Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Applied-Optimization of Banks Loan Portfolio Management-Agarana

Caricato da

Impact JournalsTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Applied-Optimization of Banks Loan Portfolio Management-Agarana

Caricato da

Impact JournalsCopyright:

Formati disponibili

Impact Factor(JCC): 1.4507 - This article can be downloaded from www.impactjournals.

us

IMPACT: International Journal of Research in Applied,

Natural and Social Sciences (IMPACT: IJRANSS)

ISSN(E): 2321-8851; ISSN(P): 2347-4580

Vol. 2, Issue 8, Aug 2014, 43-52

Impact Journals

OPTIMIZATION OF BANKS LOAN PORTFOLIO MANAGEMENT USING GOAL

PROGRAMMING TECHNIQUE

AGARANA M. C, BISHOP S. A & ODETUNMIBI O. A

Department of Mathematics, Convent University, Ota, Ogun, Nigeria

ABSTRACT

In this paper we present results of optimization of loan portfolio management of banks. An Operational Research

technique, Goal programming, is applied to the management of loan portfolio in banks in order to optimize it.

With the result obtained, using a multi objective package, provides an answer on how to handle cases of bad loans or

doubtful loans. Bad loan is a major factor militating against optimization of bank goals, and it is one of the major causes of

bank failure.

KEYWORDS: Goal Programming, Loan Portfolio, Optimization, Bad Loan, Doubtful Loan

INTRODUCTION

The success of any bank in this very competitive lending environment depends largely on the way and manner the

loan portfolio of the banks is being managed. An effective way of evaluating banks credit policies for loan portfolio is

through the Goal programming approach [2,3,6]. Goal programming is an extension of linear programming in which

management objectives are treated as goals to be attained as closely as possible within the practical constraints of the

problem. Various areas in the lending process where Goal programming is usually applied include; prospect identification

and qualification, sales and customer service, loan approval and review, loan booking and servicing, portfolio monitoring,

loan scrutinizing, loan workout, and training [4,6,8]. Most of these problems are always with multiple objectives and

criteria. These are referred to as multiple criteria optimization problems. Goal programming technique is usually applied to

these multiple criteria optimization problems. It provides a pragmatic and flexible way to cater for such problems [1, 2].

It is perhaps the most well-known method of solving multi objective optimization problems [2]. A set of goals that should

be obtained for the objective functions is constructed. The goals are assigned weighing factors to rank them in order of

importance. A single objective function is written as the minimization of the deviations from the stated goals.

The goal programming model can be written as follows: Minimize Z = d

1

+

+ d

1

-

+ d

2

-

+ d

3

-

, subject to some constraints,

where d

i

-

and d

i

+

measure the amount by which the target is under achieved and over achieved respectively [3].

MODEL FORMULATION

Notations

I denotes the ith class of the loan portfolio (where I=1 implies long term loan,

I = 2 is medium term loan and I = 3 is short term loan)

J denotes the j

th

investment type in each loan portfolio class

44 Agarana M. C, Bishop S. A & Odetunmibi O. A

Index Copernicus Value: 3.0 - Articles can be sent to editor@impactjournals.us

M represents number of loan portfolio classes

Ni represent number of investments type in the ith loan portfolio Class

Parameters

The input parameters for this study are defined as follows:

CB

t

Cooperate Banking Contribution to loan in year t.

B

t

Branches Contribution to loan in year t.

L

t

Bad debt in year t

D

t

Deposit in year t

NP

t

Non performing loan in year t

Decision Variables

Xijt denotes the amount (in naira) to be allocated to investment type j within the loan Class i in year t.

Table 1: The Decision Variables

Loan Class (i) Class Specification Investment Type(j) Decision Variable

1 Long term loan

Mortgage finance

Lease finance

X

11t

X

12t

2 Medium term loan

Higher purchase

SME finance

X

21t

X

22t

3 Short term loan

LPO finance

Contract finance

Building finance

Warehouse warrant

finance

Import finance

Export finance

overdraft finance

Rediscount finance

facility

X

31t

X

32t

X

33t

X

34t

X

35t

X

36t

X

37t

X

38t

Deviational Variables

d

+

kt

--- denotes the overachievement of the target set for goal k in year t.

d

-

kt

--- denotes the under achievement of the target set for goal k in year t.

Sources of loan and proportion of each source that is used to finance each categories of loan is shown as follows:

Table 2: Sources and Application of Funds

Sources

Long Term

Loan

Medium Term

Loan

Short Term

Loan

Commercial bank 5% 35% 60%

Individual with high worth 30% 30% 40%

Cooperative 10% 50% 40%

Debenture loan 40% 30% 30%

Family & friends 30% 30% 40%

Optimization of Banks Loan Portfolio Management Using Goal Programming Technique 45

Impact Factor(JCC): 1.4507 - This article can be downloaded from www.impactjournals.us

Table 3: Proportion of Loan Contribution

Sources of

Fund

Total

Deposit

Total

Loan

Non-Performing

Loan

Year

Commercial

Bank

61364.85

68309.30

15756.80

17344.98

157.98

146.37

1

2

Individual

20004.81

22102.90

5726.98

6214.85

5.61

-16.4

1

2

Cooperative

30112.06

33642.93

8235.85

9007.16

17.62

-8.44

1

2

Debenture

---

---

5260.60

5855.22

64.55

66.39

1

2

Family and

Friends

466535.77

467517.20

2868.42

3168.99

8.68

2.91

1

2

Goals and Priority Level

The goals stated by the bank and their priority levels are as follows:

Table 4: Goal Specification and Priority Level

S/N Goal Specification

Priority

Level

1

To achieve a loan portfolio mix of 50% each for

cooperate Banking and Branches respectively.

