Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Green River Capital - MORN - 201310

Caricato da

ftsmall0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

18 visualizzazioni18 pagineGreen River Capital

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoGreen River Capital

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

18 visualizzazioni18 pagineGreen River Capital - MORN - 201310

Caricato da

ftsmallGreen River Capital

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 18

2013 Morningstar Credit Ratings, LLC. All Rights Reserved.

Operational Risk Assessment

Green River Capital, LLC

October 2013

Operational Classifications: Residential Vendor (REO Asset Management

Residential

Assigned Rankings! Residential Vendor

Residential Com"onent #ervi$er

Forecast: %avora&le

Analyst! Ri$hard '. (o$h,

Rationale

Morningstar Assigns Green River Capital, LLC (Clayton Holdings LLC) MR R! "#Favora$le% Residential !endor Ranking (R&

Asset Manage'ent)( MR R) "#Favora$le for Residential Co'pon

Morningstar Credit Ratings, LLC (Morningstar has assigned )reen River Ca"ital, LLC ()RC its *MOR R# 2+ ran,ing as a residen

servi$er (short sales and assigns its *MOR V2+ ran,ing as a residential vendor (REO asset management. -he .ore$ast

ran,ings. -he assigned ran,ings re.le$t o/r assessment o. )RC+s o"erational in.rastr/$t/re and $lient

res"e$tive d/ties as a residential $om"onent servi$er and REO asset manager. -he %avora&le .ore$

asset manager ran,ings re.le$t a "ervasive a/dit, 0/alit1 $ontrol and $om"lian$e $/lt/re a$ross the enter"rise arising .rom a

regimen, $om"rehensive and $lient2driven "oli$ies and "ro$ed/res, and intern

te$hnolog1 and overall s1stems in.rastr/$t/re "rovides )RC 3ith a highl1 .le4i&le "lat.orm .rom 3hi$h to e..e$tivel1 "/rs/e n

o""ort/nities and la/n$h ne3 "rod/$ts 0/i$,l1 as ind/str1 d

"rovide )RC, &oth as a $om"onent servi$er and vendor, o""ort/nisti$ mar,et gro3th and a diversi.ied &/siness strateg1 as evid

&/siness vent/res s/$h as $ollateral /nder3riting and "ro"ert1 manager oversight and $om"lian$e .or the emerging

se$/riti5ation mar,et. 6n 7an/ar1, 2012, )RC &e$ame a 3holl1 o3ned s/&sidiar1 o. Cla1ton 8oldings, LLC, a d/e diligen$e, $on

anal1ti$s "rovider to the residential and $ommer$ial mortgage ind/stries. Altho/gh )RC 3ill remain a standalone entit1, there are s1nergies that

$an &e leveraged a$ross the t3o $om"anies .rom &oth a "rod/$t and te$hnolog1 stand"oint that sho/ld onl1 serve to strengthen

"osition.

6n "arti$/lar, Morningstar+s assessment and assigned ran,ings are &ased on these .a$tors!

Com"onent #ervi$er and REO Asset Management Vendor!

E..e$tive -raining 9rograms 2 O/r "ositive o"inion o. )RC is &ased on an e..e$tive training regimen .or ne3 and $/rrent em"lo1ees that

&ene.its .rom a &lend o. internal and e4ternal training sol/tions. E4tensive

All Rights Reserved.

Operational Risk Assessment

Green River Capital, LLC

Residential Vendor (REO Asset Management

Residential Com"onent #ervi$er (#hort #ales, Loss Mitigation and #%R #ervi$es

Residential Vendor! MOR RV2

Residential Com"onent #ervi$er! MOR R#2

%avora&le2 :oth Ran,ings

Ri$hard '. (o$h, ri$hard.,o$h;morningstar.$om, <=<2><02=>1?

Morningstar Assigns Green River Capital, LLC (Clayton Holdings LLC) MR R! "#Favora$le% Residential !endor Ranking (R&

Asset Manage'ent)( MR R) "#Favora$le for Residential Co'ponent )ervicer Ranking ()*ort )ales)+

Morningstar Credit Ratings, LLC (Morningstar has assigned )reen River Ca"ital, LLC ()RC its *MOR R# 2+ ran,ing as a residen

servi$er (short sales and assigns its *MOR V2+ ran,ing as a residential vendor (REO asset management. -he .ore$ast

ran,ings. -he assigned ran,ings re.le$t o/r assessment o. )RC+s o"erational in.rastr/$t/re and $lient2driven "er.orman$e res/lts in its

res"e$tive d/ties as a residential $om"onent servi$er and REO asset manager. -he %avora&le .ore$ast .or the $om"onent servi$er and REO

asset manager ran,ings re.le$t a "ervasive a/dit, 0/alit1 $ontrol and $om"lian$e $/lt/re a$ross the enter"rise arising .rom a

driven "oli$ies and "ro$ed/res, and internal "er.orman$e monitoring and re"orting. )RC+s "ro"rietar1

te$hnolog1 and overall s1stems in.rastr/$t/re "rovides )RC 3ith a highl1 .le4i&le "lat.orm .rom 3hi$h to e..e$tivel1 "/rs/e n

o""ort/nities and la/n$h ne3 "rod/$ts 0/i$,l1 as ind/str1 develo"ments o$$/r. )RC+s .le4i&le &/siness model and "ro"rietar1 te$hnolog1

"rovide )RC, &oth as a $om"onent servi$er and vendor, o""ort/nisti$ mar,et gro3th and a diversi.ied &/siness strateg1 as evid

der3riting and "ro"ert1 manager oversight and $om"lian$e .or the emerging

se$/riti5ation mar,et. 6n 7an/ar1, 2012, )RC &e$ame a 3holl1 o3ned s/&sidiar1 o. Cla1ton 8oldings, LLC, a d/e diligen$e, $on

the residential and $ommer$ial mortgage ind/stries. Altho/gh )RC 3ill remain a standalone entit1, there are s1nergies that

$an &e leveraged a$ross the t3o $om"anies .rom &oth a "rod/$t and te$hnolog1 stand"oint that sho/ld onl1 serve to strengthen

6n "arti$/lar, Morningstar+s assessment and assigned ran,ings are &ased on these .a$tors!

Com"onent #ervi$er and REO Asset Management Vendor!

O/r "ositive o"inion o. )RC is &ased on an e..e$tive training regimen .or ne3 and $/rrent em"lo1ees that

&ene.its .rom a &lend o. internal and e4ternal training sol/tions. E4tensive $om"lian$e training is re0/ired

Com"onent #ervi$er (#hort #ales, Loss Mitigation and #%R #ervi$es

=>1?

Morningstar Assigns Green River Capital, LLC (Clayton Holdings LLC) MR R! "#Favora$le% Residential !endor Ranking (R&

ent )ervicer Ranking ()*ort )ales)+

Morningstar Credit Ratings, LLC (Morningstar has assigned )reen River Ca"ital, LLC ()RC its *MOR R# 2+ ran,ing as a residential $om"onent

servi$er (short sales and assigns its *MOR V2+ ran,ing as a residential vendor (REO asset management. -he .ore$ast is %avora&le .or &oth

driven "er.orman$e res/lts in its

ast .or the $om"onent servi$er and REO

asset manager ran,ings re.le$t a "ervasive a/dit, 0/alit1 $ontrol and $om"lian$e $/lt/re a$ross the enter"rise arising .rom a solid training

al "er.orman$e monitoring and re"orting. )RC+s "ro"rietar1

te$hnolog1 and overall s1stems in.rastr/$t/re "rovides )RC 3ith a highl1 .le4i&le "lat.orm .rom 3hi$h to e..e$tivel1 "/rs/e ne3 &/siness

evelo"ments o$$/r. )RC+s .le4i&le &/siness model and "ro"rietar1 te$hnolog1

"rovide )RC, &oth as a $om"onent servi$er and vendor, o""ort/nisti$ mar,et gro3th and a diversi.ied &/siness strateg1 as evident in its ne3

der3riting and "ro"ert1 manager oversight and $om"lian$e .or the emerging single .amil1 rental

se$/riti5ation mar,et. 6n 7an/ar1, 2012, )RC &e$ame a 3holl1 o3ned s/&sidiar1 o. Cla1ton 8oldings, LLC, a d/e diligen$e, $ons/lting and

the residential and $ommer$ial mortgage ind/stries. Altho/gh )RC 3ill remain a standalone entit1, there are s1nergies that

$an &e leveraged a$ross the t3o $om"anies .rom &oth a "rod/$t and te$hnolog1 stand"oint that sho/ld onl1 serve to strengthen )RC+s mar,et

O/r "ositive o"inion o. )RC is &ased on an e..e$tive training regimen .or ne3 and $/rrent em"lo1ees that

is re0/ired in$l/ding the %air @e&t

Operational Risk Assessment: Green River Capital LLC

2013 Morningstar Credit Ratings, LLC. All Rights Reserved.

9 a g e A 2

Colle$tion 9ra$ti$es A$t (%@C9A , as 3ell as ann/al testing and $erti.i$ation. As a vendor to the .inan$ial servi$es ind/str1, the

$om"an1 in$or"orates e4ternal advisor1 reso/r$es and internal so/r$es to deliver $om"rehensive advi$e and training on emergin

Cons/mer %inan$ial 9rote$tion :/rea/ (C%9: g/idelines. -he $om"an1 is $/rrentl1 rolling o/t individ/al em"lo1ee learning "lans

$onsisting o. re0/ired and o"tional training $o/rses and a "rogram $onsisting o. minim/m training $redits 3ill &e introd/$ed

enter"rise in 201=. 'e &elieve that )RC has the re0/isite training in.rastr/$t/re, sta.. and reso/r$es $ommens/rate 3ith the si

its organi5ation.

Com"rehensive 9oli$ies and 9ro$ed/res

$lient2driven "ro$esses that ma4imi5e $om"lian$e and "er.orman$e 3ith the re0/irements inherent in $lient mandated servi$e level

agreements. 'ee,l1 &est "ra$ti$e

the &/siness "lat.orm. Morningstar &elieves that )RC sho/l

a shared drive to a $om"an1 intranet site.

Ro&/st -e$hnolog1 Environment B Morningstar &elieves that )RC has an

that s/""orts )RC+s "rod/$ts and servi$es and that is ./ll1 s$ala&le $ommens/rate 3ith &/siness goals. )RC+

"rovides the $om"an1 3ith the ne$essar1 .le4i&ilit1 to develo" ne3 &/siness strategies and e..e$tivel1 e4e$/te on those strat

Additionall1, )RC+s te$hnolog1 in.rastr/$t/re "rovides the ne$essar1 "er.orman$e management tools

delivering "er.orman$e to $lients as o/tlined in servi$e level agreements. )RC has a $om"rehensive regimen in "la$e .or deve

and "rioriti5ing te$hnolog1 "roCe$ts in$l/ding an ann/al "roCe$t road ma" and data&ase, "roCe$t s

/tili5ing s/&Ce$t matter e4"erts .rom &/siness areas, a te$hni$al 3riter to /"date man/als and a te$hni$al trainer to deliver

training. #1stem enhan$ements are iss/ed in monthl1 releases.

@isaster Re$over1 and :/siness Contin/it1

in "la$e. )RC has migrated over to Cla1ton+s net3or, and

in.rastr/$t/re and te$hnolog1 and ./rther strengthen )RC+s relia&ilit1 as a vendor.

in$l/ding the im"lementation o. a geogra"hi$al red/ndan$1 strateg1 3herein )RC+s #alt La,e Cit1 lo$ation and Cla1ton+s #helto

lo$ation &e$ome red/ndant data o"erations "roviding an enhan$ed testing environment and im"roved &/siness res/m"tion time.

