Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Blockbuster

Caricato da

pheeyonaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Blockbuster

Caricato da

pheeyonaCopyright:

Formati disponibili

BLOCKBUSTER ACQUIRES MOVIELINK: A GROWTH

STRATEGY

I. DISCUSSION QUESTIONS, CASE INTRODUCTION AND KEY POINTS

Introduction

The case covers Blockbusters emergence in the video rentals market. After detailing the

intricacies of the video rental market, the case takes a deeper dive into Blockbusters business

model, based on brick-and-mortar locations throughout the US. This costly infrastructure has

slowed the entertainment giants growth in an industry that has rapidly transitioned from the

traditional store-based model, to mail rental and video-on-demand alternatives. The rapid

transition of customer demand and the emergence of Netflix (Blockbusters main competitor) has

incited Blockbusters rapid entrance into the video-on-demand market through the acquisition of

Movielink.

The key challenges that Blockbuster faces in 2009 include: rising consumer expectations,

increases in media piracy, the impact of rising fuel costs on systems based on the distribution of

physical media, and the intricacies of competing in a rapidly changing technology industry where

new entry is enabled by low infrastructure costs.

Summary of key learning points and strategic issues

1. Understanding the challenges associated with a rapidly changing technology based industry

2. Flexibility in the face of a evolving market with high competition and new technology

3. The role of acquisitions in company growth

4. The importance of brand image and marketing in an increasingly tech-savvy market

5. Adjusting business-level strategy in light of disruptive business models

Discussion Questions

1. Perform a STEEP analysis to understand the general environment facing Blockbuster. How

will Blockbuster be affected by external factors?

2. Use Porters Five Forces Model to analyze the mail rental and video-on-demand industries in

the US. Given this analysis, are these industries attractive or unattractive?

3. Entering the video-on-demand business requires Blockbuster to shift its corporate business

strategy and compete in a new space. Discuss this shift and the key challenges associated

with it?

4. Who are Blockbusters main competitors and how does Blockbuster measure up against these

competitors? (It may be helpful to chart competitors and product offerings) What advantages

does Blockbuster have and what advantages do competitors hold?

5. What are the main capabilities of Blockbuster? Does Blockbuster have a core competence?

6. Create a SWOT analysis to understand Blockbusters strengths and weaknesses. Does

Blockbuster have a sustainable competitive advantage in the mail rental and video-ondemand industries? If so, what is the source? What about Blockbusters evolution and

current business strategy may pose problems going forward?

7. What is Blockbusters business-level strategy? Is the strategy appropriate to offset the forces

in the industries? How has Blockbuster attempted to overcome obstacles posed by being a

late player in a rapidly changing marketplace? Do you recommend any changes and/or

foresee any challenges?

BLOCKBUSTER | 1

BLOCKBUSTER ACQUIRES MOVIELINK: A GROWTH

STRATEGY

II. EXTERNAL ENVIRONMENT ANALYSIS

Summarize the external environment, including conditions in the general, industry, and

competitor environments.

a. The General Environment

Definition: The general environment is focused on the future and can be analyzed by

considering the STEEP framework: Social/demographic, Technological, Economic,

Environmental/geographic and Political/legal/governmental factors at play.

1.

2.

3.

4.

5.

Social/Demographic

Technological

Economic

Environmental/Geographic

Political/Legal/Governmental

Discussion Question 1: Perform a STEEP analysis to understand the general environment

facing Blockbuster. How will Blockbuster be affected by external factors?

Social/Demographic:

Rising customer expectations and IT literacy prompt a need for Blockbuster to digitize its

entertainment offerings for customer convenience.

Increases in consumer access to pirated media through online resources and bootlegs has

put substantial strains on the media sales and rental industries.

Increased environmental awareness among customers will likely be a way to promote the

green benefits of digitized offerings.

Technological:

Increases in the amount of entertainment content offered on the web make market entry a

must for Blockbuster to survive in a rapidly changing market environment.

Economic:

Rising fuel costs will put a substantial strain on Blockbusters distribution network and

costs

The beginning of the subprime mortgage crisis is starting to decrease consumer

discretionary spending, forcing Blockbuster to offer more economical alternatives to

maintain sales volume.

Environmental/Geographic:

BLOCKBUSTER | 2

BLOCKBUSTER ACQUIRES MOVIELINK: A GROWTH

STRATEGY

Globalization allows for access to increased customer base by using online media and

multinational brand presence.

Political/Legal/Governmental:

Increased concerns about piracy and digital rights management issues make the offering

of entertainment content through new media legally complicated and costly.