P

1

2

To achieve a maximum of 1.5% ratio of non-

performing loan as a proportion of total loan.

P

2

3 To achieve a loan deposit ratio of 30:70 P

3

4

To maintain a yield of not less than 35% on all

loans

P

4

THE MODEL

Objective Function

Minimize Z = P

1

(d

+

1t

+ d

-

1t

+ d

+

2t

+ d

-

2t

) + P

2

(d

+

3t

+d

+

3t

)+ P

3

(d

+

4t

+ d

-

4t

) +P

4

(d

+

5t

+ d

-

5t

) (1)

Subject to:

Goal Constraints

Xijt d

+

1t

+ d

-

lt

= 0.5 CBt (2)

Xijt d

+

2t

+ d

-

2t

= 0.5Bt (3)

1.5Xijt d

+

3t

+ d

+

3t

= NPt (4)

Xijt d

+

4t

+ d

-

4t

= 0.3Dt (5)

0.35Xijt d

+

5

t + d

-

5

t = 0 (6)

Structural Constraints

Loan Standing Structural Constraints: (For Year One)

X

11t

+ X

12t

< 5% of 15756.8 = 787.84 (7)

X

21t

+ X

22t

< 35% of 15756.8 = 5514.88 (8)

46 Agarana M. C, Bishop S. A & Odetunmibi O. A

Index Copernicus Value: 3.0 - Articles can be sent to editor@impactjournals.us

X

31t

+ X

32t

+X

33t

+X

34t

+X

35t

+X

36t

+X

37t

+X

38t

<60% of 15756.8 = 9454.08 (9)

X

11t

+ X

12t

< 30% of 5726.98 = 1718.094 (10)

X

21t

+X

22t

< 30% of 5726.98 = 1718.094 (11)

X

31t

+X

32t

+X

33t

+X

34t

+X

35t

+X

36t

+X

37t

+X

38t

<40% of 5726.98 (12)

X

11t

+ X

12t

< 10% of 8235.85 = 823.585 (13)

X

21t

+X

22t

< 50% of 8235.85 = 4117.925 (14)

X

31t

+X

32t

+X

33t

+X

34t

+X

35t

+X

36t

+X

37t

+X

38t

<50% 8235.85 = 3294.34 (15)

X

11t

+ X

12t

<30% of 2868.42 = 860.526 (16)

X

21t

+X

22t

<30% of 2868.42 = 860.526 (17)

X

31t

+X

32t

+X

33t

+X

34t

+X

35t

+X

36t

+X

37t

+X

38t

<40% of 2868.42 = 1147.368 (18)

X

11t

+ X

12t

<40% of 5260.60 = 2104.24 (19)

X

21t

+X

22t

<30% of 5260.60 = 1578.18 (20)

X

31t

+X

32t

+X

33t

+X

34t

+X

35t

+X

36t

+X

37t

+X

38t

<30% of 2868.42 = 860.526 (21)

Non Performing Loan Structural Constraints (For Year One)

X

11t

+ X

12t

<5% of 157.98 = 7.899 (22)

X

21t

+X

22t

< 35% of 157.98 = 55.293 (23)

X

31t

+X

32t

+X

33t

+X

34t

+X

35t

+X

36t

+X

37t

+X

38t

<60% of 157.98 = 94.788 (24)

X

11t

+ X

12t

<30% of 5.61 = 1.683 (25)

X

21t

+X

22t

<30% of 5.61 = 1.683 (26)

X

31t

+X

32t

+X

33t

+X

34t

+X

35t

+X

36t

+X

37t

+X

38t

<40% of 5.61 = 2.244 (27)

X

11t

+ X

12t

<10% of 17.62 = 1.762 (28)

X

21t

+X

22t

< 50% of 17.62 = 8.81 (29)

X

31t

+X

32t

+X

33t

+X

34t

+X

35t

+X

36t

+X

37t

+X

38t

<40% of 17.62 = 7.048 (30)

X

11t

+ X

12t

<30% of 8.68 = 2.604 (31)

X

21t

+X

22t

< 30% of 8.68 = 2.604 (32)

X

31t

+X

32t

+X

33t

+X

34t

+X

35t

+X

36t

+X

37t

+X

38t

<40% of 8.68 = 3.472 (33)

X

11t

+ X

12t

<40% of 64.65 = 25.86 (34)

X

21t

+X

22t

< 30% of 64.65 = 19.395 (35)

X

31t

+X

32t

+X

33t

+X

34t

+X

35t

+X

36t

+X

37t

+X

38t

<30% of 64.65 = 19.395 (36)

Optimization of Banks Loan Portfolio Management Using Goal Programming Technique 47

Impact Factor(JCC): 1.4507 - This article can be downloaded from www.impactjournals.us

Total Deposit Structural Constraints: (For Year One)

X

11t

+X

12t

<5% of 61364.85 = 3068.24 (37)

X

21t

+X

22t

<35% of 61364.85 = 21477.698 (38)

X

31t

+X

32t

+X

33t

+X

34t

+X

35t

+X

36t

+X

37t

+X

38t

<60% of 61364.85 = 36818.91 (39)

