Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Brac Bank

Caricato da

sourovkhanTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Brac Bank

Caricato da

sourovkhanCopyright:

Formati disponibili

Page 1 of 39

Internship Report

Credit Risk Management of BRAC Bank Limited

Prepared By:

Exam Roll: 080061

Page 2 of 39

Internship Report on

Credit Risk Management of BRAC Bank Limited

Prepared For:

Chairman

Internship Placement Committee

Prepared By:

Exam Roll Number: 080061

Class ID: 787

4

th

year, 8

th

semester

Batch No.: 17th, BBA Program

Academic Session: 2007-08

Institute of Business Administration (IBA-JU)

Jahangirnagar University, Savar, Dhaka.-1342

April 30, 2012.

Page 3 of 39

April 30, 2012

Chairman

Internship Placement Committee

BBA Program

Institute of Business Administration

Jahangirnagar University

Savar, Dhaka- 1342

Subject: Submission of Internship Report on Credit Risk Management of BRAC Bank

Limited.

Dear Sir

With due respect, I would like to submit my internship report on Credit Risk Management of BRAC

Bank Limited assigned by BRAC Bank Limited under your guidance to fulfill the requirement of the

internship program of BBA program. It has been a worthwhile experience for me undertaking such a

report work to get exposure to the real life of a banking organization. I am grateful for your guidelines

and directions. I tried to put my best effort for the preparation of this report.

Hereby, I hope that you would be kind and generous enough to accept my sincere effort and oblige

thereby. It will be my pleasure to answer any clarification regarding this report.

Sincerely yours

Exam Roll Number: 080061

Class ID: 787

4th Year, 8th Semester

Batch No: 17th, BBA Program

Academic Session: 2007-08

Page 4 of 39

ACKNOWLEDGEMENT

First and foremost, I would like to express my deep gratitude to the almighty Allah for helping me to

complete the report within the due time and without any major tribulations.

I would like to express heartiest gratitude to my academic supervisor Mr. Md. Alamgir Hossen for his

important suggestions, excellent guidelines and supervisions for preparing this internship report on

Credit Risk Management of BRAC Bank Limited. I would also like to express my heartiest

gratitude to Mr. Md. Golam Mawla, CSM, Moghbazar Branch, BRAC Bank Limited for his kind

concern and consideration regarding my academic requirements as my external supervisor.Also I

express special gratitude to all the other employees of Moghbazar branch of BRAC Bank Limited

who have shared their knowledge regarding banking with me.

Finally, I would like to convey my gratitude to my parents, teachers, friends and many others who

extend their support to prepare the report.

Page 5 of 39

Table of Contents

Topics

Headline

Topics Title Page

Executive Summary 9

Part One Introductory Part 10

Chapter 1.0 Introduction of Report 11

1.1 Introduction of the Report 11

1.2 Origin of the Report 11

1.3 Rational of the Report 11

1.4 Objective of the Report 11

1.5 Scope of the Report 12

1.5 Methodology 12

1.7 Limitations 12

1.8 Structure of the Report 12

Part Two Organization Part 13

Chap 2.0 Overview of BRAC Bank Limited 14

2.1. Company Profile 14

2.2. Human Resource 14

2.3. CRAB Rating 14

Page 6 of 39

2.4 Mobilization of Fund 14

Part Three Project Part 16

Chap 3.0 Credit Risk Management Practice of BRAC Bank Limited 17

3.1 Overview 18

3.2 Credit Policy of BRAC Bank Ltd. 18

3.3 Credit Risk Management 18

3.4 Wings of Credit Risk Management 19

Chap 4.0 Credit Approval of BRAC Bank Limited 20

4.1. Wholesale Credit and Medium Business 21

4.1.2 Types of Facilities offered to Corporate Clients 21

4.1.3 Approval Authorities 21

4.1.4 Analyzing Tools and Techniques 21

4.2. Retail Underwriting 22

4.2.1 Retail Credit 22

4.2.2 Cards Credit 22

4.2.3 Authorization and Fraud Control Unit 23

4.2.4 Central Verification Unit 23

4.3. SME Underwriting 23

Chap 5.0 Credit Collection of BRAC Bank Limited 24

Page 7 of 39

5.1. Credit Collection Unit 25

5.2. Collection Process 25

5.3. Classification of Loan on Basis of Days Past Due 25

5.4. Cards Collection Unit 25

Chapter 6.0 Bad Portfolio Recovery of BRAC Bank Limited 26

6.1. Special Asset Management-SME & Retail Banking 27

6.2. Special Asset Management & Credit Inspection -

Wholesale Banking & Medium Business

28

Chapter 7.0 Performance of Credit Risk Management 29

7.1 Performance on Basis of Amount of Unclassified &

NPL Loans

30

7.2 Loan Recovery Performance of BRAC Bank Limited

7.3 Summary of the Findings

42

43

Chapter 8.0 Recommendation and Conclusion 36

8.1 Recommendation 37

8.2 Conclusion 37

Appended Part 38

Bibliography 39

Page 8 of 39

List of Tables

Table No. Tables Title Page

5.1 Classification of Loan on Basis of Days Past Due 25

7.1 Standard Loan of BRAC Bank Limited 30

7.2 SMA Loan of BRAC Bank Limited 31

7.3 Sub standard Loan of BRAC Bank Limited 32

7.4 Doubtful Loan of BRAC Bank Limited 33

7.5 Bad/Loss Loan of BRAC Bank Limited 33

7.6 Loan Recovery Performance of BRAC Bank Limited 34

A.1 Initiatives Taken for Non Performing Loans 38

Figure No Figure Title Page

7.1 Standard Loan of BRAC Bank Limited 30

7.2 SMA Loan of BRAC Bank Limited 31

7.3 Sub standard Loan of BRAC Bank Limited 32

7.4 Doubtful Loan of BRAC Bank Limited 33

7.5 Bad/Loss Loan of BRAC Bank Limited 34

7.6 Loan Recovery Performance of BRAC Bank Limited 35

List of Figures

Page 9 of 39

EXECUTIVE SUMMARY

BRAC Bank Limited is a scheduled commercial bank in Bangladesh. This is one of the leading

private commercial banks which is established under the banking companies Act 1991, the bank

began its operation on 4

th

July,2001 with a primary objective of offering all types of commercial

banking services mostly emphasizing on promoting small and medium entrepreneurs all over the

country. At present BRAC Bank Limited has 151 branches, over 300 ATM Booths, 405 SME Unit

Offices, 1,800 remittance delivery points and 8,306 human resources.

This report is the fulfillment of the requirement for the evaluation process of the internship

program.The main purpose of the report is to have an overall idea about function and process of credit

risk management, analyzing tools and techniques used to evaluate credit proposal, analyzing steps

taken to recover Banks bad portfolio of BRAC Bank Limited.

Lending is one of the main functions of a bank. The objective of Credit Risk management of BRAC

Bank Limited is to minimize the risk and maximize banks risk adjusted rate of return by assuming

and maintaining credit exposure within the acceptable parameters. The Credit Risk Management

department is responsible for upholding the integrity of the Banks risk/return profile.

Credit Risk Management Department of BRAC Bank Limited conducted their functions by six wings.

Wholesale Credit, Retail Underwriting and SME underwriting- these three wings of Credit Risk

Management assess and approve the loan for the respective customers. Central Collection Unit

collects the credit. Special Asset Management wings help the bank to recover Banks bad portfolio.

For credit approval, the Bank has a team who approve the credit. Different tools and techniques are

being used to evaluate a credit proposal. Retail Credit, Cards Credit, Authorization and Fraud

Control, Central Verification Unit (CVU) are related with retail underwriting.

Credit Collection Unit of BRAC Bank Limited collects credit based on the level of delinquencies of

credit. Special Asset Management wings help the Bank to recover bad portfolio by taking different

types of steps.