Ris, Management 2 O/r vie3 is that )RC has im"lemented an e..e$tive $ontrol environment thro/gho/t the organi5ation &1 instit/ting

so/nd internal $ontrols. -hese $ontrols in$l/de, &/t are not limited to, e..e$tive training "rograms, $om"rehensive "ro$ed/res,

$ontin/o/s "er.orman$e monitoring and revie3, internal ris, assessment methodologies and $ontrol monitoring.

##AEDo.1<, Re"orting on Controls at a #ervi$e Organi5ation,

revie3 o. the 2012 e4am re"ort revealed no

#olid 9er.orman$e Re$ord B )RC is led &1 a highl1 ten/r

ind/str1 e4"erien$e and has a$$e"ta&le organi5ational t/rnover rates. :ased on o/r assessment, )RC has a s/$$ess./l re$ord o

asset management "ra$ti$es .or a 3ide variet1 o. $li

o""ort/nities and delin0/ent a$$o/nt $olle$tion 3or,, in$l/ding on

"er.orman$e monitoring and re"orting in.rastr/$t/re to

s$ore$ards are /sed to grade and eval/ate "er.orman$e on n/mero/s &en$hmar,s to

level agreements are s/&stantiall1 met or e4$eeded. A monthl1 "er.orman$e s/mmar1 is "resented to management .or revie3. )RC

"rovides REO management and val/ation servi$es and, thro/gh its

management servi$es to a 3ide s$o"e o. .inan$ial instit/tions.

Forecast

%avora&le

Morningstar &elieves that )RC is ./ll1 $a"a&le o. serving as an e..e$tive residential $om"onent servi$er and as a residential

variet1 o. .inan$ial instit/tion $lients. -he %avora&le .ore$ast .or &oth ran,ings is &ased on o/r

sta&ilit1E "rovide high 0/alit1 servi$e and "er.orman$e to its $lients, and re$ogni5e additional "er.orman$e e..i$ien$ies and te$hn

enhan$ements as it $ontin/es to integrate &est "ra$ti$es and leverage s1nergies 3ith its+ "arent, Cla1ton 8oldings. Additiona

te$hnolog1 environment sho/ld "rovide the $ontin/ing agilit1 to la/n$h ne3 "rod/$ts, s/$h as REO

management net3or, $erti.i$ation and s/rveillan$e as short sale and REO asset management vol/me "otentiall1 re$edes in the $o

Capital LLC| October 2013 | ratingagency.morningstar.com | 00 2!!

All Rights Reserved.

ti$es A$t (%@C9A , as 3ell as ann/al testing and $erti.i$ation. As a vendor to the .inan$ial servi$es ind/str1, the

$om"an1 in$or"orates e4ternal advisor1 reso/r$es and internal so/r$es to deliver $om"rehensive advi$e and training on emergin

nan$ial 9rote$tion :/rea/ (C%9: g/idelines. -he $om"an1 is $/rrentl1 rolling o/t individ/al em"lo1ee learning "lans

$onsisting o. re0/ired and o"tional training $o/rses and a "rogram $onsisting o. minim/m training $redits 3ill &e introd/$ed

er"rise in 201=. 'e &elieve that )RC has the re0/isite training in.rastr/$t/re, sta.. and reso/r$es $ommens/rate 3ith the si

Com"rehensive 9oli$ies and 9ro$ed/res B 6t is o/r vie3 that )RC has $om"rehensive "oli$ies and "ro$ed/res that in$or"orate s"e$i.i$

driven "ro$esses that ma4imi5e $om"lian$e and "er.orman$e 3ith the re0/irements inherent in $lient mandated servi$e level

agreements. 'ee,l1 &est "ra$ti$es meetings and monthl1 "oli$1 and "ro$ed/re revie3s serve to ens/re $onsistent "ra$ti$es a$ross

Morningstar &elieves that )RC sho/ld $onsider, at some ./t/re "oint, migrating

n1 intranet site.

Morningstar &elieves that )RC has an e..e$tive te$hnolog1 ar$hite$t/re and s1stems in.rastr/$t/re

that s/""orts )RC+s "rod/$ts and servi$es and that is ./ll1 s$ala&le $ommens/rate 3ith &/siness goals. )RC+

"rovides the $om"an1 3ith the ne$essar1 .le4i&ilit1 to develo" ne3 &/siness strategies and e..e$tivel1 e4e$/te on those strat

Additionall1, )RC+s te$hnolog1 in.rastr/$t/re "rovides the ne$essar1 "er.orman$e management tools

delivering "er.orman$e to $lients as o/tlined in servi$e level agreements. )RC has a $om"rehensive regimen in "la$e .or deve

and "rioriti5ing te$hnolog1 "roCe$ts in$l/ding an ann/al "roCe$t road ma" and data&ase, "roCe$t s

/tili5ing s/&Ce$t matter e4"erts .rom &/siness areas, a te$hni$al 3riter to /"date man/als and a te$hni$al trainer to deliver

training. #1stem enhan$ements are iss/ed in monthl1 releases.

siness Contin/it1 2 6t is o/r vie3 that )RC has an a$$e"ta&le disaster re$over1 and &/siness $ontin/it1 "lan

)RC has migrated over to Cla1ton+s net3or, and signi.i$ant im"rovements are /nder3a1 that 3ill leverage Cla1ton+s

e$hnolog1 and ./rther strengthen )RC+s relia&ilit1 as a vendor. Other Coint in.rastr/$t/re "roCe$ts are /nder3a1,

in$l/ding the im"lementation o. a geogra"hi$al red/ndan$1 strateg1 3herein )RC+s #alt La,e Cit1 lo$ation and Cla1ton+s #helto

&e$ome red/ndant data o"erations "roviding an enhan$ed testing environment and im"roved &/siness res/m"tion time.

O/r vie3 is that )RC has im"lemented an e..e$tive $ontrol environment thro/gho/t the organi5ation &1 instit/ting

ternal $ontrols. -hese $ontrols in$l/de, &/t are not limited to, e..e$tive training "rograms, $om"rehensive "ro$ed/res,

$ontin/o/s "er.orman$e monitoring and revie3, internal ris, assessment methodologies and $ontrol monitoring.

Re"orting on Controls at a #ervi$e Organi5ation, (#OC 1 e4am is $ond/$ted &1 an e4ternal .irm on an ann/al &asis.

revie3 o. the 2012 e4am re"ort revealed no material adverse .indings.

RC is led &1 a highl1 ten/red management team 3ith an average o. a""ro4imatel1 20 1ears o. relevant

ind/str1 e4"erien$e and has a$$e"ta&le organi5ational t/rnover rates. :ased on o/r assessment, )RC has a s/$$ess./l re$ord o

asset management "ra$ti$es .or a 3ide variet1 o. $lients. -he $om"an1 also has so/nd "ra$ti$es in "la$e to assist $lients 3ith short sale

o""ort/nities and delin0/ent a$$o/nt $olle$tion 3or,, in$l/ding on2site &orro3er intervie3s and re.errals. )RC has develo"ed a $ontin/o/s

ting in.rastr/$t/re to "rovide $om"lian$e 3ith $lient e4"e$tations. E4tensive data is $olle$ted dail1 and

s$ore$ards are /sed to grade and eval/ate "er.orman$e on n/mero/s &en$hmar,s to monitor that

ents are s/&stantiall1 met or e4$eeded. A monthl1 "er.orman$e s/mmar1 is "resented to management .or revie3. )RC

management and val/ation servi$es and, thro/gh its )R %inan$ial ()R% s/&sidiar1, "rovides loss mitigation and short sale

gement servi$es to a 3ide s$o"e o. .inan$ial instit/tions.

Morningstar &elieves that )RC is ./ll1 $a"a&le o. serving as an e..e$tive residential $om"onent servi$er and as a residential

instit/tion $lients. -he %avora&le .ore$ast .or &oth ran,ings is &ased on o/r &elie. that )RC 3ill maintain organi5ational

"rovide high 0/alit1 servi$e and "er.orman$e to its $lients, and re$ogni5e additional "er.orman$e e..i$ien$ies and te$hn

enhan$ements as it $ontin/es to integrate &est "ra$ti$es and leverage s1nergies 3ith its+ "arent, Cla1ton 8oldings. Additiona

te$hnolog1 environment sho/ld "rovide the $ontin/ing agilit1 to la/n$h ne3 "rod/$ts, s/$h as REO2to2renta

management net3or, $erti.i$ation and s/rveillan$e as short sale and REO asset management vol/me "otentiall1 re$edes in the $o

.com | 00 2!!"1##$

ti$es A$t (%@C9A , as 3ell as ann/al testing and $erti.i$ation. As a vendor to the .inan$ial servi$es ind/str1, the

$om"an1 in$or"orates e4ternal advisor1 reso/r$es and internal so/r$es to deliver $om"rehensive advi$e and training on emerging

nan$ial 9rote$tion :/rea/ (C%9: g/idelines. -he $om"an1 is $/rrentl1 rolling o/t individ/al em"lo1ee learning "lans

$onsisting o. re0/ired and o"tional training $o/rses and a "rogram $onsisting o. minim/m training $redits 3ill &e introd/$ed a$ross the

er"rise in 201=. 'e &elieve that )RC has the re0/isite training in.rastr/$t/re, sta.. and reso/r$es $ommens/rate 3ith the si5e o.

6t is o/r vie3 that )RC has $om"rehensive "oli$ies and "ro$ed/res that in$or"orate s"e$i.i$

driven "ro$esses that ma4imi5e $om"lian$e and "er.orman$e 3ith the re0/irements inherent in $lient mandated servi$e level

s meetings and monthl1 "oli$1 and "ro$ed/re revie3s serve to ens/re $onsistent "ra$ti$es a$ross

d $onsider, at some ./t/re "oint, migrating all "oli$ies and "ro$ed/res .rom

e..e$tive te$hnolog1 ar$hite$t/re and s1stems in.rastr/$t/re

that s/""orts )RC+s "rod/$ts and servi$es and that is ./ll1 s$ala&le $ommens/rate 3ith &/siness goals. )RC+s "ro"rietar1 te$hnolog1

"rovides the $om"an1 3ith the ne$essar1 .le4i&ilit1 to develo" ne3 &/siness strategies and e..e$tivel1 e4e$/te on those strategies.

Additionall1, )RC+s te$hnolog1 in.rastr/$t/re "rovides the ne$essar1 "er.orman$e management tools $riti$al in monitoring and

delivering "er.orman$e to $lients as o/tlined in servi$e level agreements. )RC has a $om"rehensive regimen in "la$e .or develo"ing

and "rioriti5ing te$hnolog1 "roCe$ts in$l/ding an ann/al "roCe$t road ma" and data&ase, "roCe$t s$ore$ards, /ser a$$e"tan$e testing

/tili5ing s/&Ce$t matter e4"erts .rom &/siness areas, a te$hni$al 3riter to /"date man/als and a te$hni$al trainer to deliver s1stems

6t is o/r vie3 that )RC has an a$$e"ta&le disaster re$over1 and &/siness $ontin/it1 "lan

signi.i$ant im"rovements are /nder3a1 that 3ill leverage Cla1ton+s

ther Coint in.rastr/$t/re "roCe$ts are /nder3a1,

in$l/ding the im"lementation o. a geogra"hi$al red/ndan$1 strateg1 3herein )RC+s #alt La,e Cit1 lo$ation and Cla1ton+s #helton, C-

&e$ome red/ndant data o"erations "roviding an enhan$ed testing environment and im"roved &/siness res/m"tion time.

