Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Evca Interactive Handbook

Caricato da

Deepa Devanathan0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

98 visualizzazioni49 paginepe vc guide

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentope vc guide

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

98 visualizzazioni49 pagineEvca Interactive Handbook

Caricato da

Deepa Devanathanpe vc guide

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 49

EVCA Handbook

Professional Standards for the Private

Equity and Venture Capital Industry

Edition January 2014

Disclose

conflicts of

interest

Do no harm to

the Industry

Maintain

confidentiality

Act in

fairness

Keep your

promises

Act with

integrity

1 EVCAHandbookProfessional Standardsfor thePrivateEquityandVentureCapital Industry

The EVCA is the pan-European industry association for

investors and managers in the Private Equity and Venture

Capital Industry. Its membership represents the full range

of Private Equity activity, from early-stage Venture Capital

firms to the largest Private Equity firms, investors such as

pension funds, insurance companies, fund-of-funds and

family offices, as well as welcoming associate members

from related professions.

Table of contents

Foreword 1

ThePromotionof Professional Standards 2

Section 1

Code of Conduct 4

Section 2

Commentary on the

Code of Conduct 6

Section 3

Guidance on the

Application of the Code

of Conduct: Questions

and Answers 8

Outline 9

Contents 10

3.1 Fundformation 11

3.2Fundraising 12

3.3Investing 16

3.4Management of aninvestment 21

3.5Disposal of aninvestment 26

3.6Distributions 28

3.7LPrelations 29

3.8Secondaries 31

3.9Windingupof aFund 32

3.10Management of multipleFunds 32

3.11 GPsinternal organisation 33

Glossary 38

Codeof Conduct for Placement Agents 41

IPEVReportingGuidelines 46

IPEVValuationGuidelines 62

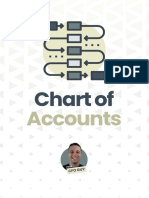

Capital

Carry

Returns

Priority

profit share/

Management Fee

Fee

Fee

Advice

Note

Dashed lines signify

optional variations

Advice

Fee

Capital

Returns

Returns

Equity/

Loans

LPs/Investors, e.g.

Institutional investors

Endowments

Family offices

Sovereign Wealth Funds

Fund

Portfolio

Companies (PC)

PC Management

PC Management

PC Management

GP/

Manager

Manager

Investment

Advisor

Sub Advisors

Capital Returns

Capital Returns

Capital Returns

Typical fund structure

TheEVCApromotesthehighest ethical and

professional standardswithinthePrivateEquity

andVentureCapital Industry.

ThisHandbookbringstogether thekeyelements

of governance, transparencyandaccountability

that areexpectedof Industryparticipants.

It providesaccessible, practical andclear

guidanceontheprinciplesthat shouldgovern

professional relationshipsbetweenall those

engagedintheIndustry, withaparticular focus

ontherelationshipbetweenGPsandtheir LPs,

andbetweenGPsandtheir PortfolioCompanies.

TheGP/LPterminologyusedinthisHandbookis

explainedunder theheadingThelong-term

partnershipbetweenGPsandLPs.

Inaddition, theHandbookincludesthecore

financial recognitionandreportingrequirements

for PrivateEquityFunds, intheformof theIPEV

ValuationandIPEVInvestor Reporting

Guidelines, asalsoendorsedbytheEVCA, as

well astheCodeof Conduct for Placement

Agentssoastoprovideanefficient onestop

locationfor all aspectsof Professional Standards.

Our highethical standards

Ethical behaviour isfundamental tothesuccessof our Industry.

Industryparticipantsoperateinanenvironment of trust. GPsandLPs

withintheIndustryareentitledtoexpect their peersandPortfolio

Companyco-investorstoact inaccordancewiththehighest ethical

andprofessional standardsandareexpectedtobehaveinasimilar

manner towardsPortfolioCompanies, serviceprovidersandother

stakeholders. Further, inorder toensuresustainableandequitable

conditionsfor theIndustryacrossEurope, it isinmembers best

intereststopromoteconfidenceintheIndustryfor thepublicat large.

EVCAmembershipcreatesaresponsibilitytoact inamanner that is

bothethical andbeneficial totheinterestsof theIndustryandits

stakeholders.

Observanceof thestandardsset out inthisHandbookenablesthe

EVCAtobetter represent theinterestsof itsmembers.

Our Industryis basedonanactiveinvestment andownershipmodel

involvingtwokeyrelationships:

1. Thelong-termpartnershipbetweenGPs andLPs

PrivateEquityandVentureCapital isforemost aco-investment

andownershipmodel for investmentsinunlisted(privatelyheld)

companiesof all sizesandat all stagesof development. Typicallythe

Fundsraisedfor suchinvestmentsarestructuredasclosed-ended

LimitedPartnerships. Theinvestorsarethelimitedpartners, andare

referredtoastheLPs, andtheinvestment manager isthegeneral

partner, andisreferredtoastheGP. Whileother legal formsarealso

commonlyused for thesakeof simplicity, thetermsGPandLP

areusedgenericallythroughout thisHandbookwhatever thelegal

structureof aparticular Fund.

Thenatureof thelong-termpartnershipformedthroughnegotiations

betweenGPsandLPsisfundamental tohowtheIndustryoperates

andiswhat setsit apart fromother asset classes. PrivateEquityFunds

typicallyhavealifespanof at least 10years. Duringthelifeof aFund

theGPandLPsactivelyengagetoensurehighprofessional standards

arefollowedinall aspectsof theinvestment andmanagement of the

Fund. LPsdemandaccountability, transparencyandalignment of

interest fromtheGPsandtheGPsdemandaccountability,

transparencyandtimelyengagement fromtheLPs.

2. Theactiveandresponsibleownershipof PortfolioCompanies

byGPs

PrivateEquityisgenerallycharacterisedbyahighlevel of

engagement betweentheGPsandthePortfolioCompanies. GPsare

abletobringnot onlyinvestment capital, but alsoexperienceand

knowledgeaswell asnetworkstothePortfolioCompanies. GPsplay

anactiverolethroughtheir boardrepresentationinthestrategyand

directionof thePortfolioCompanyinorder tocreatelastingvaluefor

all stakeholders. Goodcorporategovernanceiskeytocreatinglasting

value. GPsdemandrigorousaccountability, transparency(through

monitoringandreporting), adoptionof best practicesandalignment

of interest fromPortfolioCompanies.

AnIndustrycommittedtogoodcorporategovernance

TheIndustryhasbeenandcontinuestobeinstrumental in

developinggoodcorporategovernancestandardsinunlisted

companies. Successful investment requireswell-informeddecision

makingat all levelsandbyall parties. At itscore, goodgovernance

createsalignment of interestsandtheenvironment for theattitudes,

mechanismsandbehavioursthat allowthiswell-informeddecision

makingtotakeplace. Poor governancecanleadtomisalignment of

interests, baddecisionsandbusinessfailures.

Purposeof theHandbook

ThisHandbookaimstohelpmembersof theEVCAexercisebusiness

judgment andact withintegrity. PrivateEquityandVentureCapital

investment maygiverisetosituationsinwhichthereisaconflict

of interest betweenvariouspartiesinvolvedinaFund, business,

transactionor negotiation. It istheintentionof thisHandbookthat

thoseparticipantsintheIndustrywhofollowtheguidancewithinit will

beabletomanagesuchconflictsopenly, honestlyandwithintegrity.

ThisHandbookisdraftedsoastobeapplicabletoaswidearange

of situationsandcircumstancesaspossible, aswell asabroadrange

of investment situations, fromseedanddevelopment capital tolarge

leveragedbuyoutsor buy-intransactions. Noparticular operational

jurisdictionisenvisagedandthereforereferencestoshareholders,

theboardandmanagement shouldbetakenasfunctional titles

rather thanparticular legal structures.

Editingnotes

TheHandbookisadynamicdocument. TheEVCAsProfessional

StandardsCommitteehasresponsibilityfor maintainingthe

Handbook. TheProfessional StandardsCommitteewelcomesyour

feedbackandsuggestionsfor editing. Pleasedirect anycommentsto

handbook@evca.eu. TheHandbookwill beformallyreviewedannually.

It hasmost recentlybeenreviewedinJanuary2014bythe

Professional StandardsCommittee, includingmember consultation.

TheEVCAmayalsoissueupdatestotheHandbooktoreflect Industry

developments.

Historyof theHandbook

TheIndustrysoriginal Codeof Conduct, publishedin1983, hasbeen

developedover theyears, havingregardtotheModel Codeof Ethics:

AReport of theSROCommitteefor theInternational Organisationof

SecuritiesCommissions(IOSCO)publishedinJune2006. This

recommendsthat firmsengagedinthefinancial servicesIndustry

adopt asethical principlesIntegrityandTruthfulness; Promise

Keeping; Loyalty-ManagingandfullyDisclosingConflictsof Interest;

FairnesstotheCustomer; DoingnoHarmtotheCustomer nor the

ProfessionandMaintainingConfidentiality.

Current version

TheEVCAHandbookintegratesall EVCAprofessional standards

documents, namelytheEVCACodeof Conduct (October 2008,

reprint July2011), theEVCAGoverningPrinciples(May2003, updated

2010) andtheEVCACorporateGovernanceGuidelines(June2005,

updated2010). Thesearereplacedintheir entiretybythisHandbook,

whosefirst versionwaspublishedinJanuary2013. Thisversionwas

publishedinJanuary2014.

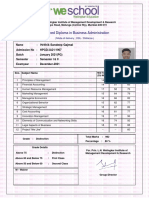

Thediagrambelowsetsout atypical Fundstructureshowingthe

relationshipbetweenLPsandGPandFundandPortfolioCompanies.

