Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Capital Budgeting Decisions Chapter

Caricato da

pheeyona100%(1)Il 100% ha trovato utile questo documento (1 voto)

96 visualizzazioni24 pagineThis document discusses capital budgeting decisions and various approaches to evaluating long-term investment projects. It covers topics such as net present value, internal rate of return, payback period, accounting rate of return, time value of money, tax benefits of depreciation, and qualitative factors to consider. Examples are provided to illustrate concepts like calculating NPV and IRR for projects with different cash flow patterns.

Descrizione originale:

MBA 504 Ch9 Solutions

Titolo originale

MBA 504 Ch9 Solutions

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThis document discusses capital budgeting decisions and various approaches to evaluating long-term investment projects. It covers topics such as net present value, internal rate of return, payback period, accounting rate of return, time value of money, tax benefits of depreciation, and qualitative factors to consider. Examples are provided to illustrate concepts like calculating NPV and IRR for projects with different cash flow patterns.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

100%(1)Il 100% ha trovato utile questo documento (1 voto)

96 visualizzazioni24 pagineCapital Budgeting Decisions Chapter

Caricato da

pheeyonaThis document discusses capital budgeting decisions and various approaches to evaluating long-term investment projects. It covers topics such as net present value, internal rate of return, payback period, accounting rate of return, time value of money, tax benefits of depreciation, and qualitative factors to consider. Examples are provided to illustrate concepts like calculating NPV and IRR for projects with different cash flow patterns.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 24

Chapter 9

Capital Budgeting Decisions

QUESTIONS

1. A capital expenditure decision is a decision involving the acquisition of a long-lived asset.

2. Time value of money must be considered because the value of money received in the future

from an investment is not equivalent to the value of money expended to acquire the

investment in the current period.

3. Two approaches that consider the time value of money are the net present value (NPV)

approach and the internal rate of return (IRR) approach.

4. With the net present value approach, investments are accepted if the net present value is

equal to or greater than zero. With the internal rate of return approach, investments are

accepted if the internal rate of return is equal to or greater than the required rate of return.

5. The cost of equity is the return demanded by shareholders for the risk they bear in

supplying capital to the firm.

6. Because depreciation reduces taxable income, it results in a tax savings equal to the tax rate

times the amount of depreciation.

7. The payback method does not consider the total stream of cash flows and it does not

consider the time value of money. The accounting rate of return method does not consider

the time value of money.

8. Managers may concentrate on short-run profitability rather than net present value if their

performance is evaluated and compensated based on current period profit.

9. With uneven cash flows, the internal rate of return is calculated using a trial and error

approach. Managers guess at the IRR and calculate the present value. If the present

value is greater than zero, the guess is increased. If the present value is negative, the guess

is decreased.

10. In many cases, the benefits of an investment are difficult to quantify (i.e., they are soft

benefits). However, ignoring them is equivalent to ignoring cash inflows and tends to

discourage investment.

Jiambalvo Managerial Accounting 9-2

EXERCISES

E1. Interest expense is not treated as a cash outflow because the charge for

interest is included in the cost of capital (i.e., the hurdle or discount rate).

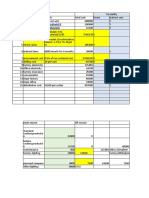

E2. The NPV is positive and Pauline should make the investment.

Time Cash Flow PV Factors

0 (25,000,000) 1.0000 $(25,000,000)

1 5,500,000 0.8929 4,910,950

2 5,500,000 0.7972 4,384,600

3 5,500,000 0.7118 3,914,900

4 5,500,000 0.6355 3,495,250

5 5,500,000 0.5674 3,120,700

6 5,500,000 0.5066 2,786,300

7 5,500,000 0.4523 2,487,650

8 5,500,000 0.4039 2,221,450

NPV $ 2,321,800

Effect on End of Year

Income Investment ROI

1 2,375,000 21,875,000 0.109

2 2,375,000 18,750,000 0.127

3 2,375,000 15,625,000 0.152

4 2,375,000 12,500,000 0.190

5 2,375,000 9,375,000 0.253

6 2,375,000 6,250,000 0.380

7 2,375,000 3,125,000 0.760

8 2,375,000 0 division by zero

not defined

Although the project has a positive NPV, if Pauline is overly focused on

short-term performance, she may hesitate to make the investment, which

has a relatively low ROI in the first year. Note that ROI increases

dramatically as the book value of the investment decreases due to

depreciation.

Chapter 9 Capital Budgeting Decisions 9-3

E3. According to Mignogna,

You can often determine the cash benefit of increases in capacity,

production efficiency, and quality, as well as reductions in operating and

maintenance costs attributable to an investment in new technology.

However, seldom accounted for are the strategic benefits which result from

such investments. With the assistance of the accompanying decision-

making flow chart, lets look at a few.

First of all, is the investment required just to stay in game (for example,

required for regulatory compliance)? If so, and assuming the game is worth

being in, then you may not have any choice but to just do it!

Next, have you considered the importance of the investment to remain

competitive in your industry? Here, I am speaking of your ability to

acquire, or at least defend, market share. While discounted cash flow

analyses may include the benefits of reduced operating costs and so on,

they seldom consider the opportunity cost of the lost business which

results from your competitors ability to offer a higher quality at a reduced

cost. In other words, there may be a very real cost attached to not pursuing

an innovation.

