Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Unit Viii - Audit of Equity Accounts - Final - T31314 PDF

Caricato da

Jake BundokTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Unit Viii - Audit of Equity Accounts - Final - T31314 PDF

Caricato da

Jake BundokCopyright:

Formati disponibili

Auditing Practice I I Third Term, AY 2013-2014

Workbook Page 8-1

UNIT8

AUDITOFEQUITYACCOUNTS

EstimatedTime:4.5HOURS

DiscussionQuestions8-1

1. Enumerate transactions that affecting the owners equity transaction of a typical

company(e.g.soleproprietorship,partnership,andcorporation).

2. Refer to Auditing & Assurance Services. 4

th

Edition, McGraw-Hill/Irwin by

Louwers,Ramsay,SinasonandStrawser.AnswerMultipleChoice10.22,28,32-

35and45(pages403to406).

Problem8-1:AnalysisofEquityAccounts

Apartiallistofaccountsandendingaccountbalancestakenfromthetrialbalanceof

AERONIncorporatedonDecember31,2013isshownasfollows:

Account Amount

Accumulatedprofitsunappropriated P410,000

BondsPayable 220,000

OrdinarySharesSubscribed 50,000

Longterminvestmentsinequitysecurities 210,000

Additionalpaidincapitalonordinaryshares 460,000

Premiumonbondspayable 30,000

AuthorizedOrdinarySharesatP10parvalue 900,000

PreferenceSharessubscribed 45,000

Additionalpaid-incapitalonpreferenceshares 112,000

AuthorizedpreferencesharesatP50parvalue 400,000

Gainonsaleoftreasuryshares 4,000

UnrealizedincreaseinvalueofAFS 3,000

OrdinaryShareWarrantsOutstanding 20,000

UnissuedOrdinaryShares 500,000

UnissuedPreferenceShares 100,000

CashDividendspayable-preference 50,000

DonatedCapital 25,000

Reserveforbondsinkingfund 220,000

Reservefordepreciation 150,000

RevaluationIncrement 100,000

Subscriptionreceivablepreference(noncurrent) 15,000

Subscriptionreceivablecommon(noncurrent) 20,000

Required:Computeforthefollowing:

1. Ordinarysharesissued

2. Preferencesharesissued

3. AdditionalPaidInCapital

4. TotalContributedCapital

5. TotalLegalCapital

6. TotalStockholdersEquity

Auditing Practice I I Third Term, AY 2013-2014

Workbook Page 8-2

Problem8-2TreasuryStockTransactions

The stockholders equity of RTW Corporation as of December 31, 2013 was as

follows:

ShareCapital,P10par,authorized300,000shares;

250,000sharesissuedandoutstanding 2,500,000

SharePremium 3,750,000

AccumulatedProfits 1,800,000

Duringtheyear,thefollowingtransactionstranspired:

a. On June 1, 20011, RTW reacquired 40,000 shares of its common stock at

P40pershare.

b. Of the 40,000 reacquired shares, 15,000 were sold at P45, 17,000 at P30,

and1,000wereretired.

Required:Computeforthefollowing:

a. Sharecapital

b. TreasuryShares

c. Sharepremium

d. Sharepremiumfromtreasuryshares

e. AccumulatedProfits

Problem8-3StockholdersEquityTransactions

The shareholders equity section of Kumander Diosa Corporations statement of

financialpositionasofDecember31,2013,isasfollows:

Ordinarysharecapital(P6par,250,000

sharesauthorized,147,500issuedand

outstanding) P885,000

Sharepremium 442,500

Totalpaid-incapital P1,327,500

Unappropriatedretainedearnings P963,500

Appropriatedretainedearnings 350,000

Totalretainedearnings 1,313,500

Totalshareholdersequity P2,641,000

TheCompanyhadthefollowingshareholdersequitytransactionsduring2010:

Jan.15 CompletedthebuildingrenovationforwhichP350,000ofretainedearnings

hadbeenrestricted.PaidthecontractorP328,300,allofwhichiscapitalized.