Thisisillustrativeonly. Theremaybevariationtothismodel.

Introduction to the Handbook

The Promotion of Professional

Standards

2 EVCAHandbookProfessional Standardsfor thePrivateEquityandVentureCapital Industry 3 EVCAHandbookProfessional Standardsfor thePrivateEquityandVentureCapital Industry

Theobjectives of theCodeare:

tostatetheprinciplesof ethical behaviour

that membersof theEVCAabideby;

toassert onbehalf of themembershipthe

collectiveobservanceof highstandardsof

commercial honour andjust andequitable

principlesof tradeandinvestment; and

toprovidethebasisfor considerationof, and

dealingwithlapsesin, professional conduct within

EVCAmembership.

CompliancewiththeCodeismandatoryfor all EVCA

membersandtheir affiliatesandisdealt withthrough

theProfessional StandardsCommitteeonbehalf of

theBoardof Directorsof theEVCA. Intheevent of a

provenseriouscaseof misconduct byamember, the

sanctionisexpulsionof that member fromtheEVCA.

Code of Conduct

1 Act with integrity

2 Keep your promises

3 Disclose conflicts of interest

4 Act in fairness

5 Maintain confidentiality

6 Do no harm to the Industry

The Code of Conduct is mandatory for all members of the EVCA.

Section 1

Code of Conduct

5 EVCAHandbookProfessional Standardsfor thePrivateEquityandVentureCapital Industry

Section 2

Commentary on the

Code of Conduct

Thefollowingsectionincludescommentary

whichishelpful intheapplicationand

interpretationof theCode. Further explanation

onhowtheCodeitself canbeusedinpracticeis

set out inSection3.

Thesixprinciplesthat comprisetheCode

standtogether asawholerather thanbeing

independent fromoneanother.

Alitmustest for applicationof thesesix

principlesisapersonal convictionthat your

actionswouldstanduptopublicscrutiny.

Analternativetest istojudgeyour actions

byreferencetowhether youwouldfindit

acceptablefor other partiestopursueasimilar

courseof actionunder similar circumstances.

2.1 Act withintegrity

Integrityisthefundamental buildingblockof trust inbusiness

relationships.

Trust isbuilt uponrepeatedinteractionsbetweenindividualsthat

involveclarity, reliabilityandhonesty. Integrityimpliesthat competitive

advantageandcommercial successarederivedthroughthe

applicationof superior individual andcollectiveskill andnot through

theuseof manipulativeor deceptivedevicesor practices. TheGP

will act withintegritytowardsitsLPs, PortfolioCompaniesandother

stakeholdersandwill seektoensurethat thePortfolioCompany

conductsitsbusinesswithintegrity. TheGPexpectsthesame

fromitsLPsinall areaswheretheyinteract. Actingwithintegrity

impliesnot seekingtoevadeor avoidtheconsequencesof error.

2.2 Keepyour promises

Ethical businessbehaviour implieskeepingpromisesregardless

of whether or not thereisalegal obligationtodoso.

WithintheIndustry, commitmentsareoftenmadesubject tothe

provisionof further information, carryingout duediligence, the

resultsof uncertainexternal eventsandother matters. Thismeans

that clarityabout what isactuallycommittedandwhat isstill subject

tofurther investigationisveryimportant.

Promisesaremadeinthelight of circumstanceswhichareknownat

thetimethat thepromiseismade. Theethical individual or business

onlymakespromiseswhichtheyreasonablybelievearecapableof

beingfulfilled.

Promisesareof equal importanceregardlessof towhomtheyaremade.

2.3 Discloseconflicts of interest

Conflictsof interest canoccur whenapersonwhohasadutyto

another alsohasapersonal or professional interest that might

interferewiththeexerciseof independent judgment. Theyinevitably

arisewithinbusiness. AGPshouldseektomanageconflictsof interest

fairly. Wheretheseconflictsof interest affect LPs, theGPshould

alwaysconsult withtheLPAdvisoryCommitteeaspart of this

process. ConflictscanarisebetweentheGPandtheFundanditsLPs;

betweendifferent Funds; betweendifferent LPsintheFund; between

LPsof different FundsmanagedbytheGP; andbetweentheFundand

other investorsintherespectivePortfolioCompanies. Tofacilitatethe

management of conflicts, LPsshouldensuretheydeclaretheir own

conflictsof interest inanysituation, for exampleif theLPisaninvestor

intwoFundsmanagedbytheGPandoneFundissellingan

investment totheother Fund. Conflictsof interest shouldbediligently

identifiedanddisclosedtoall partiesconcerned.

2.4 Act infairness

Fairnessmeansplayingbytherules, whether legislativeor not, based

onfactsandcircumstances.

Rulesfor conductingbusinessinour Industrymayvarybetween

countries, regions, societies, legal systemsandtransactions. It is

important that membersunderstandthedifferent rulesthat applyto

their particular businessor situation. AGPshouldpaydueregardto

theinterestsof LPsintheFundtakenasagroupandshould, where

relevant, consult withtheLPAdvisoryCommitteeor all LPs. An

LPshouldpaydueregardtotheinterestsof theFundasawholeand

howtheir individual behaviour mayimplicatetheFund, theother LPs

or theGP. LPsshouldengagewiththeGPandother LPsinatimely

manner whensituationsarisewhichrequireanLPvoteunder the

Funddocuments.

AGPshouldpaydueregardtotheinformationneedsof LPsinthe

Fund, andcommunicateadequateinformationtotheminawaywhich

isclear, fair andnot misleading. Goodinvestor relationsfor aGP

dependuponclear disclosureandtimelycommunicationof relevant

andmaterial information. TheGPwill seektoestablishtransparent

communicationwithPortfolioCompanymanagement. LPsshould

alsocommunicateclearlyandpromptlywiththeGP.

2.5 Maintainconfidentiality

Intheordinarycourseof business, individualsandfirmswill obtain

commerciallysensitiveinformationfromother market participants.

TheGPwill treat PortfolioCompanyor LPinformationasconfidential

andwill not makeuseof that informationinawaythat isdetrimental

tothePortfolioCompanyor LP. LPsshouldalsocomplywiththe

contractual requirementstomaintainconfidentiality, for exampleon

receivingconfidential informationwhencarryingout duediligence

onaFund(towhichit mayor maynot decidetocommit), or when

receivinginformationasanLPintheFund.

Inaneffort tosafeguardthecommercial interestsof disclosingparties,

reasonablestepsshouldbetakentoprotect informationfrom

inappropriatedisclosureandduecareshouldbetakentofollowany

agreedprocedures.

2.6 DonoharmtotheIndustry

Successincommercial enterpriserequiresthepursuit of competitive

advantage.

Thepursuit of competitiveadvantageisnot initself harmful tothe

Industry. Industrymembersshould, however, conduct their businessin

aresponsiblemanner andnot engageinpracticesthat areforeseeably

damagingtothepublicimageandgeneral interestsof theIndustry

anditsstakeholders. All participantsintheIndustryshouldpromote

best practicesfor thewider benefit of long-term, sustainable

investment, economicgrowthandvaluecreation.

7 EVCAHandbookProfessional Standardsfor thePrivateEquityandVentureCapital Industry

Outline

Thissectionof theHandbookisintendedto

provideillustrationsbywayof questionsand

answersbothfor theestablishment and

management of aFundaswell astoprovide

guidanceonhowtheCodemayapplyduring

thelifecycleof aFund. Indoingso, it takes

account of commonmarket practiceand

corporategovernanceintheIndustry

wherever possible.

Theillustrationsarenot intendedtobeexhaustiveor prescriptive.

Whilethequestionsareintendedtoprovideauseful resource, it should

not beassumedthat onesizefitsall. Someof thescenariosmaybe

inappropriateasaresult of thesize, nature, local environment and

complexityof someGPs operations. Thedifferinginvestment

objectivesof Fundsmayalsomeanthat theexamplesarenot

appropriatetoall Funds.

Local legal andregulatoryrequirements, andtheextent towhichthere

arefiduciaryrelationshipsandobligations, differ inthevarious

Europeanjurisdictions. Theprincipleisthat theselegal requirements

areobservedinall relevant jurisdictions. Thisdocument doesnot

describethoserequirementsor provideacompleteor mandatory

statement of thedutiesof thoseinvolvedintheestablishment and

management of Funds. It isnot asubstitutefor professional advice,

whichshouldstill beobtainedwhereappropriate. TheIndustry

participantsshouldalsobefamiliar withandmindful of applicable

national andsupranational corporategovernanceguidance.

Whileendeavouringtoreflect anticipatedpan-Europeanlegislation

andregulation, thisdocument doesnot reflect theimpact of differing

legal structuresusedfor PrivateEquityandVentureCapital vehicles.

Inparticular, it isassumedthat Fundsarebeingmarketedto

sophisticatedLPsandhencethisdocument doesnot reflect the

largerangeof legal protectionssurroundinginvestmentsthat are

marketedtoretail investors.