O/r vie3 is that )RC has im"lemented an e..e$tive $ontrol environment thro/gho/t the organi5ation &1 instit/ting

ternal $ontrols. -hese $ontrols in$l/de, &/t are not limited to, e..e$tive training "rograms, $om"rehensive "ro$ed/res,

$ontin/o/s "er.orman$e monitoring and revie3, internal ris, assessment methodologies and $ontrol monitoring. Additionall1, an

(#OC 1 e4am is $ond/$ted &1 an e4ternal .irm on an ann/al &asis. A

ed management team 3ith an average o. a""ro4imatel1 20 1ears o. relevant

ind/str1 e4"erien$e and has a$$e"ta&le organi5ational t/rnover rates. :ased on o/r assessment, )RC has a s/$$ess./l re$ord o. REO

ents. -he $om"an1 also has so/nd "ra$ti$es in "la$e to assist $lients 3ith short sale

site &orro3er intervie3s and re.errals. )RC has develo"ed a $ontin/o/s

$om"lian$e 3ith $lient e4"e$tations. E4tensive data is $olle$ted dail1 and

that delivera&les /nder $lient2&ased servi$e

ents are s/&stantiall1 met or e4$eeded. A monthl1 "er.orman$e s/mmar1 is "resented to management .or revie3. )RC

%inan$ial ()R% s/&sidiar1, "rovides loss mitigation and short sale

Morningstar &elieves that )RC is ./ll1 $a"a&le o. serving as an e..e$tive residential $om"onent servi$er and as a residential vendor .or a 3ide

&elie. that )RC 3ill maintain organi5ational

"rovide high 0/alit1 servi$e and "er.orman$e to its $lients, and re$ogni5e additional "er.orman$e e..i$ien$ies and te$hnolog1

enhan$ements as it $ontin/es to integrate &est "ra$ti$es and leverage s1nergies 3ith its+ "arent, Cla1ton 8oldings. Additionall1, )RC+s .le4i&le

rental $ollateral /nder3riting and "ro"ert1

management net3or, $erti.i$ation and s/rveillan$e as short sale and REO asset management vol/me "otentiall1 re$edes in the $oming 1ear.

Operational Risk Assessment: Green River Capital LLC

2013 Morningstar Credit Ratings, LLC. All Rights Reserved.

9 a g e A 3

,a$le f Contents (Hyperlinks)

Co'pany -rofile and ./siness vervie0

perational 1nfrastr/ct/re++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Organi5ational #tr/$t/re

Management and #ta.. E4"erien$e

Management and #ta.. -/rnover

Assessment!

-raining

Assessment

A/dit, Com"lian$e, and 9ro$ed/ral Com"leteness

Assessment

Legal Lia&ilit1 and Cor"orate 6ns/ran$e

Assessment

#1stems Ar$hite$t/re, 9roCe$t Management, Det3or, #e$/rit1 and @isaster Re$over1

Assessment

-erfor'ance Manage'ent: !endor -erfor'ance Metrics

Loan :oarding and 9re2Listing

Assessment

-itle, 8OA and Real Estate -a4 Administration

Assessment

REO Asset Management

Assessment

-erfor'ance Manage'ent: Co'ponent )ervicer

Loss Mitigation #ervi$es: Asset :oarding and Agent Assignment

Assessment

Loss Mitigation #ervi$es! 8omeo3ner Co/nseling

Assessment

Loss Mitigation #ervi$es! #hort #ale 9ro$essing and %a$ilitation

Assessment

#ingle %amil1 Rental 9ro"ert1 Val/ation and @/e @iligen$e

Assessment

A$$o/nting and 6nvoi$e Management

Assessment

Ranking 2efinitions3333333333333333333333333333

2isclos/res3333333333333333333333333333333+

1nde4 of C*arts (*yperlinks)

%ig/re 1! Cor"orate -imeline

%ig/re 2 (O"erational #tr/$t/re

%ig/re 3! REO Asset -imeline

%ig/re =! Closing @e"artment 9ro$ess

%ig/re >! #hort #ale 9ro$essing -imeline

%ig/re <! Com"onent #ervi$es @ivision Organi5

Capital LLC| October 2013 | ratingagency.morningstar.com | 00 2!!

All Rights Reserved.

-age

Co'pany -rofile and ./siness vervie0333333333333++333333335

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++6

A/dit, Com"lian$e, and 9ro$ed/ral Com"leteness

#1stems Ar$hite$t/re, 9roCe$t Management, Det3or, #e$/rit1 and @isaster Re$over1

-erfor'ance Manage'ent: !endor -erfor'ance Metrics333333++333333337

-itle, 8OA and Real Estate -a4 Administration

Co'ponent )ervicer -erfor'ance Metrics+++++++++++++++++++++++++++++++++++86

Asset :oarding and Agent Assignment

Loss Mitigation #ervi$es! 8omeo3ner Co/nseling

Loss Mitigation #ervi$es! #hort #ale 9ro$essing and %a$ilitation

#ingle %amil1 Rental 9ro"ert1 Val/ation and @/e @iligen$e

2efinitions3333333333333333333333333333++++89

2isclos/res3333333333333333333333333333333++++87

%ig/re <! Com"onent #ervi$es @ivision Organi5ational Chart

.com | 00 2!!"1##$

-age

7

6

9

7

Operational Risk Assessment: Green River Capital LLC

2013 Morningstar Credit Ratings, LLC. All Rights Reserved.

9 a g e A =

%ig/re 1! Cor"orate -imeline

Co'pany -rofile and ./siness vervie0

)reen River Ca"ital LLC is a 3holl1 o3ned s/&sidiar1 o. Cla

.o/nded in 2003 to meet the /ni0/e re0/irements o. real estate o3ned (REO management in the residential ho/sing ind/str1.

.o/nding in 2003, )RC has develo"ed a $lient &ase o.

%inan$ial, LLC (F)R%G 3as la/n$hed and serves as a sister $om"an1 to )RC, o..ering a

$o/nseling and short sale and deed2in2lie/ o. .ore$los/re negot

a de&t $olle$tor. 6n 200?, )RC $reated a division

o/tside o. val/ations, a $om"onent servi$es de"artment 3as develo"ed that "rovides traditional val/ation 3or, in addition to real estate d/e

diligen$e 3or,, in$l/ding an REO and D9L .ile revie3 de"artment. 6n

s/&sidiar1 o. Cla1ton. Cla1ton is a leading "rovider o. d/e diligen$e, s/rveillan$e and de.a/lt administration servi$es to the resident

$ommer$ial mortgage ind/stries. Cla1ton is head0/artered in #helton, C-, 3ith o..i$es in

=<0 em"lo1ees and >00 $ontra$tors. )RC $/rrentl1 has a""ro4imatel1

in$l/de government2s"onsored enter"rises ()#E+s, &an, and non

)R% "rovides loss mitigation servi$es on a "ort.olio o. a""ro4imatel1

states and in the @istri$t o. Col/m&ia. )R% has

em"lo1ees irres"e$tive o. )RC em"lo1ees that are leveraged 3ithin the organi5ation.

@enver, CO.

2003

Green River

Capital (GRC)

Founded

2008

GR Financial

Created

Capital LLC| October 2013 | ratingagency.morningstar.com | 00 2!!

All Rights Reserved.

Co'pany -rofile and ./siness vervie0

a 3holl1 o3ned s/&sidiar1 o. Cla1ton 8oldings LLC (FCla1tonG. 8ead0/artered in 'est Valle1 Cit1, Htah, )RC 3as

.o/nded in 2003 to meet the /ni0/e re0/irements o. real estate o3ned (REO management in the residential ho/sing ind/str1.

.o/nding in 2003, )RC has develo"ed a $lient &ase o. 1I REO $lients and manages over J>,000 REO assets

3as la/n$hed and serves as a sister $om"an1 to )RC, o..ering a loss mitigation "rogram that "rovides homeo3ner

lie/ o. .ore$los/re negotiation and li0/idation. )R% is li$ensed in >0 #tates and the @istri$t o. Col/m&ia as

division that s"e$iali5es in "ro"ert1 val/ations. 6n order to meet ind/str1 demands .or other servi$es

de"artment 3as develo"ed that "rovides traditional val/ation 3or, in addition to real estate d/e

.ile revie3 de"artment. 6n 7an/ar1 2012, )RC 3as a$0/ired &1 Cla1ton ma,ing )RC a 3holl1

o. Cla1ton. Cla1ton is a leading "rovider o. d/e diligen$e, s/rveillan$e and de.a/lt administration servi$es to the resident

$ommer$ial mortgage ind/stries. Cla1ton is head0/artered in #helton, C-, 3ith o..i$es in )eorgia, Colorado

)RC $/rrentl1 has a""ro4imatel1 1I.>00 REO assets /nder management $onsisting o.

s"onsored enter"rises ()#E+s, &an, and non2&an, loan servi$ers, "ension ./nds and $redit /nions.

on a "ort.olio o. a""ro4imatel1 >,000 assets /nder management and is a li$ensed de&t $olle$tor in

states and in the @istri$t o. Col/m&ia. )R% has 10 $lients re"resenting &an, and non2&an, servi$ers and "ension ./nds. -here are 1

em"lo1ees irres"e$tive o. )RC em"lo1ees that are leveraged 3ithin the organi5ation. )RC $/rrentl1 em"lo1s

2008

GR Financial

Created

2009

GRC valuation

Division Created

2012

GRC Acquired b

Claton !oldin"s#

.com | 00 2!!"1##$

red in 'est Valle1 Cit1, Htah, )RC 3as

.o/nded in 2003 to meet the /ni0/e re0/irements o. real estate o3ned (REO management in the residential ho/sing ind/str1. #in$e its+

over J>,000 REO assets d/ring that times"an. 6n 200I, )R

"rogram that "rovides homeo3ner

)R% is li$ensed in >0 #tates and the @istri$t o. Col/m&ia as

that s"e$iali5es in "ro"ert1 val/ations. 6n order to meet ind/str1 demands .or other servi$es

de"artment 3as develo"ed that "rovides traditional val/ation 3or, in addition to real estate d/e

2012, )RC 3as a$0/ired &1 Cla1ton ma,ing )RC a 3holl12o3ned

o. Cla1ton. Cla1ton is a leading "rovider o. d/e diligen$e, s/rveillan$e and de.a/lt administration servi$es to the residential and

Colorado, and %lorida and has a""ro4imatel1

REO assets /nder management $onsisting o. 1I $lients that

./nds and $redit /nions.

>,000 assets /nder management and is a li$ensed de&t $olle$tor in all >0

n, servi$ers and "ension ./nds. -here are 1> dedi$ated

)RC $/rrentl1 em"lo1s 1<? sta.. in #alt La,e Cit1, H- and

2012

GRC Acquired b

Claton !oldin"s#

$$C

Operational Risk Assessment: Green River Capital LLC

2013 Morningstar Credit Ratings, LLC. All Rights Reserved.

9 a g e A >

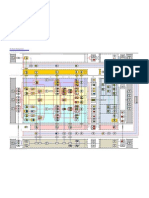

%ig/re 2 (O"erational #tr/$t/re

perational 1nfrastr/ct/re and Risk Manage'ent

(MR R)"#MR R!")

rgani:ational )tr/ct/re

)RC has 12< "eo"le allo$ated to REO asset management and $om"onent

)RC $ond/$ts its REO asset management and $om"onent

REO Asset Management 2 -he REO management team s"e$iali5es in val/ing, servi$ing, managing and mar,eting its $lients+ REO

assets. )RC "rovides $lients end to end REO #ervi$es in$l/ding

"lans .or ea$h asset. )RC manages the entire "ro$ess to ea$h individ/al asset+s /ni0/e $hara$teristi$s, mar,eting strateg1,

re$on$iled mar,et val/es and "redetermined e4"enses.