Mar.3 Issued50,000additionalordinarysharesforP1 1pershare.

May18 Declared a dividend of P1.50 per share to be paid on July 31, 2014, to

shareholdersofrecordonJune30,2014.

June19 Approved additional building renovation to be funded internationally. The

estimated cost of the project is P400,000, and retained earnings are to be

restrictedforthatamount.

July31 Paidthedividend.

Auditing Practice I I Third Term, AY 2013-2014

Workbook Page 8-3

Nov.12 Declared a property dividend to be paid on December 31, 2014, to

shareholdersofrecordonNovember30,2014.Thedividendistoconsistof

18,300 shares of Chanel Corporation ordinary shares that are currently

recordedinArmanisbooksatP9pershare.

Dec.31 ReportedP673,500ofnetincomeonDecember31,2014incomestatement.

In addition, the shares were distributed in satisfaction of the property

dividend.

Required:

a. Preparethejournalentriestorecordthetransactionsin2014.

b. DeterminethebalanceofthefollowingasofDecember31,2014:

i. No.ofSharesIssuedandOutstanding

ii. Ordinarysharecapitalaccount

iii. Sharepremiumaccount

iv. Retainedearnings

v. Totalshareholdersequity

Problem8-4:ShareholdersEquityTransactions

BurberryCompanywasformedonJuly1,2011.Itwasauthorizedtoissue600,000

shares of P10 par value ordinary shares and 200,000 shares of 8 percent P25 par

value,cumulativeandnon-participatingpreferenceshares.BurberryCompanyhasa

July1June30fiscalyear.

The following information relates to the shareholders equity accounts of Burberry

Company:

OrdinaryShares

Prior to the 2013-2014 fiscal year, Burberry Company had 250,000 of outstanding

ordinarysharesissuedasfollows:

1. 210,000shareswereissuedforcashonJuly1,2011,atP33pershare.

2. OnJuly24,2011,10,000shareswereexchangedforaplotoflandwhichcost

thesellerP160,000in2001andhadanestimatedmarketvalueofP530,000

onJuly24,2011.

3. 30,000 shares were issued on March 1, 2013; the shares had been

subscribedforP46pershareonOctober31,2012.

During the 2013-2014 fiscal year, the following transactions regarding ordinary

sharestookplace:

2013

Oct.1 FourthousandshareswereissuedforcashatP48pershare.

Nov.30 Burberrypurchased4,600ofitsownordinarysharesontheopenmarketat

P39pershare.

Dec.15 Burberry declared a 5% stock dividend for shareholders of record on

January15,2014,tobeissuedonJanuary31,2014.Burberrywashavinga

liquidity problem and could not afford a cash dividend at that time.

Burberrys ordinary shareswere selling at P52per shareon December 15,

2013.

Auditing Practice I I Third Term, AY 2013-2014

Workbook Page 8-4

2014

June20 Burberry sold 1,100 of its own ordinary shares that it had purchased on

November30,2013,forP47,000.

PreferenceShares

Burberryissued100,000preferencesharesatP47pershareonJuly1,2012.

CashDividends

BurberryhasfollowedascheduleofdeclaringcashdividendsinDecemberandJune

withpaymentbeingmadetoshareholdersofrecordinthefollowingmonth.Thecash

dividendswhichhavebeendeclaredsinceinceptionofthecompanythroughJune30,

2014,areshownbelow:

DeclarationDate OrdinaryShares PreferenceShares

12/15/12 P0.30pershare P1.50pershare

06/15/13 P0.30pershare P1.50pershare

12/15/13 --- P1.50pershare

No cash dividends were declared during June 2014 due to the companys liquidity

problems.

RetainedEarnings

As of June 30, 2013, Burberrys retained earnings account had a balance of

P1,830,000. For the fiscal year ending June 30, 2014, Burberry reported a net

incomeofP130,000.