X

11t

+ X

12t

<30% of 20004.81 = 6001.443 (40)

X

21t

+X

22t

< 30% of 20004.81 = 6001.443 (41)

X

31t

+X

32t

+X

33t

+X

34t

+X

35t

+X

36t

+X

37t

+X

38t

<40% of 20004.81 = 8001.924 (42)

X

11t

+ X

12t

<10% of 30112.06 = 3011.206 (43)

X

21t

+X

22t

< 50% of 30112.06 = 15056.03 (44)

X

31t

+X

32t

+X

33t

+X

34t

+X

35t

+X

36t

+X

37t

+X

38t

<40% of 30112.06 = 12044.824 (45)

X

11t

+ X

12t

< 30% of 466535.77 = 139960.731 (46)

X

21t

+ X

22t

< 50% of 466535.77 = 139960.731 (47)

X

31t

+ X

32t

+ X

33t

+ X

34t

+ X

35t

+ X

36t

+ X

37t

+ X

38t

< 40% of 466535.77 = 186614.308 (48)

X

11t

+ X

12t

< 40% of 21628.24 = 8651.296 (49)

X

21t

+ X

22t

< 50% of 21628.24 = 6488.472 (50)

X

31t

+ X

32t

+ X

33t

+ X

34t

+ X

35t

+ X

36t

+ X

37t

+ X

38t

<30% of 21628.24 = 6488.472 (51)

Loan Standing Structural Constraints (For Year Two)

X

11t

+ X

12t

< 5% of 17344.98 = 867.249 (52)

X

21t

+ X

22t

< 35% of 17344.98 = 6070.743 (53)

X

31t

+ X

32t

+ X

33t

+ X

34t

+ X

35t

+ X

36t

+ X

37t

+ X

38t

< 60% of 17344.98 = 10406.988 (54)

X

11t

+ X

12t

< 30% of 6214.85 = 1864.455 (55)

X

21t

+ X

22t

< 30% of 6214.85 = 1864.455 (56)

X

31t

+ X

32t

+ X

33t

+ X

34t

+ X

35t

+ X

36t

+ X

37t

+ X

38t

< 40% of 6214.85 = 2485.94 (57)

X

11t

+ X

12t

< 10% of 9007.16 = 900.716 (58)

X

21t

+ X

22t

< 50% of 9007.16 = 4503.58 (59)

X

31t

+ X

32t

+ X

33t

+ X

34t

+ X

35t

+ X

36t

+ X

37t

+ X

38t

< 40% of 9007.16 = 3602.864 (60)

X

11t

+ X

12t

< 40% of 5855.22 = 2342.088 (61)

X

21t

+ X

22t

< 50% of 5855.22 = 1756.566 (62)

X

31t

+ X

32t

+ X

33t

+ X

34t

+ X

35t

+ X

36t

+ X

37t

+ X

38t

< 30% of 5855.22 = 1756.566 (63)

48 Agarana M. C, Bishop S. A & Odetunmibi O. A

Index Copernicus Value: 3.0 - Articles can be sent to editor@impactjournals.us

X

11t

+ X

12t

< 30% of 3168.99 = 950.697 (64)

X

21t

+ X

22t

< 30% of 3168.99 = 950.697 (65)

X

31t

+ X

32t

+ X

33t

+ X

34t

+ X

35t

+ X

36t

+ X

37t

+ X

38t

< 40% of 3168.99 = 1267.596 (66)

Non-Performing Loan Structural Constraints (For Year Two)

X

11t

+ X

12t

< 5% of 146.37 = 7.319 (67)

X

21t

+ X

22t

< 35% of 146.37 = 51.23 (68)

X

31t

+ X

32t

+ X

33t

+ X

34t

+ X

35t

+ X

36t

+ X

37t

+ X

38t

< 60% of 146.37 = 87.822 (69)

X

11t

+ X

12t

< 30% of -16.37 = -4.92 (70)

X

21t

+ X

22t

< 30% of -16.37 = -4.92 (71)

X

31t

+ X

32t

+ X

33t

+ X

34t

+ X

35t

+ X

36t

+ X

37t

+ X

38t

< 40% of -16.4 = -6.56 (72)

X

11t

+ X

12t

< 10% of -8.44 = -0.844 (73)

X

21t

+ X

22t

< 50% of -8.44 = -4.22 (74)

X

31t

+ X

32t

+ X

33t

+ X

34t

+ X

35t

+ X

36t

+ X

37t

+ X

38t

< 40% of -8.44 = -3.376 (75)

X

11t

+ X

12t

< 30% of 2.91 = 0.873 (76)

X

21t

+ X

22t

< 30% of 2.91 = 0.873 (77)

X

31t

+ X

32t

+ X

33t

+ X

34t

+ X

35t

+ X

36t

+ X

37t

+ X

38t

< 40% of 2.91 = 1.164 (78)

X

11t

+ X

12t

< 40% of 66.39 = 26.556 (79)

X

21t

+ X

22t

< 30% of 66.39 = 19.917 (80)

X

31t

+ X

32t

+ X

33t

+ X

34t

+ X

35t

+ X

36t

+ X

37t

+ X

38t

< 30% of 66.39 = 19.917 (81)

Total Deposit Structural Constraints (For Year Two)

X

11t

+ X

12t

< 5% of 68309.30 = 3415.465 (82)

