12% of value based on productive capability; vacant and unused agricultural property at 12% of true

value; and commercial and all other real property at 32% of true value (Section 137.115 RSMo). Tangible personal property is

required to be assessed at 33-1/3% of its true value in money (Section 137.115.1 RSMo); Grain and other agricultural crops in an

unmanufactured condition are to be assessed at one-half of one percent of their true value in money (Section 137.115.3(1) RSMo);

Manufactured homes as defined in Section 700.010 RSMo, which are used as dwelling units, shall be assessed at the same

percentage as residential real property, which is 19% of true value in money; Motor vehicles which are eligible for registration and

are registered as historic motor vehicles under Section 301.131 RSMo shall be assessed at 5% of their true value in money (Section

137.115.3(4) RSMo); Aircraft which complies with Section 137.115.3(4) RSMo, are to be assessed at 5% of their true value in

money; Livestock and farm machinery are to be assessed at 12% of their true value in money (Section 137.115.3(2)(3) RSMo);

Qualifying agricultural and horticultural land assessments are based upon productive capability (Section 137.021 RSMo) and forest

croplands carry an assessment of $1.00 per acre if certified prior to August 14, 1974 and $3.00 per acre if certified after August 14,

1974 (Section 254.090 RSMo)

INCORPORATED TOWN LOTS: Real property, whether described by lots and blocks or some other method which appears on the

assessor's list as a tract or lot of land, which is situated in an incorporated city, town or village. This valuation must also contain

the value of improvements on such property.

MINERAL RIGHTS: Rights and interests in minerals underlying land that is owned by someone other than the owner of the land

(Section 259.220 RSMo). Mineral rights are to be assessed as commercial real property.

RURAL LAND: All land located within any county, except land in incorporated villages, towns, or cities. This valuation must also

contain the value of improvements on such property.

6. Residential

7. Agricultural

8. Commercial

Total Rural Land Total Town Lots

6. Residential

7. Agricultural

8. Commercial

Total Rural Land Total Town Lots

6. Residential

7. Agricultural

8. Commercial

Total Rural Land Total Town Lots

Boats

Airplanes

Motorcycles Trailers

Railroad & Utility Vehicles

Other Vehicles

*

Aircraft Built from a Kit

*

3. Commercial

3. Commercial

Total New Construction & Improvements

Rural Land

TAX INCREMENT FINANCE (TIF) PROPERTY (CHAPTER 99)

Lines 1, 2, 3, 6, 7 and 8 on the reverse side of this form are to include the base value and incremental increase value of TIF

property. Please report the incremental increase value only on the lines below:

Incorporated Town Lots

1. Residential

LOCALLY ASSESSED RAILROAD AND UTILITY PROPERTY

Total Tax Increment Finance Property

2. Agricultural

2. Agricultural

3. Commercial

Lines 1, 2, 3, 6, 7 and 8 on the reverse side of this form are to include the valuation of locally assessed railroad and utility real

property. The value of locally assessed railroad and utility property included in the values reported on the front of this form are:

Rural Land Incorporated Town Lots

1. Residential

VEHICLES

Line 20 on the reverse side of this form includes the value of vehicles. Please report the number of each type of vehicle listed

below:

Automobiles

RV's

Total Locally Assessed Railroad & Utility Property

Total Number of Vehicles

Trucks

HISTORIC MOTOR VEHICLES, HISTORIC AIRCRAFT AND AIRCRAFT BUILT FROM A KIT

Line 23 on the reverse side of this form is the total value of historic motor vehicles, historic aircraft and aircraft built from a kit.

Historic motor vehicles are assessed at 5%. Please report the number of each type of historic personal property below:

county, taken from the Assessment Book for 2006. IN WITNESS WHEREOF, I have hereunto set my hand and affixed the

*The total number of vehicles shown on this line should match the number of assessments reported on line 20 on the reverse

side of this form. This total will automatically be entered on line 20 on the reverse side of this form.

Buses

NEW CONSTRUCTION AND IMPROVEMENTS

Lines 1, 2,3, 6, 7 and 8 on the reverse side of this form are to include the value of new construction and improvements. The

value of new construction and improvements included in the values reported on the front of this form are:

1. Residential

2. Agricultural

Rural Land Incorporated Town Lots

Must be over 25 yrs. old and owned solely as a collector's item and used or

intended to be used for exhibition and educational purposes

Must be at least 25 years old and used solely for noncommercial purposes and

are operated less than 50 hours per year

Aircraft that are home built from a kit

Historic Motor Vehicles

Historic Aircraft

COUNTY CLERK SIGNATURE TELEPHONE NUMBER FAX NUMBER

seal of the County Commission of ________________________ County. Done at office in ___________________________,

this __________ day of ___________________, 2006

Total Number of Historic Vehicles

I, _______________________________, Clerk of the County Commission of _______________________ County, State of

Missouri, do hereby certify that the foregoing is a true, complete and correct abstract of the taxable property in the said

*The total number of historic vehicles shown on this line should match the number of assessments reported on line 23 on the

reverse side of this form. This total will automatically be entered on line 23 on the reverse side of this form.