In March 2013, Burberry received a term loan from Dior Cartier Bank. The bank

requires Burberry to establish a sinking fund and restrict retained earnings for an

amount equal to the sinking fund deposit. The annual sinking fund payment of

P150,000isdueon April30eachyear;thefirstpaymentwasmadeonscheduleon

April30,2014.

Required:

a. Journalentriestorecordthetransactionsfrom2011to2014.

b. ComputethebalancesofthefollowingaccountsasofJune30,2014:

i. Ordinarysharecapitalaccount

ii. Sharepremiumordinaryshares(includingtreasuryshares)

iii. Unappropriatedretainedearnings

iv. Numberofordinarysharesissuedandoutstanding

v. Totalshareholdersequity

Problem8-5:DividendsandEquityBalances

SirCle,Corp.(SCC)hasthefollowingamountsintheshareholdersequitysectionas

ofDecember31,2013:

Preferenceshares,10%,P10parvalue(100,000 250,000.00

sharesauthorized,25,000sharesissued)

Ordinaryshares,P5par(50,000shares 150,000.00

authorized30,000sharesissued)

Sharespremium 104,000.00

RetainedEarnings 750,000.00

Total 1,254,000.00

Auditing Practice I I Third Term, AY 2013-2014

Workbook Page 8-5

Thefollowingtransactionsoccurredduringtheyear:

a. Issued6,500preferencesharesatP17pershare.

b. Purchased 4,500 shares of its own outstanding ordinary shares for P18 per

share.

c. Reissued1,200treasurysharesforequipmentvaluedatP30,000.

d. Declared a 5% stock dividend on the outstanding ordinary shares when the

sharesweresellingforP11pershare.

e. Paidtheannual2009P1persharecashdividendonpreferencesharesanda

P0.50persharecashdividendonordinaryshares.Thesedividendshadbeen

declaredonDecember31,2013.

f. Issuedstockdividend.

g. Declared the annual 2014 P1 per share cash dividend on preference shares

and the P0.50 per share cash dividend on ordinary shares. These dividends

arepayablein2015.

h. Appropriatedretainedearningsforplantexpansion,P200,000.

i. Appropriatedretainedearningsfortreasuryshares.

Thenetincomefor2014wasP620,000.

Required:

ComputeforthefollowingbalancesasofDecember31,2014:

1. Preferenceshares

2. Ordinaryshares

3. Sharepremium

4. Treasuryshares

5. UnappropriatedRetainedEarnings

Problem8-6:Quasi-Reorganization

Shown below are Davidoff Companys condensed statements of financial position

immediatelybeforeandoneyearafterithadcompletedaquasi-reorganization.

Dec.31,2013

(beforequasi-

reorganization)

Dec.31,2014

Currentassets P1,200,000 P1,670,000

Property,plant,andequipment

(net) 5,600,000 4,140,000

Totalassets

P6,800,000 P5,810,000

Ordinaryshares

P7,400,000 P5,890,000

Sharepremium

730,000 160,000

Retainedearnings (1,330,000) (240,000)

Totalshareholdersequity

P6,800,000 P5,810,000

In 2014, Davidoff reported net income of P650,000 and depreciation expense of

P470,000.Thequasi-reorganizationonDecember31,2013,includedthewritedown

ofthecompanysinventoriesbyP490,000.Nopurchasesorsalesofproperty,plant,

andequipmentitemsandnosharetransactionsoccurredin2014.

Auditing Practice I I Third Term, AY 2013-2014

Workbook Page 8-6

Required:

Prepareallthejournalentriesmadeatthetimeofthequasi-reorganization.

Problem8-7:ShareOptions

At the beginning of year 1, the entity grants 130 shares each to 550 employees,

conditional upon the employees remaining in the entitys employ during the vesting

period.Theshareswill vestattheendofyear1iftheentitysearnings increaseby

more than 18 percent; at the end of year 2 if the entitys earning increase by more

than an average of 13 percent per year over the two-year period; and at the end of

year 3 if the entitys earnings increase by more than an average of 10 percent over

the three-year period. Theshareshaveafair value of P36 per shareat the start of

year1,whichequalsthesharepriceatgrantdate.Nodividendsareexpectedtobe

paidoverthethree-yearperiod.