X

21t

+ X

22t

< 35% of 68309.30 = 23908.255 (83)

X

31t

+ X

32t

+ X

33t

+ X

34t

+ X

35t

+ X

36t

+ X

37t

+ X

38t

< 60% of 68309.30 = 40985.58 (84)

X

11t

+ X

12t

< 30% of 22102.90 = 6630.87 (85)

X

21t

+ X

22t

< 30% of 22102.90 = 6630.87 (86)

X

31t

+ X

32t

+ X

33t

+ X

34t

+ X

35t

+ X

36t

+ X

37t

+ X

38t

< 40% of 22102.90 = 880.79 (87)

X

11t

+ X

12t

< 10% of 33642.93 = 3364.293 (88)

X

21t

+ X

22t

< 50% of 33642.93 = 16821.465 (89)

X

31t

+ X

32t

+ X

33t

+ X

34t

+ X

35t

+ X

36t

+ X

37t

+ X

38t

< 40% of 33642.93 = 13457.172 (90)

Optimization of Banks Loan Portfolio Management Using Goal Programming Technique 49

Impact Factor(JCC): 1.4507 - This article can be downloaded from www.impactjournals.us

X

11t

+ X

12t

< 30% of 467517.20 = 140255.1 (91)

X

21t

+ X

22t

< 30% of 467517.20 = 140255.1 (92)

X

31t

+ X

32t

+ X

33t

+ X

34t

+ X

35t

+ X

36t

+ X

37t

+ X

38t

< 40% of 467517.20 = 18700.88 (93)

X

11t

+ X

12t

< 40% of 2436.40 = 9744.96 (94)

X

21t

+ X

22t

< 30% of 2436.40 = 7308.72 (95)

X

31t

+ X

32t

+ X

33t

+ X

34t

+ X

35t

+ X

36t

+ X

37t

+ X

38t

< 30% of 24362.40 = 7308.72 (96)

Expansion

Goal Constraint (Expansion)

For t = 1 (i.e. year one):

X

111

+ X

121

+ X

211

+ X

222

+ X

311

+ X

322

+ X

331

+ X

341

+ X

351

+X

361

+X

371

+X

381

-d

+

11

+d

+

11

=0.5CB

1

(97)

X

111

+ X

121

+ X

211

+ X

222

+ X

311

+ X

321

+ X

331

+ X

341

+ X

351

+ X

361

+X

371

+X

381

-d

+

11

+d

+

11

=0.5B

1

(98)

1.5 (X

111

+ X

121

+ X

211

+ X

222

+ X

311

+ X

321

+ X

331

+ X

341

+ X

351

+ X

361

+ X

371

+ X

381

) d

+

31

+d

-

31

= NP

1

(99)

X

111

+ X

121

+ X

211

+ X

222

+ X

311

+ X

321

+ X

331

+ X

341

+ X

351

+ X

361

+X

371

+X

381

-d

+

41

+d

+

41

=0.3D

1

(100)

0.35 (X

111

+ X

121

+ X

211

+ X

222

+ X

311

+ X

321

+ X

331

+ X

341

+ X

351

+ X

36\1

+ X

371

+ X

381

)-d

+

51

+d

+

51

= 0 (101)

For t = 2 (i. e year 2)

X

112

+ X

122

+ X

212

+ X

222

+ X

312

+ X

322

+ X

332

+ X

342

+ X

352

+ X

362

+ X

372

+X

382

d

t

12

+d

.

12

=0.5CB

2

(102)

X

112

+ X

122

+ X

212

+ X

222

+ X

312

+ X

322

+ X

332

+ X

342

+ X

352

+ X

362

+ X

372

+ X

382

d

t

11

+d

.

11

=0.5B

2

(103)

1.5 (X

112

+ X

122

+ X

212

+ X

222

+ X

312

+ X

322

+ X

332

+ X

342

+ X

352

+ X

362

+ X

372

+ X

382

)d

t

32

+d

.

32

= NP

1

(104)

X

112

+ X

122

+ X

212

+ X

222

+ X

312

+ X

322

+ X

332

+ X

342

+ X

352

+ X

362

+ X

372

+ X

382

d

t

42

+d

t

42

=0.3D

2

(105)

Objective Function (Expansion)

MinimizeZ=P

1

(d

+

1t

+d

-

1t

+d

+

2t

+d

-

2t

)+P

2

(d

+

3t

+d

+

3t

)+P

3

(d

+

4t

+d

-

4t

)+P

4

(d

+

5t

+d

-

5t

) (106)

That is

Min Z=P

1

d

+

11

+P

1

d

-

11

+P

1

d

+

21

+P

1

d

-

21

+P

2

d

+

31

+P

2

d

-

31

+P

3

d

+

41

+P

3

d

-

41

+ P

4

d

+

51

+P

4

d

-

51

(fort=1) (107)

MinZ=P

1

d

+

12

+P

1

d

-

12

+P

1

d

+

22

+P

1

d

-

22

+P

2

d

+

32

+P

2

d

-

32

+P

3

d

+

42

+P

3

d

-

42

+P

4

d

+

52

+P

4

d

-

52

(fort=2) (108)

MODEL SOLUTION AND ANALYSIS OF RESULTS

In this study, twelve decision variables (X

ijt

) were considered, which denote the amount of different categories of

loan that fall under long term, medium term and short term, respectively, to be allocated. Other variables are also

considered. In all, twenty two variables and fifty constraints are involved. A computer package is therefore employed.