Overall Assessment: The changing customer needs highlighted in the social/demographic section

will offer Blockbuster the most opportunity but also the most threats. Blockbuster needs to

respond to changing customer needs and technology improvements in order to remain

competitive. This will be challenging given Blockbusters history as a brick-and-mortar store as

it will be both a strategic shift for the established Blockbuster and also economically challenging.

b. The Industry Environment

Definition: An industry is a group of firms producing products that are close substitutes. In the

course of competition, these firms influence one another. Typically, industries include a rich

mixture of competitive strategies that companies use to pursue above-average returns. In part,

these strategies are chosen because of the influence of an industrys characteristics. Compared

with the general environment, the industry environment often has a more direct effect on the

firms strategic competitiveness and above-average returns.

The industry environment is the set of factors that directly influences a firm and its competitive

actions and competitive responses. Porters 5 Forces Model is a powerful tool for understanding

the dynamics amongst the five key factors that determine an industrys level of rivalry and profit

potential. [Outlined below, High=H; Medium=M; Low=L]

1.

2.

3.

4.

5.

Threat of New Entrants (or barriers to entry)

Supplier Power

Threat of Product Substitutes

Buyer Power

Intensity of Rivalry

Discussion Question 2: Use Porters Five Forces Model to analyze the mail rental and videoon-demand industries in the US. Given this analysis, are these industries attractive or

unattractive?

The below Porters 5 forces analysis shows that the rental industry is not an particularly

attractive industry because competition, substitutes, and supplier power are high.

Threat of New Entrants (or barriers to entry): Medium

Mail rental infrastructure costs are much lower than those of brick-and-mortar

alternatives

VoD service providers can build infrastructure at a relatively low cost and often spring

out of new web-based delivery technologies

BLOCKBUSTER | 3

BLOCKBUSTER ACQUIRES MOVIELINK: A GROWTH

STRATEGY

Relationships with media producer are difficult to establish when trying to attain rights to

their productions

Supplier Power: High

High supplier power due to concentrated movie studio and game industries

Specialized products such as movies and games which cannot be substituted with lower

grade productions

Threat of Product Substitutes: High

Large number of substitutes compete for customer attention within the media delivery

space. (VoD based enterprises may have a competitive advantage due to increased

convenience over other substitutes)

Buyer Power: High

High price sensitivity among consumers constrained by subprime crisis, low switching

costs between alternatives

Intensity of Rivalry: High

Low customer loyalty

Large number of competitors within the media delivery industry

Competition within the industry is based on price, ease of use/convenience, selection, and

service

Discussion Question 3: Entering the video-on-demand business requires Blockbuster to shift

its corporate business strategy and compete in a new space. Discuss this shift and the key

challenges associated with it?

Blockbuster has traditionally been a brick-and-mortar business and it has dominated the video

rental retail space, however moving into the video-on-demand business will require Blockbuster

to switch gears and also swallow a bit of pride. Customers will no longer travel to Blockbuster

to rent movies, rather Blockbuster must transition from physical to virtual media, bringing the

product directly into its customers homes.

Begun in 1985, Blockbuster has proven agile in the face of changing technology, but has never

been required to change its business model in the past. Blockbuster has upgraded from VHS

tapes to DVDs and has responded to new markets by renting video games. However the new

threats from VoD providers require Blockbuster to invest more heavily in an IT infrastructure and

move its business from brick-and-mortar locations to online sites.

Blockbuster faces challenges in shifting its business model. It is an established leader in its field,

making it vulnerable to agile disruptors redefining the marketplace through new product

offerings. Blockbusters current model requires heavy investment in real estate and inventory.

BLOCKBUSTER | 4

BLOCKBUSTER ACQUIRES MOVIELINK: A GROWTH

STRATEGY

However, these core competencies do not translate into the online space. Blockbusters high

overhead costs put it at a disadvantage as it seeks to move online where competitors have much

lower cost structures. In addition Blockbusters traditional retail expertise is insufficient in

moving into the new industry which requires technology knowledge, innovative marketing, and

partnerships with cable operators.

c.

The Competitor Environment

Definition: The competitor environment is the final subject of analysis required to gain a full

understanding of the company's external environment. A competitor analysis focuses on each

company against which a firm directly competes and involves gathering and interpreting

information about Blockbusters competitors. The intense rivalry of the movie rental and VoD

industry creates a strong need to understand competitors.

Competitive rivalry is the ongoing set of competitive actions and responses that occur among

firms as they maneuver for an advantageous market position. Especially in highly competitive

industries, companies constantly jockey for advantage as they launch strategic actions and

respond or react to rivals moves. It is important to understand competitive rivalry because it

influences a firms ability to gain and sustain competitive advantages.

3 Is Framework

Leveraging the 3 Is framework provides a thorough overview by grouping competitors into

three buckets: immediate competition, impending competition, invisible competition.

1. Immediate Competition:

Immediate competitors to Blockbuster are other brick-and-mortar entertainment rental

stores such as Movie Gallery and the increasingly popular Redbox. Blockbuster is

currently outperforming competitors due to its much broader range of services and

entertainment delivery methods. Within the mail rental industry, Blockbusters main

competitor is Netflix which was the first company to enter the mail rental space. Netflix

capitalized on its first-mover-advantage to gain significant market share.