To understand the performance of the present credit risk management process, the year by year ratio

of loans which are grouped on basis of classification rules in the total loan and advances has

analyzed. From the performance analysis, it is found that the collection of Standard Loan decline in

year 2009 because of the national and global economic situation which reflects a low ratio of

Standard Loan to total loans and advances which is 89.99%. As a result, the balance of SMA, Sub

standard, Doubtful and Bad/Loss loan increases in year 2009. Since 2009, national as well as global

economy started to fallen in a dangerous phase of slowing growth and rising risk. But with the right

initiatives taken by the top management of BRAC Bank Limited i.e. establishment of regional Credit

Risk Management Centers, introduction of new wing called Special Asset Management & Credit

Inspection, since the following year 2010 the situation has become normal which reflects the

economy Bangladesh where economy starts back to upward growth phase from the impact of global

recession. Beside this in year 2010, the Bank also achieves a better loan recovery performance which

reflects by an 8.73% ratio of loan Recovery to total write off loans and advances which continues in

year 2011.

Although BRAC Bank Limited is successfully operating credit risk management, the Bank should

improve in some areas which will take help the Bank to become the leader of banking sector.

Page 10 of 39

Part One

INTRODUCTORY PART

Page 11 of 39

1.0 Introduction of Report

1.1 Introduction:

Risk is the element of uncertainty or possibility of loss that prevail in any business transaction in any

place, in any mode and at any time. In the financial arena, enterprise risks can be broadly categorized

as Credit Risk, Operational Risk, Market Risk and Other Risk. Credit risk is the possibility that a

borrower or counter party will fail to meet agreed obligations. Globally, more than 50% of total risk

elements in Banks and Financial Institution (FI) s are credit risk alone. Thus managing credit risk for

efficient management of a FI has gradually become the most crucial task. Credit risk management

encompasses identification, measurement, matching mitigations, monitoring and control of the credit

risk exposures. As a leading bank of Bangladesh, BRAC Bank Limited has a fully functioning

department to perform the crucial task of Credit Risk Management (CRM).

1.2 Origin of the Report:

To complete BBA Program in Institute of Business Administration, Jahangirnagar University, a

student requires completing an Internship Program of three months attachment with an organization

followed by writing a report at the final and 8th semester of BBA program. This report is the

fulfillment of the requirement for the evaluation process of the internship program. This report titled

Credit Risk Management of BRAC Bank Limited is conducted on the basis of my practical

experience of three months long internship at Moghbazar Branch of BRAC Bank Limited. After

consultation with my faculty supervisor Mr. Md. Alamgir Hossen Lecturer, Institute of Business

Administration, Jahangirnagar University and under the direction of my organizational supervisor Mr.

Md. Golam Mawla, Customer Service Manager, Moghbazar Branch, BRAC Bank Limited, I have

prepared this internship report with the mentioned topic.

1.3 Rational of the Report:

Bangladesh is one of the developing countries in the world. The economy of the country has a lot left

to be desired and there are lots of scopes for massive improvement. In an economy like this, banking

sector can play a vital role to improve the overall socio-economic condition of the country. The banks

by playing the role of an intermediary can mobilize the excess fund of surplus sectors to provide

necessary finance to those sectors which are needed to promote for the sound development of the

economy. As the banks provide finance or lending to its counter parts, there arises a risk of credit risk,

which is the possibility that a borrower or counter party will fail to meet its obligations in accordance

with agreed terms. Even at present, this problem is haunting many banks and poses a major threat

towards their sound performing. So its very important to have an effective and sound credit risk

management system in place which will help the bank mitigate its risk factors and carry out

successful financing service or lending. With that issue in mind, the topic Credit Risk Management

of BRAC Bank Limited has been undertaken as topic for my internship report.

1.4 Objective of the Report:

The report is prepared on the Credit Risk Management of BRAC Bank Limited with the thought of

getting in depth of the credit risk management approval and collection for different kinds of credit

and collection procedures of default loan.

Broad Objective: The broad objective of report is to evaluate the total Credit Risk Management

(CRM) process of BRAC Bank Limited.

Page 12 of 39

Specific Objectives: To attain the broad objective the following specific objectives will be pursued:

Identification of different wings and their sub units of CRM

Identifying different types of credit facilities offered to different types of clients

Identifying the functions of different wings as well as the whole department of CRM

Analyzing tools and techniques to evaluate a credit proposal

Identifying the collection process of default loans

Identifying steps taken to recover the banks bad portfolio

Analyzing performance of CRM on the basis of amount of non performing loans

Analyzing performance of CRM on the basis of loan recovery performance

1.5 Scope:

Through this report emerging Banks and other Financial Institutes who want to develop an effective

Credit Risk Management Department as well as business students who want to learn about various

functions of Credit Risk Management will be benefited.

1.6 Methodology:

After starting my internship at BRAC Bank Limited, I had assigned by my faculty supervisor and

organizational supervisor to conduct my internship report titled Credit Risk Management of BRAC

Bank Limited. To complete this report, I have collected my necessary information from both Credit

Risk Management department and branch level to successfully understand the whole process. After

completing my three months internship at Moghbazar branch of BRAC Bank Limited, with the

guidance of my faculty supervisor Mr. Md. Alamgir Hossen, I have completed my report by using my

collected information. I have also tried to focus on the performance of credit risk management in my

report by conducting different tables and figures related to credit risk management. To make the

report more meaningful and presentable, both primary and secondary data sources were used to

prepare this report. The nature of this report is descriptive with some numerical analysis.

Primary Sources: The primary source of information is based on my practical experience of three

months long internship at Moghbazar Branch of BRAC Bank Limited.

Secondary Sources: The secondary source of information is based on official website of BRAC

Bank Ltd. , operation manual of Credit Risk Management and annual report of BBL as well as related

different other websites, books etc.

1.7 Limitations:

On the way of preparing this report, I have faced following problems that may be termed as the

limitation of the study:

Banks policy of not disclosing some sensitive data and information for obvious reason posed

an obstacle to prepare more informative report.

Personal limitations like inability to understand some official terms, office decorum etc.

created a few problems.

1.8 Structure of the Report:

The report is divided into three main parts:

Part 1: Introductory Part includes origin, rational, objectives, methodology, scope, limitations of the

report.

Part 2: Organizational Part contains company profile, human resource; CRAB rating, mobilization

of fund of BRAC Bank Limited.

Part 3: Project Part contains credit risk management practice, credit approval, credit collection, bad

portfolio recovery, performance of Credit Risk Management of BRAC Bank Limited,

recommendations and lastly conclusion.

Page 13 of 39

Part Two

ORGANIZATION PART

Page 14 of 39

2.0 Overview of BRAC Bank Limited:

2.1 Company Profile of BRAC Bank Limited:

BRAC Bank Limited, one of the third generation of commercial banks started its journey on July 04,

2001. It is an affiliate of BRAC (Bangladesh Rural Advancement Committee), one of the worlds

largest non-governmental development organizations founded by Sir Fazle Hasan Abed in 1972. The

Bank operates under a "double bottom line" agenda where profit and social responsibility go hand in

hand as it strives towards a poverty-free, enlightened Bangladesh. BRAC Bank focuses on pursuing

unexplored market niches in the Small and Medium Enterprise Business, which has remained largely

untapped within the country. The management of the Bank believes that this sector of the economy

can contribute the most to the rapid generation of employment in Bangladesh. Since inception in July

2001, the Bank's footprint has grown to 151 branches, over 300 ATM Booths, 405 SME Unit Offices,

1,800 remittance delivery points and 8,306 human resources. In addition to small business lending,

BRAC Bank has fast growing remittance, savings mobilization and consumer lending businesses

BRAC Bank intends to set standards as the market leader in Bangladesh. The Bank wants to

demonstrate that a locally owned institution can provide efficient, friendly and Modern full- service

banking on a profitable basis. The Bank produces earnings and pay out dividends that can support the

activities of BRAC, the Banks major shareholder. Development and poverty alleviation on a

countrywide basis needs mass production, mass consumption and mass financing. The goal of BRAC

Bank is to provide mass financing to enable mass production and mass consumption, and thereby

contribute to the development of Bangladesh.

2.2 Human Resource:

At present, there are total 8,306 employees at BRAC Bank Limited. BRAC Bank Limited has a

vertical organizational structure with total 15 designations at the management hierarchy. The

management of BRAC Bank Limited is consisted of Board of Directors, Executives and Officers &

Staves. The Top management makes all the major decisions at BRAC Bank Limited. The Board of

directors being at the highest level plays an important role on the policy formulation. The Executives

and Officers are directly concerned with the day-to-day operation of bank.