There are several other strategic considerations that are not particularly

amenable to economic analyses. Will the investment add to or enhance

your firms core competencies? Will it provide the capability to penetrate

new markets with your product or service? Will expanded production

capacity provide access to increased sales and more rapid learning curve

progress which will ultimately lower costs? Are you in an industry where

the market perceives technological leadership as important? You can

probably think of others specific to your own situation. Such strategic

benefits are seldom considered in discounted cash flow analyses of new

technology. Remember, theres a big difference between running the

numbers and letting the numbers run you.

Jiambalvo Managerial Accounting 9-4

E4. Company Investment decision

Charles Schwab Should the company purchase additional servers and other

equipment to enhance services related to the online

business?

McDonalds Should the company purchase land, building, and

equipment for a new restaurant?

Wal-Mart Should the company remodel its superstore on the west

side of Chicago?

E5. Cash Present Value

Flow Factor Total

$100 .6209 $62.09

E6. Cash Present Value

Flow Factor Total

$100 3.7908 $379.08

E7. The numbers decrease from left to right in a given row because cash received

in the future is worth less the higher your required rate of return.

The numbers decrease from top to bottom in a given column because cash

received further in the future is less valuable today.

E8. Cash Present Value

Flow Factor Total

$200 3.7908 $ 758.16

500 .6209 310.45

$1,068.61

Chapter 9 Capital Budgeting Decisions 9-5

E9. Plan A

Total

$100,000.00

Plan B

Cash Present Value

Flow Factor Total

$ 10,000 6.7101 $ 67,101.00

100,000 .4632 46,320.00

$113,421.00

Plan C

Cash Present Value

Flow Factor Total

$20,000 6.7101 $134,202.00

Plan C should be selected as it has the highest present value.

E10. Cash Present Value

Flow Factor Total

($10,000) 1.0000 ($10,000.00)

4,000 3.0373 12,149.20

$ 2,149.20

The net present value is positive so the project should be undertaken.

Jiambalvo Managerial Accounting 9-6

E11. The investment should not be undertaken because it has a negative NPV.

Cash Present Value

Flow Factor Total

$6,000.00

(3,500.00)

950.00

(1,800.00)

1,650.00 5.2161 $8,606.56

(20,000.00) 1.0000 (20,000.00)

5,000.00 .2697 1,348.50

($ 10,044.94)

E12. Machine A should be purchased because it has the highest positive NPV.

Machine A

Cash Present Value

Flow Factor Total

$15,000.00 4.3553 $65,329.50

(50,000.00) 1.0000 (50,000.00)

$15,329.50

Machine B

Cash Present Value

Flow Factor Total

$20,000.00 4.3553 $87,106.00

(75,000.00) 1.0000 (75,000.00)

$12,106.00

Chapter 9 Capital Budgeting Decisions 9-7

E13. The investment should not be undertaken because the internal rate of return

of 12% is less than the required rate of 18%.

Initial outlay $79,100.00

Annuity amount 14,000.00

Outlay annuity amount 5.6500

Internal rate of return 12%

E14. a.

Initial outlay $79,137.00

Annuity amount 22,500.00

Outlay annuity amount 3.5172

Internal rate of return 13%

b. Nadine should make the investment because its return of 13% is greater

than the required return of 12%.

E15. Annual depreciation

$200,000 5 years $40,000.00

Annual tax savings

$40,000 .40 $16,000.00

Present value of $16,000 per year

for 5 years at 10%

$16,000 3.7908 $60,652.80

Jiambalvo Managerial Accounting 9-8

E16. Year Income (Loss)

1 ($100,000)

2 (50,000)

3 120,000

4 200,000

The $100,000 loss in year 1 will offset income in year 3 resulting in a tax

savings of $40,000 (i.e., $100,000 40% tax rate) in year 3.

With respect to the $50,000 loss in year 2, $20,000 of it can be used to offset

income in year 3 (resulting in a tax savings of $8,000 in year 3) and $30,000

of it can be used to offset income in year 4 (resulting in a tax savings of

$12,000 in year 4).

Cash Present Value

Flow Factor Total

$40,000.00 .6750 $27,000.00

8,000.00 .6750 5,400.00

12,000.00 .5921 7,105.20

$39,505.20

Chapter 9 Capital Budgeting Decisions 9-9

E17. The annual cash inflow is $5,700, calculated as follows:

Revenue $15,500

Less:

Cost other than depreciation 8,000

Depreciation 3,000

Income before taxes 4,500

Less taxes at 40% 1,800

Net income 2,700

Plus depreciation 3,000

Cash flow $5,700

The net present value is positive, so the smoker should be purchased.

Cash Present Value

Flow Factor Total

$5,700.00 4.5638 $26,013.66

(21,000.00) 1.0000 (21,000.00)

$ 5,013.66

E18. The payback period is 8.2 years as follows:

Cost $41,000.00

Cash inflows 5,000.00

Cost cash inflows 8.2 years

E19. The accounting rate of return is 30%:

Average income $30,000.00

Average investment ($200,000 2) 100,000.00

Accounting rate of return 30.00%

Jiambalvo Managerial Accounting 9-10

E20. As indicated, the NPV is close to zero ($145.00) at a rate of 14%. Thus, the

IRR is approximately 14%. Given that the required rate of return is only

13%, the e-commerce business should be developed.