Section 3

Guidance on the Application of the Code

of Conduct: Questions and Answers

9 EVCAHandbookProfessional Standardsfor thePrivateEquityandVentureCapital Industry

3.1 Fund formation

3.1.1. Earlystageplanning

3.1.2. LPsandmarketing

3.1.3. Structuring

3.2 Fundraising

3.2.1. TheFundraisingprocess

3.2.2. TheFundraisingTeam

3.2.3. Target LPs

3.2.4. Originof capital

3.2.5. LPs

3.2.6. Structureof theoffer: termsof investment

3.2.7. Structureof thedocuments

3.2.8. TermsintheFunddocuments

3.2.9. PresentationstoLPs

3.2.10. Responsibleinvesting

3.2.11. Trackrecords

3.2.12. Forecasts

3.2.13. Timeperiodfor Fundraising

3.3 Investing

3.3.1. Duediligence

3.3.2. Costs

3.3.3. Approachtoresponsibleinvestment

3.3.4. Investment decision

3.3.5. Structuringinvestments

3.3.6. Responsibilitiestoother shareholdersinthesameor other

classesof sharesandtobondholders

3.3.7. Investment Agreement

3.3.8. GPsconsent toPortfolioCompanyactionsandboard

appointments

3.3.9. ThePortfolioCompanyscorporatestrategy

3.3.10. Co-operationwithco-investorsandsyndicatepartners

3.3.11. Co-investment andparallel investment bytheGPand

itsexecutives

3.3.12. Co-investment andparallel investmentsbyLPsand

other thirdparties

3.3.13. Divestment planning

3.4 Management of aninvestment

3.4.1. Investment monitoring

3.4.2. Environmental factors

3.4.3. Social factors

3.4.4. Governancefactors

3.4.5. Boardparticipation

3.4.6. Exerciseof GPconsents

3.4.7. Exerciseof influenceonresponsibleinvestment factors

3.4.8. Responsibilitiesinrelationtoother stakeholders

3.4.9. Follow-oninvestments

3.4.10. Underperforminginvestments

3.5 Disposal of aninvestment

3.5.1. Implementationof divestment planning

3.5.2. Responsibilityfor divestment decision-making

3.5.3. Warrantiesandindemnities

3.5.4. Cashvs. shares/earn-outsonrealisation

3.5.5. Saleof aPortfolioCompanybetweenFunds

managedbythesameGP

3.5.6. Managingquotedinvestments

3.6 Distributions

3.6.1. Distributionprovisions

3.6.2. Timingof Distributions

3.7 LPrelations

3.7.1. ReportingobligationstoLPs

3.7.2. TransparencytoLPs

3.7.3. LPrelationsgenerally

3.7.4. LPconflictsof interest

3.7.5. LPAdvisoryCommittee

3.7.6. KeymanProvisions

3.8 Secondaries

3.8.1. Overview

3.8.2. SecondaryTransactions

3.9 Winding up of a Fund

3.9.1. Liquidation

3.9.2. Funddocuments

3.10 Management of multiple Funds

3.10.1. Conflictsof interest

3.10.2. Establishment of newFunds

3.11 GPs internal organisation

3.11.1. Management areresponsiblefor establishingthecontrol

environment

3.11.2. Management areresponsiblefor establishingprocedures

for riskassessment

3.11.3. Management areresponsiblefor control activities

3.11.4. Humanresources

3.11.5. Incentivisation

3.11.6. Financial resources

3.11.7. Segregationof Fundassets

3.11.8. Proceduresandorganisation

3.11.9. Internal reviewsandcontrol

3.11.10. Management areresponsiblefor theorganisations

informationandinformationsystemsandfor

communicationswithinandoutsidetheorganisation

3.11.11. External communication

3.11.12. Market Transparency EVCAResearchandData

3.11.13. External assistance

3.11.14. Considerationsrelatingtomonitoringof governance

GPgovernance

APPENDIX CODEOFCONDUCTFORPLACEMENTAGENTS

3.1 Fund formation

Thereareanumber of factorsthat theGPsFundraising

Teamshouldconsider andaddressduringitsinitial

planning. Doingsowill helptheFundraisingTeamto

ensuretheGPwill beabletooperatetheFundwithdue

skill, careanddiligenceandensureanadequatelevel of

financial andoperational resourcesfor themanagement

of theFund. Awell-structuredFundwill bebetter placed

toaccommodatedifferent typesof LPandalsoableto

maximiseanyregulatoryandtaxefficiencies. Inthis

sectionit isacknowledgedthat theGPmaynot bea

formedlegal entityat thetimetheFundlaunches.

ThetermFundraisingTeamisusedtodenotethekey

personsinvolvedintheFundraisingprocessandwho,

oncetheFundisformed, will alsobecloselyinvolvedin

theFundthroughout itslife.

3.1.1. Earlystageplanning

Question

What issuesshouldtheFundraisingTeamconsider andaddressduring

itsearlystageplanning?

Explanation

Appropriateearlystageplanningof aFundisvital toitssuccess. It

helpstofocustheFundraisingTeamsothat effort andcost arenot

expendedinappropriately. Planningduringthisstagewill normally

outlineall of theFundraisingTeamsactivitiesuptothefirst closing

of theFund.

Recommendation

TheFundraisingTeamsearlystageplanningshouldaddress

thefollowingissues:

what theFundsinvestment policy, investment objectivesand

investment strategywill beand, if applicable, deal flowallocation

toprior Fundsandcross-over Fundinvestments;

what minimumandmaximumFundsizetheFundraisingTeamwill

needtoestablishtoimplement theinvestment strategy;

what will bethelengthof theInvestment Periodandthetermof

theFund;

fromwhat typeof LPstheFundraisingTeamintendstotryand

raiseCommitmentsfor theFundandinwhichjurisdictionsthose

potential LPsarebased(asthiscanimpact onthestructure(s)

tobeused);

considerationof thecostsof theFundraising;

what humanresourcestheFundraisingTeamwill needtoput in

placeinorder toimplement theFundsobjectives, inparticular who

therelevant investment andindustryprofessionalswill beand

ensuringsuchindividualsarelikelytoremaincommittedtothe

Fundfor itsduration;

what cashresourcesshouldbebudgetedandwhat theappropriate

Management Feeisfor theFund;

what theappropriateprofit shareandCarriedInterest structurewill

be, inparticular focusingontheapportionment of CarriedInterest

betweentheFundraisingTeam, timingof payment andGP

Clawbackmechanisms(e.g. Clawbackandescrowarrangements);

howresponsibleinvestment considerationswill beincorporated

intotheorganisationandinvestment andportfoliomonitoring

processes;

considerationof theexistingFundsconstitutional documents,

if applicable, toensurethat theFundraisingTeamisawareof any

restrictionscontainedinthosedocumentsastotimingsinrelation

toraisingnewFunds, scope, etc.

3.1.2. LPs andmarketing

Question

What mattersregardingpotential LPsandmarketingof theFund

shouldbeconsideredat theearlystages?

Explanation

Anefficient andwell-plannedmarketingcampaignisvital inensuring

that Fundraisingissuccessful. ManyEuropeanaswell asnon-

Europeanjurisdictionsregulatethemarketingof Fundsandrestrict

solicitationtocertaintypesof LPs(suchassophisticatedand

professional investors) andinsomejurisdictions, theserestrictions

mayapplytoearlyinformal discussionswithpotential LPs. Planning

identifiesrelevant jurisdictionsgivingtheFundraisingTeamthe

opportunitytoobtainappropriateadvice.

Alongwiththeadvent of pan-Europeanregulation, themarketingof

FundswithintheEUmaydependonthejurisdictionof theFund

vehicle, aswell asthelocationof theGP/manager. AnEU-wide

marketingpassportwill beavailabletothoseEU-basedGPs/

managerswhocomplywiththerelevant requirementsset out inthe

AlternativeInvestment FundManagers(AIFM) Directive. Special care

shouldbetakenwhilst thisnewlegislationtakesshape, asall the

detailsof theimplementationhaveyet tobefinalised.

Recommendation

TheFundraisingTeamshouldclearlyidentifytheregulatorylandscape,

particular LPsandtypesof LPsthat theywishtoattract totheFund

inanyrelevant jurisdiction. BeforecommencingFundraising, the

FundraisingTeamshouldestablishwhat restrictionsapplytothe

marketingof Fundsineachjurisdictionwheretheywishtomarket

theFund.

Considerationshouldalsobegiventothecontent of theduediligence

informationtobeprovidedtoprospectiveLPsandthemedium

throughwhichit will bedelivered. For example, will theinformationbe

availableelectronicallythroughavirtual dataroomhostedonasecure

areaof theGPswebsite, or onasecuredatahubsite. Thought should

alsobegivenastohowmeetingswithprospectiveLPswill beheld.

For example, will theyall beone-on-onemeetingsor shouldaninitial

launchmeetingbearrangedtowhichall prospectiveLPsareinvited

toenablethemtomeet across-sectionof membersof theGPsteam.

TheQ&Acoveredinsection3, isset out under

anumber of headings, whicharehighlighted

inthegrid. TheQ&Aitself followsthisgrid.

10 EVCAHandbookProfessional Standardsfor thePrivateEquityandVentureCapital Industry 11 EVCAHandbookProfessional Standardsfor thePrivateEquityandVentureCapital Industry

3.1.3. Structuring

Question

What mattersinrelationtothestructureof theFundshouldthe

FundraisingTeamconsider duringearlystageplanning?

Explanation

Althoughthefinal structureof aFundwill bedeterminedat alater

stage, aproposedstructureisnecessarybothfromaregulatoryand

commercial perspectivetoallowtheFundraisingTeamtomarket the

Fund. Certaincategoriesof target LPmayhaveanimpact onthe

structureof theFund(suchasUS-basedERISALPs). Thesolutionsto

theseissuestendtobesimilar inall Fundsandtheymaybeaddressed

at theplanningstageif it isintendedtomarket theFundtosuchLPs.