2. Impending Competition:

Impending competitors to Blockbuster are smaller VoD providers such as Vudu who

operate on a much leaner cost base by delivering content only over the internet and do not

rely on costly brick-and-mortar operations. These businesses are also much more focused

on the technology as their core competency.

3. Invisible Competition:

Blockbusters invisible competitors consist of actual entertainment producers and studios

which can rapidly form third party joint ventures to enter distribution markets. An

example of this is the creation of Movielink by a number of movie studios.

BLOCKBUSTER | 5

BLOCKBUSTER ACQUIRES MOVIELINK: A GROWTH

STRATEGY

Discussion Question 4: Who are Blockbusters main competitors and how does Blockbuster

measure up against these competitors? (It may be helpful to chart competitors and product

offerings) What advantages does Blockbuster have and what advantages do competitors hold?

See Below for a chart of Blockbusters key competitors and their product offerings.

In-store rental: Blockbuster has a clear advantage in the in-store rental category, as it is an

established brand with premium locations.

Mail rental: Blockbuster has established itself in the concentrated mail rental space, but Netflix

remains the market leader due to its first mover advantage. The Netflix brand is synonymous

with mail rental whereas Blockbuster is struggling to make a name for itself in this business

(despite nearly identical offerings and pricing) Blockbuster does offer the convenience of in store

exchange, but it is unclear of the customer appeal of this offering given Netflix quick delivery

time.

Sales: The sales market is extremely fragmented as many players in different spaces (online,

retail, video rental) are competing to sell media content in both physical and virtual form.

Blockbuster probably has an advantage in selling previously viewed films, thereby reducing

inventory, however it has no advantage in retail sales and customers are more familiar with

Apple and Amazon with regards to online sales.

VoD: Blockbuster is entering the VoD space through its purchase of Movielink, however due to

movielinks origins, customers will not be able to burn downloaded/streamed movies to DVDs.

This puts Blockbuster at a disadvantage because customers want to watch movies on their TVs

and not on their computers.

Netflix, Vudu, and Apple sell VoD through boxes that customer can plug directly into their TVs.

While customers do not want an additional box, they prefer this to watching movies on their

computers.

Sony/Universal/Warner Bros have partnerships with cable companies allowing customers to

watch movies on their TVs without an additional box. Perhaps Blockbuster would be in a better

position if it had formed partnerships with cable operators directly instead of purchasing

Movielink.

BLOCKBUSTER | 6

BLOCKBUSTER ACQUIRES MOVIELINK: A GROWTH

STRATEGY

BLOCKBUSTER | 7

BLOCKBUSTER ACQUIRES MOVIELINK: A GROWTH

STRATEGY

III.

INTERNAL COMPANY ANALYSIS

Summarize internal company factors including: capabilities and weaknesses, value chain

activities, strategy, and financial situation.

a. Outline the company's internal capabilities and weaknesses.

Definition: Capabilities exist when resources have been integrated to achieve a specific set of

tasks and are frequently developed within a specific functional area. In addition to identifying

the company's opportunities and threats from the external environment, another important

objective of the situation analysis is to evaluate strengths and weaknesses as input for developing

the company's strategies.

Discussion Question 5: What are the main capabilities of Blockbuster? Does Blockbuster

have a core competence?

Blockbusters main capabilities include its abilities to serve customers with physical movie and

game rentals through access to large selection, premium locations, and a well established,

national brand. Its core competency is physical movie rental through an expertise in retail

strategy and know-how (location, selection, branding)

Blockbuster was able to move into the online mail rental space because it developed distribution

capabilities and marketed the new service. However the move to Vod will likely be more

challenging given the necessary technology infrastructure, competition, and customer desire to

watch movies on TV rather than computers.

Discussion Question 6: Create a SWOT analysis to understand Blockbusters strengths and

weaknesses. Does Blockbuster have a sustainable competitive advantage in the mail rental

and video-on-demand industries? If so, what is the source? What about Blockbusters

evolution and current business strategy may pose problems going forward?

Strengths

1. Strong reputation and brand recognition

2. Ability to leverage brick-and-mortar stores

for customer convenience

3. Offerings across range of media delivery

services (mail rental, VoD, sales, and instore rental)

1.

2.

3.

4.

Opportunities

Opportunity to renegotiate DRM

restrictions with movie studios

Opportunity to increase marketing of VoD

offerings to new and existing customers

Opportunity to create and rent set top box

system

Room to grow in international markets,

through low infrastructure VoD offerings

BLOCKBUSTER | 8

BLOCKBUSTER ACQUIRES MOVIELINK: A GROWTH

STRATEGY

Weaknesses

1. Brick-and-mortar stores come with high

expenses

2. Large corporate structure limits agility

3. Late player in online VoD and mail rental

market

4. Small market share of above markets

Threats

1. Decreased customer disposable income

encourages cuts to non-essential spending

2. Highly competitive and innovative market

space in VoD technology

3. Increased piracy

4. DRM restrictions

Within the brick-and-mortar space Blockbuster has a sustainable advantage through its locations,

brand, and relationships with movie studios. However it does not seem to have a sustainable

advantage in the mail rental and VoD spaces.