PV at Cash PV

13% Flow Factor Total

$(1,000,000) 1.0000 $(1,000,000)

(500,000) 0.8850 (442,500)

200,000 0.7831 156,620

630,000 0.6931 436,653

750,000 0.6133 459,975

800,000 0.5428 434,240

$ 44,988

PV at Cash PV

14% Flow Factor Total

$(1,000,000) 1.0000 $(1,000,000)

(500,000) 0.8772 (438,600)

200,000 0.7695 153,900

630,000 0.6750 425,250

750,000 0.5921 444,075

800,000 0.5194 415,520

$ 145

PV at Cash PV

15% Flow Factor Total

$(1,000,000) 1.0000 $(1,000,000)

(500,000) 0.8696 (434,800)

200,000 0.7561 151,220

630,000 0.6575 414,225

750,000 0.5718 428,850

800,000 0.4972 397,760

$ (42,745)

Chapter 9 Capital Budgeting Decisions 9-11

E21. As indicated below, the NPV is zero with a required rate of return of 9

percent. Thus, the IRR is 9 percent.

PV at Cash PV

9% Flow Factor Total

$(2,200,100) 1.0000 $(2,200,100)

200,000 0.9174 183,480

400,000 0.8417 336,680

600,000 0.7722 463,320

800,000 0.7084 566,720

1,000,000 0.6499 649,900

$ 0

E22. The online business may help the company manage a potentially stodgy

image associated with its mall locations. Also, the online business may

actually generate a number of large sales for the brick and mortar locations.

Some customers will shop the Web site to make price and quality

comparisons, but they will be unwilling to make, for example, a $5,000

purchase of a diamond ring over the Internet. Thus, after seeing

merchandise on the Web site, they may visit one of Shermans mall stores to

make a purchase. These potential benefits would be difficult to quantify.

E23. The annual value of the soft benefit must be at least $88,492.44 for the

project to have a zero net present value. Given there is general agreement

that the annual soft benefit will be at least $90,000, Pritchard should invest

in the flexible manufacturing system.

A. Present value needed to yield a zero NPV $500,000.00

B. Present value of an annuity factor at 12% 5.6502

A B Required annual value of soft benefit $88,492.44

Jiambalvo Managerial Accounting 9-12

PROBLEMS

P1. The original contract was worth $6,790,700 in present value terms while the

new offer is worth $6,960,460. When the time value of money is taken into

account, it is obvious that the new offer is not much better than the old one.

Cash PV

Time Flow Factor Total

0 $3,000,000 1.0000 $3,000,000

1 1,000,000 0.9091 909,100

2 1,000,000 0.8264 826,400

3 1,000,000 0.7513 751,300

4 1,000,000 0.6830 683,000

5 1,000,000 0.6209 620,900

$6,790,700

Cash PV

Time Flow Factor Total

1 1,000,000 0.9091 909,100

2 1,100,000 0.8264 909,040

3 1,200,000 0.7513 901,560

4 1,300,000 0.6830 887,900

5 1,400,000 0.6209 869,260

5 4,000,000 0.6209 2,438,600

$6,960,460

Chapter 9 Capital Budgeting Decisions 9-13

P2. a. Present value of ship in Caribbean/Alaska itinerary at 10%

($68,095,769 7.6061) $517,943,229

Present value of ship in Caribbean/Eastern Canada itinerary at 10%

($53,490,300 7.6061) $406,852,571

Present value of ship in Caribbean/Alaska itinerary at 15%

($68,095,769 5.8474) $398,183,200

Present value of ship in Caribbean/Eastern Canada itinerary at 15%

($53,490,300 5.8474) $312,779,180

The cost of the ship is only $180,325,005. Therefore, the NPV will be positive

under all of the alternatives which provides strong evidence that the ship

should be purchased.

b. The NPV will be positive (suggesting that the ship should be purchased)

whether the required return is 10 percent or 15 percent.

c. The difference in present values is $111,090,658 ($517,943,229 -

$406,852,571). Thus, there is a high opportunity cost if the firm decides to

operate the ship in a Caribbean/Eastern Canada itinerary.

Jiambalvo Managerial Accounting 9-14

P3. Year 1 Year 2 Year 3 Year 4

Revenue $12,000,000 $6,000,000 $2,000,000 $500,000

Less amortization 12,000,000 4,000,000 0 0

Income before taxes 0 2,000,000 2,000,000 500,000

Less taxes 0 800,000 800,000 200,000

Net income 0 1,200,000 1,200,000 300,000

Add amortization 12,000,000 4,000,000 0 0

Cash flow $12,000,000 $5,200,000 $1,200,000 $300,000

Cash PV

Time Flow Factor Total

0 ($16,000,000) 1.0000 ($16,000,000)

1 12,000,000 .9091 10,909,200

2 5,200,000 .8264 4,297,280

3 1,200,000 .7513 901,560

4 300,000 .6830 204,900

$ 312,940

Since the NPV is positive, the company should produce the film.