Due to the peculiar nature of the model constraints, the model (problem) could not be solved using ADBASE, a goal

programming computer package. A multi objective computer package, PROTASS was then adopted, and eventually

obtained solutions to the model variables. PROTASS uses the simplex algorithm. It starts at some extreme feasible

50 Agarana M. C, Bishop S. A & Odetunmibi O. A

Index Copernicus Value: 3.0 - Articles can be sent to editor@impactjournals.us

points and by a sequence of exchange, proceeds systematically to other basic feasible solutions having better values for the

objectives while giving the decision maker the privilege of setting the range for which its objectives should fall, in their

order of priority. After running the program on computer, the following results were obtained; In Model 1: the decision

variables X

111

= 244.8460 and X

311

= 860.5300 while other decision variables have zero value. This implies that the

amount to be allocated to long term mortgage finance in year one is 244.8460 million naira, while the amount to be

allocated to short term LPO finance in year one is 860.53 million naira. In Model 2: the decision variable X

311

= 2.24,

which implies that the amount to be allocated to short term LPO finance, in period 1 is 2.24 million naira in order to obtain

an optimal result. In Model 3: the decision variable X

111

is 67.8773.

That is to say the amount to be allocated to long term mortgage finance during the first period is 67.8773 million

naira. In Model 4: the value of the decision variable X

111

is same as in model 3. In Model 5: the decision variable

X

111

= 1.1600 which implies the amount to be allocated short term LPO finance in period 1 is 1.1600 million naira. In

Model 6: the decision variable X

111

= 67.8773. Which means that the amount to be allocated to long term mortgage finance

is 67.8773 million naira. Table 5 shows how much of the right hand side values of contents were actually used in Model 1

through model 6. We can deduce from the table that in model 1 out of the total amount 787.84 million naira available for

long term mortgage finance (X

111

) and lease finance (X

121

), only 244.846 million naira was used up in order to optimize the

objective. Which means that 542.994 million naira was not used. We can also see the unused fund available in the other

models. For the objective (goals): Table 6 to Table 11 show the results of objectives (goals) for model 1 to model 6

respectively.

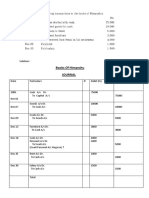

Table 5: Showing How Much of Right Hand Value was actually Used

SENSITIVITY ANALYSIS OF THE RESULTS OF THE OBJECTIVES

From table 6, it implies that if the value is outside the range, (lower and upper), the objectives will no longer be

feasible. So in order to maximize the corporate branches input in the loan portfolio management of the bank, an ideal value

of 1, 105.3760 million naira is expected, but between 169.6933 million naira and 2,508.9 million naira is still okay.

The same kind of explanation goes for the Branches, Non Performing, Deposit and Yield on loan

Optimization of Banks Loan Portfolio Management Using Goal Programming Technique 51

Impact Factor(JCC): 1.4507 - This article can be downloaded from www.impactjournals.us

Table 6: Results for Objectives (Goals) in Model 1

Name Type Lower(Million) Value(Million) Upper(Million)

1 Corporate Branches Max 169.6933 1105.3760 2508.9000

2 Branches Max 169.6933 1105.3760 2508.9000

3 Non-Performing Max 2545400 16580640 37633500

4 Deposit Max 1696933 11053760 25089000

5 Yield on Loan Max 593927 3868816 8781150

Table 7: Results for Objectives (Goals) in Model 2

Name Type Lower Value Upper

1 Corporate Branches Max 0 2.24 5.6

2 Branches Max 0 2.24 5.6

3 Non-Performing Max 0 3.36 8.4

4 Deposit Max 0 2.24 5.6

5 Yield on Loan Max 0 0.7840 1.96

Table 8: Results for Objectives (Goals) in Model 3

Name Type Lower Value Upper

1 Corporate Branches Max 0 67.8773 169.6933

2 Branches Max 0 67.8773 169.6933

3 Non-Performing Max 0 101.8160 254.54

4 Deposit Max 0 67.8773 169.6933

5 Yield on Loan Max 0 23.7571 59.3927

Table 9: Results for Objectives (Goals) in Model 4

Name Type Lower Value Upper

1 Corporate Branches Max 0 67.8773 169.6933

2 Branches Max 0 67.8773 169.6933

3 Non-Performing Max 0 101.8160 254.54

4 Deposit Max 0 67.8773 169.6933

5 Yield on Loan Max 0 23.7571 59.3927

Table 10: Results for Objectives (Goals) in Model 5

Name Type Lower Value Upper

1 Corporate Branches Max 0 1.1600 2.9000

2 Branches Max 0 1.1600 2.9000

3 Non-Performing Max 0 1.7400 4.3500

4 Deposit Max 0 1.1600 2.9000

5 Yield on Loan Max 0 0.4060 1.0150

Table 11: Results for Objectives (Goals) in Model 6

Name Type Lower Value Upper

1 Corporate Branches Max 0 1.1600 2.9000

2 Branches Max 0 1.1600 2.9000

3 Non-Performing Max 0 1.7400 4.3500

4 Deposit Max 0 1.1600 2.9000

5 Yield on Loan Max 0 0.4060 1.0150

In model 2; from table 7, it can be deduced that for the objectives (goals) of the bank to be feasible the value for

the objectives should fall within the indicated ranges (lower and upper). For instance, for corporative branches, on an

objective, in order to maximize that goal, the value should be between 0 and 5.6 million naira. This is the amount to be

allocated to short term LPO finance for period 1 which falls within the range 0 and 5.6. For model 3; in order to maximize

52 Agarana M. C, Bishop S. A & Odetunmibi O. A

Index Copernicus Value: 3.0 - Articles can be sent to editor@impactjournals.us

the goal of the bank as regards corporate branches, branches, deposit and yield on loan, the value of these goals must fall

within 0 and the respective upper value as shown in table 3. Also in order to minimize the non performing loan, the value

must not exceed 254.54 million naira. Similar explanations go for model 4, model 5, and model 6 respectively.