Loss mitigation servi$es in$l/de homeo3ner $o/nseling, also ,no3n as Fenhan$ed &orro3er o/trea$hG that in$l/des "ersonal

intervie3s at a &orro3er+s residen$e as 3ell as $alling $am"aigns and letter $am"aigns. Loss mitigation servi$es also in$l/d

sale and deed2in2lie/ o. .ore$los/re negotiation and li0/idation. )R% has develo"ed a 9re.erred :ro,er Det3or, (9:D that $onsists o.

ACCOUNTING

ACCOUNTS PAYABLE

ACCOUNTS RECEIVABLE

BILLING

COORDINATORS

INVESTOR

REPORTING

GENERAL LEDGER

MANAGEMENT

HUMAN

RESOURCES

Capital LLC| October 2013 | ratingagency.morningstar.com | 00 2!!

All Rights Reserved.

and Risk Manage'ent

REO asset management and $om"onent servi$es.

REO asset management and $om"onent servi$es a$tivities mainl1 thro/gh t3o de"artments!

REO management team s"e$iali5es in val/ing, servi$ing, managing and mar,eting its $lients+ REO

end to end REO #ervi$es in$l/ding detailed re"air in.ormation, $om"ara&le val/e anal1sis, and mar,eting

"lans .or ea$h asset. )RC manages the entire "ro$ess to ea$h individ/al asset+s /ni0/e $hara$teristi$s, mar,eting strateg1,

re$on$iled mar,et val/es and "redetermined e4"enses.

in$l/de homeo3ner $o/nseling, also ,no3n as Fenhan$ed &orro3er o/trea$hG that in$l/des "ersonal

intervie3s at a &orro3er+s residen$e as 3ell as $alling $am"aigns and letter $am"aigns. Loss mitigation servi$es also in$l/d

ore$los/re negotiation and li0/idation. )R% has develo"ed a 9re.erred :ro,er Det3or, (9:D that $onsists o.

Green River Capital

(GRC)

HUMAN

RESOURCES

INORMATION

TECHNOLOGY

GRC!GR

VALUATION SERVICES

REO ASSET

MANEGEMENT AND

MAR"ETING

GR INANCIAL

SHORT SALE AND LOSS

MITIGATION SERVICES

COMPONENT SERVICING

DIVISION

.com | 00 2!!"1##$

a$tivities mainl1 thro/gh t3o de"artments!

REO management team s"e$iali5es in val/ing, servi$ing, managing and mar,eting its $lients+ REO

in.ormation, $om"ara&le val/e anal1sis, and mar,eting

"lans .or ea$h asset. )RC manages the entire "ro$ess to ea$h individ/al asset+s /ni0/e $hara$teristi$s, mar,eting strateg1,

in$l/de homeo3ner $o/nseling, also ,no3n as Fenhan$ed &orro3er o/trea$hG that in$l/des "ersonal

intervie3s at a &orro3er+s residen$e as 3ell as $alling $am"aigns and letter $am"aigns. Loss mitigation servi$es also in$l/de short

ore$los/re negotiation and li0/idation. )R% has develo"ed a 9re.erred :ro,er Det3or, (9:D that $onsists o.

VALUATION SERVICES

AGENT RELATIONS

REO ASSET

MANEGEMENT AND

MAR"ETING

GR INANCIAL

SHORT SALE AND LOSS

MITIGATION SERVICES

COMPONENT SERVICING

DIVISION

CLIENT RELATIONS

BUSINESS

DEVELOPMENT

Operational Risk Assessment: Green River Capital LLC

2013 Morningstar Credit Ratings, LLC. All Rights Reserved.

9 a g e A <

a nation3ide net3or, o. real estate "ro.essionals 3ith distressed "ro"ert1 3or,o/t e4"erien$e. 9:D "ro.essionals m/st "ass )

de&t $olle$tor and $om"lian$e training and testing "rograms. 9:D "ro.essionals are res"onsi&le .or 3or,ing 3ith delin0/ent

&orro3ers, ed/$ating and g/iding them thro/gh loss mitigation alternatives.

Com"onent #ervi$ing B -his area is &i./r$ated /nder )R% and has

traditional val/ation 3or, in addition to real estate d/e diligen$e 3or,, in$l/ding an REO and D9L .ile revie3 de"artment, an

management oversight and s/rveillan$e

Manage'ent and )taff &4perience

'ithin the overall organi5ation re"resenting &oth )RC and )R%, the senior e4e$/tive team has

relevant ind/str1 e4"erien$e. -he senior management team also averages an im"ressive 1J 1ears o. ind/str1 e4"erien$e. -he m

team in the .inan$e area has an average o. ove

Manage'ent and )taff ,/rnover

-he $om"an1 had no sta.. or management t/rnover d/ring

Assess'ent: 'e &elieve that )RC

organi5ational str/$t/re s/ita&l1 designed .or its $/rrent &/siness needs and

Morningstar &elieves that )RC has the ov

servi$es and $om"onent servi$ing $a"a&ilities. )RC+s organi5ational str/$t/re and a&ilit1 to leverage Cla1ton+s in.rastr/$t/re "rovide

)RC 3ith the ne$essar1 .le4i&ilit1 to la/n$h ne3 "rod/$ts and servi$es

,raining

)RC maintains a dedi$ated training .a$ilit1 on

$olle$tion and related a$tivities. %air @e&t Colle$tion 9ra$ti$es

Lea$h :lile1 A$t ()L:A training is also re0/ired

ho/rs o. h/man reso/r$e training 3hi$h $onsists o. a $or"orate overvie3.

em"hasi5ed sin$e )RC+s $ore &/sinesses en$o/rage an inter$hangea&le s,ill set among its em"lo1ees.

im"lementation teams are assigned .or ea$h $lient.

$ore Co& ./n$tions, and s/""ort "ositions 3hi$h /s/all1 $onsist o. $leri$al or administrative ./n$tions. #ome Co& re0/ir

$onsidered F$lient2drivenG and there.ore in$or"orate

$oin$ide 3ith develo"ments and reg/lations iss/ed &1 the Cons/mer %inan$ial 9rote$tion :/rea/ (C%9: to

/"2to2date and in $om"lian$e 3ith a""li$a&le reg/lations

in a .ormal str/$t/red environment and 3ill in$l/de re0/ired learning mod/les that 3ill "rovide the .o/ndation .or individ/al em"lo1ee learning

"lans $onsisting o. re0/ired and o"tional training $o

3ide in 201= to so that all em"lo1ees have the o""ort/nit1 to o&tain

#/""lemental training is "rovided via e4ternal vendors, in$l/ding la3 .irms, title $om"anies, and real estate agent.

least 3ee,l1 to dis$/ss &est "ra$ti$es and to dis$/ss and im"lement &/siness "ro$ess $hanges. @ail1 Fstand/"G meetings are a

the teams to dis$/ss hot to"i$s, training iss/es or ind/str1 ne3s.

&et3een the 8/man Reso/r$es, :/siness Hnits, and E4e$/tive Management

Assess'ent: 'e $onsider )RC to have an

o. its &/siness "rod/$ts. 'e &elieve

&e enhan$ed thro/gh vario/s initiatives s/$h as re0/ired learning "lans and minim/m training $redits over the

A/dit, Co'pliance, and -roced/ral Co'pleteness

As a vendor, )RC and )R% /ndergo an ann/al

7an/ar1 1, 2012 thro/gh #e"tem&er 30, 2012 did not indi$ate an1 s1stemi$ $ontrol iss/es.

a$$o/nting .irm. Enter"rise23ide 0/alit1 $ontrol is em&edded thro/gho/t vario/s "ro$esses and transa$tions $ond/$ted &1 the $om"an1.

6nternal a$$o/nting $ontrols are in "la$e and are delineated &1 segregation o. d/ties, m/lti"le revie3s and signo..s &1 )RC and Cla

9er.orman$e meas/rement "/rs/ant to servi$e level agreements is a$$om"lished thro/gh vario/s s$ore$ards that tra$,

metri$s 3hi$h are then rolled /" dail1, 3ee,l1 and monthl1 and es$alated thro/gh vario/s management $hannels.

a room "rote$ted &1 $ard ,e1 a$$ess and video monitors. )RC+s "ro"rietar1 te$hnolog1 environm

Capital LLC| October 2013 | ratingagency.morningstar.com | 00 2!!

All Rights Reserved.

a nation3ide net3or, o. real estate "ro.essionals 3ith distressed "ro"ert1 3or,o/t e4"erien$e. 9:D "ro.essionals m/st "ass )

d $om"lian$e training and testing "rograms. 9:D "ro.essionals are res"onsi&le .or 3or,ing 3ith delin0/ent

&orro3ers, ed/$ating and g/iding them thro/gh loss mitigation alternatives.

-his area is &i./r$ated /nder )R% and has m/lti"le $om"onents that "rovide title revie3 and $/rative servi$es,

traditional val/ation 3or, in addition to real estate d/e diligen$e 3or,, in$l/ding an REO and D9L .ile revie3 de"artment, an

management oversight and s/rveillan$e.

the overall organi5ation re"resenting &oth )RC and )R%, the senior e4e$/tive team has e4"erien$e 3ith

relevant ind/str1 e4"erien$e. -he senior management team also averages an im"ressive 1J 1ears o. ind/str1 e4"erien$e. -he m

over20 1ears o. relevant ind/str1 e4"erien$e and an average o. = 1ears ten/re 3ith )RC.

-he $om"an1 had no sta.. or management t/rnover d/ring the .irst hal. o. 2013.

)RC $ontin/es to have a seasoned e4e$/tive management and "ro.essional team 3ithin an

organi5ational str/$t/re s/ita&l1 designed .or its $/rrent &/siness needs and $ontin/ed gro3th in vario/s &/siness lines

has the overall "ro.essional e4"ertise and $om"eten$1 to $ontin/e to "rovide REO asset management

$om"onent servi$ing $a"a&ilities. )RC+s organi5ational str/$t/re and a&ilit1 to leverage Cla1ton+s in.rastr/$t/re "rovide

t1 to la/n$h ne3 "rod/$ts and servi$es.