Chapter 9 Capital Budgeting Decisions 9-15

P4. Cash flow per year:

Revenue $75,000

Less costs other

than depreciation 6,800

Depreciation 40,000

Income before taxes 28,200

Less taxes 11,280

Net income 16,920

Add depreciation 40,000

Cash flow $56,920

Annuity factor equals cost divided by annual cash flow:

($200,000 $56,920) 3.5137

This implies an internal rate of return of approximately 13% (factor is 3.5172)

Given the internal rate of return exceeds the required rate of 12%, the company

should invest in the remodel.

Jiambalvo Managerial Accounting 9-16

P5. a. The net present value is positive ($43,496.60). Thus the company should

invest in the paint and body shop.

Net income $ 51,000

Add depreciation 70,000

Annual cash flow $121,000

Cash Present Value

Flow Factor Total

$121,000 6.1446 $743,496.60

(700,000) 1.0000 (700,000.00)

$ 43,496.60

b. A present value of an annuity factor of 5.7851 implies an IRR of

approximately 12%.

Initial outlay $700,000

Annuity amount 121,000

Cost annuity 5.7851

Notethe annuity factor for 12% is 5.6502.

c. The payback period is approximately 5.8 years:

Initial outlay $700,000

Annual cash flow 121,000

Number of years to recover

initial investment 5.7851

d. The accounting rate of return is approximately 35%:

Average income $51,000

Average investment

($700,000 2) 350,000

Accounting rate of return 14.57%

Chapter 9 Capital Budgeting Decisions 9-17

P6. a. Present value of Machine A

Cash PV

Flow Factor Total

Labor saving $21,000

Power saving 1,300

Chemical saving 2,900

Add. Main. (1,000)

Add. Misc. (2,200)

Total 22,000 2.9137 $ 64,101.40

Cost (43,000) 1.0000 (43,000.00)

Installation (4,500) 1.0000 (4,500.00)

Residual value 3,200 .5921 1,894.72

NPV $18,496.12

b. Present value of Machine B

Cash PV

Flow Factor Total

Labor saving $29,000

Power saving 1,900

Chemical saving 3,200

Add. Main. (1,200)

Add. Misc. (2,300)

Total 30,600 2.9137 $ 89,159.22

Cost (73,000) 1.0000 (73,000.00)

Installation (5,000) 1.0000 (5,000.00)

Residual value 5,200 .5921 3,078.92

NPV $14,238.14

c. Both NPVs are greater than zero, so both are acceptable investments.

However, the company should purchase machine A since it has the highest

NPV.

Jiambalvo Managerial Accounting 9-18

P7. Crown should invest in the new limousine since the NPV is positive.

Net income $17,790

Add depreciation 12,000

Annual cash flow $29,790

Cash Present Value

Flow Factor Total

$29,790.00 3.4331 $102,272.05

20,000.00 .5194 10,388.00

(80,000.00) 1.0000 (80,000.00)

$ 32,660.05

P8. Island Ferry should not invest in the boat because the NPV is negative.

Revenue $293,000

Less:

Labor 84,000

Fuel 15,800

Maintenance 26,700

Miscellaneous 3,500

Depreciation 95,750

Income before taxes 67,250

Taxes 26,900

Net income 40,350

Depreciation 95,750

Annual cash flow $136,100

Cash Present Value

Flow Factor Total

$136,100.00 4.9676 $676,090.36

62,000.00 .4039 25,041.80

(828,000.00) 1.0000 (828,000.00)

($126,867.84)

Chapter 9 Capital Budgeting Decisions 9-19

P9. a. Revenue (35,000 $35) $1,225,000

Less:

Component cost 300,000

Direct labor 400,000

Depreciation 60,000

Miscellaneous 180,000

Advertising 130,000

Income before taxes 155,000

Taxes 62,000

Net income 93,000

Depreciation 60,000

Annual cash flow $ 153,000

Cash Present Value

Flow Factor Total

$153,000.00 3.4331 $525,264.30

10,000.00 .5194 5,194.00

(310,000.00) 1.0000 (310,000.00)

$220,458.30

b. The payback period is approximately 2 years:

Initial outlay $310,000

Annual cash flow 153,000

Number of years to recover

initial investment 2.026 years

c. The accounting rate of return is 60%:

Average income $93,000

Average investment

($310,000 2) $155,000

Accounting rate of return 60%

d. Given the positive NPV, company should invest in Autodial.

Jiambalvo Managerial Accounting 9-20

P10. Year 1 2 3 4 5 6 7

Income $45,000 48,750 52,688 56,822 61,163 65,721 70,507

Deprec. 50,000 50,000 50,000 50,000 50,000 50,000 50,000

Cash flow $95,000 98,750 102,688 106,822 111,163 115,721 120,507

Year Cash flow Factor Total

1. $95,000 .8772 $ 83,334.00

2. 98,750 .7695 75,988.13

3. 102,688 .6750 69,314.40

4. 106,822 .5921 63,249.31

5. 111,163 .5194 57,738.06

6. 115,721 .4556 52,722.49

7. 120,507 .3996 48,154.60

7. 50,000 .3996 19,980.00

0. - 400,000 1.0000 - 400,000.00

NPV $ 70,480.99

Given the positive NPV, the company should invest in the new business.