By the end of year 1, the entitys earnings have increased by 14 percent, and 40

employeeshaveleft. The entity expects that earnings will continuetoincreaseat a

similar rate in year 2, and therefore expects that the shares will vest at the end of

year 2. The entity expects, on the basis of a weighted average probability, that a

further 34 employees will leave during year 2, and therefore expects that 476

employeeswillvestin130shareseachattheendofyear2.

By the end of year 2, the entitys earnings have increased by only 10 percent and

thereforethesharesdonotvestattheendofyear2.32employeeshaveleftduring

theyear.Theentityexpectsthatafurther28employeeswillleaveduringyear3,and

that the entitys earnings will increase by at least 6 percent, thereby achieving the

averageof10percentperyear.

Bytheendofyear3,24employeeshaveleftandtheentitysearningshadincreased

by8percent,resultinginanaverageincreaseof10.67percentperyear.Therefore,

454employeesreceived130sharesattheendofyear3.

Required:

Computefortheamountofremunerationexpenseattheendofyears1-3.

Problem8-8:ShareOptions

Atthebeginningof2013,LancomeCompanygrantsshareoptionstoeachofits125

employeesworkinginthesalesdepartment.Theshareoptionswillvestattheendof

2015, provided that the employees remain in the entitys employ, and provided that

the volume of sales of a particular product increases by at least an average of 5

percent per year. If the volume of sales of the product increases by an average of

between10percentand15percenteachyear,eachemployeewillreceive300share

options.Ifthevolumeofsalesincreasesbyanaverageof15percentormore,each

employeewillreceive400shareoptions.

Ongrantdate,LancomeCompanyestimatesthattheshareoptionshaveafairvalue

ofP34peroption.LancomeCompanyalsoestimatesthatthevolumeofsalesofthe

productwillincreasebyanaverageofbetween10percentand15percentperyear.

The company also estimates on the basis of weighted average probability that 19

percentofemployeeswillleavebeforetheendof2013.

Bytheendof2013,sevenemployeeshaveleftandthecompanystillexpectsthata

totalof19employeeswillleavebytheendof2015.Productsaleshaveincreasedby

Auditing Practice I I Third Term, AY 2013-2014

Workbook Page 8-7

12 percent and the company expects this rate of increase to continue over the next

twoyears.

By the endof 2014, a further six employees haveleft. Theentity now expects only

four more employees will leave during 2015. Product sales have increased by 18

percent.Thecompanynowexpectsthatsaleswillaverage15percentormoreover

thethree-yearperiod.

By the end of 2015, a further three employees have left. The entitys sales have

increasedbyanaverageof16percentoverthethreeyears.

Required:

a. Compensationexpense,2013

b. Compensationexpense,2014

c. Compensationexpense,2015

Problem8-9:Shareoptionswithcashalternatives

Titus Company grants to an employee the right to choose either 5,500 phantom

shares

1

or7,000shares.Thegrantisconditionaluponthecompletionofthreeyears

of service. If the employee chooses the share alternative, the shares must be held

forthreeyearsafterthevestingdate.

Atgrantdate,theentityssharepriceisP83pershare.Attheendofyears1,2and3,

thesharepriceisP84,P87andP91respectively.Theentitydoesnotexpecttopay

dividends in the next three years. After taking into account the effects of the post-

vesting transfer restrictions, the entity estimates that the grant date fair value of the

sharealternativeisP81pershare.

Required:

a. Compensationexpense,year1

b. Compensationexpense,year2

c. Compensationexpense,year3

Problem8-10:ShareAppreciationRights

On January 1, 2013, Royce Corporation grants 120 cash share appreciation rights

(SAR) to each of its 200 employees on condition that the employee remain in its

employforthenextthreeyears.