Assessment Book for the year 2006.

THIS ABSTRACT MUST BE FORWARDED TO THE STATE TAX COMMISSION BY JUNE 20.

28. TOTAL Locally Assessed Valuation - Taxable Property (Sum of lines 11 & 27)

27. TOTAL Locally Assessed Valuation - Tangible Personal Property (Sum of lines 18 & 26)

25. All Other Tangible Personal Property on Assessment Book

21. Grain and Other Agricultural Crops (Assessed at 1/2 of 1%)

26. SUBTOTAL - All Other Personal Property (Sum of lines 19-25)

19. Farm Machinery (Assessed at 12%)

20. Vehicles including Recreational Vehicles

22. Manufactured Homes Used as Dwelling Units (Assessed at 19%)

23. Historic Motor Vehicles, Historic Aircraft & Aircraft Built From Kit (Assessed at 5%)

24. Pollution Control Tools & Equipment (Assessed at 25%)

17. All Other Livestock

18. SUBTOTAL - Livestock (Assessed at 12%) (Sum of lines 12-17)

15. Sheep & Goats

16. Poultry

13. Cattle

14. Hogs

TANGIBLE PERSONAL PROPERTY NUMBER OF UNITS ASSESSED VALUATION

12. Horses, Mares, Asses, Jennets and Mules

10. TOTAL Assessed Valuation - Incorporated Town Lots

11. TOTAL Assessed Valuation - Real Property

8. Commercial

9. Forest Croplands - No. of acres @ $3 ; No. of acres @ $1

6. Residential

7. Agricultural - Assessed Value of Vacant/Unused land is

4. Forest Croplands - No. of acres @ $3 ; No. of acres @ $1

5. TOTAL Assessed Valuation - Rural Land

NUMBER OF ASSESSMENTS ASSESSED VALUATION

1. Residential

3. Commercial

Assessed valuation of locally assessed taxable property in ______________________________ County on the lst day of January, 2006, as set out in the

MO870-0037 (3-06)

STATE TAX COMMISSION OF MISSOURI

AGGREGATE ABSTRACT

(FORM 11)

2. Agricultural - Assessed Value of Vacant/Unused land is

REAL PROPERTY

Number of

Assessments

26. SUBTOTAL - All Other Personal Property (Sum of lines 19-25)

MO870-0036(3-06)

28. TOTAL Locally Assessed Valuation - Taxable Property

(Sum of lines 11 & 27)

27. TOTAL Locally Assessed Valuation - Tangible Personal Property

(Sum of lines 18 & 26)

21. Grain and Other Agricultural Crops (Assessed at 1/2 of 1%)

22. Manufactured Homes Used as Dwelling Units (Assessed at 19%)

23. Historic Motor Vehicles, Historic Aircraft & Aircraft Built From Kit (Assessed at 5%)

24. Pollution control Tools & Equipment (Assessed at 25%)

25. All Other Tangible Personal Property on Assessment Book

20. Vehicles including Recreational Vehicles

19. Farm Machinery (Assessed at 12%)

18. SUBTOTAL - Livestock (Assessed at 12%) (Sum of lines 12-17)

15. Sheep & Goats

16. Poultry

17. All Other Livestock

13. Cattle

14. Hogs

12. Horses, Mares, Asses, Jennets and Mules

11. TOTAL Assessed Valuation - Real Property

TANGIBLE PERSONAL PROPERTY

10. TOTAL Assessed Valuation - Incorporated Town Lots

8. Commercial

9. Forest Croplands - No. of acres @ $3 No. of acres @ $1

7. Agricultural - Assessed Value of Vacant/Unused land is

6. Residential

3. Commercial

4. Forest Croplands - No. of acres @ $3 No. of acres @ $1

5. TOTAL Assessed Valuation - Rural Land

REAL PROPERTY

1. Residential

2. Agricultural - Assessed Value of Vacant/Unused land is

______________________________________________ County for the year 2006.

County assessed valuation report for return to the State Tax Commission after adjournment of the County Board of Equalization in STATE TAX COMMISSION OF MISSOURI

AGGREGATE ABSTRACT

(FORM 11A)

Assessed Valuation

Other Valuation Changes

(Enter as a negative or positive figure)