Recommendation

TheFundraisingTeamshouldidentifyaproposedstructurefor the

Fund, includingsuitablevehicle(s) for theFund. Wherever possible,

theGPshouldtakeaccount of likelyrequirementsof targetedLPs

whenconsideringthesestructures(includingtheir taxrequirements

andregulatoryrequirementsof different vehiclesindifferent

jurisdictions). DuringtheFundstructuringstage, theGPshouldalso

consider what arrangementsit will makefor thecustodyof

investmentsheldbytheFund.

3.2 Fundraising

TheFundraisingstage(whichisalsooftenreferredto

asthemarketingstage) isthestageat whichtheGPs

relationshipwiththeLPsisestablished. Thisrelationship

withtheLPsshouldrest onthesixprinciplesof theCode,

together withtherequirementsof transparencyandthe

fiduciarydutiesof dueskill, careanddiligence.

3.2.1. TheFundraisingprocess

Question

Whotakespart intheFundraisingprocess?

Explanation

APrivateEquityFundraisingisacomplexandtime-intensiveprocess

withmanypartiesinvolved. It needstobeplannedandprepared

well inadvance. Thought shouldbegiventohowmuchof theprocess

canbemanagedin-housebytheGPandwhat rolescanbeplayed

byadvisors.

Recommendation

TheFundraisingTeam, whichmayalreadybeinvolvedwithearlier

Fundsunder management, will needtobalancetheir timespent

onFundraisingwiththeir timemanagingsuchFundinvestments.

Thekeyplayer intheFundformationprocessistheFundraising

Team. TypicallyaPlacement Agent, lawyers, accountantsand

Fundadministratorswouldalsobeincludedintheprocess.

3.2.2. TheFundraisingTeam

Question

HowshouldresponsibilityduringtheFundraisingperiodandprior

totheestablishment of theFundstructurebeapportioned?

Explanation

DuringtheFundraisingperiod, variouskeypeoplefromtheGPwill be

involvedintheFundraising, evenif someof thelegal entitiesforming

thestructureof theFundhavenot yet beenestablishedandthe

structureof theFundisyet tobefinalised. ThisFundraisingTeam

will usuallyhavecertainresponsibilitiesduringFundraisinge.g.

responsibilitiesfor complyingwithapplicablemarketinglaws,

responsibilitiesfor theinformationprovidedontheFundtopotential

LPsandresponsibilitiesrelatingtotheverificationof theoriginof

capital investedwithaviewtopreventingmoneylaundering.

Recommendation

TasksandresponsibilitiesduringtheFundraisingstageshouldbe

clearlyidentifiedandapportionedamongthoseinvolvedinthe

Fundraisingappropriately.

It shouldalsobemadeclear topotential LPswhichresponsibilities

will beundertakenbytheGPonceit isestablishedandwhat (if any)

theFundraisingTeamsrolewill beoncethisisinplace.

3.2.3. Target LPs

Question

Whichpotential LPsshouldtheFundraisingTeamtarget?

Explanation

Inmanyjurisdictionstherearerestrictionsonthetypesof LPsto

whomit ispermissibletopromoteFunds. InvestmentsinPrivate

EquityandVentureCapital Fundsareusuallyprimarilyaimedat

sophisticatedLPsor professional investorswhoareconsideredtobe

fullyawareof thepotential riskof makinganinvestment inaFund.

Oftenrestrictionsonlypermit marketingof Fundstopotential LPs

for whomtheyaresuitable. Thetestsfor determiningsuitabilityvary

fromjurisdictiontojurisdiction. Insomeareas, thepotential LPsnet

worthor theminimumsizeof investment maybeonegroundfor

permittingmarketing.

Recommendation

TheGPshouldcomplywithanylocal legal restrictionsonmarketing

Funds. Failuretocomplywiththeserequirementsmaymeanthat

anyagreement toinvest maybeunenforceable. Insomejurisdictions

breachof theserestrictionsisalsoacriminal offenceand, inaddition

tobeingliablefor damages, theGPmaybesubject tofinesand

imprisonment.

UsuallyFundraisingisrestrictedtotargetingpotential LPswho

canreasonablybeconsideredtobeexperiencedenoughto

properlyevaluatetheriskof theinvestment. InvestingLPsshould

beobligedtoconfirmintheir applicationdocumentsthat theyare

suitablyexperiencedandthat theyunderstandandaccept therisks

of theinvestment.

TheFundraisingTeamshouldmaintainarecordof all personsto

whomit marketstheFundandarecordof all informationprovidedto

them. TheFundraisingTeamwill normallystart bytargetingexisting

LPsif theyhavealreadyraisedaFund, asnewinvestorswill typically

takecomfort fromre-investment byexistinginvestors.

3.2.4. Originof capital

Question

ShouldtheFundraisingTeamberesponsiblefor controllingtheorigin

of theCapital Commitmentsofferedfor investment inaFundwitha

viewtopreventingmoneylaunderingor other illicit practices?

Explanation

Thedefinitionof what moneylaunderingisandtheapplicationof

anti-moneylaunderinglegislationcanvaryfromjurisdictionto

jurisdiction. However, therearegeneral requirementsandacommon

groundwithrespect toanti-moneylaunderinglegislationstipulatedin

theguidelinesissuedbytheFinancial ActionTaskForceandthese

includechecksnot onlyontheinvestingentitybut alsofor establishing

whotheultimatebeneficiaryis, toprevent investorsfromlaundering

moneythroughFunds.

Recommendation

Legal adviceshouldbeobtainedonthismatter asearlyaspossibleto

ensurethat all relevant moneylaunderingchecksareundertakenand

properlydocumented. Thesechecksshouldinall casescomplywith

therelevant local rulesinanyjurisdictionwheretheFundismarketed

andor thedomicileof thefundvehiclewherethesubscriptionmoney

will bereceived. Inaddition, duringFundraising, stepsshouldbetaken

toensurethat investmentsarenot madetoeffect moneylaundering.

Thesestepsshouldincludeverifyingtheoriginof Capital

Commitmentsofferedfor investment andtheidentityof potential LPs.

Investment shouldnot beacceptedwherethesourceof the

investment causesconcern(e.g. wheretheinvestment originatesina

FATFblack-listedcountry) or theLPs(or itsbeneficial owners) identity

cannot beverified.

Subscriptiondocumentsshouldincludesuitablewarrantiesfrom

LPsintheFundregardingtheoriginof moneyinvested, although

suchwarrantiesshouldnot beconsideredtobeasubstitutefor

makingappropriateenquiries. TheFunddocumentsmayinclude

provisionsthat allowtheGPtorequireLPstowithdrawfromthe

Fund, if theGPreasonablybelievesthat theinvestment hasbeen

madeinorder toundertakemoneylaundering.

Irrespectiveof considerationsconcerningcompliancewithlaw, aGP

shouldtakecareonlytointroducebona-fide, long-termpartnersinto

thepartnership.

3.2.5. LPs

Question

What factorsregardingLPsshouldtheFundraisingTeamconsider?

Explanation

Thequalityandreliabilityof eachLPaffect all thoseinvestingina

Fund, asDrawdownscanbemadethroughout thelifeof theFund.

If oneLPdefaults, evenwhensuitablesanctionsareapplied, other

LPsarelikelytobedisadvantagedespeciallyif theFundcannot

honour itsinvestment commitment. Managingadefault situation

requiresGPtime, inadditionthismayreflect negativelyontheGP

anditsreputation.

Moreover, whilst all LPsshouldbeaffordedequal andfair treatment,

someLPsmayrequirespecificopt-out or excuseclausesthat will

prevent themfromparticipatingincertaininvestments. If theseissues

arenot addressedduringFundraising, theFundmayfindit more

difficult tomakeinvestments, or beforcedtofindadditional financing

at short notice. GPsshouldensurethat theFunddocumentsrequire

LPstoprovideanynecessaryidentificationinformationthat theGPis

obligedtoprovidetoauthoritiesduringthelifeof theFund. Failureor

refusal tocomplywiththisrequirement shouldprovidetheGPwith

theright torequiretheLPtowithdrawfromtheFund.

Another considerationisthelong-termnatureof therelationship

withaprospectiveLPandif theyarelikelytoinvest over multiple

Fundcycles.

Recommendation

It isdifficult toforeseethedefault of anindividual LP, however the

FundraisingTeamcanreducetheoverall riskandimpact of default

byobtainingasufficient level of diversificationbytypeandgeography

of LPsandtotheextent possiblebuildabalancedLPbaseavoiding

concentrationrisk.

LPdefault isarelativelyrareoccurrence, but carriesserious

implications. Therefore, robust contractual default provisions

arerequiredtoprotect bothLPandGPinterests.

Anywithdrawal of anLPshouldbesubject tostrictlydefined

exceptional situations.

Funddocumentsshouldcontainaright torequirethewithdrawal of an

LPwhoiscausingseriouslegal, regulatoryor taxationproblemsfor

theFund.

3.2.6. Structureof theoffer: terms of investment

Question

Shoulddifferent LPsbeoffereddifferent terms?

Explanation

Thetermsof investmentsinaFundwill normallybesubject toand

theresult of negotiation. Inapartnership, it isgenerallypresumedthat

all LPswill betreatedequallyandfairly. LPsmaybekeentoget certain

preferential rightsor economicadvantages(suchaspositionsonthe

LPAdvisoryCommittee, preferential Co-investment rights, reduced

Management Feesor aparticipationinCarriedInterest). Tradeand

strategicinvestorswill havedifferent prioritiesininvestingtothose

of financial investors.