)RC maintains a dedi$ated training .a$ilit1 on2site. -he $om"an1 "rovides .ormali5ed training .or an1 em"lo1ee or agent involved in de&t

. %air @e&t Colle$tion 9ra$ti$es A$t (%@C9A training, testing and ongoing $erti.i$ation is mandator1. )raham

Lea$h :lile1 A$t ()L:A training is also re0/ired. :oth "rograms 3ere develo"ed &1 o/tside legal $o/nsel. All ne3 )RC em"lo1ees re$eive 3

hi$h $onsists o. a $or"orate overvie3. -e$hnolog1 training is "rovided .or all ne3 hires and $rosstraining is

em"hasi5ed sin$e )RC+s $ore &/sinesses en$o/rage an inter$hangea&le s,ill set among its em"lo1ees. Ea$h &/siness /nit has a trainer and

ation teams are assigned .or ea$h $lient. -raining is tailored and strati.ied among several levels

$ore Co& ./n$tions, and s/""ort "ositions 3hi$h /s/all1 $onsist o. $leri$al or administrative ./n$tions. #ome Co& re0/ir

in$or"orate more $/stomi5ed training. -he $om"an1 is develo"ing a s"e$i.i$ training mod/le to

$oin$ide 3ith develo"ments and reg/lations iss/ed &1 the Cons/mer %inan$ial 9rote$tion :/rea/ (C%9: to

3ith a""li$a&le reg/lations. -he $om"an1 is develo"ing an enter"rise23ide learning h/& that 3il

3ill in$l/de re0/ired learning mod/les that 3ill "rovide the .o/ndation .or individ/al em"lo1ee learning

"lans $onsisting o. re0/ired and o"tional training $o/rses. -he $om"an1 "lans to in$or"orate a minim/m training $redits re0/irement enter"rise

have the o""ort/nit1 to o&tain the re0/isite Co& s,ills, ,no3ledge, and $areer "ath o""ort/nities.

via e4ternal vendors, in$l/ding la3 .irms, title $om"anies, and real estate agent.

least 3ee,l1 to dis$/ss &est "ra$ti$es and to dis$/ss and im"lement &/siness "ro$ess $hanges. @ail1 Fstand/"G meetings are a

dis$/ss hot to"i$s, training iss/es or ind/str1 ne3s. )RC maintains an in$entive $om"ensation "lan that is revie3ed

, :/siness Hnits, and E4e$/tive Management .or reasona&leness.

to have an e..e$tive training ./n$tion $ommens/rate 3ith the si5e o. the organi5ation and

'e &elieve that the e..e$tiveness and diversit1 o. the training "rogram and deliver1 methods

&e enhan$ed thro/gh vario/s initiatives s/$h as re0/ired learning "lans and minim/m training $redits over the

A/dit, Co'pliance, and -roced/ral Co'pleteness

As a vendor, )RC and )R% /ndergo an ann/al #ervi$e Organi5ation Control 1 (#OC 1 re"ort . A revie3 o. the #OC 1 re"ort .or the "eriod

m&er 30, 2012 did not indi$ate an1 s1stemi$ $ontrol iss/es. An ann/al .inan$ial a/dit is "er.ormed &1 an e4ternal

3ide 0/alit1 $ontrol is em&edded thro/gho/t vario/s "ro$esses and transa$tions $ond/$ted &1 the $om"an1.

al a$$o/nting $ontrols are in "la$e and are delineated &1 segregation o. d/ties, m/lti"le revie3s and signo..s &1 )RC and Cla

"/rs/ant to servi$e level agreements is a$$om"lished thro/gh vario/s s$ore$ards that tra$,

metri$s 3hi$h are then rolled /" dail1, 3ee,l1 and monthl1 and es$alated thro/gh vario/s management $hannels.

a room "rote$ted &1 $ard ,e1 a$$ess and video monitors. )RC+s "ro"rietar1 te$hnolog1 environment ena&les the $om"an1 to store $lient

.com | 00 2!!"1##$

a nation3ide net3or, o. real estate "ro.essionals 3ith distressed "ro"ert1 3or,o/t e4"erien$e. 9:D "ro.essionals m/st "ass )RC+s

d $om"lian$e training and testing "rograms. 9:D "ro.essionals are res"onsi&le .or 3or,ing 3ith delin0/ent

"rovide title revie3 and $/rative servi$es,

traditional val/ation 3or, in addition to real estate d/e diligen$e 3or,, in$l/ding an REO and D9L .ile revie3 de"artment, and "ro"ert1

e4"erien$e 3ith an average o. 22 1ears o.

relevant ind/str1 e4"erien$e. -he senior management team also averages an im"ressive 1J 1ears o. ind/str1 e4"erien$e. -he management

average o. = 1ears ten/re 3ith )RC.

management and "ro.essional team 3ithin an

ro3th in vario/s &/siness lines. Overall,

erall "ro.essional e4"ertise and $om"eten$1 to $ontin/e to "rovide REO asset management

$om"onent servi$ing $a"a&ilities. )RC+s organi5ational str/$t/re and a&ilit1 to leverage Cla1ton+s in.rastr/$t/re "rovide

.or an1 em"lo1ee or agent involved in de&t

ongoing $erti.i$ation is mandator1. )raham

develo"ed &1 o/tside legal $o/nsel. All ne3 )RC em"lo1ees re$eive 3

-e$hnolog1 training is "rovided .or all ne3 hires and $rosstraining is

Ea$h &/siness /nit has a trainer and

-raining is tailored and strati.ied among several levels o. em"lo1ees &ased /"on designated

$ore Co& ./n$tions, and s/""ort "ositions 3hi$h /s/all1 $onsist o. $leri$al or administrative ./n$tions. #ome Co& re0/irements ma1 &e

-he $om"an1 is develo"ing a s"e$i.i$ training mod/le to

$oin$ide 3ith develo"ments and reg/lations iss/ed &1 the Cons/mer %inan$ial 9rote$tion :/rea/ (C%9: to determine that $ore "ro$esses are

3ide learning h/& that 3ill o..er E2Learning

3ill in$l/de re0/ired learning mod/les that 3ill "rovide the .o/ndation .or individ/al em"lo1ee learning

/rses. -he $om"an1 "lans to in$or"orate a minim/m training $redits re0/irement enter"rise2

the re0/isite Co& s,ills, ,no3ledge, and $areer "ath o""ort/nities.

via e4ternal vendors, in$l/ding la3 .irms, title $om"anies, and real estate agent. :/siness teams meet at

least 3ee,l1 to dis$/ss &est "ra$ti$es and to dis$/ss and im"lement &/siness "ro$ess $hanges. @ail1 Fstand/"G meetings are also held among

m"ensation "lan that is revie3ed $olle$tivel1

the si5e o. the organi5ation and the s$o"e

that the e..e$tiveness and diversit1 o. the training "rogram and deliver1 methods 3ill $ontin/e to

&e enhan$ed thro/gh vario/s initiatives s/$h as re0/ired learning "lans and minim/m training $redits over the ne4t 12 months.

. A revie3 o. the #OC 1 re"ort .or the "eriod

An ann/al .inan$ial a/dit is "er.ormed &1 an e4ternal

3ide 0/alit1 $ontrol is em&edded thro/gho/t vario/s "ro$esses and transa$tions $ond/$ted &1 the $om"an1.

al a$$o/nting $ontrols are in "la$e and are delineated &1 segregation o. d/ties, m/lti"le revie3s and signo..s &1 )RC and Cla1ton.

"/rs/ant to servi$e level agreements is a$$om"lished thro/gh vario/s s$ore$ards that tra$, internal "er.orman$e

metri$s 3hi$h are then rolled /" dail1, 3ee,l1 and monthl1 and es$alated thro/gh vario/s management $hannels. :lan, $he$, sto$, is stored in

ent ena&les the $om"an1 to store $lient

Operational Risk Assessment: Green River Capital LLC

2013 Morningstar Credit Ratings, LLC. All Rights Reserved.

9 a g e A J

s"e$i.i$ "arameters in$l/ding $/stomi5ed "ro$essing and delegated a/thorit1 levels that hel" to ens/re $om"lian$e 3ith $lient

em"lo1ees m/st sign a $or"orate $om"lian$e "oli$1 do$/ment on an ann/al &a

overseeing s1stems and net3or, se$/rit1. Monthl1 re"orts en$om"assing o"erating "er.orman$e metri$s and .inan$ial data are

the &/siness /nits and roll /" to the e4e$/tive tea

)RC maintains do$/mented "oli$ies and "ro$ed/res on its shared net3or, drive that

te$hni$al 3riter is on sta.. to $oordinate, 3rite and distri&/te "oli$1 and "ro$ed/re /"dates enter"rise

$/stomi5ed &ased on s"e$i.i$ $lient re0/irements

&/siness /nit to dis$/ss and im"lement "oli$1 and "ro$ed/re /"dates.

Assess'ent: 6n o/r vie3, )RC has

$ontrols and adheren$e to esta&lished "ro$ed/res

o. vendor &/siness "ro$esses. )RC sho/ld $onsider migrating the storage o. "oli$1 and "ro$ed/re man/als .rom a shared drive to an

intranet site .or in$reased ease o. /se, retrieval and $onsisten$1.

Legal Lia$ility and Corporate 1ns/rance

)RC management dis$losed it is not a "arti$i"ant in an1 "ending material

&/siness ins/ran$e $overage to "rote$t against vario/s lia&ilities and $ontingen$ies.

ins/red as re0/ired "/rs/ant to the "arties agreement.

Assess'ent: Overall, 3e &elieve that

and is not s/&Ce$t to an1 o/tstanding material litigation

)yste's Arc*itect/re, -ro;ect Manage'ent,

)RC /tili5es a variet1 o. "ro"rietar1 and third "art1

s$ala&le and .le4i&le .rom a "ro$essing and &/siness gro3th "ers"e$tive.

monitor and tra$, all as"e$ts o. the Real Estate O3ned asset management li.e $1$l

negotiation and $losing. -he a""li$ation is also /sed .or short sale and deed

a""li$ation that serves as a $omm/ni$ation inter.a$e &et3een )RC

mar,eting "ro$ess in$l/ding evi$tion "ro$essing, val/ation revie3s, "ro"ert1 ins"e$tions, mar,eting "lans, o..er negotiation,

$lient invoi$ing. -he $om"an1+s "ro"rietar1 AgentConne4 a""li$ation manages real estate agent in.ormation in$l/ding li$ensing, ins/ran$e

in.ormation and $onta$t details. Realt1 9ilot is a

ins"e$tion ordering and "ro$essing. M# Light#3it$h is similarl1 /sed .or

@1nami$ )9 so.t3are is /sed .or all general ledger and a$$o/nting ./n$tions and the $om"an1 /ses 6nvoi$e Management o..ered &

9ro$essing #ervi$es, 6n$. .or "ro$essing $lient invoi$ing and reim&/rsements. 6n addition to its internal REOConne4 s1stem,

vario/s data and in.ormation to $lients via third "art1 3e&

)RC has /tili5ed an e4ternal vendor .or "ortions o.

res"onsi&le .or dra.ting /"dates to the glo&al disaster re$over1 man/al 3hi$h is revie3ed &1 the e4e$/tive team ann/all1.

restores are $om"leted 3ith a ./ll disaster re$over1 test a$$om"lished ann/all1. -i

digital &a$,/" ta"es are stored at an o..2site .a$ilit1

)RC+s te$hnolog1 is &/ilt aro/nd 3e&2&ased a""

site. @/ring 2013, )RC is em&ar,ing on an enter"rise

strateg1. )RC 3ill engage in Coint in.rastr/$t/re "roCe$ts 3ith its "arent, Cla1ton. )RC 3ill migrate a3a1 .rom a third "art1 vendor "rovider .or

&/siness $ontin/it1 and instead 3ill im"lement a red/ndan$1 strateg1 /tili5ing )RC+s #alt La,e Cit1 head0/arters as a $o

Cla1ton+s #helton, C- head0/arters as 10K data $a"t/re is a$$om"lished via

.a$ilitate &/siness re$over1 time and "rovide more $om"rehensive testing. -he disaster re$over1 and &/sin

to re.le$t the $hanges.

)RC re"orts /" to a Chie. 6n.ormation O..i$er at the Cla1ton $or"orate level. 6nternal te$hnolog1 "roCe$ts are

in$or"orated into an ann/al road ma". A "roCe$t ma

Capital LLC| October 2013 | ratingagency.morningstar.com | 00 2!!