During 2013, 14 employees left and the company estimates that a further 24 will

leave during 2014 and 2015. During 2014, 10 employees left and the company

estimatesthatafurther8willleaveduring2015.During2015,8employeesleft.At

theendof2015,60employeesexercisedtheirSAR.Attheendof2016,another42

employees exercised their SAR. At the end of 2017, the remaining employees

exercisedtheirSAR.

1

Phantom shares represent the right of an employee to receive cash payments equivalent to

5,500 shares as if the employee were given an actual share of stock in the company. The

employee never actually owns shares and thus obtains no shareholder rights under the plan.

Auditing Practice I I Third Term, AY 2013-2014

Workbook Page 8-8

The entity estimates the fair value of the SAR at the end of each year in which a

liability exists as show below. At the end of 2015, all SAR held by the remaining

employeesvest.TheintrinsicvaluesoftheSARatthedateofexercise(whichequal

thecashpaidout)attheendof2015,2016,and2017arealsoshownbelow:

Year FairValue IntrinsicValue

2013 P28

2014 30

2015 33 P36

2016 41 39

2017 48

Required:

a. Compensationexpensein2014

b. Compensationexpensein2015

c. Compensationexpensein2016

d. Compensationexpensein2017

Problem8-11ComprehensiveProblem

InyourfirstyearauditofLABulldogsInc.,stockholdersequityaccountsfortheaudit

year 2014, the following schedule of the companys equity account as of December

31,2013waspresentedbyyourclient:

Ordinary Share Capital, P100 par, 200,000 shares authorized,

50,000 shares issued and outstanding, options to purchase

10,000 shares at P100 per share held by employees, no value

assignedtotheseoptions

P5,000,000

SharePremium 1,000,000

AccumulatedProfits 3,000,000

Yourexaminationdisclosedthefollowing:

a. Theoptionsreferredtoaboveweregrantedtoeachofits 100employeeson

January 1, 2012 which shall vest three years thereafter provided employees

do not leave the Company. It further provides that sales should increase at

leastbyanaverageof10%.Ifthesalesincreasebyaverageof10%peryear,

employeesreceive100shareoptions.Ifthesalesincreasebyanaverageof

15%, each employee will receive 200 share options. If sales increase by an

average of at least 20% per year, each employee shall receive 300 options.

The fair value of each share option was 30. No employees left the company

andsalesincreaseby13%in2012,13%in2013and19%in2015.

b. On May 1, 2014, the Company issued bonds of P5,000,000 at 120 giving

eachP1,000bondawarrantenablingtheholdertopurchase4sharesat120

per share for a one year period. The market value of the bond ex-warrant is

105.

c. On June 1, 2014, half of the warrants were exercised relating to the bonds

issuedlastMay2014.

Auditing Practice I I Third Term, AY 2013-2014

Workbook Page 8-9

d. OnAugust1,thecompanyissuedrightstoshareholders,permittingholdersto

acquire for a 60-day period, 1 share at P130 with every 5 rights submitted.

SharesweresellingatP150.Allbut5000oftheserightswereexercised.

e. The company declared P5 cash dividends on December 15, 2011. These

remainedunpaidasofyear-end.

f. NetincomeamountedtoP2,500,000in2011.