In the mail rental business Blockbusters locations, brand and supplier relationships along with

its distribution network give it a competitive advantage over new entrants. However

Blockbusters primary competitor, Netflix has a stronger brand in this space and has equally

robust supplier relationships and a distribution network. The only competitive advantage that

Blockbuster has is its locations, offering customers the ability to exchange mail rental DVDs

which Netflix cannot offer.

Blockbuster continues to leverage its brand and supplier relationships in the mail rental space,

but it must increase marketing in order to increase publicity around its new business expansion.

Competition is stiff in the VoD space and Blockbuster appears to have no identifiable

competitive advantage in this space. While Blockbuster can leverage the Movielink brand and

supplier relationships, competitors too have strong brands and supplier relationships. In addition

Blockbuster is at a disadvantage due to Movielinks restrictions regarding DVD burning,

disallowing customers from viewing movies on their TVs.

Blockbusters focus on its retail locations and failure to enter the mail rental and VoD spaces

sooner have put it at a disadvantage. As a result the Blockbuster brand is clearly associated with

its retail spaces rather than its new business units. Blockbuster must increase marketing efforts

in order to break free of its legacy business. Finally, Blockbusters decision to acquire Movielink

which has DRM restrictions, is likely to further inhibit the companys ability to make a place for

itself in the highly competitive VoD market unless it is able to overcome this obstacle.

b. Conduct a Value Chain analysis to identify value-creating activities.

Definition: By exploiting its core competencies, a competitive firm creates value for its

customers. Value is measured by a products performance characteristics and by its attributes for

which customers are willing to pay. Companies with a competitive advantage offer value to

BLOCKBUSTER | 9

BLOCKBUSTER ACQUIRES MOVIELINK: A GROWTH

STRATEGY

customers that is superior to the value competitors can provide. Value is created by innovatively

bundling and leveraging resources and capabilities.

A value chain analysis provides information relative to primary (inbound/outbound logistics,

operations, marketing & sales, and service) and secondary (firm infrastructure, human resources

mgmt, technological developments and procurement) activities. A value chain representation of

Blockbusters primary and support activities is presented in the diagram below. This information

can be used to establish a business strategy which targets select activities to create a sustainable

competitive advantage.

Primary Activities

Inbound/Outbound Logistics:

o 23 distribution center across the US allow Blockbuster to offer 1 business day

delivery to its customers, enhancing their experience and effectively competing

with Netflix and other mail rental companies

o 4,500 brick-and-mortar stores that Blockbuster owns provide an additional

platform for its sophisticated distribution network as the company has allowed

customers to return their mail rental DVDs to any store across the US

Operations:

o Blockbuster likely has an extensive inventory management and routing system to

ensure quick processing of movie rentals and returns.

Service:

o Blockbuster offers customers the ability to exchange movies at its physical

locations.

B L O C K B U S T E R | 10

BLOCKBUSTER ACQUIRES MOVIELINK: A GROWTH

STRATEGY

Marketing and Sales:

o Joint promotions with fast food outlets such as Dominos Pizza and McDonalds

increase exposure of the Blockbuster brand

o Printable e-Coupons for free movies, game rentals, etc. entice customers to

remain loyal

o Blockbuster now offers an online movie suggestion tool to increase customer

loyalty and rentals. This system is akin to that developed by Amazon.com to

suggest purchases to customers

Support Activities

HR Management:N/A

Technology Development:

o Blockbusters website offers a user friendly web interface, a movie queuing

service, and an extensive database, for mail order rentals

o The company recently purchased Movielink, a provider of video-on-demand

(VoD) services, to offer its customers increased convenience to watch their

favorite entertainment content online

o Due to the mail rental offerings, Blockbuster has built an extensive logistics and

inventory management IT infrastructure that must be kept up-to-date and adapt to

changing customer demands and expectations

Firm Infrastructure:

o Increased piracy concerns and digital rights management issues make the rental of

entertainment content, particularly through online media, increasingly difficult

and costly to manage from a legal aspect

Procurement:

o Along with the Movielink acquisition, Blockbuster acquired the rights to the

movies of Movielinks previous owners (Warner Bros., MGM, and Paramount),

increasing the selection the company has to offer its customers and making it

increasingly complicated for new entrants to compete in the market

c. Product-Market Growth

Using the product-market growth matrix developed by Ansoff, it is possible to outline the

possibilities that a company has to expand its product offerings and markets strategically to

increase sales.

B L O C K B U S T E R | 11

BLOCKBUSTER ACQUIRES MOVIELINK: A GROWTH

STRATEGY

Conducting this analysis for Blockbuster reveals that the media delivery giant has room for

growth in both its markets and product offerings at a relatively low cost.