Chapter 9 Capital Budgeting Decisions 9-21

P11. a. The cost of capital includes an allowance for expected inflation. Thus, in

periods where expected inflation is high, the cost of capital is high, and

firms demand a high return on their investments.

b. Note that cash flows increase by 4% per year (except for the cash flow

related to the depreciation tax shield).

Year 1 Year 2 Year 3 Year 4 Year 5

Cost savings $575,000 $598,000 $621,920 $646,797 $672,669

Taxes on

cost savings -201,250 -209,300 -217,672 -226,379 -235,434

Tax savings

related to depre. 140,000 140,000 140,000 140,000 140,000

Cash flow $513,750 $528,700 $544,248 $560,418 $577,235

Year Cash flow Factor Total

1 $513,750 .9091 $ 467,050

2 528,700 .8264 436,918

3 544,248 .7513 408,894

4 560,418 .6830 382,765

5 577,235 .6209 358,405

2,054,032

Less cost of machine 2,000,000

Net present value $ 54,032

Given the positive NPV, the company should invest in the manufacturing

equipment.

Jiambalvo Managerial Accounting 9-22

P12. Note that in problem 11, the NPV was only $54,032 using a 10% required

rate of return. This suggests that to determine the IRR, we should start with

a return larger than, but close to, 10 percent. Below, the cash flows are

brought to present value using an 11% rate of return. Since the sum of the

present values is approximately equal to the cost of the investment (a

difference of $1,620), the internal rate of return is approximately 11%.

Given that this is greater than the required return of 10%, the investment

should be undertaken.

Year Cash flow Factor Total

1. $513,750 .9009 $ 462,837

2. 528,700 .8116 429,093

3. 544,248 .7312 397,954

4. 560,418 .6587 369,147

5. 577,235 .5935 342,589

2,001,620

Less cost of machine 2,000,000

Net present value $ 1,620

Chapter 9 Capital Budgeting Decisions 9-23

P13. Most likely, a higher required rate of return should be used reflecting the

increased risk of the investment.

P14. a. Richards is evaluated and compensated based on ROI which has some

measure of income in the numerator (and a measure of investment in the

denominator). Thus, he will be highly focused on income. Some

investment opportunities facing his division may increase shareholder

wealth (as indicated by positive NPVs) but have a negative effect on

short-run accounting income. If that will cause Richards to miss a bonus

target, he may pass on these valuable investments.

b. I believe this will mitigate the problem. If Richards owns a great deal of

stock/and or options, he will have a strong incentive to work to increase

the firms stock price. And stock prices are likely to be positively

impacted when the firm takes on projects with positive NPVs.

Jiambalvo Managerial Accounting 9-24

P15. Year 1 Year 2 Year 3 Year 4 Year 5

Revenue $63,000 $69,300 $76,230 $83,853 $92,238

Less:

Ingred. 25,200 27,720 30,492 33,541 36,895

Salary 25,000 27,000 29,000 31,000 33,000

Misc. 2,200 2,400 2,600 2,800 3,000

Depre. 8,000 8,000 8,000 8,000 8,000

60,400 65,120 70,092 75,341 80,895

Inc. before taxes 2,600 4,180 6,138 8,512 11,343

Taxes 1,040 1,672 2,455 3,405 4,537

Net income 1,560 2,508 3,683 5,107 6,806

Depre. 8,000 8,000 8,000 8,000 8,000

Cash flow $ 9,560 $10,508 $11,683 $13,107 $14,806

Year Cash flow Factor Total

1. $ 9,560 .8850 $ 8,460.60

2. 10,508 .7831 8,228.81

3. 11,683 .6931 8,097.49

4. 13,107 .6133 8,038.52

5. 14,806 .5428 8,036.70

5. 2,000 .5428 1,085.60

0. -40,000 1.0000 - 42,000.00

NPV ($ 52.28)

Using a rate of return of 13%, the NPV is approximately zero. Therefore, the

IRR is approximately 13%. Melrose should investment in the delivery

business given that the companys required rate of return is only 10%.

Potrebbero piacerti anche

- Corporate Financial Analysis with Microsoft ExcelDa EverandCorporate Financial Analysis with Microsoft ExcelValutazione: 5 su 5 stelle5/5 (1)

- MBA 504 Ch3 SolutionsDocumento22 pagineMBA 504 Ch3 SolutionsMohit Kumar GuptaNessuna valutazione finora

- MBA 504 Ch4 SolutionsDocumento25 pagineMBA 504 Ch4 SolutionsPiyush JainNessuna valutazione finora

- MBA 504 Ch5 SolutionsDocumento12 pagineMBA 504 Ch5 SolutionspheeyonaNessuna valutazione finora

- Practical BEP QuestionsDocumento16 paginePractical BEP QuestionsSanyam GoelNessuna valutazione finora

- MBA 504 Ch11 SolutionsDocumento31 pagineMBA 504 Ch11 Solutionschawlavishnu100% (1)