Valuation Deducted by

Board of Equalization

(Enter as a negative figure)

Valuation Added by

Board of Equalization

Valuation Reported

on Form 11

Potrebbero piacerti anche

- 20130515075851Documento330 pagine20130515075851Renold DarmasyahNessuna valutazione finora

- Financial Plan TemplateDocumento8 pagineFinancial Plan TemplateIMEENessuna valutazione finora

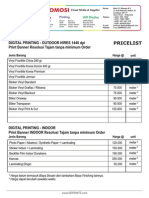

- Price List Daftar Harga Percetakan Digital Printing Indoor Hires DEPRINTZ September 2014Documento1 paginaPrice List Daftar Harga Percetakan Digital Printing Indoor Hires DEPRINTZ September 2014DEPRINTZ Distributor Jual MesinNessuna valutazione finora

- Harga KusenDocumento14 pagineHarga KusenRenold DarmasyahNessuna valutazione finora

- Schlitterbahn ProposalDocumento10 pagineSchlitterbahn ProposalRenold DarmasyahNessuna valutazione finora

- Gumilar Santika Lestari Water ParkDocumento3 pagineGumilar Santika Lestari Water ParkRenold DarmasyahNessuna valutazione finora

- 2012-2014-Real Estate Land Bus PlanDocumento55 pagine2012-2014-Real Estate Land Bus Plang4nz0Nessuna valutazione finora

- Pilot Project For Community Engagement in Water Conservation at Ali Curung PDFDocumento40 paginePilot Project For Community Engagement in Water Conservation at Ali Curung PDFRenold DarmasyahNessuna valutazione finora

- Rent ReceiptDocumento12 pagineRent ReceiptRenold DarmasyahNessuna valutazione finora

- Commercial Real Estate Valuation Model1Documento6 pagineCommercial Real Estate Valuation Model1Sajib JahanNessuna valutazione finora

- RAB C4 RevDocumento30 pagineRAB C4 RevRenold DarmasyahNessuna valutazione finora

- Real Estate Investment AnalysisDocumento26 pagineReal Estate Investment AnalysisRenold DarmasyahNessuna valutazione finora

- Pearl Garden Project Material Tracking SheetDocumento9 paginePearl Garden Project Material Tracking SheetRenold DarmasyahNessuna valutazione finora

- Rain Water Harvesting and ConservationDocumento170 pagineRain Water Harvesting and Conservationnp27031990Nessuna valutazione finora

- SOLVSAMPDocumento15 pagineSOLVSAMPcoldblood22Nessuna valutazione finora

- Resignation LetterDocumento1 paginaResignation LetterFerOz OthmanNessuna valutazione finora

- Presentation 52Documento22 paginePresentation 52Renold DarmasyahNessuna valutazione finora

- Visions and Targets: Example TextDocumento12 pagineVisions and Targets: Example TextRenold DarmasyahNessuna valutazione finora

- Wedding Checklist: Stationery CeremonyDocumento14 pagineWedding Checklist: Stationery CeremonyRenold DarmasyahNessuna valutazione finora

- Sample Business PlanDocumento12 pagineSample Business PlanedunewzNessuna valutazione finora

- Business Startup CostsDocumento6 pagineBusiness Startup CostsNoushad N HamsaNessuna valutazione finora

- Adventure Works 2006 Sales Proposal: Senior Vice PresidentDocumento16 pagineAdventure Works 2006 Sales Proposal: Senior Vice PresidentRenold DarmasyahNessuna valutazione finora

- VA FinancialPolicyVolumeXIIIChapter02aDocumento118 pagineVA FinancialPolicyVolumeXIIIChapter02aRenold DarmasyahNessuna valutazione finora

- With or Without TaxDocumento15 pagineWith or Without TaxRenold DarmasyahNessuna valutazione finora

- 12-Month Project Timeline PlanningDocumento12 pagine12-Month Project Timeline PlanningRenold DarmasyahNessuna valutazione finora

- Presentation 58Documento12 paginePresentation 58Renold DarmasyahNessuna valutazione finora

- Product/Service Satisfaction Tracker: Criteria Quarterly Baseline Q1 Q2 Q3 Q4Documento1 paginaProduct/Service Satisfaction Tracker: Criteria Quarterly Baseline Q1 Q2 Q3 Q4Renold DarmasyahNessuna valutazione finora

- Adventure Works 2008 Sales Proposal: Linda Martin Senior Vice President Worldwide Sales March 24, 2008Documento16 pagineAdventure Works 2008 Sales Proposal: Linda Martin Senior Vice President Worldwide Sales March 24, 2008Renold DarmasyahNessuna valutazione finora

