Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

News Flash Indirect Tax

Caricato da

Udyog Software India Ltd.0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

9 visualizzazioni4 pagineCustoms: Tariff values notified

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCustoms: Tariff values notified

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

9 visualizzazioni4 pagineNews Flash Indirect Tax

Caricato da

Udyog Software India Ltd.Customs: Tariff values notified

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 4

News Flash Indirect Tax

Udyog Software (India) Ltd.

22/09/2014

This document contains a brief summary of the latest updates related to Indirect Taxes

All Rights Reserved USIL an Adaequare Company Page 1

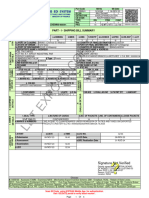

Customs: Tariff values notified

The CBEC has notified tariff values of specified commodities for customs assessment under section 14 of the

Customs Act 1962. The downward trend in the value of palm oils and oleins and crude soyabean oil continues.

The value of brass scrap too has been lowered. The value of poppy seeds and areca nuts remains unchanged.

The value of gold in respect of which the benefit of exemption under serial numbers 321 and 323 of

notification 12/2012-Customs is availed has been reduced to USD 400 per 10 grams (from USD 420 per 10

grams). The value of silver in respect of which the benefit of serial numbers 322 and 324 of notification

12/2012-Customs is availed has been reduced to USD 609 per kilogram (from USD 645 per kilogram). The

notification 76/2014-Customs (NT) dated 15 September 2014 can be seen at http://cbec.gov.in/customs/cs-

act/notifications/notfns-2014/cs-nt2014/csnt76-2014.htm.

Customs: Modinagar notified as ICD

The CBEC has amended notification 12/97-Customs (NT) to include Modinagar, Ghaziabad, Uttar Pradesh, as

an inland container depot for the purpose of unloading of import goods and loading of export goods. The

amendment has been made by notification 86/2014-Customs(NT) dated 18 September 2014, which can be seen

at http://cbec.gov.in/customs/cs-act/notifications/notfns-2014/cs-nt2014/csnt86-2014.htm.

Customs: Exchange rates notified

The CBEC has notified rates of exchange of specified currencies for the purpose of section 14 of the Customs

Act 1962, to arrive at the value of imported and export goods for assessment to customs duties. Inter alia, the

exchange rate of the Euro is Rs 79.65 for imported goods and Rs 77.75 for export goods; the exchange rate of

the pound sterling is Rs 100.75 for imported goods and Rs 98.55 for export goods; and the US dollar exchanges

for Rs 61.75 for valuation of imported goods and Rs 60.75 for export goods. The notification 87/2014-Customs

(NT) dated 18 September 2014 can be seen at http://cbec.gov.in/customs/cs-act/notifications/notfns-

2014/cs-nt2014/csnt87-2014.htm.

Customs: Provisional anti-dumping duty on insulators of glass, ceramic, porcelain from China

The Director-General (Anti-Dumping) had begun investigations on 5 September 2013 on a complaint by WS

Industries (India) Limited, Modern Insulators Limited, Insulators & Electrical Company, Bharat Heavy

Electricals Limited and Aditya Birla Nuvo Limited that electrical insulators were being dumped from China,

causing injury to domestic industry. He issued preliminary findings on 1 July 2014

(http://commerce.nic.in/writereaddata/traderemedies/adpref_Electrical_Insulators_ChinaPR.pdf ) to the

effect that there has been dumping, which has caused injury to domestic industry; and has recommended

imposition of provisional duty on the goods. Accordingly the central government has issued notification

40/2014-Customs(ADD) dated 16 September 2014 levying provisional anti-dumping duty on electric insulators

of glass, ceramic and porcelain from the Peoples Republic of China, for a period of six months

(http://cbec.gov.in/customs/cs-act/notifications/notfns-2014/cs-add2014/csadd40-2014.htm.)

Customs: Anti-dumping duty on sulphur black from China

Anti-dumping duty had been levied on sulphur black from the Peoples Republic of China vide notification

127/2008-Customs dated 3 December 2008, and had been extended till 10 April 2014 by notification 5/2013-

Customs (ADD) dated 10 April 2013. The DG (Anti-Dumping) conducted a sunset review and recommended

imposition of the duty for a further period. Accordingly the central government has issued notification

41/2014-Customs (ADD) dated 18 September 2014, imposing anti-dumping duty of USD 766 per MT on the

import of sulphur black from China. The duty will be valid for a period of five years from the date of the

notification, which can be downloaded from http://cbec.gov.in/customs/cs-act/notifications/notfns-2014/cs-

add2014/csadd41-2014.htm.

Customs: Goods for AEW&C System for defence exempted upto 5 October

The central government has issued notification 27/2014-Customs dated 18 September 2014 exempting customs

duty on import of goods for the Airborne Early Warning & Control (AEW&C) System Program of the Ministry of

Defence. The exemption will expire on 5 October 2014. The notification, which introduced the exemption by

amending existing notification 39/96-Customs, can be perused at http://cbec.gov.in/customs/cs-

act/notifications/notfns-2014/cs-tarr2014/cs27-2014.htm.