CONCLUSIONS

Loan portfolio management is a very important aspect of Banking. If it is mismanaged, it can cause the Bank a

huge loss of income. The problem of decision facing banks, as lenders, in selecting credit policy can be tackled by

application of some Operational Research Techniques. To know the best strategies to adopt in order to achieve the goals or

objectives of a bank in Nigeria especially as it concerns loan portfolio management, an operational research

technique goal programming is used. Of great interest also is to know how the loan portfolio should be proactively

positioned in order to manage threats and maximize opportunities. With the results obtained, using a multi objective

package, provide an answer on how to handle, not only the above but also how to make sure that the case of bad loan is

minimize. Based on the analysis of the result obtained and discussion that followed the following conclusions are drawn.

Firstly, for the organization (bank) to optimize her objectives (goal), the decision variable X

111

, that is, the

long term mortgage finance should be closely monitored.

Secondly, the decision variable X

311

, which is the short term LPO finance, plays a very important role in ensuring

that the organization optimizes her goals.

Thirdly, the range of values of the amount allocated to the decision variables have to be put into consideration

because any attempt to go out of the range will definitely prevent the organisation from achieving her goals. For instance in

model 1; for short term, loan resources were use up which implies more should be allocated to that sector.

REFERENCES

1. M W Harvey (1969), Principles of Operations Research, Prentice Hall Int. Inc. London.

2. U P Welam (1976), Comments on goal Programming for aggregate planning; Journal of Management Science,

Vol. 22, 708 712.

3. D Y White (1990), A Bibliography on the application of Mathematical Programming multiple objective methods

Journal of the Operations Research Society 41, 669 691.

4. Stever R E (1986) Multiple Criteria Optimization Theory, Compensation and Application. Wiley New York.

5. A J Tachia (1998), towards effective and efficient loan portfolio management in Nigeria commercial bank:

a study of Savannah bank (Nig) plc and Habib Nigeria bank Ltd, Thesis Amadu Bello University, Zaria Nigeria.

6. M C Agarana (2014), An Application of Goal Programming Technique to loan Portfolio Management in Banking

Industry. ICAPTA 2014 conference, University of Lagos, by Mathematics Analysis and Optimization Research

Group. MANORG.

7. N R Al-Faraj and Taga (1990). Simulating the waiting line Problem: A Spread sheet Application, International

Journal of Operations and Production Management, Vol.11 No.2, pp 49-53.

8. O O Aniel (2011). Optimum Loan Portfolio selection: a case study of Juaben Rural Bank, Ashanti Region.

Potrebbero piacerti anche

- 19-11-2022-1668837986-6-Impact - Ijrhal-2. Ijrhal-Topic Vocational Interests of Secondary School StudentsDocumento4 pagine19-11-2022-1668837986-6-Impact - Ijrhal-2. Ijrhal-Topic Vocational Interests of Secondary School StudentsImpact JournalsNessuna valutazione finora

- 19-11-2022-1668838190-6-Impact - Ijrhal-3. Ijrhal-A Study of Emotional Maturity of Primary School StudentsDocumento6 pagine19-11-2022-1668838190-6-Impact - Ijrhal-3. Ijrhal-A Study of Emotional Maturity of Primary School StudentsImpact JournalsNessuna valutazione finora

- 12-11-2022-1668238142-6-Impact - Ijrbm-01.Ijrbm Smartphone Features That Affect Buying Preferences of StudentsDocumento7 pagine12-11-2022-1668238142-6-Impact - Ijrbm-01.Ijrbm Smartphone Features That Affect Buying Preferences of StudentsImpact JournalsNessuna valutazione finora

- 28-10-2022-1666956219-6-Impact - Ijrbm-3. Ijrbm - Examining Attitude ...... - 1Documento10 pagine28-10-2022-1666956219-6-Impact - Ijrbm-3. Ijrbm - Examining Attitude ...... - 1Impact JournalsNessuna valutazione finora

- 12-10-2022-1665566934-6-IMPACT - IJRHAL-2. Ideal Building Design y Creating Micro ClimateDocumento10 pagine12-10-2022-1665566934-6-IMPACT - IJRHAL-2. Ideal Building Design y Creating Micro ClimateImpact JournalsNessuna valutazione finora

- 09-12-2022-1670567569-6-Impact - Ijrhal-05Documento16 pagine09-12-2022-1670567569-6-Impact - Ijrhal-05Impact JournalsNessuna valutazione finora

- 14-11-2022-1668421406-6-Impact - Ijrhal-01. Ijrhal. A Study On Socio-Economic Status of Paliyar Tribes of Valagiri Village AtkodaikanalDocumento13 pagine14-11-2022-1668421406-6-Impact - Ijrhal-01. Ijrhal. A Study On Socio-Economic Status of Paliyar Tribes of Valagiri Village AtkodaikanalImpact JournalsNessuna valutazione finora