12 EVCAHandbookProfessional Standardsfor thePrivateEquityandVentureCapital Industry 13 EVCAHandbookProfessional Standardsfor thePrivateEquityandVentureCapital Industry

Theextent towhichspecificLPsaregrantedinfluenceover the

management of theFundshouldbeconsideredcarefully. If such

influencealtersthemanagement structureof theFundit can

compromiseLPs limitedliability. Substantial influenceonthe

management of aFund(inparticular thedecisionstoinvest or

divest) cansubject theFundtomerger regulationsandnotification

requirementswithundesirableconsequencesfor it andtheLPs.

Recommendation

Whenever possible, theGPshouldtrytoensurethat all LPsinthe

Fundbenefit fromequal treatment. Different termscanbeoffered

todifferent LPs, but, wherever possible, preferential treatment or

specificeconomicbenefitstoindividual LPsor LPgroupsshould

bejustifiable(e.g. withreferencetotheamount investedbya

preferredLPor byspecificexperienceof anLPwhichadds

additional valuetotheFund).

Also, anypreferential treatment shouldbeclearlydisclosedtoall other

LPsfromtheoutset inawaythat suchLPsat least knowthat certain

other LPsmaybenefit frompreferential treatment. If certainLPsare

ondifferent terms, thiscanimpact onLPalignment of interests.

LPsshouldnot generallyparticipateintheday-to-daymanagement

(includingtheinvestment decisionprocess) of theFund. Wherethey

doso, theyandtheir fellowLPsshouldbeawareof thelegal risksthat

arisefromdoingsoincertainjurisdictionsandwhichmaymeanthat

anLPlosesitslimitedliability. Theymayalsoexposethemselvesto

claimsfromother LPs.

Indetermininginitial termsandsubsequent negotiationswith

potential LPs, aGPshouldconsider thealignment of interest

of thegroupwithall LPs.

WhereaFundisstructuredasmultipleparallel partnershipsor

entities, theFundraisingTeamshouldprevent onesuchentityor

asingleminorityLP(inthecontext of thewholeFund) beingable

toundulyinfluencetheFundor blockspecial resolutionswithout

adequatejustification.

3.2.7. Structureof thedocuments

Question

What documentsshouldtheFundraisingTeamproducewithrespect

totheFundandwhat mattersshouldit address?

Explanation

Duetotheongoingnegotiationsuntil final closingof aFund,

documentstendtobecontinuallyrevisedtoreflect all discussions

withLPs. However, certaincoreelementsdescribetheoffer andits

essential characteristics.

Thesecoreelementswill usuallybeaddressedinacombination

of documentswhichwill normallyincludeaprivateplacement

memorandum(oftenthemainmarketingdocument) andthe

constitutional documentsof theFund. TheFundraisingTeamwill

normallyalsoassembleacomprehensivedatapackor virtual data

roomanddocumentsabout theFundanditsinvestment strategy,

collectivelycomprisingtheduediligencematerials.

Local lawsinthejurisdictionswheretheFundismarketedmayset out

requirementsonthestructureandcontent of theprivateplacement

memorandumandFunddocuments.

Continuousamendment of documentscreatesariskthat not all LPs

receivethesameinformationabout theFundbeforetheymakean

investment.

Recommendation

Adraft privateplacement memorandumor similar Funddocuments

shouldtypicallybemadeavailabletoLPsprior tofirst closing.

Constitutional documentsestablishingtheFundshouldalso

beproduced.

Appropriaterecordsshouldbekept toensurethat all LPsareableto

reviewthesameinformation. Theuseof duediligencerooms(physical

or virtual) canbeaneffectivewaytoprovideinformationto

prospectiveLPs. Betweenthefirst andfinal closingsthisinformation

shouldbeupdatedif changesarerequiredandsuchupdatesshould

bedisclosedtobothexistingandpotential LPs, sothat all havehad

accesstothesameinformation.

Appropriateadviceshouldbesought ontherequirementsof the

lawsinall jurisdictionswheretheFundispromoted.

TheFunddocumentsshouldcontainfull andtrueinformation

presentedinamanner that isclear, fair andnot misleading.

Appropriatestepsshouldbetakentoensureandrecordtheaccuracy

andcompletenessof thedocuments, employingthird-partyadvisors

whereappropriatee.g. auditingof aGPstrackrecord.

TheFundraisingTeamshouldensurethat it canjustifyexpressionsof

belief andstatementsmadeintheFundsmarketingmaterialsusing

reliabledocumentsandresearch, updatingwherenecessaryuntil the

Fundhasclosed.

Asageneral rule, anychangestotheFunddocumentswouldrequire

theapproval of LPs. However, therewill typicallybeacarveout for

changesagreedafter thefirst closewithprospectiveinvestorsinthe

Fundwhicharenot adversetotheinterestsof existingLPs. These

changescanbemadebytheGPwithout LPconsent inorder to

facilitateitsFundraisingefforts, providedhowever that whereanyLP

isadverselyaffectedbythechangeinquestionthentheaffectedLP

wouldhavetoconsent tothechange.

3.2.8. Terms intheFunddocuments

Question

What arethetypical termstobeset out intheFunddocuments?

Explanation

TheFunddocumentsshouldset out thekeytermsandprovide

theframeworkwithinwhichtheGPwill operatetheFund. It is

recommendedthat theFunddocumentsshouldaddress, at a

minimum, thefollowingmatters:

Team

adescriptionof themanagement structureandthemanagement

team, identificationof thekeyexecutivesof thisteamandthe

regulationof aKeymanevent (suchasdepartureof akey

executive);

adescriptionof theteamsskillsandexperience;

detailsof teamcontinuity, dynamics, decision-makingprocesses

andteamsuccession;

Trackrecord

thetrackrecordof prior investmentsmadebytheGP;

Investment strategy

theinvestment scopeof theFund;

theinvestment policy, investment criteriaandInvestment Period

of theFund, includingtheapplicableinvestment, lendingand

borrowingguidelinesandinvestment restrictions. (NB: Thesemust

beset out particularlyclearlyas, often, theseimportant matterswill

not beset out inanydetail inother keydocuments, andtheyare

usuallyincorporatedbycross-referencetotheprivateplacement

memorandum);

theresponsibleinvestment policyof theFundandtheprocedures

for ensuringcompliancewithsuchpolicy;

Structureandpowers

adescriptionof thelegal structureof theFund;

asummaryof thepowersof theGP;

conflict of interest resolutionprocedures;

remit andcompositionof theLPAdvisoryCommittee;

thereportingobligationsthat theGPwill havetoLPs;

carriedinterest escrow, clawbackandtrue-upprovisions, andother

LPprotections(includingkeymanandGPremoval provisions);

transfer of LPinterest provisions;

Financial

thecost andfeestructure(includingdifferentiatingbetweencosts

bornebytheFundandthosebornebytheGP. Usually, placement

agent feesshouldbebornebytheGPandLPsshouldnot be

reimbursedfor duediligencecostsduringtheir reviewof theFund.

Acapisnormallyset onFundinceptioncostsincludinglegal and

accountingfeesetc.);

howanyTransactionfeesanddirectors feesreceivedbytheGP

will betreated;

theGPCommitment andCarriedInterest arrangements;

themechanicsfor Drawdownof Commitmentsanddefault

mechanicsintheevent of LPs defaultsonDrawdowns(which

shouldnormallyimposesignificant sanctionsondefault toreduce

theriskof suchdefault);

thevaluationpolicythat will apply;

if applicable, thepricingof interests, units, shares, etc. intheFund;

howDistributionstoLPswill bemade;

indemnificationprovisions;

Co-investments andfollow-oninvestments

Co-investment rightsandpowers;

thepolicyonCo-investment withother Fundsmanagedbythe

GPor anyof itsassociates;

theprovisionsthat theGPwill makefor follow-oninvestments;

Term, Exits andnewFunds

thetermof theFund, theprocessfor extendingtheFundand

terminationandliquidationproceduresfor theFund;

Exit strategies;

thecircumstancesinwhichinvestmentsmaybepurchasedfrom

or soldtoother FundsmanagedbytheGPor itsassociates;

anyrestrictionsonthecircumstancesinwhichtheFundraising

Teamor theGPwill bepermittedtoestablishanyother Fund

withasimilar investment strategyor objective;

Riskfactors

asummaryof theriskfactorsthat arerelevant toinvestment in

theFund, includingageneral warningtoLPsof therisksthat are

inherent ininvestinginFunds, andalsoanyparticular riskfactors

that mayadverselyaffect theFundsabilitytocarryout the

investment policyor tomeet anyprojectionor forecast made.

TheFunddocuments(privateplacement memorandumor similar

andconstitutional documents) shouldbepreparedandmadeavailable

toLPsinsufficient timefor themtoconsider themprior toclosingand

toallowtimefor negotiationwithLPs. Appropriatesubscription

documentsandconfirmationof participationshouldalsobecirculated.

TheFundraisingTeamshouldtakeadviceonwhether thelawinany

jurisdictionwherethedocumentswill besent requiresanyother

matterstobeaddressed.

3.2.9. Presentations toLPs

Question

What responsibilitiesarisewithrespect tomarketingpresentations?

Explanation

PresentationsandinformationprovidedbytheFundraisingTeam

that influenceLPs decisionsareoftensubject tothelawof all

jurisdictionswhereaFundispromoted. Theselawswill oftenapply

toinformationprovidedtoLPs, irrespectiveof themediabywhich

it iscommunicated.

Insomecircumstances, presentationsmaybemadetopotential LPs

at anearlystageandtheinformationprovidedtothemmayinfluence

their decisiontoinvest, eventhoughtheyhavenot yet receivedany

formal Funddocuments. It isimportant that potential LPsaremade

awareof anychangestoinformationprovidedtothemat anypoint

duringtheFundraisingprocess, sothat theyareabletomakea

balancedinvestment decisionbasedoncorrect information.