- (1.3.1) Managerial Accounting (Jiambalvo) CH4Documento2 pagine(1.3.1) Managerial Accounting (Jiambalvo) CH4gregcwstl100% (1)

- Cost-Volume-Profit Relationships: Solutions To QuestionsDocumento106 pagineCost-Volume-Profit Relationships: Solutions To QuestionsAbene Man Wt BreNessuna valutazione finora

- Solutions For Capital Budgeting QuestionsDocumento7 pagineSolutions For Capital Budgeting QuestionscaroNessuna valutazione finora

- Cost-Volume-Profit AnalysisDocumento50 pagineCost-Volume-Profit AnalysisMarkiesha StuartNessuna valutazione finora

- CH 11Documento51 pagineCH 11Nguyen Ngoc Minh Chau (K15 HL)Nessuna valutazione finora

- Project Appraisal 1Documento23 pagineProject Appraisal 1Fareha RiazNessuna valutazione finora

- Costing Prob FinalsDocumento52 pagineCosting Prob FinalsSiddhesh Khade100% (1)

- Cost-Volume-Profit Relationships: Solutions To QuestionsDocumento90 pagineCost-Volume-Profit Relationships: Solutions To QuestionsKathryn Teo100% (1)

- Chapter 4 CVP AnalysisDocumento40 pagineChapter 4 CVP Analysisthrust_xone100% (1)

- The Utease CorporationDocumento8 pagineThe Utease CorporationFajar Hari Utomo0% (1)

- Donato's analysis of special order and ethical conflictDocumento12 pagineDonato's analysis of special order and ethical conflictT Yoges Thiru MoorthyNessuna valutazione finora

- Horngren Ima15 Im 07Documento19 pagineHorngren Ima15 Im 07Ahmed AlhawyNessuna valutazione finora

- 10 - Submarine Sandwich Dec 2016Documento6 pagine10 - Submarine Sandwich Dec 2016FurqanTariqNessuna valutazione finora

- Solutions Nss NC 11Documento19 pagineSolutions Nss NC 11saadullahNessuna valutazione finora

- Harsh ElectricalsDocumento7 pagineHarsh ElectricalsR GNessuna valutazione finora

- The Cost of Capital: HKD 100,000,000 HKD 250,000,000 HKD 150,000,000 HKD 250,000,000Documento24 pagineThe Cost of Capital: HKD 100,000,000 HKD 250,000,000 HKD 150,000,000 HKD 250,000,000chandel08Nessuna valutazione finora

- Capital Budgeting Investment AnalysisDocumento12 pagineCapital Budgeting Investment AnalysisRauful Sworan100% (1)

- 1.5performance Management PDFDocumento232 pagine1.5performance Management PDFsolstice567567Nessuna valutazione finora

- Chapter 20Documento93 pagineChapter 20Irina AlexandraNessuna valutazione finora

- Answers To Chapter 7 - Interest Rates and Bond ValuationDocumento8 pagineAnswers To Chapter 7 - Interest Rates and Bond ValuationbuwaleedNessuna valutazione finora

- Solution - Financial Leverage and Capital StructureDocumento7 pagineSolution - Financial Leverage and Capital StructureEkjon DiptoNessuna valutazione finora

- CH 12Documento3 pagineCH 12ghsoub777Nessuna valutazione finora

- The Cross-Price Elasticity of Demand For The Two Is CalculatedDocumento3 pagineThe Cross-Price Elasticity of Demand For The Two Is CalculatedhaNessuna valutazione finora

- Solution Manual For Book CP 4Documento107 pagineSolution Manual For Book CP 4SkfNessuna valutazione finora

- Chapter 6 CostDocumento144 pagineChapter 6 CostMaria LiNessuna valutazione finora

- Chicago Valve TemplateDocumento5 pagineChicago Valve TemplatelittlemissjaceyNessuna valutazione finora

- Standard CostingDocumento18 pagineStandard Costingpakistan 123Nessuna valutazione finora

- Chapter 06 PDFDocumento24 pagineChapter 06 PDFadarshNessuna valutazione finora

- Add or Drop Product DecisionsDocumento6 pagineAdd or Drop Product DecisionsksnsatishNessuna valutazione finora

- Understand Support Department Cost Allocation MethodsDocumento27 pagineUnderstand Support Department Cost Allocation Methodsluckystar251095Nessuna valutazione finora

- BUSI 353 S18 Assignment 6 SOLUTIONDocumento4 pagineBUSI 353 S18 Assignment 6 SOLUTIONTanNessuna valutazione finora

- Chapter 4Documento45 pagineChapter 4Yanjing Liu67% (3)

- Wilkerson ABC at CapacityDocumento1 paginaWilkerson ABC at CapacityTushar DuaNessuna valutazione finora

- Cost II Chapter ThreeDocumento11 pagineCost II Chapter ThreeSemira100% (1)

- Answers Exercises Chapter 4 and 5Documento10 pagineAnswers Exercises Chapter 4 and 5Filipe FrancoNessuna valutazione finora

- Ilide - Info Review Qs PRDocumento93 pagineIlide - Info Review Qs PRMobashir KabirNessuna valutazione finora