All Rights Reserved.

s"e$i.i$ "arameters in$l/ding $/stomi5ed "ro$essing and delegated a/thorit1 levels that hel" to ens/re $om"lian$e 3ith $lient

em"lo1ees m/st sign a $or"orate $om"lian$e "oli$1 do$/ment on an ann/al &asis. A dedi$ated se$/rit1 o..i$er .rom Cla1ton is res"onsi&le .or

overseeing s1stems and net3or, se$/rit1. Monthl1 re"orts en$om"assing o"erating "er.orman$e metri$s and .inan$ial data are

the &/siness /nits and roll /" to the e4e$/tive team.

maintains do$/mented "oli$ies and "ro$ed/res on its shared net3or, drive that en$om"ass its $ore

te$hni$al 3riter is on sta.. to $oordinate, 3rite and distri&/te "oli$1 and "ro$ed/re /"dates enter"rise23ide. 9oli$1 a

$/stomi5ed &ased on s"e$i.i$ $lient re0/irements to ens/re $om"lian$e 3ith servi$e level agreements. Monthl1 meetings are held among the

&/siness /nit to dis$/ss and im"lement "oli$1 and "ro$ed/re /"dates.

has so/nd m/lti2level a/diting and 0/alit1 $ontrol me$hanisms

and adheren$e to esta&lished "ro$ed/res. 'e &elieve the $om"an1+s "oli$ies and "ro$ed/res ade0/atel1 address $ore areas

)RC sho/ld $onsider migrating the storage o. "oli$1 and "ro$ed/re man/als .rom a shared drive to an

intranet site .or in$reased ease o. /se, retrieval and $onsisten$1.

it is not a "arti$i"ant in an1 "ending material litigation related to its o"erations.

&/siness ins/ran$e $overage to "rote$t against vario/s lia&ilities and $ontingen$ies. Most )RC and )R% $

ins/red as re0/ired "/rs/ant to the "arties agreement.

Overall, 3e &elieve that )RC, &ased on its re"resentations, e..e$tivel1 addresses its $or"orate ins/ran$e re0/irements

ding material litigation.

-ro;ect Manage'ent, <et0ork )ec/rity and 2isaster Recovery

third "art1 te$hnolog1 a""li$ations in its dail1 &/siness transa$tions.

s$ala&le and .le4i&le .rom a "ro$essing and &/siness gro3th "ers"e$tive. REOConne4 is a "ro"rietar1 3e&

monitor and tra$, all as"e$ts o. the Real Estate O3ned asset management li.e $1$le, in$l/ding "ro"ert1 maintenan$e, mar,eting, sale

negotiation and $losing. -he a""li$ation is also /sed .or short sale and deed2in2lie/ o. .ore$los/re "ro$essing. REOConne4 is a real time

a""li$ation that serves as a $omm/ni$ation inter.a$e &et3een )RC asset managers and real estate agents

mar,eting "ro$ess in$l/ding evi$tion "ro$essing, val/ation revie3s, "ro"ert1 ins"e$tions, mar,eting "lans, o..er negotiation,

"rietar1 AgentConne4 a""li$ation manages real estate agent in.ormation in$l/ding li$ensing, ins/ran$e

in.ormation and $onta$t details. Realt1 9ilot is a third "art1 3e&2&ased a""li$ation that is /tili5ed .or :ro,er 9ri$e O"inion (:9O and "ro"ert1

ion ordering and "ro$essing. M# Light#3it$h is similarl1 /sed .or $ollateral revie3 and do$/ment tra$,ing

@1nami$ )9 so.t3are is /sed .or all general ledger and a$$o/nting ./n$tions and the $om"an1 /ses 6nvoi$e Management o..ered &

9ro$essing #ervi$es, 6n$. .or "ro$essing $lient invoi$ing and reim&/rsements. 6n addition to its internal REOConne4 s1stem,

vario/s data and in.ormation to $lients via third "art1 3e&2&ased a""li$ations s/$h as the E0/ator 'or,statio

"ortions o. disaster re$over1 and &/siness $ontin/it1 "rovisioning.

res"onsi&le .or dra.ting /"dates to the glo&al disaster re$over1 man/al 3hi$h is revie3ed &1 the e4e$/tive team ann/all1.

restores are $om"leted 3ith a ./ll disaster re$over1 test a$$om"lished ann/all1. -ier 1 a""li$ations are restored 3ithin 3< ho/rs

site .a$ilit1. A generator $an "rovide $ontin/o/s "o3er d/ring an interr/"tion at the main .a$ilit1.

&ased a""li$ations, em"lo1ees $an 3or, .rom home, i. ne$essar1, d/ring an interr/"tion at the main 3or,

@/ring 2013, )RC is em&ar,ing on an enter"rise23ide &/siness $ontin/it1 "lat.orm that 3ill in$or"orate a geogra"hi$al red/ndan$1

in Coint in.rastr/$t/re "roCe$ts 3ith its "arent, Cla1ton. )RC 3ill migrate a3a1 .rom a third "art1 vendor "rovider .or

&/siness $ontin/it1 and instead 3ill im"lement a red/ndan$1 strateg1 /tili5ing )RC+s #alt La,e Cit1 head0/arters as a $o

as 10K data $a"t/re is a$$om"lished via2dis,2to dis, Co/rnaling. -he "lat.orm

.a$ilitate &/siness re$over1 time and "rovide more $om"rehensive testing. -he disaster re$over1 and &/sin

)RC re"orts /" to a Chie. 6n.ormation O..i$er at the Cla1ton $or"orate level. 6nternal te$hnolog1 "roCe$ts are

in$or"orated into an ann/al road ma". A "roCe$t management data&ase is /"dated 0/arterl1 and te$hnolog1 "roCe$ts are "rioriti5ed 3ith in"/t

.com | 00 2!!"1##$

s"e$i.i$ "arameters in$l/ding $/stomi5ed "ro$essing and delegated a/thorit1 levels that hel" to ens/re $om"lian$e 3ith $lient g/idelines. All

A dedi$ated se$/rit1 o..i$er .rom Cla1ton is res"onsi&le .or

overseeing s1stems and net3or, se$/rit1. Monthl1 re"orts en$om"assing o"erating "er.orman$e metri$s and .inan$ial data are develo"ed &1

&/siness "ra$ti$es. A dedi$ated

3ide. 9oli$1 and "ro$ess man/als are

to ens/re $om"lian$e 3ith servi$e level agreements. Monthl1 meetings are held among the

s in "la$e to monitor o"erational

he $om"an1+s "oli$ies and "ro$ed/res ade0/atel1 address $ore areas

)RC sho/ld $onsider migrating the storage o. "oli$1 and "ro$ed/re man/als .rom a shared drive to an

litigation related to its o"erations. -he $om"an1 maintains a""ro"riate

Most )RC and )R% $lients are listed as an additional

, &ased on its re"resentations, e..e$tivel1 addresses its $or"orate ins/ran$e re0/irements

te$hnolog1 a""li$ations in its dail1 &/siness transa$tions. -he s1stems ar$hite$t/re is ./ll1

a "ro"rietar1 3e&2&ased a""li$ation that is /sed to

e, in$l/ding "ro"ert1 maintenan$e, mar,eting, sale

lie/ o. .ore$los/re "ro$essing. REOConne4 is a real time

asset managers and real estate agents that tra$, vario/s ste"s in the REO

mar,eting "ro$ess in$l/ding evi$tion "ro$essing, val/ation revie3s, "ro"ert1 ins"e$tions, mar,eting "lans, o..er negotiation, $losing "ro$ess and

"rietar1 AgentConne4 a""li$ation manages real estate agent in.ormation in$l/ding li$ensing, ins/ran$e

a""li$ation that is /tili5ed .or :ro,er 9ri$e O"inion (:9O and "ro"ert1

revie3 and do$/ment tra$,ing "/r"oses. Mi$roso.t+s

@1nami$ )9 so.t3are is /sed .or all general ledger and a$$o/nting ./n$tions and the $om"an1 /ses 6nvoi$e Management o..ered &1 Lender

9ro$essing #ervi$es, 6n$. .or "ro$essing $lient invoi$ing and reim&/rsements. 6n addition to its internal REOConne4 s1stem, )RC "rovides

&ased a""li$ations s/$h as the E0/ator 'or,station, RE#.DE- and 91ramid 9lat.orm.

disaster re$over1 and &/siness $ontin/it1 "rovisioning. A dedi$ated te$hni$al 3riter is

res"onsi&le .or dra.ting /"dates to the glo&al disaster re$over1 man/al 3hi$h is revie3ed &1 the e4e$/tive team ann/all1. L/arterl1 s1stem

er 1 a""li$ations are restored 3ithin 3< ho/rs and nightl1

A generator $an "rovide $ontin/o/s "o3er d/ring an interr/"tion at the main .a$ilit1. #in$e

li$ations, em"lo1ees $an 3or, .rom home, i. ne$essar1, d/ring an interr/"tion at the main 3or,

3ide &/siness $ontin/it1 "lat.orm that 3ill in$or"orate a geogra"hi$al red/ndan$1

in Coint in.rastr/$t/re "roCe$ts 3ith its "arent, Cla1ton. )RC 3ill migrate a3a1 .rom a third "art1 vendor "rovider .or

&/siness $ontin/it1 and instead 3ill im"lement a red/ndan$1 strateg1 /tili5ing )RC+s #alt La,e Cit1 head0/arters as a $o2lo$ation .a$ilit1 3ith

-he "lat.orm red/ndan$1 strateg1 3ill

.a$ilitate &/siness re$over1 time and "rovide more $om"rehensive testing. -he disaster re$over1 and &/siness $ontin/it1 "lan is &eing re3ritten

)RC re"orts /" to a Chie. 6n.ormation O..i$er at the Cla1ton $or"orate level. 6nternal te$hnolog1 "roCe$ts are $oordinated 3ith Cla1ton and

nagement data&ase is /"dated 0/arterl1 and te$hnolog1 "roCe$ts are "rioriti5ed 3ith in"/t

Operational Risk Assessment: Green River Capital LLC

2013 Morningstar Credit Ratings, LLC. All Rights Reserved.

9 a g e A I

&1 &/siness leaders. #/&Ce$t matter e4"erts in the &/siness gro/"s "arti$i"ate in /ser a$$e"tan$e testing and monthl1 te$hnolog1 releases are

iss/ed $ontaining s1stem enhan$ement in.ormation.

and /ser "ass3ord "roto$ols. Hser "ass3ords are tas, and role s"e$i.i$ 3ithin the organi5ation and "ass3ord $hanges and dele

$omm/ni$ated in real time &et3een h/man reso/r$es and in.ormation te$hnolog1

/na/thori5ed s1stem a$$ess. -he $om"an1 has $om"rehensive enter"rise

"rote$t the integrit1 o. $on.idential data as it is stored or $omm/ni$ated internall1 or e4ternall1.

intr/sion "revention s1stems designed to identi.1 and minimi5e mali$io/s a$tivit1. A$tive net3or, s$anning and se$/rit1 moni

"er.ormed to identi.1 s1stem v/lnera&ilities.

Assess'ent: Morningstar &elieves that

management re0/irements as 3ell as its internal "ro$essing needs and e4ternal $lient "er.orman$e management. -he $om"an1+s

"ro"rietar1 te$hnolog1 "rovides the .le4i&ilit1 ne$essar1 to meet individ/al $lient re0/irements and "rovides the agilit1 re0

introd/$e ne3 "rod/$ts and servi$es into the mar,et"la$e.

is leveraging Cla1ton+s te$hnolog1 "lat.orm and geogra"hi$ lo$ation to "rovide a more ro&/st

$ontin/it1 regimen.

-erfor'ance Manage'ent: !endor -erfor'ance Metrics

(MR R!8) R& Asset Manage'ent

)RC "rovides REO asset management servi$es .or third "art1 $lients.

$lients. -hese servi$es in$l/de determining the estimated mar,et val/e (EMV .or

strateg1 .or asset mar,eting. )RC 3ill monitor mar,et .l/$t/ations, l

re"air &ids. )RC 3ill oversee o..er negotiations as 3ell as the $losing "ro$ess and .inal asset dis"osition.

a/thori5ation a""roval levels are determined &1 Co& level among sales s"e$ialists, senior sales s"e$ialists and managers.

Loan .oarding and -re=Listing

)RC /tili5es its "ro"ietar1 REOConne4 s1stem

managers and real estate agents to notate a$tions d/ring the mar,eting "ro$ess on a real

.ollo3ing "ro$esses!