Recommendation

AsmentionedinthesectiononLPsandmarketingabove, the

FundraisingTeammust complywithlocal lawsrelatingtothe

marketingof Fundsinall jurisdictionswheretheFundispromoted

andappropriateprofessional adviceshouldbeobtained.

Theteamshouldensurethat informationprovidedtopotential

LPsandpromotional statementsmadetotheminwhatever form

(e.g. intelephonecalls, meetings, slidepresentations, letters, emails,

websites, etc.) evenat anearlystage, iscorrect andfairlypresented.

Anysubsequent material changestosuchinformationshouldbe

communicatedtopotential LPs.

14 EVCAHandbookProfessional Standardsfor thePrivateEquityandVentureCapital Industry 15 EVCAHandbookProfessional Standardsfor thePrivateEquityandVentureCapital Industry

3.2.10. Responsibleinvesting

Question

What informationshouldGPsprovidetoLPsontheissuesof

responsibleinvesting?

Explanation

Thetopicof responsibleinvestingisbecomingincreasinglyimportant

toLPswhorequireconsiderationtobegiventoenvironmental,

social andgovernancefactorsintheGPsinvestment processes.

Recommendation

GPsshouldclearlydefineanddocument their responsibleinvestment

policyandproceduresfor compliancewithsuchpolicyandwill

typicallybeaskedbyLPstoprovideinformationbothduringdue

diligenceandthroughout thelifeof theFund. TheGPshoulddisclose

anyindustryassociationmembershipsor affiliations.

3.2.11. Trackrecords

Question

What informationshouldbeprovidedabout thetrackrecordof

theGP?

Explanation

Potential LPswill expect detailedtrackrecordinformationof the

GPtobeavailableaspart of theduediligenceprocess. It isveryeasy

for suchmaterial tobemisreador tomisleadpotential LPs,

particularlyinviewof changingcircumstancesor if thereisselective

presentationof material.

Recommendation

Marketinglawsgenerallyprohibit thepresentationof trackrecord

informationonacherrypickingbasis. Informationwithrespect to

thetrackrecordshouldnot thereforebemadeonthebasisof

selectivedatathat isunrepresentative, misleadingor incomplete.

Thebasisof all suchstatementsshouldbefullydisclosedinthe

Funddocuments. Inparticular, theperiodtowhichanytrackrecord

informationrelatesshouldbedisclosed. Grossandnet trackrecord

informationshouldbecalculatedandcompiledinaccordancewith

thevaluationandaccountingstandardsappropriatefor theFunds

jurisdiction. Anyuseof benchmarksmust beappropriate, consistent

andclearlydefined.

TheFundraisingTeamshouldensurethat whenthereisanymaterial

changethat affectssuchinformationprior tofinal closing, it is

disclosedtoall LPs.

Trackrecordinformationmaybeconfidential (for example, toprevious

employersor PortfolioCompanies) andtheFundraisingTeamshould

ensurethat appropriateconsent isobtainedbeforeit isused.

3.2.12. Forecasts

Question

ShouldtheFundraisingTeammakeforecasts?

Explanation

TheFundraisingTeammaywishtomakeforecastsregardinglikely

performanceintheFundschosensectors, target IRRandmoney

multiple. However, it isveryeasyfor suchmaterial tobemisreador to

misleadpotential LPs, particularlyinviewof changingcircumstances

or if thereisselectivepresentationof material.

Recommendation

Forecastsarelegallynot requiredininstitutional products/private

placementsandarethereforenot atypical featureof theFund

documents. Themakingof forecastswithintheFunddocumentsis

ultimatelyabusinessandeconomicdecisionof theGP/Fundraising

Teamwhenmarketingtherespectiveproduct.

If theGP/FundraisingTeamdecidetoincludeforecastsinanoffering

document, suchforecastsmust not bemadeonthebasisof datathat

isunrepresentative, misleadingor incomplete. Further, therelevant

data, theassumptionsandtheapproachtakentoproducethe

forecastsshouldbefullydisclosedintheFunddocuments.

3.2.13. Timeperiodfor Fundraising

Question

IsthereanyspecificperiodduringwhichFundraisingmust be

completed?

Explanation

It isimportant Fundraisingdoesnot continueindefinitely, asthiscan

prevent theGPfromimplementingtheFundsinvestment strategy,

whileresourcescontinuetobecommittedtomarketing.

Recommendation

TheFundraisingTeamandtheGPshouldensurethat Fundraising

iscompletedwithinareasonabletimeafter first closingof theFund.

Market termstypicallydictatethat afinal closeshouldtakeplace

withinaprescribedperiodof thefirst close, unlessbyLPs consent.

Considerationshouldbegiventolevyinganequalisinginterest

payment fromLPswhocommit totheFundafter thefirst closingto

reflect thecost of moneyfor LPscommittingat anearlier stageof

theFundraisingprocess. Thepurposeof thisissothat all LPscanbe

treatedasif theyhadcommittedat thefirst closing. Theequalising

paymentsaregenerallycreditedprorataamongtheexistingLPsand

not treatedasanasset of theFund.

3.3 Investing

Whenmakinginvestmentsonbehalf of theFund, the

GPshouldimplement theFundsinvestment policywith

dueskill, careanddiligenceandinaccordancewiththe

agreementstheGPhasmadewiththeLPsintheFund.

AGPshouldbemindful of theresponsibleinvestment

impact of theconduct of itsbusinessandshouldgive

dueconsiderationtomaterial risksandopportunities

associatedwithresponsibleinvestment factorssuchas

environmental, social andgovernance(ESG) factors

throughout theperiodof itsinvestment.

3.3.1. Duediligence

Question

What duediligenceshouldbedonewhenevaluatinganinvestment

andtowhat level of detail?

Explanation

TheduediligenceprocessundertakenbytheGPisvital. The

informationacquiredduringtheprocess, together withtheGPs

ownknowledgeandexpertise, will formthebasisof anyinvestment

decision.

Theduediligenceprocesswill investigateawiderangeof aspectsof

thetarget companysbusinessincludingcommercial, financial, tax,

legal, regulatory, technology, environmental, social andgovernance

aspectsandmanagement capability. Theobjectivewill betogaina

detailedunderstandingof theprospectsfor thetarget company,

evaluatingtherisksandissuesit isfacingor mayhavetofaceinthe

futurethat mayplayapart intheGPsinvestment decisionandthe

ultimatesuccessof thePortfolioCompanyover theprojected

Investment Period.

Fromthis, anassessment will bemadeof potential for valuecreation

andultimatelyExit opportunitiesfromtheinvestment for theFund.

Recommendation

AGPshouldseeksufficient informationtoallowit toproperlyevaluate

theinvestment opportunitybeingproposedandtoestablishthevalue

of thetarget company. Theinformationsought shouldaddressall

appropriateissues(whichmayincludethefinancial positionof the

target company, theexperienceandabilityof itsmanagement team,

themarket inwhichthetarget companyoperates, thepotential to

exploit anytechnologyor researchbeingdevelopedbythetarget

company, possiblescientificproof of anyimportant concept,

protectionof important intellectual propertyrights, pensionliabilities,

possibleenvironmental liabilitiesandother responsibleinvestment

factorsinthebroader context, litigationrisksandinsurancecoverage).

Theduediligenceprocessshouldalsoincludetestingtheassumptions

uponwhichbusinessplansarebased, verifyingtheidentity, experience

andcapabilityof GPsandco-investors, andobjectivelyevaluatingthe

risksthat mayarisefrominvestingandthepotential returnon

investment.

Other appropriatechecks, asrequiredbyLPs, regulatorsandother

stakeholdersshouldbecarriedout. Thisspecificallyincludeschecks

beingmadeonthesellerstoensurethat theinvestment doesnot

facilitatemoneylaundering, andtoensurethat theinvestment

complieswithanti-corruptionor anti-briberyregulations.

3.3.2. Costs

Question

Isit right toexpect either theFundor GPtoreimburseLPdue

diligencecosts?

Explanation

Onoccasion, LPsmayrequest for theGPtopartiallyor fullyreimburse

thecost of theFundreviewprocesse.g. travel expenses, consultants,

advisers, legal fees, etc.

Recommendation

It isnot agenerallyacceptablepracticefor LPstoexpect that their due

diligencecostsshouldbereimbursedeither bytheFundor theGP

whenconsideringaninvestment inaFund. Thispracticeislikelytobe

unacceptabletotheother committedLPs, whowouldultimatelybear

theburdenof thesecosts. It couldalsoleavetheLPinquestionandGP

opentoaccusationsof bribery.

Question

ShouldcostsincurredbytheGPduringtheFundraisingprocessbe

bornebytheFundor theGP?

Explanation

TheFundraisingprocesscanbeacostlyexercise, withseveral parties

involvedincludingaPlacement Agent, lawyers, accountantsandFund

administrators. TheGPshouldensurethat thought goesinto

budgetingfor theprocessandhowtheadvisorswill bepaid.

Recommendation

It isgenerallyacceptedthat Placement Agent feesshouldbepaidby

theGPandnot out of theFunditself. Lawyers, accountantsandFund

administratorscanbepaidout of theFundformationcostsuptoan

agreedcap.

3.3.3. Approachtoresponsibleinvestment

Question

HowshouldaGPapproachresponsibleinvestment factors?