2.3 CRAB Rating:

Credit Rating Agency of Bangladesh (CRAB) Limited has retained AA3 rating in Long Term and

ST-2 rating in the Short Term of BRAC Bank Limited in view of the performance of the Bank for

year 2010. The AA3 rating refers that BRAC Bank Ltd. has very strong capacity to meet banks

financial commitments. The Bank differs from the highest-rated Commercial Banks only to a small

degree. AA3 is judged to be of very high quality and is subject to very low credit risk.The ST2

rating in the short term refers that the Bank has strong capacity for timely repayment. This rating also

refers that the Bank is characterized with commendable position in terms of liquidity, internal fund

generation, and access to alternative sources of funds.

2.4 Mobilization of Fund:

The main sources of fund for BRAC Bank Limited are:

i. Deposit

ii. Borrowing

i. Deposit: Deposit is the mainstay of the Bank's sources of funds. Following usual practices,

the Bank collects deposit through:

Current Deposit

Page 15 of 39

Savings Deposit

Term Deposit

ii. Borrowing: Apart from deposit, BRAC Bank Limited receives funds from other Banks,

Financial Institutions and Agents as borrowing which are in Bangladesh and also outside of

Bangladesh. In 2011, BRAC Bank Limited only receives funds as demand term borrowing

from

Bangladesh Bank

Uttara Bank Limited

Beside this, in previous years the Bank borrowed from other Banks, Financial Institutions and

Agents as demand term borrowing, short term deposit borrowing and fixed deposit borrowing

in Bangladesh. The Bank also received funds as demand term borrowing (non-interest

bearing) from different outside bank i.e. Standard Chartered Bank USA, The Bank of Nova

Scotia- Canada, Citibank NA-USA,ICICI-India, Standard Chartered Bank-UK, Hypo Vereins

Bank Germany, HSBC-USA,HSBC-UK, HSBC-AUS, HSBC-Pakistan etc.

Page 16 of 39

Part Three

PROJECT PART

Page 17 of 39

Chapter Three

Credit Risk Management Practice of BRAC Bank

Limited

Page 18 of 39

3.0 Credit Risk Management Practice of BRAC Bank Limited

3.1 Overview:

Credit is the ability to command goods or services of another in return for promise to pay such goods

or services at some specified time in the future .For a bank, it is the main source of profit and on the

other hand, the wrong use of credit would bring disaster not only for the bank but also for the

economy as a whole. Credit risk is most simply defined as the potential that a bank borrower or

counterparty will fail to meet its obligations in accordance with agreed terms and conditions.

The objective of Credit Risk management of BRAC Bank Limited is to minimize the risk and

maximize banks risk adjusted rate of return by assuming and maintaining credit exposure within the

acceptable parameters. The Credit Risk Management department is responsible for upholding the

integrity of the Banks risk/return profile. It ensures that risks are properly assessed, and that

risk/return decisions are made accurately and transparently. The overall success in credit management

depends on the banks credit policy, portfolio of credit, monitoring, supervision and follow-up of the

loan and advance. Therefore, while analyzing the credit risk management of BRAC Bank Limited, it

is required to analyze its credit policy, credit procedure and performance regarding credit risk

management.

3.2 Credit Policy of BRAC Bank Limited:

In order to minimize credit risk, BRAC Bank Limited has formulated a comprehensive credit policy

according to Bangladesh Bank Core Risk Management guidelines. Credit policy of the Bank provided

for the separation of the credit approval function from business, marketing and loan administration

function. Credit policy of BBL recommended through credit assessment and risk grading of all clients

at the time of approval and portfolio review. Credit policy also provides the guidelines of required

information for credit assessment, marketing strategy, approval process, loan monitoring, early alert

process, credit recovery, NPL account monitoring, NPL provisioning and write off policy, etc. The

board of directors reviews the credit policy of the bank annually.

3.2 Credit Risk Management:

Considering the key elements of Credit Risk the bank has segregated duties of the officers/ executives

involved in credit related activities. Separate division for Corporate, SME, Retail and Credit Cards

have been formed which are entrusted with the duties of maintaining effective relationship with the

customers, marketing of credit products, exploring new business opportunities etc. For transparency

in the operations during the entire credit year four teams have been set up. Those are:

i. Credit Approval Team

ii. Asset Operations Department

iii. Recovery Unit

iv. Impaired Asset Management

In credit management process, Sales Teams of the Corporate, Retail, SME, AND Credit Cards

business units book the customers; the Credit Division does thorough assessment before approving

the credit facility. Asset Operations Department ensures compliance of all legal formalities,

completion of all documentation, and security of the proposed credit facility and finally disburses the

amount. The Sales Team reports to the Managing Director & CEO through their line, the Credit

Division reports to the Managing Director & CEO, while the Asset Operations Department reports to

the Deputy Managing Director & COO. This arrangement has not only ensured segregation of duties

Page 19 of 39

and accountability but also helps in minimizing the risk of compromise with quality of the credit

portfolio.

3.3 Wings of Credit Risk Management Department:

Credit Risk Management Department of BRAC Bank Limited conducted their functions by six wings.

Those are:

I. Wholesale Credit

II. Retail Underwriting

III. SME Underwriting

IV. Central Collection Unit

V. Special Asset Management, SME and Retail Banking

VI. Special Asset Management & Credit Inspection, Wholesale Banking & Medium

Business

Wholesale Credit, Retail Underwriting and SME underwriting- these three wings of Credit Risk

Management assess and approve the loan for the respective customers. Central Collection Unit

collects the credit. Special Asset Management wings help the bank to recover Banks bad portfolio.

Page 20 of 39

Chapter Four

Credit Approval of

BRAC Bank Limited

Page 21 of 39

4.0 Credit Approval of BRAC Bank Limited

4.1.1 Wholesale Credit & Medium Business:

Wholesale or corporate Credit means a contractual agreement in which a corporate client receives

something of value now and agrees to repay the lender the principle with interest at some later date.

Wholesale credit (WC) team mainly looks after two kinds of portfolio.

i. Corporate Business: WC team assesses and approves proposals from large established

corporate and emerging business

ii. Medium Business: WC team financing businesses which have crossed their early years

but has not yet become a large corporate entity

4.1.2 Types of Facilities Offered to Corporate Client:

BRAC Bank offers two types of credit facilities to corporate clients. Those are: (i) Funded and (ii)

Non-funded.

i. Funded facility: Funded facility means financing through cash. Overdraft, import and

export loans, long term loans are example of funded facility.

ii. Non-funded facility: Non- funded facility means non-involvement of fund/cash. Banks

extend this type of facility against some documents to third party on behalf of corporate

clients. Import and Export Loans i.e. Letter of Credit. and Guarantees and Bond i.e.

Performance Guarantee, Advance Payment Guarantee, Bid Bonds are examples of Non-

funded facility.

Beside these two types of facilities, BRAC Bank also offers Syndication Loan.

4.1.3 Approval Authorities of the Corporate Loans:

The approval authority of corporate loan may change time-to-time based on business volume and

person behind the desk but it mainly consists of

I. Head of Credit, Wholesale Banking & Medium Business

II. Chief Credit Officer

III. Managing Director & CEO

IV. Board

Due to large ticket size of loan facility, most of the proposals received by Wholesale Credit team are

approved by the Board of Directors.

4.1.4 Analyzing Tools and Techniques to Evaluate a Corporate Proposal:

To evaluate a corporate proposal, Wholesale Credit team apply the General 5Cs which are-

I. Character

II. Capacity

III. Capital

IV. Conditions

V. Collateral

Page 22 of 39

4.2. Retail Underwriting:

Retail Underwriting is a unit of Credit Risk Management which deals with Retail Loans of the Bank.

Total retail underwriting is done from this wing. There is a prescribed Product Program Guide (PPG)

for each product & on the basis of that PPG, retail loans are approved.

Retail Underwriting is comprised with the following sub units:

i. Retail Credit

ii. Cards Credit

iii. Authorization & Fraud Control

iv. Central Verification Unit (CVU)

4.2.1 Retail Credit:

Currently Bank is offering Retail Loans under Retail Credit in following three categories:

I. Unsecured personal Loan: Unsecured personal loan is clean loan product where no cash

security is taken against the loan. Currently BRAC Bank is offering two Types of Unsecured

Personal Loans which are Quick Loan and Salary Loan.

II. Secured Loan: There are two secured retail loans offered by BRAC Bank which are Auto

Loan and House Building Loan.