Products/Markets Present Products

Present

Markets

New Markets

New Products

Increase marketing of VoD

Offer integrated platform for

and mail rental products

online and mail order gaming

through rebranding efforts to services

appeal to younger, tech savvy

segments

Market VoD services to

Expand service offerings to

growing international markets provide online gaming services to

including UK, Germany,

international markets

France, and Scandinavia

B L O C K B U S T E R | 12

BLOCKBUSTER ACQUIRES MOVIELINK: A GROWTH

STRATEGY

d. Financial Analysis

Definition: Financial analysis is used to assess the viability, stability and profitability of a

company or operating division. The analysis is done using quantitative historical performance

found in the financial reporting documents (Balance Sheet, Income Statement, Statement of Cash

Flows). The goal of the analysis is to understand a companys financial health through its

profitability, solvency, liquidity, and stability.

Given the financial information provided in the case, it is clear that Blockbuster is facing

operational issues that span beyond the current financial downturn. Net income has suffered

substantially over the last four quarters as both operating revenues and costs have fallen. As can

be seen in the chart below, COGS + SGA expenses have fallen at a slower rate that operating

revenue, placing substantial strain on the company.

An analysis of Blockbusters COGS and NI as a percent of revenue reveals that even though

efficiencies have been achieved (COGS as percent of revenue is steadily declining), net income

is no improving.

B L O C K B U S T E R | 13

BLOCKBUSTER ACQUIRES MOVIELINK: A GROWTH

STRATEGY

B L O C K B U S T E R | 14

BLOCKBUSTER ACQUIRES MOVIELINK: A GROWTH

STRATEGY

IV.STRATEGY FORMULATION

Summarize Blockbusters strategic position as it relates to its current strategy and the

components thereof

a. Summarize Blockbusters current strategy.

Blockbusters current strategic objective is to dominate the VoD and mail rental markets by

leveraging its size and current infrastructure. Although Blockbuster is a household name for

entertainment content rental, it fell behind its main competitor Netflix by arriving late to both the

mail rental and VoD markets. These late entries have forced Blockbuster to invest significant

resources and capital to catch up, the most recent of these investments taking the form of the

acquisition of a VoD service provider, Movielink.

b. Strategic Analysis

Definition: Conduct an analysis of Blockbusters business strategy by using the 4 Ps

Framework. The 4 Ps Framework is used to understand a companys strategy based on its

Position (Mission, Values, and Vision), Priorities, Payments (what it will spend its money on to

reach those priorities), and Performance (how it will measure success).

By completing the framework, we can analyze a companys current, future, or recommended

priorities as well as set forth a path in order to achieve goals and measure accomplishments.

Use the 4 Ps Framework to analyze the firms past/current/future strategy.

1.

Position

a. Mission:

Offer customers an expanding array of convenient ways to access entertainment

content

b. Values:

Infinite selection, broad customer appeal, convenient access

c. Vision:

US leader in online entertainment content

2.

Priorities:

1. Build a flexible and agile online content delivery system

2. Lower costs and improve efficiency

3. Capture greater share of VoD and mail rental markets

3.

Payments:

1. Continue to invest heavily in IT infrastructure

2. Rebrand Blockbuster as premium provider of VoD and mail rental services

3. Invest in negotiating DRM for Movielink VoD service

4.

Performance:

1. Market share growth in online rental and VoD space

B L O C K B U S T E R | 15

BLOCKBUSTER ACQUIRES MOVIELINK: A GROWTH

STRATEGY

2. Customer and revenue growth

3. Increased profit due to ability to spread costs over larger customer base

In order to gain a market leader position within the mail rental and VoD markets, Blockbuster

must:

1.

Build a flexible and agile online content delivery system by:

i. Creating a web platform that offers integrated online movie sales, rentals, and downloads

to provide maximum customer ease of use

ii. Negotiating DRM terms to allow for burning of entertainment content to DVDs until the

linking of TVs and PCs becomes more commonplace

2.

Lower costs and improve efficiency by:

i. Increasing investment in IT infrastructure to ensure optimal inventory management, rapid

and cost effective routing, and a seamless customer experience

ii. Continuing to close unprofitable brick-and-mortar stores and move its focus to the less

infrastructure intensive mail rental and VoD markets

iii. Achieving economies of scale through new customer acquisition in both new and existing

markets

3.

Capture greater share of VoD and mail rental markets by:

i. Rebranding Blockbuster to appeal to younger, tech savvy users that view Blockbuster as

a legacy brand famous for its brick-and-mortar locations

ii. Expanding marketing efforts beyond the US to capture growing international markets

(UK, Germany, France, Scandinavia) through the use of VoD technologies.