Evi$tion 9ro$ess -ra$,ing

Val/ation Revie3E

6ns"e$tion -ra$,ingE

Mar,eting 9lans and #tat/s Re"orts

O..er DegotiationE

Closing 9ro$ess -ra$,ingE

Client OversightE and

Client 6nvoi$ing.

De3 assets $an &e &oarded in a n/m&er o. 3a1s in$l/ding! email, se$/re .ile trans.er "roto$ol (%-9 site,

re$ord. -he asset set2/" $ler, (A#C "ro$eeds 3ith the &oarding o. the asset validating all asset details "rovided &1 the $lient as 3ell as other

)RC2s"e$i.i$ details s/$h as the stat/s o. the "ro"ert1 (a$0/ired, redem

the Asset #et2H" Manager 3ho "er.orms a $om"rehensive revie3 o. the &oarded assets to

relevant asset details are $om"lete and $orre$t. As "art o. this "ro$ess, the manager 3ill $he$, the date and time stam" o.

.ile and re$on$ile that in.ormation 3ith the $om"letion date o. the A

"/rs/ant to esta&lished $lient and $om"an1 g/idelines. -he $lient .ile is then .or3arded to the Vendor Management de"artment

estate agent 3ill &e assigned. As an additional level o. revie3, the Vendor Manager (VM revie3s a dail1 re"ort that lists all assets that have a

&oarded stat/s &/t have aged more than one da1 3itho/t &eing assigned to an e4ternal real estate agent. -he VM 3ill .ollo3

the asset is timel1 re.erred to an agent. A 3ee,l1 re"ort o. aged assets is revie3ed, along 3ith s/""orting notes, and es$alated to an

Controls Anal1st and e4e$/tive management.

Capital LLC| October 2013 | ratingagency.morningstar.com | 00 2!!

All Rights Reserved.

#/&Ce$t matter e4"erts in the &/siness gro/"s "arti$i"ate in /ser a$$e"tan$e testing and monthl1 te$hnolog1 releases are

iss/ed $ontaining s1stem enhan$ement in.ormation. A dedi$ated enter"rise23ide se$/rit1 o..i$er is res"onsi&le .or ens/ring net3or, se$

and /ser "ass3ord "roto$ols. Hser "ass3ords are tas, and role s"e$i.i$ 3ithin the organi5ation and "ass3ord $hanges and dele

$omm/ni$ated in real time &et3een h/man reso/r$es and in.ormation te$hnolog1 and revie3ed monthl1 and semi

-he $om"an1 has $om"rehensive enter"rise23ide en$r1"tion and .ire3all "oli$ies and methodologies in "la$e to

"rote$t the integrit1 o. $on.idential data as it is stored or $omm/ni$ated internall1 or e4ternall1. )RC+s $om"/ter net3or, in$or"orates several

intr/sion "revention s1stems designed to identi.1 and minimi5e mali$io/s a$tivit1. A$tive net3or, s$anning and se$/rit1 moni

ar &elieves that )RC o"erates 3ithin a highl1 e..e$tive te$hnolog1 ar$hite$t/re designed

management re0/irements as 3ell as its internal "ro$essing needs and e4ternal $lient "er.orman$e management. -he $om"an1+s

"ro"rietar1 te$hnolog1 "rovides the .le4i&ilit1 ne$essar1 to meet individ/al $lient re0/irements and "rovides the agilit1 re0

introd/$e ne3 "rod/$ts and servi$es into the mar,et"la$e. )RC has $om"rehensive data integrit1 and se$/rit1 "roto$ols in "la$e and

is leveraging Cla1ton+s te$hnolog1 "lat.orm and geogra"hi$ lo$ation to "rovide a more ro&/st glo&al

-erfor'ance Manage'ent: !endor -erfor'ance Metrics

)RC "rovides REO asset management servi$es .or third "art1 $lients. )RC has a&o/t 1I.>00 assets /nder management on average 3ith 22

-hese servi$es in$l/de determining the estimated mar,et val/e (EMV .or Fas2isG and Fre"airedG

strateg1 .or asset mar,eting. )RC 3ill monitor mar,et .l/$t/ations, listing a$tivit1, $hanges in "ro"ert1 $onditions

re"air &ids. )RC 3ill oversee o..er negotiations as 3ell as the $losing "ro$ess and .inal asset dis"osition.

ned &1 Co& level among sales s"e$ialists, senior sales s"e$ialists and managers.

)RC /tili5es its "ro"ietar1 REOConne4 s1stem, as 3ell as other third "art1 s1stems, as a $omm/ni$ation "ortal &et3een the $om"an1+s asset

managers and real estate agents to notate a$tions d/ring the mar,eting "ro$ess on a real2time &asis. -he s1stems are

Evi$tion 9ro$ess -ra$,ingE

Mar,eting 9lans and #tat/s Re"ortsE

E

De3 assets $an &e &oarded in a n/m&er o. 3a1s in$l/ding! email, se$/re .ile trans.er "roto$ol (%-9 site,

"ro$eeds 3ith the &oarding o. the asset validating all asset details "rovided &1 the $lient as 3ell as other

s"e$i.i$ details s/$h as the stat/s o. the "ro"ert1 (a$0/ired, redem"tion or $on.irmation. On$e re$on$iled, the A#C .or3ards an email to

3ho "er.orms a $om"rehensive revie3 o. the &oarded assets to monitor that &oarding 3as $om"leted and that all

relevant asset details are $om"lete and $orre$t. As "art o. this "ro$ess, the manager 3ill $he$, the date and time stam" o.

.ile and re$on$ile that in.ormation 3ith the $om"letion date o. the A#C+s email to determine i. assets are &oarded 3ithin an a$$e"ta&le timeline

"/rs/ant to esta&lished $lient and $om"an1 g/idelines. -he $lient .ile is then .or3arded to the Vendor Management de"artment

tional level o. revie3, the Vendor Manager (VM revie3s a dail1 re"ort that lists all assets that have a

&oarded stat/s &/t have aged more than one da1 3itho/t &eing assigned to an e4ternal real estate agent. -he VM 3ill .ollo3

is timel1 re.erred to an agent. A 3ee,l1 re"ort o. aged assets is revie3ed, along 3ith s/""orting notes, and es$alated to an

Controls Anal1st and e4e$/tive management.

.com | 00 2!!"1##$

#/&Ce$t matter e4"erts in the &/siness gro/"s "arti$i"ate in /ser a$$e"tan$e testing and monthl1 te$hnolog1 releases are

3ide se$/rit1 o..i$er is res"onsi&le .or ens/ring net3or, se$/rit1

and /ser "ass3ord "roto$ols. Hser "ass3ords are tas, and role s"e$i.i$ 3ithin the organi5ation and "ass3ord $hanges and deletions are

and revie3ed monthl1 and semi2ann/all1 to minimi5e

"oli$ies and methodologies in "la$e to

+s $om"/ter net3or, in$or"orates several

intr/sion "revention s1stems designed to identi.1 and minimi5e mali$io/s a$tivit1. A$tive net3or, s$anning and se$/rit1 monitoring is ro/tinel1

ar$hite$t/re designed to meet its data

management re0/irements as 3ell as its internal "ro$essing needs and e4ternal $lient "er.orman$e management. -he $om"an1+s

"ro"rietar1 te$hnolog1 "rovides the .le4i&ilit1 ne$essar1 to meet individ/al $lient re0/irements and "rovides the agilit1 re0/ired to

)RC has $om"rehensive data integrit1 and se$/rit1 "roto$ols in "la$e and

glo&al disaster re$over1 and &/siness

assets /nder management on average 3ith 22

assets and sele$ting the a""ro"riate

isting a$tivit1, $hanges in "ro"ert1 $onditions, mar,eting e4"enses and

re"air &ids. )RC 3ill oversee o..er negotiations as 3ell as the $losing "ro$ess and .inal asset dis"osition. %/n$tional res"onsi&ilities and

ned &1 Co& level among sales s"e$ialists, senior sales s"e$ialists and managers.

as a $omm/ni$ation "ortal &et3een the $om"an1+s asset

-he s1stems are /sed to manage the

De3 assets $an &e &oarded in a n/m&er o. 3a1s in$l/ding! email, se$/re .ile trans.er "roto$ol (%-9 site, and dire$t .rom a $lient+s s1stem o.

"ro$eeds 3ith the &oarding o. the asset validating all asset details "rovided &1 the $lient as 3ell as other

. On$e re$on$iled, the A#C .or3ards an email to

that &oarding 3as $om"leted and that all

relevant asset details are $om"lete and $orre$t. As "art o. this "ro$ess, the manager 3ill $he$, the date and time stam" o. the in$oming $lient

#C+s email to determine i. assets are &oarded 3ithin an a$$e"ta&le timeline

"/rs/ant to esta&lished $lient and $om"an1 g/idelines. -he $lient .ile is then .or3arded to the Vendor Management de"artment 3here a real

tional level o. revie3, the Vendor Manager (VM revie3s a dail1 re"ort that lists all assets that have a

&oarded stat/s &/t have aged more than one da1 3itho/t &eing assigned to an e4ternal real estate agent. -he VM 3ill .ollo32/" to see that

is timel1 re.erred to an agent. A 3ee,l1 re"ort o. aged assets is revie3ed, along 3ith s/""orting notes, and es$alated to an 6nternal

Operational Risk Assessment: Green River Capital LLC

2013 Morningstar Credit Ratings, LLC. All Rights Reserved.

9 a g e A ?

Assess'ent: Morningstar &elieves that

te$hnolog1 .or &oarding assets and re$on$iling data integrit1. -he m/lti"le levels o. revie3 serve to

a$$/ratel1 in a$$ordan$e 3ith esta&lished $om"an1 g/idelines and $lient

,itle, HA and Real &state ,a4 Ad'inistration

Hnen$/m&ered title is an integral as"e$t o. mar,eting an REO asset.

an asset. -he title order re"ort is revie3ed dail1 &1 an A#C to

$om"anies designated &1 the $lient and maintains individ/al state

"o"/lated in REOConne4 .or tra$,ing "/r"oses.

missing title re"ort is revie3ed &1 the A#C to ens/re that title is re$eived 3ithin the 1> da1 t/rnaro/nd time. An1 dela1s in re$eiving title

$ommitments are es$alated to management and the title $om"an1. 'ithin three da1s o. re$eiving the title

/sing REOConne4, 3ill revie3 the title $ommitment and notate an1 o/tstanding iss/es 3ith an estimated $om"letion time

and moving the asset to /nder $ontra$t stat/s.

D/m&er o. aged assets 3ith o/tstanding

9er$entage o. assets 3ith $lear title as a ratio to total asset $o/nt

D/m&er o. title orders re0/ested and re$eived as 3ell as timeline e4$e"tions

D/m&er o. assets assigned to title s"e$ialists as 3ell as their individ/al "er.orman$e metri$s

-he -itle Manager revie3s the re"ort to identi.1 "er.orman$e trends and "rovides .eed&a$, to title s"e$ialists as "e

8omeo3ner Asso$iation (8OA .ees and real estate ta4es are revie3ed to

mar,eting "ro$ess. 9ost2&oarding, the 8OA Coordinator 3ill re0/est the

in$l/ding "ar$el n/m&er and ta4ing a/thorit1 $onta$t in.ormation 3ithin a three da1 t/rnaro/nd time. H"on re$ei"t, the in.or

into REOConne4 .or tas, tra$,ing "/r"oses. )RC 3ill .ollo3 /" 3ith the ta4ing m/ni$i"alit1 and 8

3ho 3ill advise and a""rove "a1ment amo/nts. A monthl1 "er.orman$e re"ort is "rod/$ed and revie3ed &1 the Asset :oardingM8OA

that in$l/des o"erational metri$s s/$h as!