III. Cash Covered loan: The general terms Cash Secured Facilities is used to indicate two

specific Retail Lending products. These are: Secured Overdraft (SOD) & Secured Loan (SL)

which are the major products of Retail Lending Portfolio of the bank.

All retail loans are EMI (Equal Monthly Installment) based loans other than Secured Overdraft

facility.

4.2.2 Cards Credit:

The main objective of Cards Credit sub wing is to assess the applications and come to a decision

whether to approve for issuing of credit card or not. If everything provided document is ok of a

particular application; credit then fix a credit limit according to PPG of Credit Cards. Another

important job is done by Cards Credit is duplicate checking. This is done to stop issuing more than

one card for a particular applicant. To have the control existing credit card database is checked by

several criteria i.e. Name, DOB, Mothers Name, Contact no. etc.

4.2.3 Authorization & Fraud Control Unit:

Authorization & Fraud Control Unit, Cards is functioning into three areas:

i. Authorization: Authorization is a process of approval or refusal of a payment card

transaction, limit issued in BDT, USD or in dual currency according to customized

amount desired by customer on different time and location. The major activity of the unit

is processing credit card cheque request from BBL branches and ROCs and providing

manual Authorization against specific code.

ii. Transaction Monitoring: Transaction Monitoring and detection team usually make calls

to all BBL credit card customer (Issuing and acquiring) to verify (POS and non POS)

transactions that fall under certain rules. As soon as a suspicious transaction is noticed

through live monitoring or internal reports, designated officer from detection team

contact the customer for authenticity of the transaction. If the customer disputed the

Page 23 of 39

transaction/s, the card is blocked immediately by placing specific block code. The

customer is also requested to send disputed letter to Customer Service regarding the

transaction/s.

iii. Detection and Investigation: Detection and Investigation Unit performs to check credit

card/loan applications after approval to prevent fraud attempts on sample basis. At the

same time, objective of Investigation team is to investigate fraud cases relating on

situation basis to identify the actual facts and build control measures to prevent the

similar fraud attempts in future.

4.2.4 Central Verification Unit (CVU):

As BRAC bank has a huge customer base it felt the importance of verifying clients before disbursing

any loan. The main purpose of this wing is to ensure contact point verification.CVU is committed is

delivering a contact point verification (CPV) services and other pertinent task in relevance to loan,

credit card application from prospective customers for services in consumer credit division of the

Bank.

4.3.1 SME Underwriting:

SME Credit team is a unit under Credit Risk Management Division of BRAC Bank Limited which

manages the credit risk of Banks SME credit portfolio.

Credit Analysts of SME Credit team assess the proposal with due emphasis on Clients requirement

and capacity. During assessment the analysts fulfill a Risk Evaluation Sheet (which covers most PPG

criteria) to ensure compliance with Policy and PPG. Identifying key risks involved in the proposal is

one of the most critical and tricky tasks for the credit analysts; it requires experience of handling such

clients directly to understand the business modalities and more importantly behavioral issues viz.

reputation, character etc.

Unlike Corporate, Retail and Cards (where all loan proposals require approval from Head office)

SME credit deals with approval of loan proposals of certain area at present.

4.3.2 SME Credit Risk Management Process:

The whole process of Credit Risk Management of SME is as follows

Step 1: CROs located in the unit offices across the country prepares a loan proposal

Step 2: Respective Supervisor (ZM / ARM) Recommends the loan proposal and sent to SME Credit

Step 3: Credit Analysts analyzes the loan proposal and place it before approver

Step 4: Credit Approver Approves / Declines the loan proposal based on the recommendation

Step 5: File sent to disbursement unit for disbursement

Page 24 of 39

Chapter Five

Credit Collection of

BRAC Bank Limited

Page 25 of 39

5.0 Credit Collection of BRAC Bank Limited:

5.1 Credit Collection Unit:

The collection process for SME and Retail starts when the customer failed to make one or more

contractual payment (installment). It therefore becomes the duty of the collection unit to minimize

the outstanding delinquent receivable and credit losses. Collection plays a key part in the credit

process and in ensuring the profitability of asset products and quality of the portfolio by collecting

the delinquent receivables efficiently and effective. The main objective of collection is to ensure

that, wherever possible, an account that is in arrears is brought up to date and the customers

goodwill is retained.

5.2 Collection Processes:

Customers are provided with an Offer Letter or Banking Arrangement letter during Loan

disbursement where the total payment mood and loan details are described. When a customer fails

to fulfill the agreed terms or misses the required payment, the account then enters collections.

Collection department is responsible for collecting the overdue amount from the delinquent

customers. There are different stages involved in collection after an account enters delinquency

till regularization of the account by recovering the overdue. Basically collection can be broadly

divided into four stages which are servicing, locating, collecting and cancellation & write-off. The

aging of an account in collections is with reference to the days since missed payment.

5.3 Classification of Loan on Basis of Days Past Due:

The level of delinquencies of loan is determined based on the number days past of monthly

installment from 1st payment date by the customer, following are basis of bucket calculation as

guided in the Days Past Due (DPD):

Table 5.1: Classification of Loan on Basis of Days Past Due

Particulars DPD Reporting as

Regular Customer 0 DPD Regular

The sum past due is equivalent to one

months payment

X DPD(0-29) Delinquent

The sum past due is equivalent to two

months payment

30 DPD(30-59) Delinquent

The sum past due is equivalent to three

months payment

60 DPD(60-89) Delinquent

The sum past due is equivalent to four

months payment. Interest to be suspended

at this point.

90 DPD(90-119) Delinquent

The sum past due is equivalent to five

months payment

120 DPD (120-149) Delinquent

The sum past due is equivalent to six

months payment. 50% charge off at this

point.

150 DPD (150-179) Delinquent

5.4 Cards Collection Unit:

The collection process of credit cards starts when the cardholder failed to meet one or more

contractual payment (i.e. minimum 5 % of the outstanding payment) or exceeds the allocated

credit limit or both. It therefore becomes the duty of the Collection Unit to minimize the

outstanding delinquent receivable and credit losses.

Page 26 of 39

Chapter Six

Bad Portfolio Recovery of

BRAC Bank Limited

Page 27 of 39

6.0 Bad Portfolio Recovery of BRAC Bank Limited:

6.1 Special Asset Management- SME and Retail Banking:

Special Assets Management (SAM)-SME & Retail Banking is a special department under CRM.

Its vital role is to recover the Banks bad portfolio. SAM deals with Banks non-performing loans

through legal persuasion/procedure and facilitates external and internal recovery forces to

maintain Banks portfolio at risk (PAR) at a steady position.

Based on priority, SAM is designed mainly as SME unit and Retail unit and also two separate

units for Legal support & MIS and a Monitoring unit which acts as internal audit of the both

portfolio. SAM department deals with the legal actions regarding mitigation of bad portfolio

under SME & Retail Banking Division.

6.1.1 File Transfer:

Files transfer to SAM from SME when the loan reaches at DPD 180. SAM receives the file from

Retail when the loan reaches at DPD 360.

6.1.2 Legal Notice:

Legal notice issued to SME at DPD 145 and for Retail at DPD 360, SAM-S&R would arrange to

serve 1st legal notice for warning the default borrower to adjust the total outstanding and 2nd

legal notice would be served after bouncing the cheque or before litigation. 1

st

legal notice served

centrally across the country and 3

rd

party recovery agencies are working with retail defaulters. 15

(fifteen) days in 1

st

legal notice and 30 (thirty) days in 2

nd

legal notice under NI Act given to the

defaulter to adjust the total outstanding.SAM will offer Auction to recover the overdue loan

against mortgaged properties before filing the case.

6.1.3 Write- off Management:

BRAC Bank has a specific Write-off policy developed based on Bangladesh Bank circulars. SAM

takes initiative to write-off bad portfolios as per policy if following criteria satisfied,

a) Classification status will be Bad/Loss (BL)

b) 100% provided

c) Litigated (under any kind of Law of the land)

6.1.4 Waiver process:

SAM with its country wide recovery structure takes initiative to settle bad loans amicably by

giving delinquent customer waiver facility. The waiver amount will be fixed on judgmental basis

i.e. affected by natural calamities, demise, business closed etc. however, in any cases; waiver of

principal portion is not awarded.