Prepare and audit working paper showing the retrospective adjustment to retained

earnings (accumulated profits) and a rollforward analysis of the Companys

StockholdersEquity.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- At Reviewer Part II - (May 2015 Batch)Documento22 pagineAt Reviewer Part II - (May 2015 Batch)Jake BundokNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- AP 5904 InvestmentsDocumento9 pagineAP 5904 InvestmentsJake BundokNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Mandarin V3Documento18 pagineMandarin V3Jake BundokNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Calendar - 2015 02 01 - 2015 03 01 PDFDocumento1 paginaCalendar - 2015 02 01 - 2015 03 01 PDFJake BundokNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Maple Leaf Study EDocumento4 pagineMaple Leaf Study EFaraz HaqNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- AP 5904 InvestmentsDocumento9 pagineAP 5904 InvestmentsJake BundokNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Jan 2015 (Manila) ,: Holidays in PhilippinesDocumento1 paginaJan 2015 (Manila) ,: Holidays in PhilippinesJake BundokNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Gmat Handbook PDFDocumento20 pagineGmat Handbook PDFVishal GolchaNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Advanced Accounting-Volume 2Documento4 pagineAdvanced Accounting-Volume 2ronnelson pascual25% (16)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- REVIEW QUESTIONS Investment in Debt SecuritiesDocumento1 paginaREVIEW QUESTIONS Investment in Debt SecuritiesJake BundokNessuna valutazione finora

- Debt Securities: BondsDocumento9 pagineDebt Securities: BondsCorinne GohocNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- AP 5904 InvestmentsDocumento9 pagineAP 5904 InvestmentsJake BundokNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- GuideDocumento4 pagineGuideJake BundokNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Dlsu Thesis Paper LetterheadDocumento1 paginaDlsu Thesis Paper LetterheadJake BundokNessuna valutazione finora

- X Deal FoodDocumento1 paginaX Deal FoodJake BundokNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Elimination Round BreakthroughDocumento16 pagineElimination Round BreakthroughJake BundokNessuna valutazione finora

- Seitani (2013) Toolkit For DSGEDocumento27 pagineSeitani (2013) Toolkit For DSGEJake BundokNessuna valutazione finora

- SOX On ISDocumento5 pagineSOX On ISJake BundokNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Park JMP PDFDocumento56 paginePark JMP PDFJake BundokNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Child Labor Data 2011 - 2013 (Jan)Documento2 pagineChild Labor Data 2011 - 2013 (Jan)Jake BundokNessuna valutazione finora

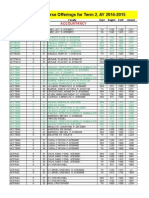

- RVR-COB Course Offerings Term 2Documento19 pagineRVR-COB Course Offerings Term 2sweetjar22Nessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Tips DefenseDocumento35 pagineTips DefenseJake BundokNessuna valutazione finora

- SSRN Id975135Documento44 pagineSSRN Id975135Jake BundokNessuna valutazione finora

- Modeling With Exp & Power FunctionsDocumento27 pagineModeling With Exp & Power FunctionsJake BundokNessuna valutazione finora

- Cpi 1997Documento17 pagineCpi 1997Jake BundokNessuna valutazione finora

- CPAR Auditing TheoryDocumento62 pagineCPAR Auditing TheoryKeannu Lewis Vidallo96% (46)

- New Zealand Best, Indonesia Worst in World Poll of International CorruptionDocumento10 pagineNew Zealand Best, Indonesia Worst in World Poll of International CorruptionNasir JamalNessuna valutazione finora

- Cpi 1996Documento9 pagineCpi 1996Jake BundokNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- SOX On ISDocumento5 pagineSOX On ISJake BundokNessuna valutazione finora

- GuideDocumento4 pagineGuideJake BundokNessuna valutazione finora

- The Positive and Negative Sides of Incessant Asuu Strikes in Nigeria: An Exploratory Study Based On Academic Staff PerceptionsDocumento11 pagineThe Positive and Negative Sides of Incessant Asuu Strikes in Nigeria: An Exploratory Study Based On Academic Staff PerceptionspetrolumideNessuna valutazione finora

- A Study On Dealers Perception Towards Asbestos Cement Sheets Mba ProjectDocumento86 pagineA Study On Dealers Perception Towards Asbestos Cement Sheets Mba ProjectPrarthana Srinivasan40% (5)

- 0 GSIS Finals QuestionsDocumento11 pagine0 GSIS Finals QuestionsClauds GadzzNessuna valutazione finora