Explanation

AGPshouldbemindful of therisksposedandopportunitiespresented

toitsPortfolioCompaniesbyresponsibleinvestment factors. The

successof aninvestment maybeimpactednot onlybyitsfinancial

performancebut alsobyother performancecriteria. AGPneedsalso

tobemindful of itsownLPs approachestoresponsibleinvestment

andtoseektocomplywiththeir requirements, whichmayinclude

expectationsasregardsreportingonresponsibleinvestment factorsin

theinvestment andownershipprocessesandinsomecasesexclusions

frominvestingincertainsectors.

Recommendation

GPsshouldintegrateconsiderationof responsibleinvestment risks

andopportunitiesintotheir duediligenceandinvestment approval

processesandkeeptheir investment documentsandprocessesunder

periodicreview.

Anystaff trainingneedsonresponsibleinvestment mattersshouldbe

addressed. Evaluationof responsibleinvestment mattersshouldnot

belimitedtolegal compliance, but couldalsoincludepotential future

regulationandmarketplacefactorssuchasexistingor emerging

voluntarystandards; consumer expectationsandclient requirements;

andbroader issuesthat couldhavereputational impact.

WheretheGPhasidentifiedrisksandopportunities(includingESG

risks) that aredeemedmaterial tothesuccessof theinvestment, the

GPshouldensurethat practicesaredevelopedtomitigateassociated

risksandpursueopportunities. Theimplementationandeffectiveness

of thesepracticesshouldbemonitoredasappropriate. Notingthat

themarketplacecontext couldchange, theGPshouldoccasionally

undertaketoupdatetheresponsibleinvestment risk/opportunity

analysisandrevise, removeor addpoliciesasappropriate. Wherethe

FundsLPshaveexpressedaninterest inresponsibleinvestment

factors, theGPshouldseektoreport totheseLPsonasuitablyregular

basis. TheGPmayalsochoosetosendunsolicitedreportson

responsibleinvestment factorstoall LPs.

16 EVCAHandbookProfessional Standardsfor thePrivateEquityandVentureCapital Industry 17 EVCAHandbookProfessional Standardsfor thePrivateEquityandVentureCapital Industry

3.3.4. Investment decision

Question

Howshouldadecisiontoinvest inaPortfolioCompanybereachedby

aGP?

Explanation

AnydecisionbyaGPtomakeaninvestment involvesanappraisal

of theopportunityandanevaluationof therisksversustherewards

of theopportunity. Theinformationonwhichthisdecisionwill be

basedwill usuallyhavebeengatheredandcriticallyappraisedwithin

theteamof executivesworkingonthetransactionduringthedue

diligencephase. Thequantitiesof information, however, will normally

besogreat that it will needtobesummarisedbeforeit ispresented

totheInvestment Committeeor other decision-makingbodyof the

GPthat ultimatelydecideswhether or not tomakeaninvestment.

Undertakingasuccessful duediligenceexercisethat confirmsthe

validityof theunderlyingassumptionsof abusinessplanwill not

generallybesufficient initself. What isalsorequiredistheexperience

of thesenior executivesof aGPtoaddvaluetotheduediligence

exercisebycriticallyevaluatingtheinformationcollectedbyapplying

their depthof businessandinvestment experience.

Recommendation

Theresultsof theduediligenceexerciseandtheGPssenior

executives recommendationsshouldbedistilledintoacomprehensive

writteninvestment proposal whichaccuratelyreflectsthepotential

of thetarget company, addressingarangeof bothfinancial and

non-financial factors. Aspart of thisprocess, considerationwill

alsohavebeengivenastowhether theproposedinvestment fits

theinvestment criteriaandcomplieswiththeinvestment restrictions

intheFunddocuments. Theinvestment proposal isanimportant

document; not onlydoesit provideawrittenrecordof theinformation

consideredinmakinganinvestment decision, but it will typically

containthecoreinvestment thesisthat will continuetoprovidethe

yardstickbywhichthesuccessof aninvestment will bejudgedduring

itsregular reviewbytheGP.

Investment decisionsshouldbemadebysuitablysenior and

experiencedpersonnel of theGP; normallytheseindividualswill

formanInvestment Committee. Typically, theexperiencedindividuals

responsiblefor evaluatingandproposinganinvestment will not be

involvedinmakingthefinal investment decision. If thereareany

significant changestoaninvestment proposal, further review,

evaluationandadditional approvalsmayberequired.

It isgoodpracticetousetheunderlyingreportsfromwhichthe

investment proposal isdrawntoformanimportant sourcedocument

for strategicreviewandperformancefor thePortfolioCompanies.

3.3.5. Structuringinvestments

Question

What factorsshouldtheGPconsider whenstructuringand

negotiatinganinvestment?

Explanation

InvestmentsbyFundscanbestructuredinmanyways. Insomecases

theFundmaybeapassiveminorityinvestor inaPortfolioCompany,

whileinothers, theFundmayobtainsubstantial or indeedfull control

over thePortfolioCompany. Indetermininghowtheinvestments

shouldbestructured, considerationshouldbegiventothejurisdiction

inwhichtheinvestment istobemade, theinvestment strategyof the

Fundandwhether theinvestment istobetheacquisitionof aminority

or majorityinterest inaPortfolioCompany.

TheFundmayalsoneedtocarefullyconsider itspositionandstrategy

wheninvestingalongsideother parties(e.g. aspart of asyndicate) and

whether it owesanydutiesor obligationstoothersasaresult.

It ispossiblefor thestructureof aninvestment toimposeliabilities

andresponsibilitiesontheFundbeyondthoseenvisagedandany

suchrestrictionswill typicallybethoroughlyinvestigatedwiththe

helpof theFundslawyers.

Recommendation

TheGPshouldstructureandnegotiateeachinvestment madebythe

Fundinsuchawaysoastoensurethat it meetsboththeobligations

toandtheinterestsof theFund.

Whenstructuringanyinvestment theGPshouldtakestepsto

minimiseanyadversetaxor other consequences. For example, the

GPshouldtakeintoconsiderationERISArequirementswherethere

areUSbasedERISALPs, of anyinvestment for theFundanditsLPs,

whichmayrequirecertaininformationandobserver/boardrightsto

beobtainedinrespect of thePortfolioCompany.

3.3.6. Responsibilities toother shareholders inthesame

or other classes of shares andtobondholders

Whether asashareholder inthePortfolioCompany, or through

provisionsagreedintheInvestment Agreement, theFundhas

ownershipresponsibilitiesandshouldexercisethoseresponsibilities

proactivelyandinawaythat continuallysupportsthevalueof the

Fundsinvestment.

Question

HowshouldtheFundconduct itself inrelationtoother investorsinthe

PortfolioCompany?

Explanation

Insomejurisdictions, it iscommonpracticeintheIndustryfor different

classesof investorstoacquiredifferent typesof securitiesaccording

totheir relativepositioninthetransaction, thenatureandlevel of

therisktheyaretakingonandtherelativevaluetheyarebringing

totheinvestment.

Thereturnsfor eachtypeof security, whether equityor debt,

will typicallyvarydependingoncertainoutcomes. It istherefore

possiblethat conflictsmayarisebetweenholdersof different classes

of securitiesif expectationsareunclear or basedonerroneous

assumptions, or if actual PortfolioCompanyperformanceisnot

asprojectedat theoutset.

Recommendation

Thenegotiationof shareholder rightsshouldbeconductedopenly

andwithclarityamongall investorsinthePortfolioCompany.

Dueconsiderationshouldbegiveninadvancetopotential areasof

conflict andwhereconflict doesarise, theresolutionof that conflict

should, totheextent possible, beconductedfairlyandinsuchaway

that theoutcomedoesnot impact thevalueof thePortfolioCompany.

3.3.7. Investment Agreement

Question

What documentsshouldconstitutetheInvestment Agreement and

what commercial termswill theyaddress?

Explanation

Therewill bealargenumber of documentsproducedduringthe

processof makinganinvestment, for exampleshareholders and

investor rights agreements, articlesof associationandloan

agreements, thesearecollectivelyreferredtointhisHandbookasthe

Investment Agreement. Thecontent of thesewill beinfluencedby

manyfactors, for examplelocal legal andregulatoryrequirementsand

structural andtaxconsiderations, suchaswhether aminorityor

majorityinterest istobeacquired.

Thedocumentswill needtofullyreflect all aspectsof theagreed

transactionandtakeaccount of thecommercial termsthat theGPhas

agreedwithother shareholders(if any) andthePortfolioCompany. It

iscommonpracticefor therolesof theGP, other partiesandthe

management teamof thePortfolioCompanyinrelationtotherunning

of thePortfolioCompany, tobeset out intheInvestment Agreement

at thetimeof theinvestment.

Thesecommercial termsmayaddressthefollowingmatters, although

thisvariesdependingonwhether aminorityor majorityinterest inthe

PortfolioCompanyisacquired:

ownershipandcontrol of thePortfolioCompanypost-investment;

sharetransfers(mandatory, permittedandprohibited) and

pre-emptionrights;

incentivesfor themanagement teamof thePortfolioCompany

andobligationsimposedonthem;

divisionof managerial responsibilitiesfollowingtheinvestment;

warranties, representationsandindemnities;

investment performancemilestonesandanyfutureobligations

toprovidefurther funding;

boardandshareholder consentsneededbeforespecifiedactions

aretaken;

agreementswithlenderstothePortfolioCompanyand

inter-creditor arrangements;

quality, quantityandfrequencyof informationthat isto

beprovided;

Exit provisionssuchastag-alongor drag-alongrightsand/or

compulsorysaleprovisionstoresolveanydeadlockregardinga

sale, andalsoorder of prioritiesonaliquidation

1

; and

theconsiderationof responsibleinvestment factors.

Thereisastronglikelihoodthat local legal advicewill berequiredin

thedraftingof thevariousdocumentsconstitutingtheInvestment

Agreement.