- 19-09-2022-1663587287-6-Impact - Ijrhal-3. Ijrhal - Instability of Mother-Son Relationship in Charles Dickens' Novel David CopperfieldDocumento12 pagine19-09-2022-1663587287-6-Impact - Ijrhal-3. Ijrhal - Instability of Mother-Son Relationship in Charles Dickens' Novel David CopperfieldImpact JournalsNessuna valutazione finora

- 09-12-2022-1670567289-6-Impact - Ijrhal-06Documento17 pagine09-12-2022-1670567289-6-Impact - Ijrhal-06Impact JournalsNessuna valutazione finora

- 05-09-2022-1662375638-6-Impact - Ijranss-1. Ijranss - Analysis of Impact of Covid-19 On Religious Tourism Destinations of Odisha, IndiaDocumento12 pagine05-09-2022-1662375638-6-Impact - Ijranss-1. Ijranss - Analysis of Impact of Covid-19 On Religious Tourism Destinations of Odisha, IndiaImpact JournalsNessuna valutazione finora

- 29-08-2022-1661768824-6-Impact - Ijrhal-9. Ijrhal - Here The Sky Is Blue Echoes of European Art Movements in Vernacular Poet Jibanananda DasDocumento8 pagine29-08-2022-1661768824-6-Impact - Ijrhal-9. Ijrhal - Here The Sky Is Blue Echoes of European Art Movements in Vernacular Poet Jibanananda DasImpact JournalsNessuna valutazione finora

- 21-09-2022-1663757902-6-Impact - Ijranss-4. Ijranss - Surgery, Its Definition and TypesDocumento10 pagine21-09-2022-1663757902-6-Impact - Ijranss-4. Ijranss - Surgery, Its Definition and TypesImpact JournalsNessuna valutazione finora

- 22-09-2022-1663824012-6-Impact - Ijranss-5. Ijranss - Periodontics Diseases Types, Symptoms, and Its CausesDocumento10 pagine22-09-2022-1663824012-6-Impact - Ijranss-5. Ijranss - Periodontics Diseases Types, Symptoms, and Its CausesImpact JournalsNessuna valutazione finora

- 25-08-2022-1661426015-6-Impact - Ijrhal-8. Ijrhal - Study of Physico-Chemical Properties of Terna Dam Water Reservoir Dist. Osmanabad M.S. - IndiaDocumento6 pagine25-08-2022-1661426015-6-Impact - Ijrhal-8. Ijrhal - Study of Physico-Chemical Properties of Terna Dam Water Reservoir Dist. Osmanabad M.S. - IndiaImpact JournalsNessuna valutazione finora

- 06-08-2022-1659783347-6-Impact - Ijrhal-1. Ijrhal - Concept Mapping Tools For Easy Teaching - LearningDocumento8 pagine06-08-2022-1659783347-6-Impact - Ijrhal-1. Ijrhal - Concept Mapping Tools For Easy Teaching - LearningImpact JournalsNessuna valutazione finora

- Monitoring The Carbon Storage of Urban Green Space by Coupling Rs and Gis Under The Background of Carbon Peak and Carbon Neutralization of ChinaDocumento24 pagineMonitoring The Carbon Storage of Urban Green Space by Coupling Rs and Gis Under The Background of Carbon Peak and Carbon Neutralization of ChinaImpact JournalsNessuna valutazione finora

- 23-08-2022-1661248432-6-Impact - Ijrhal-4. Ijrhal - Site Selection Analysis of Waste Disposal Sites in Maoming City, GuangdongDocumento12 pagine23-08-2022-1661248432-6-Impact - Ijrhal-4. Ijrhal - Site Selection Analysis of Waste Disposal Sites in Maoming City, GuangdongImpact JournalsNessuna valutazione finora

- 23-08-2022-1661248618-6-Impact - Ijrhal-6. Ijrhal - Negotiation Between Private and Public in Women's Periodical Press in Early-20th Century PunjabDocumento10 pagine23-08-2022-1661248618-6-Impact - Ijrhal-6. Ijrhal - Negotiation Between Private and Public in Women's Periodical Press in Early-20th Century PunjabImpact JournalsNessuna valutazione finora

- 25-08-2022-1661424544-6-Impact - Ijranss-6. Ijranss - Parametric Metric Space and Fixed Point TheoremsDocumento8 pagine25-08-2022-1661424544-6-Impact - Ijranss-6. Ijranss - Parametric Metric Space and Fixed Point TheoremsImpact JournalsNessuna valutazione finora

- The Analysis On Tourist Source Market of Chikan Ancient Town by Coupling Gis, Big Data and Network Text Content AnalysisDocumento16 pagineThe Analysis On Tourist Source Market of Chikan Ancient Town by Coupling Gis, Big Data and Network Text Content AnalysisImpact JournalsNessuna valutazione finora

- 24-08-2022-1661313054-6-Impact - Ijranss-5. Ijranss - Biopesticides An Alternative Tool For Sustainable AgricultureDocumento8 pagine24-08-2022-1661313054-6-Impact - Ijranss-5. Ijranss - Biopesticides An Alternative Tool For Sustainable AgricultureImpact JournalsNessuna valutazione finora