All Rights Reserved USIL an Adaequare Company Page 2

Customs: Sample fabric, oil cake etc, import exemptions extended

The central government has amended notification 12/2012-Customs to increase the permitted duty-free

import of free samples of fabric to 1000 m in a year. It has also extended the exemption for import of various

kinds of oil cakes and oil cake meal till the end of March 2015. The notification can be seen at

http://cbec.gov.in/customs/cs-act/notifications/notfns-2014/cs-tarr2014/cs28-2014.htm.

Customs: Goods for AEW&C System for defence exempted upto 5 October

The CBEC has issued Circular 984/08/2014-CX dated 16 September 2014 providing much-needed clarifications

on the new provisions of pre-deposit for appeals. The clarifications are as follows:

(i) In appeal from an order of the Commissioner (Appeals), the pre-deposit at the CESTAT level will be

10% of the duty or penalty payable in terms of the order of the Commissioner (Appeals), not in terms

of the order of the lower authority;

(ii) Pre-deposit can be made by e-payment, and a self-attested copy of the proof of payment will suffice

before the appellate authority;

(iii) Payment made during investigation or audit can be treated as deposit made towards the appeal, and

the date of filing the appeal will be treated as the date of pre-deposit (-this is relevant for purpose of

interest, if it arises). Such payment as is in excess of the amount required for filing the appeal will not

be treated as pre-deposit in terms of the sections of the statute that govern pre-deposit for appeal;

(iv) Upon payment of the required pre-deposit, no action will be taken for recovery of the disputed

amounts during pendency of the appeal.

(v) Upon decision of the case in favour of the assessee, or even upon remand of the case for re-decision

by a lower authority, the pre-deposit amount will be refunded upon application by the assessee, even

if the department plans to go in appeal against the decision. This is not a refund claim and will not

treated as such.

The circular can be downloaded from http://cbec.gov.in/excise/cx-circulars/cx-circ14/984-2014cx.htm.

Customs, excise, service tax: CESTAT clarifies on pre-deposit in appeal

The CESTAT has issued a circular 15/CESTAT/General/2013-14 dated 28 August 2014 to clarify some issues

regarding pre-deposit. This says, inter alia, that mandatory deposit of penalty has to be made in cash, while

mandatory deposit of duty can be made out of Cenvat credit. The circular can be accessed from the list under

the Important Circulars tab on http://cestat.gov.in/.

Customs, excise, service tax: Jurisdiction and powers of officers notified

Pursuant to cadre review in the department and creation of new posts and designations, the CBEC has notified

the jurisdiction and powers of officers. This includes manpower for the Directorate-General of Audit, including

officers for carrying out on-site audit under the On-site Post Clearance Audit at the Premises of Importers and

Exporters Regulations, 2011. The customs notifications numbering 77 to 85/2014-Customs (NT), all dated 16

September 2014, can be seen at http://cbec.gov.in/csnt77-85-notifications.pdf. The excise notifications

numbering 27 to 29/2014-CE(NT) dated 16 September 2014 can be seen at http://cbec.gov.in/cent27-29-

notifications.pdf. The service tax notifications numbering 20 to 22/2014-ST can be seen at

http://cbec.gov.in/st20-22-notifications.pdf.

Central excise: CBEC draws attention of officers to SC judgment on sales tax incentive scheme

The Supreme Court had held in its judgment dated 28 February 2014 the case of CCE Jaipur v Super Synotex

India Limited that when the manufacturer had collected sales tax from the buyer and was allowed to retain

75% of it under a sales tax incentive scheme, this amount was to form part of the assessable value for central

excise. This case is accessible from the Supreme Court website at

http://judis.nic.in/supremecourt/chejudis.asp by using the name of the respondent and date of the

judgment. The CBEC has now written to its field formations inviting their attention to this judgment for

finalisation of similar cases. See http://cbec.gov.in/excise/cx-circulars/cx-ins-14/cx-ins-salestax-

incentivesceme.htm.

All Rights Reserved USIL an Adaequare Company Page 3

Content provided by:

Radha Arun

Consultants to Udyog Software (India) Ltd.

radha.arjuni@gmail.com

Please connect with us at:

Web: www.udyogsoftware.com

Call: +91 (0) 40 6603 6561

Email: teammarketing@udyogsoftware.com

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Standard Operating Procedure (SOP) For Shipping An Outbound PackageDocumento15 pagineStandard Operating Procedure (SOP) For Shipping An Outbound PackagegcldesignNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- ANNEX 9 - FacilitationDocumento62 pagineANNEX 9 - FacilitationSyahid Macheda100% (1)

- Annex Budget 2022 2023Documento82 pagineAnnex Budget 2022 2023Defimediagroup LdmgNessuna valutazione finora