Client s"e$i.i$ asset stat/s (

Aged asets &e1ond 30 da1s re0/iring .ollo3

#"e$ialist s"e$i.i$ n/m&er o. assets and monthl1 "er.orman$e, in$l/ding e4$e"tions

-he Asset :oardingM8OA Manager revie3s the

re0/ires.

)RC also "rovides $ode violation servi$es to its $lients. A Code Violation Coordinator (CVC 3or,s 3ith the agent, title de"

m/ni$i"alit1 to o&tain $ode violation in.ormation 3hi$h is then /"loaded to REOConne4 .or tra$,ing. -he CVC revie3s a dail1 re"o

violation in.ormation that is /sed to "rioriti5e assets &ased on violation t1"e and e4"os/re. -he CVC then $omm/ni$ates

m/ni$i"alit1 to resolve violations in$l/ding negotiation and "a1ment.

that in$l/des o"erational metri$s s/$h as!

Client s"e$i.i$ asset stat/s (D/m&er &oarded and $l

Aged asets &e1ond 30 da1s 3ith $ode violations re0/iring .ollo3

CVC s"e$i.i$ n/m&er o. assets and monmthl1 "er.orman$e, in$l/ding e4$e"tions

Assess'ent: Morningstar &elieves that

environment that in$l/des e..e$tive te$hnolog1 .or identi.1ing and resear$hing o/tstanding items related to title iss/es, o/t

8OA .ees, "ro"ert1 ta4es and $ode violati

Capital LLC| October 2013 | ratingagency.morningstar.com | 00 2!!

All Rights Reserved.

Morningstar &elieves that )RC o"erates 3ithin a 3ell $ontrolled loan &oarding environment that in$l/des e..e$tive

te$hnolog1 .or &oarding assets and re$on$iling data integrit1. -he m/lti"le levels o. revie3 serve to

a$$/ratel1 in a$$ordan$e 3ith esta&lished $om"an1 g/idelines and $lient dire$tives.

,itle, HA and Real &state ,a4 Ad'inistration

Hnen$/m&ered title is an integral as"e$t o. mar,eting an REO asset. )RC+s -itle @e"artment assigns a title re0/est 3ithin =I ho/rs o. &ording

an asset. -he title order re"ort is revie3ed dail1 &1 an A#C to monitor that title has &een ordered on all re0/isite assets. -he A#C /ses title

$om"anies designated &1 the $lient and maintains individ/al state and $lient s"e$i.i$ $riteria .or title $om"an1 sele$tion. -he title order date is

"o"/lated in REOConne4 .or tra$,ing "/r"oses. -itle $ommitments are s$hed/led to &e re$eived 3ithin 1> da1s o. the order date and a 3ee,l1

&1 the A#C to ens/re that title is re$eived 3ithin the 1> da1 t/rnaro/nd time. An1 dela1s in re$eiving title

$ommitments are es$alated to management and the title $om"an1. 'ithin three da1s o. re$eiving the title

EOConne4, 3ill revie3 the title $ommitment and notate an1 o/tstanding iss/es 3ith an estimated $om"letion time

and moving the asset to /nder $ontra$t stat/s. A $om"rehensive monthl1 re"ort is "re"ared 3ith "er.orman$e metri$s in$l/

D/m&er o. aged assets 3ith o/tstanding title iss/es 3ithin 120 da1s o. title re"ortE

9er$entage o. assets 3ith $lear title as a ratio to total asset $o/ntE

D/m&er o. title orders re0/ested and re$eived as 3ell as timeline e4$e"tionsE and

o. assets assigned to title s"e$ialists as 3ell as their individ/al "er.orman$e metri$s

-he -itle Manager revie3s the re"ort to identi.1 "er.orman$e trends and "rovides .eed&a$, to title s"e$ialists as "e

8omeo3ner Asso$iation (8OA .ees and real estate ta4es are revie3ed to monitor that o/tstanding or "ast d/e items do not im"ede the REO

&oarding, the 8OA Coordinator 3ill re0/est the re0/isite in.ormation .rom the agent .or 8OA and

in$l/ding "ar$el n/m&er and ta4ing a/thorit1 $onta$t in.ormation 3ithin a three da1 t/rnaro/nd time. H"on re$ei"t, the in.or

into REOConne4 .or tas, tra$,ing "/r"oses. )RC 3ill .ollo3 /" 3ith the ta4ing m/ni$i"alit1 and 8OA and $omm/ni$ate the res/lts to the $lient

3ho 3ill advise and a""rove "a1ment amo/nts. A monthl1 "er.orman$e re"ort is "rod/$ed and revie3ed &1 the Asset :oardingM8OA

Client s"e$i.i$ asset stat/s (n/m&er &oarded and $losedE (&eginning and ending monthl1 &alan$es

Aged asets &e1ond 30 da1s re0/iring .ollo32/" and resol/tion, and

#"e$ialist s"e$i.i$ n/m&er o. assets and monthl1 "er.orman$e, in$l/ding e4$e"tions.

revie3s the re"ort to identi.1 "er.orman$e trends and "rovides .eed&a$, to

)RC also "rovides $ode violation servi$es to its $lients. A Code Violation Coordinator (CVC 3or,s 3ith the agent, title de"

i"alit1 to o&tain $ode violation in.ormation 3hi$h is then /"loaded to REOConne4 .or tra$,ing. -he CVC revie3s a dail1 re"o

violation in.ormation that is /sed to "rioriti5e assets &ased on violation t1"e and e4"os/re. -he CVC then $omm/ni$ates

m/ni$i"alit1 to resolve violations in$l/ding negotiation and "a1ment. A monthl1 "er.orman$e re"ort is "rod/$ed and revie3ed &1 management

Client s"e$i.i$ asset stat/s (D/m&er &oarded and $losedE &eginning and ending monthl1 &alan$es

Aged asets &e1ond 30 da1s 3ith $ode violations re0/iring .ollo32/" and resol/tion, and

CVC s"e$i.i$ n/m&er o. assets and monmthl1 "er.orman$e, in$l/ding e4$e"tions.

Morningstar &elieves that )RC o"erates 3ithin a 3ell $ontrolled title, 8OA and real estate ta4 administration

environment that in$l/des e..e$tive te$hnolog1 .or identi.1ing and resear$hing o/tstanding items related to title iss/es, o/t

8OA .ees, "ro"ert1 ta4es and $ode violations. )RC has 3ell esta&lished timelines .or investigating and re0/esting data and invoi$es

.com | 00 2!!"1##$

oan &oarding environment that in$l/des e..e$tive

te$hnolog1 .or &oarding assets and re$on$iling data integrit1. -he m/lti"le levels o. revie3 serve to monitor that assets are &oarded

a title re0/est 3ithin =I ho/rs o. &ording

ordered on all re0/isite assets. -he A#C /ses title

and $lient s"e$i.i$ $riteria .or title $om"an1 sele$tion. -he title order date is

$eived 3ithin 1> da1s o. the order date and a 3ee,l1

&1 the A#C to ens/re that title is re$eived 3ithin the 1> da1 t/rnaro/nd time. An1 dela1s in re$eiving title

$ommitments are es$alated to management and the title $om"an1. 'ithin three da1s o. re$eiving the title $ommitment, a -itle #"e$ialist,

EOConne4, 3ill revie3 the title $ommitment and notate an1 o/tstanding iss/es 3ith an estimated $om"letion time "rior to $learing title

A $om"rehensive monthl1 re"ort is "re"ared 3ith "er.orman$e metri$s in$l/ding the!

o. assets assigned to title s"e$ialists as 3ell as their individ/al "er.orman$e metri$s.

-he -itle Manager revie3s the re"ort to identi.1 "er.orman$e trends and "rovides .eed&a$, to title s"e$ialists as "er.orman$e re0/ires.

that o/tstanding or "ast d/e items do not im"ede the REO

re0/isite in.ormation .rom the agent .or 8OA and "ro"ert1 ta4es

in$l/ding "ar$el n/m&er and ta4ing a/thorit1 $onta$t in.ormation 3ithin a three da1 t/rnaro/nd time. H"on re$ei"t, the in.ormation is entered

OA and $omm/ni$ate the res/lts to the $lient

3ho 3ill advise and a""rove "a1ment amo/nts. A monthl1 "er.orman$e re"ort is "rod/$ed and revie3ed &1 the Asset :oardingM8OA Manager

&eginning and ending monthl1 &alan$esE

s and "rovides .eed&a$, to s"e$ialists as "e.orman$e

)RC also "rovides $ode violation servi$es to its $lients. A Code Violation Coordinator (CVC 3or,s 3ith the agent, title de"artment and

i"alit1 to o&tain $ode violation in.ormation 3hi$h is then /"loaded to REOConne4 .or tra$,ing. -he CVC revie3s a dail1 re"ort o. $ode

violation in.ormation that is /sed to "rioriti5e assets &ased on violation t1"e and e4"os/re. -he CVC then $omm/ni$ates 3ith the agent and

A monthl1 "er.orman$e re"ort is "rod/$ed and revie3ed &1 management

osedE &eginning and ending monthl1 &alan$esE

, and

in a 3ell $ontrolled title, 8OA and real estate ta4 administration

environment that in$l/des e..e$tive te$hnolog1 .or identi.1ing and resear$hing o/tstanding items related to title iss/es, o/tstanding

ons. )RC has 3ell esta&lished timelines .or investigating and re0/esting data and invoi$es

Operational Risk Assessment: Green River Capital LLC

2013 Morningstar Credit Ratings, LLC. All Rights Reserved.

9 a g e A 10

as 3ell as .ollo3ing /" on aged items. -he m/lti"le levels o. revie3 serve to

a$$ordan$e 3ith esta&lished $om"an1 g/id

R& Asset Manage'ent

)RC "rovides REO management servi$es to vario/s $lients in$l/ding

investment &an,s and investors o. non2"er.orming loans and

o. the REO dis"osition li.e$1$le .rom "ost2.ore$los/re a$0/isition thro/gh mar,eting and $losing.

%ig/re 3! REO Asset -imeline

As "art o. the REO management "ro$ess )RC 3ill

val/e (RMV .or ea$h asset. )RC /tili5es a "ro"rietar1 3e&

$onta$t data, li$ense in.ormation and ins/ran$e. Agent assignments are managed via this s1stem.

)RC+s net3or, o. a""ro4imatel1 J,>00 agents and oversees agent sele$tion, s$oring, training and $omm/ni$ation.

)RC+s teams o. sale s"e$ialists are res"onsi&le .or the .ollo3ing REO asset management ./n$tions!

@etermining the estimated mar,et val/e (EMV .or as

#ele$ting the a""ro"riate mar,eting strateg1 (as

Monitoring the "ro"ert1 mar,eting stat/s in$l/ding mar,et .l/$t/ations, listing a$tivit1,

that ma1 re0/ire re"airsE

Degotiating o..ersE and

Oversee $losing and .inal asset dis"osition

-he organi5ational str/$t/re is em&edded 3ith a

sales s"e$ialists &/t have a higher level o. a/thorit1.

)RC has develo"ed standard timelines to tra$, the REO dis"osition li.e$1$le. A "re

asset .rom va$ant to listed stat/s. 6n general, the timeline $riteria is 1I da1s .or an as

o. this "ro$ess )RC 3ill determine the estimated mar,et val/e 3hi$h $onsists o. a $onsideration o. m/lti"le varia&les in$l/di

/ni0/eness, e$onomi$ $onditions, "ro"ert1 amenities and overall $ondition.

3ill "a1 in the asset+s $/rrent mar,et. A determination is made 3hether to mar,et the "ro"ert1 in an