- 08-08-2022-1659935395-6-Impact - Ijrbm-2. Ijrbm - Consumer Attitude Towards Shopping Post Lockdown A StudyDocumento10 pagine08-08-2022-1659935395-6-Impact - Ijrbm-2. Ijrbm - Consumer Attitude Towards Shopping Post Lockdown A StudyImpact JournalsNessuna valutazione finora

- The Analysis On Environmental Effects of Land Use and Land Cover Change in Liuxi River Basin of GuangzhouDocumento16 pagineThe Analysis On Environmental Effects of Land Use and Land Cover Change in Liuxi River Basin of GuangzhouImpact JournalsNessuna valutazione finora

- 25-08-2022-1661424708-6-Impact - Ijranss-7. Ijranss - Fixed Point Results For Parametric B-Metric SpaceDocumento8 pagine25-08-2022-1661424708-6-Impact - Ijranss-7. Ijranss - Fixed Point Results For Parametric B-Metric SpaceImpact JournalsNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Legal Environment of BusinessDocumento6 pagineLegal Environment of BusinessjakartiNessuna valutazione finora

- T03 - Working Capital FinanceDocumento40 pagineT03 - Working Capital FinanceJesha JotojotNessuna valutazione finora

- Indicative Profit Rates: Savings Accounts Term DepositsDocumento1 paginaIndicative Profit Rates: Savings Accounts Term DepositsHammad HaseebNessuna valutazione finora

- PMC Bank Scam - Aditi PatelDocumento2 paginePMC Bank Scam - Aditi PatelRahul ChawlaNessuna valutazione finora

- Basics of Islamic BankingDocumento6 pagineBasics of Islamic BankingMnk BhkNessuna valutazione finora

- Nasik To ThaneDocumento1 paginaNasik To ThaneAlok ThakkarNessuna valutazione finora

- On May 31 2015 Reber Company Had A Cash BalanceDocumento1 paginaOn May 31 2015 Reber Company Had A Cash BalanceAmit PandeyNessuna valutazione finora

- Using The Swap To Transform A LiabilityDocumento2 pagineUsing The Swap To Transform A LiabilityThuỷ TrìnhNessuna valutazione finora

- Afm MCQDocumento10 pagineAfm MCQSarannya PillaiNessuna valutazione finora

- FIN221: Lecture 2 Notes Securities Markets: - Initial Public Offerings Versus Seasoned New IssuesDocumento6 pagineFIN221: Lecture 2 Notes Securities Markets: - Initial Public Offerings Versus Seasoned New Issuestania_afaz2800Nessuna valutazione finora

- Central Bank of India Analyst Presentation ReviusedDocumento29 pagineCentral Bank of India Analyst Presentation ReviusedAkshay V SalunkheNessuna valutazione finora

- D) Click Next at Account List Window E) Enter The Amount NextDocumento3 pagineD) Click Next at Account List Window E) Enter The Amount NextNoor Salehah100% (6)

- Ok, Paper by RISIDocumento30 pagineOk, Paper by RISILavneesh VarshneyNessuna valutazione finora

- CV - Ca. Vaibhav GattaniDocumento2 pagineCV - Ca. Vaibhav GattaniCA Vaibhav GattaniNessuna valutazione finora

- Policy For Settlement of Claims in Respect of Deceased Account HoldersDocumento52 paginePolicy For Settlement of Claims in Respect of Deceased Account HoldersAaju KausikNessuna valutazione finora

- Facebookiq Millennials Money January2016Documento18 pagineFacebookiq Millennials Money January2016dangatz4763Nessuna valutazione finora

- Books of Himanshu JournalDocumento4 pagineBooks of Himanshu Journalrakesh19865Nessuna valutazione finora

- Ipo OrderDocumento252 pagineIpo Orderapi-3701467Nessuna valutazione finora

- Philippine - National - Bank - v. - Banatao PDFDocumento8 paginePhilippine - National - Bank - v. - Banatao PDFAcelojoNessuna valutazione finora

- CV of Olof AnderssonDocumento1 paginaCV of Olof Andersson101superstarNessuna valutazione finora

- ONGC - EPP - Apple Offer - 03-10-22Documento3 pagineONGC - EPP - Apple Offer - 03-10-22sameer bakshiNessuna valutazione finora

- E Payments in MauritiusDocumento3 pagineE Payments in Mauritiuskurs23Nessuna valutazione finora

- Boa Tos RFBTDocumento6 pagineBoa Tos RFBTMr. CopernicusNessuna valutazione finora

- III.j-solid Builders v. China Banking, 695 SCRA 101Documento2 pagineIII.j-solid Builders v. China Banking, 695 SCRA 101Jerwin Cases TiamsonNessuna valutazione finora

- Month Wise Checklist For Submission of Various ReturnsDocumento3 pagineMonth Wise Checklist For Submission of Various Returnsadith24Nessuna valutazione finora

- Average Daily Traffic On NH - 42 (2011)Documento25 pagineAverage Daily Traffic On NH - 42 (2011)Anek AgrawalNessuna valutazione finora

- BDO Vs RepublicDocumento2 pagineBDO Vs RepublicAngel Phyllis PriasNessuna valutazione finora

- Fema ActDocumento34 pagineFema ActKARISHMAATNessuna valutazione finora

- Preparing FinancialDocumento18 paginePreparing FinancialAbhishek VermaNessuna valutazione finora

- 3 de Thi ToeicDocumento115 pagine3 de Thi ToeicTiểu MinhNessuna valutazione finora