- CH 11Documento48 pagineCH 11Pham Khanh Duy (K16HL)Nessuna valutazione finora

- IMT 58 Management Accounting M3Documento23 pagineIMT 58 Management Accounting M3solvedcareNessuna valutazione finora

- FalseDocumento13 pagineFalseJoel Christian MascariñaNessuna valutazione finora

- Calculate FCFE XYZDocumento4 pagineCalculate FCFE XYZaks171Nessuna valutazione finora

- BEP N CVP AnalysisDocumento49 pagineBEP N CVP AnalysisJamaeca Ann MalsiNessuna valutazione finora

- Cost Allocation Joint by ProductsDocumento31 pagineCost Allocation Joint by ProductsFanie Saphira100% (1)

- Section B. Decision Making Techniques - TutorDocumento73 pagineSection B. Decision Making Techniques - TutorNirmal ShresthaNessuna valutazione finora

- Time Value of MoneyDocumento64 pagineTime Value of MoneyYasir HussainNessuna valutazione finora

- 340 - Resource - 10 (F) Learning CurveDocumento19 pagine340 - Resource - 10 (F) Learning Curvebaby0310100% (2)

- Problem Sets 15 - 401 08Documento72 pagineProblem Sets 15 - 401 08Muhammad GhazzianNessuna valutazione finora

- 032431986X 104971Documento5 pagine032431986X 104971Nitin JainNessuna valutazione finora

- Chapter Three CVP AnalysisDocumento65 pagineChapter Three CVP AnalysisBettyNessuna valutazione finora

- GG Toys WAC Final PDFDocumento9 pagineGG Toys WAC Final PDFTanaya SahaNessuna valutazione finora

- Case 11-55Documento3 pagineCase 11-55HETTYNessuna valutazione finora

- Incremental AnalysisDocumento25 pagineIncremental AnalysisAngel MallariNessuna valutazione finora

- Capital Investment AppraisalDocumento2 pagineCapital Investment AppraisalHadiBiesNessuna valutazione finora

- Net Present Value MethodDocumento9 pagineNet Present Value MethodRain Roslan100% (2)

- Case 1 ToyotaDocumento5 pagineCase 1 Toyotapheeyona0% (1)

- Business Plan Kickoff ContestDocumento1 paginaBusiness Plan Kickoff ContestpheeyonaNessuna valutazione finora

- Green Tea Crème Brûlée 抹茶クレームブリュレDocumento1 paginaGreen Tea Crème Brûlée 抹茶クレームブリュレpheeyonaNessuna valutazione finora

- MBA507Documento10 pagineMBA507pheeyonaNessuna valutazione finora

- Website For Asian Movie, HK Movie, Korean Movie, Indian Movie, JapaneseDocumento2 pagineWebsite For Asian Movie, HK Movie, Korean Movie, Indian Movie, JapanesepheeyonaNessuna valutazione finora

- MBA 504 Ch8 SolutionsDocumento11 pagineMBA 504 Ch8 SolutionspheeyonaNessuna valutazione finora

- Analyzing Blockbuster's Strategic Challenges in a Disrupted MarketDocumento2 pagineAnalyzing Blockbuster's Strategic Challenges in a Disrupted MarketpheeyonaNessuna valutazione finora

- Case - Euro Disney Disucssion QuestionsDocumento1 paginaCase - Euro Disney Disucssion QuestionspheeyonaNessuna valutazione finora

- Examplary QuestionsDocumento2 pagineExamplary QuestionspheeyonaNessuna valutazione finora

- MBA 504 Ch8 SolutionsDocumento11 pagineMBA 504 Ch8 SolutionspheeyonaNessuna valutazione finora

- CASE05 BlockbusterDocumento18 pagineCASE05 BlockbusterpheeyonaNessuna valutazione finora

- Marketing Analytics PresentationDocumento40 pagineMarketing Analytics PresentationpheeyonaNessuna valutazione finora

- Analyzing Blockbuster's Strategic Challenges in a Disrupted MarketDocumento2 pagineAnalyzing Blockbuster's Strategic Challenges in a Disrupted MarketpheeyonaNessuna valutazione finora

- CafeDocumento4 pagineCafepheeyonaNessuna valutazione finora

- Syllabus (BUS 536)Documento9 pagineSyllabus (BUS 536)pheeyonaNessuna valutazione finora

- Business Plan Kickoff ContestDocumento1 paginaBusiness Plan Kickoff ContestpheeyonaNessuna valutazione finora

- Case SolutionDocumento7 pagineCase SolutionpheeyonaNessuna valutazione finora

- N01799857@hawkmail Newpaltz EduDocumento4 pagineN01799857@hawkmail Newpaltz EdupheeyonaNessuna valutazione finora

- Global Business TODAY GBVDocumento8 pagineGlobal Business TODAY GBVpheeyona33% (6)

- Country DataDocumento1 paginaCountry DatapheeyonaNessuna valutazione finora

- Gamma Gamma FinaDocumento11 pagineGamma Gamma FinapheeyonaNessuna valutazione finora

- TNK BP RussiaDocumento16 pagineTNK BP RussiapheeyonaNessuna valutazione finora

- Action Plan Template GuidanceDocumento4 pagineAction Plan Template GuidanceJanith DushyanthaNessuna valutazione finora