- Shareholders & StakehodersDocumento9 pagineShareholders & StakehodersresharofifahutoroNessuna valutazione finora

- Final Report On SME and Micro Credit and Micro FinanceDocumento65 pagineFinal Report On SME and Micro Credit and Micro FinanceMohammad SumonNessuna valutazione finora

- Memo To SupervisorDocumento2 pagineMemo To SupervisorArem Capuli100% (2)

- HRM ScriptDocumento4 pagineHRM ScriptRachel Ann RazonableNessuna valutazione finora

- Effects of Wage DiscriminationDocumento15 pagineEffects of Wage DiscriminationJorge Reyes ManzanoNessuna valutazione finora

- HR Practices in Construction IndustryDocumento9 pagineHR Practices in Construction IndustryVijay Baskar S0% (1)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- HCM US Balance Adjustments White PaperDocumento184 pagineHCM US Balance Adjustments White Paperajay kumarNessuna valutazione finora

- Nebosh 1 2 Moral Social and EconomicDocumento28 pagineNebosh 1 2 Moral Social and EconomicMuhammadObaidullahNessuna valutazione finora

- Philippine AirlinesDocumento6 paginePhilippine AirlinesammeNessuna valutazione finora

- Salman BDADocumento7 pagineSalman BDAATIF HASANNessuna valutazione finora

- SRS FormDocumento2 pagineSRS FormJerz PortNessuna valutazione finora

- J21 1RSDocumento169 pagineJ21 1RSferdinandventNessuna valutazione finora

- Eobi Act 1976Documento43 pagineEobi Act 1976shahidtoor175% (4)

- Caste & Class in Bihar-Anand ChakravartyDocumento15 pagineCaste & Class in Bihar-Anand Chakravartyletterstomukesh0% (1)

- Agrarian Law and Social Legislation NotesDocumento18 pagineAgrarian Law and Social Legislation Notesmcris101Nessuna valutazione finora

- Assignment ComtempoararyDocumento17 pagineAssignment Comtempoararyhoney balolongNessuna valutazione finora

- PIDE, Internship Report FormatDocumento7 paginePIDE, Internship Report FormatMalik YasirNessuna valutazione finora

- Manalo V TNSDocumento14 pagineManalo V TNSyousirneighmNessuna valutazione finora

- Pepsi CoDocumento10 paginePepsi CoTainosavageNessuna valutazione finora

- LABREL Full Text - 1st HWDocumento104 pagineLABREL Full Text - 1st HWIanBiagtanNessuna valutazione finora

- NSDC Scheme For Market LED Fee Based Program 18052022Documento13 pagineNSDC Scheme For Market LED Fee Based Program 18052022Niranjan KaushikNessuna valutazione finora

- Multiple Choice: Employee Training and DevelopmentDocumento12 pagineMultiple Choice: Employee Training and DevelopmentSadaf WaheedNessuna valutazione finora

- Campus Recruitment TrainingDocumento4 pagineCampus Recruitment TrainingSagar Paul'gNessuna valutazione finora

- Competency MappingDocumento31 pagineCompetency MappingKirti Sangwan100% (1)

- Technical English 3 Homework 3 2023Documento3 pagineTechnical English 3 Homework 3 2023Efrain De GraciaNessuna valutazione finora

- Princeton, New JerseyDocumento16 paginePrinceton, New JerseyJiabin LiNessuna valutazione finora

- Paid Family LeaveDocumento5 paginePaid Family LeaveDimitri SpanosNessuna valutazione finora

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisDa EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisValutazione: 5 su 5 stelle5/5 (6)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successDa EverandReady, Set, Growth hack:: A beginners guide to growth hacking successValutazione: 4.5 su 5 stelle4.5/5 (93)

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNDa Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNValutazione: 4.5 su 5 stelle4.5/5 (3)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 4.5 su 5 stelle4.5/5 (14)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetDa EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetValutazione: 5 su 5 stelle5/5 (2)