- Syllabi-2017 Customs Broker Licensure Examination (CBLE)Documento5 pagineSyllabi-2017 Customs Broker Licensure Examination (CBLE)lito77100% (2)

- Atlas Fertilizer vs. CommissionerDocumento10 pagineAtlas Fertilizer vs. CommissionerBenedick LedesmaNessuna valutazione finora

- Tariff and Customs Code Case DigestsDocumento116 pagineTariff and Customs Code Case DigestsRhea Mae A. SibalaNessuna valutazione finora

- Commissioner of Customs v. ReluniaDocumento5 pagineCommissioner of Customs v. ReluniaCarissa CruzNessuna valutazione finora

- Tcode GTSDocumento30 pagineTcode GTSrprabhakt4000% (1)

- RR 7-95 Consolidated VATDocumento64 pagineRR 7-95 Consolidated VATjankriezlNessuna valutazione finora

- Budget Highlights 2014-15Documento4 pagineBudget Highlights 2014-15Udyog Software India Ltd.Nessuna valutazione finora

- Udyog Tax News FlashDocumento6 pagineUdyog Tax News FlashUdyog Software India Ltd.Nessuna valutazione finora

- Udyog Tax News FlashDocumento5 pagineUdyog Tax News FlashUdyog Software India Ltd.Nessuna valutazione finora

- Udyog Tax News FlashDocumento5 pagineUdyog Tax News FlashUdyog Software India Ltd.Nessuna valutazione finora

- Operational Plan This Section of The Business Plan Presents The Evaluation of Suppliers, MaterialsDocumento9 pagineOperational Plan This Section of The Business Plan Presents The Evaluation of Suppliers, MaterialsKc Alcantara NacarioNessuna valutazione finora

- CBP Form 7501 - InstructionsDocumento32 pagineCBP Form 7501 - InstructionsAlfred MartinNessuna valutazione finora

- Oman - Corporate SummaryDocumento12 pagineOman - Corporate SummarymujeebmuscatNessuna valutazione finora

- Ecommerce Report - Recommendations Proposed For Ecommerce Environment Harmonisation in The EaP Countries UkraineDocumento87 pagineEcommerce Report - Recommendations Proposed For Ecommerce Environment Harmonisation in The EaP Countries UkraineYukai JiangNessuna valutazione finora

- Country Presentation - Viet Nam (2) - 0Documento24 pagineCountry Presentation - Viet Nam (2) - 0Charles LimNessuna valutazione finora

- Foreign Trade Policy FTP 2023 Concepts Notes Questions With MCQsDocumento27 pagineForeign Trade Policy FTP 2023 Concepts Notes Questions With MCQscadkmarwah0% (1)

- Deemed ExportDocumento9 pagineDeemed ExportRavula RekhanathNessuna valutazione finora

- Commissioner vs. Hypermix Feeds PDFDocumento8 pagineCommissioner vs. Hypermix Feeds PDFLalaine FelixNessuna valutazione finora

- Custom Clearance ProcessDocumento5 pagineCustom Clearance ProcessAsif KhanNessuna valutazione finora

- Jalan Udyog. Edited.Documento8 pagineJalan Udyog. Edited.SAURABH SUNNYNessuna valutazione finora

- LEO CopiesDocumento18 pagineLEO CopiesSuneethaaNessuna valutazione finora

- Bulletin of Vacant Positions Bureau of Customs 12 05 16Documento216 pagineBulletin of Vacant Positions Bureau of Customs 12 05 16TobzMakabayanNessuna valutazione finora

- Gemandept Internship ReportDocumento90 pagineGemandept Internship ReportThao PhamNessuna valutazione finora

- Mining in EthiopiaDocumento11 pagineMining in EthiopiaTsinatNessuna valutazione finora

- Single Administrative Document (SAD) (SAD) : User'S ManualDocumento42 pagineSingle Administrative Document (SAD) (SAD) : User'S Manualian mercadoNessuna valutazione finora

- Notification 151-2009 (As Amended)Documento4 pagineNotification 151-2009 (As Amended)Retvik M PNessuna valutazione finora

- E-Vám - E-Regadó - CDPS Interface SpecificationDocumento85 pagineE-Vám - E-Regadó - CDPS Interface SpecificationJohn MelichNessuna valutazione finora

- Tariff CodeDocumento39 pagineTariff CodeAlexPamintuanAbitanNessuna valutazione finora

- Seicane-NAVARA ANDROID INSTALLATION GUIDEDocumento13 pagineSeicane-NAVARA ANDROID INSTALLATION GUIDEJun NarvaezNessuna valutazione finora

- AHKFTA - Chapter - 4Documento10 pagineAHKFTA - Chapter - 4Tuyết Cương TrầnNessuna valutazione finora

- Cancio v. CADocumento3 pagineCancio v. CAMartinCroffsonNessuna valutazione finora