Discussion Question 7: What is Blockbusters business-level strategy? Is the strategy

appropriate to offset the forces in the industries? How has Blockbuster attempted to overcome

obstacles posed by being a late player in a rapidly changing marketplace? Do you recommend

any changes and/or foresee any challenges?

Blockbusters strategy for the mail rental and VoD businesses does not seem, to be particularly

unique. It is attempting to match competitor offerings, but does not seem to have any distinctive

products or services to set it apart from other players in the market (aside from the flexibility to

exchange movies in physical locations which may or may not be important to consumers). Thus

Blockbusters strategy is not appropriate in order to offset the competitive forces in the industry.

B L O C K B U S T E R | 16

BLOCKBUSTER ACQUIRES MOVIELINK: A GROWTH

STRATEGY

Blockbuster has attempted to overcome the obstacles posed by being a late player by matching

Netflix offerings and prices and also by acquiring Movielink to offer Blockbuster quick entry

into the VoD market.

Blockbuster could increase its chances of success in the mail rental business through an

aggressive marketing campaign and perhaps some free trial subscriptions. However it is unclear

the extent to which this market is growing relevant to the VoD market.

In the VoD space, Blockbuster can only succeed if it can overcome the DRM restrictions

allowing customers to burn DVDs or by developing technology that will enable TV viewing.

This said, the competitive obstacles in place in this space seem quite high, and Blockbuster may

not be able to overcome its late market entry.

Blockbusters main challenge in the mail rental and VoD markets will be creating a name for

itself and differentiating services/product offerings from competitors. Given Blockbusters

current trajectory its chances seem to be grim.

B L O C K B U S T E R | 17

BLOCKBUSTER ACQUIRES MOVIELINK: A GROWTH

STRATEGY

Discuss possible recommendations that Blockbuster could follow going forward to improve

the performance of the company. Determine the decision criteria and also analyze the pros

and cons of each recommendation.

a. Key Questions and Recommendations

Question

Option /

Hypothesis

Decision

Criteria

Pros

Cons

International

market

strategy

Expand into

growing

markets

through the

use of VoD

technologies

Market access

Costs/Benefits

Regulatory

barriers

Intl.

competition

High cost

FX exposure and DRM

regulations

No trial period

Language and

integration logistics

Domestic

market

strategy

Grow

market

share in

VoD and

mail rental

markets by

rebranding

Blockbuster

Offer online

and mail

order game

rentals and

sales

Market share

growth

Brand

recognition

Cost analysis

Ability to

compete

Growing markets

offer large upside

potential

Opportunity to

dominate

fragmented

marketplace

First-mover

advantage

Opportunity to

become major

player in VoD space

Appeal to greater

customer base

Rejuvenate the

brand

Diversify risk

through broader

portfolio

Appeal to younger

audience

First mover

advantage

High cost associated

with additional

infrastructure

Lack of market

expertise

Undeveloped supplier

relationships

Relatively small

market

New product

offerings

Costs/Benefits

Ability to

compete

Tech risk

Unknown cost (may

have to offer more

extensive services)

Turn off loyal

customer base

Incite price war with

lower cost competitors

B L O C K B U S T E R | 18

Potrebbero piacerti anche

- BS Case Study - Block BusterDocumento11 pagineBS Case Study - Block BusterAmbika SharmaNessuna valutazione finora

- Blockbuster Case StudyDocumento8 pagineBlockbuster Case StudybmsimNessuna valutazione finora

- Netflix Vs Blockbuster Case 5Documento21 pagineNetflix Vs Blockbuster Case 5Angelita Rodríguez Frisancho50% (4)

- R7Documento1 paginaR7eishwarNessuna valutazione finora

- Blockbuster Video: Written Analysis of Cases Assignment-6Documento8 pagineBlockbuster Video: Written Analysis of Cases Assignment-6Sid DharthNessuna valutazione finora

- Netflix Leading With DataDocumento19 pagineNetflix Leading With DataJuan Quiroz0% (2)

- Netflix Case NotesDocumento16 pagineNetflix Case NotesSergio AcuñaNessuna valutazione finora

- Blockbuster Strategy PresentationDocumento26 pagineBlockbuster Strategy PresentationJMcDon1007100% (1)

- Blockbuster CaseDocumento9 pagineBlockbuster CasemskrierNessuna valutazione finora

- The CIOs Guide To Innovation Strategy For The Digital Age PDFDocumento14 pagineThe CIOs Guide To Innovation Strategy For The Digital Age PDFjithendraNessuna valutazione finora

- StratMan 8thed Ch3 2017 Webtext FinalDocumento32 pagineStratMan 8thed Ch3 2017 Webtext FinalReyn CebuNessuna valutazione finora

- Blockbuster 1Documento6 pagineBlockbuster 1breacyaNessuna valutazione finora

- Summary of The Innovator's Dilemma: by Clayton M. Christensen | Includes AnalysisDa EverandSummary of The Innovator's Dilemma: by Clayton M. Christensen | Includes AnalysisNessuna valutazione finora