- MOIT Project 1Documento24 pagineMOIT Project 1pheeyonaNessuna valutazione finora

- Barclay CaseDocumento7 pagineBarclay CasepheeyonaNessuna valutazione finora

- CASE05 BlockbusterDocumento18 pagineCASE05 BlockbusterpheeyonaNessuna valutazione finora

- Beer in NYDocumento12 pagineBeer in NYpheeyonaNessuna valutazione finora

- BBCaseDocumento10 pagineBBCasepheeyonaNessuna valutazione finora

- Project Finance & Project Evaluation at Indian Oil Project ReportDocumento89 pagineProject Finance & Project Evaluation at Indian Oil Project Reportkamdica100% (2)

- Fundamentals of Corporate Finance Canadian Canadian 8th Edition Ross Test Bank 1Documento77 pagineFundamentals of Corporate Finance Canadian Canadian 8th Edition Ross Test Bank 1robert100% (37)

- 16 - (S4) Sma Sa PDFDocumento7 pagine16 - (S4) Sma Sa PDFSaalim FaheemNessuna valutazione finora

- Diagnostic Test General MathematicsDocumento5 pagineDiagnostic Test General MathematicsGrace Lamano89% (27)

- 3chapter Three FM ExtDocumento19 pagine3chapter Three FM ExtTIZITAW MASRESHANessuna valutazione finora

- Lecture 2 - Time Value of Money - StuDocumento22 pagineLecture 2 - Time Value of Money - StuLan LinhNessuna valutazione finora

- AkuntansiDocumento46 pagineAkuntansiRo Untoro ToroNessuna valutazione finora

- Starting Right CorporationDocumento18 pagineStarting Right CorporationLyka Marie Pajares100% (1)

- Acquiring Term Loan For Starting Drinking Water Company - MAIN ProjectDocumento50 pagineAcquiring Term Loan For Starting Drinking Water Company - MAIN ProjectAMIT K SINGHNessuna valutazione finora

- ExerciseDocumento3 pagineExerciseHoang AnNessuna valutazione finora

- Chapter 8 - Bond Valuation and RiskDocumento32 pagineChapter 8 - Bond Valuation and RiskJenniferNessuna valutazione finora

- FinaMan Final TermDocumento15 pagineFinaMan Final TermHANNAH ROSS BAELNessuna valutazione finora

- Profel1 AC Activity Assets Part1Documento9 pagineProfel1 AC Activity Assets Part1Dizon Ropalito P.Nessuna valutazione finora

- Core and Principle of Corporate FinanceDocumento12 pagineCore and Principle of Corporate FinancePermata Ayu WidyasariNessuna valutazione finora

- Ans: Uses of Sensitivity Analysis: Optimistic Return - Pessimistic ReturnDocumento7 pagineAns: Uses of Sensitivity Analysis: Optimistic Return - Pessimistic ReturnKumardeep SinghaNessuna valutazione finora

- Time Value of MoneyDocumento13 pagineTime Value of MoneyAulia EndiniNessuna valutazione finora

- Assignment - Fall 2022Documento11 pagineAssignment - Fall 2022gmoreno1087Nessuna valutazione finora

- Gen Math Quarter 2 Summative TestDocumento6 pagineGen Math Quarter 2 Summative TestAngelie ButalidNessuna valutazione finora

- The Loyalty EffectDocumento15 pagineThe Loyalty Effectrushies123Nessuna valutazione finora

- FIN220 - Time Value of Money Practice QuestionsDocumento2 pagineFIN220 - Time Value of Money Practice QuestionsMatt ZaheadNessuna valutazione finora

- 01 Time Value of Money PDFDocumento31 pagine01 Time Value of Money PDFJainn SNessuna valutazione finora

- Sol. Man. - Chapter 2 - Statement of Comprehensive IncomeDocumento15 pagineSol. Man. - Chapter 2 - Statement of Comprehensive IncomeKATHRYN CLAUDETTE RESENTE100% (1)

- Principles of Finance Formulae SheetDocumento4 paginePrinciples of Finance Formulae SheetAmina SultangaliyevaNessuna valutazione finora

- P9 Nov 09 ExampaperDocumento24 pagineP9 Nov 09 ExampaperShahbazYaqubNessuna valutazione finora

- LBO Valuation of Cheek ProductsDocumento4 pagineLBO Valuation of Cheek ProductsEfri Dwiyanto100% (2)

- CH 12 Powerpoint A334Documento62 pagineCH 12 Powerpoint A334ThiNessuna valutazione finora

- Model Exam 1Documento25 pagineModel Exam 1rahelsewunet0r37203510Nessuna valutazione finora

- Vishnuram.v 73772161158Documento47 pagineVishnuram.v 73772161158Deepika ENessuna valutazione finora

- Ta / Da: Travelling AllowanceDocumento21 pagineTa / Da: Travelling AllowanceArun DubeyNessuna valutazione finora

- BAF 462 Investment Analysis and Portfolio Management: Security ValuationDocumento54 pagineBAF 462 Investment Analysis and Portfolio Management: Security ValuationLaston MilanziNessuna valutazione finora