6.1.5 Case Withdraw:

SAM withdraw the case when a litigated defaulter adjusts outstanding amount in full with updated

interest, legal costs and other expenses if any, and/or upon amicable settlement SAM withdraws

the case against such defaulters on receipt of clearance certificate from Operations.

6.1.6 External 3rd party agency Management:

SAM hands over the files to 3rd party recovery agency after one month of issuance of 1st legal

notice. Only the retail loan files, which are delinquent (if minimum 30% of outstanding is not

recovered within 30 days after 1st legal notice) are handed over to outsource. SAM takeover the

files from 3

rd

party recovery agency after 90 days.

6.2 Special Asset Management & Credit Inspection - Wholesale Banking & Medium

Business: Special Asset Management & Credit Inspection - Wholesale Banking & Medium

Page 28 of 39

Business department is split up from the Corporate CRM to maintain and ensure appropriate

recovery strategies are implemented as per policy guideline.

The department functions under three major areas which are as follows:

i. Credit Inspection through File and Field level area

ii. Early Alert Account

iii. Legal Procedure

6.2.1 Credit Inspection:

Credit Inspection through file and field level area deals with all matters relating to credit

inspection, ensuring compliance of BBL policy towards credit granting process, corporate

portfolio review and physical inspection of client's premise and files, including security

documents, for providing management information reports on a regular and ad hoc basis.

6.2.2 Early Alert Account (EAA):

Early Alert Process is an effective tool & technique that help BBL in detecting any deterioration

in corporate and medium enterprise clients account and trigger Banks problem accounts at an

early stage so that proper attention can be given to avoid any losses. An Early Alert Report (EAR)

is developed by respective RM and sent to CRM within 07 days for identification of weakness

and other discrepancy. On the basis of market information/ industry position or other subjective

issues which has some strong ground, CRM may recommend transferring the status of a regular

account to EAA status.

6.2.3 Legal Procedure:

SAM & CI deals with managing impaired assets, Non-Performing Loan and the associated legal

aspects.

6.2.3.1 Account Transfer Procedure:

When an account is being downgraded to SS and below, a Request for Action (RFA) along with a

checklist should be completed by RM with the help of CRM division and forwarded to Head of

Special Asset Management & Credit Inspection (HOSAM&CI) for acknowledgement.

6.2.3.2 Non Performing Loans Account Monitoring:

Nonperforming loans (NPLs) refer to those financial assets from which banks no longer receive

interest and/or installment payments as scheduled. As the account is handed over to SAM & CI,

WB & MB, the account is assigned to an account manager within SAM, who will review all

documentation, meet the customer with RM and prepare a Classified Loan Review (CLR) report.

The CLR must be approved by the Chief Credit Officer and copied to the Head of Corporate

Banking. The initial CLR should highlight any documentation issues, loan structuring weakness,

proposed workout strategy and seek approval for any loan loss provisions that are

necessary(Please see Appendix for details of initiatives taken for NPLs).

Page 29 of 39

Chapter Seven

Performance of Credit Risk Management

of BRAC Bank Limited

Page 30 of 39

7.0 Performance of Credit Risk Management:

7.1 Performance of Credit Risk Management on the Basis of Amount of Unclassified Loans

and Non Performing Loans:

Non Performing Loans can be classified into different varieties usually based on the length of

overdue of the said loans. NPLs are viewed as a typical byproduct of financial crisis: they are not

a main product of the lending function but rather an accidental occurrence of the lending process,

one that has enormous potential to deepen the severity and duration of financial crisis and to

complicate macroeconomic management. This is because NPLs can bring down investors

confidence in the banking system, piling up unproductive economic resources even though

depreciations are taken care of, and impeding the resource allocation process. For this reasons, a

banks Credit Risk Management performance can easily measured by analyzing present balance

of NPL or in other words by analyzing the year by year ratio of loans which are grouped on basis

of classification rules in the total Loan and Advances.

7.1.1 Standard Loan:

Standard loan is an unclassified loan. These types of loan accounts are performing satisfactorily in

the terms of its installments and no overdue is occurred.

Table 7.1: Standard Loan of BRAC Bank Limited from Year 2007 to Year 2011

Year Total Loans and

Advances(in BDT)

Amount of Standard

Loan (in BDT)

Ratio of Standard Loan to

Total Loans and Advances

2007 32,461,102,180 30,001,002,686 92.42%

2008 52,676,716,740 49,102,865,704 93.22%

2009 64,150,835,159 57,728,435,549 89.99%

2010 84,302,789,317 77,162,088,870 91.53%

2011 90,822,174,665 83,649,643,140 92.10%

Figure 7.1: Standard Loan of BRAC Bank Limited from Year 2007 to Year 2011

From the above figure of ratio of Standard Loan to Total Loans and Advances of BRAC Bank

Ltd., we can see that in year 2009 the ratio declined .Otherwise in other four years the ratio

increases than the previous year.

88.00%

89.00%

90.00%

91.00%

92.00%

93.00%

94.00%

2007 2008 2009 2010 2011

Ratio of Standard Loan to Total Loans

and Advances (2007-2011)

Page 31 of 39

7.1.2 Special Mention Account-SMA:

Special Mention Account-SMA is an unclassified type of loan. This classification contains where

irregularities have been occurred but such irregularities are temporarily in nature. The overdue

period of this type of loan is 90-179 days.

Table 7.2: Special Mention Account-SMA of BRAC Bank Limited from Year 2007 to Year

2011

Year Total Loans and

Advances(in BDT)

Amount of Special

Mention Account-

SMA (in BDT)

Ratio of SMA to Total Loans

and Advances

2007 32,461,102,180 1,015,321,964 3.13%

2008 52,676,716,740 1,100,839,246 2.09%

2009 64,150,835,159 2,544,742,867 3.97%

2010 84,302,789,317 2,211,142,271 2.62%

2011 90,822,174,665 2,217,648,340 2.44%

Figure 7.2: Special Mention Account-SMA Loan of BRAC Bank Limited from Year 2007 to

Year 2011

From the above figure, it can easily be understand that in year 2009 the SMA slightly increases

than the previous year. Otherwise in other four years the ratio decreases than the previous year.

3.13%

2.09%

3.97%

2.62%

2.44%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

2007 2008 2009 2010 2011

Ratio of SMA to Total Loans and Advances

(2007-2011)

Page 32 of 39

7.1.3 Sub Standard Loan:

Sub Standard SS is a classified loan. The overdue period of this type of loan is 180-269 days.

Table 7.3: Sub Standard Loan of BRAC Bank Limited from Year 2007 to Year 2011

Year Total Loans and

Advances(in BDT)

Amount of Sub

standard Loan (in

BDT)

Ratio of Sub standard Loan to

Total Loans and Advances

2007 32,461,102,180 646,601,996 1.99%

2008 52,676,716,740 1,004,430,866 1.91%

2009 64,150,835,159 1,504,126,278 2.35%

2010 84,302,789,317 1,142,795,194 1.36%

2011 90,822,174,665 1,487,012,988 1.44%

Figure 7.3: Sub Standard Loan of BRAC Bank Limited from Year 2007 to Year 2011

From the above figure, we can say that in year 2009 the ratio of Sub standard loan to total loan

and advances were the highest.

7.1.4 Doubtful Loan:

This classification contains where doubt exists on the full recovery of the loan and advance along

with a loss is anticipated but can not be quantifiable at this stage. The overdue period of this type

of loan is 270-359 days. This type of loan is an example of classified loan.

2007 2008 2009 2010 2011

Series1 1.99% 1.91% 2.35% 1.36% 1.44%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

Ratio of Sub standard Loan to Total

Loans and Advances (2007-2011)

Page 33 of 39

Table 7.4: Doubtful Loan of BRAC Bank Limited from Year 2007 to Year 2011

Year Total Loans and

Advances(in BDT)

Amount of Doubtful

Loan (in BDT)

Percentage of Doubtful Loan

in Total Loans and Advances

2007 32,461,102,180 317,048,692 0.98%

2008 52,676,716,740 684,605,428 1.3%

2009 64,150,835,159 990,855,828 1.54%

2010 84,302,789,317 1,430,876,989 1.7%

2011 90,822,174,665 1,289,101,344 1.42%

Figure 7.4: Doubtful Loan of BRAC Bank Limited from Year 2007 to Year 2011

Although the ratio of doubtful loan to total loan and advances continuously increases since 2010,

the ratio decreases in 2011.