- BIM for Building Owners and Developers: Making a Business Case for Using BIM on ProjectsDa EverandBIM for Building Owners and Developers: Making a Business Case for Using BIM on ProjectsValutazione: 5 su 5 stelle5/5 (1)

- Netflix MBUS 807Documento5 pagineNetflix MBUS 807OMZ81Nessuna valutazione finora

- Final ExamDocumento7 pagineFinal ExamMohammad Umer InamNessuna valutazione finora

- ASME Engineering Solutions For The BoPDocumento57 pagineASME Engineering Solutions For The BoPskhiitNessuna valutazione finora

- Environmental Analysis BSBINN601Documento4 pagineEnvironmental Analysis BSBINN601pravesh bhattaraiNessuna valutazione finora

- Case 2 NetflixDocumento3 pagineCase 2 NetflixshoaibNessuna valutazione finora

- Research Paper On BlockbusterDocumento6 pagineResearch Paper On Blockbustergz8jpg31100% (1)

- Netflix Case AnalysisDocumento11 pagineNetflix Case AnalysisTanushree Panda100% (9)

- Performance Task (Information Management)Documento4 paginePerformance Task (Information Management)jollydeng01Nessuna valutazione finora

- Netflix Case AnalysisDocumento13 pagineNetflix Case AnalysisFaraz Haq100% (4)

- GROUP-A9 (W.R.T Paper)Documento3 pagineGROUP-A9 (W.R.T Paper)arun pratap singh bharatiNessuna valutazione finora

- Blockbuster VideoDocumento31 pagineBlockbuster VideoQuazi Aritra ReyanNessuna valutazione finora

- Deloitte - Sample Cases 20141210 - v2Documento13 pagineDeloitte - Sample Cases 20141210 - v2Aman BafnaNessuna valutazione finora

- Big Bets For The U.S. Cable Industry: Key Opportunities For Future Revenue GrowthDocumento0 pagineBig Bets For The U.S. Cable Industry: Key Opportunities For Future Revenue Growthqweasd222Nessuna valutazione finora

- Incentivizing Collaborative BIM-Enabled Projects: A Synthesis of Agency and Behavioral ApproachesDa EverandIncentivizing Collaborative BIM-Enabled Projects: A Synthesis of Agency and Behavioral ApproachesNessuna valutazione finora

- Strategic Management Concepts and Cases 2nd Edition Carpenter Solutions ManualDocumento16 pagineStrategic Management Concepts and Cases 2nd Edition Carpenter Solutions Manualedithbellamyhd3a100% (18)

- Comcast Corporation: Case AnalysisDocumento15 pagineComcast Corporation: Case AnalysissaurabhNessuna valutazione finora

- Case Analysis On Consumer Behavior: Submitted To: Ms. Deborah Catilo Submitted By: Joycelyn Dapula (BSBA III-I)Documento4 pagineCase Analysis On Consumer Behavior: Submitted To: Ms. Deborah Catilo Submitted By: Joycelyn Dapula (BSBA III-I)Dared KimNessuna valutazione finora

- Failure of BlockbusterDocumento11 pagineFailure of BlockbusterAhmad KashifNessuna valutazione finora

- Mueed Babar - ArticleDocumento4 pagineMueed Babar - ArticleJunaid MalikNessuna valutazione finora

- Blockbuster Case AnalysisDocumento4 pagineBlockbuster Case AnalysisBushra HaroonNessuna valutazione finora

- Indian Television Industry: in Indian Industry The Korean Companies Are Clearly Dominating The MarketDocumento14 pagineIndian Television Industry: in Indian Industry The Korean Companies Are Clearly Dominating The MarketManu AgarwalNessuna valutazione finora

- Blockbuster 111Documento57 pagineBlockbuster 111Kourosh ShNessuna valutazione finora

- Hofers DPMDocumento39 pagineHofers DPMramansharmachdNessuna valutazione finora

- Brand Awareness of VideoconDocumento86 pagineBrand Awareness of VideoconBhagyashree Dosi100% (2)

- Sample Assignment 3Documento11 pagineSample Assignment 3Cee JayNessuna valutazione finora

- Industry Analysis Report PDFDocumento11 pagineIndustry Analysis Report PDFRishita SukhadiyaNessuna valutazione finora

- SimrandeepSingh SecB MIS1Documento7 pagineSimrandeepSingh SecB MIS1Ravi Kant SinghNessuna valutazione finora

- Netflix Case Study PDFDocumento26 pagineNetflix Case Study PDFHarish KumarNessuna valutazione finora

- Building Information Modelling (BIM) Working Party Strategy Paper, March 2011Documento107 pagineBuilding Information Modelling (BIM) Working Party Strategy Paper, March 2011ChriscabscadcomNessuna valutazione finora

- Introduction To Business: Morning 5 December 2007Documento12 pagineIntroduction To Business: Morning 5 December 2007Jonathan SmokoNessuna valutazione finora