Recommendation

Thesemattersshouldbeconsideredwhennegotiatinganinvestment

toensurethat thelegal documentsreflect thecommercial terms

negotiatedbytheGP. Theteamshouldconsider usinglocal legal

adviceontheappropriatemanner for recordingwhat hasbeen

agreed.

3.3.8. GPs consent toPortfolioCompanyactions

andboardappointments

Question

Throughwhat mechanismsshouldtheGPseektoensurethat it is

able, onbehalf of theFund, toinfluenceaPortfolioCompany?

Explanation

Thereareanumber of different waysinwhichtheGPcanensurethat

theFundcaninfluenceaPortfolioCompany. Whichof thesewill be

appropriatewill dependonanumber of factors(includingthesizeof

theFundsinvestment andthelevel of influencethat theGPconsiders

tobeappropriate). If theFundholdsamajorityshareholdinginthe

PortfolioCompany, it will havetheability, asamatter of company

law, toeffect anumber of decisions, andinsodoinginfluencesthe

PortfolioCompanybyvirtueof thismajorityshareholding. TheGP

mayalsoseektospecifycertainrightsinthePortfolioCompanys

constitutional documentsandagreecontractual rightsinthe

Investment Agreement it entersintowiththeshareholdersof the

PortfolioCompany, suchasobtaining(i) investor consents; and(ii)

boardappointments.

1 Note, (i) atag-alongisaright for ashareholder toinsist that his/her sharesarebought onthesame

termsbythesamepurchaser asanother shareholder whoissellinghis/her shares; and(ii) adrag-along

right entitlesasellingshareholder, suchasaPrivateEquityinvestor, torequiretheremaining

shareholderstosell toathird-partypurchaser onthesameterms.

(i) Investor consents

Insomejurisdictions, it iscommonintheInvestment Agreement

betweentheFundandthePortfolioCompanyfor certainactions

of thePortfolioCompanytobesubject totheprior consent of the

GPonbehalf of theFundinitscapacityasshareholder. Theseare

commonlycalledinvestor consents.

WheretheGPhasappointedindividualstothePortfolioCompanys

decision-makingbody, their consent mayalsoberequiredbefore

certainactioncanbeundertakenbythePortfolioCompany, although

theywill oftenbeunder adutytoact inthebest interestsof the

PortfolioCompany, rather thantheFund.

Theavailabilityandlevel of investor consentsthat aredeemed

appropriatewill varydependingonthesizeandnatureof the

Fundsinvestment.

(ii) Boardappointments

TheGPwill typicallyalsoconsider making:

appointmentstotheboardor other decision-makingbodiesof the

PortfolioCompany(seefurther thesectiononBoardparticipation

below); and

appointmentsof personstointernal committeesof thePortfolio

Company(e.g. advisorycommitteesor theremunerationandaudit

committee, whererelevant).

It isimportant tonotethat individualsappointedtosit ontheboard

of thePortfolioCompanybytheGPmayhaveresponsibilitiesboth

towardstheGP, whohasarrangedtheir appointment, aswell astothe

PortfolioCompanyandall itsshareholdersasacompanydirector (as

well astothecompanyscreditorsincertaincircumstances). Typically,

suchindividuals, asdirectorsof thePortfolioCompany, will berequired

toact inthebest interestsof thePortfolioCompany. ThePortfolio

Companysinterestsmayconflict withthoseof theFundandinsuch

circumstancesthedirector must act inaccordancewiththeduties

owedtothePortfolioCompany.

18 EVCAHandbookProfessional Standardsfor thePrivateEquityandVentureCapital Industry 19 EVCAHandbookProfessional Standardsfor thePrivateEquityandVentureCapital Industry

Recommendation

Inrelationtoinvestor consents, theGPshouldconsider requiringthe

PortfolioCompanytoobtaininvestor consentsfor corporate, financial

andaccounting, businessandother keymatters. Thelist of matters

will varydependingontherelevant jurisdiction, thesizeof investment

andtheshareholdingheld, but thefollowingshouldbeconsidered:

significant developmentsinthebusiness(e.g. capital expenditure,

newissuesof capital, disposalsof asignificant amount of assets

includingreal estate, changestothePortfolioCompanys

constitution);

changesinthecapital structureandborrowingarrangements;

changesinleasesor other material contracts;

material litigationclaims;

changesof control, acquisitionor disposal of sharesbyother

shareholders;

adoptionof thePortfolioCompanysauditedaccounts;

makinganydividendsor distributions;

adoptionof anewbusinessplan;

changestothePortfolioCompanyskeymanagement or their

remuneration;

adoptionof or changestothecommunicationpolicy;

developmentsinthefinancial or other performancecriteriaof the

PortfolioCompanywhichwill materiallychangethenatureof the

businessinwhichtheFundhasinvested;

windingupor dissolvingthePortfolioCompany; and

anytransactionsbetweenPortfolioCompanyandShareholder,

PortfolioCompanymanagement or other relatedparties.

Investor consents, whileneedingtobecomprehensiveinscope, must

not besowide-rangingastorestrict themanagement teamsabilityto

runthePortfolioCompanyor takeupexcessiveamountsof theGPs

time. Theabovelist isnot exhaustive, rather it givesanindicationof

sometypical matterswhicharesubject toinvestor consent.

WhenconsideringtheadvantagestotheFundof takinganycontrol

rights, theGPshouldalsoconsider possibleliabilitiesor restrictions

imposedbylawonthoseexercisingcertaintypesof control.

3.3.9. ThePortfolioCompanys corporatestrategy

Question

Towhat extent istheGPonbehalf of theFundresponsiblefor the

definitionandexecutionof thePortfolioCompanyscorporate

strategy?

Explanation

At thetimeof investment byaFund, theinvestment decisionis

normallytakeninsupport of aspecificstrategy, businessplanand

management team. Frequently, throughthenegotiationprocess

leadinguptoinvestment bytheFund, theGPwill havehadsignificant

input indeterminingthetargetsfuturecorporatestrategy. Over

aperiodof time, thisbusinessstrategymayneedtoberefined

andamended.

Recommendation

TheGPshouldbeanactiveparticipant throughitsboard

representationor, wherepermittedbytherelevant companylaw

inaparticular jurisdiction, throughtheexerciseof shareholder voting

or contractual rightsinthesettingof thePortfolioCompanysstrategy.

Theresponsibilityfor executionof strategysitswiththeboardand

management teamof thePortfolioCompany. TheGPshouldensure

that it remainsinformedontheprogressbeingmadetowards

achievement of thestrategy. Whereappropriate, theGP, once

againthroughitsboardrepresentationor throughtheexerciseof

shareholder votingor contractual rights, wheresopermitted, should

beavailabletoadviseandassist wherethestrategyneedstobe

refinedandamended.

Further, theGPshouldensurethat thePortfolioCompany

understandstheimportanceof havingtheright mechanisms

andprocessesinplacefor responsible, efficient andappropriate

decision-makingandeffectivecorporategovernance.

Thedegreeof activismof theGPwill varyaccordingtothenature

andstructureof investmentsmadeandthejurisdictioninwhichthe

PortfolioCompanyislocated. TheGPshouldthereforeensureitslevel

of involvement issuitablerelativetothecircumstancesof aparticular

PortfolioCompanyandtheFundsownershipstrategy/policy.

3.3.10. Co-operationwithco-investors andsyndicatepartners

Question

What relationshipshouldtheGPhavewithco-investorsandother

membersof asyndicateinwhichtheFundparticipates?

Explanation

Whereaninvestment hasbeensyndicatedor thereareco-investors,

aGPmaynot beabletocontrol aninvestment andmayhaveto

co-operatewithother shareholdersinorder toachievedefined

goalsandbuildaconsensusastoappropriateactionstobetaken.

Recommendation

TheGPshouldact intheinterestsof theFundandanyother clients

investingintherelevant PortfolioCompanyandidentifyandmanage

anyconflictsof interest that mayarisebetweenthem. Wherever

possible, theGPshouldnot accept anyobligationsinfavour of other

investors, unlessit wouldbeintheFundsintereststohavesome

agreement or understandingwiththoseinvestors.

3.3.11. Co-investment andparallel investment bythe

GPandits executives

Question

What issuesshouldtheGPconsider regardingCo-investment and

parallel investment byitself, itsassociatesor itsexecutives?

Explanation

WheretheFunddocumentspermit theGP, itsassociatesor its

executivestoco-invest or makeparallel investmentsalongsidethe

Fund, thereispotential tocreateaconflict of interest for theGP.

Recommendation

Subject towhat isprovidedintheFunddocuments, detailsof

Co-investment arrangementsshouldbedisclosedtotheFunds

LPs. Toavoidthepotential of prejudicetotheFundsinterest, it is

recommendedthat suchdocumentsonlypermit Co-investment or

parallel investment bytheGP, itsassociatesor itsexecutiveswhere

investment anddivestment isexercisedonapro-ratabasiswiththe

Fund, inthesamesecurities, at thesametimeandonthesame

terms. If thisrecommendationisnot followed, it isparticularly

important that theoperationof theCo-investment arrangements

shouldbedisclosedtoLPsanddocumented.

3.3.12. Co-investment andparallel investments byLPs

andother thirdparties

Question

What issuesshouldtheGPconsider regardingCo-investment and

parallel investmentsbyLPco-investorsandother thirdparties?

Explanation

Insomecircumstances, LPco-investorsintheFundor other third

partieswithwhomtheGPhassomerelationshipmaywishtoinvest

directlyintoacompanythat theGPisconsideringinvestinginon