7.1.5 Bad/Loss Loan:

Bad/Loss Loan is a particular loan and advance fall in this class when it seems that this loan and

advance is not collectable or worthless even after all the security has been exhausted. This type of

loan is not recovered within more than360 days. This type of loan is another example of classified

loan

Table 7.5: Bad/Loss Loan of BRAC Bank Limited from Year 2007 to Year 2011

Year Total Loans and

Advances(in BDT)

Amount of Bad/Loss

Loan (in BDT)

Percentage of Bad/Loss Loan

in Total Loans and Advances

2007 32,461,102,180 481,126,842 1.48%

2008 52,676,716,740 783,975,496 1.49%

2009 64,150,835,159 1,382,674,637 2.16%

2010 84,302,789,317 2,355,885,993 2.80%

2011 90,822,174,665 2,361,372,301 2.6%

0.98%

1.30%

1.54%

1.70%

1.42%

0.00%

0.50%

1.00%

1.50%

2.00%

2007 2008 2009 2010 2011

Ratio of Doubtful Loan toTotal

Loans and Advances (2007-2011)

Page 34 of 39

Figure 7.5: Bad/Loss Loan of BRAC Bank Limited from Year 2007 to Year 2011

Although the ratio of doubtful loan to total loan and advances continuously increases since 2010,

the ratio decreases in 2011.

7.2 Loan Recovery Performance of BRAC Bank Limited:

The recovery performance of the bank was not so good during the period 2007-2009. In the year

2010, The Bank recovered that most percentage of recovery write off to total write off loans and

advances which is 8.73%.But the rate declines in 2011. Loan recovery is a time consuming and

there are lots of works to do for the recovery of loans.

Table 7.6: Loan Recovery Performance of BRAC Bank Limited from Year 2007 to Year

2011

Year Write off Loans and

Advances (in BDT)

Recovery of Write off

Loans (in BDT)

Ratio of Loan Recovery to

Total Write off Loans and

Advances

2007 103,825,117 5,104,282 4.92%

2008 160,400,517 6,573,347 4.10%

2009 1,156,448,923 55,497,494 4.80%

2010 2,123,858,831 185,483,529 8.73%

2011 2,932,247,750 224,876,871 7.67%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

2007 2008 2009 2010 2011

Ratio of Bad/Loss Loan to Total Loans

and Advances (2007-2011)

Page 35 of 39

Figure 7.6: Loan Recovery Performance of BRAC Bank Limited from Year 2007 to Year

2011

7.3 Summary of the Findings:

From the performance analysis, it is found that the collection of Standard Loan decline in year

2009 because of the national and global economic situation which reflects a low ratio of Standard

Loan to total loans and advances which is 89.99%. As a result, the balance of SMA, Sub standard,

Doubtful and Bad/Loss loan increases in year 2009. Since 2009, national as well as global

economy started to fallen in a dangerous phase of slowing growth and rising risk. But with the

right initiatives taken by the top management of BRAC Bank Limited i.e. establishment of

regional Credit Risk Management Centers, introduction of new wing called Special Asset

Management & Credit Inspection, since the following year 2010 the situation has become normal

which reflects the economy Bangladesh where economy starts back to upward growth phase from

the impact of global recession. Beside this in year 2010, the Bank also achieves a better loan

recovery performance which reflects by an 8.73% ratio of loan Recovery to total write off loans

and advances which continues in year 2011. BRAC Bank Limited is also rated AA3 in Long

Term and this rating is judged to be of very high quality and is subject to very low credit risk.

4.92%

4.10%

4.80%

8.73%

7.67%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

8.00%

9.00%

10.00%

2007 2008 2009 2010 2011

Ratio of Loan Recovery to Total Write

off Loans and Advances(2007-2011)

Page 36 of 39

Chapter Eight

Recommendation

And

Conclusion

Page 37 of 39

8.0 Recommendation and Conclusion

8.1 Recommendation:

To improve credit risk management further, BRAC Bank Limited should improve in some areas.

Those are:

The Bank should apply 7C instead of 5C as evaluation tools and technique of a credit

proposal. Additional 2C which are Coverage and Cash flow to better understand the credit

worthiness of borrower.

In the Classified loan amount the Bank should identify which sector has the largest

position of loan classification. By analyzing past data this kind of risky sector can be

identified. After identifying it, strict monitoring can be done for avoiding classified loans.

Various facilities should be provided to regular borrowers which will encourage a

borrower to be a good borrower. Names of defaulters as well as the good and regular

payers may be published in various publications which would help the bank to decrease

the number of defaulter as well as the volume of large outstanding loan amount.

Like SME sector, in wholesale and retail sector credit approval authority should be

delegated to individual executives rather than Board to ensure accountability. This system

will not only ensure accountability of individual executive but also expedite the approval

process.

8.2 Conclusion:

Credit Risk Management is very important for any bank. As a third generation bank, BRAC Bank

Limited has a great credit risk management practice which is one of the best in Bangladesh. To

prepare this internship report, I have tried to incorporate the necessary and relevant information in

my report from my own personal experience as well as other sources. The study was conducted

by using the data of BRAC Bank Limited from the year 2007 to 2011.Like previous years, BRAC

Bank Limited should continue to take regular initiatives to achieve better quality portfolio and

move the Bank forward.

Page 38 of 39

Appended Part

Table A.1: Initiatives Taken for Non Performing Loans

Step Overdu

e

Period

Action Plan Initiative taken

Department /

Division

0 days For each corporate customers, letter to be generated to

inform about expiry of the existing limit, at least two

months ahead of the expiry date and due date for

installment

Corporate

Banking

Division

1 1 to 30

days

Pursue over telephone for adjustment/payment of overdue

installment / interest and make a diary note.

Issue letter-informing about account fallen overdue and

request for regularization

Corporate

Banking

Division

2 31 to 45

days

Persuasion over telephone to be continued

Issue 1

st

reminder

Corporate

Banking

Division

3 46 to 59

days

Issue 2

nd

reminder for adjustment

Visit customer and submit a visit report

Check security documents

Corporate

Banking

Division

Wholesale

Banking

Operation

4 60 to 89

days

Issue 3

rd

reminder for adjustment

Report as EAA by Corporate/CRM

Call report

Corporate

Banking

Division

Corporate CRM

SAM & CI, WB

& MB

5 90 to

179

days

Treat as Special Mention Account (SMA)

Charge interest into Suspense

Issue notice to the borrower at least one month ahead of

classification stating that the account is going to be

classified

Corporate

Banking

Division

Page 39 of 39

Final reminder demanding payments and informing of the

consequences i.e. warning of legal action in case of

default.

6 180 to

269

days

Borrower to be transferred to SAM & CI through

prescribed format with proper justification

Letter to Guarantor referring to above efforts seeking their

cooperation/asking for adjustments

Corporate

Banking

Division

SAM & CI, WB

& MB

7 270 to

329

days

Review all documents (internally/Externally)

Meet the customer

Classified Loan Review Report

SAM & CI, WB

& MB

8 330 to

420

days

Meet the customer

Site visit

Strategy preparation for reschedule/exist/case filling under

NI Act and Artha RIN

Circulate the defaulter names to different Banks/NBFI

SAM & CI, WB

& MB

BIBLIOGRAPHY

1. R.S. Raghavan. (2003). Risk Management in Banks. Chartered Accountant, 841-851.

2. Molla, N. (2011). Rating Report (Surveillance): BRAC Bank Limited. CRAB Rating, 45.

3. Focus Group on Credit Risk Management of Bangladesh Bank. (2005). Credit Risk

Management: Industry Best Practices. Dhaka: Bangladesh Bank Publishing Service.

4. E. R. Fiedler. (1971).The Meaning and Importance of Credit Risk. Measures of Credit Risk

and Experience, 10-18.