- Presentation 55Documento13 paginePresentation 55Renold DarmasyahNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- 2014 Import Intelligence Study Wine in BoliviaDocumento46 pagine2014 Import Intelligence Study Wine in BoliviaalainNessuna valutazione finora

- April 6, 2012 Strathmore TimesDocumento32 pagineApril 6, 2012 Strathmore TimesStrathmore TimesNessuna valutazione finora

- Caesalpinia Sappan LDocumento4 pagineCaesalpinia Sappan LSriArthiNessuna valutazione finora

- Sriramsagar Project (Stage-I) : PreambleDocumento5 pagineSriramsagar Project (Stage-I) : PreambleSrinivas SherpallyNessuna valutazione finora

- Analysis PresentationDocumento7 pagineAnalysis Presentationapi-542560527Nessuna valutazione finora

- Food PyramidDocumento22 pagineFood PyramidTeejay520% (1)

- Universidad Nacional Pedro Ruiz Gallo: Facultad AgronomiaDocumento7 pagineUniversidad Nacional Pedro Ruiz Gallo: Facultad AgronomiaWagner Piterson Espinoza CastroNessuna valutazione finora

- Agro302 Agronomy of Field Crops-I 2+1Documento3 pagineAgro302 Agronomy of Field Crops-I 2+1YashaswiniNessuna valutazione finora

- Intro To Ratios NearpodDocumento35 pagineIntro To Ratios Nearpodapi-376970027Nessuna valutazione finora

- Grade 8 History Term 2 ExamDocumento14 pagineGrade 8 History Term 2 ExamNeo NetandaNessuna valutazione finora

- 21 at The SupermarketDocumento7 pagine21 at The SupermarketCorina CoryNessuna valutazione finora

- Nga Hai Cooperative Grows Cantaloupe Using High-Tech GreenhouseDocumento4 pagineNga Hai Cooperative Grows Cantaloupe Using High-Tech GreenhouseNguyen Ngoc Thu TrangNessuna valutazione finora

- Week 1 - Q3 - ACP 10Documento4 pagineWeek 1 - Q3 - ACP 10Cherry100% (1)

- My Little GardenDocumento1 paginaMy Little GardenJomarc Cedrick GonzalesNessuna valutazione finora

- Mustard yield and water productivity under sprinkler and basin irrigationDocumento14 pagineMustard yield and water productivity under sprinkler and basin irrigationShravan Kumar MauryaNessuna valutazione finora

- Module 3 3rd Edition 2016 08 Oil PlamDocumento57 pagineModule 3 3rd Edition 2016 08 Oil PlamjingsiongNessuna valutazione finora

- Mmu ProgramDocumento27 pagineMmu Programabiri bunaebiNessuna valutazione finora

- Limus® - Urea InhibitorDocumento6 pagineLimus® - Urea InhibitorsharemwNessuna valutazione finora

- Unemployment in India: Causes, Types and MeasurementDocumento35 pagineUnemployment in India: Causes, Types and MeasurementVaibhav Eknathrao TandaleNessuna valutazione finora

- ACES 2010 Book of AbstractsDocumento268 pagineACES 2010 Book of Abstractsjhanna4495Nessuna valutazione finora

- PteridophytesDocumento17 paginePteridophytesswischris0% (1)

- Sobha ProjectDocumento103 pagineSobha Projectlakshmanlakhs0% (1)

- (Very Short Introductions) Lawrence, Mark Atwood-The Vietnam War - A Concise International History-Oxford University Press (2008)Documento225 pagine(Very Short Introductions) Lawrence, Mark Atwood-The Vietnam War - A Concise International History-Oxford University Press (2008)Милан Стевановић100% (2)

- Gender and Climate Change ModuleDocumento49 pagineGender and Climate Change ModuleSalvador David Higuera LópezNessuna valutazione finora

- CMT - WoodsDocumento22 pagineCMT - WoodsPrecious Anne PalmaNessuna valutazione finora

- Martin Lemoine, Unsung Gender Hero, Asian Development Bank (ADB)Documento3 pagineMartin Lemoine, Unsung Gender Hero, Asian Development Bank (ADB)ADBGADNessuna valutazione finora

- Ecological Succession ActivityDocumento3 pagineEcological Succession Activityapi-236697820100% (1)

- Apatani HerbsDocumento0 pagineApatani HerbsLuvjoy ChokerNessuna valutazione finora

- Chapter 1Documento20 pagineChapter 1Vera Carpentero LamisNessuna valutazione finora

- Variations of Peroxidase Activity in Cocoa (Theobroma Cacao L.) PDFDocumento4 pagineVariations of Peroxidase Activity in Cocoa (Theobroma Cacao L.) PDFFadli Ryan ArikundoNessuna valutazione finora