- Video ConDocumento42 pagineVideo Congyanprakashdeb302Nessuna valutazione finora

- Week 10 Closing of Blockbuster FINALDocumento10 pagineWeek 10 Closing of Blockbuster FINALgraju800% (1)

- Marketing - CHPTR 6 - Case Cisco - 6-18,21,22Documento3 pagineMarketing - CHPTR 6 - Case Cisco - 6-18,21,22Benedictus Kevin RNessuna valutazione finora

- Analysising Net Ix " S Strategy: ArticleDocumento4 pagineAnalysising Net Ix " S Strategy: Articlesimsim sasaNessuna valutazione finora

- Case 1Documento3 pagineCase 1John Paul AdolfoNessuna valutazione finora

- Quality Enhancement in Voluntary Carbon Markets: Opening up for MainstreamDa EverandQuality Enhancement in Voluntary Carbon Markets: Opening up for MainstreamNessuna valutazione finora

- RedboxDocumento10 pagineRedboxYakshya ThapaNessuna valutazione finora

- Case-Study (Netflix VS Blockbuster) PDFDocumento4 pagineCase-Study (Netflix VS Blockbuster) PDFranarahman100% (1)

- Strategy& PwC Booz Casebook Consulting Case Interview Book思略特 - 博斯 - 普华永道咨询案例面试Documento14 pagineStrategy& PwC Booz Casebook Consulting Case Interview Book思略特 - 博斯 - 普华永道咨询案例面试issac li100% (3)

- Netflix Strategy PDFDocumento12 pagineNetflix Strategy PDFRicky Mukherjee100% (2)

- Netflix StrategyDocumento12 pagineNetflix StrategyRicky Mukherjee100% (1)

- Netflix Case PaperDocumento8 pagineNetflix Case PaperM Sul100% (1)

- OECDreport2005 DigitalBroadbandDocumento38 pagineOECDreport2005 DigitalBroadbandIwa JamesNessuna valutazione finora

- Final Exam Block A 1Documento3 pagineFinal Exam Block A 1Louie Jasson YamitNessuna valutazione finora

- Quality of Experience Paradigm in Multimedia Services: Application to OTT Video Streaming and VoIP ServicesDa EverandQuality of Experience Paradigm in Multimedia Services: Application to OTT Video Streaming and VoIP ServicesNessuna valutazione finora

- MBA507Documento10 pagineMBA507pheeyonaNessuna valutazione finora

- Green Tea Crème Brûlée 抹茶クレームブリュレDocumento1 paginaGreen Tea Crème Brûlée 抹茶クレームブリュレpheeyonaNessuna valutazione finora

- Case 1 ToyotaDocumento5 pagineCase 1 Toyotapheeyona0% (1)

- CASE05 BlockbusterDocumento18 pagineCASE05 BlockbusterpheeyonaNessuna valutazione finora

- BlockbusterDocumento2 pagineBlockbusterpheeyonaNessuna valutazione finora

- Case - Euro Disney Disucssion QuestionsDocumento1 paginaCase - Euro Disney Disucssion QuestionspheeyonaNessuna valutazione finora

- MBA 504 Ch8 SolutionsDocumento11 pagineMBA 504 Ch8 SolutionspheeyonaNessuna valutazione finora

- Syllabus (BUS 536)Documento9 pagineSyllabus (BUS 536)pheeyonaNessuna valutazione finora

- MBA 504 Ch9 SolutionsDocumento24 pagineMBA 504 Ch9 Solutionspheeyona100% (1)

- MBA 504 Ch5 SolutionsDocumento12 pagineMBA 504 Ch5 SolutionspheeyonaNessuna valutazione finora

- Website For Asian Movie, HK Movie, Korean Movie, Indian Movie, JapaneseDocumento2 pagineWebsite For Asian Movie, HK Movie, Korean Movie, Indian Movie, JapanesepheeyonaNessuna valutazione finora

- MBA 504 Ch8 SolutionsDocumento11 pagineMBA 504 Ch8 SolutionspheeyonaNessuna valutazione finora

- N01799857@hawkmail Newpaltz EduDocumento4 pagineN01799857@hawkmail Newpaltz EdupheeyonaNessuna valutazione finora

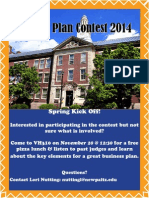

- Business Plan Kickoff ContestDocumento1 paginaBusiness Plan Kickoff ContestpheeyonaNessuna valutazione finora

- TNK BP RussiaDocumento16 pagineTNK BP RussiapheeyonaNessuna valutazione finora

- Global Business TODAY GBVDocumento8 pagineGlobal Business TODAY GBVpheeyona33% (6)

- Microeco HW Answers Ch. 3, 4Documento7 pagineMicroeco HW Answers Ch. 3, 4pheeyona100% (3)