5. Company Profile of BRAC Bank Limited. (2011). Retrieved April 17, 2012 from

http://www.bracbank.com/company_profile.php

6. Annual report 2010 of BRAC Bank Limited. (2011). Credit Risk Management, 91-94.

7. Annual report 2007-2011of BRAC Bank Limited. Notes to the Financial Statement.

Potrebbero piacerti anche

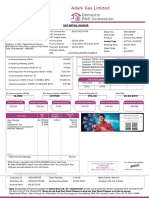

- Your Adani Gas Consumption BilDocumento2 pagineYour Adani Gas Consumption BilHarDik PatelNessuna valutazione finora

- Regional Rural Banks of India: Evolution, Performance and ManagementDa EverandRegional Rural Banks of India: Evolution, Performance and ManagementNessuna valutazione finora

- SynopsisDocumento17 pagineSynopsisHarini Bhandaru100% (1)

- 01.19 Safe CustodyDocumento9 pagine01.19 Safe Custodymevrick_guyNessuna valutazione finora

- Audit Procedure For LIABILITIESDocumento2 pagineAudit Procedure For LIABILITIESDana67% (3)

- Case 3 Lehman BrothersDocumento19 pagineCase 3 Lehman BrothersYusuf UtomoNessuna valutazione finora

- HardikDocumento28 pagineHardikKeyur PatelNessuna valutazione finora

- Bank of Boroda RajibDocumento131 pagineBank of Boroda Rajibutpalbagchi100% (5)

- ConclusionDocumento2 pagineConclusionMasud Khan Shakil0% (1)

- Credit Appraisal For Term Loan and Working Capital AssessmentDocumento65 pagineCredit Appraisal For Term Loan and Working Capital AssessmentMarius AngaraNessuna valutazione finora

- Credit Appraisal For Term Loan And: Working Capital FinancingDocumento93 pagineCredit Appraisal For Term Loan And: Working Capital FinancingRohit AggarwalNessuna valutazione finora

- BASEL I, II, III-uDocumento43 pagineBASEL I, II, III-uMomil FatimaNessuna valutazione finora

- To Study Credit Appraisal in Home Loan Fin - Final - Docx 1Documento69 pagineTo Study Credit Appraisal in Home Loan Fin - Final - Docx 1Swapnil BhagatNessuna valutazione finora

- A Study On Bank of Maharashtra: Commercial Banking SystemDocumento13 pagineA Study On Bank of Maharashtra: Commercial Banking SystemGovind N VNessuna valutazione finora

- Analysis of Non Performing Assets of Nepalese Commercial Banks PDFDocumento150 pagineAnalysis of Non Performing Assets of Nepalese Commercial Banks PDFSudeep Baral100% (1)

- Aaaaa As A AaaaaaaaaaDocumento132 pagineAaaaa As A AaaaaaaaaaAmbelu AberaNessuna valutazione finora

- Risk Management in Banking A Study With Reference-Risk Management in Banking A Study With ReferenceDocumento12 pagineRisk Management in Banking A Study With Reference-Risk Management in Banking A Study With ReferencePavithra GowthamNessuna valutazione finora

- A Study On HDFC Bank LTDDocumento17 pagineA Study On HDFC Bank LTDbahaaraujlaNessuna valutazione finora

- Final Internship ReportDocumento43 pagineFinal Internship ReportDeepak GuptaNessuna valutazione finora

- A Study On Credit Appraisal System in India With Special Reference To South Indian BanksDocumento5 pagineA Study On Credit Appraisal System in India With Special Reference To South Indian BanksEditor IJTSRDNessuna valutazione finora

- Submitted By: Project Submitted in Partial Fulfillment For The Award of Degree ofDocumento9 pagineSubmitted By: Project Submitted in Partial Fulfillment For The Award of Degree ofMOHAMMED KHAYYUMNessuna valutazione finora

- Icici Bank Project Summer Internship Program 2020Documento45 pagineIcici Bank Project Summer Internship Program 2020Bhavna PatnaikNessuna valutazione finora

- PDF Credit Analysis of Personal Loan HDFC Bank Specialisation ProjectDocumento89 paginePDF Credit Analysis of Personal Loan HDFC Bank Specialisation ProjectTejas BhavsarNessuna valutazione finora

- Study of NPA by Ajinkya (3) FinalDocumento70 pagineStudy of NPA by Ajinkya (3) FinalAnjali ShuklaNessuna valutazione finora

- Credit AppraisalDocumento89 pagineCredit AppraisalSkillpro KhammamNessuna valutazione finora

- XX Credit Appraisal Project FinalDocumento40 pagineXX Credit Appraisal Project FinalDhaval ShahNessuna valutazione finora

- Internship Report The Bank of PunjabDocumento23 pagineInternship Report The Bank of Punjabadil shahrozNessuna valutazione finora

- Non Performing AssetsDocumento24 pagineNon Performing AssetsAmarjeet DhobiNessuna valutazione finora

- Overview of Credit AppraisalDocumento14 pagineOverview of Credit AppraisalAsim MahatoNessuna valutazione finora

- Retail Banking Kotak Mahendra Bank (Operational ManagementDocumento99 pagineRetail Banking Kotak Mahendra Bank (Operational ManagementMaster PrintersNessuna valutazione finora

- A Study of Credit Assessment in Dena BankDocumento48 pagineA Study of Credit Assessment in Dena BankDeepali MahilagiriNessuna valutazione finora

- THEJASWINI ProjectDocumento112 pagineTHEJASWINI Projectswamy yashuNessuna valutazione finora

- Bhavna Gaikwad Project of SbiDocumento80 pagineBhavna Gaikwad Project of SbiAkshay BoteNessuna valutazione finora

- General Banking Function of Agrani Bank LimitedDocumento41 pagineGeneral Banking Function of Agrani Bank LimitedArefeen HridoyNessuna valutazione finora

- A Project On Banking SectorDocumento81 pagineA Project On Banking SectorAkbar SinghNessuna valutazione finora

- A Study On Retail Loans, at UTI Bank Retail Asset CentreDocumento74 pagineA Study On Retail Loans, at UTI Bank Retail Asset CentreBilal Ahmad LoneNessuna valutazione finora

- 1.1 Background: " A Study On SME Banking Practices in Janata Bank Limited"Documento56 pagine1.1 Background: " A Study On SME Banking Practices in Janata Bank Limited"Tareq AlamNessuna valutazione finora

- Personal Load in SbiDocumento42 paginePersonal Load in SbiNitinAgnihotriNessuna valutazione finora

- NPA of Jammu and Kashmir BankDocumento22 pagineNPA of Jammu and Kashmir BankE-sabat RizviNessuna valutazione finora

- Internship Report On Loan and AdvanceDocumento72 pagineInternship Report On Loan and AdvanceAsad KhanNessuna valutazione finora

- Uco BankDocumento77 pagineUco BankSankalp PurwarNessuna valutazione finora

- Credit Appraisal Process of Sbi: A Case Study of Branch of Sbi in HisarDocumento1 paginaCredit Appraisal Process of Sbi: A Case Study of Branch of Sbi in Hisarnbtamana4Nessuna valutazione finora

- 1302-19-672-030 SynopsisDocumento17 pagine1302-19-672-030 SynopsisMohmmedKhayyumNessuna valutazione finora

- Credit Risk Management-City BankDocumento69 pagineCredit Risk Management-City BankGobinda saha100% (1)

- Comprehensive Study On Financial Analysis of HDFC Bank: Prepared byDocumento38 pagineComprehensive Study On Financial Analysis of HDFC Bank: Prepared byshrutilatherNessuna valutazione finora

- Bank of Maharashtra History INFORMATIONDocumento3 pagineBank of Maharashtra History INFORMATIONbharatNessuna valutazione finora

- Roll No. 161 (PROJECT REPORT ON "IMPACT OF E-BANKING ON SERVICE QUALITY OF BANKS")Documento96 pagineRoll No. 161 (PROJECT REPORT ON "IMPACT OF E-BANKING ON SERVICE QUALITY OF BANKS")Varun Rodi0% (1)

- Bank of Maharashtra PDFDocumento76 pagineBank of Maharashtra PDFPRATIK BhosaleNessuna valutazione finora

- Credit Risk Management in Commercial BanksDocumento40 pagineCredit Risk Management in Commercial BanksAnjali KumariNessuna valutazione finora

- 80 Pages ProjectDocumento80 pagine80 Pages ProjectR AdenwalaNessuna valutazione finora

- 205 - F - Icici-A Study On Credit Appraisal System at Icici BankDocumento71 pagine205 - F - Icici-A Study On Credit Appraisal System at Icici BankPeacock Live Projects0% (1)

- Union Bank of IndiaDocumento58 pagineUnion Bank of IndiaRakesh Prabhakar ShrivastavaNessuna valutazione finora

- Credit Appraisal at Uco BankDocumento115 pagineCredit Appraisal at Uco BankRaju Rawat0% (1)

- Further Scope of The Study Regarding Investment BankingDocumento3 pagineFurther Scope of The Study Regarding Investment BankingMehedi HassanNessuna valutazione finora

- HDFC Summer Project ReportDocumento60 pagineHDFC Summer Project Reportumanggg90% (10)

- Bank Loan Project ReportDocumento2 pagineBank Loan Project ReportNirupa Krishna100% (1)

- Basics of Bank LendingDocumento23 pagineBasics of Bank LendingRosestella PereiraNessuna valutazione finora

- Fraud Prevention A Complete Guide - 2019 EditionDa EverandFraud Prevention A Complete Guide - 2019 EditionNessuna valutazione finora

- Fair Lending Compliance: Intelligence and Implications for Credit Risk ManagementDa EverandFair Lending Compliance: Intelligence and Implications for Credit Risk ManagementNessuna valutazione finora

- A Case Study Onsoutheast Bank LTD, Cda Avenue Branch, ChittagongDocumento66 pagineA Case Study Onsoutheast Bank LTD, Cda Avenue Branch, ChittagongTamim SikderNessuna valutazione finora

- CRM BCBLDocumento60 pagineCRM BCBLHasnat ShakirNessuna valutazione finora

- Internship Report: Nusrat Hafiz Lecturer, Brac Business SchoolDocumento45 pagineInternship Report: Nusrat Hafiz Lecturer, Brac Business SchoolBokulNessuna valutazione finora

- Credit Management Practice of UCBL Bank PDFDocumento61 pagineCredit Management Practice of UCBL Bank PDFBishal Islam100% (1)

- SME Banking Division of BRAC Bank LimiteDocumento72 pagineSME Banking Division of BRAC Bank Limiteraad.rafanNessuna valutazione finora

- The Role of Center Bangladesh For The Economic Stability of BangladeshDocumento2 pagineThe Role of Center Bangladesh For The Economic Stability of BangladeshTarequl IslamNessuna valutazione finora

- Trade Relationship Between Bangladesh and USADocumento23 pagineTrade Relationship Between Bangladesh and USATarequl IslamNessuna valutazione finora

- Strategic Analysis of Pharmaceutical Firms in BangladeshDocumento13 pagineStrategic Analysis of Pharmaceutical Firms in BangladeshTarequl IslamNessuna valutazione finora

- Functions of Bangladesh BankDocumento33 pagineFunctions of Bangladesh Bankledpro100% (4)

- Role of Bangladesh Bank For Economic DevelopmentDocumento2 pagineRole of Bangladesh Bank For Economic DevelopmentTarequl Islam50% (4)

- Role of Bangladesh Bank For Economic DevelopmentDocumento2 pagineRole of Bangladesh Bank For Economic DevelopmentTarequl Islam50% (4)

- History: Entrepreneurs, and Other Self-Employed, Lenore Janecek Claims That Entrepreneurs ShouldDocumento18 pagineHistory: Entrepreneurs, and Other Self-Employed, Lenore Janecek Claims That Entrepreneurs ShouldTarequl IslamNessuna valutazione finora

- Climate ChangeDocumento8 pagineClimate ChangeTarequl IslamNessuna valutazione finora

- Climate ChangeDocumento8 pagineClimate ChangeTarequl IslamNessuna valutazione finora

- Prospects and Problem Women Entrepreneurship in BangladeshDocumento13 pagineProspects and Problem Women Entrepreneurship in BangladeshTarequl IslamNessuna valutazione finora

- Management Information System of Standard Charterd Bank PVT LTDDocumento17 pagineManagement Information System of Standard Charterd Bank PVT LTDTarequl IslamNessuna valutazione finora

- A Primer On Financial Markets & InstitutionsDocumento34 pagineA Primer On Financial Markets & InstitutionsRakibul IslamNessuna valutazione finora

- Assignment 2b QuestionsDocumento2 pagineAssignment 2b Questionsshar winNessuna valutazione finora

- Defibering UnitDocumento3 pagineDefibering UnitArie MambangNessuna valutazione finora

- Topic 2: Globalization and Global CitiesDocumento37 pagineTopic 2: Globalization and Global CitiesPhaul QuicktrackNessuna valutazione finora

- ZACARIAS v. REVILLADocumento2 pagineZACARIAS v. REVILLAEmmanuel Princess Zia Salomon100% (1)

- Movie Sypnosis The Big Short Is Based On The True Story and Best-Selling Book of Michael Lewis. Christian BaleDocumento2 pagineMovie Sypnosis The Big Short Is Based On The True Story and Best-Selling Book of Michael Lewis. Christian BaleWinter SummerNessuna valutazione finora

- Valuation of Securities: by - ) Ajay Rana, Sonam Gupta, Shivani, Gurpreet, ShilpaDocumento46 pagineValuation of Securities: by - ) Ajay Rana, Sonam Gupta, Shivani, Gurpreet, ShilpaTanmoy ChakrabortyNessuna valutazione finora

- CAT-CB Questionnaires (Encoded)Documento13 pagineCAT-CB Questionnaires (Encoded)Anob Ehij100% (1)

- TEST Bank Chapter 22Documento19 pagineTEST Bank Chapter 22Rhea llyn BacquialNessuna valutazione finora

- Sychographic Segmentation of Indian Urban ConsumersDocumento24 pagineSychographic Segmentation of Indian Urban ConsumersLinesh BabariyaNessuna valutazione finora

- Interest Rate Derivatives: An Introduction To The Pricing of Caps and FloorsDocumento12 pagineInterest Rate Derivatives: An Introduction To The Pricing of Caps and FloorsImranullah KhanNessuna valutazione finora

- Hemedes Vs CADocumento2 pagineHemedes Vs CAJocel Elid EspinolaNessuna valutazione finora

- NPA ManagementDocumento18 pagineNPA ManagementVincy LuthraNessuna valutazione finora

- 05 TRENNERY The Origin and Early History of Insurance Including The Contract On BottomryDocumento40 pagine05 TRENNERY The Origin and Early History of Insurance Including The Contract On BottomryJul A.Nessuna valutazione finora

- Six Months Current Affairs PDF (Jan To June 2015)Documento73 pagineSix Months Current Affairs PDF (Jan To June 2015)Dr-Jitendra VaishNessuna valutazione finora

- Co-Operative Banks Preservation of Records RulesDocumento4 pagineCo-Operative Banks Preservation of Records Rulessherry j thomasNessuna valutazione finora

- Aguenza Vs Metrobank DigestDocumento1 paginaAguenza Vs Metrobank DigestVincent Quiña PigaNessuna valutazione finora

- EBL FinalDocumento31 pagineEBL FinalAbdul KaderNessuna valutazione finora

- TOA (1) KeyDocumento7 pagineTOA (1) KeyTrek ApostolNessuna valutazione finora

- Rise and Role of Microfinance in CambodiaDocumento6 pagineRise and Role of Microfinance in CambodiaSandy WellsNessuna valutazione finora

- Project For Bank LoanDocumento2 pagineProject For Bank Loangopi_saumyaNessuna valutazione finora

- Accounting For Partnership - Basic ConceptsDocumento19 pagineAccounting For Partnership - Basic ConceptsAashutosh PatodiaNessuna valutazione finora

- Time Value of MoneyDocumento10 pagineTime Value of MoneyanjaliNessuna valutazione finora

- 10000003617Documento231 pagine10000003617Chapter 11 DocketsNessuna valutazione finora

- Determinants of Interest Rate Spreads in Sub-Saharan African Countries A Dynamic Panel AnalysisDocumento26 pagineDeterminants of Interest Rate Spreads in Sub-Saharan African Countries A Dynamic Panel AnalysisEdson AlmeidaNessuna valutazione finora

- Jean Jamailah Tomugdan JD - 2: Property Case Digests Makati Leasing and Finance Corp. Vs Wearever Textile Mills Inc.Documento4 pagineJean Jamailah Tomugdan JD - 2: Property Case Digests Makati Leasing and Finance Corp. Vs Wearever Textile Mills Inc.Jean Jamailah TomugdanNessuna valutazione finora